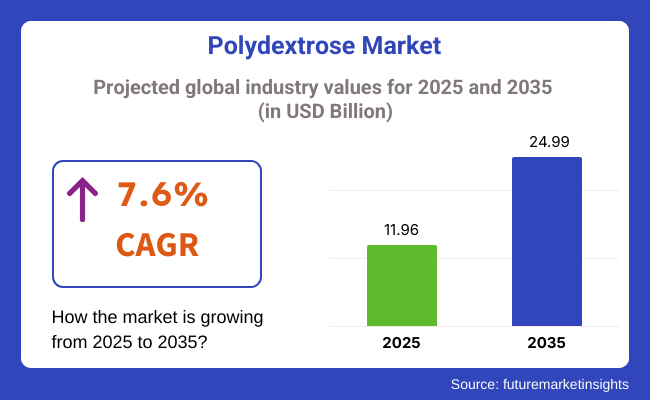

The Polydextrose Industry Analysis in Korea was approximately worth USD 11.96 million in 2025 and is projected to grow at 7.6% CAGR until 2035. The industry valuation is expected to reach USD 24.99 million by 2035. The increasing consumer shift associated with health-oriented food products towards functional and dietary fibers increases the driving forces for this expansion. An additional boost is given by increasing awareness about digestive health as well as low-calorie, high-fiber ingredients associated with well-being, which creates a strong pull for using polydextrose as an additive in several formulations.

Polydextrose is emerging as the new food ingredient in the country for fortifying fibers, sugar replacement, and bulky production by food and beverage manufacturers in South Korea. The reason for the growing popularity of this include the neutral taste and superior stability in the process. These features also point to a whammy in reduced calories, drinks and health supplements for weight management and glycemic control. Growth is further strengthened by supportive government policies on the addition of dietary fiber in processed foods.

Besides traditional food applications, it is finding new roles in the pharmaceutical and nutraceutical sectors. Prebiotic properties and low glycemic index make polydextrose diversified for medical nutrition products such as those targeting metabolic health, diabetes, and geriatrics. Further categories like personalized nutrition tools and hybrid wellness formulations that relate to specific health outcomes, such as gut microbiota modulation, are becoming the young product line of companies integrating polydextrose. The evidence shows that these trends are aligned with the move toward preventive health among the major demographic groups in South Korea, which is the aging population.

The industry is expected to have a bright future in South Korea as it ventures beyond 2035 into the health-oriented behavior of consumers, regularity facilitation, and renewed innovation in functional food ingredients. The industry will witness a much closer integration of nutrition science with consumer lifestyle tastes, therefore solidifying polydextrose's position in future wellness products.

The powder form is likely to dominate the market in 2025, accounting for 88.2% of the revenue share, while the Liquid will comprise 11.8%.

Powdered polydextrose is leading because the component supports the efficient production of low-calorie, sugar-free, and high-fiber products. The segments above consist of Bakery, Confectionery, and Snacks, where powdered form is used as a bulking agent, a sugar substitute, or a fiber fortifier. For instance, powdered polydextrose is used in sugar-free candies, biscuits, and snacks offered by major food producers such as CJ CheilJedang and Orion to meet increasing health concerns.

Such long shelf life, convenient handling, and stability during storage conditions make it a perfect product for mass manufacturing operations. Furthermore, powdered polydextrose is widely applied to functional foods to promote digestive health, positioning it in the market as one of the central ingredients for fiber-enriched products.

The increasing use of Liquid polydextrose in beverage applications requires and demands solubility, smooth texture, and sweetness. Low-calorie beverages and Dairy Drinks include it to replace sugar while maintaining mouthfeel and flavor.

Beverage manufacturers such as Amore pacific and Samyang Foods employ liquid polydextrose in their lines of smoothies, shakes, and diet beverages, targeting functional and health-oriented consumers through appealing advertisements. Its easy blending and dissolution into liquids, essential features in beverage manufacturing, make Liquid polydextrose favored in liquid formulations. It is also used to thicken sauces, add sweetness to syrups, and add health supplements.

The industry will be segmented into bakery & confectionery with 22.4%, followed by beverages & dairy drinks with a share of 11.9%. Beverage & dairy drinks find a high use of polydextrose. Large formulated low-calorie prepared foods include sugar-free or reduced-calorie baked goods as well as candies and snacks. Polydextrose provides bulking and sweetness while adding no significant calories to the diet or affecting the glycemic index.

Most important South Korean companies, CheilJedang and Orion, have incorporated polydextrose in their low-sugar range of confectionery chocolates and snack foods. Demand for healthier substitutes for traditional sugar-laden items, as well as the growing popularity of functional foods and fiber-enriched products, boost this segment. Polydextrose adds value because of its propensity to improve texture, reduce sugar, and also contribute to digestive health.

Much of the volume, around 11.9%, will also be taken by Beverages & Dairy Drinks. Polydextrose is used in low-calorie, sugar-free, and healthy drinks such as functional drinks, smoothies, and other products based on dairy products. It has an even better flavor for the preparation of beverages that contain prebiotic fibers and conditions for gut health, weight control, and digestion. Prominent companies such as Amore pacific and Lotte Chilsung have started incorporating polydextrose in their functional beverage lines, seeing an increase in demand for such health-conscious products.

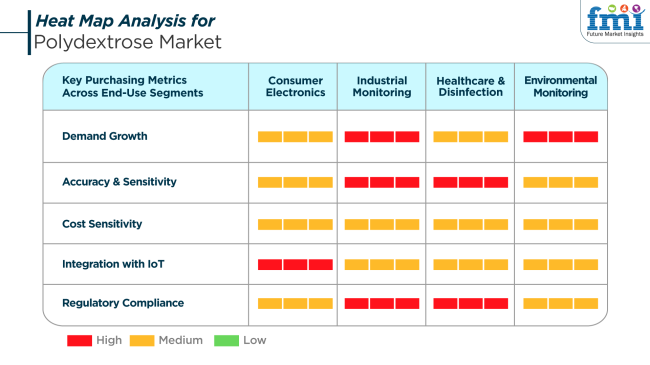

Polydextrose-based formulations are made to exhibit high performance in smart sensors and biosystems, where increased accuracy, fast responsiveness, and regulatory assurance demand it in industrial monitoring and environmental applications. There is a high demand in the industry due to increased industrial and ecological automation needs.

In healthcare and disinfection, polydextrose utilizes its non-toxic, biocompatible profile, making the sector strict in complying with health and safety requirements and maintaining product consistency and sensitivity. It has also been providing its growing feature on digestive health and therapies supportive of the microbiome, particularly as preventive healthcare is getting mainstream focus.

Key Purchasing Metrics Across End-Use Segments

Slowly rising into consumer electronics applications through wellness tracking and personalized health interfaces, this area highly requires integration with IoT systems for digital compatibility. Cost may be a secondary concern in most of the segments, whereas purchasing criteria weigh heavily on functional accuracy, sensitivity, and compliance; therefore, quality and performance become the dominating factors in making decisions.

From 2020 to 2024, the industry experienced noteworthy growth due to growing consumer awareness of health and wellness. Lifestyle diseases like diabetes and obesity encouraged the growing demand for dietary fiber, such as polydextrose. Polydextrose gained popularity as a functional food, beverage, and dietary supplement ingredient due to its low-calorie content and prebiotic nature. The food processing industry was the largest consumer, and it gained a major revenue share. Powdered polydextrose was the leading product because it was diverse and cost-effective.

During 2025 to 2035, South Korea is projected to continue its upward trajectory. Innovations in food technology and formulation are expected to lead to the development of a variety of polydextrose-based products with improved flavor and texture. The increasing trend toward healthy eating habits and personalized nutrition is anticipated to boost the demand for dietary fibers further. Additionally, the emphasis on sustainable sourcing and transparent labeling will become increasingly important to meet consumer expectations and regulatory standards.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Healthy consumers who want low-calorie, high-fiber foods | More health and wellness, personalization in nutrition |

| Functional foods, drinks, dietary supplements | Greater use in functional snack foods, beverages, and personalized nutrition products |

| Food safety and labeling compliance | Projected stricter regulations affecting product development and marketing |

| Growing incidence of lifestyle diseases | Increased demand for personalized nutrition and clean-label, sustainable products |

| Clean-label, allergen-free product development and product transparency | Introduction of proprietary polydextrose products and green lines |

Despite solid fundamentals that would support its growth, the industry faces several risks. One key concern is the government regulatory reclassification of food labels and dietary fiber standards. Changes in acceptable levels of usage or ingredient listing could lead to expensive product reformulations in the industry. Supply chain dynamics also bring forth considerable risk.

South Korea heavily depends on international sources for certain raw materials, and interruptions due to geopolitical instabilities, global logistics inconveniences, or price increases of input commodities could compromise product availability and add to profitability exposure. Local manufacturers could also strategically face bottlenecks in sourcing inputs of consistent quality, particularly if those inputs are required on constrained timelines.

Consumer perceptions are fluid, posing a reputational risk. Given that polydextrose is accepted in society at large, variations in consumer perceptions, particularly in that of synthetic versus natural or processed versus unprocessed ingredients, may lead to reduced demand. The demand can be increased by continued investment in transparent communication, backed by scientific evidence in support of health claims, and aligning with fast-consuming, clean-label trends to build consumer trust and lead to further growth in the industry.

South Korea will grow at 6.1% CAGR during the study period. This growth trend is fueled by some of the most important factors, some of which include mounting consumer interest in digestive health, growing demand for low-calorie items, and intense government efforts to improve national diet quality. Polydextrose, as a functional fiber, is increasingly being used across various industries, such as health supplements, functional foods and beverages, bakery, and dairy alternatives.

The increasing rate of lifestyle diseases such as obesity and type-2 diabetes have generated the demand for nutritional remedies that enhance digestion and reduce the consumption of sugar-two key benefits of polydextrose. The dramatic expansion in South Korea's food processing industry and the increase in R&D spending have served to integrate polydextrose into a broad spectrum of consumer products.

Top domestic food and beverage companies are leveraging polydextrose to reformulate established SKUs and launch new ones that respond to growing demand for fiber-rich, low-glycemic products. A technology-driven supply chain and strategic collaboration between ingredient suppliers and FMCG brands also support the growth.

Additionally, an increase in online buying and direct-to-consumer nutrition companies has created a pace in functional food ingredient access, boosting further sales. Polydextrose is also being introduced to clinical nutritional and elderly foods, which responds to the aging population in the country and their specific dietary needs.

Encouragement by South Korean regulators, who perceive polydextrose as healthy and safe to consume as a dietary fiber, also drives product innovation and development. With further product diversification and a strong consumer culture with high health awareness, South Korea is expected to remain a high-growth polydextrose market during the forecasting period of 2025 to 2035.

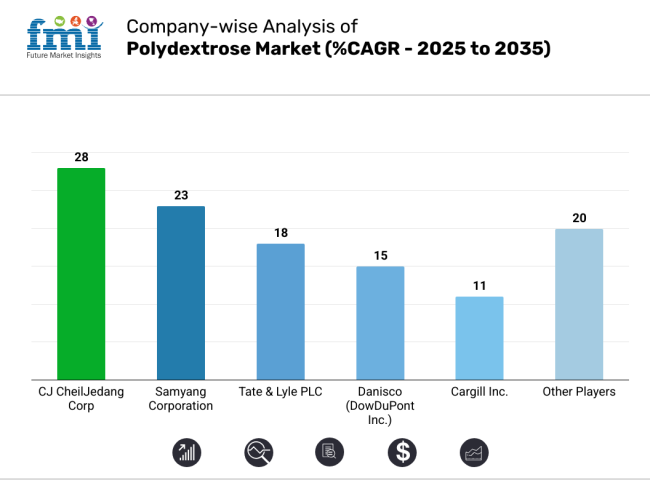

The industry is highly competitive, and domestic food conglomerates compete with global ingredient specialists. CJ CheilJedang Corp leads the local market through its vertically integrated production system and strong relationships with Korean food manufacturers, particularly in functional food applications. Samyang Corporation complements this with specialized blends tailored to Korea's unique food processing requirements, including instant coffee mixes and health beverages.

Global players Tate & Lyle PLC and Danisco (DowDuPont Inc.) maintain a significant presence through their premium branded offerings, focusing on sugar reduction and dietary fiber fortification in multinational food products. Cargill Inc. competes with clean-label solutions that align with Korea's stringent food safety regulations, while The Scoular Company provides cost-effective bulk ingredients for industrial applications.

Chinese suppliers like Baolingbao Biology and Henan Tailijie Biotech are gaining market share through competitive pricing, though they face challenges in meeting Korea's premium quality expectations for functional foods.

Key Purchasing Metrics Across End-Use Segments

Key Success Factors Driving the Polydextrose Market in Korea

CJ CheilJedang Corp dominates the industry with a 25-28% share, leveraging its domestic production facilities and deep understanding of local food industry needs. The company's focus on functional food applications and strategic partnerships with Korean health brands strengthens its market position. Samyang Corporation holds a 20-23% share through its specialized formulations for traditional Korean food products and innovative health beverage solutions.

Tate & Lyle PLC maintains a 15-18% share of its premium Litesse® brand, particularly in multinational food products sold in Korea. Danisco (DowDuPont Inc.) accounts for 12-15% of the market, offering technical solutions for dairy and bakery applications. Cargill Inc. completes the top five with an 8-11% share, focusing on clean-label and non-GMO polydextrose for health-conscious Korean consumers. These market leaders are driving innovation in prebiotic and low-glycemic formulations to meet Korea's growing demand for functional ingredients.

The market is segmented into Powder Form and Liquid Form.

The market includes applications in Bakery & Confectionery, Breakfast Cereals, Snacks & Bars, Dairy Products, Desserts & Ice Cream, Soups, Sauces, & Dressings, Spreads & Fillings, Beverages & Dairy Drinks, Dietary Supplements, Animal Feed and Pet Food, and Others.

The market is segmented by regions in South Korea, including South Gyeongsang, North Jeolla, South Jeolla, Jeju, and the Rest of Korea.

The industry is expected to reach USD 11.96 million in 2025.

The industry is projected to grow to USD 24.99 million by 2035.

The market is expected to grow at a CAGR of approximately 7.6% during the forecast period.

The powder form is one of the most prominent segments.

Key players include CJ CheilJedang Corp, Samyang Corporation, Tate & Lyle PLC, Danisco (DowDuPont Inc.), Cargill Inc., The Scoular Company, Baolingbao Biology, Golden Grain Group Limited, Foodchem International Corporation, and Henan Tailijie Biotech Co., Ltd.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Industry Analysis and Outlook Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 4: Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 6: Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2018 to 2033

Table 7: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 8: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 9: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 10: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2018 to 2033

Table 11: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 12: North Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 13: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 14: North Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2018 to 2033

Table 15: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 16: South Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 2: Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 3: Industry Analysis and Outlook Value (US$ Million) by Region, 2023 to 2033

Figure 4: Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Industry Analysis and Outlook Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 9: Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 10: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 11: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 12: Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 13: Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 14: Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 15: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 16: Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 17: Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 18: Industry Analysis and Outlook Attractiveness by Region, 2023 to 2033

Figure 19: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 20: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 21: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 22: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 23: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 24: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 25: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 26: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 27: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 28: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 29: South Gyeongsang Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 30: South Gyeongsang Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 31: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 32: North Jeolla Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 33: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 34: North Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 35: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 36: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 37: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 38: North Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 39: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 40: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 41: North Jeolla Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 42: North Jeolla Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 43: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 44: South Jeolla Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 45: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 46: South Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 47: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 48: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 49: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 50: South Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 51: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 52: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 53: South Jeolla Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 54: South Jeolla Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 55: Jeju Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 56: Jeju Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 57: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 58: Jeju Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 59: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 60: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 61: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 62: Jeju Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 63: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 64: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 65: Jeju Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 66: Jeju Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 67: Rest of Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 68: Rest of Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 69: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 70: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 71: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 72: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 73: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 74: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 75: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 76: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 77: Rest of Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 78: Rest of Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polydextrose Market Analysis - Size, Share & Forecast 2025 to 2035

Polydextrose Ingredients Market Trends - Functional Benefits 2025 to 2035

Polydextrose Industry Analysis in Japan – Demand & Market Trends 2025 to 2035

Polydextrose Industry Analysis in Western Europe Growth, Trends and Forecast from 2025 to 2035

Demand for Polydextrose in the EU Size and Share Forecast Outlook 2025 to 2035

Industry 4.0 Market

Industry Analysis of Syringe and Needle in GCC Size and Share Forecast Outlook 2025 to 2035

Industry Analysis Non-commercial Acrylic Paint in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Medical Device Packaging in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Paper Bag in North America Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Lidding Film in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Last-mile Delivery Software in Japan Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Automotive Lightweight Body Panel in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Japan Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Western Europe Size and Share Forecast Outlook 2025 to 2035

Germany Outbound Tourism Market Trends – Growth & Forecast 2024-2034

Europe Second-hand Apparel Market Growth – Trends & Forecast 2024-2034

Industry Analysis of Electronic Skin in Korea Size and Share Forecast Outlook 2025 to 2035

FIBC Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

DOAS Industry Growth in the United States – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA