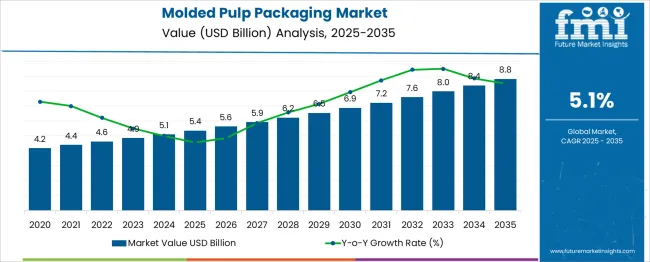

The molded pulp packaging market is estimated to be valued at USD 5.4 billion in 2025 and is projected to reach USD 8.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period. From 2025 to 2030, the market is expected to advance from approximately USD 5.4 billion to USD 6.9 billion, driven by rising demand for biodegradable and recyclable packaging solutions across food service, electronics, and consumer goods sectors.

Year-on-year analysis shows a steady increase, with values reaching USD 5.6 billion in 2026 and USD 5.9 billion in 2027, supported by eco-friendly packaging mandates and the shift away from plastic. By 2028, the market is projected to grow to USD 6.2 billion, advancing to USD 6.5 billion in 2029 and USD 6.9 billion by 2030. Advancements in molded fiber technology for enhanced durability, printability, and design versatility are expected to accelerate adoption. Expansion in e-commerce packaging and protective solutions for fragile products will further stimulate market penetration.

These factors position molded pulp packaging as a sustainable and cost-effective alternative for businesses aiming to reduce environmental impact while meeting regulatory standards and consumer expectations for responsible packaging practices.

| Metric | Value |

|---|---|

| Molded Pulp Packaging Market Estimated Value in (2025 E) | USD 5.4 billion |

| Molded Pulp Packaging Market Forecast Value in (2035 F) | USD 8.8 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The molded pulp packaging market occupies an important position within the eco-friendly and protective packaging landscape. In the sustainable packaging market, its share is approximately 10–12%, driven by rising demand for biodegradable alternatives to plastic. Within the paper and pulp packaging market, molded pulp accounts for around 8–9%, as corrugated and carton packaging remain dominant. In the protective packaging market, its share is nearly 6–7%, given its application in cushioning fragile goods such as electronics, glassware, and industrial components.

For the foodservice packaging market, the share stands at 5–6%, with adoption growing in trays, clamshells, and takeaway containers. In the consumer goods and electronics packaging market, molded pulp represents about 4–5%, due to its role in sustainable protective inserts for high-value items. Increasing environmental regulations, bans on single-use plastics, and consumer inclination toward eco-conscious products are driving this market’s growth globally.

Technological advancements, such as thermoformed and colored molded pulp, have expanded its application across premium product packaging. Moreover, e-commerce penetration and the need for shock-resistant, recyclable packaging solutions are reinforcing adoption across multiple industries. As companies prioritize sustainability goals and brand differentiation, molded pulp packaging is expected to gain a higher share in these parent markets over the next decade.

Rising concerns over plastic waste and stricter regulatory environments have encouraged industries to adopt molded pulp as a viable alternative. The market is being shaped by innovation in material compositions and manufacturing processes that enhance product durability and aesthetic appeal while maintaining eco-friendliness. Future growth is expected to be fueled by wider acceptance in premium and mid-tier packaging segments, driven by both environmental responsibility and consumer preference for natural-looking, recyclable packaging.

Strategic investments in automation and scale efficiencies are paving the way for reduced costs and higher production capacities, positioning molded pulp as a competitive choice in both developed and emerging markets.

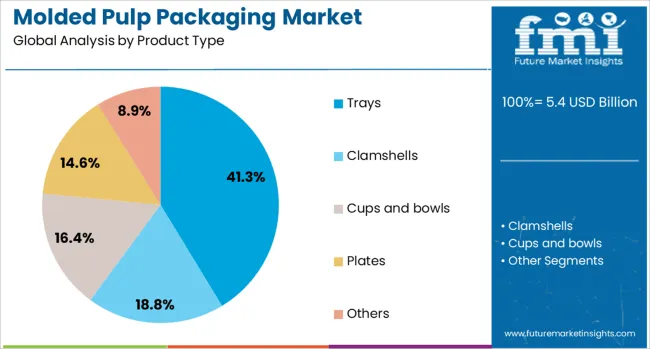

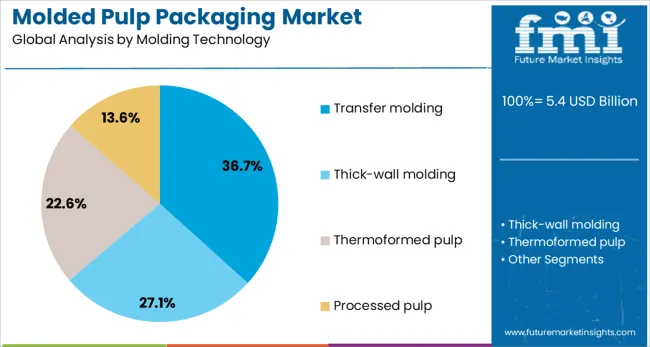

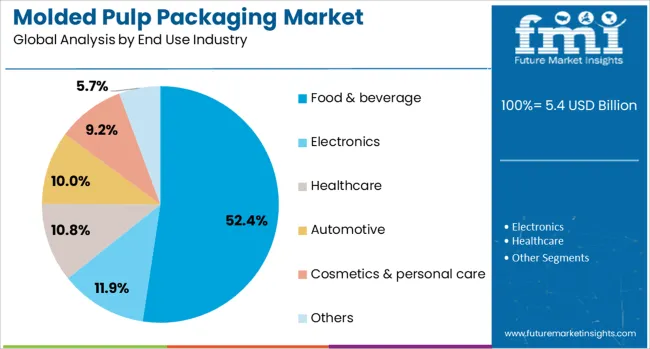

The molded pulp packaging market is segmented by product type, molding technology, end-use industry, and geographic regions. The molded pulp packaging market is divided by product type into Trays, Clamshells, Cups and bowls, Plates, and Others. In terms of molding technology, the molded pulp packaging market is classified into Transfer molding, Thick-wall molding, Thermoformed pulp, and processed pulp. Based on the end-use industry, the molded pulp packaging market is segmented into Food & beverage, Electronics, Healthcare, Automotive, Cosmetics & personal care, and Others. Regionally, the molded pulp packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by product type, trays are anticipated to account for 41.3% of the total market revenue in 2025, making them the dominant product category. This leadership is attributed to the functional versatility of trays in protecting, displaying, and transporting products across various industries.

The ability to offer compartmentalized, stackable, and durable solutions has supported their adoption, particularly in high-volume applications. Continuous improvements in tray design to enhance strength, reduce weight, and improve printability have also contributed to their appeal.

Their compatibility with automated filling and handling systems further strengthens their position, as operational efficiency becomes a key driver for manufacturers and end users.

By molding technology, transfer molding is projected to command 36.7% of the total market revenue in 2025, retaining its lead among available techniques. This dominance is driven by its capacity to produce intricate, uniform, and higher-quality products at a competitive cost.

The efficiency of transfer molding in achieving consistent wall thickness and smooth surfaces has made it preferable for premium packaging requirements. Its suitability for both small and large production runs has enabled manufacturers to cater to a diverse set of clients while maintaining economies of scale.

Additionally, the adaptability of transfer molding to work with different pulp materials and achieve faster cycle times has reinforced its continued leadership.

When segmented by end use industry, the food and beverage sector is expected to represent 52.4% of the total market revenue in 2025, securing its place as the most prominent industry segment. This prominence is driven by stringent hygiene standards, growing demand for sustainable foodservice disposables, and the need for packaging that maintains product freshness and integrity.

The sector’s high consumption volumes and rapid turnover rates have created a favorable environment for molded pulp products, which are perceived as both functional and environmentally responsible. Evolving consumer preferences toward eco-friendly dining and takeout experiences have accelerated adoption.

Regulatory mandates on single-use plastics in foodservice applications have acted as a catalyst for wider integration of molded pulp solutions in this industry.

The molded pulp packaging market is expanding as demand grows for renewable and reusable packaging solutions across industries. In 2024, adoption surged in foodservice and consumer products where protective and compostable packaging was valued. By 2025, retailers and e-commerce brands increasingly specified molded pulp packaging for fragile goods, meal kits, and electronics. Manufacturers offering high‑performance pulp forms with consistent structure and customization options are positioned to capture demand within logistics‑focused and aesthetic‑oriented packaging segments.

Strong emphasis on sustainable product protection has positioned molded pulp packaging as a preferred alternative to plastic-based cushions and trays. In 2024, food delivery and consumer electronics brands chose pulp-based inserts for shock absorption during transit, supporting both durability and environmental image. In 2025, meal-kit and cosmetic subscription services adopted molded pulp fiber trays and mailers that resist deformation and leakage without requiring foam or plastic. These shifts show that functional packaging performance—not simply cost containment—is shaping procurement choices. Suppliers delivering molded pulp solutions with validated strength ratings, moisture resistance, and dimensional accuracy are emerging as key partners for protective packaging needs.

Advances in molded pulp design flexibility are opening new commercial opportunities for brands. In 2024, companies began exploring custom-shaped pulp packaging for branded presentation of consumer products and food kits, offering aesthetic consistency alongside functionality. By 2025, premium beauty and electronics companies requested bespoke molded pulp packaging with embossed branding and unique geometries for unboxing experiences. This evolution indicates that molded pulp can serve not just practical protection but also brand storytelling. Suppliers capable of delivering high-fidelity custom molds, decorative surface textures, and package personalization are well positioned to serve companies seeking both protection and premium package design.

In 2024 and 2025 it was observed that fluctuations in recycled pulp costs significantly affected profit margins across molded pulp operations. Packaging firms faced unpredictability due to volatile procurement pricing for raw fibers, especially wood-derived or agricultural waste sources, which comprise over 80% of the supply. These material cost swings were reported to constrain pricing flexibility in end-use sectors such as food service and electronics. Smaller converters in Asia Pacific and Latin America were noted to struggle with sudden input cost surges, eroding competitive pricing. Unless fiber sourcing is stabilized or hedged effectively, margin compression may persist as a primary barrier to expansion

Between 2024 and 2025, it was noted that bespoke molded pulp formats were increasingly supplied to food, electronics and healthcare segments. Firms introduced tailored trays, clamshells and inserts shaped to deliver optimal protective fit and branded aesthetics, especially for sensitivity‑prone products. The trays segment held a dominant share in 2024 while clamshell formats expanded rapidly, reflecting demand for packaging that fits delicate items with minimal waste. This trend signals one clear opportunity for providers to differentiate via precision‑engineered pulp designs that meet industry‑specific requirements and support premium positioning.

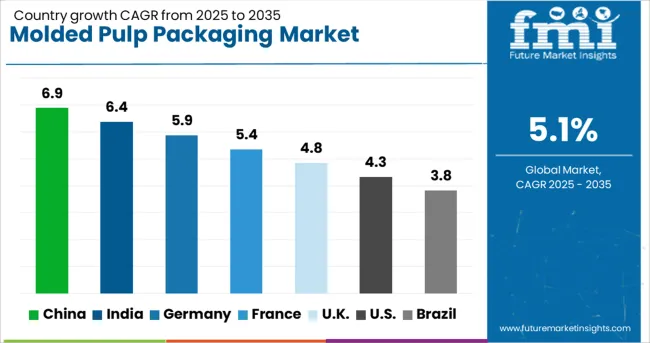

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global molded pulp packaging market is expected to grow at a CAGR of 5.1% from 2025 to 2035. China leads with 6.9%, followed by India at 6.4% and Germany at 5.9%. France posts 5.4%, while the United Kingdom stands at 4.8%. Growth is driven by increasing demand for eco-friendly packaging and regulatory pressure to reduce single-use plastics. China and India dominate due to strong e-commerce penetration and large-scale manufacturing. Germany emphasizes high-quality molded pulp for electronics and premium products. France and the UK focus on lightweight, recyclable designs catering to foodservice and sustainable retail packaging.

China is forecast to grow at 6.9%, supported by high demand from electronics, e-commerce, and foodservice industries. Advanced molded pulp solutions dominate protective packaging for fragile goods. Manufacturers invest in automated molding technologies for cost efficiency and scalability. Export-driven growth in sustainable packaging strengthens China’s leadership in global markets.

India is projected to grow at 6.4%, driven by foodservice growth, retail packaging needs, and increased demand for sustainable alternatives. Low-cost molded pulp trays dominate quick-service restaurant chains. Manufacturers adopt water-resistant coatings to expand use in fresh food delivery. Rising focus on biodegradable packaging in government initiatives accelerates industry adoption.

Germany is expected to grow at 5.9%, supported by strong demand for sustainable packaging solutions in electronics and premium consumer goods. High-strength molded pulp packaging dominates fragile item protection. Manufacturers integrate precision molding and automated drying systems to achieve consistency. Compliance with EU circular economy goals further accelerates eco-friendly packaging adoption.

France is forecast to grow at 5.4%, driven by adoption in foodservice packaging and retail-ready solutions. Lightweight molded pulp containers dominate bakery and café applications. Manufacturers focus on color customization and branding to attract premium food brands. Increased demand for home-delivery packaging strengthens growth in metropolitan areas.

The UK is projected to grow at 4.8%, supported by consumer preference for sustainable packaging and stringent anti-plastic regulations. Egg trays and cup carriers dominate usage in food retail chains. Manufacturers innovate with compostable coatings to improve moisture resistance. Private-label grocery brands invest in molded pulp packaging for eco-certifications.

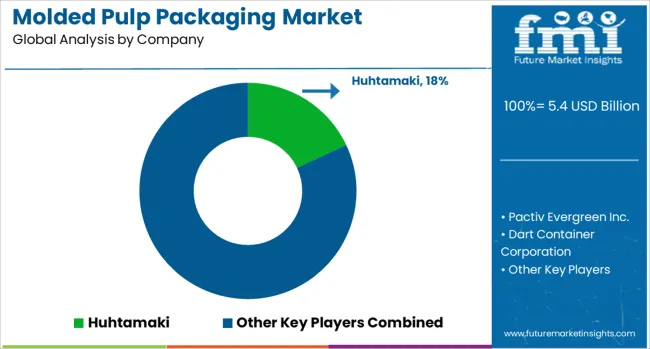

The molded pulp packaging market is moderately consolidated, with Huhtamaki holding a significant position due to its extensive global manufacturing footprint, sustainable product portfolio, and strong relationships with major foodservice brands. The company’s expertise in fiber-based packaging solutions positions it as a leading supplier for eco-friendly and recyclable alternatives to plastic packaging.

Key players include Pactiv Evergreen Inc., Dart Container Corporation, UFP Technologies, Inc., Eco Pulp Packaging, and Henry Molded Products Inc. These companies offer molded pulp solutions for a wide range of applications such as protective packaging, food trays, beverage carriers, and electronics cushioning. They focus on delivering high-strength, biodegradable products designed to meet stringent environmental compliance standards.

Market growth is being driven by increasing regulatory restrictions on single-use plastics, consumer preference for sustainable packaging, and the rapid expansion of e-commerce and food delivery services. Leading manufacturers are investing in advanced molding technologies, lightweight designs, and water-resistant coatings to enhance performance and expand applicability.

Emerging trends include the development of custom-shaped molded pulp packaging for electronics and premium consumer goods, as well as the integration of automated production systems to improve scalability and cost efficiency. Asia-Pacific and North America are expected to remain key growth regions due to rising demand from quick-service restaurants and online retail platforms.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.4 Billion |

| Product Type | Trays, Clamshells, Cups and bowls, Plates, and Others |

| Molding Technology | Transfer molding, Thick-wall molding, Thermoformed pulp, and Processed pulp |

| End Use Industry | Food & beverage, Electronics, Healthcare, Automotive, Cosmetics & personal care, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Huhtamaki, Pactiv Evergreen Inc., Dart Container Corporation, UFP Technologies, Inc., Eco Pulp Packaging, and Henry Molded Products Inc. |

| Additional Attributes | Dollar sales by product type (trays, clamshells, cups), Dollar sales by molding technology (transfer, thermoformed, thick wall), regional demand trends, competitive landscape, buyer preferences for sustainable alternatives, integration with foodservice and e-commerce, innovations in biodegradable coatings and automated molding systems. |

The global molded pulp packaging market is estimated to be valued at USD 5.4 billion in 2025.

The market size for the molded pulp packaging market is projected to reach USD 8.8 billion by 2035.

The molded pulp packaging market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in molded pulp packaging market are trays, clamshells, cups and bowls, plates and others.

In terms of molding technology, transfer molding segment to command 36.7% share in the molded pulp packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Molded Fiber Pulp Packaging Industry Analysis in Australia and New Zealand Forecast Outlook 2025 to 2035

Molded Fiber Pulp Packaging Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Pulp Packaging Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Pulp Packaging industry Analysis in USA and Canada - Size, Share, and Forecast Outlook 2025 to 2035

Market Share Breakdown of Molded Fiber Pulp Packaging Providers

Europe Molded Fiber Pulp Packaging Market Analysis – Demand, Growth & Future Outlook 2024-2034

Japan Molded Fiber Pulp Packaging Market Trends – Growth & Forecast 2023-2033

Korea Molded Fiber Pulp Packaging Market Insights – Trends & Forecast 2023-2033

Western Europe Molded Fiber Pulp Packaging Market Insights – Growth & Forecast 2023-2033

Breaking Down Market Share in Europe Molded Fiber Pulp Packaging

Market Share Breakdown of USA and Canada Molded Fiber Pulp Packaging Manufacturers

Molded Wood Pallets Market Forecast and Outlook 2025 to 2035

Molded Fiber Bowl Market Size and Share Forecast Outlook 2025 to 2035

Molded FRP Grating Market Size and Share Forecast Outlook 2025 to 2035

Molded Foam Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Cup Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Wine Packs Market Size and Share Forecast Outlook 2025 to 2035

Molded Underfill Material Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber End Caps Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA