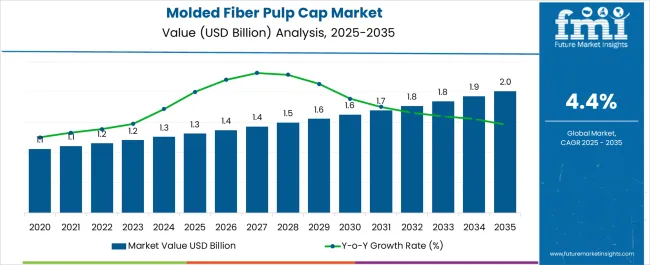

The Molded Fiber Pulp Cap Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 2.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

| Metric | Value |

|---|---|

| Molded Fiber Pulp Cap Market Estimated Value in (2025 E) | USD 1.3 billion |

| Molded Fiber Pulp Cap Market Forecast Value in (2035 F) | USD 2.0 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

The molded fiber pulp cap market is progressing steadily, influenced by rising demand for sustainable and eco-friendly packaging solutions. Industry news and company disclosures have emphasized the shift away from single-use plastics, which has accelerated adoption of molded fiber pulp products across food, beverage, and consumer goods industries. Advancements in pulp processing technologies have enabled manufacturers to deliver caps with improved durability, precision, and compatibility with automated bottling lines.

Regulations supporting circular economy practices and bans on non-biodegradable materials have created favorable conditions for the market. Additionally, beverage companies and packaging suppliers have increased their focus on sustainable branding, further stimulating demand.

Expansion of recycling infrastructure and investments in high-strength processed pulp have contributed to scalability and quality improvements. Looking forward, the market is expected to grow with continued innovation in material engineering, integration of renewable raw materials, and stronger distribution networks, with processed pulp, offline channels, and beverages emerging as the leading segments.

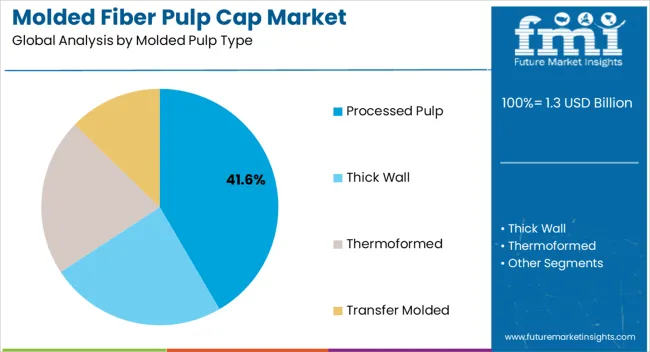

The processed pulp segment is projected to account for 41.60% of the molded fiber pulp cap market revenue in 2025, maintaining its position as the leading pulp type. Growth in this segment has been supported by its enhanced mechanical properties, which provide superior strength, shape consistency, and moisture resistance compared to traditional molded pulp.

Processed pulp has been favored by beverage manufacturers for its ability to meet stringent quality standards in sealing and product preservation. Industry developments have shown that investments in refining technologies have improved fiber bonding and reduced porosity, making processed pulp caps suitable for high-volume bottling operations.

Moreover, the increasing consumer demand for sustainable yet durable packaging has reinforced the adoption of processed pulp in premium beverage applications. With regulatory pressures on packaging sustainability intensifying, processed pulp is expected to remain the preferred choice for producers seeking reliable performance and environmental compliance.

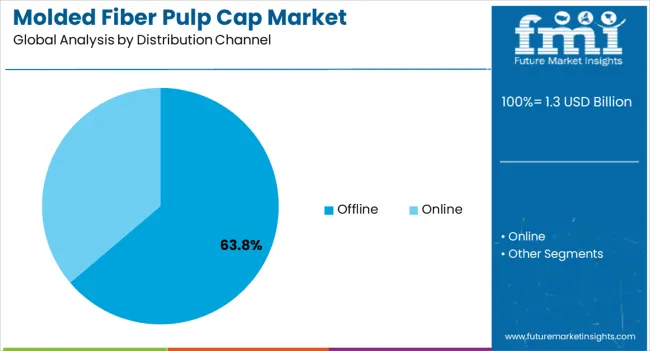

The offline segment is projected to contribute 63.80% of the molded fiber pulp cap market revenue in 2025, solidifying its role as the dominant distribution channel. This leadership has been shaped by the established procurement practices of beverage companies and packaging distributors, which rely heavily on direct supplier relationships and bulk purchases.

Offline channels, including business-to-business sales and distributor networks, have provided manufacturers with stable demand streams and opportunities for long-term contracts. Reports from industry trade associations have noted that offline purchasing remains preferred due to the ability to negotiate pricing, ensure quality inspection, and secure customized orders.

Additionally, offline channels are better suited to managing the logistics of large-scale packaging supply chains, which are critical in beverage and food production industries. Despite the growth of e-commerce, the offline channel continues to dominate because of its alignment with industrial procurement needs, making it the cornerstone of molded fiber pulp cap distribution.

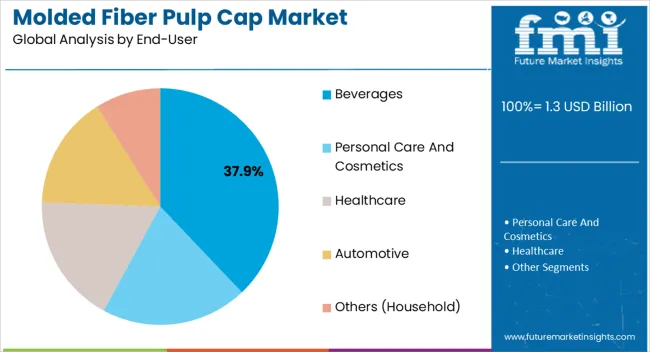

The beverages segment is projected to hold 37.90% of the molded fiber pulp cap market revenue in 2025, positioning it as the leading end-user category. This dominance has been driven by the beverage industry’s strong focus on sustainable packaging solutions in response to consumer preferences and regulatory mandates.

Companies in this sector have prioritized molded fiber pulp caps as a substitute for plastic closures, particularly in bottled water, juices, and ready-to-drink categories. Press releases from leading beverage firms have highlighted sustainability commitments that include transitioning to biodegradable and recyclable packaging formats, directly supporting this segment’s growth.

Additionally, the compatibility of molded pulp caps with automated bottling and sealing technologies has enhanced their practicality in high-throughput operations. Consumer awareness regarding plastic waste reduction has further accelerated adoption, as brands leverage eco-friendly caps to strengthen their market positioning. The beverages segment is expected to remain the largest contributor, supported by ongoing sustainability initiatives and expanding product lines using pulp-based closures.

The molded fiber pulp cap market size developed at a CAGR of 3.1.3% from 201.38 to 2025. In 201.38, the global market size stood at USD 1.3 billion. The market witnessed significant growth in the following years, accounting for USD 1.3.2 billion in 2025.

In recent years, consumer preferences have significantly shifted in favor of eco-friendly and sustainable products. There is now more demand for molded fiber pulp caps as a result of this trend, which has encouraged companies to look for packaging solutions that support these ideals.

Many countries and regulatory organizations started enforcing stronger laws against single-use plastics and promoting eco-friendly packaging techniques. To comply with changing rules and regulations, businesses have been forced to seek alternatives like molded fiber pulp caps.

In the coming years, future developments in manufacturing methods may enable the ability to customize molded fiber pulp caps even more. This presents an opportunity for brands to develop highly individualized packaging that appeals to customers and strengthens brand identity.

Partnerships between packaging producers, brands, and sustainability-focused organizations may also produce creative approaches and plans. Collaboration could result in innovations in recycling techniques, designs, and materials.

| Historical CAGR (201.38 to 2025) | 3.1.3% |

|---|---|

| Projected CAGR (2025 to 2035) | 4.6% |

According to our lead research consultant for the packaging domain at FMI, the thermoformed molded fiber segment is projected to thrive at a CAGR of 5.2% from 2025 to 2035. The segment captured nearly 33.3% of the global molded fiber pulp caps market in 2025.

Due to its detailed design and exact fit, thermoformed molded pulp caps provide higher protection. Thermoforming makes it possible to produce caps that closely resemble the shapes of the goods they are designed to protect, improving cushioning and stress absorption during transport.

Thermoformed molded pulp caps are adaptable and have uses in a variety of sectors, including consumer products, electronics, automotive, and cosmetics. They are excellent for a range of product categories due to their versatility and improved protection.

The beverages segment is predicted to thrive at a 4.7% CAGR from 2025 to 2035. The segment is anticipated to surpass a valuation of USD 2 million by 2035. Molded fiber pulp caps can provide beverage packaging with a high-end and attractive appearance.

For artisanal markets and premium beverages, this factor is especially crucial. Molded fiber pulp caps can also accommodate a variety of beverage container types, including bottles, cans, and cartons. Due to their adaptability, they can be used with a variety of beverages and container types.

The beverage industry has been criticized for contributing to plastic trash, notably with products like dairy, juices, and bottled water. A significant push is being made for sustainable packaging options as consumer knowledge of environmental issues rises, which makes molded fiber pulp caps an alluring choice.

The molded fiber pulp cap market in India is anticipated to thrive at a striking CAGR of 7.2% from 2025 to 2035. The nation’s market is expected to reach USD 2 million by 2035.

The Indian government has been actively pushing green actions, such as lowering plastic waste. Efforts like the 'Make in India' campaign and constraints on single-use plastics have forced companies to employ eco-friendly packaging materials like molded fiber pulp caps.

Lead times and costs have been decreased for molded fiber pulp caps due to the accessibility of raw materials and local production capacity. The 'Vocal for Local' movement, which promotes home manufacturing, stands in accordance with the localization trend.

In India, niche markets for traditional goods, artisanal crafts, and organic and health-focused products are expanding. To support their values, these sectors frequently prioritize environmentally friendly packaging, which fuels the need for molded fiber pulp caps.

The United States molded fiber pup cap market is projected to develop at a steady CAGR of 4.8% from 2025 to 2035, creating an absolute dollar growth opportunity worth USD 171.1 million by 2035. It can be a statement of sustainable luxury to use molded fiber pulp caps on high-end products like luxury goods or high-end cosmetics.

Considering that consumers increasingly link premium quality with ecologically friendly packaging, these caps may increase the perceived worth of the product. Additionally, the protective qualities of molded fiber pulp caps match the pharmaceutical industry's sterile and tamper-evident packaging requirements.

Integrating tamper-evident elements into these caps can address product integrity and safety concerns in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.2% |

| United States | 4.8% |

Key Players Emphasize Pooling Expertise to Gain Greater Revenues

Regional differences exist in the competitive environment of this market. Global players are widely present, but regional manufacturers and suppliers are also engaged, frequently meeting unique regional regulations.

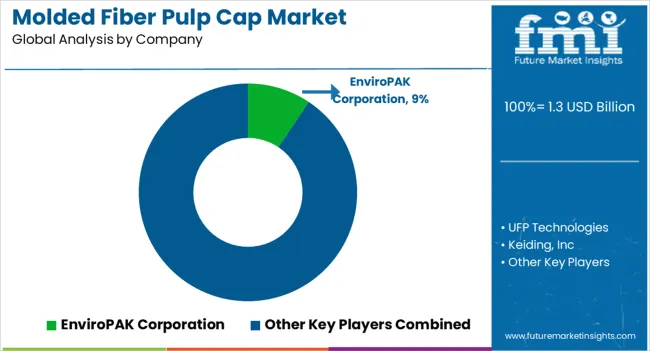

Market dynamics, customer preferences, and regulatory frameworks vary by region, affecting how players compete. Tier-1 companies account for 20% to 30% of the market’s value.

Continuous research and development projects to improve the characteristics of molded fiber pulp caps shape the competitive environment.

This covers new developments in materials, production techniques, customization possibilities, and extra features like tamper-evident fixes and smart packaging integration.

Various industry participants are establishing partnerships and collaborations in response to the rising need for sustainable packaging solutions. These agreements frequently seek to advance molded fiber pulp cap technology innovation by sharing information, combining resources, and pooling expertise.

Recent Developments Observed by FMI:

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.4% from 2025 to 2035 |

| Market Value in 2025 | USD 1.3 billion |

| Market Value in 2035 | USD 2.0 billion |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | By Functions, By Beam, By Light Type, By End-user, By Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East and Africa |

| Key Countries Profiled | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, China, Japan, South Korea, Malaysia, Singapore, Australia, New Zealand, GCC Countries, South Africa, Israel |

| Key Companies Profiled | EnviroPAK Corporation; UFP Technologies; Kieding Inc.; FiberCel Packaging LLC; ProtoPak Engineering Corporation; Pacific Pulp Molding LLC; Cullen Eco-friendly Packaging; Huhtamaki Oyj; Henry Molded Products Inc.; Spectrum Lithograph Inc.; ESCO Technologies Inc.; Brodrene Hartmann A/S; OrCon Industries Corporation; Celluloses De La Loire; Dynamic Fibre Molding Pvt. Ltd.; Primapack SAE; Greenpacking Environmental Protection Technology Co.; Dongguan City Luheng Paper Company Ltd.; Guangxi Qiaowang Pulp Packing Products Co. Ltd.; Guangzhou NANYA Pulp Molding Equipment Co. Ltd. |

| Customization | Available Upon Request |

The global molded fiber pulp cap market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the molded fiber pulp cap market is projected to reach USD 2.0 billion by 2035.

The molded fiber pulp cap market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in molded fiber pulp cap market are processed pulp, thick wall, thermoformed and transfer molded.

In terms of distribution channel, offline segment to command 63.8% share in the molded fiber pulp cap market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Molded FRP Grating Market Size and Share Forecast Outlook 2025 to 2035

Molded Foam Market Size and Share Forecast Outlook 2025 to 2035

Molded Underfill Material Market Size and Share Forecast Outlook 2025 to 2035

Molded Wood Pallets Market Analysis - Size, Share & Forecast 2025-2035

Competitive Overview of Molded Wood Pallets Market Share

Molded Case Circuit Breaker (MCCB) Market Growth – Trends & Forecast 2023-2033

Molded Interconnect Devices (MID) Market

Molded Pulp Packaging Market Size and Share Forecast Outlook 2025 to 2035

Molded Pulp Basket Market Size and Share Forecast Outlook 2025 to 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Market Share Breakdown of the Molded Pulp Basket Industry

Molded Fiber Packaging Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Cup Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Wine Packs Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Containers Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Tray Market Trends – Growth & Forecast 2024-2034

Molded Fiber Bowl Market Trends – Growth & Demand 2024-2034

Molded Fiber End Caps Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Pulp Packaging Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Pulp Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA