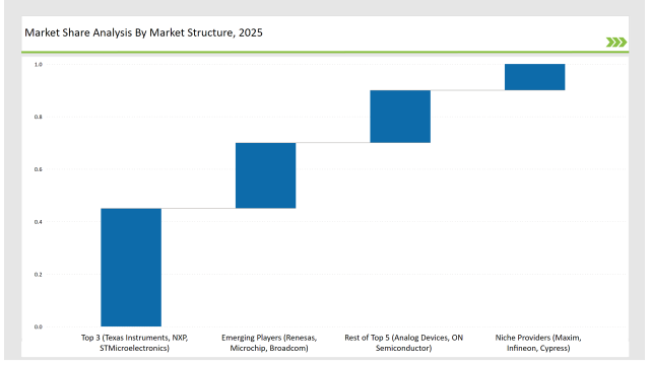

The I2C (Inter-Integrated Circuit) bus market is witnessing impressive growth as the industries are inclined towards the adoption of efficient, low power communication protocols for embedded systems, consumer electronics, and automotive applications. Texas Instruments, NXP Semiconductors, and STMicroelectronics, the leading three I2C bus manufacturers, account for 45% of market share and offer high-performance I2C bus solution, low-power communication interface, and circuits integration board.

While the remaining top five, which includes Analog Devices and ON Semiconductor, account for 20%, focused on signal integrity, high speed data transmission and compatibility across different applications. 25% share is held by emerging players like Renesas Electronics, Microchip Technology, Broadcom, which specialize in faster data transfers, bidirectional communication and end-to-end real-time monitoring solutions. 10% is filled by niche providers like Maxim Integrated, Infineon Technologies, and Cypress Semiconductor, solving for industrial automation, IoT, and security use case.

| Category | Industry Share (%) |

|---|---|

| Top 3 (Texas Instruments, NXP, STMicroelectronics) | 45% |

| Rest of Top 5 (Analog Devices, ON Semiconductor) | 20% |

| Emerging Players (Renesas, Microchip, Broadcom) | 25% |

| Niche Providers (Maxim, Infineon, Cypress) | 10% |

The market is moderately consolidated, where top players control 45-65% of the market. Companies like Texas Instruments and NXP Semiconductors dominate, but mid-sized vendors continue to innovate for IoT and automotive applications.

AI-Powered Communication Optimization

To enhance real-time data flow: High-performance chips today need to transmit data at greater rates while also consuming less power which is brought by high integration and innovation.

Blockchain-Based Data Authentication

Blockchain is also integrated with I2C communication modules to guarantee data integrity, which is a significant factor in critical areas like automotive and healthcare.

Cloud-Based Monitoring Solutions

Cloud-integrated I2C bus analytics tools are being employed by organizations to keep track of device interactions and identify anomalies in real time.

Security & Encryption Enhancements

Data Leakage and cyber threats are common in industrial applications and consumer products due to which new encryption standards are integrated with I2C communication.

Legal & Compliance Integration

Vendors are adapting their I2C solutions to meet global standards like ISO 26262 for automotive use and IEC 60601 for medical equipment.

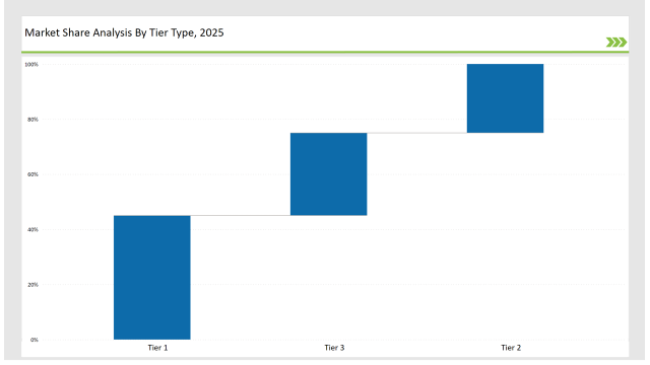

| Tier | Tier 1 |

|---|---|

| Vendors | Texas Instruments, NXP, STMicroelectronics |

| Consolidated Market Share (%) | 45% |

| Tier | Tier 2 |

|---|---|

| Vendors | Analog Devices, ON Semiconductor, Renesas |

| Consolidated Market Share (%) | 25% |

| Tier | Tier 3 |

|---|---|

| Vendors | Microchip, Broadcom, Infineon, Maxim Integrated |

| Consolidated Market Share (%) | 30% |

| Vendor | Key Focus |

|---|---|

| Texas Instruments | Low-power I2C solutions for battery-operated devices |

| NXP Semiconductors | Automotive-grade I2C interfaces with EMI protection |

| STMicroelectronics | AI-powered, high-speed I2C communication modules |

| Analog Devices | Secure I2C communication with built-in encryption |

| ON Semiconductor | Space-efficient, high-performance I2C transceivers |

| Renesas | IoT-ready I2C bus solutions with cloud integration |

| Microchip Technology | Robust, real-time I2C monitoring tools |

Vendors are focused on AI-driven signal integrity improvements, security enhancements and ultra-fast I2C protocols for next-generation applications. The shift towards cloud-based monitoring and automated data authentication will redefine market dynamics while emerging regions present high-growth potential for expanded adoption.

Leading vendors Texas Instruments, NXP, and STMicroelectronics hold 45% of the market.

Emerging players such as Renesas, Microchip, and Broadcom account for 25%.

Market concentration is categorized as medium, with top 10 players controlling 60-70% of the market.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

I2C Bus Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Inter-Integrated Circuit (I2C) Bus Market Growth – Trends, Demand & Innovations 2025–2035

Japan I2C Bus Market - Trends & Forecast 2025 to 2035

Korea I2C Bus Market Trends & Forecast 2025 to 2035

Breakdown for IBC Rental Business Market: Trends, Players, and Innovations

Competitive Overview of Business Analytics BPO Services Companies

Market Share Breakdown of Europe Trolley Bus Industry

Busbar for Industrial Market Size and Share Forecast Outlook 2025 to 2035

Bus Isolator Market Size and Share Forecast Outlook 2025 to 2035

Busbars Market Size and Share Forecast Outlook 2025 to 2035

Business Jet Market Size and Share Forecast Outlook 2025 to 2035

Business Storage Units Market Size and Share Forecast Outlook 2025 to 2035

Business as a Service Market Size and Share Forecast Outlook 2025 to 2035

Business Cloud VoIP & UC Services Market Size and Share Forecast Outlook 2025 to 2035

Business Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Business Process Automation (BPA) Market Size and Share Forecast Outlook 2025 to 2035

Business Analytics BPO Services Market Analysis – Size, Share & Forecast 2025 to 2035

Business Value Dashboard Market Size and Share Forecast Outlook 2025 to 2035

Bus Flooring Market Growth – Trends & Forecast 2025 to 2035

Bus Bellows Market Insights – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA