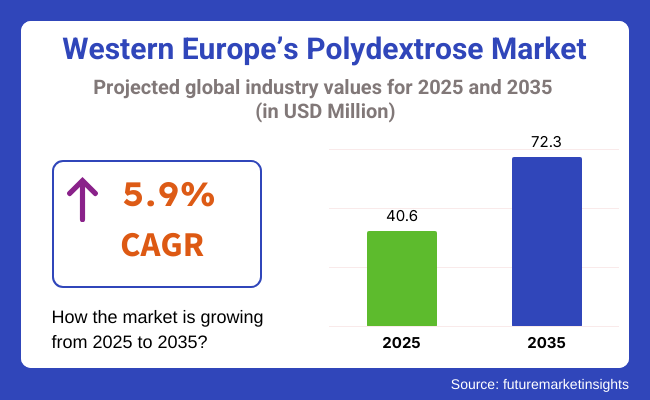

The size of western Europe’s polydextrose market is estimated at USD 40.6 million in 2025, projected to grow at a CAGR of 5.9% between 2025 and 2035. By 2035, the industry is expected to reach USD 72.3 million.

The rise in health and wellness, including the growing functional nutrition trend among consumers in this region, is one of the major contributors to this growth, for consumers opt for low-calorie, high-fiber food substitutes. Added to this, polydextrose's prebiotic properties and low energy value make it a particularly wise additive in food and beverage formulations in Western Europe.

With a growing rise in demand by consumers for clean-label and sugar-reduced products, producers and manufacturers have been incorporating polydextrose to improve the texture, fiber contents, and sweetness profile without changing the flavor integrity.

Many robust regulations in such regions, including the EFSA endorsement of dietary fibers and also the ongoing governmental public health initiatives that target reduced sugar, further accelerated the adoption of polydextrose across both the typical product lines and the premium ones.

Also, in this slow-growth health and wellness industry of Western Europe, polydextrose will find its usefulness in nutraceuticals, sports nutrition, and specially formulated diets. It would fit into vegan, diabetic and gluten-free diets, thereby adding versatility and meeting the needs of changing dietary habits. Further diversifying products, these applications have extended the marketplace to the extent possible.

On the innovation front, companies are spending on research and reformulation efforts to develop next-generation fiber-added products to combine functionality with sensory appeal. Western European markets are particularly pushing forward new introductions that involve polydextrose in functional beverages, fortified snacks, and clinical nutrition.

Thus, the polydextrose industry of Western Europe will have steady growth until 2035. A blend of health trends, regulatory support, and ingredient innovation continues to make it one important enabler in the formulation of healthier, sustainable food systems in the region.

In 2025, in western Europe, the polydextrose industry will be dominated by powder form with a share of 87.1%, followed by liquid form at 12.9%. This powder form of polydextrose shall rule the western European industry because of its normality in dry food applications, such as bakery, confectionery, and snacks. Its stability in dry applications, easy handling, and long shelf life have made this form highly suitable for industrial food processing.

This form of polydextrose is commonly added to sugar-free and reduced-calorie products to provide bulk and texture while preventing high-calorie or high-sugar content. The powdered form of polydextrose is utilized in fiber-enriched foods marketed as zero-caloric sweets, cakes, and snacks by companies like Tate & Lyle and Roquette. There is also a powdered type in functional foods, wherein it contributes to prebiotic fiber in digestive health and overall well-being.

Although a smaller segment, the liquid form of polydextrose contributes anything less in the area of beverage and dairy drinks, where it serves to enhance sweetness and mouthfeel in low-calorie or sugar-free drinks, areas of functional beverages such as diet sodas, smoothies, and nutritional drinks look forward to using it due to its ready dissolution and delivery of a smooth texture.

Companies like BENEO and Cargill are integrating liquid polydextrose into beverage formulations to meet the increasing demand for healthier drink options. The liquid form is also employed in sauces, syrups, and health supplements, allowing for quick blending into liquid formulations.

In 2025, the bakery and confectionery applications will lead the polydextrose industry in western Europe, taking up a share of 24.3%, while beverages and dairy drinks are going to contribute about 10.5%. The bakery & confectionery will be the sectors with the most significant investment in western Europe's Polydextrose industry. Polydextrose is a main ingredient used in baking, confectionery, and candy-making operations with reduced calories, reduced sugar, or increased fiber content.

Also, it provides properties for bulking, sweetness, and mouthfeel without energy and glycemic effects. Leading companies such as Tate & Lyle and Roquette manufacture powdered polydextrose for wide applications, such as cakes, cookies, and biscuits, as well as for sugarless candies and gums. This drive stems from the increasing demand for healthier functional foods and changing consumer attitudes toward sugary novelties of the past.

Polydextrose is also significantly utilized within the beverages & dairy drinks area, recently projected to hold about 10.5% of the part of the overall industry. Among the others, it is especially relevant for low-calorie, sugar-free, functional beverages while in dairy applications, particularly yogurt and smoothies, which have recently made impressive sales figures.

The prebiotic fiber function of polydextrose has promoted the health of its rising usage in health drinks. As for the use of polydextrose within the range of diet drinks, functional beverages, and dairy variants by organizations like Cargill and BENEO, it is understood to be the actual response to an indication for healthier product alternatives. Polydextrose is clearly useful in beverage applications since the liquid varieties allow for good dissolution and smoothness.

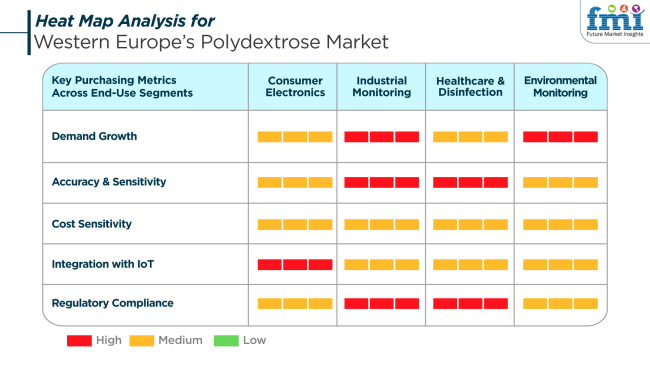

Given the very broad application potential of polydextrose and factors steering this demand, namely wellness considerations, environmental sustainability, and the public health delivery system, it is believed that there is very strong demand in Western European countries. In biochemical assays and sensor technology, this biopolymer, polydextrose, finds applications where crucial parameters are measured with utmost precision and must adhere to regulatory compliance.

Therefore, this addresses the need for safety and consistency, especially in therapeutic nutrition and microbiome-supportive formulations, while posing an obstacle in terms of regulatory affairs in the sense that European authorities set very strict guidelines when it comes to health-related ingredients.

Connectivity to IoT platforms is thus hugely important for any consumer electronics development, especially in the area of personalized nutrition and smart health tracking. The first possible application where interoperability and precision matter in procurement considerations is the management of real-time health data using polydextrose-enhanced consumables. Cost is still an option, but the technical and regulatory performance has forever been the dealmaker.

Key Purchasing Metrics Across End-Use Segments

Between 2020 and 2024, western Europe's polydextrose industry witnessed consistent growth, fueled by growing consumer interest in health and wellness. The increasing incidence of lifestyle diseases like obesity and diabetes created a heightened demand for dietary fibers such as polydextrose.

Low-calorie polydextrose having prebiotic character gained growing popularity in manufacturing functional food, beverages, and dietary supplements. The food processing industry became its major consumer with a dominant portion of the industry. Dried polydextrose was also a best seller due to being versatile and economically priced.

Looking ahead to 2025 to 2035, the polydextrose industry in Western Europe is projected to continue its upward trajectory. Innovations in food technology and formulation are expected to lead to the development of a variety of polydextrose-based products with improved flavor and texture.

The increasing trend toward healthy eating habits and personalized nutrition is anticipated to further boost the demand for dietary fibers. Additionally, the emphasis on sustainable sourcing and transparent labeling will become increasingly important to meet consumer expectations and regulatory standards.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Health-conscious consumers in search of low-calorie, high-fiber products | Increased focus on health and wellness, with an emphasis on individualized nutrition |

| Functional foods, drinks, dietary supplements | Growing application in functional snacks, drinks, and individualized nutrition solutions |

| Compliance with food safety and labeling legislation | Emerging tighter legislation influencing product development and promotion |

| Sustained rise in lifestyle-related disease prevalence | Growing demand for clean-label, sustainable, and personalized nutrition |

| Clean-label, allergen-free product development and product transparency | Launch of personalized polydextrose products and sustainable product offerings |

In Western Europe, the polydextrose industry is rife with complexities and risks that are largely related to changing legislation on food safety and complicated requirements for food labeling. Even in the cases where fiber health claims or ingredient classifications are up for regulatory re-approvals in the EU food law, formulation strategy changes and product launch delays might be favored.

Unstable supply-side conditions, with imported raw materials more dependent right now, and all these pressures from sustainability compliance have logistics and financial implications. Cost pressure and environmental constraints need to be maintained alongside the quality of many products. This has what I refer to as the need for agile supply chain strategies as well as resilient sourcing partnerships.

Behavior change in consumers also tends to cause reputational risk. The moment health benefits are perceived to be derived from synthetic or processed additives, they tend to attract increased scrutiny. Therefore, as expectations for a clean label become increasingly demanding, manufacturers have to ensure clear messaging around the ingredients, as well as transparency toward gaining trust and, thus, brand equity in this quality-conscious industry.

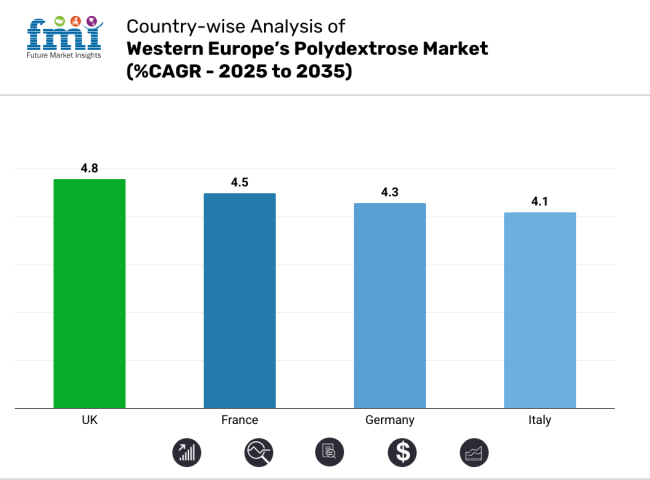

| Countries | CAGR (2025 to 2035) |

|---|---|

| UK | 4.8% |

| France | 4.5% |

| Germany | 4.3% |

| Italy | 4.1% |

The UKindustry will grow at 4.8% CAGR over the study period. Demand for polydextrose in the UK is anticipated to grow steadily, driven by increasing consumer preference towards low-calorie and low-sugar food and beverages.

Greater awareness of diet fiber benefits, coupled with rising obesity rates, has resulted in a demand for functional ingredients such as polydextrose within food and drinks. Major use areas like bakery and farinaceous products, dairy, and nutrition beverages are increasing in popularity on account of changing health trends.

Furthermore, positive regulatory conditions favoring the use of dietary fibers as food ingredients are helping drive industry growth. The domestic food processing industry has been quick to embrace clean-label and functional food ingredients to fulfill changing consumer demands.

Expansion in vegan and vegetarian food products, which tend to use polydextrose as a texturizer or as a sugar substitute, is also having a positive impact on the industry. Demand for gut health and digestive wellness products among consumers is also increasing, further supporting the prospect of polydextrose in the UK Penetration of e-commerce in health-oriented food categories is facilitating wider availability of fiber-rich foods, promoting quicker industry penetration. Further innovation from UK-founded food companies within the wellness and nutrition sector is projected to hold steady demand from 2035.

The industry for France is predicted to advance at 4.5% CAGR in the study years. The French polydextrose industry is to grow through greater awareness of the benefits of functional foods, coupled with mounting consumer interest in decreasing sugar intake.

As increasing demand for low-calorie food options leads to an upsurge in demand for polydextrose, French food manufacturers are incorporating polydextrose into a broad range of food products such as desserts, confectionery, and processed meals.

Urban-based, health-aware populations are leading the demand for dietary fibers that promote weight control and gut health. In addition, robust government support for sugar reduction in processed food through reformulation activities is compelling food manufacturers to embrace polydextrose. Product category innovation within organic and plant-based product lines is another driver of industry expansion.

Clean-label and natural ingredient preferences of the French consumer drive broader functionality acceptance of ingredients such as multifunctional polydextrose that satisfy nutritional and texture needs. The French food and beverage industry focuses on preserving palatability while increasing health benefits, which is consistent with polydextrose integration. The industry is further stimulated by rising investments in food technology and nutritional research to strengthen foods with healthy fibers in order to achieve changing health and wellness requirements.

Germany's industry is forecasted to grow at 4.3% CAGR throughout the study period. Germany offers a mature yet constantly expanding industry for polydextrose, stimulated by its well-established functional food sector and heightened nutritional awareness among consumers.

An increasing number of elderly people have unique nutritional requirements, including enhanced digestive health and blood sugar control, which is impacting the addition of fibers such as polydextrose to their daily diets.

This is especially pronounced in specialty foods like diabetic diets and senior nutritionals. Regulatory encouragement of fiber enrichment and steady consumer education on digestive health account for increased product visibility.

German bakery and beverage industries are increasingly developing low-sugar versions of polydextrose without sacrificing taste and texture. Companies are making R&D investments to include functional fibers in more products, such as yogurts, protein bars, and cereals.

The German affinity for high-quality, health-focused food products adds to the value proposition of polydextrose as a multifunctional additive. The industry is also witnessing growth in demand from vegan and plant-based industries, where polydextrose is involved in attaining desirable mouthfeel and fiber levels in meat and dairy alternatives.

The Italian industry will grow at 4.1% CAGR throughout the study period. Demand for polydextrose in Italy is growing steadily because of changing eating habits and increased interest in healthier food consumption. Conventional Italian food is changing through contemporary influences, promoting the formation of functional food substitutes that include fiber-based ingredients like polydextrose.

Producers use polydextrose to lower the levels of sugar in key categories such as gelato, biscuits, and pasta sauces without compromising taste and texture. The increasing prevalence of lifestyle diseases has heightened consumer desire for preventative health, hence the need for functional foods and dietary fibers.

Italian consumers increasingly recognize the nutritional value of packaged foods, particularly in younger age groups and healthy urban segments. In addition, the trend towards clean-label and "better-for-you" food products is transforming the Italian processed food industry. Polydextrose is being used more and more as a fiber enricher and sugar substitute in health-positioned brands.

Increased retail and internet-based availability of high-fiber specialized products, coupled with advertising promotions targeting digestive health, will tend to support steady industry expansion over the forecast period.

The western European polydextrose industry is characterized by strong competition between established multinational ingredient suppliers and emerging Asian manufacturers. Tate & Lyle PLC maintains industry leadership through its premium Litesse® brand, which dominates applications in sugar reduction and dietary fiber fortification across functional foods and beverages. Danisco A/S (now part of IFF) follows closely with its specialized polydextrose solutions for dairy and bakery applications, leveraging its strong technical support network.

The Scoular Company competes effectively in the bulk ingredients segment, offering cost-competitive polydextrose for industrial food applications. Asian manufacturers, including Baolingbao Biology and Shandong Bailong Chuangyuan Bio-Tech, are gaining industry share through aggressive pricing strategies.

However, they face challenges in meeting Europe's stringent quality and sustainability standards. Samyang Corporation and Golden Grain Group Limited differentiate themselves through customized polydextrose blends tailored for specific functional food applications. Smaller players like Rajvi Enterprise and Foodchem International compete through niche offerings and flexible supply chain solutions.

Market Share Analysis by Company

| Company | Market Share (%) |

|---|---|

| Tate & Lyle PLC | 28-32% |

| Danisco A/S | 22-25% |

| The Scoular Company | 15-18% |

| Baolingbao Biology | 10-13% |

| Samyang Corporation | 8-11% |

| Other Players | 15-20% |

Key Company Insights

Tate & Lyle PLC leads the Western European polydextrose industry with a 28-32% share, driven by its premium Litesse® brand and strong presence in sugar-reduced product formulations. The company's extensive application expertise and technical support services reinforce its industry dominance. Danisco A/S holds a 22-25% share through its specialized polydextrose solutions for dairy and bakery applications, benefiting from its integration with IFF's broader ingredient portfolio.

The Scoular Company accounts for 15-18% of the industry as a leading supplier of cost-effective polydextrose for industrial food applications. Baolingbao Biology has gained a 10-13% share through competitive pricing, particularly in the bulk ingredients segment. Samyang Corporation rounds out the top five with an 8-11% share, offering customized polydextrose blends for functional food applications. These industry leaders are driving innovation in clean-label and sustainable polydextrose solutions to meet evolving consumer demands in Western Europe.

By form, the industry is segmented into powder form and liquid form.

By end use, the industry includes applications in bakery & confectionery, breakfast cereals, snacks & bars, dairy products, desserts & ice cream, soups, sauces, & dressings, spreads & fillings, beverages & dairy drinks, dietary supplements, animal feed and pet food, and others.

By country, the industry is segmented into the UK, Germany, Italy, France, Spain, and the rest of western Europe.

The industry is expected to reach USD 40.6 million in 2025.

The industry is projected to grow to USD 72.3 million by 2035.

The industry is expected to grow at a CAGR of approximately 5.9% during the forecast period.

Powder form is a key segment in the industry.

Key players include Tate & Lyle PLC, Danisco A/S, The Scoular Company, Baolingbao Biology, Samyang Corporation, Golden Grain Group Limited, Foodchem International Corporation, Shandong Bailong Chuangyuan Bio-Tech Co., Ltd., Henan Tailijie Biotech Co., Ltd., and Rajvi Enterprise Private Limited.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2018 to 2033

Table 2: Industry Analysis and Outlook Volume (Tons) Forecast by Country, 2018 to 2033

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 4: Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 6: Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2018 to 2033

Table 7: UK Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 8: UK Industry Analysis and Outlook Volume (Tons) Forecast By Region, 2018 to 2033

Table 9: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 10: UK Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 11: UK Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 12: UK Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2018 to 2033

Table 13: Germany Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 14: Germany Industry Analysis and Outlook Volume (Tons) Forecast By Region, 2018 to 2033

Table 15: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 16: Germany Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 17: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 18: Germany Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2018 to 2033

Table 19: Italy Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 20: Italy Industry Analysis and Outlook Volume (Tons) Forecast By Region, 2018 to 2033

Table 21: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 22: Italy Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 23: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 24: Italy Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2018 to 2033

Table 25: France Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 26: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 27: Rest of Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 28: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 29: Rest of Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2018 to 2033

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 2: Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 3: Industry Analysis and Outlook Value (US$ Million) by Country, 2023 to 2033

Figure 4: Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 5: Industry Analysis and Outlook Volume (Tons) Analysis by Country, 2018 to 2033

Figure 6: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 7: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 8: Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 9: Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 10: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 11: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 12: Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 13: Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 14: Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 15: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 16: Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 17: Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 18: Industry Analysis and Outlook Attractiveness by Region, 2023 to 2033

Figure 19: UK Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 20: UK Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 21: UK Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 22: UK Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 23: UK Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2018 to 2033

Figure 24: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 25: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 26: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 27: UK Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 28: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 29: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 30: UK Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 31: UK Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 32: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 33: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 34: UK Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 35: UK Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 36: UK Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 37: Germany Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 38: Germany Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 39: Germany Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 40: Germany Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 41: Germany Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2018 to 2033

Figure 42: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 43: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 44: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 45: Germany Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 46: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 47: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 48: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 49: Germany Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 50: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 51: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 52: Germany Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 53: Germany Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 54: Germany Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 55: Italy Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 56: Italy Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 57: Italy Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 58: Italy Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 59: Italy Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2018 to 2033

Figure 60: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 61: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 62: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 63: Italy Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 64: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 65: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 66: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 67: Italy Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 68: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 69: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 70: Italy Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 71: Italy Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 72: Italy Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 73: France Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 74: France Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 75: France Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 76: France Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 77: France Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2018 to 2033

Figure 78: France Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 79: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 80: France Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 81: France Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 82: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 83: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 84: France Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 85: France Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 86: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 87: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 88: France Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 89: France Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 90: France Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 91: Spain Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 92: Spain Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 93: Spain Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 94: Spain Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 95: Spain Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2018 to 2033

Figure 96: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 97: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 98: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 99: Spain Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 100: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 101: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 102: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 103: Spain Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 104: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 105: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 106: Spain Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 107: Spain Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 108: Spain Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 109: Rest of Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 110: Rest of Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 111: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 112: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 113: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 114: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 115: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 116: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 117: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 118: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 119: Rest of Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 120: Rest of Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Western Europe Automotive Lighting Market Growth – Trends & Forecast 2023-2033

Western Europe Probiotic Supplement Market Analysis in – Growth & Market Trends from 2025 to 2035

Western Europe Automotive Load Floor IndustryAnalysis in Western Europe Forecast & Analysis 2025 to 2035

Western Europe Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Turbocharger Market Growth – Trends & Forecast 2023-2033

Western Europe Building Automation System Market by System, Application and Region - Forecast for 2025 to 2035

Western Europe Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Mezcal Industry Analysis in Western Europe Report – Growth, Demand & Forecast 2025 to 2035

Western Europe Pectin Market Analysis by Product Type, Application, and Country Through 2035

I2C Bus Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Isomalt Industry Analysis in Western Europe – Size, Share & Forecast 2025 to 2035

Taurine Industry in Western Europe - Trends, Market Insights & Applications 2025 to 2035

Western Europe Steel Drum Market Insights – Trends & Forecast 2023-2033

Pallet Wrap Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Resveratrol Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Western Europe Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Tarpaulin Sheet Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Western Europe Industrial Drum Market Growth – Trends & Forecast 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA