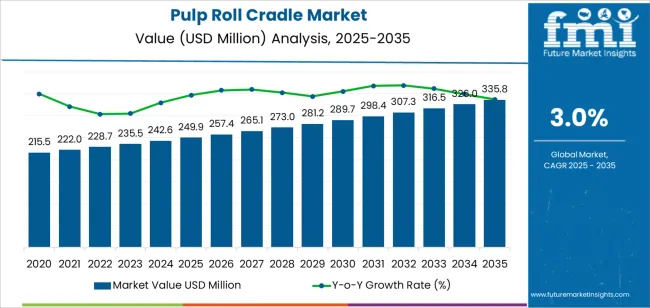

The Pulp Roll Cradle Market is estimated to be valued at USD 249.9 million in 2025 and is projected to reach USD 335.8 million by 2035, registering a compound annual growth rate (CAGR) of 3.0% over the forecast period.

The pulp roll cradle market is experiencing gradual growth, supported by rising demand for secure packaging solutions in the paper and pulp transportation industry. As global paper consumption continues across publishing, packaging, and industrial sectors, protective handling solutions like pulp roll cradles have gained traction for their role in minimizing damage during logistics.

Manufacturers are prioritizing recyclable and biodegradable cradle materials in response to tightening environmental regulations and consumer preference for eco-safe packaging components. Operational data from pulp and paper mills have indicated increasing adoption of molded fiber-based cradles to support heavy rolls and reduce shifting during transit.

Investments in automation and cradle design optimization have also enabled bulk production and consistent performance across varying load capacities. With increasing focus on supply chain efficiency and sustainability, the market is expected to continue expanding steadily. Key segmental drivers include growing preference for Standard cradle formats, compact sizing for roll flexibility, and Wood Pulp as the dominant cradle source for its renewable profile and structural resilience.

| Metric | Value |

|---|---|

| Pulp Roll Cradle Market Estimated Value in (2025 E) | USD 249.9 million |

| Pulp Roll Cradle Market Forecast Value in (2035 F) | USD 335.8 million |

| Forecast CAGR (2025 to 2035) | 3.0% |

The market is segmented by Product Type, Sizes (cm), Source, Type, and End-Use and region. By Product Type, the market is divided into Standard, Customised, Recycled, and Non-recycled. In terms of Sizes (cm), the market is classified into 12 x 40, 80 x 20, 76 x 40, and 65 x 40. Based on Source, the market is segmented into Wood Pulp and Non-Wood Pulp. By Type, the market is divided into Thick Wall, Transfer, Thermoformed, and Processed. By End-Use, the market is segmented into Industrial, Food Packaging, Food Service, Electronics, Healthcare, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

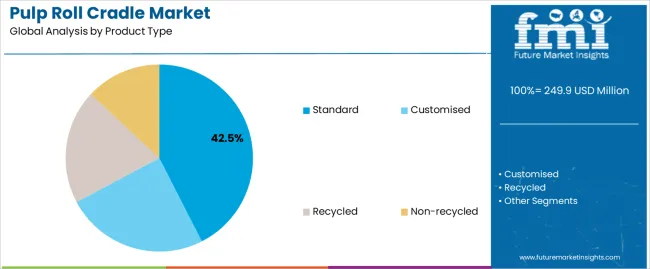

The Standard segment is projected to hold 42.5% of the pulp roll cradle market revenue in 2025, establishing itself as the most utilized format across industrial applications. This segment’s leadership has been influenced by the widespread need for cradle designs that meet uniform packaging requirements and are compatible with automated roll handling systems.

Standard cradles have offered consistent dimensional stability and stackability, making them ideal for high-volume distribution environments. Manufacturers have increasingly relied on these formats to simplify inventory management and streamline operations across varied pulp grades and roll sizes.

Additionally, standard cradles have been engineered to deliver optimal compression strength while maintaining lightweight profiles, supporting both transport safety and material cost-efficiency. As demand continues for standardized, scalable packaging formats that align with lean logistics principles, the Standard product type segment is expected to maintain its market dominance.

.webp)

The 12 x 40 cm segment is forecasted to contribute 29.7% of the pulp roll cradle market revenue in 2025, reflecting its importance in medium-load applications and space-constrained handling operations. This size format has been favored by end users for its adaptability in both manual and automated systems, allowing reliable stabilization of medium-sized pulp rolls.

Packaging engineers have cited this size as a functional balance between surface coverage and cradle footprint, supporting effective load distribution without excess material use. Additionally, manufacturers have optimized mold configurations for this size category, ensuring high production throughput and reduced lead times.

In distribution scenarios where packaging density and pallet fit are critical, the 12 x 40 cm size has emerged as a practical standard. As packaging operations seek to reduce waste and improve space utilization, this size segment is expected to sustain its position as a preferred format within the pulp roll cradle market.

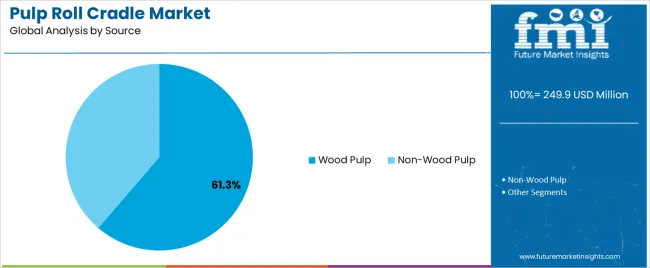

The Wood Pulp segment is expected to dominate the pulp roll cradle market in 2025, contributing 61.3% of total revenue due to its material strength, renewability, and widespread industry acceptance. Growth in this segment has been driven by sustainability mandates and the circular economy movement, which have prioritized cradle solutions derived from renewable resources.

Wood pulp-based cradles have demonstrated superior cushioning and load-bearing capacity, essential for protecting heavy pulp rolls during storage and transit. Manufacturers have highlighted the material’s molding versatility and moisture absorption properties, which enhance performance during fluctuating temperature and humidity conditions.

Additionally, recycling infrastructure is well-developed for wood pulp products, enabling cradle reuse or disposal without environmental burden. The preference for wood pulp has also been supported by regulatory shifts encouraging the phase-out of petroleum-based foams and plastics in industrial packaging. As sustainability remains central to material selection criteria, the Wood Pulp segment is expected to maintain its commanding position in the pulp roll cradle market.

In India, the growth of the pulp roll cradle market is fuelled by the rapid expansion of e-commerce in the country, which is driving demand for protective packaging solutions. With the increasing popularity of online shopping platforms, there's a growing need for packaging that can effectively safeguard products during transit, making pulp roll cradles a preferred choice.

The Indian government's focus on sustainability and initiatives promoting eco-friendly practices is encouraging businesses to adopt biodegradable packaging solutions like pulp roll cradles.

The growth of the pulp roll cradle market in China is attributed to the country's thriving manufacturing sector and export-oriented economy. As China remains a global manufacturing hub, there's a significant demand for packaging solutions that ensure product safety during shipping. Pulp roll cradles, with their ability to securely cradle and protect goods, are increasingly favored by Chinese manufacturers and exporters.

The Chinese government's stringent environmental regulations and initiatives to reduce plastic waste are driving the adoption of sustainable packaging solutions like pulp roll cradles.

In the United States, the growth of the pulp roll cradle market is driven by several factors, including the booming e-commerce sector and increasing consumer awareness of environmental issues. With the rise of online shopping platforms such as Amazon and Walmart, there's a growing demand for protective packaging solutions that can withstand the rigors of shipping. Pulp roll cradles, known for their durability and eco-friendliness, are gaining traction among American businesses seeking reliable and sustainable packaging options.

The USA government's focus on promoting sustainable practices and reducing plastic waste is fostering the adoption of eco-friendly packaging solutions like pulp roll cradles, contributing to market growth in the country.

Customized pulp roll cradles are increasingly sought after due to their ability to fulfill specific packaging requirements and enhance brand identity. Businesses are recognizing the importance of packaging as a branding tool and are leveraging customized pulp roll cradles to differentiate their products in the market.

By incorporating unique designs, logos, and brand colors into the packaging, companies can create a memorable and distinctive brand experience for consumers, fostering brand loyalty and recognition. Customized pulp roll cradles offer enhanced product protection tailored to the dimensions and fragility of the packaged items, ensuring optimal safety during transit.

The increasing popularity of pulp roll cradles made from wood pulp is attributed to the growing emphasis on sustainability and environmental responsibility in packaging practices. As businesses and consumers alike become more conscious of their environmental footprint, there's a heightened demand for packaging materials that are renewable, biodegradable, and eco-friendly.

Pulp roll cradles made from wood pulp meet these criteria, as they are derived from a renewable resource and can be recycled or composted at the end of their lifecycle, reducing their impact on the environment.

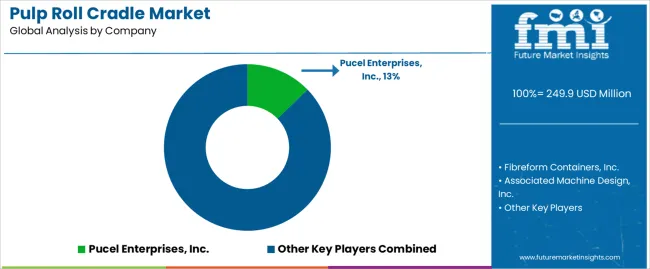

The competitive landscape of pulp roll cradles is characterized by a mix of established manufacturers and emerging players vying for market share. Key players in the market include companies such as Smurfit Kappa Group, Pregis LLC, Cascades Inc., and DS Smith PLC, among others. These industry giants leverage their extensive experience, technological capabilities, and global presence to maintain a competitive edge.

There's a notable presence of smaller, niche players offering specialized pulp roll cradle solutions tailored to specific industries or applications. Intense competition within the market drives continuous innovation, quality enhancements, and strategic collaborations, ultimately benefiting consumers with a diverse range of options.

The pulp roll cradle market offers a diverse range of product types including standard, customized, recycled, and non-recycled options.

Pulp roll cradles come in various sizes such as 12 x 40 cm, 80 x 20 cm, 76 x 40 cm, and 65 x 40 cm, catering to different packaging needs.

These pulp roll cradles find applications across various end-uses including food packaging, food service, electronics, healthcare, industrial, and others

Pulp roll cradles are sourced from either wood pulp or non-wood pulp.

The industry is divided on the basis of regions including North America, Latin America, Europe, Asia-Pacific, and the Middle East and Africa.

The global pulp roll cradle market is estimated to be valued at USD 249.9 million in 2025.

The market size for the pulp roll cradle market is projected to reach USD 335.8 million by 2035.

The pulp roll cradle market is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in pulp roll cradle market are standard, customised, recycled and non-recycled.

In terms of sizes (cm), 12 x 40 segment to command 29.7% share in the pulp roll cradle market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Roller Gear Cam Unit Market Size and Share Forecast Outlook 2025 to 2035

Roller Press Gear Units Market Size and Share Forecast Outlook 2025 to 2035

Roll Type Thermal Paper Market Forecast and Outlook 2025 to 2035

Rolling Stock Management Market Forecast Outlook 2025 to 2035

Roll Handling Machine Market Size and Share Forecast Outlook 2025 to 2035

Pulp Molding Tooling Market Size and Share Forecast Outlook 2025 to 2035

Roll-dried Starch Market Size and Share Forecast Outlook 2025 to 2035

Pulp Liner Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Rolling Stocks Market Size and Share Forecast Outlook 2025 to 2035

Pulpwood Market Size and Share Forecast Outlook 2025 to 2035

Roller Sports Product Market Size and Share Forecast Outlook 2025 to 2035

Rolled-Dried Starch Market Size and Share Forecast Outlook 2025 to 2035

Pulp Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Rolling Mill Machine Market Size and Share Forecast Outlook 2025 to 2035

Roll-up Laminate Tubes Market Analysis Size and Share Forecast Outlook 2025 to 2035

Rolled Or Extruded Aluminum Rods Bars And Wires Market Size and Share Forecast Outlook 2025 to 2035

Roll Containers Market Size and Share Forecast Outlook 2025 to 2035

Roll Trailer Market Growth – Trends & Forecast 2025 to 2035

Roll-Your-Own Tobacco Products Market Trends - Growth & Forecast 2025 to 2035

Rolling Papers Market Trends - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA