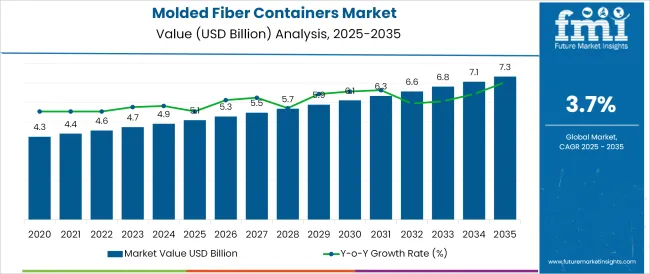

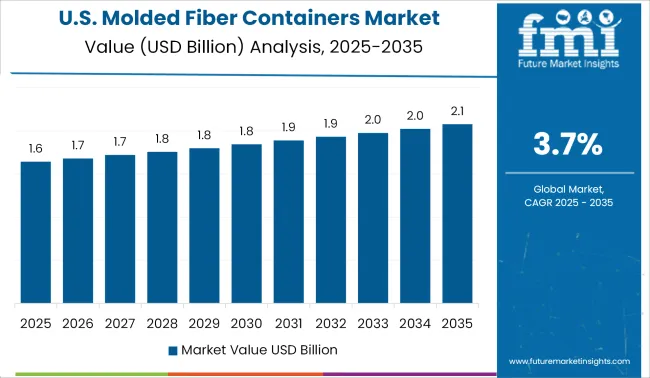

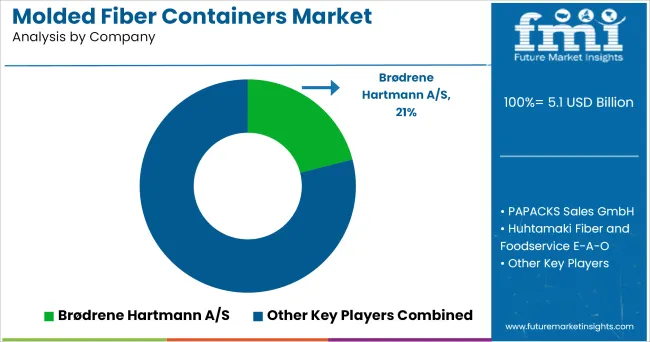

The Molded Fiber Containers Market is estimated to be valued at USD 5.1 billion in 2025 and is projected to reach USD 7.3 billion by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period.

The molded fiber containers market is experiencing robust growth, supported by rising global emphasis on sustainable packaging, reduction in single-use plastics, and consumer demand for compostable materials. Regulatory policies across major economies are promoting the transition to fiber-based alternatives, especially in foodservice, electronics, and industrial packaging sectors.

Advancements in molding precision, drying technology, and moisture resistance coatings have significantly improved the performance and appearance of molded fiber containers. Companies are increasingly investing in fully automated forming systems and using renewable feedstocks such as recycled paper and virgin pulp to align with circular economy goals.

Additionally, partnerships between packaging firms and food producers are accelerating product innovation for custom-fit, durable packaging designs. Growth opportunities are expected to rise from emerging markets and institutional foodservice systems as demand shifts toward disposable yet recyclable packaging that meets hygiene and safety benchmarks.

The market is segmented by Source Type, Molded Type, and Application and region. By Source Type, the market is divided into Wood Pulp and Non-wood Pulp. In terms of Molded Type, the market is classified into Transfer, Thick Wall, Thermoformed, and Processed. Based on Application, the market is segmented into Food Packaging, Food Service, Electronics, Healthcare, Industrial, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

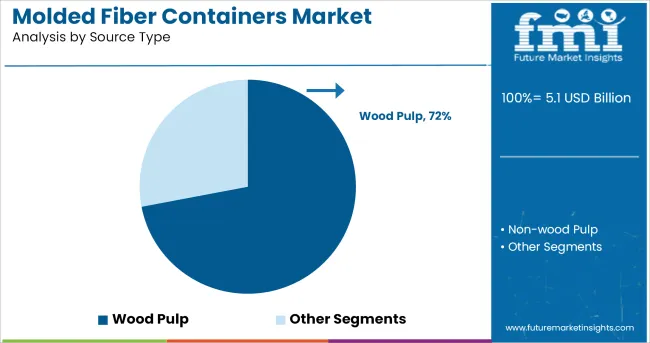

Wood pulp is expected to account for 72% of the total revenue share in the molded fiber containers market by 2025, making it the leading source type. This dominance is being driven by the widespread availability, high fiber strength, and renewable nature of wood pulp. T

he material's compatibility with various molded fiber production techniques allows for consistent formation, structural integrity, and enhanced durability, particularly in packaging applications requiring moisture resistance and stackability.

Additionally, wood pulp offers a clean, white aesthetic which enhances product visibility and brand presentation in retail environments. As companies strive to meet sustainability targets and reduce dependence on petroleum-based inputs, wood pulp has emerged as the preferred source material due to its biodegradability and lower lifecycle emissions. Regulatory support for forest stewardship and traceable sourcing has further bolstered its use across packaging lines globally.

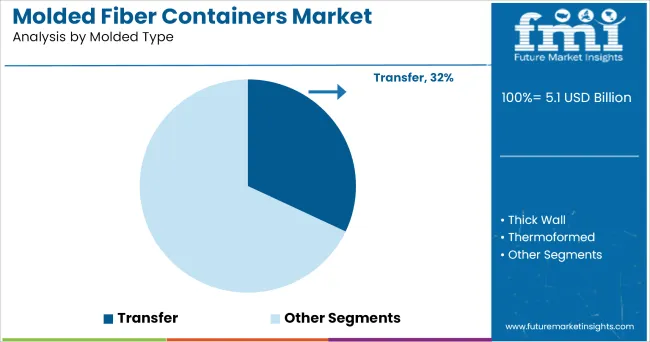

The transfer molded segment is projected to hold 32.0% of the molded fiber containers market revenue in 2025. This segment’s growth is being driven by its ability to produce thin-walled, high-precision containers suitable for retail-ready and consumer-facing packaging.

Transfer molding allows for smoother surfaces and tighter dimensional tolerances, making it ideal for applications where appearance, printability, and stacking efficiency are critical. Its scalability for high-volume production without compromising product uniformity has increased its adoption across food packaging, electronics, and medical device sectors.

In addition, the flexibility of transfer molding to support hybrid barrier coatings and integrated labeling solutions aligns with both functional and branding requirements. As demand increases for molded fiber packaging with higher aesthetic and performance standards, transfer molding continues to emerge as the technology of choice in premium and sensitive applications.

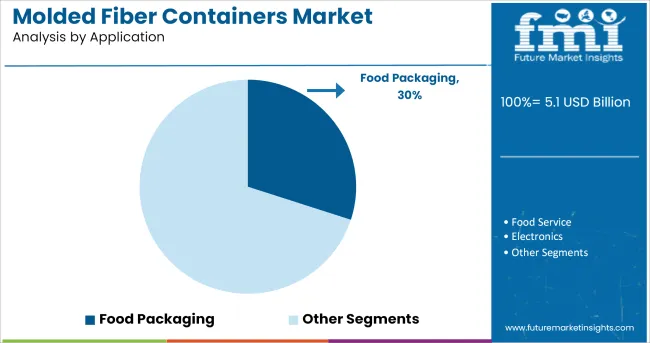

Food packaging is projected to contribute 30% of the total market revenue in the molded fiber containers market by 2025, positioning it as the leading application segment. This growth is being fueled by rising demand for single-use, compostable packaging in quick service restaurants, takeout, and institutional foodservice environments.

Molded fiber containers are increasingly favored for their ability to offer grease resistance, thermal insulation, and safe contact with hot and cold food products without chemical leaching. The elimination of plastic linings and integration of water-based coatings further supports environmental compliance and consumer safety.

Moreover, heightened scrutiny of food packaging waste and bans on polystyrene have prompted brands and food operators to switch to molded fiber alternatives. The segment’s momentum is also driven by growing availability of customizable designs and branding options that cater to both upscale dining and mass-market food packaging needs.

Molded fiber containers are manufactured with waste paper or other natural fibres and are recyclable along with other waste. They can also be destroyed without damaging incinerators. Moreover, there are no hazardous or toxic waste materials expelled into the environment.

Hence, molded fiber containers happen to be an environmentally friendly alternative to the single use plastics. Growing awareness regarding the greenhouse effect and global warming are the major factors responsible for driving the growth of molded fiber containers among the environmentally conscious consumers market across the globe.

On the basis of source, the sensor market has been bifurcated in to wood pulp and non-wood pulp. Out of which, the wood pulp segment is anticipated to account for the largest share of the global molded fiber containers sales. The growth of the segment can be attributed to the declining pulp prices in most of the regions over the past few years.

However, the non-wood source segment is anticipated to grow at the fastest CAGR over the forecast period. A large number of non-conventional raw materials are being explored and companies operating in the market are making use of bamboo as a material for pulp manufacturing since bamboo plants can be easily cultivated in almost all regions.

Moreover, higher rates of paper recycling in the developed economies of Europe and North America are anticipated to favor the growth of non-wood pulp segment.

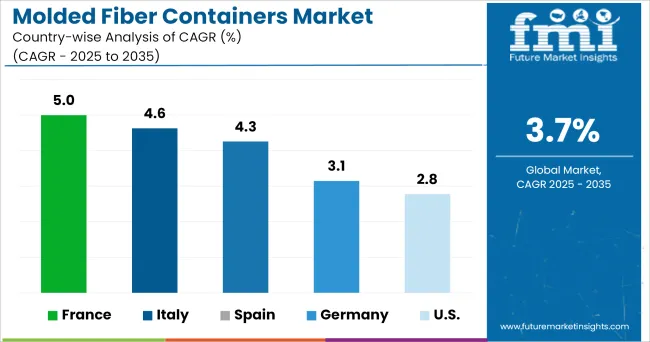

USA happens to be one of the largest markets for molded fiber containers across the globe. The growth in USA is attributed to the presence of a large number of food service outlets and restaurants in the region. Moreover, increase in disposable incomes coupled with a rise in dining out instance owing to the hectic lifestyles are further expected to boost the growth of molded fiber containers market in the North America region.

The demand for molded fiber containers in the Europe has been on the rise. With a growing number of food outlets and restaurants in the region, there has been a surge in the demand for sustainable packaging solutions too. Thereby driving the demand for molded fiber containers in the Europe region.

Moreover, the member countries of the European Union maintain strict regulatory regimes in order to keep a check on environmental impacts caused by waste disposal, mainly due to single use plastics. This happens to be another major reason responsible for the growth of molded fiber containers market in the region.

Some of the leading providers of molded fiber containers include

Companies in the market are coming up with different products in order to enhance their product portfolio and meet the changing consumer demands. For instance, in February 2020, Genpak announced the addition of four new innovative designs to its Harvest Fiber line of earth-friendly food packaging with the introduction of four containers with unique compartment configurations.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global molded fiber containers market is estimated to be valued at USD 5.1 billion in 2025.

The market size for the molded fiber containers market is projected to reach USD 7.3 billion by 2035.

The molded fiber containers market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in molded fiber containers market are wood pulp and non-wood pulp.

In terms of molded type, transfer segment to command 32.0% share in the molded fiber containers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Molded Wood Pallets Market Forecast and Outlook 2025 to 2035

Molded FRP Grating Market Size and Share Forecast Outlook 2025 to 2035

Molded Foam Market Size and Share Forecast Outlook 2025 to 2035

Molded Pulp Packaging Market Size and Share Forecast Outlook 2025 to 2035

Molded Pulp Basket Market Size and Share Forecast Outlook 2025 to 2035

Molded Underfill Material Market Size and Share Forecast Outlook 2025 to 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Market Share Breakdown of the Molded Pulp Basket Industry

Competitive Overview of Molded Wood Pallets Market Share

Molded Case Circuit Breaker (MCCB) Market Growth – Trends & Forecast 2023-2033

Molded Interconnect Devices (MID) Market

Molded Fiber Egg Packaging Market Forecast and Outlook 2025 to 2035

Molded Fiber Bowl Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Pulp Packaging Industry Analysis in Australia and New Zealand Forecast Outlook 2025 to 2035

Molded Fiber Pulp Packaging Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Packaging Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Pulp Cap Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Pulp Packaging Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Cup Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Wine Packs Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA