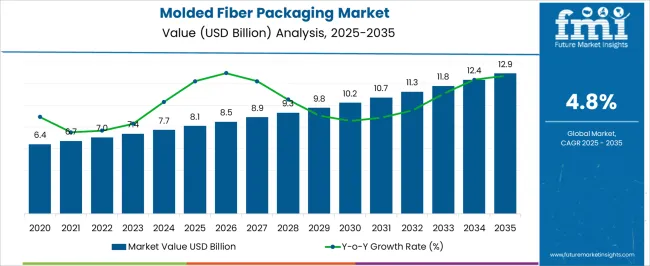

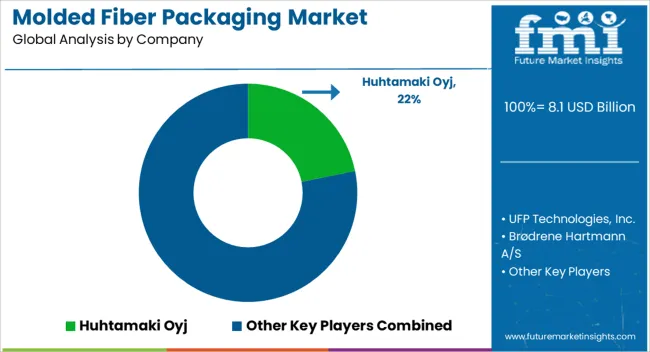

The molded fiber packaging market, estimated at USD 8.1 billion in 2025 and projected to reach USD 12.9 billion by 2035 with a CAGR of 4.8%, reflects the varied contributions of multiple production technologies toward overall market growth. The gradual increase in annual market value from USD 8.1 billion to USD 12.9 billion indicates that each technology segment contributes incrementally, supporting steady expansion rather than rapid disruptive adoption.

Traditional pulp molding techniques, including thermoforming and wet molding, continue to dominate the market due to their established supply chains, cost efficiency, and adaptability across packaging applications such as trays, cartons, and protective inserts. Emerging technologies, such as advanced fiber molding using recycled and blended materials, contribute increasingly to the market by enabling higher performance in terms of durability, moisture resistance, and design flexibility. Innovations in automated molding machinery and digital process controls enhance production throughput, reduce waste, and support customization, thereby reinforcing the role of technology in shaping market share.

Additionally, enzymatic and chemical treatments for fiber modification provide incremental value by enhancing product strength and barrier properties, enabling broader adoption in high-demand sectors, including electronics, food, and e-commerce. The contribution analysis indicates a balanced distribution where legacy technologies maintain a strong base while newer methods progressively capture market share. The cumulative effect of incremental improvements, automation, and material innovations ensures that the market grows steadily, with technology-driven differentiation underpinning competitive positioning and long-term profitability.

| Metric | Value |

|---|---|

| Molded Fiber Packaging Market Estimated Value in (2025 E) | USD 8.1 billion |

| Molded Fiber Packaging Market Forecast Value in (2035 F) | USD 12.9 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The molded fiber packaging market represents a specialized segment within the global packaging and sustainable materials industry, emphasizing lightweight, protective, and environmentally compatible solutions. Within the broader packaging materials sector, it accounts for about 4.5%, driven by demand from food and beverage, consumer electronics, and fragile goods packaging. In the sustainable and biodegradable packaging segment, its share is approximately 5.2%, reflecting adoption of pulp-based, molded fiber, and recycled materials for eco-friendly alternatives. Across the protective and cushioning packaging market, it contributes around 3.9%, supporting shock absorption, thermal insulation, and product integrity during transport.

Within the foodservice and convenience packaging category, it represents 3.6%, highlighting adoption for trays, clamshells, and takeaway containers. In the overall packaging innovation and material efficiency ecosystem, the market contributes about 3.1%, emphasizing operational performance, recyclability, and cost-effective production. Recent developments in the molded fiber packaging market have focused on material innovation, process efficiency, and sustainability.

Groundbreaking trends include high-strength molded pulp designs, integration of coatings for moisture and grease resistance, and use of post-consumer recycled fibers. Key players are collaborating with foodservice providers, electronics manufacturers, and e-commerce logistics firms to deliver tailored packaging solutions. Adoption of automation, rapid molding technology, and lightweight designs is gaining traction to improve scalability and reduce costs. The push for zero-waste packaging and regulatory compliance in major markets is shaping product development.

The molded fiber packaging market is gaining significant traction due to increasing environmental awareness, regulatory pressures on plastic usage, and the growing demand for sustainable packaging alternatives. This eco-friendly packaging solution, derived from recycled and renewable materials, is being rapidly adopted across industries seeking biodegradable and compostable options.

Market expansion is supported by the shift of major brands toward plastic-free commitments and investments in circular economy practices. Technological advancements in production processes have improved the strength, precision, and customization of molded fiber products, enhancing their competitiveness against traditional materials.

As the packaging industry adapts to changing consumer preferences and stringent environmental mandates, molded fiber packaging is emerging as a scalable and reliable alternative. The future outlook is strong, driven by its applications in protective transit packaging, consumer electronics, and food service sectors where sustainable, functional, and cost-efficient solutions are highly valued

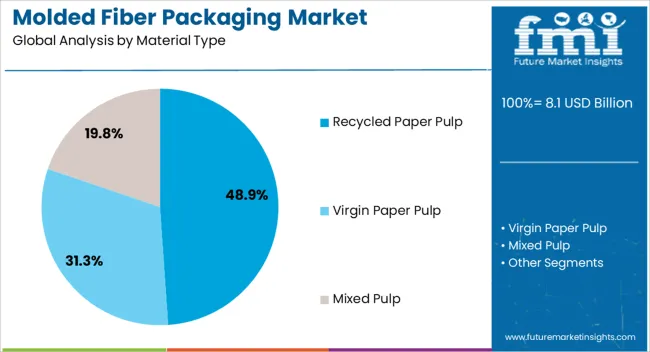

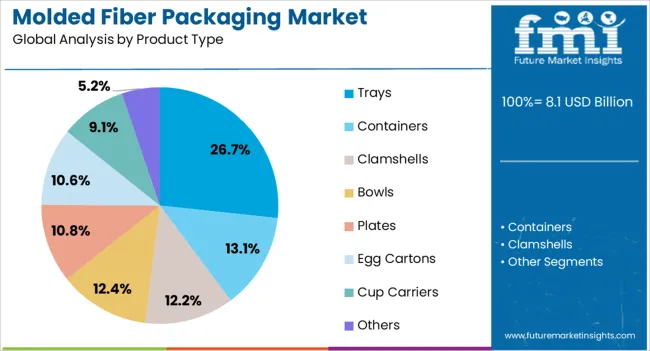

The molded fiber packaging market is segmented by material type, product type, packaging application, end-use, and geographic regions. By material type, molded fiber packaging market is divided into Recycled Paper Pulp, Virgin Paper Pulp, and Mixed Pulp. In terms of product type, molded fiber packaging market is classified into Trays, Containers, Clamshells, Bowls, Plates, Egg Cartons, Cup Carriers, and Others.

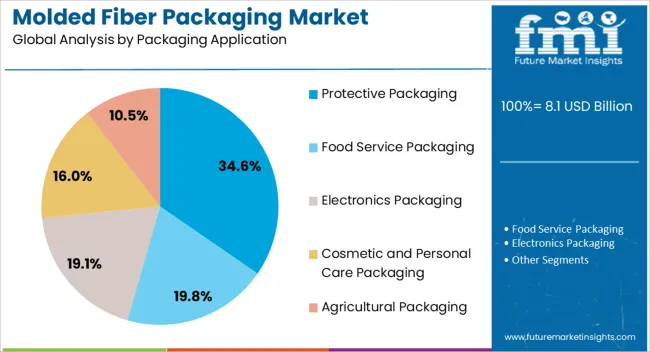

Based on packaging application, molded fiber packaging market is segmented into Protective Packaging, Food Service Packaging, Electronics Packaging, Cosmetic and Personal Care Packaging, and Agricultural Packaging. By end-use, molded fiber packaging market is segmented into Food and Beverage, Electronics, Healthcare and Pharmaceuticals, Consumer Goods, Industrial Packaging, E-commerce and Retail, Agriculture, and Others. Regionally, the molded fiber packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The recycled paper pulp segment leads the material type category with a 49% market share, reflecting its wide acceptance as a sustainable and cost-effective raw material. Its dominance is supported by an abundant supply chain of post-consumer paper waste, which aligns with circular economy models and helps brands reduce their environmental footprint.

The material offers excellent molding capabilities and can be adapted for various packaging designs without compromising biodegradability. Manufacturers are increasingly optimizing recycled pulp formulations to meet specific performance standards, including moisture resistance and shock absorption.

Regulatory endorsements for recycled materials and consumer demand for green packaging further fuel growth in this segment. As end-use industries prioritize sustainable sourcing and life-cycle responsibility, recycled paper pulp is expected to maintain its pivotal role in driving volume across the molded fiber packaging market.

Trays represent a significant 27% share within the product type segment, attributed to their versatility and high utility across food service, consumer goods, and industrial packaging. Molded fiber trays are widely used for organizing, securing, and displaying products while offering excellent cushioning and environmental benefits.

Their adoption has grown in retail-ready packaging formats, particularly in sectors seeking to replace plastic clamshells and foam trays with compostable alternatives. Innovations in tray design now allow for multi-cavity configurations, enhanced stacking strength, and improved moisture resistance, expanding their functional appeal.

Food-grade certifications and the compatibility of molded trays with automated packing lines have further cemented their position in the market. Continued growth in ready-to-eat meals, fresh produce, and electronics packaging is expected to reinforce tray demand, as businesses align packaging solutions with sustainability goals and evolving regulatory frameworks.

The protective packaging segment commands a 35% share within the packaging application category, driven by rising demand for damage-resistant and eco-conscious transit solutions. Molded fiber’s ability to provide shock absorption, secure product fit, and thermal insulation makes it a favored choice for protecting fragile items during transportation.

This segment has witnessed increased adoption in consumer electronics, medical devices, and industrial components, where performance and sustainability are equally prioritized. Unlike traditional plastic-based foam and EPS materials, molded fiber solutions meet environmental compliance standards while reducing packaging waste.

Custom-engineered designs and advancements in tooling technology have enabled precise fitments and improved packaging efficiency. As e-commerce continues to grow and businesses face mounting pressure to reduce their environmental impact, protective molded fiber packaging is expected to remain a key growth driver in this market.

The market has witnessed strong growth as sustainable alternatives to plastic packaging are increasingly adopted across food and beverage, electronics, consumer goods, and e-commerce sectors. Molded fiber materials, derived from recycled paper, bagasse, wheat straw, and other fibrous feedstocks, provide biodegradability, lightweight performance, and cushioning properties for protective packaging. Consumer awareness about environmental impact, along with stricter regulations on single-use plastics in various regions, has accelerated market expansion. Manufacturers are investing in advanced molding technologies, including thermoforming and compression molding, to improve precision, structural integrity, and scalability.

Demand for molded fiber packaging is strongly influenced by sustainability trends in consumer goods and food industries. Companies are transitioning from plastic trays, clamshells, and cups to molded fiber alternatives to meet regulatory restrictions and reduce carbon footprints. High resilience, shock absorption, and temperature tolerance make molded fiber packaging suitable for perishable foods, fragile electronics, and medical devices. Eco-conscious retailers and e-commerce providers are encouraging the use of biodegradable packaging to enhance brand perception and comply with waste management standards. Continuous innovation in product design, surface coatings for water resistance, and optimized fiber blends ensure functional performance while supporting environmentally responsible supply chains, making molded fiber packaging a key solution for modern packaging demands.

Advancements in molding techniques, fiber processing, and coating technologies have enhanced the quality and versatility of molded fiber packaging. Precision molding, vacuum forming, and automated production lines enable consistent dimensions, improved mechanical strength, and high throughput. Surface treatments, wax coatings, and barrier layers extend shelf life for food applications and prevent moisture penetration. Integration of automation and robotics in production has increased efficiency and reduced labor costs. Research into novel feedstocks, including agricultural residues and post-consumer paper, has improved sustainability metrics without compromising performance. These innovations enable molded fiber packaging to compete with traditional plastics in durability, visual appeal, and protective capability while aligning with global eco-friendly packaging initiatives.

Regulatory frameworks and environmental policies are central to the expansion of molded fiber packaging. Bans on single-use plastics, extended producer responsibility guidelines, and packaging waste reduction mandates have prompted manufacturers to adopt biodegradable and recyclable alternatives. Certifications for compostability, recyclability, and compliance with food safety standards influence product design and material selection. Manufacturers are optimizing production processes to minimize emissions, water use, and energy consumption, meeting both regulatory requirements and corporate sustainability targets. By aligning with international and regional environmental directives, molded fiber packaging producers are able to expand market access, enhance consumer trust, and capitalize on the global shift toward sustainable packaging solutions.

The growth of e-commerce and organized retail has amplified demand for molded fiber packaging solutions. Protective trays, clamshells, mailers, and inserts are increasingly used to ensure safe transport of fragile goods, fresh produce, and packaged foods. Retailers are integrating molded fiber packaging into product branding and customer experience, emphasizing eco-friendliness and sustainability. Urbanization and rising disposable incomes in emerging markets are supporting the proliferation of packaged goods, further boosting demand. Investments in automated production facilities, logistics optimization, and localized manufacturing have enabled cost-effective supply, reducing lead times. These trends are driving sustained adoption of molded fiber packaging across multiple sectors globally.

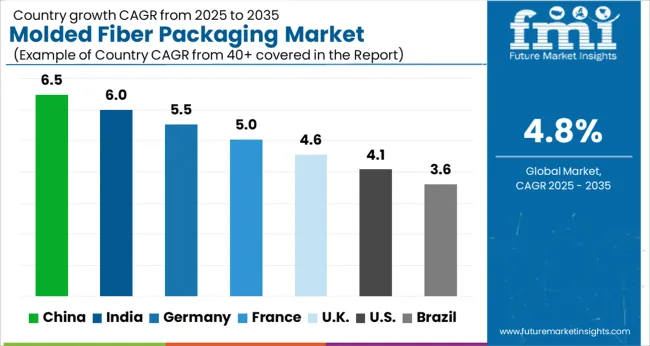

| Country | CAGR |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| France | 5.0% |

| UK | 4.6% |

| USA | 4.1% |

| Brazil | 3.6% |

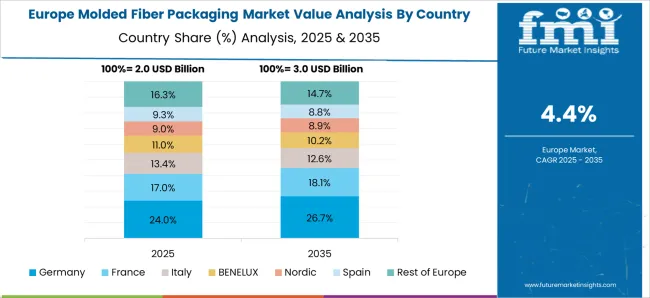

The market is projected to grow at a CAGR of 4.8% from 2025 to 2035, supported by the increasing preference for eco-friendly and biodegradable packaging solutions. China leads with 6.5%, reflecting large-scale production and adoption in the food and consumer goods sectors. India follows at 6.0%, driven by expanding packaging requirements in e-commerce and retail industries. Germany records 5.5%, supported by sustainability initiatives and regulatory compliance. The UK reaches 4.6%, reflecting innovation in packaging materials and processes. The USA registers 4.1%, with growth attributed to rising demand for environmentally responsible packaging and advanced manufacturing technologies. Market expansion is reinforced by the shift toward sustainable supply chains. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is witnessing a CAGR of 6.5%, driven by growing demand from food and beverage, electronics, and consumer goods industries. Molded fiber trays, containers, and protective packaging solutions are increasingly adopted to replace conventional materials for industrial and retail applications. Local manufacturers focus on sustainable production methods, lightweight designs, and cost-effective solutions for high-volume applications. Partnerships with international suppliers enable technology transfer for advanced molding techniques, improved durability, and consistent quality. Rising e-commerce and processed food packaging requirements further support the adoption of molded fiber solutions across multiple sectors.

India is growing at a CAGR of 6.0%, fueled by demand from packaged foods, confectionery, and electronics sectors. Molded fiber packaging is increasingly adopted to provide sustainable and protective solutions for industrial and consumer applications. Local manufacturers focus on modular production lines, low-cost molding processes, and hygienic packaging suitable for food applications. Government initiatives to reduce single-use plastics and promote eco-friendly packaging further stimulate market growth. Strategic partnerships with international companies enable access to advanced equipment and molding technologies.

Germany is witnessing a CAGR of 5.5%, driven by packaging demand in food, pharmaceuticals, and consumer electronics. High-quality molded fiber solutions are preferred for protective packaging, compliance with EU environmental standards, and recyclable materials. German manufacturers focus on advanced molding technologies, durability, and lightweight designs to improve logistics efficiency. Demand for industrial and retail applications is growing, particularly for food-grade packaging, electronics transport, and consumer goods. Innovation in biodegradable coatings and moisture-resistant products supports sustainable packaging adoption.

The United Kingdom is growing at a CAGR of 4.6%, supported by food packaging, beverage containers, and protective packaging needs. Adoption of molded fiber products is encouraged by environmental regulations and consumer preference for recyclable packaging. Manufacturers focus on design efficiency, low-cost production, and modular solutions for small to medium enterprises. Growth in takeaway food and e-commerce packaging drives adoption of molded fiber trays, plates, and containers. Collaborative projects with European suppliers enable high-quality production and advanced molding techniques.

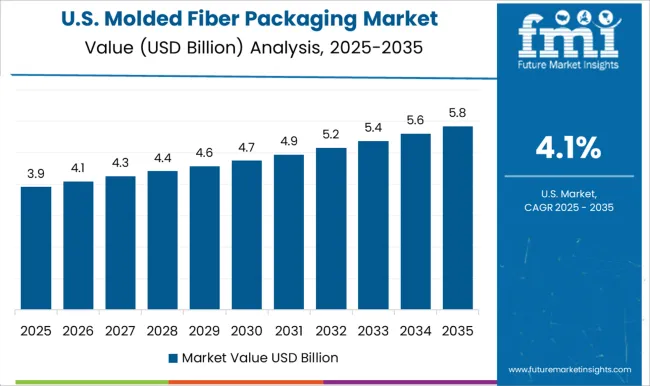

The United States is expanding at a CAGR of 4.1%, driven by demand from foodservice, bakery, and electronics packaging. Molded fiber packaging is favored for sustainable, lightweight, and protective applications. Manufacturers focus on automated production lines, recyclable materials, and consistent quality for high-volume industrial and retail requirements. Regulatory incentives for eco-friendly packaging and growing consumer awareness further support market adoption. Large multinational players dominate production, supplying high-performance molded fiber products for both domestic and export markets.

The market exhibits robust growth driven by increasing demand for sustainable, eco-friendly packaging solutions across foodservice, consumer goods, and e-commerce sectors. Leading players such as Huhtamaki Oyj, UFP Technologies, Inc., Brødrene Hartmann A/S, and Pactiv LLC maintain strong market positions through diversified product portfolios, advanced manufacturing capabilities, and global distribution networks. These companies emphasize innovation in pulp molding technologies, lightweight design, and biodegradability to meet evolving regulatory standards and environmental expectations. Mid-sized and regional players like Henry Molded Products, Inc., Fabri-Kal Corporation, Earthly 4Molded Solutions, and FiberPak, Inc. compete by focusing on niche applications, customization, and local supply chain advantages.

Their ability to provide tailored solutions and rapid turnaround times enhances competitiveness against larger multinational manufacturers. The market is increasingly shaped by sustainability-driven consumer preferences and regulatory frameworks promoting compostable packaging, encouraging continuous R&D investment. Strategic partnerships, mergers, and acquisitions are common as firms seek to expand regional presence and technological capabilities. Companies that can combine cost efficiency, scalable production, and environmentally responsible offerings are positioned to capture significant market share and drive long-term growth in the molded fiber packaging industry.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.1 Billion |

| Material Type | Recycled Paper Pulp, Virgin Paper Pulp, and Mixed Pulp |

| Product Type | Trays, Containers, Clamshells, Bowls, Plates, Egg Cartons, Cup Carriers, and Others |

| Packaging Application | Protective Packaging, Food Service Packaging, Electronics Packaging, Cosmetic and Personal Care Packaging, and Agricultural Packaging |

| End-use | Food and Beverage, Electronics, Healthcare and Pharmaceuticals, Consumer Goods, Industrial Packaging, E-commerce and Retail, Agriculture, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Huhtamaki Oyj, UFP Technologies, Inc., Brødrene Hartmann A/S, Pactiv LLC, Henry Molded Products, Inc., Fabri-Kal Corporation, Earthly 4Molded Solutions, FiberPak, Inc., Genpak, LLC, Keiding, Inc., Pacific Pulp Molding, and ProPak Corporation |

| Additional Attributes | Dollar sales by packaging type and application, demand dynamics across food, beverage, and consumer goods sectors, regional trends in sustainable packaging adoption, innovation in pulp molding, moisture resistance, and structural design, environmental impact of biodegradability and recycling, and emerging use cases in e-commerce packaging, ready-to-eat meals, and protective shipping solutions. |

The global molded fiber packaging market is estimated to be valued at USD 8.1 billion in 2025.

The market size for the molded fiber packaging market is projected to reach USD 12.9 billion by 2035.

The molded fiber packaging market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in molded fiber packaging market are recycled paper pulp, virgin paper pulp and mixed pulp.

In terms of product type, trays segment to command 26.7% share in the molded fiber packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Molded Fiber Egg Packaging Market Forecast and Outlook 2025 to 2035

Molded Fiber Pulp Packaging Industry Analysis in Australia and New Zealand Forecast Outlook 2025 to 2035

Molded Fiber Pulp Packaging Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Pulp Packaging Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Pulp Packaging industry Analysis in USA and Canada - Size, Share, and Forecast Outlook 2025 to 2035

Market Share Breakdown of Molded Fiber Pulp Packaging Providers

Europe Molded Fiber Pulp Packaging Market Analysis – Demand, Growth & Future Outlook 2024-2034

Japan Molded Fiber Pulp Packaging Market Trends – Growth & Forecast 2023-2033

Korea Molded Fiber Pulp Packaging Market Insights – Trends & Forecast 2023-2033

Western Europe Molded Fiber Pulp Packaging Market Insights – Growth & Forecast 2023-2033

Breaking Down Market Share in Europe Molded Fiber Pulp Packaging

Market Share Breakdown of USA and Canada Molded Fiber Pulp Packaging Manufacturers

Molded Fiber Bowl Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Pulp Cap Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Cup Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Wine Packs Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Pulp Edge Protectors Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber End Caps Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Containers Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Tray Market Trends – Growth & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA