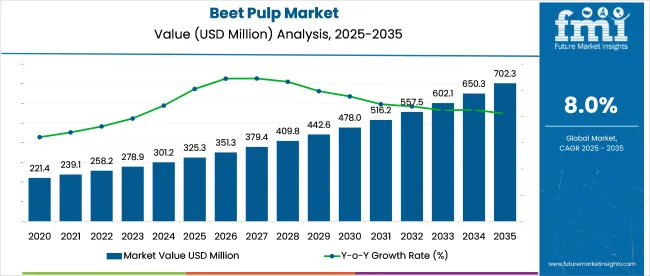

The beet pulp market is projected to be valued at approximately USD 325.3 million in 2025, advancing toward a valuation of USD 702.9 million by 2035. This reflects an 8% compound annual growth rate over the forecast period, with consistent demand seen across developed and emerging regions.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 325.3 million |

| Industry Value (2035F) | USD 702.9 million |

| CAGR (2025 to 2035) | 8% |

North America, led by the United States, remains the dominant regional contributor, accounting for nearly 88.4% of total revenue in 2023. Despite its current lead, future expansion is expected to be paced by Asian markets, particularly India, where annual growth is anticipated at 8.1%. The broader trend reflects a shift in livestock nutrition practices, where both commercial and small-scale producers seek high-energy, digestible, and cost-effective feed components.

The industry registers varying degrees of share across its parent categories. It accounts for 4.2% of the animal feed market, driven by its niche use in high-fiber formulations. Within the livestock nutrition market, its share is estimated at 5.8%, owing to targeted inclusion in cattle and equine diets. In the equine feed market, its presence is more substantial, comprising nearly 11.3% due to its digestibility and energy benefits.

As a component of the sugar industry by-products market, it contributes about 9.5%, given its derivation from sugar beet processing. Lastly, in the functional fiber ingredients market, beet pulp represents 6.7%, supported by growing awareness of its prebiotic and gut-health advantages.

Recent trials in EU-funded livestock programs have evaluated micronized beet pulp pellets infused with postbiotics and chelated trace minerals. These modified formulations demonstrated a 17% improvement in dry matter digestibility in early-lactation dairy cows without altering total ration energy.

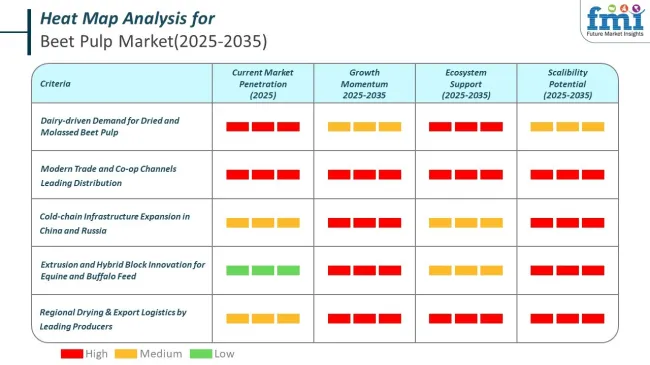

In India, agri-tech cooperatives in Maharashtra and Gujarat have begun contracting local sugar mills to standardize product moisture and fiber ratios for hybrid feed blocks targeted at smallholder buffalo operations. Meanwhile, patent activity from North American feed manufacturers points to extrusion-activated beet pulp blends being tested as an alternative to conventional soybean hulls in high-performance equine diets, especially where dust minimization and respiratory safety are priorities.

Beet pulp, widely used as animal feed and in industrial applications, shows sharp contrasts in per‑capita availability across major economies. Based on a global allocation of 10 million tonnes, European markets record the highest per‑capita figures, while populous nations such as China and India see minimal availability per person despite significant aggregate volumes.

The top ten economies collectively account for 5 million tonnes, or 50 percent of global beet pulp volume, with Europe alone representing the largest share on a per‑capita basis. The rest of the world absorbs the remaining 5 million tonnes, spread across diverse agricultural markets, where average per‑capita availability remains far lower than in Europe and North America.

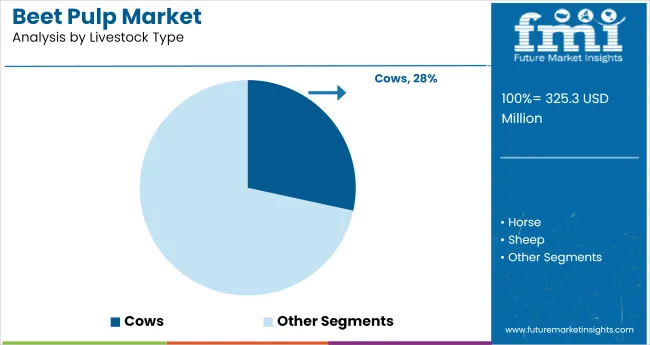

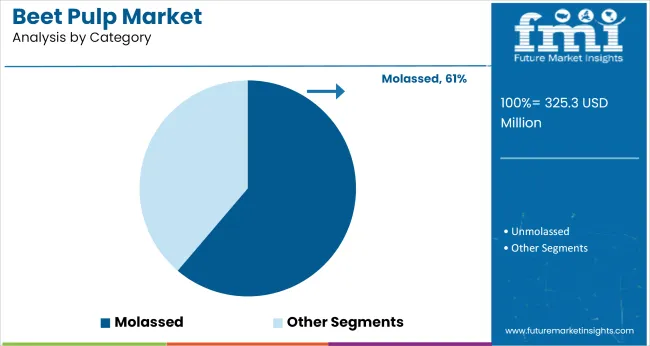

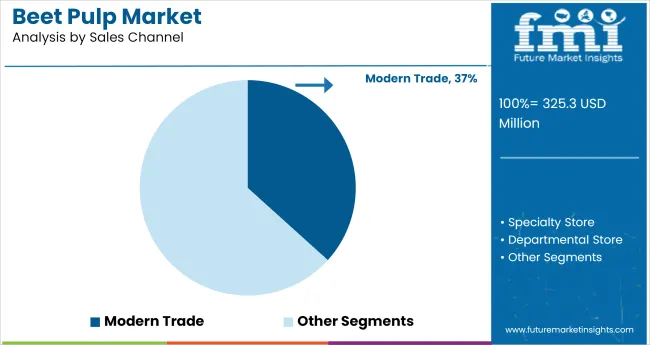

Dried pulp is projected to lead by product type in 2025 with a 42.6% share due to its storability and transport benefits, while cows dominate livestock usage at 28.4% driven by dairy feed demand. Molassed beet pulp leads by category at 61.2%, favored for its energy and taste profile. Modern trade accounts for 36.7% of sales, supported by bulk supply and retail integration.

Dried pulp is projected to remain the dominant segment in 2025, capturing around 42.6% of total product-type revenue. Its long shelf life and low moisture content make it suitable for bulk handling, extended storage, and cross-border trade, especially in markets where climatic conditions limit the use of wet or ensiled variants.

Cows are expected to lead consumption in 2025, accounting for nearly 28.4% of total livestock-based demand. Their high nutritional requirements and consistent feed intake patterns make beet-derived fiber an ideal supplement, particularly in dairy operations.

Molassed beet pulp is projected to dominate in 2025, holding an estimated 61.2% share of category-based sales. Its enhanced palatability and elevated energy content make it highly favored among livestock owners, particularly in high-performance dairy and equine systems.

Modern trade is expected to lead sales in 2025, capturing around 36.7% of total distribution share. Its extensive geographic coverage, bulk procurement capabilities, and integration with agricultural cooperatives position it as the most effective channel for beet pulp distribution.

Beet pulp demand is driven by its digestible fiber, cost-efficiency, and role in high-yield livestock nutrition. Industrial integration with sugar processing and global trade expansion are further supporting its position in feed supply chains.

Rising Livestock Feed Demand

Rising emphasis on feed quality and cost-efficient nutrition in livestock farming has accelerated the use of product in structured rations. Dairy, equine, and beef producers are increasingly selecting products for its digestible fiber and stable energy yield. This trend is reinforced by growing awareness of gut health benefits and enhanced nutrient absorption associated with beet-derived fiber. The market is also benefiting from broader adoption in regions shifting toward intensive animal agriculture, where optimized feed conversion ratios are essential for profitability.

Industrial Integration and Trade Expansion

Beet pulp demand is also being shaped by strategic alignment with the sugar industry and growth in cross-border trade of processed feed ingredients. With rising global sugar beet production, beet pulp is increasingly captured as a co-product and distributed through formalized supply chains.

Export demand, especially in Asia and the Middle East, is being supported by modern trade networks and long-shelf-life variants like dried and molassed pulp. These developments are positioning product as a reliable commodity in both domestic and export-driven feed economies.

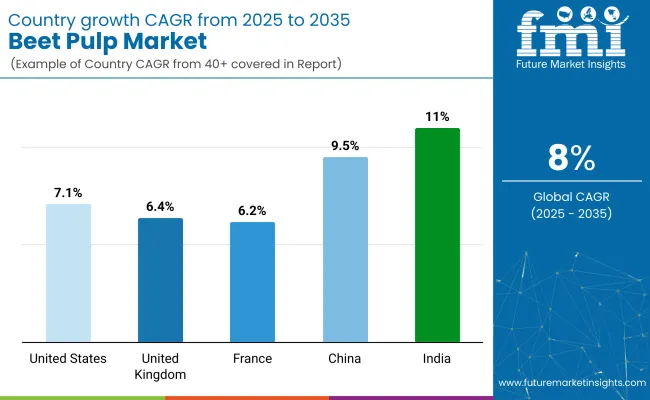

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.1% |

| United Kingdom | 6.4% |

| France | 6.2% |

| China | 9.5% |

| India | 11.0% |

The beet pulp market is projected to expand at an 8% CAGR between 2025 and 2035, led by rising demand in ruminant feed and fermentation substrates. Russia, a BRICS country, outpaces the global trend with 9.4% growth, supported by expansion in sugar beet cultivation and strong regional demand for pelletized feed inputs. Processing clusters in Krasnodar and Voronezh are optimizing drying and densification to meet EU and Middle East export standards.

India follows at 8.7%, where beet pulp is gaining ground as a low-cost fiber additive in compound feeds. Growth is tied to diversification in dairy feed formulations and regional supply chain development in Uttar Pradesh and Maharashtra. ASEAN economies such as Thailand and Vietnam record 8.2%, slightly above trend, driven by increasing usage in aquaculture and contract farming models. OECD nations underperform. France grows at 6.9% due to stagnant sugar beet output, while the United States posts 6.5%, constrained by cost inflation in transportation and drying stages.

The report covers a detailed analysis of 40+ countries and the top five countries have been shared as a reference.

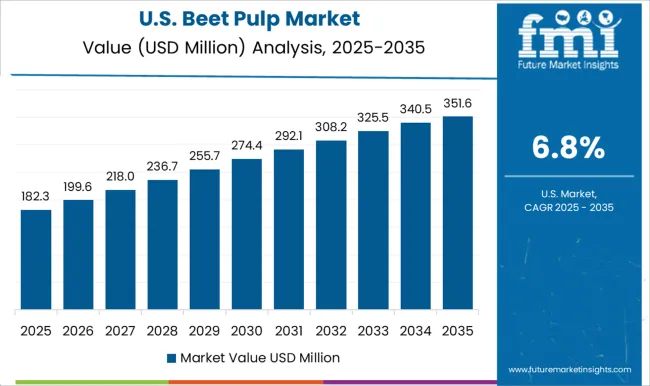

The USA beet pulp market is projected to expand at a 7.1% CAGR through 2025 to 2035. Growth is being underpinned by large dairy and beef herds that require fiber‐rich, low-starch rations to maintain rumen health and support high milk yields. Steady supplies of product from domestic sugar processors in the Upper Midwest and Pacific Northwest ensure price stability, encouraging feed formulators to lock in long-term contracts.

Emphasis on feed efficiency under the Dairy Margin Coverage program is prompting producers to incorporate beet-derived fiber in total mixed rations, while equine owners value the product for its slow-release energy profile. Modern trade chains dedicated to farm inputs are broadening distribution, aided by logistics hubs near grain terminals, enabling reliable year-round availability even during roughage shortages.

The United Kingdom’s beet pulp market value is expected to rise at a 6.4% CAGR over the forecast horizon. Demand is being driven by a sizable leisure and performance horse population that relies on beet-based fiber to offset limited grazing during colder months. Sugar beet processing clusters in eastern England provide a local co-product stream that is pelleted, stored, and moved through integrated feed mills, keeping transport costs low.

Sectoral focus on gut health and laminitis prevention in horses has been amplified by veterinary guidelines that favor low-starch diets, placing product high on purchasing lists. Dairy herds concentrated in the West Country are supplementing conserved forages with beet-derived fiber to maintain butterfat levels, while online farm stores have accelerated small-lot sales.

France’s beet pulp market is anticipated to progress at a 6.2% CAGR throughout 2025 to 2035. Northern sugar refineries generate consistent product volumes that are pelletized and routed to cooperative feed plants serving the country’s extensive dairy basin. Policy measures aimed at reducing antibiotic use have placed greater emphasis on feed ingredients that promote gut microbiota balance, and beet-derived pectin and hemicellulose are viewed as effective prebiotic sources.

Producer organizations have negotiated collective procurement agreements, securing favorable pricing and minimizing inventory risk. Rising interest in forage extenders during drought-prone summers is encouraging dairies to blend beet pulp with maize silage, safeguarding milk solids. Equine breeding regions such as Normandy are also adopting molassed variants for young stock conditioning.

China’s beet pulp market is forecast to register a 9.5% CAGR between 2025 and 2035. Rapid expansion of commercial dairy clusters in Inner Mongolia and Heilongjiang, combined with large-scale beef feedlots in the Northeast, has amplified demand for digestible fiber that complements high-grain diets. Domestic products output lags consumption, so import volumes from the EU and North America are rising, aided by tariff concessions under recent trade protocols.

Government feed standards targeting improved conversion ratios encourage formulators to replace part of the cereal base with fiber-rich co-products, moderating feed costs without sacrificing energy density. Cold-chain enhancements along rail corridors facilitate long-distance shipment of dried and molassed pellets to inland provinces, reducing spoilage risk and supporting year-round supply.

India’s beet pulp market is poised to grow at an 11.0% CAGR during the forecast period. Rising milk demand and government initiatives to professionalize dairy farming are accelerating the shift from fodder-based diets to compound feeds that incorporate energy-dense fiber. Pilot sugar beet cultivation programs in Gujarat and Uttar Pradesh are providing an emerging domestic source of pulp, while import channels via west-coast ports backstop supply during lean periods.

Animal nutrition companies are promoting products as a cost-effective replacer for maize and oilseed cakes, highlighting improved rumen health and weight gain. Expansion of organized feed retail in tier-two cities, coupled with digital advisory platforms for smallholders, is broadening market penetration beyond traditional cooperative networks.

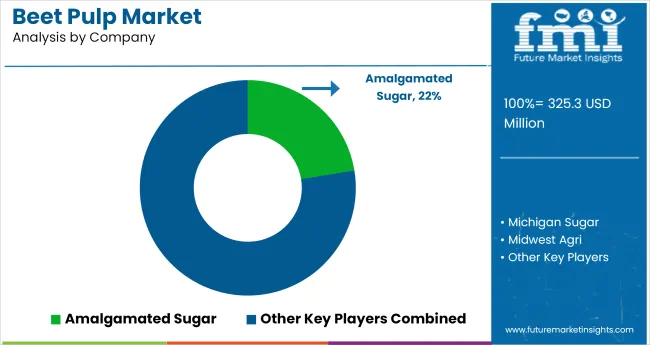

The beet pulp industry is shaped by established sugar cooperatives and processing companies focused on by-product valorization and feed-grade fiber optimization. Leading the sector is Amalgamated Sugar, recognized for consistent output and integrated supply chains across North America. Other key players include Michigan Sugar, Midwest Agri, and American Crystal Sugar, all leveraging proximity to beet-growing regions to ensure feedstock security.

European firms such as Tereos, British Sugar, and Nordzucker specialize in molassed and pelleted variants for livestock nutrition. Canadian supplier Ontario Dehy Inc. and Egypt-based Delta Sugar Company enhance global trade flows, while Nippon Beet Sugar Manufacturing brings Asia-Pacific capabilities to the segment. Strategic investments in drying technology and regional distribution continue to strengthen the competitive landscape.

Recent Beet Pulp Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 325.3 million |

| Projected Market Size (2035) | USD 702.9 million |

| CAGR (2025 to 2035) | 8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value |

| Product Type Analyzed (Segment 1) | Wet Pulp, Pressed Pulp, Dried Pulp (Pellets and Shreds), and Ensiled Pulp. |

| Livestock Type Analyzed (Segment 2) | Cow, Horse, Sheep, Goat, Pig, Buffaloes, Mules, and Asses. |

| Category Type Analyzed (Segment 3) | Molassed and Unmolassed. |

| Sales Channel Analyzed (Segment 4) | Modern Trade, Specialty Store, Departmental Store, Convenience Store, and Online Retailers. |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Amalgamated Sugar, Michigan Sugar, Midwest Agri, Tereos, British Sugar, Nordzucker, Ontario Dehy Inc., American Crystal Sugar, Delta Sugar Company, Nippon Beet Sugar Manufacturing. |

| Additional Attributes | Dollar sales, share, growth rate, top livestock users, leading product forms, trade dynamics, regional demand shifts, raw material access, pricing trends, and dominant distribution channels. |

The industry is segmented into wet pulp, pressed pulp, dried pulp (pellets and shreds), and ensiled pulp.

The industry is segmented into cow, horse, sheep, goat, pig, buffaloes, mules, and asses.

The industry finds molassed and unmolassed.

The industry is segmented into modern trade, specialty store, departmental store, convenience store, and online retailers.

The industry covers regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The global beet pulp market is estimated to be valued at USD 325.3 million in 2025.

The market size for the beet pulp market is projected to reach USD 702.3 million by 2035.

The beet pulp market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in beet pulp market are wet pulp, pressed pulp, dried pulp (pellets and shreds) and ensiled pulp.

In terms of livestock type, cow segment to command 54.2% share in the beet pulp market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Beet Pulp in EU Size and Share Forecast Outlook 2025 to 2035

Pulp Roll Cradle Market Forecast and Outlook 2025 to 2035

Pulp Molding Tooling Market Size and Share Forecast Outlook 2025 to 2035

Beetroot Powder Market Size and Share Forecast Outlook 2025 to 2035

Pulp Liner Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Pulpwood Market Size and Share Forecast Outlook 2025 to 2035

Pulp Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Beet Sugar Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pulp Drying Equipment Market Trend Analysis Based on Type, End-Use, Region 2025 to 2035

Beetroot Molasses Market

Pulp Moulding Tooling Market

Pulp Washing Equipment Market

Pulp Cells Market

Repulpable Tape Market Size and Share Forecast Outlook 2025 to 2035

Hydrapulper Market Size and Share Forecast Outlook 2025 to 2035

Wood Pulp Market Analysis – Demand & Growth Forecast 2024-2034

Drum Pulper Market

Sugar Beet Pectin Market Growth - Functional Applications & Demand 2025 to 2035

Sugar Beet Juice Extract Market Analysis by Confectionery, Cosmetics & Personal care, Dietary supplements, Sports Nutrition, Biofuel Through 2035

Citrus Pulp Fiber Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA