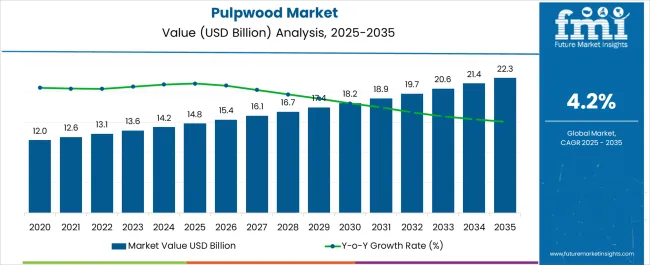

The pulpwood market, valued at 14.8 USD billion in 2025, is projected to reach 22.3 USD billion by 2035, reflecting a CAGR of 4.2% over the period. The market maturity curve shows steady growth from early, selective adoption in 2020–2024, when supply chains and procurement practices were being tested.

By 2025, the curve begins a sharper upward trajectory as production volumes scale and processing capacities expand. Between 2025–2030, annual market size grows from 14.8 to 18.2 USD billion, reflecting wider adoption among paper, packaging, and fiberboard producers. From 2030 to 2035, growth moderates as the market reaches consolidation, with established suppliers capturing the majority of demand. The adoption lifecycle reflects this progression. In 2020–2024, early adopters validated supply consistency and cost efficiency, establishing reference points for broader uptake.

From 2025 to 2030, scaling occurs as mainstream buyers increase orders, regional supply networks strengthen, and inventory management becomes standardized. By 2030–2035, consolidation dominates, with late entrants following proven sourcing models, mergers and acquisitions shaping competitive dynamics, and procurement driven by cost optimization rather than experimentation. The market evolves from experimental adoption, through scaling and replication, to a stable, organized phase with predictable volumes and established supplier relationships.

| Metric | Value |

|---|---|

| Pulpwood Market Estimated Value in (2025 E) | USD 14.8 billion |

| Pulpwood Market Forecast Value in (2035 F) | USD 22.3 billion |

| Forecast CAGR (2025 to 2035) | 4.2% |

Seasonality in the pulpwood market is influenced by logging cycles, processing schedules, and paper production demand. Data shows that harvesting activity peaks in late spring and early summer, contributing 20–25% higher quarterly volumes compared to winter months. Similarly, paper and packaging mills increase procurement in Q2 and Q3 to meet mid-year production targets, while Q1 often records 10–15% lower activity due to inventory drawdowns.

Regional climatic conditions also affect output, with areas experiencing heavy rainfall showing delayed harvesting. Suppliers adjust shipments to align with these cycles, ensuring stable raw material flow and avoiding production bottlenecks across the value chain. Cyclicality in pulpwood reflects broader capital expenditure and market demand patterns. Large mills typically replace equipment or expand capacity every 5–7 years, causing periodic demand spikes for raw pulpwood, sometimes increasing annual volumes by USD 0.5–1 billion.

Policy or trade-related shifts, such as import/export restrictions, can temporarily accelerate or suppress procurement by 15–20%, creating short-term cycles. Over the decade, these cycles overlay the underlying CAGR of 4.2%, producing periods of faster growth followed by stabilization. Understanding these patterns enables suppliers and buyers to plan contracts, inventory, and logistics efficiently, aligning with both seasonal peaks and cyclical surges.

The pulpwood market is experiencing stable expansion, supported by rising global demand for paper-based products and the growing preference for sustainable raw materials. Increasing investment in modern pulping technologies and improved forestry management practices has enhanced supply efficiency and quality. The market is further strengthened by the adoption of certified sourcing standards, ensuring sustainable harvesting and traceability throughout the supply chain.

Demand from the paper, packaging, and hygiene product industries continues to drive procurement of pulpwood, with additional opportunities emerging from bio-based material applications. Government policies encouraging responsible forestry and the circular economy are also contributing to market growth.

Technological advancements in processing and logistics have reduced production costs, while rising environmental awareness is prompting industries to adopt pulpwood from sustainably managed sources With both established and emerging markets prioritizing renewable resources, the pulpwood sector is well-positioned for continued growth, supported by expanding industrial applications and evolving consumer preferences for eco-friendly products.

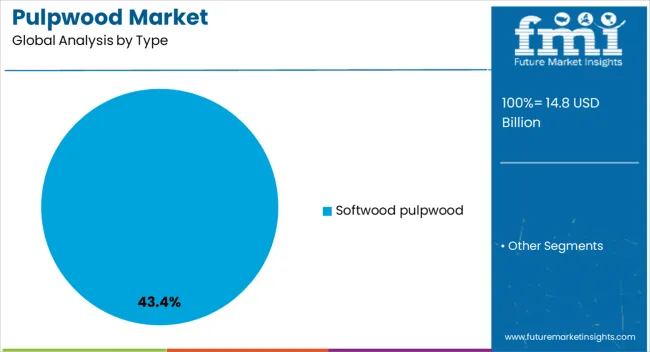

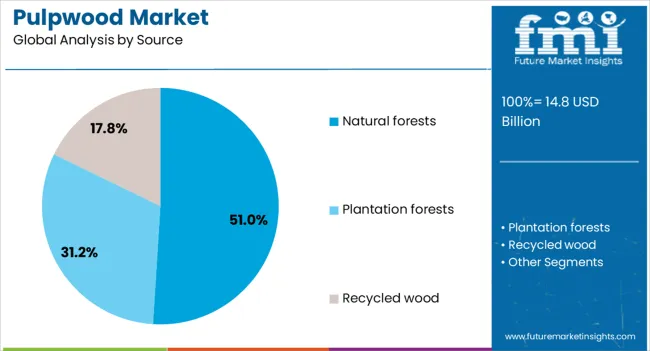

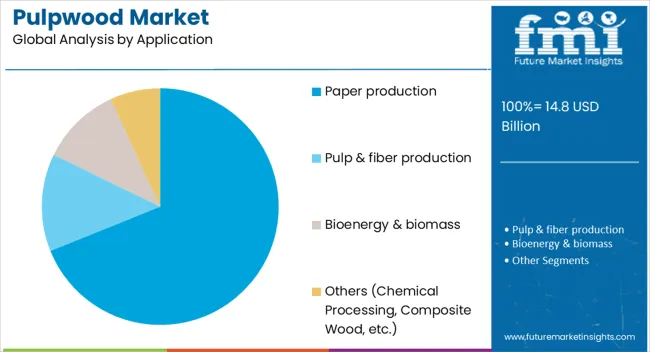

The pulpwood market is segmented by type, source, application, and geographic regions. By type, pulpwood market is divided into Softwood pulpwood and Hardwood pulpwood. In terms of source, pulpwood market is classified into Natural forests, Plantation forests, and Recycled wood. Based on application, pulpwood market is segmented into Paper production, Pulp & fiber production, Bioenergy & biomass, and Others (Chemical Processing, Composite Wood, etc.).

Regionally, the pulpwood industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The softwood pulpwood segment is projected to hold 43.40% of the Pulpwood market revenue share in 2025, making it the leading type segment. This leadership has been attributed to the long fiber structure of softwood, which enhances paper strength and durability. Industries have shown a preference for softwood pulpwood in applications requiring high tensile strength, particularly in packaging and printing-grade papers.

The consistent quality of softwood pulp, along with its adaptability to various pulping methods, has supported its dominance in the market. Sustainable forest management practices in softwood-producing regions have also ensured reliable supply, meeting both volume and quality requirements.

Furthermore, softwood pulpwood’s compatibility with advanced processing technologies allows for efficient production and cost optimization As global demand for high-strength paper products continues to grow, the softwood pulpwood type remains a preferred choice for manufacturers seeking performance and sustainability in their raw materials.

The natural forests segment is anticipated to account for 51% of the Pulpwood market revenue share in 2025, establishing itself as the leading source. Its dominance has been supported by the abundant availability and mature growth characteristics of trees in natural forests, which produce high-quality pulpwood.

The established forestry infrastructure in regions with vast natural forests has enabled efficient harvesting, processing, and transport, reducing supply chain complexities. Preference for natural forest pulpwood has also been influenced by its fiber consistency and suitability for diverse paper manufacturing processes.

In many countries, regulated harvesting from natural forests has ensured a balance between industrial demand and environmental preservation, supporting long-term supply stability Additionally, competitive production costs and well-developed export channels have further strengthened the position of natural forests as a key pulpwood source in global markets.

The paper production segment is expected to hold 68.90% of the Pulpwood market revenue share in 2025, making it the leading application segment. This leadership is driven by the sustained global demand for printing, writing, and packaging papers, along with emerging uses in specialty paper products. Pulpwood’s role as the primary raw material in paper manufacturing has ensured a steady and significant demand base.

The ongoing growth of the packaging industry, especially in e-commerce and consumer goods, has further reinforced the need for high-quality pulpwood. Paper producers are increasingly favoring pulpwood due to its ability to deliver consistent fiber quality, supporting both product performance and operational efficiency.

The segment has also benefited from advancements in paper production technologies that optimize pulp usage while maintaining product quality As environmental considerations push for greater reliance on renewable and biodegradable materials, pulpwood’s role in paper production is expected to remain critical, ensuring its continued market leadership.

The pulpwood market is expanding due to growing demand for paper, tissue, and packaging products driven by e-commerce, hygiene needs, and industrial applications. Both hardwood and softwood species are used for chemical and mechanical pulping. North America and Europe are major producers of high-quality pulpwood, while Asia-Pacific shows rapid consumption growth. Manufacturers focus on sustainable sourcing, consistent fiber quality, and optimized logistics. Market players also emphasize plantation management and harvesting efficiency to meet global pulp and paper industry requirements.

Pulpwood is a primary raw material for paper, cardboard, and packaging production. The surge in e-commerce and online retail has increased packaging requirements, while hygiene products such as tissues and napkins continue to drive consumption. Softwood provides longer fibers for strength, while hardwood adds bulk and smoothness. Manufacturers require a reliable, consistent supply of high-quality pulpwood to ensure production continuity. Until alternative fiber sources like agricultural residues or recycled paper meet industrial-scale demand with equivalent quality, traditional pulpwood will remain critical for the paper and packaging sectors.

Sustainable forest management and plantation cultivation are key to ensuring a steady pulpwood supply. Companies focus on optimizing growth cycles, harvesting practices, and replanting strategies to maintain long-term fiber availability. Certification programs, such as FSC or PEFC, enhance credibility and meet regulatory and consumer expectations. Efficient plantation practices also reduce environmental impact, support biodiversity, and minimize soil degradation. Until alternative fiber production methods can provide the same consistent volume and quality without environmental consequences, sustainable pulpwood plantations will remain central to meeting industrial demands.

Pulpwood supply chains involve complex logistics from forest harvesting to pulp mills. Seasonal weather conditions, road accessibility, and fuel costs affect transportation efficiency. Delays or disruptions in harvesting or transport can impact mill operations and increase costs. Companies invest in integrated supply chain management, including satellite monitoring, predictive harvesting schedules, and bulk transport solutions to maintain continuous fiber flow. Until alternative fiber sourcing or local production reduces dependency on long-distance logistics, supply chain efficiency remains a critical factor influencing pulpwood market stability and pricing.

Recycled paper, agricultural residues, and non-wood fibers increasingly compete with traditional pulpwood. While these alternatives help reduce deforestation and environmental impact, they often require process adjustments and may not fully replicate fiber characteristics of hardwood or softwood. Industries such as high-strength paper and specialty packaging still rely on pulpwood for quality and performance. Until alternative fibers achieve cost-efficiency, scalability, and equivalent quality, pulpwood will remain a dominant feedstock for the global paper and packaging industry.

| Country | CAGR |

|---|---|

| China | 5.7% |

| India | 5.3% |

| Germany | 4.8% |

| France | 4.4% |

| UK | 4.0% |

| USA | 3.6% |

| Brazil | 3.2% |

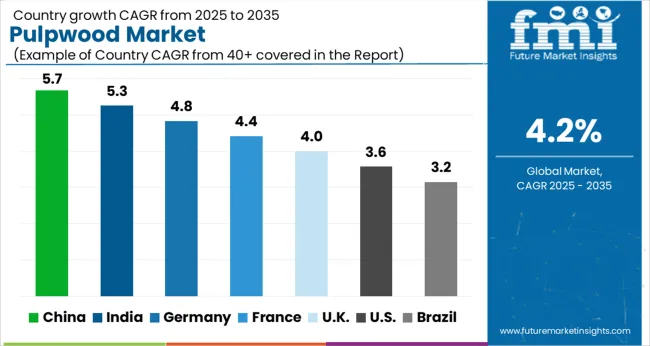

The global pulpwood market is projected to grow at a CAGR of 4.2% through 2035, supported by increasing demand across paper production, packaging, and industrial wood applications. Among BRICS nations, China has been recorded with 5.7% growth, driven by large-scale production and deployment in paper and packaging industries, while India has been observed at 5.3%, supported by rising utilization in pulp and industrial wood applications. In the OECD region, Germany has been measured at 4.8%, where production and adoption for paper, packaging, and industrial applications have been steadily maintained. The United Kingdom has been noted at 4.0%, reflecting consistent use in paper and packaging sectors, while the USA has been recorded at 3.6%, with production and utilization across industrial, packaging, and paper industries being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The pulpwood market in China is growing at a CAGR of 5.7%, driven by increasing demand for paper, packaging, and tissue products. The country’s expanding e-commerce and packaging industries, coupled with rising consumption of paper-based goods, contribute to steady growth. Technological advancements in pulp processing, including improved yield and sustainability practices, enhance production efficiency. Government initiatives promoting sustainable forestry and renewable resources support the pulpwood industry. The market also benefits from investments in modern pulp mills and logistics infrastructure, ensuring timely supply to manufacturers. Rising awareness about eco-friendly packaging and recycled paper products further encourages the use of pulpwood. China’s large-scale manufacturing base and increasing domestic consumption position the pulpwood market for sustained expansion over the forecast period.

The pulpwood market in India is expanding at a CAGR of 5.3%, supported by growing paper production and packaging needs. Increasing demand for tissue paper, cardboard, and specialty paper products drives pulpwood consumption. Investments in modern pulp mills, coupled with adoption of sustainable forestry practices, enhance production efficiency and quality. Government initiatives promoting renewable resources and eco-friendly paper products encourage market growth. India’s growing e-commerce sector further fuels demand for packaging materials derived from pulpwood. Technological innovations, such as chemical and mechanical pulping advancements, reduce waste and improve fiber recovery. Rising awareness about environmental sustainability and increased export opportunities also contribute to steady market expansion. The pulpwood industry in India continues to grow as paper-based products gain traction across domestic and international markets.

The pulpwood market in Germany is witnessing steady growth at a CAGR of 4.8%, driven by demand for paper, tissue, and packaging materials. Germany’s emphasis on sustainable forestry and renewable resources supports responsible sourcing of pulpwood. Technological advancements in pulp production, including efficient chemical and mechanical processes, improve yield and reduce environmental impact. Industrial demand for packaging and specialty paper products, especially recycled paper, contributes to market expansion. Government policies promoting eco-friendly production, carbon neutrality, and renewable resource utilization create favorable conditions for growth. Adoption of modern pulp mills and logistics optimization ensures timely supply to domestic and European markets. Germany’s strong regulatory framework and environmental awareness continue to shape the pulpwood market, balancing industrial demand with sustainability objectives.

The pulpwood market in the United Kingdom is growing at a CAGR of 4.0%, driven by demand for paper, packaging, and tissue products. Sustainable forestry practices and responsible sourcing initiatives support the market’s environmental objectives. Increasing demand for recycled paper and eco-friendly packaging contributes to steady growth. Technological improvements in pulp processing enhance production efficiency and fiber recovery. The UK government promotes renewable resources and eco-conscious manufacturing, encouraging market expansion. Industrial demand from packaging, printing, and tissue paper industries ensures consistent consumption of pulpwood. Rising awareness of sustainability among consumers further drives preference for paper-based products over plastic alternatives. The UK pulpwood market benefits from a combination of industrial demand, sustainability trends, and technological advancements.

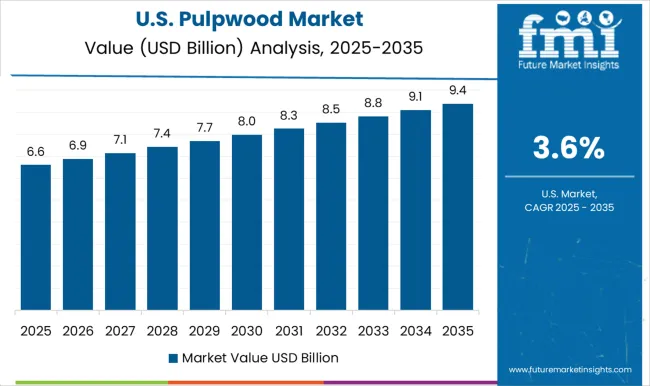

The pulpwood market in the United States is expanding at a CAGR of 3.6%, supported by steady consumption in paper, packaging, and tissue industries. Sustainable forestry and renewable resource initiatives ensure responsible pulpwood sourcing. Technological innovations in pulping processes improve fiber recovery and reduce waste. Industrial demand for cardboard, packaging, and specialty paper products drives market growth. Government policies promoting eco-friendly manufacturing and carbon neutrality further support the industry. The USA market also benefits from rising demand for recycled paper and environmentally responsible packaging. Industrial players continue to invest in modern pulp mills and logistics infrastructure, strengthening supply chains. Overall, the pulpwood market in the United States maintains steady growth through a combination of industrial demand, sustainability focus, and technological innovation.

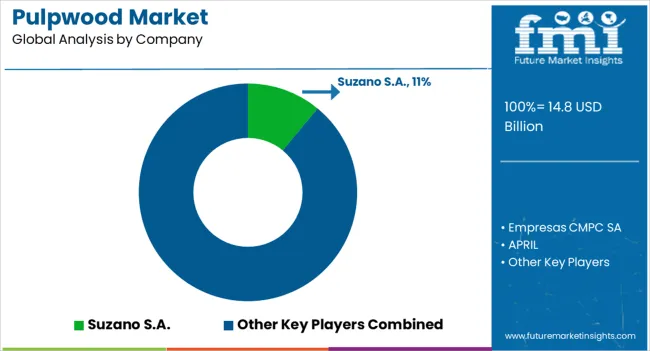

The pulpwood market is a critical segment of the global forestry and paper industry, providing the primary raw material for paper, packaging, tissue, and specialty fiber products. Rising demand for sustainable packaging, tissue products, and printing paper continues to drive the consumption of pulpwood worldwide. Environmental regulations and certification programs, such as FSC and PEFC, have emphasized sustainable forest management, prompting key players to adopt responsible sourcing practices. Suzano S.A. is a major global pulp producer from Brazil, known for its integrated eucalyptus plantations and large-scale pulp production facilities. Empresas CMPC SA, based in Chile, specializes in softwood and hardwood pulp and operates with a strong focus on sustainability. APRIL, headquartered in Indonesia, leverages acacia plantations for pulp production, emphasizing environmental responsibility and reforestation programs.

European players such as Metsä Group and UPM-Kymmene are leaders in high-quality paper pulp, focusing on renewable and circular forestry solutions. Other significant participants include Georgia-Pacific LLC, West Fraser, Weyerhaeuser, and International Paper, which dominate the North American pulpwood market, providing softwood and hardwood fibers for a variety of paper and board applications. Stora Enso, Sappi, Domtar, Resolute Forest Products, Nippon Paper, Mondi, and Nine Dragons Paper round out the global market, supplying pulp across Europe, Asia, and Oceania. Together, these companies are investing in modern production technologies, sustainable forestry, and logistics efficiency to meet growing demand while minimizing environmental impact. The pulpwood market remains poised for steady growth as global demand for paper and packaging solutions continues to expand.

| Item | Value |

|---|---|

| Quantitative Units | USD 14.8 Billion |

| Type | Softwood pulpwood and Hardwood pulpwood |

| Source | Natural forests, Plantation forests, and Recycled wood |

| Application | Paper production, Pulp & fiber production, Bioenergy & biomass, and Others (Chemical Processing, Composite Wood, etc.) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Suzano S.A., Empresas CMPC SA, APRIL, Metsä Group, UPM-Kymmene, Georgia-Pacific LLC, West Fraser, Weyerhaeuser, International Paper, Stora Enso, Sappi, Domtar, Resolute Forest Products, Nippon Paper, Mondi, and Nine Dragons Paper |

| Additional Attributes | Dollar sales in the Pulpwood Market vary by type including hardwood and softwood, application across paper, packaging, and specialty cellulose products, and region covering North America, Europe, and Asia-Pacific. Growth is driven by increasing demand for paper and packaging materials, expansion of the tissue and hygiene products industry, and rising adoption of sustainable forestry practices. |

The global pulpwood market is estimated to be valued at USD 14.8 billion in 2025.

The market size for the pulpwood market is projected to reach USD 22.3 billion by 2035.

The pulpwood market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in pulpwood market are softwood pulpwood and _hardwood pulpwood.

In terms of source, natural forests segment to command 51.0% share in the pulpwood market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA