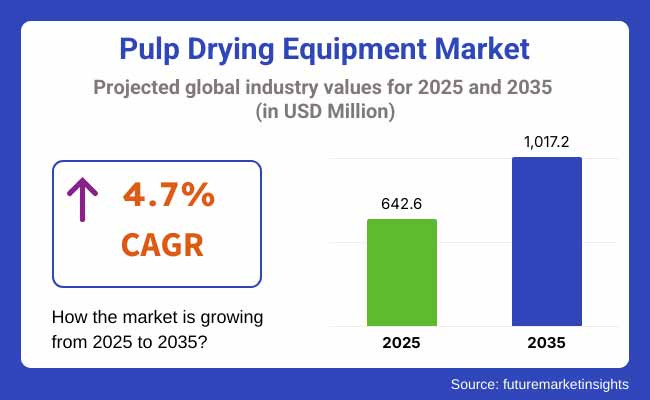

The pulp drying equipment industry is anticipated to be worth USD 642.6 million in 2025 and is likely to grow to USD 1,017.2 million by 2035, with a CAGR of 4.7% over the forecast period. Increasing demand for paper and packaging materials, based on e-commerce and industrial expansion, is driving growth. Emerging nations are experiencing growth in investments in pulp and paper sectors, aided by supportive government policies.

In 2024, the pulp drying equipment industry developed with a comeback of print media, reversing digital trends and fueling demand for high-quality paper production. Companies focused on energy-efficient and intelligent drying solutions as Industry 4.0 integration gained momentum. The trend towards lightweight, low-cost packaging materials fueled innovations in drying technology, maximizing material strength while minimizing environmental footprint.

Expanding in 2025 will be driven by the swift uptake of smart manufacturing, with Industrial IoT driving real-time process optimization. Higher efficiency will be facilitated through advanced automation, minimizing downtime and operating expenses. Increased demand for green packaging will drive manufacturers to upgrade drying systems to ensure sustainability without sacrificing productivity. Emerging economies will see substantial investment, fortifying global supply chains and accelerating the take-up of equipment.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Gradual Transition to Smart Manufacturing - Industry 4.0 implementation started, but integration was only for large manufacturers because of prohibitive costs and technical complexities. | Full-Scale Implementation of Industry 4.0 - Large-scale use of IoT, AI-based process control, and predictive maintenance will improve efficiency and lower downtime. |

| Energy Efficiency Improvements Were Incremental - Manufacturers made efforts to save energy, but dependence on conventional drying technologies continued. | Sustainable Drying Technologies to Dominate - The transition to renewable energy resources, waste heat recovery, and carbon capture technologies will gain pace. |

| Lightweight Packaging Need Arisen - Growing demand for lightweight material began to affect pulp drying innovations, but it was not highly adopted. | State-of-the-art Lightweight Material Processing - Ultra-light high-performance drying machinery will service industries demanding ultra-light, long-lasting packaging without consuming much resources. |

| Investment Focused on Developed Sectors - Expansion was led by North America and Europe, but emerging economies registered slow uptake due to infrastructure issues. | Durable Growth in Developing Economies - Asian-Pacific, Latin American, and African governments will encourage pulp and paper sector, fueling high-capacity equipment installations. |

| Regulatory Pressures Were Increasing - Sustainability laws grew more stringent, but compliance was not uniform across geographies. | Tighter Environmental Regulation - Governments will implement tougher carbon-cutting regulations, forcing manufacturers to switch to green drying technologies. |

The pulp drying equipment industry, which is included in the industrial machinery and capital goods segment, is influenced by world manufacturing practices, sustainability requirements, and trade regulation.

Between 2025 and 2035, increasing demand for low-emission and energy-efficient drying technologies to produce sustainable paper and packaging will drive investments. Industrial growth in Asia-Pacific and Latin America will drive adoption, with the help of government incentives and infrastructure development. Volatile energy prices and inflation could affect production costs, compelling manufacturers to adopt renewable-powered drying technology to stay profitable.

Rigid carbon policies and sustainability targets in mature economies will propel the shift towards intelligent, automated drying systems with IoT and AI integration. Moreover, supply chain diversification and geopolitical dynamics will influence investment decisions, prompting businesses to set up regional manufacturing centers.

Rotary drying systems will control almost 30% of the industry in 2025 on account of their better management of high-moisture pulp and thermal efficiency optimization potential. They will be favored by manufacturers for mass production, incorporating advanced heat recovery systems that will keep energy expenses to a minimum.

Flash drying systems will become more popular due to their speed and versatility, especially in high-output applications where quick moisture elimination must be accomplished without loss of fiber integrity. Their small size will render them a must in facilities that value space optimization and automation.

Ring-type drying systems will continue to experience steady demand, especially in specialty pulp uses where consistent moisture control is essential. Their ability to improve fiber uniformity and lower drying irregularity will appeal to investments from high-grade paper manufacturers.

The pulp and paper sector will be at the forefront of adoption, using intelligent drying technologies to advance process control, maximize the use of heat, and minimize carbon footprints. Sustainability requirements will bring about a transition to low-energy, high-performance systems.

The packaging industry will grow strongly as companies look for compostable, high-strength materials. High-end drying solutions will be key to preserving fiber integrity and minimizing processing time, addressing the increasing need for lightweight yet resilient packaging.

The printing and writing sector, with a close to 25% of the market share in 2025, will continue to maintain demand for high-end pulp drying solutions. With print media steadying, high-quality refined pulp processing will be necessary to produce top-grade writing and specialty papers.

The USA pulp drying equipment industry will expand gradually as manufacturers emphasize precision automation, energy recovery, and AI-facilitated process optimization. The move toward carbon-neutral operations will propel investments in closed-loop drying systems with built-in waste heat recovery. Growing sustainability regulations will compel manufacturers to invest in sophisticated rotary and flash drying technologies that minimize emissions and energy use.

The need for quality recycled pulp will also increase the demand for specialty drying solutions, especially in the growing sustainable packaging industry. Having industry giants in automation and intelligent manufacturing will also keep driving technology advancements, and the USA will be a center for high-performance drying solutions.

FMI analysis found that the USA industry is expected to grow at a CAGR of approximately 4.6% from 2025 to 2035.

India's pulp drying machinery industry will grow strongly, driven by the surging demand for biodegradable packaging and energy-efficient paper manufacturing. The government's drive for sustainability, such as tough plastic reduction regulations, will drive investment in sophisticated drying technology suited to lightweight but strong pulp-based products.

As local pulp and paper mills upgrade, they will implement high-efficiency drying technologies that minimize moisture control while saving energy. Rising exports of packaging materials and paper will also fuel demand for high-capacity, heavy-duty drying equipment capable of continuous operation. India's strong focus on self-reliant industrial development will also promote domestic manufacture of advanced drying machinery.

FMI opines that India’s industry is expected to grow at a CAGR of approximately 5.1% from 2025 to 2035.

China will continue to be a leading force in the pulp drying equipment industry, spurred by fast-paced industrialization and technological innovation. The nation's large-scale pulp mills are incorporating intelligent drying systems with real-time data analysis to maximize production efficiency and minimize waste. Low-carbon industrial processes encouraged by government policies will compel manufacturers to implement AI-driven energy recovery solutions and environmentally friendly drying technologies.

The transition to high-strength, light-weight paper for international exports will trigger innovation in moisture management and optimization of fibers. The leadership of China in the production of machinery will enable speedy development in precise drying methods, establishing industry standards in efficiency and automation. FMI analysis found that China’s industry is expected to grow at a CAGR of approximately 4.9% from 2025 to 2035.

The UK pulp drying equipment industry will develop at a fast pace because of its emphasis on circular economy concepts and tough environmental regulations. The growth of fiber-based packaging as a substitute for plastics will propel demand for drying systems that can generate high-quality, moisture-free pulp. Government-sponsored programs supporting carbon neutrality will prompt manufacturers to implement drying technologies fueled by biomass and waste heat recovery.

As the UK fortifies domestic paper manufacturing to cut back on imports, investment in high-speed, automated drying technologies will grow. The sector will also enjoy advancements in modular drying systems, where production remains flexible while energy efficiency is maximized. FMI opines that the UK’s industry is expected to grow at a CAGR of approximately 4.5% from 2025 to 2035.

Germany's pulp drying machinery sector will progress with the help of high-precision engineering and innovation based on sustainability. The nation's experience in industrial automation will spur the implementation of AI-fitted drying systems that promote efficiency and fiber quality. The growth of the auto and pharma industries' adoption of fiber-based packaging will likewise propel the demand for sophisticated drying equipment with high fiber retention efficiency.

Germany's dominance in green production will likewise spur the use of drying equipment based on renewable energy sources. FMI analysis found that Germany’s industry is expected to grow at a CAGR of approximately 4.8% from 2025 to 2035.

South Korea's pulp drying equipment industry will grow as manufacturers focus on intelligent manufacturing systems and AI-based efficiency upgrades. The nation's highly developed industrial base will drive the implementation of automated drying technology that maximizes heat usage and minimizes production downtime. South Korea will take the lead in incorporating IoT and predictive maintenance into drying equipment, reducing disruptions to production.

The trend towards the use of lighter, higher-strength packaging material in the packaging industry will drive demand for high-accuracy drying systems that do not compromise on fiber integrity. Moreover, South Korea's increasing position as a technology exporter will make it a dominant source of emerging pulp drying technology across the Asia-Pacific region. FMI opines that the CAGR of South Korea’s industry will reach approximately 4.7% from 2025 to 2035.

Japan's pulp drying machinery sector will change through precision engineering, energy recovery, and automation. As the nation already enjoys a strong reputation for technology leadership, it will concentrate on highly efficient drying systems that increase fiber uniformity at reduced energy levels.

Robotics and AI-based controls will come into the limelight, providing high-speed and accurate moisture control in production lines. With Japan's population aging and labor shortages worsening, manufacturers will step up investments in completely automated drying processes to avoid productivity loss. FMI analysis found that Japan’s industry is expected to grow at a CAGR of approximately 4.6% from 2025 to 2035.

France's pulp drying machinery industry will witness steady growth, driven by stringent environmental regulations and an increasing need for high-quality pulp products. The trend towards sustainable packaging in segments such as cosmetics and luxury products will promote the use of high-precision drying technologies. France's government will keep promoting green manufacturing, resulting in greater investment in energy-efficient drying systems driven by renewable energy.

The recycling of paper industry will also significantly influence segment forces, compelling the demand for new drying technologies with enhanced moisture management for repulping operations. FMI opines that France’s industry will expand at a CAGR of approximately 4.5% from 2025 to 2035.

Italy's pulp drying equipment industry will prosper as the nation enhances its position in the production of high-end paper and packaging. The high-end segment's dependence on superior-grade paper items will compel the demand for superior drying technology with the capability of sustaining extraordinary fiber quality. Italian manufacturers will infuse their drying systems with automation and AI-driven analytics to provide higher precision and operational performance.

The nation's robust engineering proficiency will encourage innovations in compact yet high-performance drying machinery specifically suited for niche paper manufacturing. In addition, Italy's large volume of high-value pulp-based products exported will call for ultra-hygienic and high-velocity drying solutions to maintain world-class competitiveness. FMI analysis found that Italy’s industry will grow at a CAGR of approximately 4.7% from 2025 to 2035.

The Australian and New Zealand pulp drying equipment sectors will be fuelled by environment-sensitive policies and the fast-paced growth of paper and packaging industries. The high-performance drying machinery will be spent liberally on the two countries as they build the demand for recyclable and degradable pack materials. Backed by their respective governments, green initiatives will accelerate the replacement of conventional energy-draining technologies with energy-saving ones, most specifically in segments which are seeking an exit out of plastic-packaged products.

With both nations aiming to minimize carbon footprints, producers will adopt renewable-powered drying technologies and AI-based moisture control to maximize production efficiency. FMI opines that the industry in Australia and New Zealand will grow at a CAGR of approximately 4.6% from 2025 to 2035.

(Surveyed Q4 2024, n=450 stakeholder participants, including pulp and paper manufacturers, equipment suppliers, industry consultants, and sustainability experts across North America, Europe, and Asia-Pacific.)

Regional Difference

72% of large-scale producers viewed high-efficiency drying systems as a long-term investment, whereas 45% of mid-cap companies found initial costs prohibitive.

Material & Technology Preferences

Regional Variance

Raw Material Price Volatility: 79% named increased steel and component prices as the key inhibitor for equipment upgrade.

Regional Differences

Manufacturers

End-Users

75% of producers aimed to invest in next-generation drying technology within the decade.

Regional Focus Areas

Policy & Regulatory Impact

High Consensus: Energy efficiency, automation, and sustainability are core concerns.

Key Regional Variances

Strategic Insight

| Country | Government Policies & Regulatory Impact |

|---|---|

| United States | The EPA Clean Air Act mandatorily controls industrial drying techniques with tough emission standards. It is required to meet the efficiency standards provided by the Department of Energy (DOE) in order to conduct business. Voluntary certifications like ENERGY STAR for industrial equipment are promoted. |

| India | The Bureau of Energy Efficiency (BEE) supports energy-saving technologies. The Paper and Pulp Industry Development Council promotes green manufacturing. The Environmental Protection Act is followed by companies, with an emphasis on wastewater treatment and emissions. |

| China | The government's Five-Year Plan emphasizes low-carbon manufacturing. Green Factory certifications and the implementation of energy efficiency standards set by the National Development and Reform Commission (NDRC) are mandatory for industries. Importation of old drying equipment is restricted. |

| United Kingdom | The UK Emissions Trading Scheme (UK ETS) charges industrial emissions carbon pricing. Large manufacturers are required to comply with the Energy Savings Opportunity Scheme (ESOS) by the government. CE marking is necessary for industrial machinery. |

| Germany | The German Energy Act encourages energy-efficient industrial production. Blue Angel eco-label certification is preferred for eco-friendly production. Firms are required to conform to the Federal Emission Control Act (BImSchG). |

| South Korea | The Green Growth Policy encourages investment in environmentally friendly industrial machinery. Industries have to comply with the Air Conservation Act, which controls the emissions from the drying of pulp. KS certification is compulsory for industrial equipment. |

| Japan | The Energy Conservation Act requires improvement in the efficiency of pulp drying machinery. The government encourages low-energy industrial equipment subsidies. JIS certification is necessary for domestic industry compliance. |

| France | The French Environmental Code imposes stringent control of pollution in industrial drying processes. Equipment sales require conformity to European CE marking and eco-labeling. There are tax incentives for using energy-efficient technology. |

| Italy | Industrial efficiency is a priority of the National Energy Strategy. The EU rules on industrial emissions need to be followed by companies and CE certification is required. Investment in advanced pulp drying technology is supported by government grants. |

| Australia-New Zealand | The Clean Energy Regulator implements carbon-cutting policies. The Australian Industrial Energy Efficiency Program promotes sustainable production practices. AS/NZS industrial safety and energy efficiency standards must be followed by companies. |

Incorporating advanced drying technologies such as vacuum drying and superheated steam systems can reduce energy expenses while increasing productivity. Extending into fast-growing sectors of South Asia and Africa is a prime opportunity, with increasing demand for packing materials.

Localized manufacturing and joint ventures can assist in overcoming regulatory ecosystems while taking share in emerging sectors. Furthermore, creating drying systems for lightweight and biodegradable packaging will be in sync with changing consumer and industrial trends.

Regulatory adherence is becoming a industry differentiator. Providing pre-certified, energy-efficient equipment that complies with stringent certifications such as Energy Star (USA) or Blue Angel (Germany) will ease adoption. Vertical integration with the pulp and paper industry can lead to proprietary solutions, obtaining long-term contracts and exclusivity. Predictive maintenance and monitoring based on IoT will be important to minimize downtime and maximize efficiency.

The industry for pulp drying equipment is moderately fragmented, with many regional and international players vying for market share. Top players in the pulp drying equipment industry are emphasizing technological innovation, strategic alliances, and geographic expansion to enhance their industry positions. Competitive pricing continues to be a strategy, but differentiation based on cutting-edge technologies and full-service offerings is becoming more common.

In 2024, Suzano's Imperatriz mill partnered with ANDRITZ to introduce artificial intelligence and smart controls in their pulp drying machines, which lowered unproductive time considerably and accelerated their digital transformation journey. In June 2024, Valmet and Flootech formed a partnership to develop water treatment solutions for the board, paper, and tissue industry to provide cost-effective and efficient water treatment solutions to customers.

Valmet enhanced its roll services for the EMEA region in August 2024, enabling its entire-scope roll technology and services to be more readily available and affordable to pulp and paper manufacturers with small and medium-sized machines.

Valmet ~30-35%

Valmet is a leading global provider of pulp, paper, and energy technologies, offering superior drying solutions and being one of the leading players in the pulp drying equipment industry.

Andritz ~25-30%

Andritz provides extensive pulp drying and processing equipment, placing great emphasis on innovation and environmental sustainability.

Voith Group ~15-20%

Voith is recognized for its innovative pulp drying and papermaking technologies for the global pulp and paper industry.

Kadant ~10-15%

Kadant is a company that deals in fluid handling and drying systems, such as pulp drying equipment, for the pulp and paper sector.

Beloit Corporation ~5-10%

Beloit Corporation, now owned by Kadant, is a renowned brand in pulp drying and papermaking machinery.

Metso Outotec ~5-10%

Metso Outotec offers a variety of equipment for the pulp and paper sector, including drying solutions.

Rotary Drying System, Flash Drying System, Ring-Type Drying System

Printing and Writing Industry, Pulp and Paper Industry, Packaging Industry, Other End Use

North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East and Africa

Tighter carbon controls and the drive for energy efficiency are leading manufacturers to invest in renewable-fueled and low-emission drying technology.

AI-powered monitoring and predictive maintenance are reducing downtime, maximizing resource utilization, and minimizing waste in production.

Increasing cost of logistics and regulatory pressure on single-use plastics are propelling the need for next-generation drying equipment to make high-strength, low-weight materials.

Trade barriers and supply chain disruption are leading firms to localize production and lock in regional supplier networks for key components.

Leading players are signing long-term deals with large paper manufacturers, investing in AI-based drying solutions, and buying local companies to increase their presence.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Type, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 16: Latin America Market Volume (Units) Forecast by Type, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 21: Western Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 22: Western Europe Market Volume (Units) Forecast by Type, 2019 to 2034

Table 23: Western Europe Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 24: Western Europe Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 28: Eastern Europe Market Volume (Units) Forecast by Type, 2019 to 2034

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 30: Eastern Europe Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Type, 2019 to 2034

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 36: South Asia and Pacific Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 39: East Asia Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 40: East Asia Market Volume (Units) Forecast by Type, 2019 to 2034

Table 41: East Asia Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 42: East Asia Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 46: Middle East and Africa Market Volume (Units) Forecast by Type, 2019 to 2034

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 48: Middle East and Africa Market Volume (Units) Forecast by End Use, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by End Use, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 9: Global Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 13: Global Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 16: Global Market Attractiveness by Type, 2024 to 2034

Figure 17: Global Market Attractiveness by End Use, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by Type, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by End Use, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 27: North America Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 31: North America Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 34: North America Market Attractiveness by Type, 2024 to 2034

Figure 35: North America Market Attractiveness by End Use, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by Type, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by End Use, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 45: Latin America Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 49: Latin America Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Type, 2024 to 2034

Figure 53: Latin America Market Attractiveness by End Use, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 56: Western Europe Market Value (US$ Million) by End Use, 2024 to 2034

Figure 57: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 63: Western Europe Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 66: Western Europe Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 67: Western Europe Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 70: Western Europe Market Attractiveness by Type, 2024 to 2034

Figure 71: Western Europe Market Attractiveness by End Use, 2024 to 2034

Figure 72: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: Eastern Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 74: Eastern Europe Market Value (US$ Million) by End Use, 2024 to 2034

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 81: Eastern Europe Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 85: Eastern Europe Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 88: Eastern Europe Market Attractiveness by Type, 2024 to 2034

Figure 89: Eastern Europe Market Attractiveness by End Use, 2024 to 2034

Figure 90: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia and Pacific Market Value (US$ Million) by Type, 2024 to 2034

Figure 92: South Asia and Pacific Market Value (US$ Million) by End Use, 2024 to 2034

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 106: South Asia and Pacific Market Attractiveness by Type, 2024 to 2034

Figure 107: South Asia and Pacific Market Attractiveness by End Use, 2024 to 2034

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 109: East Asia Market Value (US$ Million) by Type, 2024 to 2034

Figure 110: East Asia Market Value (US$ Million) by End Use, 2024 to 2034

Figure 111: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: East Asia Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 117: East Asia Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 120: East Asia Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 121: East Asia Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 124: East Asia Market Attractiveness by Type, 2024 to 2034

Figure 125: East Asia Market Attractiveness by End Use, 2024 to 2034

Figure 126: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 127: Middle East and Africa Market Value (US$ Million) by Type, 2024 to 2034

Figure 128: Middle East and Africa Market Value (US$ Million) by End Use, 2024 to 2034

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 139: Middle East and Africa Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 142: Middle East and Africa Market Attractiveness by Type, 2024 to 2034

Figure 143: Middle East and Africa Market Attractiveness by End Use, 2024 to 2034

Figure 144: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pulp Roll Cradle Market Forecast and Outlook 2025 to 2035

Pulp Molding Tooling Market Size and Share Forecast Outlook 2025 to 2035

Pulp Liner Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Pulpwood Market Size and Share Forecast Outlook 2025 to 2035

Pulp Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Pulp Moulding Tooling Market

Pulp Cells Market

Pulp Washing Equipment Market

Repulpable Tape Market Size and Share Forecast Outlook 2025 to 2035

Beet Pulp Market Size and Share Forecast Outlook 2025 to 2035

Hydrapulper Market Size and Share Forecast Outlook 2025 to 2035

Wood Pulp Market Analysis – Demand & Growth Forecast 2024-2034

Drum Pulper Market

Citrus Pulp Fiber Market Size and Share Forecast Outlook 2025 to 2035

Molded Pulp Packaging Market Size and Share Forecast Outlook 2025 to 2035

Molded Pulp Basket Market Size and Share Forecast Outlook 2025 to 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Citrus Pulp Market Analysis - Trends & Growth Forecast 2025 to 2035

Market Share Breakdown of the Molded Pulp Basket Industry

Hardwood Pulp Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA