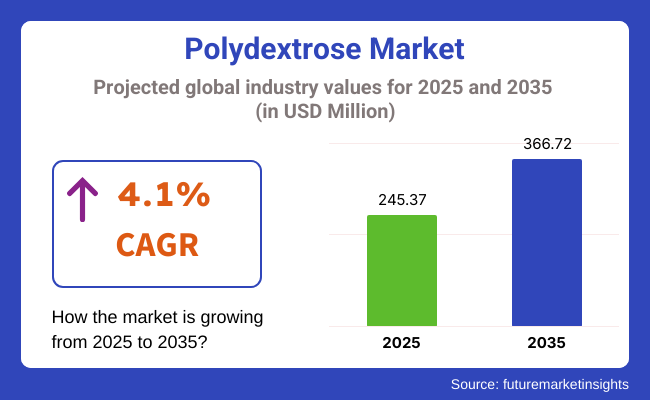

The global polydextrose market is valued at USD 245.37 million in 2025 and is poised to reach USD 366.72 million by 2035, expanding at a CAGR of 4.1% during the forecast period. This growth is primarily driven by the increasing demand for healthier, low-calorie food ingredients and growing awareness about the benefits of dietary fibers.

The ingredient in question, a versatile element, serves as a fiber, bulking agent, and low-calorie sweetener in various applications. The rising global demand for functional foods, particularly those promoting digestive health, is contributing significantly to this growth. As consumers become more health-conscious, they are increasingly turning toward ingredients like this to enhance the nutritional content of their diets. The widespread acceptance of such ingredients in the food and beverage industry further drives market expansion, especially in products targeting weight management, gut health, and improved fiber intake.

Looking forward, the market is likely to experience continued growth, especially in emerging regions such as Asia-Pacific, where the demand for functional foods and low-calorie ingredients is expected to rise rapidly. As the focus on health and wellness strengthens, particularly in regions with increasing disposable incomes, the demand for products containing this ingredient is likely to surge.

Moreover, technological advancements in ingredient formulations are expected to broaden its applications, enabling further growth in the food, beverage, and dietary supplement industries. The ability of this ingredient to enhance the texture, sweetness, and fiber content of foods without altering flavor or texture remains a key driver of its adoption in both mainstream and niche markets.

Government regulations in this market focus on ensuring the safety and quality of the ingredient in food products. Regulatory bodies such as the USA. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) have classified it as a generally recognized as safe (GRAS) ingredient. These regulations ensure that the ingredient meets the required safety standards for human consumption and is used in acceptable amounts in food products.

Stringent labeling requirements mandate that manufacturers provide clear nutritional information, including fiber content, to ensure transparency. As the market for functional foods grows, it is likely that regulatory agencies will continue to refine their guidelines to address emerging trends and health concerns, particularly around clean-label and health claims, ensuring that the ingredient remains compliant with consumer protection and health standards.

Polydextrose is gaining ground as a go-to synthetic fiber in regions with growing urban health awareness. Ingredient intake per person is climbing, particularly in Asian and European cities where dietary fiber targets are being integrated into public health initiatives.

Supermarket audits and survey-backed menu analyses reveal higher usage of polydextrose in packaged foods, especially among working professionals and young adults who favor convenience formats like shakes, bars, and instant cereals. The market reflects clear shifts in how nutritional ingredients are consumed daily.

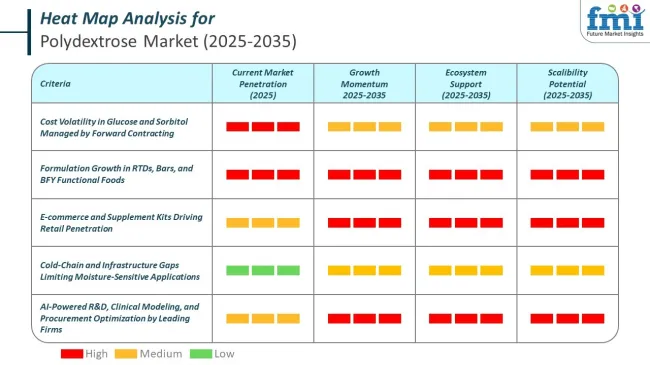

Modern trade visibility of polydextrose-based products has increased across organized retail chains, especially in diabetic-friendly and weight management categories. Foodservice applications remain limited to premium wellness menus. Cold-chain reliance is minimal due to polydextrose’s ambient stability, though large-format storage facilities in Brazil and Poland are being upgraded to support expanded blending operations.

| Particulars | Details |

|---|---|

| H1 2021 | 3.9% |

| H1 2022 Projected | 3.9% |

| H1 2022 Expected | 4.3% |

| BPS Change | - 42.9 ↓ |

FMI provides an evaluation and comparison of the market growth rates and future development possibilities on a half-yearly basis for the global market. The expansion of the worldwide polydextrose market is projected to be fueled by growing demands for functional foods because of the growing benefits of prebiotics.

The global market for Polydextrose Market has witnessed H1 2021 growth at a magnitude of 3.9%. However, this growth is not evenly spread across all regions, with the developing markets recording higher growth rates of 4.3%. Thus, leaving a gap of -42.9 BPS points between expected and projected growth during H1 2022.

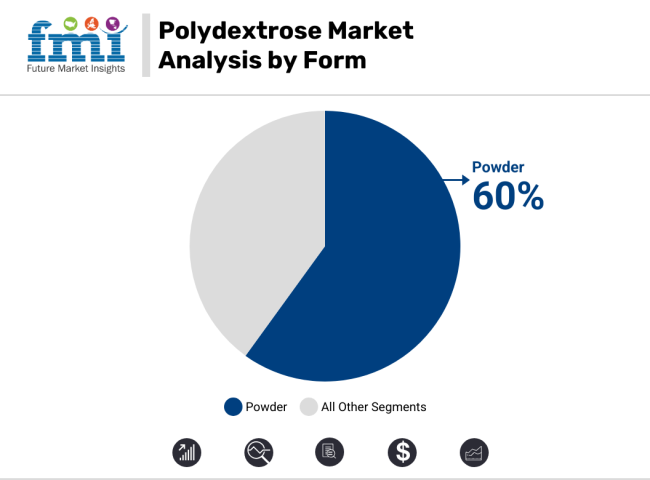

The market is segmented based on form, end-use, and region. By form, the market is divided into liquid and powder. In terms of end-use, the key segments include animal feed and pet food, bakery and confectionery, beverages and dairy drinks, breakfast cereals, dairy products, desserts and ice-cream, dietary supplements, snacks and bars, soups, sauces and dressings, and spreads and fillings. Regionally, the market is classified into North America, Latin America, Europe, Asia Pacific Excluding China, China, and the Middle East and Africa.

The powder form segment holds 60% share of the market and is expected to experience the fastest growth from 2025 to 2035. This growth is driven by the rising demand for easy-to-consume and versatile products such as protein powders, meal replacements, and nutritional supplements. Powders are preferred for their long shelf life, convenience, and easy integration into applications like beverages, health supplements, and fortified foods.

They are highly customizable, aligning with the trend of personalized nutrition. Additionally, powders are crucial in functional foods due to their stability and ability to be formulated into products like shakes, smoothies, and baked goods. As consumer preferences shift toward healthier lifestyles, powders offer a practical solution to meet these needs. The growing demand for cleaner labels and natural ingredients is further pushing the adoption of powders, which are often free from preservatives and additives.

The liquid form segment, while growing steadily, faces challenges in terms of shelf life and stability compared to powders. Liquids remain popular for beverages and ready-to-drink formulations due to their rapid absorption and convenience. Despite slower growth, the liquid segment continues to cater to consumer needs in functional beverages and liquid dietary supplements.

The dietary supplements segment is expected to experience the fastest growth, with a CAGR of 7.8% from 2025 to 2035. The growing consumer awareness of health and wellness, particularly in preventive healthcare, immunity support, and digestive health, is fueling this rise. As consumers become more proactive about their health, they are increasingly turning to dietary supplements to fulfill specific nutritional gaps.

This has led to a surge in the demand for products that offer personalized nutrition solutions, such as probiotics, vitamins, minerals, and plant-based supplements. Moreover, the rise of e-commerce platforms is making dietary supplements more accessible, contributing significantly to the expansion of this market. The trend toward clean labels, transparency, and natural ingredients also plays a key role, as consumers are increasingly aware of what they are putting into their bodies.

The dietary supplements segment is particularly strong in regions with rising disposable incomes, where consumers are more willing to invest in their health. This segment is benefiting from innovations such as customized formulations tailored to individual health concerns. Meanwhile, while other sectors such as bakery and confectionery, beverages, and animal feed and pet food show steady growth, the dietary supplements segment remains the frontrunner, driven by an increasingly health-conscious consumer base.

The USA polydextrose market is expected to grow at 2.6% CAGR during the study period. The growth of the market is largely driven by rising health concerns, particularly the increasing prevalence of obesity. According to the USA. Centers for Disease Control and Prevention (CDC), obesity rates have surged significantly, prompting consumers to seek healthier dietary options.

Polydextrose, a low-calorie, high-solubility fiber, is increasingly used in food and beverage formulations aimed at weight management and improved digestion. Its ability to enhance texture and maintain flavor while reducing sugar and calorie content makes it an attractive ingredient for health-focused products. In addition, supportive regulations from the USA. Food and Drug Administration (FDA) and growing endorsements for functional ingredients have bolstered its adoption across dietary supplements and functional foods, contributing to the steady expansion of the polydextrose market in the country.

The demand for polydextrose in China is poised to grow at 5.9% CAGR from 2025 to 2035. The growth of the polydextrose market in China is primarily driven by rising health awareness and the increasing prevalence of lifestyle-related conditions such as diabetes and obesity. As consumers become more conscious of their dietary habits, there is growing demand for functional foods and beverages that support digestive health and offer low-calorie alternatives. Polydextrose, with its ability to serve as a sugar and fat replacer while enhancing fiber content, fits well into this trend.

Additionally, China’s expanding middle class and rapid urbanization have led to a surge in health-conscious consumer behavior, particularly among younger demographics. Government initiatives promoting better nutrition and the development of the domestic functional food industry further support market growth. As a result, manufacturers are increasingly incorporating polydextrose into products such as supplements, dairy alternatives, and fortified snacks, driving strong demand across the country.

The polydextrose market in India is expected to grow at 4.6% CAGR during the study period. The polydextrose market in India is experiencing strong growth due to shifting consumer preferences toward healthier lifestyles and increased awareness of dietary wellness. Rising rates of obesity, diabetes, and digestive disorders have prompted Indian consumers to seek low-calorie, high-fiber food options. Polydextrose, known for its ability to reduce sugar content without compromising taste or texture, is gaining popularity as a functional ingredient in a wide range of food and beverage products.

Additionally, the expanding middle class, growing urbanization, and increased disposable incomes are fueling demand for health supplements and fortified foods. The influence of Western dietary trends, along with the rise of fitness culture and preventive healthcare, is also contributing to greater adoption of polydextrose in India’s functional food and nutraceutical industries.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 245.37 million |

| Projected Market Size (2035) | USD 366.72 million |

| Overall Market CAGR (2025 to 2035) | 4.10% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Analysis Parameter | Revenue in USD million/Volume in Metric Tons |

| By Form | Liquid and Powder |

| By End-use | Animal feed and pet food, bakery and confectionery, beverages and dairy drinks, breakfast cereals, dairy products, desserts and ice-cream, dietary supplements, snacks and bars, soups, sauces and dressings, and spreads and fillings. |

| By Regions | North America, Latin America, Europe, Asia Pacific, and Middle East & Africa |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | Tate and Lyle, DowDuPont Inc., Cargill Inc., The Scoular Company, CJ CheilJedang Corp, Baolingbao Biology, Samyang Corporation, Golden Grain Group Limited, Farbest-Tallman Foods Corporation, Foodchem International Corporation, Shandong Bailong Chuangyuan Bio-Tech Co., Ltd., HYET Sweet B.V., Henan Tailijie Biotech Co., Ltd., Akhil Healthcare Pvt. Ltd., Rajvi Enterprise Private Limited, and Triveni Interchem Private Limited. |

| Additional Attributes | Dollar sales by value, market share analysis by region, country-wise analysis |

| Customization and Pricing | Available upon request |

The global market is expected to reach USD 366.72 million by 2035, growing from USD 245.37 million in 2025, at a CAGR of 4.1% during the forecast period.

The powder segment is projected to grow at the fastest pace due to its longer shelf life, versatility in functional foods, and rising demand for clean-label, health-focused products.

The dietary supplements segment is the fastest-growing end-use category, with a CAGR of 7.8%, driven by increasing consumer preference for personalized, health-boosting nutritional solutions.

Key drivers include rising health consciousness, demand for low-calorie and high-fiber ingredients, growth of functional foods, and regulatory support for safe dietary fiber use in food and beverages.

Top companies include Tate & Lyle, DuPont, Cargill, Baolingbao Biology, CJ CheilJedang, Samyang, Shandong Minqiang Biotechnology, and Henan Tailijie Biotech, offering innovative fiber solutions.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 4: Global Market Volume (Tons) Forecast by Form, 2017 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End-use, 2017 to 2033

Table 6: Global Market Volume (Tons) Forecast by End-use, 2017 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2017 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 10: North America Market Volume (Tons) Forecast by Form, 2017 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End-use, 2017 to 2033

Table 12: North America Market Volume (Tons) Forecast by End-use, 2017 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2017 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Form, 2017 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End-use, 2017 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by End-use, 2017 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 20: Europe Market Volume (Tons) Forecast by Country, 2017 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 22: Europe Market Volume (Tons) Forecast by Form, 2017 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by End-use, 2017 to 2033

Table 24: Europe Market Volume (Tons) Forecast by End-use, 2017 to 2033

Table 25: Asia Pacific Excluding China Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 26: Asia Pacific Excluding China Market Volume (Tons) Forecast by Country, 2017 to 2033

Table 27: Asia Pacific Excluding China Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 28: Asia Pacific Excluding China Market Volume (Tons) Forecast by Form, 2017 to 2033

Table 29: Asia Pacific Excluding China Market Value (US$ Million) Forecast by End-use, 2017 to 2033

Table 30: Asia Pacific Excluding China Market Volume (Tons) Forecast by End-use, 2017 to 2033

Table 31: China Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 32: China Market Volume (Tons) Forecast by Country, 2017 to 2033

Table 33: China Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 34: China Market Volume (Tons) Forecast by Form, 2017 to 2033

Table 35: China Market Value (US$ Million) Forecast by End-use, 2017 to 2033

Table 36: China Market Volume (Tons) Forecast by End-use, 2017 to 2033

Table 37: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 38: Middle East and Africa Market Volume (Tons) Forecast by Country, 2017 to 2033

Table 39: Middle East and Africa Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 40: Middle East and Africa Market Volume (Tons) Forecast by Form, 2017 to 2033

Table 41: Middle East and Africa Market Value (US$ Million) Forecast by End-use, 2017 to 2033

Table 42: Middle East and Africa Market Volume (Tons) Forecast by End-use, 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End-use, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2017 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Form, 2017 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End-use, 2017 to 2033

Figure 13: Global Market Volume (Tons) Analysis by End-use, 2017 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 16: Global Market Attractiveness by Form, 2023 to 2033

Figure 17: Global Market Attractiveness by End-use, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End-use, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2017 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Form, 2017 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End-use, 2017 to 2033

Figure 31: North America Market Volume (Tons) Analysis by End-use, 2017 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 34: North America Market Attractiveness by Form, 2023 to 2033

Figure 35: North America Market Attractiveness by End-use, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End-use, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2017 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Form, 2017 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End-use, 2017 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by End-use, 2017 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End-use, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by End-use, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 59: Europe Market Volume (Tons) Analysis by Country, 2017 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 63: Europe Market Volume (Tons) Analysis by Form, 2017 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by End-use, 2017 to 2033

Figure 67: Europe Market Volume (Tons) Analysis by End-use, 2017 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 70: Europe Market Attractiveness by Form, 2023 to 2033

Figure 71: Europe Market Attractiveness by End-use, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Excluding China Market Value (US$ Million) by Form, 2023 to 2033

Figure 74: Asia Pacific Excluding China Market Value (US$ Million) by End-use, 2023 to 2033

Figure 75: Asia Pacific Excluding China Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Asia Pacific Excluding China Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 77: Asia Pacific Excluding China Market Volume (Tons) Analysis by Country, 2017 to 2033

Figure 78: Asia Pacific Excluding China Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Excluding China Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Excluding China Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 81: Asia Pacific Excluding China Market Volume (Tons) Analysis by Form, 2017 to 2033

Figure 82: Asia Pacific Excluding China Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 83: Asia Pacific Excluding China Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 84: Asia Pacific Excluding China Market Value (US$ Million) Analysis by End-use, 2017 to 2033

Figure 85: Asia Pacific Excluding China Market Volume (Tons) Analysis by End-use, 2017 to 2033

Figure 86: Asia Pacific Excluding China Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 87: Asia Pacific Excluding China Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 88: Asia Pacific Excluding China Market Attractiveness by Form, 2023 to 2033

Figure 89: Asia Pacific Excluding China Market Attractiveness by End-use, 2023 to 2033

Figure 90: Asia Pacific Excluding China Market Attractiveness by Country, 2023 to 2033

Figure 91: China Market Value (US$ Million) by Form, 2023 to 2033

Figure 92: China Market Value (US$ Million) by End-use, 2023 to 2033

Figure 93: China Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: China Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 95: China Market Volume (Tons) Analysis by Country, 2017 to 2033

Figure 96: China Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: China Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: China Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 99: China Market Volume (Tons) Analysis by Form, 2017 to 2033

Figure 100: China Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 101: China Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 102: China Market Value (US$ Million) Analysis by End-use, 2017 to 2033

Figure 103: China Market Volume (Tons) Analysis by End-use, 2017 to 2033

Figure 104: China Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 105: China Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 106: China Market Attractiveness by Form, 2023 to 2033

Figure 107: China Market Attractiveness by End-use, 2023 to 2033

Figure 108: China Market Attractiveness by Country, 2023 to 2033

Figure 109: Middle East and Africa Market Value (US$ Million) by Form, 2023 to 2033

Figure 110: Middle East and Africa Market Value (US$ Million) by End-use, 2023 to 2033

Figure 111: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 113: Middle East and Africa Market Volume (Tons) Analysis by Country, 2017 to 2033

Figure 114: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: Middle East and Africa Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 117: Middle East and Africa Market Volume (Tons) Analysis by Form, 2017 to 2033

Figure 118: Middle East and Africa Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 119: Middle East and Africa Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 120: Middle East and Africa Market Value (US$ Million) Analysis by End-use, 2017 to 2033

Figure 121: Middle East and Africa Market Volume (Tons) Analysis by End-use, 2017 to 2033

Figure 122: Middle East and Africa Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 123: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 124: Middle East and Africa Market Attractiveness by Form, 2023 to 2033

Figure 125: Middle East and Africa Market Attractiveness by End-use, 2023 to 2033

Figure 126: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polydextrose Industry Analysis in Korea – Growth & Consumer Demand 2025 to 2035

Polydextrose Industry Analysis in Japan – Demand & Market Trends 2025 to 2035

Polydextrose Industry Analysis in Western Europe Growth, Trends and Forecast from 2025 to 2035

Polydextrose Ingredients Market Trends - Functional Benefits 2025 to 2035

Demand for Polydextrose in the EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA