The global pulse safety resistor market is projected to reach USD 1,090.3 million by 2035, recording an absolute increase of USD 427.3 million over the forecast period. The market is valued at USD 663.0 million in 2025 and is set to rise at a CAGR of 5.1% during the assessment period. The overall market size is expected to grow by nearly 1.64X during the same period, supported by increasing demand for electronic device safety systems and growing adoption of advanced automotive electronics. Market expansion faces constraints from component miniaturization challenges and rising raw material costs.

Between 2025 and 2030, the pulse safety resistor market is projected to expand from USD 663.0 million to USD 850.2 million, resulting in a value increase of USD 187.2 million, which represents 43.8% of the total forecast growth for the decade.

This phase of growth will be shaped by rising demand for electronic safety systems, product innovation in automotive pulse protection and industrial control systems, and expanding consumer electronics manufacturing. Companies are establishing competitive positions through investment in precision manufacturing technologies, advanced material development strategies, and strategic market expansion across automotive applications, industrial automation systems, and emerging consumer electronics.

From 2030 to 2035, the market is forecast to grow from USD 850.2 million to USD 1,090.3 million, adding another USD 240.1 million, which constitutes 56.2% of the overall ten-year expansion. This period is expected to be characterized by expansion of specialized high-power resistor development including automotive EV systems and industrial automation variants tailored for specific power management applications, strategic collaborations between component manufacturers and OEM equipment producers, and enhanced safety compliance with regulatory transparency requirements.

The growing emphasis on electric vehicle safety systems and industrial automation reliability will drive demand for advanced pulse safety resistors across diverse power management applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 663.0 million |

| Market Forecast Value (2035) | USD 1,090.3 million |

| Forecast CAGR (2025-2035) | 5.1% |

The pulse safety resistor market grows through enhanced circuit protection requirements that reduce equipment damage risks and improve system reliability across electronic applications. Rising demand stems from expanding electric vehicle production requiring advanced power management systems, increasing industrial automation deployment needing precise pulse control mechanisms, growing consumer electronics manufacturing requiring miniaturized safety components, and strengthening automotive safety regulations mandating comprehensive electrical protection systems.

Consumer electronics manufacturers and automotive OEMs represent priority segments driving consistent demand across North America and Asia Pacific regions where electronic device production concentrates. Growth faces limitations from semiconductor supply chain disruptions affecting component availability and pricing pressures.

The pulse safety resistor market (USD 663.0M → 1,090.3M by 2035, CAGR ~5.1%) is fueled by rising demand in consumer electronics, industrial automation, and automotive electronics, where surge protection and power stability are critical. Classification segments span rated power from 2W, 3W, to 4W, supporting diverse voltage endurance requirements. Growth is anchored in China (USD 6.9M), India (6.4M), and Germany (5.9M), while North America and Europe maintain steady demand from automation and automotive industries. Together, power-rating innovation and application diversification unlock ~USD 427M incremental opportunities by 2035.

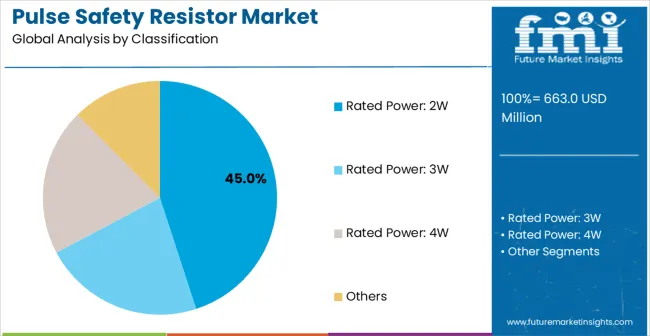

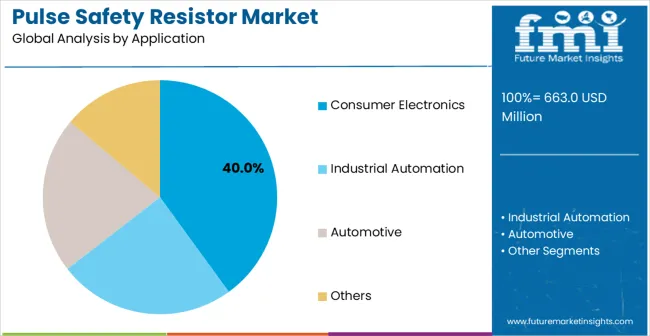

The market is segmented by rated power product type, application, and region. By rated power classification, the market is divided into 2W, 3W, 4W, and other power ratings. By application, the market is categorized into consumer electronics, industrial automation, and automotive systems. Regionally, the market is divided into North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

Rated power 2W pulse safety resistors are projected to account for 45% of the market in 2025, reflecting widespread adoption in consumer electronics and cost-effective manufacturing processes that support competitive pricing strategies. The 2W rating strikes an optimal balance between protection capability and compact component size, making it highly suitable for modern electronic devices where space efficiency, thermal management, and reliable circuit protection are critical.

Manufacturers of smartphones, tablets, laptops, and other portable electronics favor 2W resistors for power management circuits, protection of sensitive semiconductors, and surge prevention in low-to-moderate power applications.

The automotive electronics increasingly adopt 2W resistors for infotainment systems, navigation modules, and driver assistance circuits, where moderate power handling ensures protection without excessive heat generation. The segment’s versatility allows integration across diverse applications without the need for oversized components, supporting compact PCB layouts and cost-efficient production. As consumer electronics continue to innovate, demand for 2W resistors remains robust, driven by miniaturization trends, high-volume production requirements, and the necessity of reliable, repeatable performance.

Rated power 3W pulse safety resistors are projected to account for 25% of the market in 2025, serving applications that require enhanced power handling capabilities beyond standard 2W components. This segment caters to industrial equipment, automotive electronics, and professional-grade systems where higher power dissipation, increased protection margins, and improved thermal management are critical. Industrial automation systems increasingly rely on 3W resistors for motor control circuits, power supply protection, and process control devices that face frequent power transients or operate in demanding environments.

In automotive applications, 3W resistors are used in engine control modules, transmission systems, and safety-critical electronics where enhanced surge protection ensures operational reliability. Growth in this segment is fueled by expanding adoption of electric vehicles, industrial automation initiatives, and stricter safety regulations for professional equipment. Manufacturers face the dual challenge of maintaining cost competitiveness while delivering superior performance characteristics. The 3W rating provides a reliable solution for systems experiencing higher energy transients, offering extended component lifecycles and consistent performance under more extreme conditions.

Consumer electronics applications are expected to account for 40% of the pulse safety resistor market in 2025, supported by high-volume production of smartphones, tablets, laptops, and portable devices. The segment’s growth is driven by the necessity of surge protection for sensitive semiconductor components, power management circuits, and portable device systems vulnerable to power fluctuations.

Manufacturers require resistors that provide reliable circuit protection while maintaining compact designs, supporting increasingly miniaturized electronics. Regulatory compliance and industry safety standards further drive the integration of pulse safety resistors into consumer devices. Expanding global smartphone penetration, increasing complexity of electronic devices, and the emergence of wearable electronics continue to fuel demand. Fully automatic assembly and standardized resistor specifications reduce integration challenges and production costs, creating efficiency across high-volume manufacturing operations. The consumer electronics segment benefits from established supply chains, cost-effective procurement, and consistent quality control, making it a key driver for market expansion.

Market drivers center on expanding electronic device complexity requiring enhanced circuit protection, increasing automotive electronics adoption demanding reliable pulse safety systems, and strengthening safety regulations mandating comprehensive protection across consumer and industrial applications. Electric vehicle production growth creates substantial demand for high-power pulse protection components, while industrial automation expansion drives consistent demand for reliable circuit protection systems. Consumer electronics miniaturization trends require advanced protection solutions maintaining performance while reducing component size and cost.

Market restraints include semiconductor supply chain disruptions affecting component availability and production schedules, rising raw material costs impacting manufacturing economics and pricing strategies, and intense price competition from alternative protection technologies. Component standardization challenges across different application requirements create design complexity, while rapid technological changes in electronics require continuous product development investment. Regulatory compliance costs and testing requirements increase development expenses for specialized applications.

Key trends show adoption acceleration in electric vehicle applications and industrial automation systems where reliability requirements drive premium component demand. Design shifts toward higher power density, improved thermal management, and integrated protection solutions enable enhanced performance in compact configurations. Market expansion depends on maintaining cost competitiveness while meeting increasing performance requirements, though supply chain instabilities and material cost inflation could constrain growth momentum.

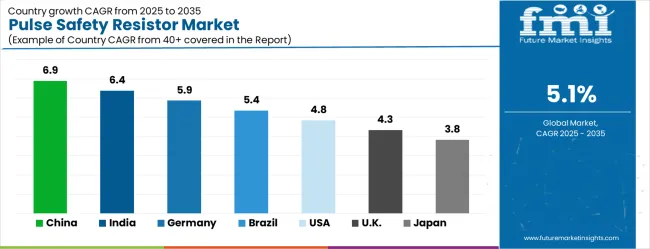

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| Brazil | 5.4% |

| United States | 4.8% |

| United Kingdom | 4.3% |

| Japan | 3.8% |

The pulse safety resistor market is gathering pace worldwide, with China taking the lead thanks to massive consumer electronics production and expanding automotive manufacturing capabilities. Close behind, India benefits from growing electronic device assembly and increasing industrial automation adoption, positioning itself as a strategic growth hub.

Germany shows steady advancement, where automotive electronics integration strengthens its role in the regional supply chain. Brazil is sharpening focus on industrial modernization and consumer electronics manufacturing, signaling an ambition to capture niche opportunities.

Meanwhile, the United States stands out for its advanced automotive technology development, and the United Kingdom and Japan continue to record consistent progress. Together, China and India anchor the global expansion story, while the rest build stability and diversity into the market's growth path.

The report covers an in-depth analysis of 40+ countries with top-performing countries are highlighted below.

China demonstrates strong market potential with comprehensive electronics manufacturing infrastructure supporting diverse pulse safety resistor applications across consumer electronics, automotive systems, and industrial equipment production. Revenue growth at a CAGR of 6.9% through 2035 reflects expanding production capacity in major manufacturing centers including Shenzhen, Shanghai, and Guangzhou where component integration supports growing domestic and export market demand.

Consumer electronics manufacturers adopt pulse safety resistors for smartphone protection circuits, tablet power management systems, and portable device applications requiring reliable circuit protection and cost-effective implementation. Automotive electronics production facilities expand capabilities for electric vehicle components, advanced driver assistance systems, and infotainment applications requiring enhanced protection systems.

Industrial automation sectors utilize pulse safety resistors for motor control systems, process automation equipment, and manufacturing machinery requiring reliable protection components. Government policies supporting electronics manufacturing competitiveness and environmental regulations drive demand for certified components meeting international safety standards. The expanding electric vehicle industry creates substantial opportunities for high-power pulse protection components supporting charging systems, battery management, and power conversion applications.

The electronics manufacturing sector in India experiences rapid expansion through government Make in India initiatives and increasing consumer electronics assembly operations in Bangalore, Chennai, and Delhi NCR regions. Growth at a CAGR of 6.4% through 2035 stems from expanding smartphone production, growing automotive electronics manufacturing, and increasing industrial automation adoption across manufacturing sectors. Consumer electronics assembly facilities require reliable pulse protection components for mobile device production, consumer appliance manufacturing, and electronic component integration supporting domestic and export markets.

Automotive sector development drives demand for pulse safety resistors supporting vehicle electronics, engine control systems, and safety applications as domestic production expands and international automotive companies establish manufacturing operations. Industrial automation growth across textiles, pharmaceuticals, and manufacturing sectors creates opportunities for protection components supporting process control, motor drives, and automated equipment applications.

German automotive and industrial sectors drive pulse safety resistor demand through advanced technology development and precision manufacturing requirements in Stuttgart, Munich, and Frankfurt regions where automotive engineering excellence supports component innovation and application development. Growth at a CAGR of 5.9% reflects the country's leadership in automotive electronics, industrial automation, and renewable energy systems requiring sophisticated protection components. Automotive manufacturers integrate advanced pulse protection systems for electric vehicle development, engine control modules, and safety-critical applications where reliability and performance standards exceed general consumer requirements.

Industrial automation and machinery production utilize high-performance pulse safety resistors for motor control systems, process automation, and manufacturing equipment supporting export markets and domestic industrial applications. Renewable energy sector expansion creates demand for protection components supporting solar inverters, wind power systems, and energy storage applications requiring reliable operation in demanding environmental conditions.

Manufacturing capabilities focus on precision components meeting stringent automotive and industrial standards while supporting innovation in protection technology development. Research institutions and automotive companies collaborate on advanced protection system development supporting next-generation vehicle electronics and industrial applications.

Brazil's industrial development and consumer electronics assembly sectors create growing demand for pulse safety resistor components across automotive, industrial, and electronics manufacturing applications in São Paulo, Rio de Janeiro, and Belo Horizonte regions. Growth at a CAGR of 5.4% reflects expanding automotive production, increasing industrial automation adoption, and growing consumer electronics manufacturing supporting domestic market development. Automotive manufacturing facilities integrate pulse protection components for vehicle electronics, engine management systems, and safety applications as domestic and international automotive companies expand production capabilities.

Industrial modernization programs drive adoption of automation systems requiring reliable circuit protection for manufacturing processes, motor control applications, and process equipment supporting diverse industrial sectors including mining, petrochemicals, and manufacturing. Consumer electronics assembly operations require cost-effective protection components for appliance production, electronic device manufacturing, and component integration supporting growing domestic consumption. One challenge involves managing component import dependencies and currency fluctuations affecting manufacturing cost structures and pricing strategies.

The United States leads technology development in automotive electronics and industrial applications requiring advanced pulse safety resistor solutions across Silicon Valley, Detroit, and industrial regions where innovation drives component performance requirements. Growth at a CAGR of 4.8% through 2035 reflects cost-per-outcome compression under compliance and reliability constraints as automotive and industrial sectors demand enhanced protection capabilities while managing operational costs and regulatory requirements. Consumer electronics manufacturers and automotive OEMs adopt pulse safety resistors for advanced driver assistance systems, electric vehicle components, and industrial automation applications requiring superior reliability and performance characteristics.

Automotive technology development creates demand for specialized protection components supporting autonomous vehicle systems, electric powertrain applications, and advanced safety systems. Industrial sectors utilize high-performance pulse safety resistors for process control, manufacturing automation, and critical infrastructure applications. The Tesla Gigafactory expansion and Ford electric vehicle programs demonstrate large-scale adoption of advanced protection systems supporting high-volume production requirements.

The United Kingdom maintains steady growth through automotive technology development and industrial manufacturing applications requiring reliable pulse safety resistor solutions across London, Birmingham, and Manchester industrial regions. The country represents a medium growth market with a CAGR of 4.3% where established automotive and industrial sectors drive consistent demand for protection components supporting vehicle electronics, industrial automation, and specialized equipment applications. British automotive companies focus on electric vehicle development, advanced driver assistance systems, and vehicle electronics integration requiring enhanced protection capabilities.

Industrial automation sectors utilize pulse safety resistors for manufacturing equipment, process control systems, and specialized machinery supporting aerospace, pharmaceutical, and manufacturing applications. Consumer electronics and telecommunications equipment manufacturing creates opportunities for protection components supporting device production and infrastructure development.

Government regulations supporting automotive safety standards and industrial equipment compliance drive demand for certified protection components meeting European and international requirements. Brexit trade arrangements affect component sourcing strategies and supply chain management affecting cost structures and market access.

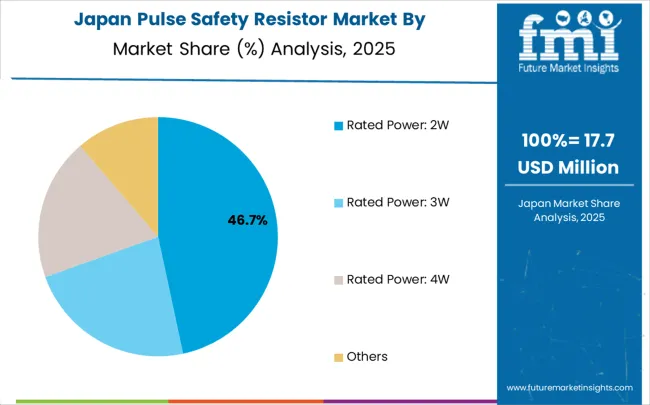

Japanese electronics and automotive industries drive pulse safety resistor demand through technology innovation and precision manufacturing in Tokyo, Osaka, and Nagoya regions where advanced component development supports automotive electronics, industrial automation, and consumer electronics applications. Revenue growth at a CAGR of 3.8% reflects the country's focus on high-value applications requiring superior component performance and reliability standards. Consumer electronics manufacturers including Sony, Panasonic, and Nintendo integrate advanced pulse protection systems for gaming consoles, audio equipment, and electronic device applications requiring exceptional quality and performance characteristics.

Automotive sector leadership in hybrid technology, advanced safety systems, and precision manufacturing drives demand for specialized protection components supporting vehicle electronics and powertrain applications. Industrial automation and robotics sectors require high-performance pulse safety resistors for precision manufacturing equipment, process control systems, and automated production lines supporting export markets and domestic applications.

Technology development focuses on miniaturization, performance enhancement, and cost optimization supporting component innovation and application development. Research institutions and electronics companies collaborate on advanced protection technologies supporting next-generation electronic systems and automotive applications.

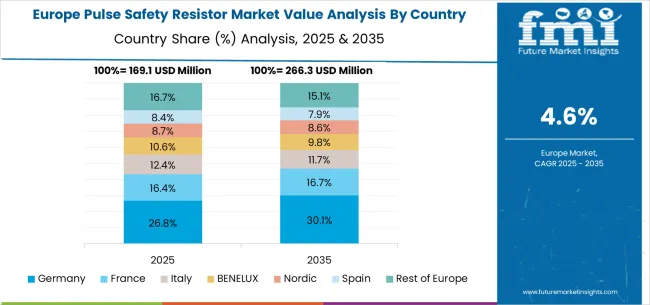

The European pulse safety resistor market demonstrates diverse regional dynamics with Germany leading through automotive electronics innovation and industrial automation excellence, while France contributes through aerospace and transportation applications requiring specialized protection components. The United Kingdom maintains steady demand through automotive development and industrial manufacturing, while Italy and Spain focus on consumer electronics assembly and automotive component production. Nordic countries including Sweden and Denmark emphasize renewable energy applications and industrial automation systems requiring reliable protection components.

Eastern European countries including Poland, Czech Republic, and Hungary experience growing demand through expanding automotive manufacturing and electronics assembly operations supporting regional supply chains. The European market benefits from stringent safety regulations, advanced technology standards, and established supply chain relationships supporting consistent demand for high-quality protection components across automotive, industrial, and consumer electronics applications.

In Japan, the pulse safety resistor market is largely driven by the rated power 2W segment, which accounts for 55% of total component revenues in 2025. The high penetration of 2W components in consumer electronics manufacturing and the stringent protection requirements for precision electronic devices are key contributing factors. Consumer electronics applications follow with a 30% share, primarily in gaming console manufacturing that integrates advanced protection systems and precision electronic components. Industrial automation applications contribute 15% as specialized protection requirements continue expanding across manufacturing sectors.

In South Korea, the market is expected to remain dominated by OEM manufacturers, which hold a 50% share in 2025. These manufacturers are typically the primary integration point where electronic device assembly and component integration require comprehensive protection solutions. Electronic component distributors and industrial suppliers each hold 25% market share, with rising standardization of protection components across diverse application requirements. Maintenance service providers account for the remaining 25%, but are gradually gaining traction in industrial service models due to equipment reliability requirements and preventive maintenance programs.

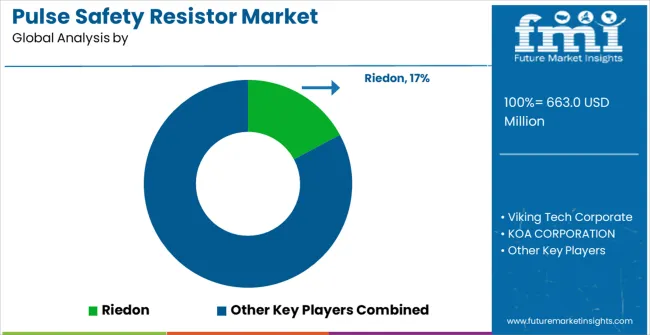

The pulse safety resistor market operates with approximately 15-20 meaningful players, demonstrating moderate concentration where the top five companies control roughly 40-45% of market share through established manufacturing capabilities, broad product portfolios, and global distribution networks. Competition emphasizes technical performance, cost efficiency, and supply chain reliability as manufacturers serve diverse application requirements across consumer electronics, automotive systems, and industrial automation markets.

Market leaders including Vishay, TE Connectivity, and Yageo maintain competitive advantages through manufacturing scale, comprehensive product ranges, and established relationships with major OEM customers across automotive and electronics industries. These companies leverage advanced manufacturing technologies, global production capabilities, and extensive distribution networks to maintain market positions while investing in product development and capacity expansion. Technical expertise in materials science, precision manufacturing, and application engineering supports their ability to serve demanding automotive and industrial applications requiring superior performance and reliability.

Challengers including Riedon, Viking Tech Corporate, and KOA CORPORATION focus on specialized applications, regional market strength, and technical innovation to compete against larger competitors. These companies emphasize custom solutions, responsive customer service, and specialized expertise in specific application areas including automotive electronics, industrial control systems, and high-power applications. Their competitive strategies center on technical differentiation, application-specific product development, and direct customer relationships.

Specialists including Hokuriku Electric Industry, Vitrohm, Bourns, Firstohm, Exxelia, and Ohmcraft serve niche markets through specialized products, technical expertise, and focus on specific application requirements including precision instruments, aerospace applications, and high-reliability systems. These companies compete through technical innovation, customized solutions, and superior performance characteristics that justify premium pricing in specialized applications requiring exceptional quality and reliability standards.

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 6663.0 million |

| Rated Power Classification | 2W, 3W, 4W, Others |

| Application | Consumer Electronics, Industrial Automation, Automotive |

| End User | OEM Manufacturers, Component Distributors, Maintenance Services |

| Material Type | Carbon Film, Metal Film, Wirewound, Ceramic |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Riedon, Viking Tech Corporate, KOA CORPORATION, TE Connectivity, Hokuriku Electric Industry, Vitrohm, Yageo, Vishay, Bourns, Firstohm, Exxelia, Ohmcraft |

| Additional Attributes | Dollar sales by power rating categories, regional component demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established electronics manufacturers and specialized component suppliers, adoption patterns for different power ratings across applications, integration with automotive electronics and industrial automation systems, innovations in thermal management and power handling capabilities, and development of specialized protection solutions with enhanced reliability, environmental resistance, and performance optimization for advanced electronic systems applications. |

The global pulse safety resistor market is estimated to be valued at USD 663.0 million in 2025.

The market size for the pulse safety resistor market is projected to reach USD 1,090.3 million by 2035.

The pulse safety resistor market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in pulse safety resistor market are rated power: 2w, rated power: 3w, rated power: 4w and others.

In terms of application, consumer electronics segment to command 40.0% share in the pulse safety resistor market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA