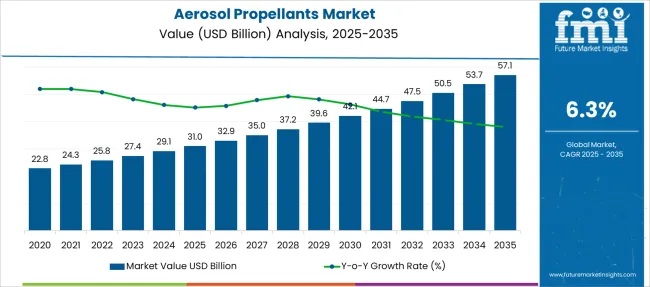

The Aerosol Propellants Market is estimated to be valued at USD 31.0 billion in 2025 and is projected to reach USD 57.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period.

| Metric | Value |

|---|---|

| Aerosol Propellants Market Estimated Value in (2025 E) | USD 31.0 billion |

| Aerosol Propellants Market Forecast Value in (2035 F) | USD 57.1 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The aerosol propellants market is growing steadily, supported by the increasing demand for convenient and effective delivery systems in personal care and other industries. The rise in consumer preference for easy-to-use products such as deodorants, hairsprays, and skincare formulations has driven the adoption of aerosol propellants.

Advances in formulation technology have improved product stability and performance while meeting regulatory standards. Sustainability concerns and environmental regulations have prompted manufacturers to focus on eco-friendly propellant options, yet hydrocarbons continue to dominate due to their effectiveness and cost efficiency.

The expansion of the personal care segment, driven by lifestyle changes and rising disposable incomes, has contributed significantly to market growth. Going forward, innovation in low-global-warming-potential propellants and increasing demand in emerging markets are expected to sustain the market’s upward trajectory.

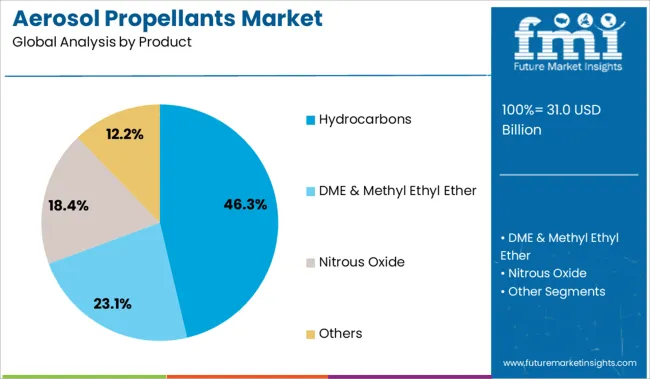

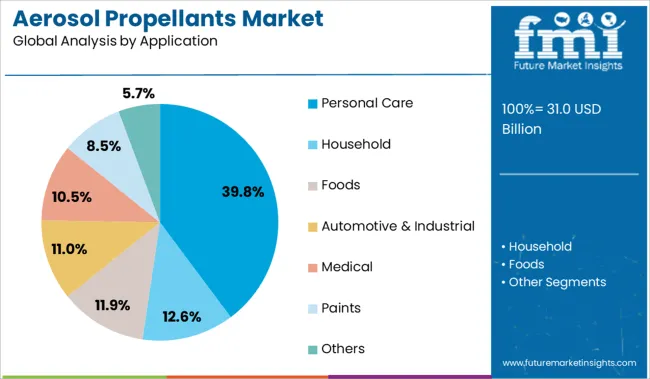

The market is segmented by product, application and region. By Product, the market is divided into Hydrocarbons, DME & Methyl Ethyl Ether, Nitrous Oxide, and Others. In terms of Application, the market is classified into Personal Care, Household, Foods, Automotive & Industrial, Medical, Paints, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hydrocarbons segment is projected to account for 46.3% of the aerosol propellants market revenue in 2025, maintaining its position as the leading product type. This dominance can be attributed to hydrocarbons’ excellent propellant properties, such as high vapor pressure and cost-effectiveness. Their compatibility with a wide range of formulations and ease of availability have further strengthened their position.

Despite increasing environmental scrutiny, hydrocarbons remain preferred for many applications due to their ability to deliver consistent product performance. Manufacturers have focused on improving safety measures and ensuring compliance with environmental regulations to support continued use.

The hydrocarbons segment’s balance of performance and affordability is expected to keep it as the market leader.

The personal care segment is projected to hold 39.8% of the aerosol propellants market revenue in 2025, making it the largest application segment. Growth in this segment has been driven by consumer demand for convenience and enhanced sensory experiences in products like deodorants, hair sprays, and body mists.

The increasing adoption of personal grooming routines and product innovations targeting specific consumer needs have supported growth. Retail expansion and marketing initiatives have improved product accessibility and awareness, contributing to wider adoption.

Additionally, the development of sustainable formulations aligned with consumer preferences for environmentally responsible products has further boosted the segment. The personal care application is expected to remain a key driver of market growth.

The aerosol propellants market is experiencing significant growth, driven by increasing demand across personal care, medical, and household applications. However, challenges such as environmental regulations, raw material price volatility, and safety concerns continue to impact the market's expansion.

The aerosol propellants market is expanding due to the increasing demand for aerosol-based products in various sectors. In the personal care industry, products like deodorants, hair sprays, and shaving foams are widely used, driving the need for propellants. The medical sector's reliance on metered-dose inhalers (MDIs) for respiratory treatments further contributes to market growth. Additionally, the household sector's demand for cleaning products, air fresheners, and insecticides boosts the consumption of aerosol propellants. This diverse application base ensures a steady demand for propellants, supporting market expansion.

Despite the market's growth, several challenges hinder its expansion. Stricter environmental regulations, such as the phase-out of ozone-depleting substances, have led to the adoption of alternative propellants with lower global warming potential. However, these alternatives often come with higher production costs and limited availability. Additionally, the volatility in raw material prices, influenced by factors like crude oil fluctuations and geopolitical tensions, affects the cost stability of propellants. These challenges necessitate continuous innovation and adaptation within the industry to maintain growth trajectories.

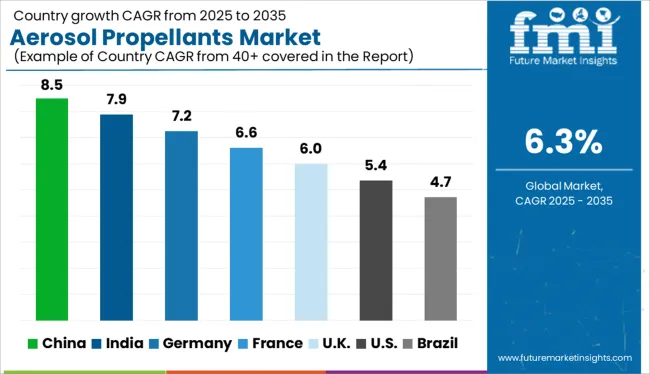

| Country | CAGR |

|---|---|

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| UK | 6.0% |

| USA | 5.4% |

| Brazil | 4.7% |

Global aerosol propellants market demand is projected to rise at a 6.3% CAGR from 2025 to 2035. Of the five profiled markets out of 40 covered, China leads at 8.5%, followed by India at 7.9%, and Germany at 7.2%, while the United Kingdom posts 6.0% and the United States records 5.4%. These rates translate to a growth premium of +35% for China, +25% for India, and +14% for Germany versus the baseline, while the United States and the United Kingdom show slower growth. Divergence reflects local catalysts: strong demand for aerosol-based products in China and India, driven by both consumer and industrial applications, while more mature markets like the United States and the United Kingdom experience more gradual growth due to established infrastructure and market maturity.

The aerosol propellants market in China is projected to grow at 8.5 percent CAGR through 2035. The surge stems from growing demand for personal care, automotive sprays, and air fresheners, with domestic companies scaling butane and dimethyl ether output. Packaging suppliers and FMCG firms are forming local alliances to streamline filler-to-retailer delivery cycles. National policies phasing out ozone-depleting substances have incentivized newer, low-GWP formulations. Multinational players are investing in plant expansions, particularly around the Yangtze River Delta. Market fragmentation remains, but demand consolidation is expected across hygiene and household segments, improving supply chain integration in coming years.

India is projected to expand its aerosol propellants market at a CAGR of 7.9 percent from 2025 to 2035. Household disinfectants and deodorant sprays dominate usage, with local manufacturing supported by expanding butane and LPG blending capacity. Fast-moving consumer goods companies are introducing regional scent lines and herbal aerosols, increasing segment-specific penetration. India's aerosol supply chain is becoming more integrated, with propellant suppliers forging exclusive contracts with urban filler plants. Rising awareness regarding personal hygiene, especially in semi-urban markets, is further solidifying demand, despite regulatory pressures around VOCs.

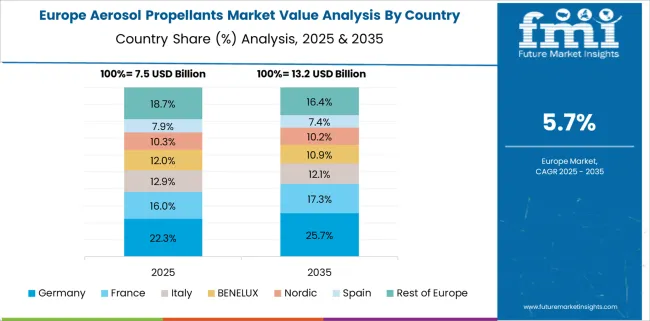

The aerosol propellants market in Germany is anticipated to grow at 7.2 percent CAGR through 2035. Tight regulations regarding volatile organic compound emissions are nudging producers toward hydrocarbon-alternative propellants. Demand is especially concentrated in industrial lubricants, spray paints, and cosmetic aerosols. German manufacturers are investing in precision valve systems and low-GWP mixtures to maintain their edge in export markets. Bio-based propellant R&D has been prioritized by public-private consortiums, which aim to phase out traditional hydrocarbons in household sprays. The country's logistics and engineering capabilities further facilitate custom propellant canister designs catering to niche sectors.

The United Kingdom is forecasted to grow its aerosol propellants market at 6.0 percent CAGR between 2025 and 2035. Household disinfectants and cosmetic aerosols represent the largest consumption base. Propellant manufacturers are focusing on blends with minimal environmental impact, including HFOs and compressed air-based systems. The regulatory environment encourages labelling transparency, nudging retailers to demand safer and certified propellant content. Demand for compact and travel-sized products has grown, especially in convenience retail and airport outlets. The market is also benefiting from a consumer shift toward multipurpose and water-based sprays.

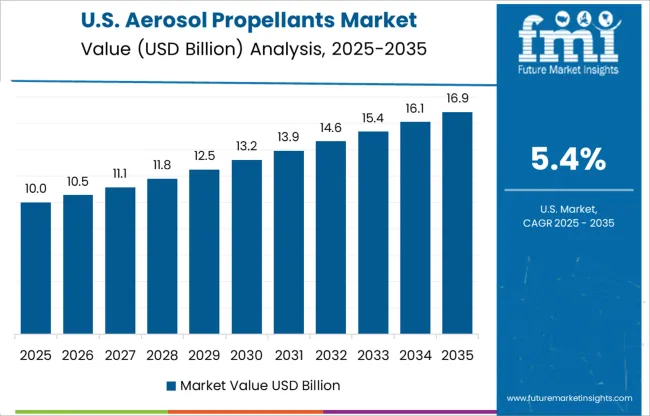

The United States aerosol propellants market is expected to post a 5.4 percent CAGR through 2035. Regulatory changes—especially from the EPA and state-level CARB standards—are shaping the composition of propellants. Industry players have adjusted by introducing more low-emission hydrocarbons and compressed gases across product lines. Hygiene-conscious consumers continue to drive deodorant and disinfectant usage, with refillable options gradually gaining traction. The industrial segment remains resilient, particularly in rust-proofing sprays and maintenance lubricants. Supply chain constraints have prompted nearshoring of certain components, with Midwest-based filling facilities expanding capacity.

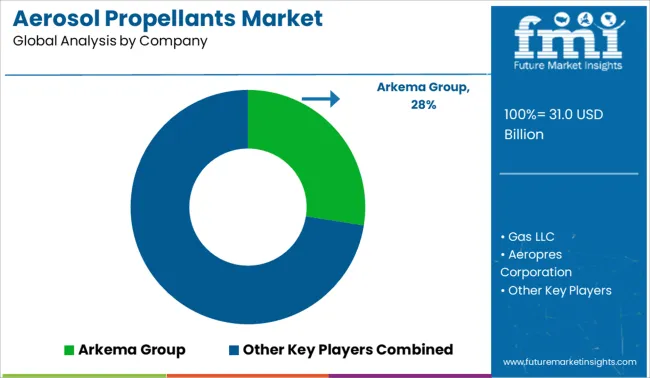

In the aerosol propellants market, competitiveness is structured around propellant type, regional production capacity, and regulatory alignment. Arkema leads by leveraging its global fluorochemical portfolio, especially low-GWP propellants, supplying personal care, household, and medical aerosol brands across Europe and North America. Royal Dutch Shell and Aveflor (part of Aeropres) supply hydrocarbon and CO₂ blends with integrated distribution, while Lapolla Industries and Gas LLC serve industrial sealants and foams under private-label agreements. Environmental regulations in the EU and USA have accelerated the shift to HFOs and hydrocarbons, influencing Arkema’s product positioning. Market reach extends into Asia via Shell, with niche solutions from Lapola targeting ASEAN insulation and spray applications.

Hydrocarbon propellants, led by i-butane and blends with ~80% market share, are projected to hit USD 15.8 billion by 2034. However, shifting trade tariffs and increasing environmental regulations are influencing global pricing, production strategies, and long-term supply stability.

| Item | Value |

|---|---|

| Quantitative Units | USD 31.0 Billion |

| Product | Hydrocarbons, DME & Methyl Ethyl Ether, Nitrous Oxide, and Others |

| Application | Personal Care, Household, Foods, Automotive & Industrial, Medical, Paints, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Arkema Group, Gas LLC, Aeropres Corporation, Royal Dutch Shell LLC, Lapola Industries Inc, and Aveflor A.S |

| Additional Attributes | Dollar sales dominated by consumer goods (sprays, disinfectants) and automotive care, share led by low-GWP hydrofluoroolefins and isobutane blends, demand rising for precise metered-dose automation, retrofitting common in legacy aerosol filling lines, ergonomic valve design critical for user comfort, and bio-based propellants gaining ground over traditional HFCs. |

The global aerosol propellants market is estimated to be valued at USD 31.0 billion in 2025.

The market size for the aerosol propellants market is projected to reach USD 57.1 billion by 2035.

The aerosol propellants market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in aerosol propellants market are hydrocarbons, dme & methyl ethyl ether, nitrous oxide and others.

In terms of application, personal care segment to command 39.8% share in the aerosol propellants market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aerosol Cap Market Size and Share Forecast Outlook 2025 to 2035

Aerosol Packaging Market Size and Share Forecast Outlook 2025 to 2035

Aerosol Printing And Graphics Market Size and Share Forecast Outlook 2025 to 2035

Aerosol Market Size and Share Forecast Outlook 2025 to 2035

Aerosol Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Market Leaders & Share in the Aerosol Packaging Industry

Analyzing Aerosol Cap Market Share & Industry Leaders

Market Share Breakdown of Aerosol Valves Industry

Market Share Breakdown of Aerosol Printing and Graphics

Market Share Insights of Aerosol Actuators Product Providers

Aerosol Valves Market Growth and Trends 2025 to 2035

Aerosol Sprayers Market

Aerosol Dispensing Systems Market

Non-Aerosol Overcaps Market Size and Share Forecast Outlook 2025 to 2035

VCI Aerosol Market

Metal Aerosol Can Market Size and Share Forecast Outlook 2025 to 2035

Metal Aerosol Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plastic Aerosol Packaging Market

Aluminum Aerosol Cans Market Size and Share Forecast Outlook 2025 to 2035

Monobloc Aerosol Cans Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA