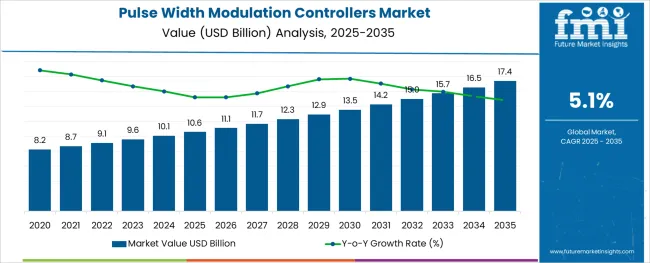

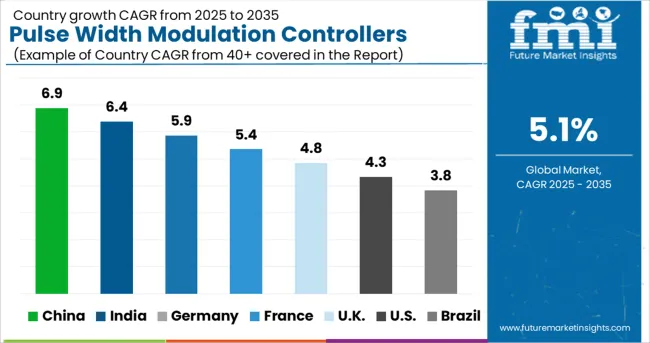

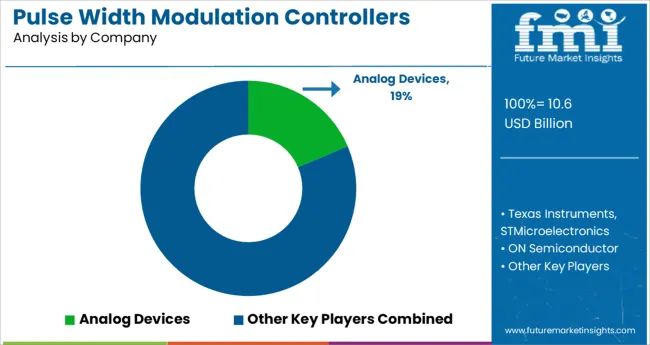

The Pulse Width Modulation Controllers Market is estimated to be valued at USD 10.6 billion in 2025 and is projected to reach USD 17.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

The pulse width modulation controllers market is undergoing dynamic evolution, supported by rising demand for efficient power management across a broad spectrum of electronic systems. With energy efficiency becoming a priority in both industrial and consumer-facing devices, manufacturers are turning to advanced modulation techniques to optimize switching performance, thermal control, and voltage regulation.

Compact form factor requirements and increasing adoption of battery-powered devices are also elevating the need for intelligent controllers that minimize power loss. Enhanced integration of PWM controllers with digital signal processing units and power factor correction modules is streamlining system performance in automotive, telecom, and industrial automation environments

As more power-intensive applications migrate toward miniaturized and smart architectures, the demand for high-frequency, multi-mode controllers is anticipated to rise. The future of the market is expected to be shaped by developments in GaN and SiC technologies, which demand precision control circuits and improved switching dynamics, further solidifying the role of PWM controllers in next-generation power systems.

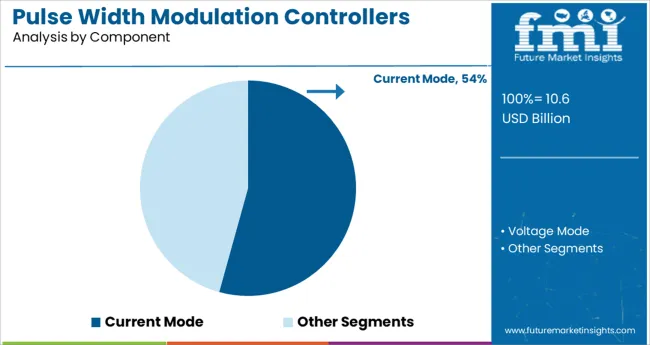

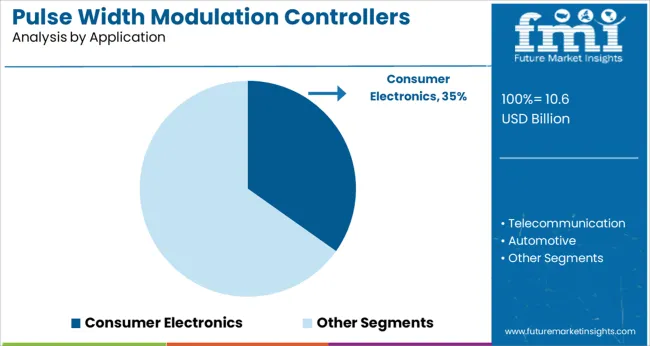

The market is segmented by Component and Application and region. By Component, the market is divided into Current Mode and Voltage Mode. In terms of Application, the market is classified into Consumer Electronics, Telecommunication, Automotive, and Industrial. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The current mode subsegment is anticipated to lead the component category with a 54.3% revenue share in 2025, making it the dominant configuration. This leadership has been driven by the superior loop response, enhanced line regulation, and inherent cycle-by-cycle current limiting that current mode controllers provide.

Their architecture enables simpler compensation and more precise control of the output voltage, which is critical in compact and thermally sensitive applications. Integration ease with high-efficiency topologies such as flyback and forward converters has also contributed to widespread adoption in DC to DC and off-line converter designs.

Moreover, current mode controllers facilitate faster transient response and improved noise immunity, which are essential in devices where voltage fluctuations must be tightly regulated. As industries increasingly demand compact power supplies with robust control features, the current mode design remains preferred for its stability, scalability, and efficiency benefits.

The consumer electronics application segment is projected to hold a 34.8% share of the overall market revenue in 2025, establishing it as the leading application area. This dominance has been propelled by the growing demand for energy-efficient power supplies in devices such as smartphones, televisions, gaming consoles, and wearable electronics.

As consumer products evolve toward higher performance with lower energy footprints, the integration of PWM controllers that support tight voltage regulation and thermal management has become essential. These controllers play a critical role in extending battery life, reducing heat generation, and ensuring operational reliability in compact form factors.

Additionally, increased R&D by consumer electronics manufacturers in fast-charging adapters and multifunctional devices has accelerated the adoption of PWM solutions. With the continued miniaturization of electronic components and the proliferation of smart connected devices, the reliance on precise and responsive power management systems is expected to keep this segment at the forefront of application growth.

The advantage of enabling optimum solutions for systems that utilize distributed power architectures is likely to surge the adoption of pulse width modulation controllers. Likewise, the ability to use higher frequencies such as 50-100 kHz is expected to bolster the pulse width modulation controllers’ market share.

The longer battery life and extremely low power consumption of PWM controllers are anticipated to expand the pulse width modulation controllers' market size. This is owing to its ability to self-regulate its battery conditions and recharging requirements.

The ability to control temperature effects, as well as regulate voltage drops in solar panels by efficiently using solar array energy, meets consumer demands and is expected to increase the sales of pulse width modulation controllers in the coming days.

Pulse width modulation controllers market growth is expected to boost owing to the capacity of PWMs to provide point-of-load regulation in networking and industrial power supplies to various devices such as servers, workstations, telecom/datacom, microprocessor-based equipment, portable battery-powered devices, and wireless infrastructure products.

PWM techniques further enable greater efficiency of DC motors that require control of the power supplied to them and are expected to boost the demand for pulse width modulation controllers for managing and overcoming inertial loads and internal motor resistance. Also, devices equipped with smart communication technology and other technological developments, such as auto night detection capabilities and smart sensor technology, are anticipated to surge the demand for pulse width modulation controllers as well.

The low cost of manufacturing is expected to increase the adoption of pulse width modulation controllers for analog devices as the demand for analog devices increases. The pulse width modulation controllers’ market share is likely to escalate owing to the reduced requirement to switch filters.

Long-term return on investments for the PWM controllers, as well as its high implementation cost, are likely to curb the sales of pulse width modulation controllers for some more years. The PWM systems require a semiconductor device that has low turn ON and turn OFF times. This is expected to increase the cost and hinder the demand for pulse width modulation controllers for a wider mass.

The complexity of the circuit may not protect the controllers during voltage spikes. This is also speculated to hamper the pulse width modulation controllers’ market growth. Further, the inability of the PWM controllers to regulate radio frequency interferences and the requirement of large bandwidth to use in communication which increases the expenses, are predicted to obstruct the adoption of pulse width modulation controllers.

Globalization and technological breakthroughs of PWM controllers present lucrative opportunities for market investors and are anticipated to increase the sales of pulse-width modulation controllers. Ever-increasing demand from data centers and communication base stations for PWM devices is expected to accelerate the adoption of pulse width modulation controllers further.

Research and development activities for the improvement of PWM controllers, along with the growing consumption of smart devices in developing countries and skilled manpower, are anticipated to drive the demand for pulse width modulation controllers.

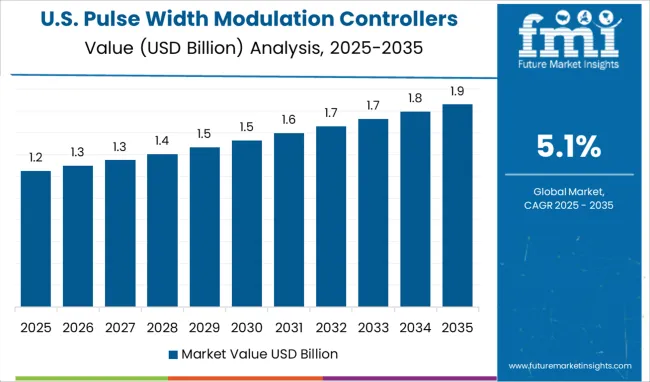

North America is the leading pulse width modulation controllers market share, with a share of 34.5% in 2025.

This is owing to the rapid development of the economy and advanced production technology. Moreover, the saturation of the analog devices market, as well as other smart devices in the market of this region, is expected to increase the demand for pulse width modulation controllers. The USA is anticipated to surge the adoption of pulse width modulation controllers and witness substantial growth due to its flourishing solar energy industry as well.

The Asia-Pacific is a rapidly growing pulse width modulation controller market with a revenue share of 35.8%.

China contributes to the majority of the revenue share, with the presence and expansion of commercial offices. Furthermore, the sales of pulse width modulation controllers in this region are expected to increase due to the rising electricity demand-supply gap in other developing economies. Moreover, the expansion of infrastructure and industrialization in the Asia Pacific countries is projected to remain the major driving factor for the pulse width modulation controller’s market growth.

Europe contributes a revenue share of 23.9% and is also a positively growing pulse width modulation controllers market.

The advanced production technology and rapid development of analog devices in this region are expected to expand the global pulse width modulation controllers’ market size. Furthermore, the pulse width modulation controllers’ market share in Europe is likely to accelerate owing to the demand for clean electricity, as well as the increasing number of industrial-scale projects.

Start-up companies are coming up with innovative strategies for PWM controllers for higher converter efficiency and lowering the design costs of these devices, which in turn - lowers the cost of purchasing PWM controllers and is anticipated to increase the sales of pulse width modulation controllers in the coming days.

New players in the pulse width modulation controllers’ market share cater to consumer demands and use research and development activities to improve market trends. They strive to expand production and create PWM controllers that support both isolated and non-isolated AC-DC and DC-DC switch mode power supplies based on the most popular topologies in both single-ended and double-ended configurations for mid to high-power SMPS.

Some of the key participants of the pulse width modulation controllers market are Analog Devices (Linear Technology), Texas Instruments, STMicroelectronics, ON Semiconductor, Microchip Technology, Maxim Integrated, Infineon Technology, Vishay, Diodes Incorporated, Renesas Electronics, Semtech, Active-Semi, Schneider Electric, Sungrow, Wenzhou Xihe Electric Co. Ltd., Sunforge LLC, Luminous India, KATEK Memmingen GmbH, Victron Energy, Outback Power Inc., Xantrex Technologies, Gena Sun LLC, Studer Innotec, Steca Electronic GmbH, Simplex America Inc., Shenzhen Shuori New Energy Technology Co. Ltd., Phocas, Microtek, etc.

Curbing voltage fluctuations and still maintaining the encoding of a pulsing signal is an area in which key pulse width modulation controllers market players are investing when it comes to the adoption of pulse width modulation controllers.

Some of the recent developments in the pulse width modulation controllers market are:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 5.1% from 2025 to 2035 |

| The base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis, |

| Segments Covered | Type, Application, Region |

| Regional scope | North America; Western Europe, Eastern Europe, Middle East, Africa, ASEAN, South Asia, Rest of Asia, Australia, and New Zealand |

| Country scope | United States of America, Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, Iran, South Africa |

| Key companies profiled | Analog Devices (Linear Technology), Texas Instruments, STMicroelectronics, ON Semiconductor, Microchip Technology, Maxim Integrated, Infineon Technology, Vishay, Diodes Incorporated, Renesas Electronics; Semtech; Active-Semi; Schneider Electric; Sungrow; Wenzhou Xihe Electric Co. Ltd.; Sunforge LLC; Luminous India; KATEK Memmingen GmbH; Victron Energy; Outback Power Inc.; Xantrex Technologies; Gena Sun LLC; Studer Innotec; Steca Electronic GmbH; Simplex America Inc.; Shenzhen Shuori New Energy Technology Co. Ltd.; Phocas; Microtek, etc. |

| Customization scope | Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global pulse width modulation controllers market is estimated to be valued at USD 10.6 billion in 2025.

It is projected to reach USD 17.4 billion by 2035.

The market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types are current mode and voltage mode.

consumer electronics segment is expected to dominate with a 34.8% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pulse Ingredient Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Pulse Ingredient Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Pulse Ingredient Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Pulse Safety Resistor Market Size and Share Forecast Outlook 2025 to 2035

Pulses Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Pulse Flours Market Size and Share Forecast Outlook 2025 to 2035

Pulse Lavage Market Size and Share Forecast Outlook 2025 to 2035

Pulse Electromagnetic Field Therapy Devices Market Size and Share Forecast Outlook 2025 to 2035

Pulse Ingredients Market Analysis – Size, Share, and Forecast 2025 to 2035

Pulse Oximeter Market Size and Share Forecast Outlook 2025 to 2035

Pulse Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Analyzing Pulses Market Share & Industry Trends

Pulsed Field Ablation Market Analysis by Product, End User, and Region - Forecast for 2025 to 2035

Pulse Generator Market

UK Pulses Market Growth – Trends, Demand & Innovations 2025–2035

MRI Pulse Oximeters Market Size and Share Forecast Outlook 2025 to 2035

USA Pulses Market Insights – Demand, Size & Industry Trends 2025–2035

LiDAR Pulsed Fiber Laser Market Size and Share Forecast Outlook 2025 to 2035

Smart Pulse Oximeters Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Pulses Market Analysis – Size, Share & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA