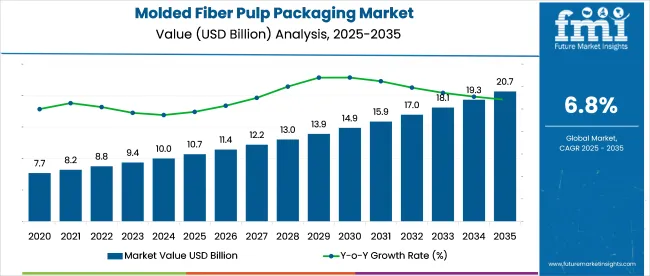

The molded fiber pulp packaging demand is projected to grow from USD 2.8 billion in 2025 to approximately USD 4.0 billion by 2035, recording an absolute increase of USD 957 million over the forecast period. This translates into a total growth of 33.7%, with demand forecast to expand at a compound annual growth rate (CAGR) of 2.9% between 2025 and 2035. The overall demand size is expected to grow by nearly 1.34X during the same period, supported by the rising adoption of sustainable packaging solutions and increasing regulatory pressure for plastic alternatives.

Between 2025 and 2030, the molded fiber pulp packaging demand is projected to expand from USD 2.8 billion to USD 3,271 million, resulting in a value increase of USD 428 million, which represents 44.7% of the total forecast growth for the decade. This phase of growth will be shaped by rising penetration of sustainable packaging alternatives in European retail and food service sectors, increasing consumer preference for eco-friendly packaging materials, and growing implementation of circular economy principles. Packaging manufacturers are expanding their production capabilities to address the growing complexity of application requirements and performance standards.

From 2030 to 2035, demand is forecast to grow from USD 3,271 million to USD 3,800 million, adding another USD 529 million, which constitutes 55.3% of the overall ten-year expansion. This period is expected to be characterized by the expansion of advanced molding technologies, the integration of barrier coating solutions, and the development of standardized recycling protocols across different European nations. The growing adoption of fiber-based packaging in electronics and healthcare sectors will drive demand for more sophisticated manufacturing processes and specialized material formulations.

Between 2020 and 2025, the demand for molded fiber pulp packaging experienced steady expansion, driven by increasing environmental consciousness among consumers and growing regulatory restrictions on single-use plastics. The demand developed as packaging converters recognized the need for sustainable alternatives that could match the performance characteristics of traditional packaging materials. Brand owners and retailers began emphasizing recyclable and compostable packaging solutions to meet sustainability commitments and consumer expectations.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 2.8 billion |

| Forecast Value in (2035F) | USD 4.0 billion |

| Forecast CAGR (2025 to 2035) | 3.8% |

Demand expansion is being supported by the rapid implementation of plastic reduction policies and the corresponding need for sustainable packaging alternatives that maintain product protection and shelf appeal. Modern packaging applications rely on precise fiber formulation and molding techniques to ensure proper functioning of protective features, including moisture resistance, structural integrity, and stackability. Even minor adjustments in material composition or processing parameters can significantly impact packaging performance and end-product quality.

The growing complexity of packaging requirements and increasing sustainability commitments are driving demand for advanced molded fiber solutions from certified manufacturers with appropriate technology and expertise. Retailers are increasingly requiring sustainable packaging documentation and lifecycle assessments to maintain supplier relationships and ensure environmental compliance. Regulatory requirements and brand specifications are establishing standardized quality parameters that require specialized manufacturing capabilities and consistent material sourcing.

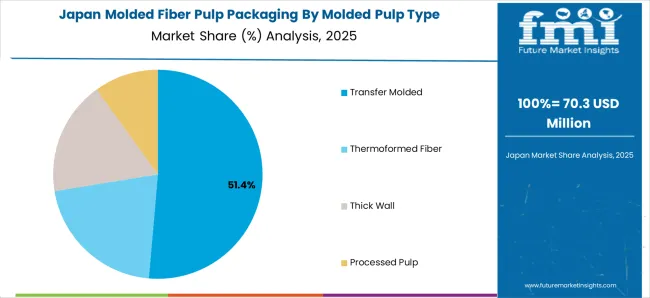

The market is segmented by molded pulp type, product type, source, application, end-use, and geographic region. Based on molded pulp type, the market is categorized into transfer molded, thermoformed fiber, thick wall, and processed pulp. By product type, the market is divided into trays, Drink Carriers (2 cups, 4 cups, 6 cups, more than 8 cups), boxes, end caps, plates, bowls, cups, bottles (below 250 ml, 250 to 750 ml, above 750 ml), and clamshell containers. By source, the market includes virgin pulp and recycled pulp. By application, the market is segmented into primary packaging, secondary packaging, and edge protectors. By end-use, the market includes Consumer Durables (Mobile Phone, Television, Laptops, Tube Light & Bulbs, Others (Air Conditioners, Refrigerators)), Food & Beverage (Egg Packaging (4 Eggs, 6 Eggs, 12 Eggs, 24 Eggs, More than 30 Eggs), Wine Packaging (375 ml, 750 ml, 1.5 Liter, More than 3 Liter), Fruit Packaging, Others), Cosmetics, Food Services, Healthcare, Automotive, Logistics, Others (Candles, Flower Packaging). By region, the market is segmented into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East and Africa.

Transfer molded products are projected to account for 51% of the molded fiber pulp packaging demand in 2025. This leading share is supported by the widespread adoption of this manufacturing method for premium packaging applications, which represent the majority of current sustainable packaging innovations. Transfer molded packaging provides smooth surface finish and precise dimensional control, making it the preferred method for consumer-facing applications and branded packaging solutions. The segment benefits from established manufacturing processes and comprehensive equipment availability from multiple technology providers.

Food and beverage applications are expected to represent 47.6% of molded fiber pulp packaging demand in 2025. This dominant share reflects the high penetration of sustainable packaging solutions in the food retail segment and the large volume of packaging required for fresh produce, eggs, and beverage carriers. Modern food packaging increasingly features barrier coatings and moisture-resistant treatments that maintain product freshness while ensuring compostability. The segment benefits from growing consumer awareness of packaging sustainability and increasing retailer commitments to plastic reduction targets.

The Molded Fiber Pulp Packaging Market demand is advancing steadily due to increasing environmental regulations and growing recognition of the importance of sustainable packaging. However, demand faces challenges, including higher production costs compared to plastic alternatives, limitations in barrier performance for certain applications, and varying recycling infrastructure across different regions. Standardization efforts and technology advancement programs continue to influence packaging quality and demand development patterns.

The growing deployment of thermoformed and transfer molding technologies is enabling the production of high-quality packaging with enhanced aesthetics, improved structural properties, and superior surface finish. Advanced molding equipment incorporating precision tooling and automated processing provides consistency and reduced production waste while expanding design possibilities. These technologies are particularly valuable for brand owners and premium product manufacturers that require distinctive packaging solutions without compromising sustainability credentials.

Modern molded fiber manufacturers are incorporating advanced barrier coatings and surface treatments that improve moisture resistance and extend shelf-life capabilities. Integration of bio-based coating solutions and water-resistant additives enables more diverse application possibilities and comprehensive product protection. Advanced treatments also support packaging requirements for refrigerated storage and moisture-sensitive products, including electronics and pharmaceutical applications.

| Country | CAGR (2025-2035) |

|---|---|

| United States | 3.2% |

| Brazil | 4.4% |

| Germany | 1.6% |

| China | 4.8% |

| India | 5.2% |

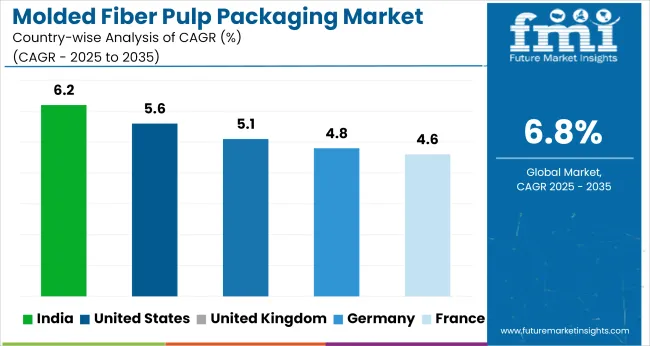

Between 2025 and 2035, molded fiber pulp packaging demand will expand at varied rates across major global markets. India leads with the fastest CAGR of 5.2%, fueled by industrial growth, government plastic bans, and expanding manufacturing capacity. China follows at 4.8%, supported by large-scale production capabilities and strong regulatory emphasis on sustainability. Brazil, with 4.4%, benefits from abundant natural fiber resources and rising packaging demand in food and consumer goods. The United States grows moderately at 3.2%, driven by corporate sustainability programs and premium applications, though tempered by market maturity. Germany remains slowest at 1.6%, reflecting a saturated market focused on engineering-driven, high-value packaging solutions. Overall, emerging markets significantly outpace mature economies, lifting the global CAGR to 3.8%.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

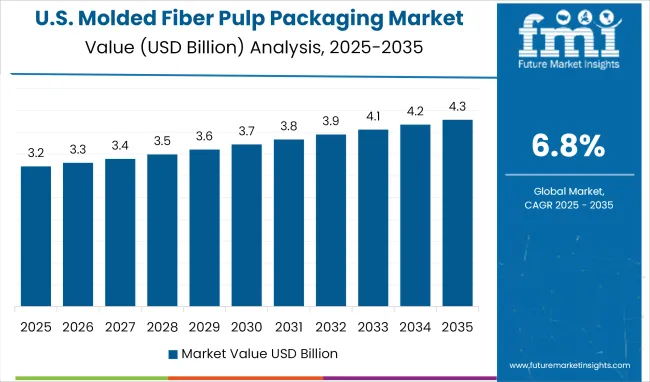

Demand for molded fiber pulp packaging in United States is expanding at a CAGR of 3.2%, driven by increasing corporate sustainability commitments and growing consumer awareness of environmental packaging alternatives. American retailers and brand owners are implementing comprehensive sustainable packaging strategies to meet evolving regulatory requirements and consumer expectations. The country's advanced manufacturing capabilities and innovation ecosystem are enabling development of specialized molded fiber solutions for diverse application requirements across food service, retail, and e-commerce sectors.

Revenue from molded fiber pulp packaging in India is projected to exhibit the highest growth rate with a CAGR of 5.2% through 2035, driven by rapid industrialization and increasing adoption of sustainable packaging solutions across food processing and consumer goods sectors. The country's expanding middle class and growing environmental awareness are creating significant demand for eco-friendly packaging alternatives. Major manufacturing hubs and agricultural processing regions are establishing comprehensive molded fiber production capabilities to serve domestic and export market opportunities.

Revenue from molded fiber pulp packaging in China is expanding at a CAGR of 4.8%, supported by massive manufacturing scale and increasing government emphasis on environmental protection requirements. The country's comprehensive industrial ecosystem and advanced production capabilities are enabling rapid deployment of molded fiber technologies across diverse packaging applications. Major manufacturing regions and urban centers are investing in large-scale molded fiber production facilities to serve growing domestic demand and export market opportunities.

Demand for molded fiber pulp packaging in Brazil is projected to grow at a CAGR of 4.4%, driven by increasing environmental awareness and expanding sustainable packaging adoption across food processing and consumer goods industries. The country's abundant natural fiber resources and established paper manufacturing infrastructure provide competitive advantages for molded fiber production development. Major urban centers and agricultural regions are implementing comprehensive sustainable packaging programs to serve growing domestic and regional market demands.

Demand for molded fiber pulp packaging in Germany is expanding at a CAGR of 1.6%, reflecting the market's maturity and focus on high-value engineering applications and premium sustainable packaging solutions. German packaging companies are leveraging advanced manufacturing technologies and precision engineering capabilities to develop specialized molded fiber products for demanding industrial and consumer applications. Growth is driven by stringent environmental regulations, sophisticated supply chain requirements, and established sustainability commitments across major German corporations.

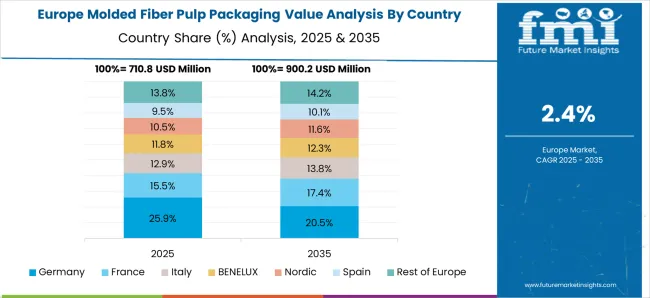

The molded fiber pulp packaging demand across Europe demonstrates diverse growth patterns reflecting varying regulatory environments, industrial structures, consumer behaviors, and sustainability priorities across different national markets. Spain leads regional growth with an impressive CAGR of 5.5% through 2035, driven by its substantial agricultural export sector requiring sustainable packaging for fruits and vegetables, rapidly expanding e-commerce market demanding protective cushioning solutions, and strong tourism industry transitioning to eco-friendly food service packaging. The Spanish government's Circular Economy Strategy España 2030 creates supportive conditions through green public procurement requirements, waste prevention measures, and financial incentives for sustainable packaging adoption.

Italy exhibits robust expansion at 4.5% CAGR, supported by the country's globally renowned food industry seeking packaging that preserves product excellence while reinforcing premium positioning and environmental values. Italian manufacturers excel in producing sophisticated molded fiber solutions for wine, olive oil, pasta, cheese, and specialty foods that combine functional protection with aesthetic sophistication befitting the "Made in Italy" brand. France demonstrates 3.5% CAGR growth, benefiting from comprehensive anti-waste legislation, strong consumer environmental consciousness, and leadership in luxury goods requiring sustainable yet premium packaging solutions. The United Kingdom maintains 3.4% growth despite Brexit-related market adjustments, with major retailers pioneering plastic-free initiatives and driving industry-wide transformation.

Netherlands shows 3.2% CAGR growth through its strategic position as Europe's logistics gateway, leadership in horticultural exports requiring breathable packaging, and commitment to circular economy innovation. Poland demonstrates 2.8% growth as manufacturing capabilities expand to serve both domestic consumption and export markets, benefiting from cost advantages while meeting Western European quality standards. Germany, despite market maturity, sustains 1.6% growth through continuous technological advancement, premium product development, and engineering excellence in manufacturing equipment that benefits the entire European industry.

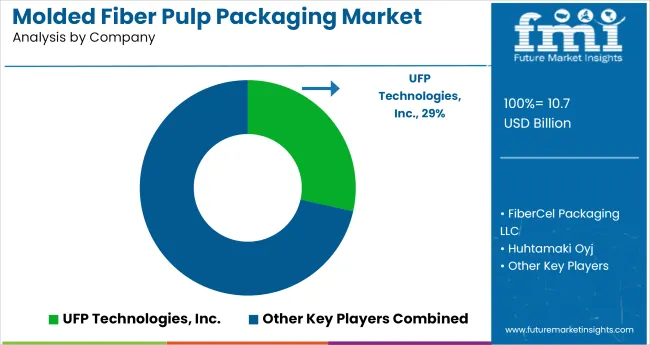

The molded fiber pulp packaging demand is defined by competition among established packaging manufacturers, specialized converters, and sustainable packaging innovators. Companies are investing in advanced molding equipment, barrier coating technologies, standardized production processes, and material innovation to deliver sustainable, functional, and cost-effective packaging solutions. Strategic partnerships, technological innovation, and production capacity expansion are central to strengthening product portfolios and regional presence.

Huhtamaki Oyj, Finland-based, offers comprehensive molded fiber packaging solutions with 8.9% share, focusing on food service applications, fresh produce packaging, and industrial protective packaging. Brodrene Hartmann, Denmark, provides specialized egg packaging and fruit protection solutions with 7.2% share, emphasizing recycled fiber utilization and closed-loop systems. Stora Enso, Finland-Sweden, delivers innovative fiber-based packaging with 6.8% share through advanced manufacturing technologies and barrier coating solutions. Mondi Group, Austria-UK, holds 5.4% share, emphasizing sustainable packaging design and comprehensive material expertise.

DS Smith, UK-based, offers integrated packaging solutions with 4.7% share, combining molded fiber production with comprehensive recycling capabilities. These companies collectively represent significant production capacity, technological expertise, and sustainability leadership across molded fiber packaging demand, driving innovation in material formulation, manufacturing processes, and application development while supporting circular economy principles and plastic reduction objectives throughout the region.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 2.8 Billion |

| Molded Pulp Type | Thick Wall, Transfer Molded, Thermoformed Fiber, Processed Pulp |

| Product Type | Trays, Drink Carriers (2 Cups, 4 Cups, 6 Cups, More Than 8 Cups), Boxes, End Caps, Plates, Bowls, Cups, Bottles (Below 250 ml, 250 ml To 750 ml, Above 750 ml), Clamshell Containers |

| Source | Virgin Pulp, Recycled Pulp |

| Application | Primary Packaging, Secondary Packaging, Edge Protectors |

| End Use | Consumer Durables (Mobile Phone, Television, Laptops, Tube Light & Bulbs, Others Such As Air Conditioners And Refrigerators), Food & Beverage (Egg Packaging – 4 Eggs, 6 Eggs, 12 Eggs, 24 Eggs, More Than 30 Eggs; Wine Packaging – 375 ml, 750 ml, 1.5 Liter, More Than 3 Liter; Fruit Packaging, Others), Cosmetics, Food Services, Healthcare, Automotive, Logistics, Others (Candles, Flower Packaging). |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Huhtamaki Oyj, Stora Enso,Mondi Group, DS Smith, Sonoco Products Company, Brodrene Hartmann, International Paper Company, Sabert Corporation, Novolex, Detpak, Henry Molded Products, Inc., Robert Cullen Ltd, Omnipac Group, KIEFEL GmbH, Bio Pak, Useo, PAPACKS Sales GmbH, Decapulp SL, Pulp-Tec Limited, James Cropper Plc, TRIDAS, Cemosa & El Taller CM |

| Additional Attributes | Dollar sales by molded pulp type and barrier coating level, regional demand trends, competitive landscape, buyer preferences for recycled versus virgin fiber sources, integration with compostable/biodegradable certification positioning, innovations in nano-coating technologies, controlled barrier release, and sustainable forestry sourcing practices |

The global molded fiber pulp packaging is estimated to be valued at USD 2.8 billion in 2025.

The market size for the molded fiber pulp packaging is projected to reach USD 4.1 billion by 2035.

The molded fiber pulp packaging is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in molded fiber pulp packaging are transfer molded, thermoformed fiber, thick wall and processed pulp.

In terms of end-use segment, food & beverage segment to command 47.6% share in the molded fiber pulp packaging in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA