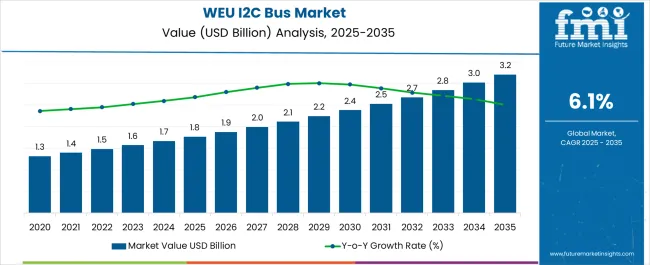

The I2C Bus Industry Analysis in Western Europe is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 3.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period.

| Metric | Value |

|---|---|

| I2C Bus Industry Analysis in Western Europe Estimated Value in (2025 E) | USD 1.8 billion |

| I2C Bus Industry Analysis in Western Europe Forecast Value in (2035 F) | USD 3.2 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

The I2C bus industry in Western Europe is expanding steadily. Growth is being supported by increasing adoption of connected devices, rising demand for efficient communication protocols in automotive and consumer electronics, and strong integration within system management applications. Current dynamics are marked by accelerated digitalization across industries, growing semiconductor innovation, and alignment with energy-efficient design standards.

Manufacturers are focusing on enhancing data transfer rates and reliability, meeting the demand for compact and scalable communication solutions. Regulatory frameworks promoting interoperability and safety standards have further reinforced adoption across industrial automation and healthcare electronics. The future outlook is defined by wider deployment in IoT-enabled ecosystems, automotive electronics requiring robust data transfer, and embedded system applications.

Growth rationale rests on the protocol’s simplicity, low-power consumption, and ability to support multiple devices on the same bus Increasing investments in R&D, combined with the region’s strong emphasis on advanced electronics manufacturing, are expected to underpin sustained revenue growth in the Western European market.

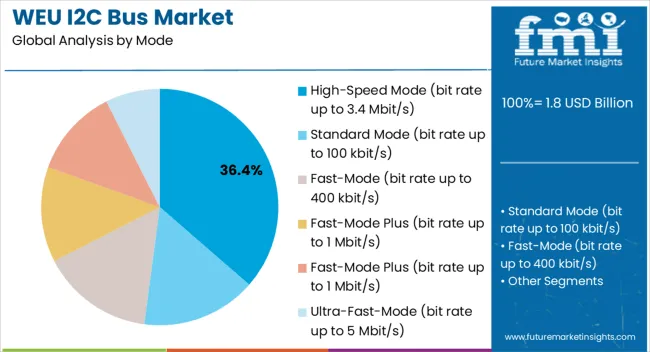

The high-speed mode, holding 36.40% of the mode category, has become a leading segment due to its suitability for data-intensive applications in advanced electronics. Its growth is being supported by rising adoption in consumer devices, automotive infotainment, and industrial automation where rapid communication between components is essential.

Enhanced transmission capability and reliability at higher data rates have reinforced preference among manufacturers. The segment benefits from ongoing advancements in semiconductor technologies that improve power efficiency and reduce latency.

In Western Europe, increased adoption in smart mobility solutions and medical electronics is further driving demand Continued innovation in signal integrity and compatibility improvements is expected to sustain this mode’s competitive positioning in the regional market.

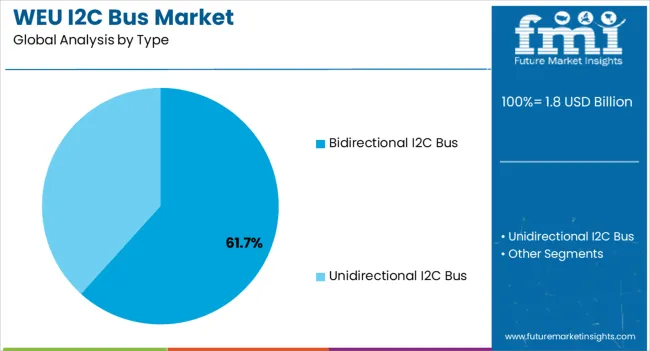

The bidirectional I2C bus, accounting for 61.70% of the type category, has dominated the market owing to its adaptability and simplified architecture. Its wide use in system-on-chip designs and embedded systems has reinforced its prominence.

The bidirectional design allows efficient two-way communication between multiple devices, enabling seamless data transfer across complex circuits. This structure has proven highly effective for applications demanding flexibility and scalability.

Adoption in Western Europe has been supported by strong penetration in automotive and industrial electronics, where cost-efficient integration is critical As electronic ecosystems evolve toward higher connectivity and integration, the bidirectional bus is expected to maintain its dominance, supported by ongoing enhancements in compatibility and performance.

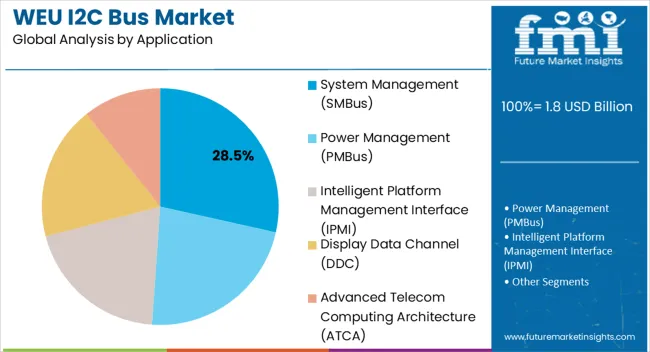

The system management application, representing 28.50% of the application category, has emerged as a significant driver of growth in the I2C bus industry. Its role in monitoring and controlling system health, power usage, and device communication has reinforced demand.

Adoption has been strong in servers, data centers, and high-performance computing environments in Western Europe, where operational efficiency and reliability are critical. The segment has also gained momentum in smart industrial systems, benefiting from regulatory alignment with energy efficiency and sustainability standards.

Continuous innovation in monitoring protocols and the growing requirement for predictive maintenance are expected to sustain demand for I2C bus integration in system management The segment is projected to maintain its growth trajectory as Western European industries adopt more advanced digital infrastructure and automation solutions.

Growing Need for IoT Devices: The I2C bus technology is in high demand as a result of recent advancements and the widespread adoption of IoT devices by residents and industries in Western European countries.

Rising Export of Automotive: The introduction of smart sensors in both passenger and commercial vehicles has increased the use of integrated circuit (I2C) buses in the automotive industry. In line with this development, the expanding electric vehicle manufacturing sector has also emerged as a key reason for the growing demand for I2C bus in Western Europe.

Role of European Regulators: Regulators in Western European countries frequently encourage and mandate the adoption of standardized communication protocols. This, in turn, has also prompted the adoption and implementation of inter-integrated circuit or I2C bus in Western Europe by electronics manufacturers.

The bidirectional I2C bus segment dominates over the unidirectional I2C bus segment and is expected to capture 66.7% of the overall demand in 2025.

| Leading Type for I2C Bus in Western Europe | Bidirectional I2C Bus |

|---|---|

| Total Value Share (2025) | 66.7% |

Bidirectional I2C technology is well-known for its low energy consumption, which attracts businesses seeking to produce goods with minimal electricity use. This is also in line with Europe's focus on energy conservation goals which is expected to retain the dominance of the bidirectional I2C segment over the coming years.

According to our survey, the demand for I2C bus with fast-mode technology is higher in Western European countries. In 2025, this segment is anticipated to garner about 29.4% of the total sales of I2C bus in the region.

| Leading Data Transfer Mode Type for I2C Bus in Western Europe | Fast Mode (up to 400 kbit/s) |

|---|---|

| Total Value Share (2025) | 29.4% |

Many businesses in Western Europe are making significant investments in research and development. This has fuelled the development of fast-mode I2C bus technology. Competitiveness, cost-cutting, and product enhancement are all driven by the use of the internal integrated circuit bus with a communication speed of 400 kbit/sec, making it the leading segment in the region.

| Key Countries in Western Europe | Value CAGR (2025 to 2035) |

|---|---|

| Germany | 7.6% |

| United Kingdom | 8.7% |

| France | 5.1% |

Germany, with a huge electronics manufacturing industry base, is the leading producer of I2C bus in Europe. Over the next ten years, this production volume is expected to increase by 7.6% per year.

Germany is now emphasizing industrial automation heavily and it could accelerate the adoption of communication devices in many industries located in the country. Given the critical role that I2C technology plays in enabling communication between components in automated systems the domestic demand for I2C bus is anticipated to soar higher.

The demand for I2C bus in the United Kingdom is anticipated to witness a higher growth rate of 8.7% per year from 2025 to 2035.

The United Kingdom is renowned for having a highly developed healthcare system with hospitals and medicals equipped with advanced digital monitoring systems. With further expansion of the healthcare infrastructure and medical tourism in the country, there is a corresponding rise in the use of and demand for I2C Bus components.

France has emerged as an important manufacturing hub of different electronics components for global players in the last few years. As per our analysis, the I2C bus production in the country is projected to witness a 5.7% CAGR through 2035.

France is hopeful to transform its national economy on the back of its rapidly developing electronics sector, encompassing semiconductor and device producers. So the regional industries are expected to experience some newfound opportunities in the country as the I2C bus is highly demanded by such industrial ecosystems.

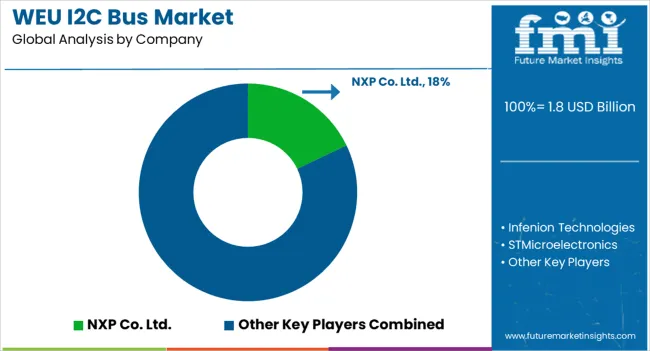

Owing to the presence of very few renowned I2C bus manufacturing companies, the competition among Western European players is relatively low. However, the emergence of many small players in recent years that design and manufacture I2C bus products has increased the competition to some degree.

European electronics and semiconductor circuit manufacturers frequently work with universities, research centers, and other tech firms. This encourages the sharing of information, creativity, and the creation of cutting-edge I2C solutions and is expected to encourage start-ups to enter the sector.

Recent Developments Observed in I2C Bus in Western Europe

| Attribute | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 1.8 billion |

| Projected Industry Size by 2035 | USD 3.2 billion |

| Anticipated CAGR between 2025 to 2035 | 6.1% CAGR |

| Historical Analysis of Demand for I2C Bus in Western Europe | 2020 to 2025 |

| Demand Forecast for I2C Bus in Western Europe | 2025 to 2035 |

| Report Coverage | Industry Size, Industry Trends, Analysis of key factors influencing the Adoption of I2C Bus in Western Europe, Insights on Global Players and their Industry Strategy in Western Europe, Ecosystem Analysis of Local and Regional Western Europe Manufacturers |

| Key Countries Analyzed while Studying Opportunities in I2C Bus in Western Europe | Germany, Italy, France, Spain, United Kingdom, BENELUX, Rest of Western Europe |

| Key Companies Profiled | NXP Co. Ltd.; Infenion Technologies; STMicroelectronics; Dialog Semiconductors; Imagination Technologies; Robert Bosch GmbH; Siemens Inc.; Continental AG; Valeo Co. Ltd. |

The global I2C bus industry analysis in Western Europe is estimated to be valued at USD 1.8 billion in 2025.

The market size for the I2C bus industry analysis in Western Europe is projected to reach USD 3.2 billion by 2035.

The I2C bus industry analysis in Western Europe is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in I2C bus industry analysis in Western Europe are high-speed mode (bit rate up to 3.4 mbit/s), standard mode (bit rate up to 100 kbit/s), fast-mode (bit rate up to 400 kbit/s), fast-mode plus (bit rate up to 1 mbit/s), fast-mode plus (bit rate up to 1 mbit/s) and ultra-fast-mode (bit rate up to 5 mbit/s).

In terms of type, bidirectional I2C bus segment to command 61.7% share in the I2C bus industry analysis in Western Europe in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Inter-Integrated Circuit (I2C) Bus Market Growth – Trends, Demand & Innovations 2025–2035

Understanding Market Share Trends in the I2C Bus Sector

Japan I2C Bus Market - Trends & Forecast 2025 to 2035

Korea I2C Bus Market Trends & Forecast 2025 to 2035

Busbars Market Size and Share Forecast Outlook 2025 to 2035

Bus Bellows Market Insights – Growth & Forecast 2025 to 2035

Bus Chassis Market

Business Jet Market Size and Share Forecast Outlook 2025 to 2035

Business Storage Units Market Size and Share Forecast Outlook 2025 to 2035

Business as a Service Market Size and Share Forecast Outlook 2025 to 2035

Business Cloud VoIP & UC Services Market Size and Share Forecast Outlook 2025 to 2035

Business Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Business Process Automation (BPA) Market Size and Share Forecast Outlook 2025 to 2035

Business Analytics BPO Services Market Analysis – Size, Share & Forecast 2025 to 2035

Business Value Dashboard Market Size and Share Forecast Outlook 2025 to 2035

Business Email Market Analysis by Channel, Deployment, and Region Through 2035

Business Process as a Service (BPaaS) Market Analysis by Process and Region Through 2035

Business Card Holder Market from 2024 to 2034

Bus Flooring Market Growth – Trends & Forecast 2025 to 2035

Competitive Overview of Business Analytics BPO Services Companies

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA