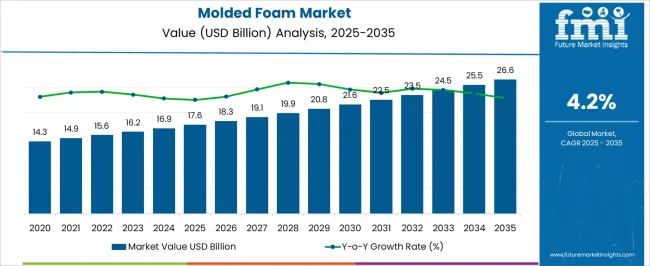

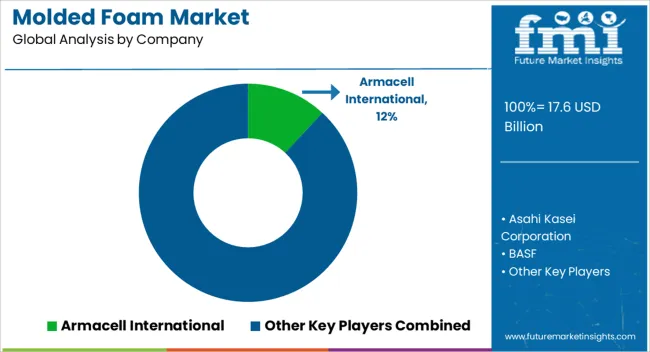

The molded foam market is expected to grow from USD 17.6 billion in 2025 to USD 26.6 billion by 2035, registering a 4.2% CAGR and generating an absolute dollar opportunity of USD 9.0 billion. Growth is driven by rising demand across automotive, packaging, construction, and furniture applications, where molded foam provides cushioning, thermal insulation, and lightweight structural support. Advancements in polyurethane, polystyrene, and polyethylene foam technologies, along with increasing use of environmentally friendly and recyclable materials, are contributing to market expansion.

Analysis of the growth rate volatility index indicates a relatively stable market with moderate fluctuations during the forecast period. The early years from 2025 to 2027 show minor volatility as mature markets in North America and Europe maintain steady consumption across automotive and construction sectors. Between 2028 and 2032, short-term volatility increases slightly due to rising demand in Asia Pacific and Latin America, driven by industrial growth, expanding automotive production, and urban infrastructure projects.

Post-2032, the index stabilizes as supply chains mature and market penetration increases. Regional analysis shows North America and Europe exhibiting low volatility due to established manufacturing and adoption, while Asia Pacific reflects higher short-term volatility influenced by economic growth and large-scale industrial developments. Overall, the molded foam market demonstrates a balanced growth curve, with the USD 9.0 billion opportunity supported by both replacement demand and new applications from 2025 to 2035.

| Metric | Value |

|---|---|

| Molded Foam Market Estimated Value in (2025 E) | USD 17.6 billion |

| Molded Foam Market Forecast Value in (2035 F) | USD 26.6 billion |

| Forecast CAGR (2025 to 2035) | 4.2% |

The molded foam market is driven by five primary parent markets, each contributing a specific share. The automotive sector leads with 35%, supported by the demand for lightweight, energy-absorbing materials in vehicle interiors and seating. The furniture industry accounts for 25%, where molded foams are widely used in cushions, mattresses, and upholstered furniture. Packaging applications hold 20%, driven by the need for protective and shock-absorbing solutions in shipping and e-commerce. The construction sector represents 15%, using molded foams for insulation, soundproofing, and structural components.

Electronics and appliances make up 5%, providing thermal and component protection in sensitive devices. Recent trends in the molded foam market emphasize sustainability, performance, and technological innovation. Manufacturers are increasingly adopting bio-based and recyclable materials to reduce environmental impact and comply with regulations. Advanced molding techniques, including precision molding and 3D printing, are enabling complex, customized designs.

Temperature-sensitive and pressure-sensitive foams are being introduced for automotive, healthcare, and packaging applications. Lightweight and energy-efficient materials are in high demand across industries, prompting innovation in foam density, durability, and versatility. Growing awareness of environmental impact and material efficiency continues to shape product development and market growth.

The molded foam market is experiencing steady expansion, driven by its diverse applications across automotive, furniture, construction, and packaging industries. Industry developments and manufacturing trends have underscored molded foam’s versatility, lightweight properties, and cushioning performance as key drivers of adoption. Advancements in molding technologies have enhanced precision, density control, and customization capabilities, enabling manufacturers to meet industry-specific performance requirements.

The growing emphasis on energy efficiency and material durability in end-use sectors has also supported the use of molded foam in both functional and aesthetic applications. Furthermore, the rising demand for ergonomic and comfort-oriented products in automotive seating and office furniture is boosting market growth.

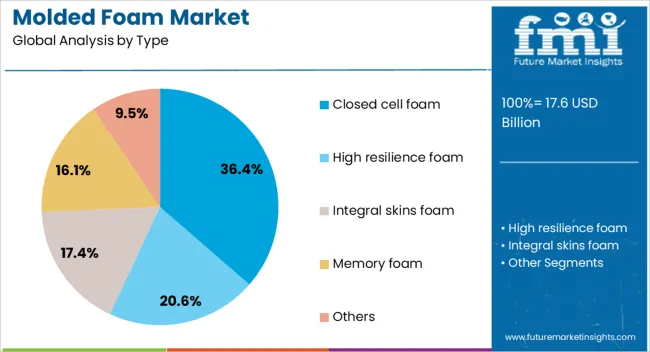

Sustainable manufacturing practices, including the integration of recyclable materials and bio-based feedstocks, are beginning to influence procurement preferences, particularly in markets with strict environmental regulations. Moving forward, demand is expected to be led by closed cell foam for its durability, rigid forms for structural performance, and seating applications due to the need for comfort and support in high-use environments.

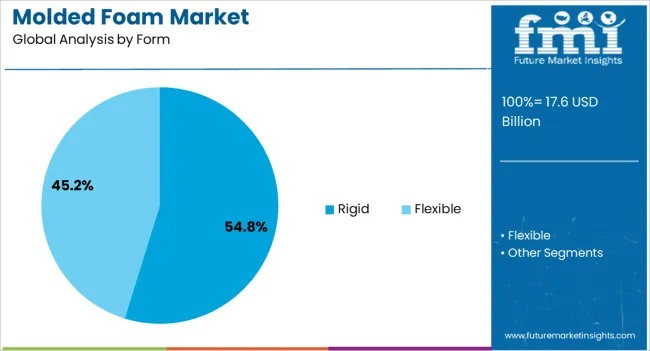

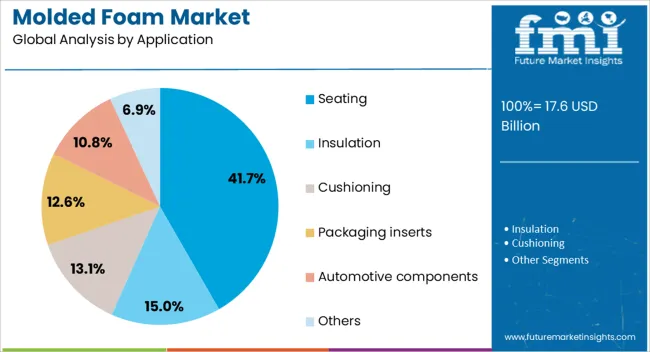

The molded foam market is segmented by type, form, application, material, and geographic regions. By type, molded foam market is divided into Closed cell foam, High resilience foam, Integral skins foam, Memory foam, and Others. In terms of form, molded foam market is classified into Rigid and Flexible.

Based on application, molded foam market is segmented into Seating, Insulation, Cushioning, Packaging inserts, Automotive components, and Others. By material, molded foam market is segmented into Polyurethane foam, Expanded polystyrene, Expanded polyethylene, Expanded polypropylene, and Others. Regionally, the molded foam industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The closed cell foam segment is projected to account for 36.4% of the molded foam market revenue in 2025, maintaining a strong position due to its superior durability and moisture resistance. This type of foam is characterized by a compact cell structure that limits water absorption, making it suitable for applications requiring long-term performance in challenging environments.

Industrial usage has favored closed cell foam for its insulation properties, high compressive strength, and ability to maintain shape under load. Manufacturers have also capitalized on its protective qualities in packaging and construction applications.

Additionally, the closed cell structure offers better resistance to chemical degradation, extending product lifespan and reducing maintenance requirements. These performance attributes, combined with growing demand in industries prioritizing durability and low maintenance, are expected to sustain the segment’s growth trajectory.

The rigid form segment is projected to contribute 54.8% of the molded foam market revenue in 2025, leading due to its structural integrity and dimensional stability. This form has been widely adopted in applications where shape retention and load-bearing capacity are essential, such as in automotive interiors, protective packaging, and construction components.

Rigid molded foam provides excellent thermal insulation and impact resistance, supporting its use in energy-efficient building materials and durable product designs.

Manufacturing advancements have enabled greater precision in producing rigid foam components, meeting stringent industry specifications. Its adaptability in being molded into complex shapes without compromising strength has broadened its application base. As industries continue to demand lightweight yet robust materials, the rigid foam segment is expected to maintain its leadership position in the market.

The seating segment is projected to hold 41.7% of the molded foam market revenue in 2025, dominating due to its central role in comfort and ergonomics for automotive, office, and residential furniture. Molded foam in seating applications offers consistent support, shape retention, and resilience, making it a preferred material for high-use seating environments.

Automotive manufacturers have adopted molded foam to enhance passenger comfort and reduce weight, contributing to fuel efficiency.

In office and residential furniture, its cushioning properties and durability support long-term comfort without frequent replacement. Advances in foam formulations have introduced options with improved breathability, temperature regulation, and hypoallergenic properties, further increasing appeal. As consumer expectations for ergonomic design and comfort continue to rise, the seating segment is expected to drive sustained demand for molded foam products.

The global molded foam market is growing due to increasing demand from automotive, packaging, furniture, and construction industries. Molded foam products provide lightweight, durable, and energy-absorbing solutions suitable for cushioning, insulation, and protective packaging. Rising adoption of polyurethane, polystyrene, and polyethylene-based foams is driving innovation in automotive seating, electronic packaging, and sports equipment.

Rapid growth in e-commerce and logistics has increased demand for molded foam packaging to prevent product damage during transit. Sustainable alternatives such as biodegradable and recyclable foam are gaining traction due to environmental awareness. Advancements in CNC molding, injection molding, and compression molding techniques are improving precision, reducing material waste, and enabling complex designs across diverse industrial applications.

Automotive manufacturers increasingly adopt molded foam for seating, headrests, door panels, and sound insulation due to its lightweight and energy-absorbing properties. Polyurethane foam dominates interior applications, offering comfort, durability, and vibration reduction. The trend toward electric and autonomous vehicles is driving innovation in seating ergonomics and lightweight interior components. Foam-based energy absorbers are widely used in bumpers and crash management systems to enhance passenger safety. Rising automotive production in North America, Europe, and Asia Pacific supports molded foam demand. Manufacturers are focusing on advanced molding techniques to reduce cycle times and material waste. The growing need for fuel-efficient vehicles is further boosting adoption of lightweight molded foam in automotive components globally.

Innovations in molding techniques, including injection molding, compression molding, and CNC-controlled processes, are improving molded foam quality, precision, and efficiency. Advanced polyurethane and polyethylene formulations provide enhanced fire resistance, thermal insulation, and mechanical strength. Automation and robotics integration in production lines reduce human error, increase throughput, and enable complex foam geometries for packaging and automotive applications. Foam surface finishing and coating technologies improve aesthetic appeal and durability. Lightweight, high-resilience foam variants are being developed for sports equipment, furniture cushions, and protective packaging. Manufacturers are also exploring biodegradable and recyclable foams to meet environmental regulations. These advancements are driving adoption across automotive, electronics, packaging, and construction industries globally.

Molded foam is increasingly used in protective packaging for electronics, fragile goods, and high-value items due to its shock absorption and lightweight properties. The e-commerce boom and expansion of logistics networks are accelerating adoption of molded foam inserts and trays. In furniture, molded foam cushions, mattresses, and upholstery components provide comfort, durability, and shape retention. Demand is growing for molded foam products that are ergonomically designed, fire-resistant, and chemically stable. Manufacturers are also producing anti-static foam for electronic packaging. Rising awareness of workplace ergonomics and home comfort solutions is boosting molded foam usage. Packaging and furniture sectors remain key growth drivers for molded foam globally.

The molded foam market faces constraints due to fluctuating raw material prices, primarily polyurethane, polystyrene, and polyethylene resins. High production costs for specialty foam with fire resistance, thermal insulation, or chemical stability limit adoption in cost-sensitive sectors. Environmental regulations on foam waste disposal and single-use plastics are prompting manufacturers to invest in recyclable or biodegradable alternatives, increasing production complexity. Energy-intensive molding processes contribute to operational costs. Supply chain disruptions for polymer resins also affect production schedules. Balancing performance, cost, and environmental compliance remains a challenge. Companies are adopting sustainable formulations and efficient manufacturing techniques to overcome restraints while meeting growing demand in automotive, packaging, and construction markets.

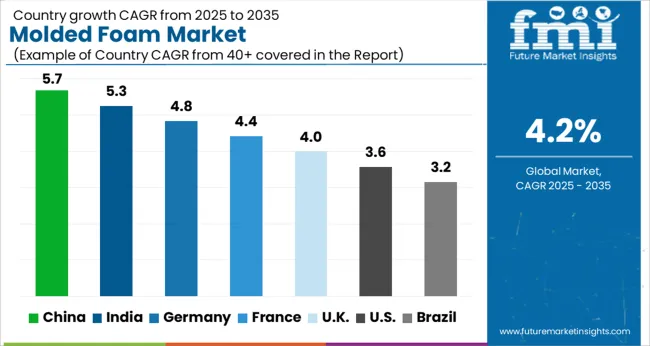

| Country | CAGR |

|---|---|

| China | 5.7% |

| India | 5.3% |

| Germany | 4.8% |

| France | 4.4% |

| UK | 4.0% |

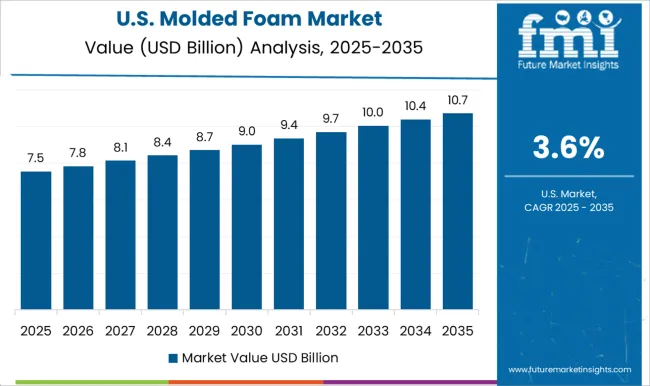

| USA | 3.6% |

| Brazil | 3.2% |

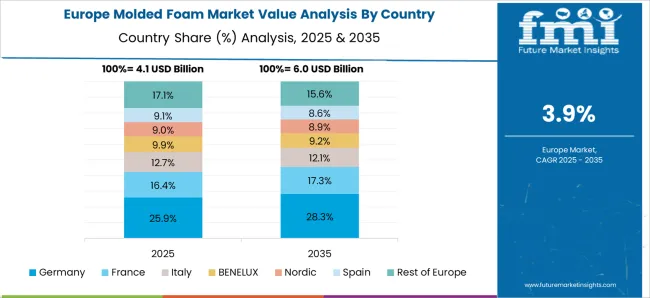

The molded foam market is projected to grow at a global CAGR of 4.2% from 2025 to 2035, driven by increasing use in packaging, automotive interiors, insulation, and consumer goods applications. China leads at 5.7%, 36% above the global benchmark, supported by BRICS-related growth in manufacturing, packaging industries, and automotive production. India follows at 5.3%, 26% higher than the global average, reflecting rising demand for protective packaging, furniture, and construction insulation. Germany records 4.8%, 14% above the benchmark, shaped by OECD-backed innovation in high-performance foams, automotive applications, and energy-efficient insulation. The United Kingdom posts 4.0%, 5% below the global rate, influenced by selective adoption in specialty packaging, construction, and industrial applications. The United States stands at 3.6%, 14% below the benchmark, with steady uptake in automotive, consumer goods, and niche packaging solutions. BRICS economies drive volume growth, OECD countries focus on performance and efficiency, while ASEAN markets contribute through expanding manufacturing, construction, and packaging sectors.

The molded foam market in China is projected to grow at a CAGR of 5.7%, driven by rising demand from automotive, packaging, and consumer electronics sectors. In 2024, over 48% of new automotive seating and interior components incorporated molded foam for lightweight and ergonomic design. Production capacity in Jiangsu and Guangdong increased by 16% to meet domestic and export demand. Packaging applications, including protective inserts for electronics, grew by 22% in 2024, with polypropylene and polyethylene foam accounting for 61% of total usage. Household appliance manufacturers adopted molded foam for insulation and vibration reduction, expanding applications by 18%. Leading domestic suppliers introduced high density, flame retardant, and recyclable foam products, supporting industrial growth. Market expansion is further supported by investments in automated cutting, shaping, and molding technologies that improve yield and reduce material waste.

The molded foam market in India is projected to grow at a CAGR of 5.3%, with rising adoption in automotive interiors, packaging, and furniture applications. In 2024, 42% of passenger vehicles incorporated molded foam for seat cushioning and headliners. Production hubs in Maharashtra, Gujarat, and Tamil Nadu expanded capacity by 12% to meet industrial and commercial demand. Protective packaging demand increased by 19%, driven by electronics and e-commerce shipments. Furniture applications, including mattresses and cushions, accounted for 15% of molded foam consumption in 2024. Local manufacturers introduced high resilience polyurethane and flexible foam solutions, enabling ergonomic and lightweight designs. Growth is further supported by investments in hot pressing, thermoforming, and molding technologies that enhance precision and reduce scrap. The market outlook remains positive as industrial and residential applications continue to adopt molded foam solutions.

The molded foam market in Germany is projected to grow at a CAGR of 4.8%, supported by automotive, industrial, and consumer goods applications. In 2024, 38% of new automotive seating systems integrated molded foam for ergonomic and lightweight performance. Production output in Bavaria and North Rhine-Westphalia increased by 10% to meet both domestic and European demand. Packaging applications for electronics and medical devices grew by 14%, while furniture applications accounted for 12% of total molded foam consumption. Foam with enhanced fire retardancy and durability gained traction, representing 25% of premium product adoption in 2024. European OEMs collaborated with suppliers to optimize molded foam density and compression resistance, improving component lifespan. Market growth is reinforced by automation in cutting and molding processes, reducing waste and improving manufacturing efficiency across industries.

The molded foam market in the United Kingdom is projected to grow at a CAGR of 4.0%, with rising adoption in automotive, furniture, and packaging sectors. In 2024, 31% of new vehicles included molded foam for interior seating and cushioning. Production capacity in the Midlands and South East increased by 8% to meet domestic demand. Protective packaging applications grew by 11%, driven by electronics and fragile goods shipments. Furniture and mattress applications represented 16% of total molded foam consumption. Manufacturers introduced high resilience polyurethane and flame retardant foams, expanding premium product offerings. Market growth is supported by advancements in thermoforming and molding technologies that reduce scrap and improve product consistency. Adoption in light commercial vehicles and office furniture is expected to increase steadily, further driving demand for molded foam.

The molded foam market in the United States is projected to grow at a CAGR of 3.6%, driven by automotive interiors, furniture, and packaging applications. In 2024, 34% of passenger vehicles incorporated molded foam for seats, headrests, and door panels. Production output in Michigan, Ohio, and Texas increased by 7% to meet rising domestic demand. Protective packaging for electronics and medical devices expanded by 10% in 2024. Furniture and mattress applications accounted for 18% of total molded foam usage. Manufacturers introduced flame retardant and high density polyurethane foams to meet safety and performance standards. Market expansion is further supported by investments in automated cutting and molding systems, enhancing precision and minimizing material waste. Demand is expected to remain steady, driven by increased adoption in automotive and industrial applications.

Competition in the molded foam market is being shaped by product performance, thermal insulation properties, and compliance with industrial safety standards. Market positions are being maintained through quality certifications, customized formulations, and global distribution networks that ensure timely supply across construction, automotive, and packaging sectors. Armacell International is being represented with flexible foams engineered for thermal and acoustic insulation, while Asahi Kasei Corporation is being promoted with high-resilience foams designed for automotive and furniture applications. BASF is being recognized with engineered polymer foams tailored for lightweight structural and energy-efficient solutions. Carpenter Technology Corporation is being applied with high-performance specialty foams suitable for extreme environments, while Covestro is being highlighted with polyurethane foams designed for durability and chemical resistance. Dow is being advanced with thermoplastic and closed-cell foams optimized for insulation and cushioning. Knauf Industries is being positioned with construction-grade foam panels engineered for structural stability, while Recticel is being promoted with customized foams for bedding, seating, and acoustic purposes.

Sumitomo Chemical is being represented with high-quality polymer foams designed for industrial applications, and Primex is being associated with molded foam solutions suitable for packaging and protective applications. Strategies across these manufacturers are being focused on R&D investment, product customization, and regulatory compliance. Development efforts are being allocated to enhance flame retardancy, density control, and resilience under varying environmental conditions.

| Item | Value |

|---|---|

| Quantitative Units | USD 17.6 Billion |

| Type | Closed cell foam, High resilience foam, Integral skins foam, Memory foam, and Others |

| Form | Rigid and Flexible |

| Application | Seating, Insulation, Cushioning, Packaging inserts, Automotive components, and Others |

| Material | Polyurethane foam, Expanded polystyrene, Expanded polyethylene, Expanded polypropylene, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Armacell International, Asahi Kasei Corporation, BASF, Carpenter Technology Corporation, Covestro, Dow, Knauf Industries, Recticel, Sumitomo Chemical, and Primex |

| Additional Attributes | Dollar sales by foam type and end use, demand dynamics across packaging, automotive, and construction, regional trends in lightweight material adoption, innovation in density and thermal insulation, environmental impact of disposal and recycling, and emerging use cases in protective packaging and automotive interiors. |

The global molded foam market is estimated to be valued at USD 17.6 billion in 2025.

The market size for the molded foam market is projected to reach USD 26.6 billion by 2035.

The molded foam market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in molded foam market are closed cell foam, high resilience foam, integral skins foam, memory foam and others.

In terms of form, rigid segment to command 54.8% share in the molded foam market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA