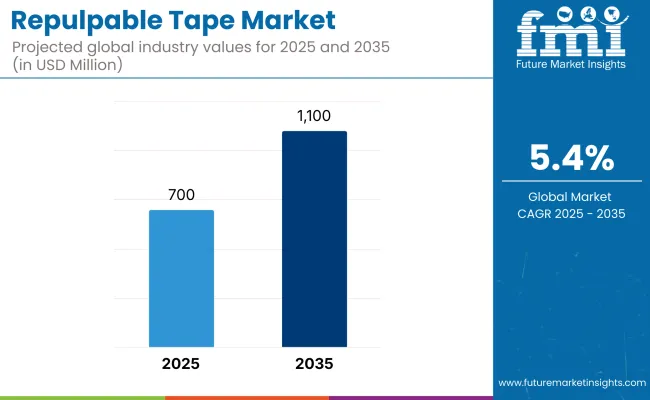

The repulpable tape market is forecast to grow from USD 700 million in 2025 to USD 1,100 million by 2035, adding USD 400 million over the ten-year period. This reflects a 57.1% total market growth, supported by a compound annual growth rate (CAGR) of 5.4%. Over the forecast timeline, the market expands by a 1.5 multiple.

| Metric | Value |

|---|---|

| Estimated Value in (2025 E) | USD 700 million |

| Forecast Value in (2035 F) | USD 1,100 million |

| Forecast CAGR (2025 to 2035) | 5.4% |

In the first half of the decade (2025 to 2030), the market increases from USD 700 million to USD 900 million, contributing USD 200 million, or 50.0% of the total decade’s growth. Demand in this stage is fueled by adoption in paper mills, printing operations, and converting facilities, where repulpable adhesives enable waste reduction and fiber recovery without contamination. Water-soluble adhesives dominate due to their compatibility with high-speed paper production lines.

During the second half (2030 to 2035), the market grows from USD 900 million to USD 1,100 million, adding USD 200 million, or 50.0% of the total decade’s growth. Growth in this phase is driven by sustainability mandates, zero-waste manufacturing initiatives, and increasing uptake in corrugated board production. Technological advancements in adhesive chemistry enhance shear strength and heat resistance, allowing for wider use in specialty papers, coated stocks, and high-moisture environments.

From 2020 to 2024, the repulpable tape market grew from USD 560 million to USD 669 million, driven by hardware-centric adoption in paper mills, printing facilities, and converting plants where adhesive solutions must be fully recyclable in the paper repulping process. During this period, the competitive landscape was dominated by specialty adhesive manufacturers controlling nearly 70% of market revenue, with leaders such as Tesa SE, Nitto Denko, and 3M Company focusing on water-soluble, fiber-compatible tapes designed for splicing and roll changeover in paper production.

Competitive differentiation relied on adhesive performance in wet environments, tensile strength, and ease of removal during pulping, while digital features such as application tracking or adhesive-use analytics remained bundled in broader plant management systems rather than serving as independent revenue streams. Service-based models, including on-site adhesive application training and efficiency audits, contributed less than 10% of the total market value.

Demand for repulpable tape will expand to USD 1,100 million in 2035, and the revenue mix will shift as sustainability consulting, adhesive optimization services, and automated splicing solutions grow to over 40% share. Traditional tape manufacturers face rising competition from eco-innovation companies offering bio-based adhesives, customizable roll widths, and IoT-enabled splice monitoring systems.

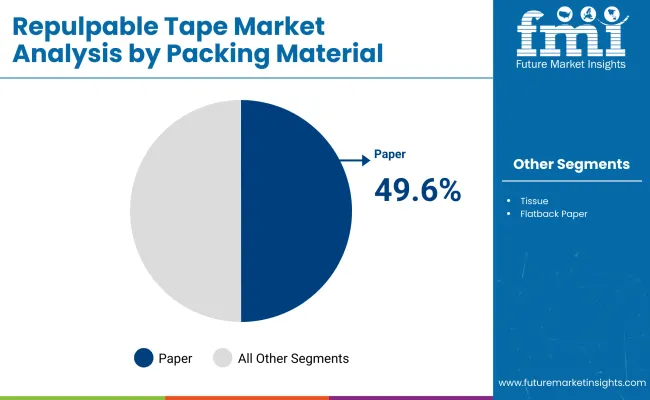

The market is segmented by backing material, adhesive type, application, end-user industry, repulpability grade, and region. Backing material includes paper, tissue, and flatback paper, each offering varying tensile strength, surface smoothness, and compatibility with paper-based substrates. Adhesive type segmentation comprises water-based acrylic, modified starch, and natural rubber adhesives, chosen for their repulpability, bonding strength, and environmental compliance.

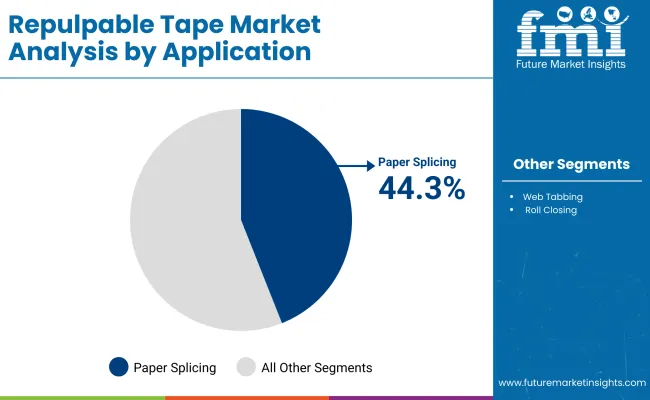

Application areas include paper splicing, web tabbing, and roll closing, supporting seamless operations in printing, packaging, and converting lines. End-user industries include paper & pulp, printing, packaging, and label manufacturing, where repulpable tapes minimize contamination in recycling streams and meet sustainability goals.

Repulpability grade is categorized into fully repulpable and partially repulpable variants, catering to different recycling process requirements. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

The paper segment is forecasted to hold the largest share of 49.6% in the repulpable tape market by 2025. Its dominance is rooted in the rising preference for eco-friendly materials that integrate seamlessly into paper recycling streams without contaminating the pulp. Paper-based repulpable tapes offer strong adhesion while dissolving in the repulping process, ensuring zero disruption to paper fiber recovery.

Manufacturers are innovating paper tape structures with improved tensile strength and printability to meet branding and operational needs in packaging and converting industries. This segment is further propelled by increasing government mandates on reducing non-recyclable adhesives, positioning paper as the preferred substrate for sustainable sealing and splicing solutions.

The paper and pulp industry is projected to account for 52.4% of the end-user market share in 2025, driven by the sector’s reliance on contamination-free splicing solutions. Repulpable tapes enable seamless reel-to-reel splicing during paper production without introducing plastic waste or adhesive clumps into the pulp.

With rising production volumes in printing, packaging, and specialty paper, mills are adopting repulpable tapes to optimize line efficiency and reduce fiber loss. As zero-waste manufacturing gains traction, paper & pulp producers are investing in high-performance repulpable tapes that maintain adhesion under high-speed operations while supporting closed-loop recycling systems.

Water-based acrylic adhesives are set to capture 46.2% of the adhesive type segment in 2025, favored for their low VOC emissions, strong tack, and repulpability. These adhesives dissolve completely in the recycling process without leaving residue, ensuring the quality of recovered fibers.

They offer consistent performance across varying humidity and temperature conditions, making them suitable for global supply chains. The growing push for solvent-free adhesive technologies is further accelerating the adoption of water-based acrylics in both converting and end-use applications.

Paper splicing applications are expected to hold a 44.3% share of the market in 2025, driven by the critical role repulpable tapes play in maintaining continuous operations in printing presses, corrugation plants, and packaging lines. These tapes enable quick, secure joins that withstand high-speed machinery without failure.

Manufacturers are developing repulpable splicing tapes with enhanced tear resistance and compatibility across various paper grades. As efficiency and waste reduction remain top priorities for paper converters, the demand for specialized tapes that support both operational performance and recyclability continues to rise.

Fully repulpable tapes are projected to lead the repulpability grade segment with a commanding 63.2% share in 2025. Their ability to completely disperse during the repulping process ensures that 100% of the paper fibers can be recovered for reuse, making them essential for closed-loop recycling.

This grade is particularly critical for premium printing, packaging, and specialty paper applications where fiber quality directly impacts end-product performance. As industries adopt stricter sustainability goals, fully repulpable tapes are emerging as a default choice for companies committed to waste-free, circular manufacturing practices.

Increasing emphasis on sustainable packaging and waste reduction in paper and pulp processing industries is driving the growth of the repulpable tape market. These tapes are designed to disintegrate during the repulping process without contaminating recycled fiber streams, making them essential for paper splicing, core starting, and roll finishing operations. The shift toward eco-friendly adhesive solutions in industrial applications is further accelerating adoption.

Water-soluble adhesive repulpable tapes and high-strength paper-backed variants have gained popularity due to their compatibility with various paper grades and their ability to maintain adhesion in high-speed converting processes. These tapes eliminate the need for manual tape removal, reducing downtime and improving operational efficiency in printing, corrugated board, and specialty paper manufacturing.

Moisture resistance challenges and adhesion limitations on low-energy surfaces restrict wider adoption, even as demand grows across paper mills, printing, and converting industries for recyclable, fiber-based adhesive tapes that eliminate waste in the repulping process.

Sustainability-led Adoption in Paper and Printing Industries

Repulpable tapes are gaining strong momentum in sectors such as paper manufacturing, corrugated board production, and printing due to their ability to dissolve completely in the pulping process without contaminating fiber streams. They are essential for splicing, patching, and tabbing paper webs in continuous production lines, ensuring operational efficiency while aligning with zero-waste goals.

Performance Limitations in High-moisture and Specialized Applications

Despite their eco-friendly advantages, repulpable tapes face technical challenges that limit their versatility. Exposure to excessive moisture or steam during processing can weaken adhesive performance, leading to splice failure or tape lifting in demanding environments. Their adhesion strength may be insufficient for substrates with low surface energy or coated finishes, restricting application in certain specialty papers.

Advances in High-tack Adhesives and Wider Industry Applications

A major trend in the market is the development of next-generation repulpable tapes with enhanced adhesive strength, heat resistance, and faster dissolution rates. Manufacturers are introducing formulations that maintain bond integrity under higher moisture and temperature ranges, enabling use in more challenging papermaking and printing environments.

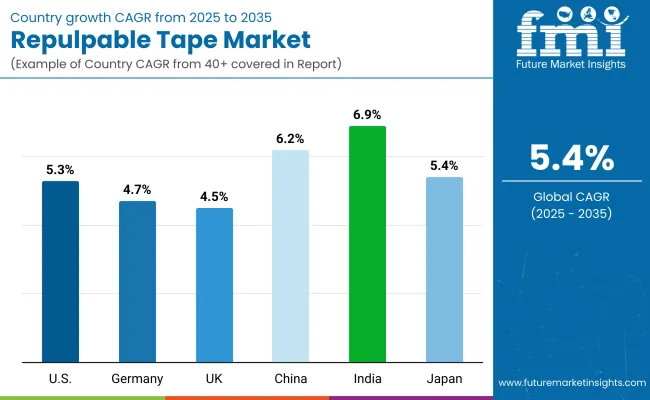

| Country | CAGR |

|---|---|

| USA | 5.3% |

| China | 6.2% |

| India | 6.9% |

| UK | 4.5% |

| Germany | 4.7% |

| Japan | 5.4% |

| South Korea | 4.5% |

The repulpable tape market is experiencing consistent growth across multiple industries, fueled by the paper & pulp sector’s shift toward sustainable, fiber-based sealing solutions. This product category is designed to disintegrate during the repulping process, eliminating contamination risks and improving recyclability for paper-based packaging. Its increasing use in splicing paper webs, secure sealing in converting lines, and clean removal applications is gaining traction in printing, packaging, and industrial operations.

The USA repulpable tape market is projected to expand at a CAGR of 5.3% between 2025 and 2035, driven by strong demand from paper mills, printing presses, and converting plants that are under increasing pressure to meet sustainability targets. The shift toward residue-free splicing solutions is particularly evident in high-speed newsprint, magazine, and corrugated packaging production lines, where downtime reduction is critical.

This growth is further reinforced by environmental compliance measures and a steady replacement cycle of conventional plastic-based tapes. Market participants are also focusing on improved adhesive formulations to perform under high temperatures and moisture exposure, enabling their use across diverse substrates.

Germany’s repulpable tape market is expected to grow at a 4.7% CAGR through 2035, propelled by stringent recycling mandates under the EU’s Circular Economy Action Plan and the presence of advanced printing facilities. The nation’s specialty paper production sector, which caters to luxury packaging, fine art printing, and security paper, is a major consumer of high-performance repulpable tapes.

German manufacturers are spearheading innovations in solvent-free adhesives and fiber-reinforced backings to improve tensile strength, tear resistance, and machine compatibility. Sustainability-conscious end-users are adopting tapes that meet both FSC and Blue Angel certification standards.

The UK repulpable tape market is forecast to expand at a 4.5% CAGR between 2025 and 2035, with momentum fueled by eco-compliance regulations, the Plastic Packaging Tax, and significant investment in printing press automation. Demand is rising in publication printing, tissue production, and premium folding carton manufacturing, where repulpable splicing minimizes waste and maintains product quality.

Local converters are focusing on adhesives that deliver strong bonds without leaving residue, a critical factor for recycling purity. The push toward closed-loop recycling in the paper sector is increasing the need for tapes compatible with both virgin and recycled fiber stock.

China’s repulpable tape market is anticipated to grow at a 6.2% CAGR through 2035, driven by the scale of its packaging production sector, expanding paper exports, and the government’s aggressive waste reduction and recycling mandates. Large-scale mills are adopting high-performance repulpable adhesives for kraft linerboard, corrugated containers, and high-volume newsprint production.

Domestic producers are increasingly targeting export markets, especially the EU, by aligning with international recycling standards such as EN 643. The country’s investment in automated and AI-driven paper production lines is creating demand for tapes that deliver consistent performance at high speeds and under varying humidity conditions.

India’s repulpable tape market is set to register the fastest global CAGR at 6.9% between 2025 and 2035, supported by rising domestic paper consumption, expanding tissue and napkin production, and increasing corporate and government sustainability initiatives.

Demand is driven by converters seeking cost-effective yet high-strength alternatives to plastic tapes for splicing and sealing. The market benefits from growth in both consumer and industrial paper products, with investments in high-speed printing presses and automated production lines.

Japan’s repulpable tape market is projected to grow at a 5.4% CAGR, driven by a high-value paper production ecosystem, continuous packaging innovation, and stringent waste minimization policies. The market favors compact roll formats with precision unwind features to support fast reel changes in automated lines, minimizing downtime.

Manufacturers are focusing on ultra-thin and high-strength adhesive solutions to cater to the country’s demand for premium packaging, specialty printing, and rigid box assembly. Adoption is further accelerated by Japan’s commitment to circular economy principles and eco-label certifications.

South Korea’s repulpable tape market is forecast to grow at a 4.9% CAGR, driven by increased investment in sustainable printing, tissue production, and high-grade packaging exports. The country’s strong base in smart manufacturing is enabling rapid adoption of AI-guided splicing systems that optimize tape usage and reduce waste.

Demand is particularly high among automated high-speed printing lines and premium tissue converters, where operational uptime is a competitive advantage. Manufacturers are also innovating in moisture-tolerant and reinforced tape variants to meet the needs of heavy-duty paper and board production.

The repulpable tape market is moderately fragmented, with global adhesive technology leaders, paper-converting solution providers, and specialty industrial tape manufacturers competing across printing, paper production, and packaging sectors. Global leaders such as 3M Company, Tesa SE, and Nitto Denko hold significant market share, driven by high-bond, water-dispersible adhesives, compatibility with paper recycling processes, and compliance with mill safety standards. Their strategies increasingly emphasize solvent-free formulations, high-tensile strength paper backings, and eco-certified adhesives supporting circular economy goals.

Established mid-sized players including Kikusui Tape and ECHOtape are expanding adoption through application-specific repulpable tapes for splicing, tabbing, and roll-starting in printing presses and paper manufacturing lines. These companies focus on rapid adhesion, clean removal, and minimal impact on pulp quality, enabling higher operational efficiency in high-speed converting processes.

Specialized providers such as Mutual Industries target niche applications with cost-effective repulpable tapes tailored for small and medium paper mills, publishing houses, and packaging converters. Their competitive edge lies in localized distribution networks, customized width and length formats, and rapid delivery capabilities for time-sensitive production environments.

Key Development of Repulpable Tape Market

| Item | Value |

|---|---|

| Quantitative Units | USD 700 Million |

| By Backing Material | Paper, Tissue, and Flatback Paper |

| By Adhesive Type | Water-based Acrylic, Modified Starch, and Natural Rubber Adhesives |

| By Application | Paper Splicing, Web Tabbing, and Roll Closing |

| By End-User Industry | Paper and Pulp, Printing, Packaging, and Label Manufacturing |

| By Repulpability Grade | Fully Repulpable and Partially Repulpable |

| Key Companies Profiled | Tesa SE, Nitto Denko, 3M Company, Kikusui Tape, Mutual Industries, and ECHOtape |

| Additional Attributes | Increasing adoption in high-speed printing and converting operations, preference for water-dispersible adhesives to reduce recycling contamination, growth in sustainable and eco-friendly tape solutions, rising use in paper mills for seamless roll splicing, innovation in fully repulpable adhesive chemistries, compliance with global environmental standards, strong demand from label and specialty paper manufacturing, improved fiber recovery rates with fully repulpable grades, expansion in Asia-Pacific’s paper production hubs, and steady replacement demand in North America and Europe |

The global repulpable tape market is estimated to be valued at USD 700 million in 2025.

The market size for the repulpable tape market is projected to reach USD 1,100 million by 2035.

The repulpable tape market is expected to grow at a CAGR of 5.4% between 2025 and 2035.

The key material segments in the repulpable tape market include paper, non-woven fibers, and biodegradable films.

In terms of material, the paper segment is expected to account for the highest share of 49.6% in the repulpable tape market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tape Unwinder Market Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Tape Measure Market Size and Share Forecast Outlook 2025 to 2035

Tape Backing Materials Market Analysis by Material Type, Application, and Region through 2025 to 2035

Tape Stretching Line Market Analysis – Growth & Trends 2025 to 2035

Tapes Market Insights – Growth & Demand 2025 to 2035

Tape Banding Machine Market Overview - Demand & Growth Forecast 2025 to 2035

Competitive Overview of Tape Dispenser Companies

Competitive Overview of Tape Backing Materials Companies

Tape & Label Adhesives Market

Tape Applicator Machines Market

UV Tapes Market Growth - Trends & Forecast 2025 to 2035

PVC Tapes Market Size and Share Forecast Outlook 2025 to 2035

Leading Providers & Market Share in PVC Tapes Industry

ESD Tapes and Labels Market from 2025 to 2035

USA Tapes Market Analysis – Growth & Forecast 2024-2034

Duct Tape Market Size and Share Forecast Outlook 2025 to 2035

Tear Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA