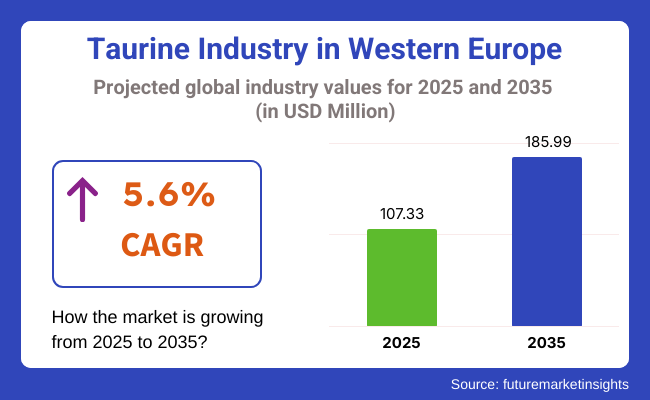

The taurine industry in Western Europe is projected to reach a market size of USD 107.33 million in 2025, with a compound annual growth rate (CAGR) of 5.6% from 2025 to 2035, reaching USD 185.99 million by 2035. This growth has come because of burgeoning consumption levels in energy drinks, dietary supplements, and functional foods, with taurine also playing a big role in addressing energy and well-being needs.

Taurine, an amino acid widely recognized in nature, is administered for energy enhancement, exercise performance improvement, and cardiovascular health. In Western Europe, people tend to get this amino acid mainly from energy drinks, which are widely accepted among athletes, young adults, and professionals. The frantic lifestyles in various countries also serve to drive the consumption of energy drinks, for which users look for almost instant solutions to energy and alertness.

The demand has increased due to the growing knowledge about its health aspects, such as improved heart health, improved cognitive function, and metabolic-associated benefits. Such interest has extended its scope to functional food and beverage applications. A healthy benefit concept for consumers would be more towards energy but with added health benefits.

In addition to energy drinks, this amino acid is also increasingly mixed into products that focus on wellness and healthy lifestyle-enhancing opportunities in consumers' everyday lives. Functional foods are increasingly popular in Western Europe, especially among older populations, who become more focused on health and vitality. It can be said that taurine-supplemented functional foods can be very beneficial in the sense that they are both supposed to boost physical and cognitive function.

This trend of clean-label- which specifies transparency and naturalness- has largely been taken to boost this industry in Western Europe. Consumers now, more than ever, have become critical ingredients in their foods and beverages, craving products with sorts of simple, natural, and scientifically-backed components. Taurine is an amino acid naturally found in the human body, which is probably an easy fit under the demand for clean-label.

The increasing cases of lifestyle-related health problems such as stress and sleep deprivation, together with mental fatigue, have increased the need for functional ingredients that tackle a certain number of these problems. Because of the mood regulation and mental clarity support, it is now highly demanded to be included in the ever-growing range of functional supplements that aim at enhancing mental health and well-being.

The leading segment will be the Food Grade segment, accounting for 43.8% of the share, followed by the Feed Grade segment with 18.2%.The Food Grade taurine is the largest segment in Western Europe because of the high application of taurine in functional foods and beverages.

Today, taurine is one of the main substances used in beverage formulations, dietary supplements, and fortified food products that are directed to improve physical performance, stimulate cognition, and support wellness. Energy drinks are still the most important consumption portion, with popular brands such as Red Bull and Monster Energy and local brands offering products that feature taurine to achieve levels of increased energy and endurance.

The amino acid is also heavily marketed in sports nutrition, among protein bars, beverages, and functional waters, and is directed toward the health-conscious class. Most importantly, with the increasing demand for foods that are known to boost mental clarity, energy, and overall vitality, taurine in Western European households, as well as specialty health products, is only going to increase.

The adaptation of including taurine into the portfolio has been evident by some companies such as Nestlé, PepsiCo, and Unilever, which have been looking forward to tapping into those changing customer needs in favor of healthier and more functional food.

The feed-grade taurine segment is also growing in importance, notably in the fields of pet food and aquaculture. Certain animals, such as cats, cannot synthesize taurine and must, therefore, acquire it through their diet to maintain good health.

This fact makes taurine necessary in the pet food and aquaculture markets. With interest in the premiumization of pet food in Western Europe rising, especially among pet owners wanting more specialized diets for their pets, this feed-grade taurine will grow.

Major players such as Mars Petcare and Nestlé Purina add taurine to their recipes in order to enhance the nutrient profile of the products marketed for cats and other animals. Also, it is used to improve health and promote the growth of farmed fish in aquaculture feeds, a steadily growing market resulting from the rising demand for sustainable seafood.

In 2025, the Food sector will account for 39.0% of the industry, and the Beverage sector will hold 25.1% of the total share.The food sector will lead the industry. Taurine, as an ingredient, is found in energy bars, protein supplements, and fortified snacks, catering to the increasing demand for health-related food and on-the-go nutrition.

Consumers are now more demanding with their food choices and are looking for foods offering benefits that go beyond those, such as energy, mental performance, and general improvement of wellness. Industries such as Nestlé, Danone, and Mondelez have utilized taurine's advantage in developing functional food products based on health and wellness trends in the region.

The beverage industry has a widespread application of this amino acid in energy drinks and functional beverages. Taurine is a vital substance in energy drinks owing to the fact that it is alleged to boost endurance, cognitive function, and physical performance. In energy drinks produced by well-known brands like Red Bull and Monster, as well as local brands, taurine is included to support the products' fortifying and energizing appeal to active consumers.

Due to this existing demand for taurine in sports drinks, functional waters, and wellness beverages, it is gaining a foothold in these products. With consumers on the lookout for beverages that hydrate and provide health benefits, it is an important ingredient for brands that want to focus on health and wellness beverages.

Western Europe is currently experiencing consistent growth as demand for energy drinks, functional foods, and dietary supplements continues to increase. This amino acid derivative is well-known for its properties that reportedly energize, sharpen focus, and improve overall physical performance.

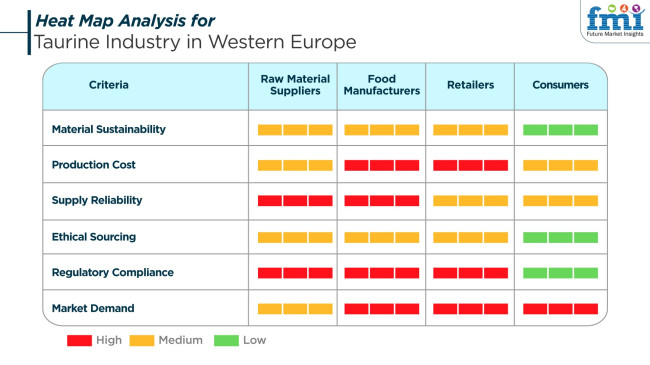

In Western Europe, the raw material suppliers require a reliable and sustainable supply. Basically, lysine from animal tissues is used for taurine excUS production in Europe. The major concern in ensuring supply reliability arises in cases where taurine is widely applied in energy drinks and functional food applications.

While the sustainability aspect is important, it is not a priority at present. Suppliers have medium production cost-pressuring conditions because the synthetic process is cheap. Balancing the cost with the growing demand is their immediate challenge, while ethical sourcing will be a secondary challenge.

Food and beverage manufacturers are pivotal in controlling the industry dynamics. They tend to focus on the management of high production costs and complying with the regulations controlling taurine, which is a highly controlled ingredient, especially in energy drinks. Regulatory institutions such as the EFSA impose legislation on 1000 taurine usage.

Protection from fines and product recalls cannot be taken lightly by manufacturers. However, with the soaring demand for this amino acid in energy drinks and functional beverages, the industry players are striving hard to incorporate changing consumer trends toward clean-label products with fewer artificial ingredients. Rising production costs are an impediment across the board as transparency in ingredients has taken a front seat.

Retailers in Western Europe are witnessing the soaring demand for taurine-based products, in particular energy drinks and functional beverages. Fueled by health and wellness consciousness among consumers, demand for these products continues to grow.

Retailers focus on product availability for consumer choice, along with expanding their offerings to include a variety of taurine-enriched functional drinks. While supply reliability and production costs are accounted for, the dominant consideration is demand.

Sustainability and ethical sourcing are finding their way more into retail strategies; however, these are still a second concern to consumer demand. Retailers should be in a position to take advantage of the emerging trend for taurine-designated products.

(Stakeholders: Raw Material Suppliers, Food & Beverage Manufacturers, Retailers, Consumers)

From 2020 to 2024, Western Europe witnessed consistent growth in sales owing to heightened customer focus on well-being and health. The increasing cases of lifestyle diseases, including obesity and diabetes, pushed the demand for food supplements upward.

Taurine, with its antioxidant and cardiovascular health effects, became popular in the manufacturing of functional foods, drinks, and dietary supplements. The growing population of elderly people in Western Europe also fueled the demand for healthy aging supplements.

During the forecast period 2025 to 2035, Western Europe is expected to grow further. Food technology and formulation innovations are likely to result in the creation of a range of taurine-containing products with enhanced bioavailability and effectiveness.

The growing trend towards healthy diets and individualized nutrition is also expected to drive demand for taurine supplements further. Furthermore, the focus on sustainable sourcing and clear labeling will become more critical to address consumer demands and regulatory requirements.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Health-conscious consumers who look for antioxidant-enhanced, cardiovascular wellness supplements | Increased fo cus on health and well-being, with attention toward personalized nutrition |

| Functional foods, drinks, dietary supplements | Increased application in personal nutrition products and innovative formulations |

| Food safety and labeling compliance | Projected tightening regulations influencing product formulation and promotion |

| The growing population of seniors, rising incidence of lifestyle-relevant health problems | Increased demand for personalized nutrition and sustainable, clean-label products |

| Formulation d evelopment with enhanced bioavailability | Launch of personalized products and sustainable portfolios |

Western Europe is exposed to various risks that could hinder the further growth of the industry. One of the primary risks is regulation. The EU imposes strict rules on food additives and dietary supplements. Changes in laws or delays in approval processes might pose significant barriers, which in turn would hurt sales. Companies should always keep an eye on the evolving standards and ensure compliance to avoid any illegal implications and restrictions.

The second category of threat that has become common in every industry in recent times is supply chain vulnerability. The industry replenishes world supply chains, putting its business in jeopardy with military disagreements, trade wars and natural hazards. Such incidents entail delays in sourcing or relevant active ingredients, elevating production costs and product release timings. To avoid this risk, companies should be diversifying their supply chain and preparing for any disruption that might take place.

Taurine competes with caffeine, creatine, and herbal extracts, which offer energy and performance benefits. That creates competition since the demand for all-natural plant-derived alternatives is increasing. Market differentiation of taurine-based products on account of their unique benefits and innovative formulations will be essential for the survival of companies.

Finally, consumer perception and education are two significant "trouble" areas. In spite of the well-known health benefits that taurine offers, it is not as famous or accepted as many other supplements, which may act against its further acceptance.

Misperceptions or lack of awareness may have an adverse effect on consumer demand. It will be important for the companies in this sector to invest in consumer education and open communication to build trust and enhance the greater acceptance of taurine-based products in Western Europe.

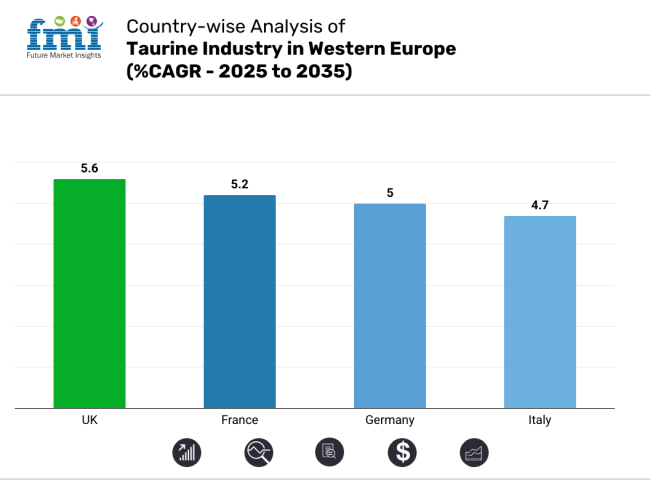

| Countries | CAGR (2025 to 2035) |

|---|---|

| UK | 5.6% |

| France | 5.2% |

| Germany | 5.0% |

| Italy | 4.7% |

The UK is expected to grow at 5.6% CAGR during the forecast period. Demand in the UK is being driven by the increasing energy drinks sales, increased interest in sports nutrition, and greater intake of functional ingredients in health and wellness products.

This amino acid is being added more to beverages, supplements, and fortified foods due to its properties to improve endurance, cardiovascular function, and neurological function. There is an increasing fitness awareness and changing consumer lifestyles that promote active and energetic living.

Excluding the sport and energy segment, the fast-growing nutraceutical and pharmaceutical sectors are integrating the amino acid into products addressing stress management, fatigue, and metabolic well-being.

UK's increasing vegan and vegetarian culture also contributes to the rising demand for artificial taurine as consumers seek alternatives that are not animal-based to impart nutritional benefits. Product innovation by local and global participants in the energy supplement space and a robust retail and online infrastructure are enhancing access and product visibility. Continuous marketing emphasis on taurine's functional action, particularly its synergy with caffeine and other amino acids, will be expected to drive steady growth over the forecast period.

France is expected to grow at 5.2% CAGR over the forecast period. France is experiencing expansion due to greater interest in performance and recovery-based formulas in the energy and sports nutrition industries.

Taurine's well-established role as an enhancer of cognitive focus, muscle resupply, and electrolyte balance has made it a valued ingredient across energy drinks, dietary supplements, and functional foods. Consumers concerned with retaining stamina and intellectual acuity, especially younger consumers and health-conscious individuals exercising and participating in sports, are actively looking for such products.

The application of this amino acid is also expanding in pharmaceuticals and pet foods, where physiological effects complement therapeutic and developmental actions. Regulatory clarity and product safety policies in France have provided a legitimate environment for functional ingredients. The soft drink industry continues to innovate with taurine-containing ready-to-drink products, gravitating towards targeting consumers seeking alternatives to conventional caffeine-infused stimulants.

Germany will grow at a 5.0% CAGR over the forecast period. Germany is driven by strong demand for energy drinks, health supplements, and pharmaceutical applications. Characterized by a health-oriented and disciplined consumer base, Germany is receptive to scientifically proven performance-enhancing ingredients.

Taurine has been known traditionally for its physiological roles in augmenting cardiovascular performance, metabolic balance, and mental acuity and supporting health issues at all stages of life. The German market for sports nutrition remains buoyant as a result of increased activity in sporting exercises and a rising trend of individualized health interventions. Taurine is now being emphasized in recovery supplements, pre-workouts, and strength-enhanced functional drinks aimed at endurance and concentration.

The country's pet food industry is also embracing this amino acid to address development and cardiovascular well-being needs in dogs and cats. Prominent beverage players and nutraceutical companies are driving continual product innovation. German consumers are also demanding higher efficacy and integrity of ingredients, contributing to the demand for high-purity and bioavailable forms of taurine in finished product applications.

Italy will expand at a 4.7% CAGR in the research period. Italy's consumption of taurine is gradually gaining momentum with enhanced knowledge about its application in body and mental performances. The product has extensive applications in energy drinks and functional drinks that have gained popularity among young adults and active consumers.

There is a growing trend towards sporting and healthier living, inducing demand for performance-based supplements in which taurine plays a critical part with its roles in hydration, muscle contraction, and neurological function.

Italy's veterinary and pharmaceutical industries are also incorporating taurine into therapeutic uses, particularly cardiovascular and metabolic health. Synthetic taurine is gaining popularity among consumers who remain committed to animal-free, science-based nutritional supplements.

Italian drink brands are launching taurine-enriched products with cleaner labels and higher ingredient clarity to attract health-conscious consumers. Growth is expected to be consistent as the benefits of taurine become more and more popular. Improvements in distribution channels and digital health platforms are also driving the visibility and availability of taurine-based products across Italy.

Western Europe is characterized by a strong interplay between global suppliers and regional distributors, driven by stringent EU regulatory compliance and demand from pharmaceutical, energy drink, and pet nutrition sectors.

Atlantic Chemicals Trading GmbH, headquartered in Germany, plays a pivotal role as a regional leader, leveraging its deep-rooted distribution infrastructure and regulatory expertise to supply EU-compliant taurine across diverse applications. It remains a preferred partner for bulk buyers requiring consistent documentation and REACH-certified ingredients.

Hubei Grand Fuchi Pharmaceutical & Chemicals Co., Ltd. and Qianjiang Yongan Pharmaceutical Co., Ltd., two major Chinese taurine producers, continue to expand their influence in Western Europe by collaborating with European distributors. Their cost-competitive taurine meets the purity and traceability standards required for energy drinks, animal feed, and food fortification industries.

Western Europe’s preference for traceability and documentation has created a niche for high-purity taurine from firms like New Zealand Pharmaceuticals Ltd. and Stauber USA, who appeal to clinical, supplement, and infant nutrition segments.

Companies such as AuNutra Industries Inc., MTC Industries, and Avanscure LifeSciences Pvt. Ltd. have carved a position by offering flexible supply volumes and tailoring ingredient specs to suit mid-sized manufacturers in Germany, France, and the Benelux countries. Japanese-origin taurine from The Honjo Chemical Corporation and Taisho Pharmaceutical Holdings Co., Ltd. maintains a boutique presence, particularly among functional beverage formulators prioritizing brand lineage and precision formulation.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Atlantic Chemicals Trading GmbH | 24-28% |

| Hubei Grand Fuchi Pharmaceutical Co., Ltd. | 18-22% |

| Qianjiang Yongan Pharmaceutical Co., Ltd. | 14-17% |

| Stauber USA | 9-12% |

| New Zealand Pharmaceuticals Ltd. | 6-9% |

| Other Players | 14-20% |

Key Company Insights

Atlantic Chemicals Trading GmbH has the largest share in Western Europe, estimated at 24-28%. Their strengths include solid compliance with EU safety and sourcing regulations and good standing with beverage and pharma producers regarding logistics and technical quality. It serves as a major mediator for Asian producers to ensure compliance with REACH and HACCP.

By exploiting cost benefits and stringent export documentation, Hubei Grand Fuchi has captured an 18-22% share, helping it to access clients in Germany, the Netherlands, and the UK. Qianjiang Yongan Pharmaceutical has captured 14-17% by using the amino acid in diversified applications across fortified foods and pet care, generally supplying through EU distributors after tailoring specifications. Stauber USA has managed a 9-12% share by providing premium ingredients for nutraceuticals, mainly in Scandinavia and Germany.

New Zealand Pharmaceutical Ltd. has a share of 6-9% and emphasizes providing high-quality traceable taurine that conforms to Western Europe's strict purity criteria. Their biggest pull is to firms dealing in medical nutrition and high-end beverage companies. The rest of the industry is serviced by flexible suppliers such as AuNutra, MTC Industries, and Avanscure, who thrive on small-batch customization and price-tiered sourcing strategies to meet a pool of varied buyer needs.

The segmentation is into Food Grade, Feed Grade, Pharmaceuticals Grade, and Others.

The segmentation is into Food (Dairy Products, Infant, Bakery Products, Cereal Products), Beverage (Energy Drinks, Caffeinated Drinks, Soft & Carbonated Drinks), Animal Feed (Aquaculture Feed, Poultry Feed), Pet Food (Cat Food, Dog Food), Pet Supplements (Cat Supplements, Dog Supplements), Dietary Supplements, Cosmetics & Personal Care (Skin Care Products, Hair Care Products, Toiletries), Agriculture, and Pharmaceuticals.

The regions covered in Western Europe include the UK, Germany, Italy, France, Spain, and the Rest of Western Europe.

The taurine market in Western Europe is expected to reach USD 107.33 million in 2025.

The industry valuation is projected to grow to USD 185.99 million by 2035.

The UK accounts for approximately 5.6% of the share in Western Europe.

The food-grade segment is a key focus in the taurine market in Western Europe.

Key players include Atlantic Chemicals Trading GmbH, Hubei Grand Fuchi Pharmaceutical & Chemicals Co., Ltd., Qianjiang Yongan Pharmaceutical Co., Ltd., Stauber USA, New Zealand Pharmaceuticals Ltd., MTC Industries Inc., AuNutra Industries Inc., Taisho Pharmaceutical Holdings Co., Ltd., The Honjo Chemical Corporation, and Avanscure LifeSciences Pvt. Ltd.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2018 to 2033

Table 2: Industry Analysis and Outlook Volume (Tons) Forecast by Country, 2018 to 2033

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 4: Industry Analysis and Outlook Volume (Tons) Forecast by Grade, 2018 to 2033

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Industry Analysis and Outlook Volume (Tons) Forecast by Application, 2018 to 2033

Table 7: UK Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 8: UK Industry Analysis and Outlook Volume (Tons) Forecast By Region, 2018 to 2033

Table 9: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 10: UK Industry Analysis and Outlook Volume (Tons) Forecast by Grade, 2018 to 2033

Table 11: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: UK Industry Analysis and Outlook Volume (Tons) Forecast by Application, 2018 to 2033

Table 13: Germany Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 14: Germany Industry Analysis and Outlook Volume (Tons) Forecast By Region, 2018 to 2033

Table 15: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 16: Germany Industry Analysis and Outlook Volume (Tons) Forecast by Grade, 2018 to 2033

Table 17: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Germany Industry Analysis and Outlook Volume (Tons) Forecast by Application, 2018 to 2033

Table 19: Italy Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 20: Italy Industry Analysis and Outlook Volume (Tons) Forecast By Region, 2018 to 2033

Table 21: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 22: Italy Industry Analysis and Outlook Volume (Tons) Forecast by Grade, 2018 to 2033

Table 23: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Italy Industry Analysis and Outlook Volume (Tons) Forecast by Application, 2018 to 2033

Table 25: France Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 26: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 27: Rest of Industry Analysis and Outlook Volume (Tons) Forecast by Grade, 2018 to 2033

Table 28: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 29: Rest of Industry Analysis and Outlook Volume (Tons) Forecast by Application, 2018 to 2033

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Grade, 2023 to 2033

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 3: Industry Analysis and Outlook Value (US$ Million) by Country, 2023 to 2033

Figure 4: Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 5: Industry Analysis and Outlook Volume (Tons) Analysis by Country, 2018 to 2033

Figure 6: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 7: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 8: Industry Analysis and Outlook Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 9: Industry Analysis and Outlook Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 10: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 11: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 12: Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Industry Analysis and Outlook Volume (Tons) Analysis by Application, 2018 to 2033

Figure 14: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Industry Analysis and Outlook Attractiveness by Grade, 2023 to 2033

Figure 17: Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 18: Industry Analysis and Outlook Attractiveness by Region, 2023 to 2033

Figure 19: UK Industry Analysis and Outlook Value (US$ Million) by Grade, 2023 to 2033

Figure 20: UK Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 21: UK Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 22: UK Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 23: UK Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2018 to 2033

Figure 24: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 25: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 26: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 27: UK Industry Analysis and Outlook Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 28: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 29: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 30: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: UK Industry Analysis and Outlook Volume (Tons) Analysis by Application, 2018 to 2033

Figure 32: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: UK Industry Analysis and Outlook Attractiveness by Grade, 2023 to 2033

Figure 35: UK Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 36: UK Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 37: Germany Industry Analysis and Outlook Value (US$ Million) by Grade, 2023 to 2033

Figure 38: Germany Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 39: Germany Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 40: Germany Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 41: Germany Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2018 to 2033

Figure 42: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 43: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 44: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 45: Germany Industry Analysis and Outlook Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 46: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 47: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 48: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Germany Industry Analysis and Outlook Volume (Tons) Analysis by Application, 2018 to 2033

Figure 50: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Germany Industry Analysis and Outlook Attractiveness by Grade, 2023 to 2033

Figure 53: Germany Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 54: Germany Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 55: Italy Industry Analysis and Outlook Value (US$ Million) by Grade, 2023 to 2033

Figure 56: Italy Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 57: Italy Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 58: Italy Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 59: Italy Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2018 to 2033

Figure 60: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 61: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 62: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 63: Italy Industry Analysis and Outlook Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 64: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 65: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 66: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Italy Industry Analysis and Outlook Volume (Tons) Analysis by Application, 2018 to 2033

Figure 68: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Italy Industry Analysis and Outlook Attractiveness by Grade, 2023 to 2033

Figure 71: Italy Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 72: Italy Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 73: France Industry Analysis and Outlook Value (US$ Million) by Grade, 2023 to 2033

Figure 74: France Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 75: France Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 76: France Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 77: France Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2018 to 2033

Figure 78: France Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 79: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 80: France Industry Analysis and Outlook Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 81: France Industry Analysis and Outlook Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 82: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 83: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 84: France Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: France Industry Analysis and Outlook Volume (Tons) Analysis by Application, 2018 to 2033

Figure 86: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: France Industry Analysis and Outlook Attractiveness by Grade, 2023 to 2033

Figure 89: France Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 90: France Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 91: Spain Industry Analysis and Outlook Value (US$ Million) by Grade, 2023 to 2033

Figure 92: Spain Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 93: Spain Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 94: Spain Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 95: Spain Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2018 to 2033

Figure 96: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 97: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 98: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 99: Spain Industry Analysis and Outlook Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 100: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 101: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 102: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: Spain Industry Analysis and Outlook Volume (Tons) Analysis by Application, 2018 to 2033

Figure 104: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: Spain Industry Analysis and Outlook Attractiveness by Grade, 2023 to 2033

Figure 107: Spain Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 108: Spain Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 109: Rest of Industry Analysis and Outlook Value (US$ Million) by Grade, 2023 to 2033

Figure 110: Rest of Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 111: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 112: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 113: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 114: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 115: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 116: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by Application, 2018 to 2033

Figure 117: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 118: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 119: Rest of Industry Analysis and Outlook Attractiveness by Grade, 2023 to 2033

Figure 120: Rest of Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Western Europe Automotive Lighting Market Growth – Trends & Forecast 2023-2033

Western Europe Probiotic Supplement Market Analysis in – Growth & Market Trends from 2025 to 2035

Western Europe Automotive Load Floor IndustryAnalysis in Western Europe Forecast & Analysis 2025 to 2035

Western Europe Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Turbocharger Market Growth – Trends & Forecast 2023-2033

Western Europe Building Automation System Market by System, Application and Region - Forecast for 2025 to 2035

Western Europe Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Mezcal Industry Analysis in Western Europe Report – Growth, Demand & Forecast 2025 to 2035

Western Europe Pectin Market Analysis by Product Type, Application, and Country Through 2035

I2C Bus Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Isomalt Industry Analysis in Western Europe – Size, Share & Forecast 2025 to 2035

Western Europe Steel Drum Market Insights – Trends & Forecast 2023-2033

Pallet Wrap Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Resveratrol Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Western Europe Size and Share Forecast Outlook 2025 to 2035

Polydextrose Industry Analysis in Western Europe Growth, Trends and Forecast from 2025 to 2035

Glassine Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Tarpaulin Sheet Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Western Europe Industrial Drum Market Growth – Trends & Forecast 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA