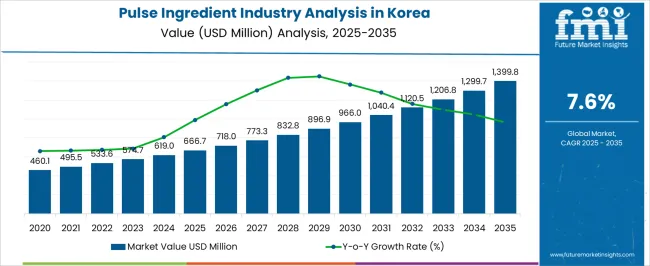

The Pulse Ingredient Industry Analysis in Korea is estimated to be valued at USD 666.7 million in 2025 and is projected to reach USD 1399.8 million by 2035, registering a compound annual growth rate (CAGR) of 7.6% over the forecast period.

| Metric | Value |

|---|---|

| Pulse Ingredient Industry Analysis in Korea Estimated Value in (2025 E) | USD 666.7 million |

| Pulse Ingredient Industry Analysis in Korea Forecast Value in (2035 F) | USD 1399.8 million |

| Forecast CAGR (2025 to 2035) | 7.6% |

The pulse ingredient industry in Korea is advancing steadily, fueled by rising demand for plant-based nutrition and functional food applications. Increasing consumer focus on balanced diets and wellness-oriented products has created strong growth opportunities for pulse-derived ingredients.

The market benefits from favorable supply dynamics, supported by imports and domestic processing capabilities. Continuous research and product innovation have improved sensory properties, enhancing the appeal of pulse-based flours and proteins across various food applications.

Additionally, the alignment of pulse ingredients with sustainability and clean-label preferences strengthens their market positioning. With rising bakery consumption and the increasing presence of plant-forward diets, the outlook for pulse ingredients in Korea remains highly positive.

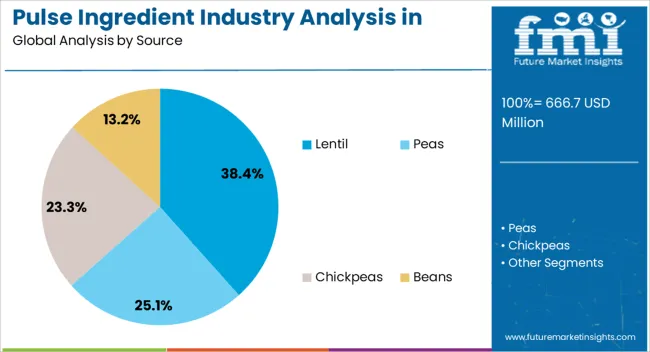

The lentil segment dominates the source category, accounting for approximately 38.40% share of Korea’s pulse ingredient market. Lentils are favored for their high nutrient density, digestibility, and affordability, making them a key raw material in flour and protein production.

Their balanced amino acid profile and compatibility with diverse applications strengthen their role in processed foods. The segment also benefits from rising consumer awareness of lentil-based foods and strong integration into traditional and modern diets.

With increasing incorporation into bakery, snacks, and convenience products, lentils are expected to retain their prominence in the source category.

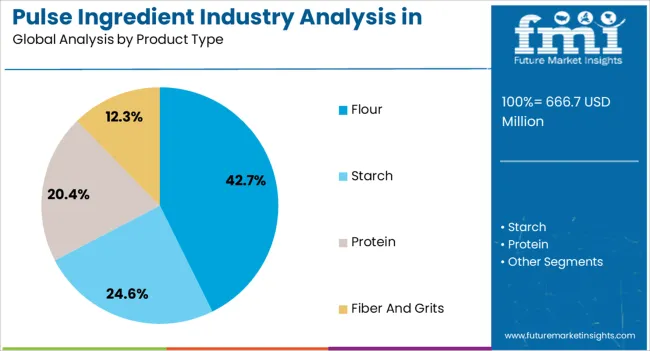

The flour segment leads the product type category with approximately 42.70% share. This dominance is attributed to the widespread use of pulse flours in bakery, snack, and ready-meal formulations, where they enhance nutritional value while serving as gluten-free alternatives.

Pulse flours are valued for their ability to improve texture and protein content without requiring major formulation changes, supporting their adoption across multiple product categories. The segment’s growth is reinforced by consumer demand for healthier alternatives in everyday foods.

With continued innovation in flour blends and fortification, pulse flours are expected to maintain a strong trajectory in the Korean market.

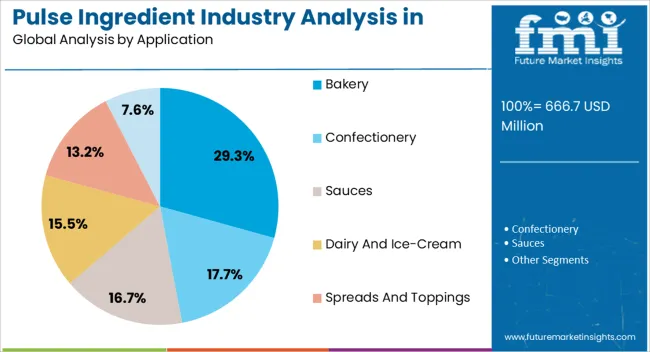

The bakery segment accounts for approximately 29.30% share in the application category, driven by increasing use of pulse-based flours and proteins in bread, cakes, and pastries. Rising demand for fortified and gluten-free bakery options has accelerated incorporation of pulse ingredients in product development.

The segment benefits from high bakery consumption in Korea, supported by the popularity of packaged and convenience-based formats. Manufacturers are leveraging pulse ingredients to meet consumer demand for healthier, functional baked goods without compromising taste.

With continued product innovation and increasing consumer focus on nutrition, the bakery segment is expected to retain its leading share in applications.

Pulse ingredients are frequently found in a wide range of foods, including soups, sauces, bread goods, dinners, snacks, and sweets. They are also available in different forms like flour, protein, and fiber. The industry is growing because of the increasing demand for plant-based and gluten-free products and the increasing acceptance of protein-rich foodstuffs.

South Korea could be one of the leading contributors to revenue generation for pulse ingredient manufacturers. This can be attributed to an aging population that consumes a variety of pulse ingredient-enriched protein-rich products. The pulse ingredient industry is further expanding in line with the increasing demand for natural ingredients and clean-labeled food products. Consumers are shifting their diets toward more and more natural and organic products.

The growing inclination of the consumer toward protein-rich food, such as pulse component protein, fuels growth in the Korean pulse ingredient market. Due to the health benefits related to high protein content, there is a growing demand from consumers for pea protein, pea flour, and pea starch.

Moreover, the increased number of aged people who consume various protein-rich products, including pulse ingredients in Korea is expected to be a key income driver for makers of pulse ingredients. The industry in Korea is also influenced by the need for medical supplies.

Slowly but surely, nutritional value, sustainability, and versatility of the food product have started gaining precedence as significant factors in the food and beverage industry. Hence, positioning pulse ingredients as a growing sector in the broader food and beverage sector.

The pulse ingredients industry report in Korea is divided into two sections: product type and pulses type. As far as the product type is concerned, the flour segment rules the roost. On the other hand, depending on pulse type, peas are the holding the green flag by dominating the industry.

The flour segment is expected to capture an industry share of 52.3% in 2025. This is attributed to the fact that pulse flour contains a huge amount of proteins, iron, and fibers, hence it is highly demanded. Various recipes are created with pulse flour, such as cookies, pasta, and puddings.

Demand for pulse flours is expected to rise due to the surging demand from consumers for vegan and plant-based protein sources. Pulses in flour form are versatile and therefore can be used in multiple plant-based dishes.

| Attributes | Details |

|---|---|

| Product Type | Flour |

| Industry Share in 2025 | 52.3% |

The peas segment is estimated to capture a share of 51.1% in 2025 alone on account of their extended applications in several food products in the country. An increasing application of pea protein in well-being supplements and healthy food products adds to the growth of this segment in the country.

| Attributes | Details |

|---|---|

| Pulses Type | Peas |

| Industry Share in 2025 | 51.1% |

A growing trend towards vegetarian and vegan diets is expected to fuel the growth of the pulse ingredient market during the forecast period. Rising demand for gluten-free and clean-label food products is expected to give opportunities to players in the market to leverage untapped potential.

Consequently, on the back of such developments, many of the key players in this industry are found to be investing in different strategic expansion modes to maintain their growth momentum over the forecast period. Product innovation, acquisitions, collaborations, and expansions are likely to continue as favored routes for the industry participants to gain an upper hand.

Recent Developments in the Pulse Ingredient Industry in Korea

Adroit Food Ingredient Co., Ltd.

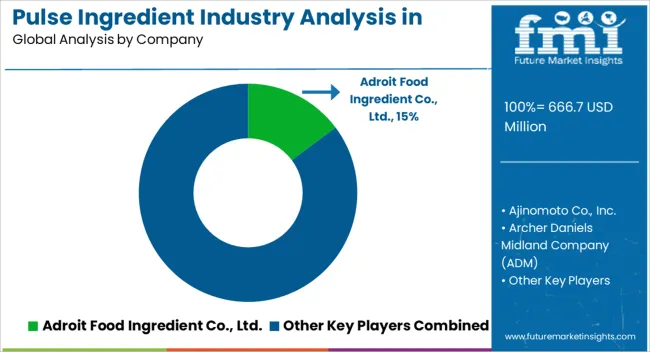

Adroit Food Ingredient Co., Ltd. is a rapidly expanding company specializing in manufacturing high-quality pulse ingredients. Adroit has established itself as a key player in the food industry through a commitment to excellence. The company enjoys providing innovative and nutritious pulse-based solutions to meet customers' demands.

Ajinomoto Co., Inc.

The pulse ingredient production industry at Ajinomoto is based on its patented fermentation process. The company employs this method to develop a range of pulse components, including L-glutamate, the key component of umami. Pulses from Ajinomoto are used in a wide range of food products, including soups, sauces, snacks, and ready-to-eat meals.

| Attribute | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 574.74 million |

| Projected Industry Size by 2035 | USD 1,202.02 million |

| Anticipated CAGR between 2025 to 2035 | 7.7% CAGR |

| Historical Analysis of Demand for Pulse Ingredient Industry in Korea | 2020 to 2025 |

| Demand Forecast for Pulse Ingredient Industry in Korea | 2025 to 2035 |

| Report Coverage | Industry Size, Industry Trends, Key Insights for Pulse Ingredient Industry in Korea, Insights on Global Players and Leading Industry Strategy in Korea, Ecosystem Analysis of Local and Regional. |

| Key Companies Profiled | Adroit Food Ingredient Co., Ltd.; Ajinomoto Co., Inc.; Archer Daniels Midland Company (ADM); Cargill Incorporated; Ingredia; Ingredion Inc.; Kerry Group plc; Korea Grain & Feed Trading Corporation (KGF); Sensus Natural Ingredient Ltd.; SunOpta Inc.; Symrise AG; Tate & Lyle plc |

The global pulse ingredient industry analysis in Korea is estimated to be valued at USD 666.7 million in 2025.

The market size for the pulse ingredient industry analysis in Korea is projected to reach USD 1,399.8 million by 2035.

The pulse ingredient industry analysis in Korea is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in pulse ingredient industry analysis in Korea are lentil, peas, chickpeas and beans.

In terms of product type, flour segment to command 42.7% share in the pulse ingredient industry analysis in Korea in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pulse Ingredient Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Pulse Ingredient Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Pulse Ingredients Market Analysis – Size, Share, and Forecast 2025 to 2035

Korea Isomalt Industry – Market Trends & Industry Growth 2025 to 2035

Korea Multihead Weigher Market Insights – Growth & Forecast 2024-2034

Korea Automotive Lighting Market Growth – Trends & Forecast 2023-2033

Korea Probiotic Supplement Industry – Industry Insights & Demand 2025 to 2035

Demand for Pulse Ingredients in EU Size and Share Forecast Outlook 2025 to 2035

Korea Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Korea Automotive Turbocharger Market Growth – Trends & Forecast 2023-2033

Korea Low Rolling Resistance Tire Market Growth – Trends & Forecast 2023-2033

Korea Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Mezcal Industry Analysis in Korea – Trends, Demand & Industry Growth

Industry Analysis of Electronic Skin in Korea Size and Share Forecast Outlook 2025 to 2035

Taurine Industry Analysis in South Korea - Trends, Market Insights & Applications 2025 to 2035

Korea Steel Drum Market Growth – Trends & Forecast 2023-2033

Resveratrol Industry Analysis in Korea Growth, Trends and Forecast from 2025 to 2035

Polydextrose Industry Analysis in Korea – Growth & Consumer Demand 2025 to 2035

Glassine Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Tarpaulin Sheet Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA