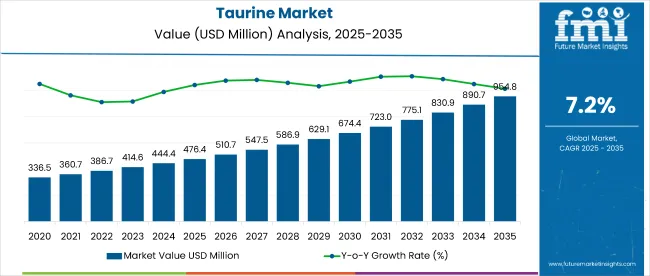

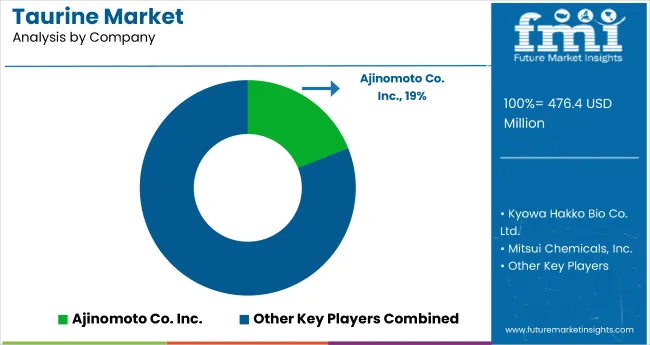

The global taurine market is projected to grow from USD 476.4 million in 2025 to USD 954.8 million by 2035, registering a CAGR of 7.2%. The market expansion is being driven by rising health awareness, increasing adoption of dietary supplements, and taurine’s growing use in infant nutrition and pet food.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 476.4 million |

| Industry Value (2035F) | USD 954.8 million |

| CAGR (2025 to 2035) | 7.2% |

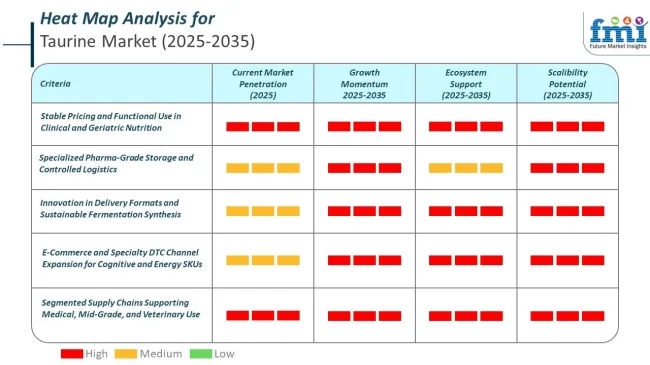

Taurine’s multifunctional benefits in cardiovascular health, metabolism, and neurological development are encouraging its incorporation in food, pharmaceutical, and veterinary products. Diversification into functional beverages, cosmetics, and personal care formulations is further accelerating global demand across multiple consumer categories.

The market holds an estimated 28% share in the amino acid market, driven by its wide application in supplements and beverages. Within the nutraceutical ingredients market, taurine accounts for roughly 5%, while its contribution to the dietary supplements market stands at around 3%.

It makes up 4.5% of the sports nutrition ingredients market and 2% of the infant nutrition sector. In pet food additives, taurine represents about 6% due to its essentiality in feline diets. Its share in broader markets like functional food ingredients and pharmaceutical ingredients remains modest, averaging below 1%.

Regulatory guidelines impacting the market focus on ingredient safety, dosage standards, and nutritional claims. Organizations such as the USA FDA, European Food Safety Authority (EFSA), and Japan’s FOSHU regulate taurine use in foods and supplements.

For pets, bodies like the AAFCO and NRC recommend taurine inclusion in regulated amounts, especially in feline and canine diets. These regulations are driving the adoption of standardized, food-grade, and pharmaceutical-grade taurine in commercial formulations, supporting both human and animal health outcomes.

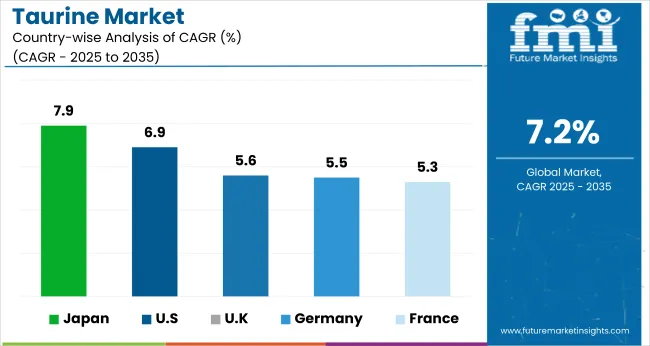

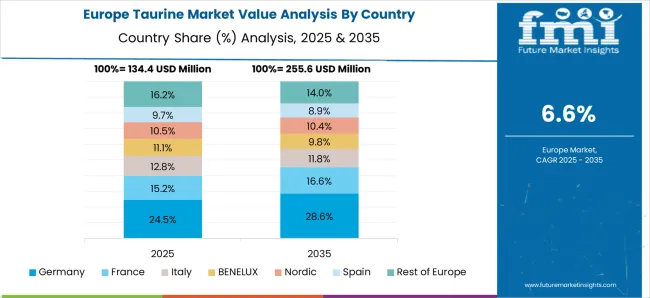

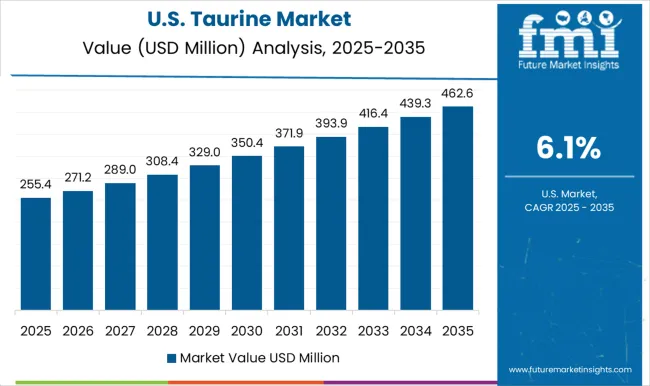

Japan is projected to be the fastest-growing market, expected to expand at a CAGR of 7.9% from 2025 to 2035. The dietary supplements will lead the end-use application segment with a 24% market share in 2025, while food grade will dominate the grade segment with a 48% share. The USA and Germany markets are also expected to grow steadily at CAGRs of 6.9% and 5.5%, respectively. The UK and France are projected to expand at 5.6% and 5.3% CAGR, respectively.

The taurine market witnesses highly uneven per-capita consumption across regions. Japan and South Korea show the highest intake per individual, led by widespread functional drink adoption. Southeast Asia follows, with taurine used in low-cost energy beverages available through modern retail. In contrast, per-capita volumes in Europe are moderate, confined mostly to urban beverage categories. North American usage remains tied to sports nutrition.

Cold-chain coverage for taurine concentrates is limited to industrial parks in South and East Asia. Ambient-stable formulations dominate consumer-facing sales. Retail distribution is strongest in Japan and South Korea. In India, taurine SKUs are limited to fitness retail chains and online vending.

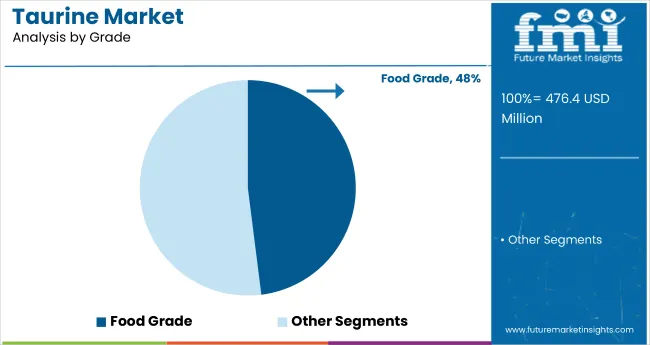

The global market is segmented by grade, end-use application, and region. By grade, the market is divided into food grade, feed grade, pharmaceutical grade, and others (cosmetic grade, industrial grade, reagent grade, and lab grade).

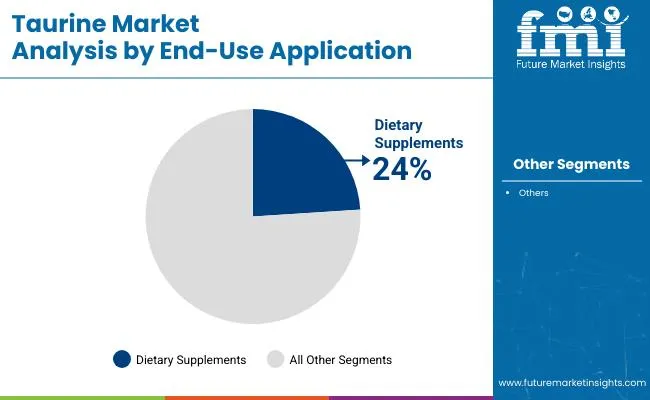

By end-use application, the market includes food (dairy products, infant, bakery products, cereal products), beverages (energy drinks, caffeinated drinks, soft & carbonated drinks), animal feed (aquaculture feed, poultry feed), pet food (cat food, dog food), pet supplements (cat supplements, dog supplements), dietary supplements, cosmetics & personal care (skin care products, hair care products, toiletries), agriculture, and pharmaceuticals.

Regionally, the market is segmented into North America, Latin America, Western Europe, Eastern Europe, Asia Pacific excluding Japan (APEJ), Japan, and the Middle East & Africa (MEA).

Food grade is expected to lead the grade segment with a 48% market share by 2025, driven by its widespread use in functional foods, energy drinks, and infant nutrition across global markets. Its high purity levels, safety profile, and regulatory approvals across regions like North America, Europe, and Asia-Pacific make it the preferred choice among manufacturers.

The ingredient’s role in enhancing cognitive performance, cardiovascular health, and electrolyte balance has fueled its inclusion in health-focused product formulations. Additionally, growing consumer awareness regarding its antioxidant and metabolic benefits supports its expanding application in wellness-centric food and beverage launches.

Dietary supplements are projected to lead the end-use application segment in the taurine market, capturing a 24% share by 2025, driven by growing consumer demand for health, energy, and performance-boosting formulations.

Taurine’s benefits in muscle function, fat metabolism, and oxidative stress reduction make it a key ingredient in sports nutrition and wellness products. The segment is further supported by rising fitness trends, aging populations seeking vitality, and increased supplement intake among younger consumers. Additionally, the convenience of capsules, powders, and effervescent tablets has enhanced taurine’s accessibility in global nutraceutical markets.

The global market is experiencing steady growth, driven by rising health awareness, expanding applications in functional foods, and growing use in dietary supplements, infant nutrition, and pet health. Taurine is increasingly recognized for its critical role in cardiovascular function, neurological development, and metabolic support, contributing to its widespread demand across multiple end-use industries.

Recent Trends in the Taurine Market

Challenges in the Taurine Market

Japan’s taurine market momentum is anchored in advanced health science research, functional nutrition, and the aging population’s growing reliance on supplements. Germany and France maintain consistent demand, driven by EU nutrition regulations and innovations in pharmaceutical-grade amino acids. In comparison, developed economies such as the USA (6.9% CAGR), UK(5.6%), and Japan (7.9%) are expected to grow at 0.78-1.09 times the global growth rate.

Japan shows the strongest momentum in the market, fueled by high demand for functional beverages, senior health supplements, and infant nutrition. The United States follows with robust growth, supported by expanding use in sports nutrition, pet supplements, and fortified wellness products. Germany benefits from strong pharmaceutical integration, with taurine widely used in heart and energy formulations.

France mirrors this trend, with growing applications in infant nutrition and skincare. The United Kingdom, while progressing steadily, sees relatively slower expansion due to post-Brexit regulatory adjustments, but demand is sustained by innovations in dietary supplements and functional beverages across digital and retail platforms.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The Japan taurine market is growing at a CAGR of 7.9% from 2025 to 2035. Growth is driven by a rising senior population, strong functional beverage demand, and long-standing cultural acceptance of amino acid supplementation. Taurine is widely used for eye health, cardiovascular support, and infant nutrition. Japan’s continued leadership in clinical R&D and nutrition-backed public health policies supports the use of high-purity taurine in preventive care.

Sales of taurine in Germany are expected to expand at a CAGR of 5.5% during the forecast period, below the global average but supported by regulatory-backed nutraceutical demand. The market benefits from Germany’s robust pharmaceutical production and the use of taurine in cardiometabolic health products. Functional energy drinks and taurine-integrated OTC supplements are gaining popularity, especially among aging and performance-focused consumers.

The French taurine market is projected to grow at a CAGR of 5.3%, similar to Germany, driven by functional food trends, national nutrition programs, and a mature pharmaceutical sector. Usage is concentrated in dietary supplements, clean-label functional drinks, and premium infant nutrition. France is also exploring taurine’s topical applications in skincare and anti-aging formulations.

The USA taurine market is forecasted to grow at a CAGR of 6.9% from 2025 to 2035, translating to 0.96 times the global rate. Growth is driven by strong demand in sports nutrition, energy drinks, and pet supplements. Taurine is also increasingly included in fortified products for heart health and neurological support. A high consumer focus on performance nutrition, combined with regulatory clarity from the FDA, supports stable expansion.

The UK taurine market is projected to grow at a CAGR of 5.6% from 2025 to 2035, representing the slowest pace among top OECD markets at 0.76 times the global rate. Demand is supported by dietary supplement expansion, infant formula enhancements, and functional beverage launches. Despite post-Brexit regulatory friction, domestic production and e-commerce distribution of taurine products are rising steadily.

The global market is moderately consolidated, with major players such as QianjiangYongan Pharmaceutical Co. Ltd., Ajinomoto Co. Inc., Kyowa Hakko Bio Co. Ltd., and The Honjo Chemical Corporation playing a central role. These companies are known for their high-purity taurine production and global supply networks, serving industries such as pharmaceuticals, dietary supplements, pet nutrition, and functional beverages.

QianjiangYongan focuses on cost-effective bulk supply, while Ajinomoto and Kyowa Hakko emphasize pharmaceutical-grade taurine through precision fermentation processes. The Honjo Chemical Corporation specializes in amino acid derivatives and taurine integration in healthcare applications.

Other significant contributors include MTC Industries, Stauber USA, Foodchem International Corporation, New Zealand Pharmaceutical Ltd., Jiangsu Yuanyang Chemical Co. Ltd., Funchi Pharmaceutical Co., Ltd., Penta Manufacturing Company, Mitsui Chemicals, Inc., and AuNutra Industries Inc., all of which support global taurine demand with region-specific expertise and customized offerings.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 476.4 million |

| Projected Market Size (2035) | USD 954.8 million |

| CAGR (2025 to 2035) | 7.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD million for value/volume in metric tons |

| Grade Analyzed | Food Grade, Feed Grade, Pharmaceuticals Grade, Others (Cosmetic Grade, Industrial Grade, Reagent Grade, Lab Grade) |

| End-use Application Analyzed | Food (Dairy Products, Infant, Bakery Products, Cereal Products), Beverage (Energy Drinks, Caffeinated Drinks, Soft & Carbonated Drinks), Animal Feed (Aquaculture Feed, Poultry Feed), Pet Food (Cat Food, Dog Food), Pet Supplements (Cat Supplements, Dog Supplements), Dietary Supplements, Cosmetics & Personal Care (Skin Care Products, Hair Care Products, Toiletries), Agriculture, Pharmaceuticals |

| Regions Covered | North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia and 40+ countries |

| Key Players Influencing the Market | MTC Industries, Stauber USA, Foodchem International Corporation, The Honjo Chemical Corporation, Qianjiang Yongan Pharmaceutical Co. Ltd., New Zealand Pharmaceutical Ltd., Ajinomoto Co. Inc., Kyowa Hakko Bio Co. Ltd., Jiangsu Yuanyang Chemical Co. Ltd., Funchi Pharmaceutical Co., Ltd., Penta Manufacturing Company, Mitsui Chemicals, Inc., and AuNutra Industries Inc. |

| Additional Attributes | Dollar sales by grade, demand by application, regional consumption analysis, policy trends, nutraceutical innovation, and competitive benchmarking |

The global taurine market is estimated to be valued at USD 547.5 million in 2025.

The market size for the taurine market is projected to reach USD 1,097.3 million by 2035.

The taurine market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in taurine market are food grade, feed grade, pharmaceuticals grade and others.

In terms of end-use application, food segment to command 48.6% share in the taurine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Taurine Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Taurine Industry Analysis in South Korea - Trends, Market Insights & Applications 2025 to 2035

Taurine Industry in Western Europe - Trends, Market Insights & Applications 2025 to 2035

Demand for Taurine in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA