The Molded Fiber Pulp Packaging market in Australia and New Zealand is experiencing consistent growth driven by increasing environmental awareness and the shift towards sustainable packaging solutions. The future outlook for this market is strongly influenced by regulatory support for eco-friendly materials and the rising demand from food, beverage, and consumer goods sectors. Increasing adoption of biodegradable and recyclable packaging alternatives is reducing reliance on conventional plastics, further accelerating market expansion.

The market is also benefiting from advancements in molding technologies that enhance durability, strength, and cost efficiency of fiber pulp packaging. Growth is being propelled by the need for lightweight, protective, and customizable packaging solutions that align with sustainability goals.

Additionally, consumer preference for environmentally responsible brands is contributing to higher adoption rates, particularly in retail and e-commerce sectors Continuous investments in research, production efficiency, and waste reduction practices are expected to support the long-term growth of the molded fiber pulp packaging market across Australia and New Zealand.

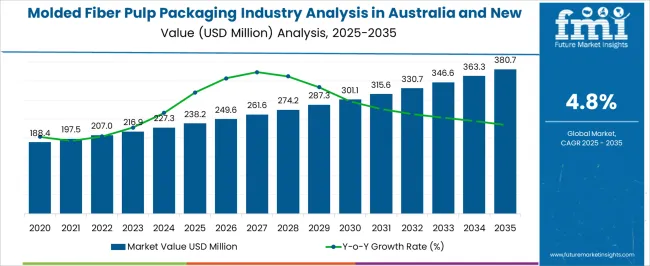

| Metric | Value |

|---|---|

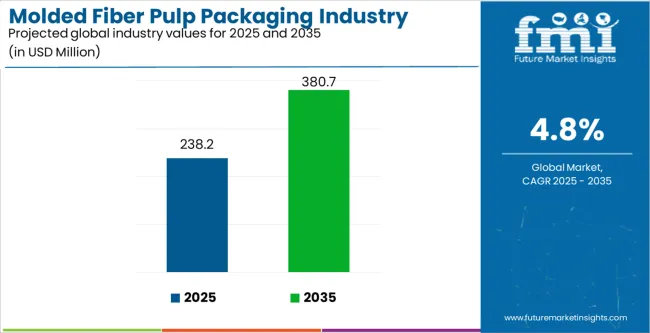

| Molded Fiber Pulp Packaging Industry Analysis in Australia and New Zealand Estimated Value in (2025 E) | USD 238.2 million |

| Molded Fiber Pulp Packaging Industry Analysis in Australia and New Zealand Forecast Value in (2035 F) | USD 380.7 million |

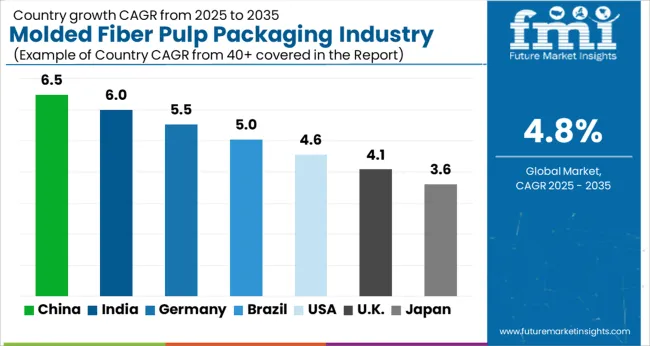

| Forecast CAGR (2025 to 2035) | 4.8% |

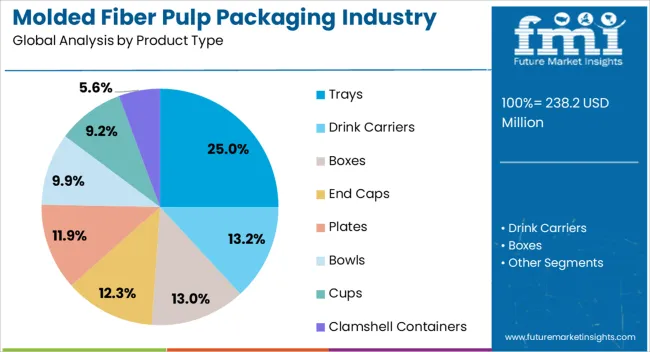

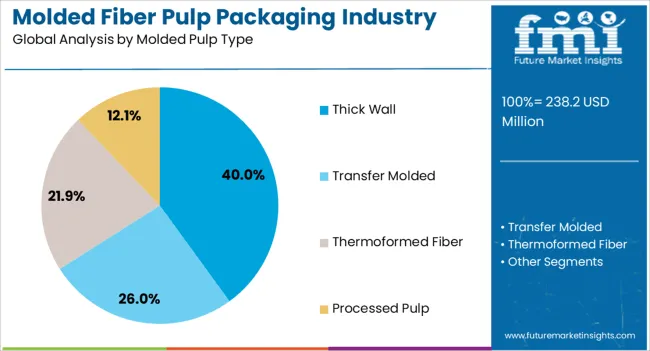

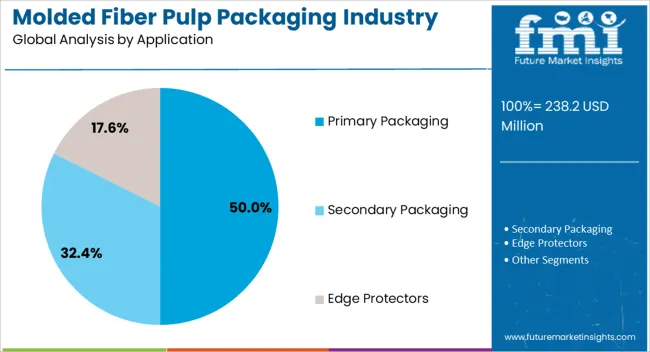

The market is segmented by Product Type, Molded Pulp Type, Application, and End Use and region. By Product Type, the market is divided into Trays, Drink Carriers, Boxes, End Caps, Plates, Bowls, Cups, and Clamshell Containers. In terms of Molded Pulp Type, the market is classified into Thick Wall, Transfer Molded, Thermoformed Fiber, and Processed Pulp. Based on Application, the market is segmented into Primary Packaging, Secondary Packaging, and Edge Protectors. By End Use, the market is divided into Consumer Durables, Food & Beverage, Cosmetics, Food Services, Healthcare, Automotive, Logistics, and Others (Candles, Flower Packaging). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The trays product type segment is projected to hold 25.0% of the molded fiber pulp packaging market revenue share in 2025, establishing it as a leading product type. The growth of this segment is driven by its versatility in protecting and presenting food and consumer goods, offering structural strength while maintaining environmental sustainability.

Trays provide efficient stacking, ease of handling, and enhanced protection during transportation, which is critical in the food and retail industries. Additionally, the ability to customize tray designs for different product dimensions and branding requirements has further supported its adoption.

Increasing demand for sustainable packaging in restaurants, supermarkets, and e-commerce packaging has reinforced the prominence of the trays segment The segment benefits from the overall shift towards eco-friendly packaging alternatives, as consumers and manufacturers prioritize reducing plastic usage and adopting recyclable solutions.

The thick wall molded pulp type segment is expected to account for 40.0% of the molded fiber pulp packaging market revenue share in 2025, making it the leading molded pulp type. The segment has been driven by its superior durability and protective qualities, which are essential for fragile and high-value products during storage and transportation.

Thick wall pulp packaging provides enhanced impact resistance, moisture protection, and structural integrity compared to standard pulp packaging. Adoption is further supported by innovations in pulp molding technology that allow cost-effective production without compromising performance.

Growing emphasis on sustainable supply chains and compliance with environmental standards has reinforced the use of thick wall molded pulp packaging across various industries Its reliability, combined with alignment to sustainability goals, has solidified its dominant position in the market.

The primary packaging application segment is anticipated to hold 50.0% of the molded fiber pulp packaging market revenue share in 2025, making it the leading application. The growth of this segment is fueled by the increasing need for protective and sustainable packaging that comes into direct contact with products, particularly in food and consumer goods industries.

Primary packaging solutions help maintain product quality, extend shelf life, and ensure safe transportation while meeting consumer expectations for environmentally responsible packaging. The segment benefits from rising adoption of molded fiber pulp in retail-ready packaging and e-commerce shipments, where product safety and sustainability are priorities.

Enhanced design flexibility, combined with the segment’s alignment with regulatory and consumer sustainability demands, continues to drive the prominence of primary packaging in the molded fiber pulp packaging market.

The industry in Australia & New Zealand recorded a CAGR of 3.8% during the historical period. It attained a valuation of USD 238.2.0 million in 2025.

Government agencies in Australia & New Zealand are taking steps to promote the use of biodegradable and compostable packaging materials. The Australian Government has banned single-use plastic bags. Such bans have translated into pushing the demand for pulp packaging solutions.

Manufacturers looking for protective and specialty retail packaging with high aesthetics are projected to adopt molded fiber packaging. Customization features and the inexpensive nature of molded fiber pulp packaging allow its expansion across various sectors.

Emergence of Online Food Services

Australia and New Zealand, like any other country, are experiencing remarkable growth in online food delivery services, which is contributing to the industry’s expansion. Pulp packaging is a great choice for packaging food items as it can cut down the waste created by plastic packaging.

Consumers nowadays are embracing eco-friendly packaging options as sustainability has become an important factor. This has led to its increased use in online food delivery services. Implementation of stringent government regulations regarding plastic usage in both countries is also pushing its application in food packaging.

Technological innovations in the manufacturing sector have led to the development of superior techniques for printing and coating molded fiber pulp products. The use of bio-based coatings in paper-based packaging is gaining traction in the industry, as it maintains the sustainable nature of the product and enhances its moisture resistance & printability.

For instance, Earthodic Pty Ltd, an Australia-based manufacturer, offers Biobarc™, a unique bio-based, water-resistant coating that meets the demand for eco-friendly paper coating solutions. The application of bio-based coatings has started to emerge in molded fiber pulp packaging. It is projected to boost the usage of these products for protective packaging.

Development in manufacturing technologies in the molded fiber industry is encouraging manufacturers to create products with appealing aesthetics. This has broadened its application across several industries as unique coating solutions offer moisture-resistant properties and better printability features.

| Particular | Value CAGR |

|---|---|

| H1(2025 to 2035) | 4.5% |

| H2(2025 to 2035) | 5.3% |

| H1(2025 to 2035) | 5.2% |

| H2(2025 to 2035) | 4.7% |

The table below shows the CAGRs of Australia and New Zealand. New Zealand is anticipated to remain at the forefront by showcasing a CAGR of 5.8% from 2025 to 2035. Australia, on the other hand, is estimated to witness a steady CAGR of 4.5% through 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| Australia | 4.5% |

| New Zealand | 5.8% |

New Zealand’s industry is estimated to be valued at USD 238.2 million by 2025. It is set to generate an incremental dollar opportunity worth USD 380.7 million by 2035, growing at 5.8% CAGR during the assessment period.

New Zealand has a growing retail sector that is demanding eco-friendly and versatile packaging solutions. The New Zealand Government has reported that the retail sales recorded were USD 238.2 billion for the September 2025 quarter. Also, th country has transformed to become carbon neutral. It is slowly embracing sustainability, which can propel the demand for pulp packaging.

Australia’s molded fiber pulp packaging industry is projected to reach a valuation of USD 239.2 million, broadening 1.4 times its current value by 2035. The country’s government reported that it has banned the usage of problematic single-use plastics, including plastic straws, cutlery, stirrers, plates, cotton buds sticks, EPS food service items, and drink containers. The government also plans to introduce mandatory requirements for compostable and reusable alternatives to single-use plastics.

Pollution of waterways and harm to marine life has become a key issue in Australia. It is estimated that around 130,000 tons of plastic waste end up in the environment each year, with single-use plastics being a significant contributor.

Demand for sustainable packaging solutions is rising remarkably in Australia due to escalating environmental concerns. The shift toward the use of biodegradable and compostable packaging materials in the country is pushing the demand for pulp packaging.

The section below explains different types of segments present in the regional industry. The table contains the CAGRs of the dominant segments under numerous categories. Based on product type, the clamshell container segment is set to witness a CAGR of 5.6% through 2035. By end-use, the food & beverage segment is anticipated to showcase a CAGR of around 4.0% in 2035.

Trays and clamshells made from molded fiber pulp are set to remain highly preferred by today’s customers. Both segments together are projected to capture around 65% of the molded fiber pulp packaging industry share in Australia & New Zealand.

Molded fiber pulp trays and clamshells are excellent options for food packaging as they can protect food products and maintain their freshness & quality. Trays and clamshells can be designed to accommodate specific food products, such as fruits, vegetables, meat, and poultry. This reduces the risk of damage during transportation and storage.

Trays and clamshells are also grease and moisture-resistant, which makes them ideal for packaging food products that are too oily and greasy. The food industry in Australia & New Zealand has been growing due to population growth, rising disposable income, and changing consumer preferences. This growth in the food industry is creating lucrative opportunities for the industry.

Industry Growth Outlook by End-use

| End-use | Value CAGR (2025 to 2035) |

|---|---|

| Food & Beverage | 4.0% |

| Food Services | 3.4% |

The food and beverage industry is projected to rise at a CAGR of 4.0% and generate an incremental revenue opportunity worth USD 48.9 million during the forecast period. The rising adoption of pulp packaging, especially for eggs, fruits, and fast food products, is influencing the segment’s growth.

The food & beverage industry is growing rapidly due to rising consumer preference for processed and convenient packaged foods. Molded fiber pulp offers additional benefits over other production methods, such as easy operation, less maintenance, time-saving property, and cost-effectiveness.

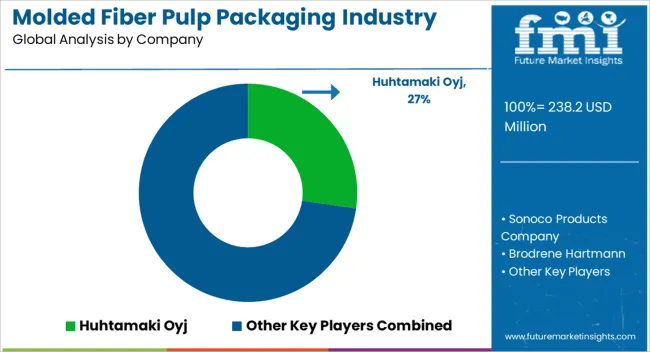

Leading industry players in Australia and New Zealand are ramping up their production capacities to meet the high demand from customers. This demand is mainly fueled by a consumer-driven shift from plastic to molded fiber.

Companies are extending their presence by investing in novel technology and infrastructure. They are also joining hands with different firms in emerging countries.

For instance

| Attribute | Details |

|---|---|

| Estimated Industry Size (2025) | USD 227.3 million |

| Projected Industry Size (2035) | USD 363.4 million |

| Growth Rate (2025 to 2035) | 4.8% CAGR |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million, Volume in tons, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Product Type, Molded Pulp Type, Application, End-use, Country |

| Key Countries Covered | Australia, New Zealand |

| Key Companies Profiled | Huhtamaki Oyj; Sonoco Products Company; Brodrene Hartmann; Hawk Group; EnviroPAK Corporation; Australia Pak Pty Ltd; Zume Inc.; Greenomics; Jenkins Freshpac Systems |

The global molded fiber pulp packaging industry analysis in australia and new zealand is estimated to be valued at USD 238.2 million in 2025.

The market size for the molded fiber pulp packaging industry analysis in australia and new zealand is projected to reach USD 380.7 million by 2035.

The molded fiber pulp packaging industry analysis in australia and new zealand is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in molded fiber pulp packaging industry analysis in australia and new zealand are trays, drink carriers, _2 cups, _4 cups, _6 cups, _more than 8 cups, boxes, end caps, plates, bowls, cups and clamshell containers.

In terms of molded pulp type, thick wall segment to command 40.0% share in the molded fiber pulp packaging industry analysis in australia and new zealand in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Molded Wood Pallets Market Forecast and Outlook 2025 to 2035

Molded Foam Market Size and Share Forecast Outlook 2025 to 2035

Molded Underfill Material Market Size and Share Forecast Outlook 2025 to 2035

Molded Case Circuit Breaker (MCCB) Market Growth – Trends & Forecast 2023-2033

Molded Interconnect Devices (MID) Market

Molded FRP Grating Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Molded Wood Pallets Market Share

Molded Pulp Basket Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of the Molded Pulp Basket Industry

Molded Pulp Packaging Market Size and Share Forecast Outlook 2025 to 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Molded Fiber Bowl Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Cup Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber End Caps Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Tray Market Trends – Growth & Forecast 2024-2034

Molded Fiber Wine Packs Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Containers Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Packaging Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Egg Packaging Market Forecast and Outlook 2025 to 2035

Molded Fiber Pulp Cap Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA