The Aerosol Market is estimated to be valued at USD 44.1 billion in 2025 and is projected to reach USD 76.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period. Regional growth imbalances are apparent, with Asia-Pacific anticipated to dominate the market due to high population density, rapid industrialization, and expanding consumer demand for packaged goods. Rising urban centers and increasing penetration of modern retail formats accelerate the adoption of aerosol products, positioning Asia-Pacific as the fastest-growing regional segment over the forecast period.

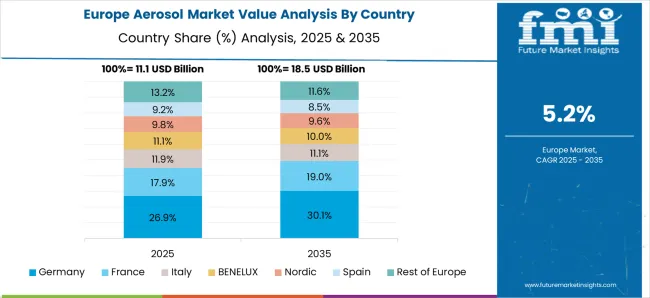

Europe presents a more mature market characterized by steady growth, where regulatory frameworks concerning environmental standards, volatile organic compound (VOC) limits, and packaging safety significantly influence product formulation and manufacturing processes. The focus on eco-friendly propellants and sustainable packaging solutions contributes to moderate market growth, emphasizing compliance-driven innovation rather than volume expansion. North America demonstrates stable but slower growth relative to Asia-Pacific, driven by high per capita consumption and strong market penetration of aerosols in personal care and household segments.

Consumer preference for premium and specialized products encourages gradual expansion, while stringent regulations on emissions and chemical composition require ongoing adaptation by manufacturers. These regional disparities highlight the interplay between market maturity, regulatory environments, and consumer adoption patterns, with Asia-Pacific leading growth, Europe focused on compliance and innovation, and North America sustaining consistent demand through premiumization and technological adaptation.

| Metric | Value |

|---|---|

| Aerosol Market Estimated Value in (2025 E) | USD 44.1 billion |

| Aerosol Market Forecast Value in (2035 F) | USD 76.1 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The aerosol market is witnessing strong momentum driven by increased demand for hygienic, convenient, and sustainable dispensing solutions across both consumer and industrial sectors. Advancements in formulation science and packaging engineering are enabling safer and more efficient aerosol delivery systems that meet modern performance and environmental standards.

Heightened focus on product shelf life, controlled dosage, and user safety is encouraging industries to adopt aerosol formats in applications ranging from personal care to pharmaceuticals and automotive. Regulatory measures promoting low emission propellants and recyclable can designs are reshaping the competitive landscape.

As consumer expectations evolve and green packaging gains priority, manufacturers are increasingly investing in lightweight materials and eco friendly propellants. The market outlook remains optimistic, supported by continuous innovation and adoption in sectors requiring portable, precise, and tamper proof product delivery mechanisms.

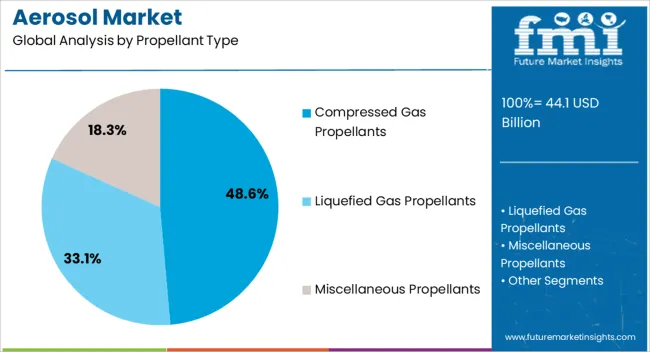

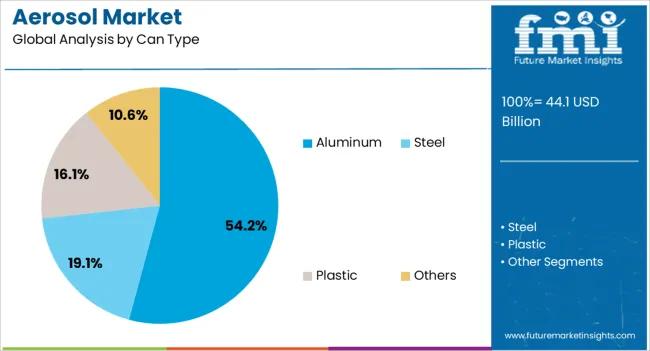

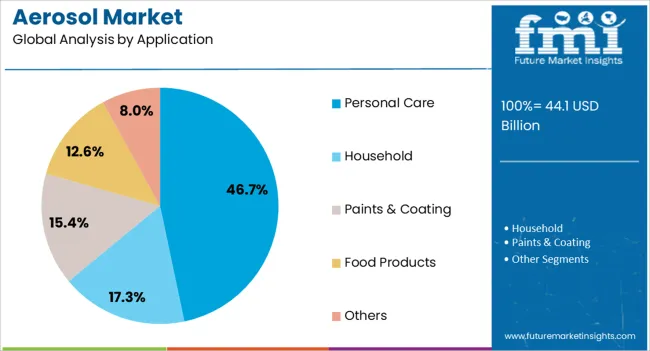

The aerosol market is segmented by propellant type, can type, application, and geographic regions. By propellant type, the aerosol market is divided into Compressed Gas Propellants, Liquefied Gas Propellants, and Miscellaneous Propellants. In terms of the type of aerosol market, it is classified into Aluminum, Steel, Plastic, and Others. The aerosol market is segmented into Personal Care, Household, Paints & Coatings, Food Products, and Others. Regionally, the aerosol industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Compressed gas propellants are projected to account for 48.60% of total market revenue by 2025 within the propellant type category, making them the leading segment. This is due to their reduced environmental impact compared to hydrocarbon-based alternatives, and their growing acceptance in regulations focused on air quality and volatile organic compound emissions.

The use of nitrogen, carbon dioxide, and other inert gases offers a safer and cleaner alternative for both consumer and industrial aerosol applications. Their adoption has been particularly strong in markets with stringent sustainability mandates and among brands promoting non-flammable and eco-sensitive packaging.

As awareness grows around the environmental impact of traditional propellants, compressed gas options are increasingly preferred for their safety, compliance, and performance characteristics.

The aluminum segment within the can type category is expected to contribute 54.20% of overall market revenue by 2025, making it the most dominant material choice. This is attributed to its lightweight structure, corrosion resistance, and infinite recyclability, which align well with circular economy principles.

Aluminum cans also offer excellent barrier properties that protect product integrity while enhancing shelf appeal through premium finishes. Manufacturers are favoring aluminum due to its compatibility with various propellant systems and its performance under high pressure conditions.

Additionally, the widespread availability of aluminum recycling infrastructure supports its position as the most sustainable and cost effective can solution in the aerosol market. These functional and environmental advantages have solidified aluminum’s leadership across both consumer and industrial applications.

The personal care segment is expected to hold 46.70% of the total market revenue by 2025 under the application category, positioning it as the dominant use case. Growth in this segment is fueled by rising demand for convenient and hygienic packaging in products such as deodorants, shaving foams, hair sprays, and dry shampoos.

The ability of aerosol packaging to deliver consistent dosage, extended shelf life, and user-friendly handling has enhanced its appeal among both manufacturers and consumers. Innovations in formulation, such as alcohol free sprays and sensitive skin variants, are further expanding product offerings in this category.

Moreover, the growing influence of grooming routines and premium personal care brands is driving the adoption of visually appealing and travel-friendly aerosol formats. These trends collectively reinforce personal care as the largest and most dynamic application in the aerosol packaging landscape.

The market has been expanding due to widespread applications in personal care, household products, pharmaceuticals, and industrial sectors. Aerosol products have been valued for their convenience, portability, and precise dispensing mechanisms. Market growth has been influenced by innovations in propellants, packaging, and formulations that enhance product performance and safety. Rising demand for ready-to-use products, combined with urban population growth and evolving consumer lifestyles, has strengthened adoption. Increasing awareness of hygiene and specialized delivery solutions has further reinforced the relevance of aerosols across diverse applications globally.

The market has been significantly driven by its applications in personal care and household sectors. Products such as deodorants, hair sprays, air fresheners, insecticides, and cleaning sprays have been widely adopted due to their convenience and easy-to-use format. Personal care brands have leveraged aerosols to provide uniform product application, extended shelf life, and portability. Household consumers have preferred aerosol-based insecticides and air fresheners for rapid delivery and controlled dosing. In addition, innovative formulations, including fragrance blends and low-odor variants, have strengthened appeal. Distribution through supermarkets, online marketplaces, and specialty stores has enhanced accessibility, ensuring steady demand. These factors have collectively positioned personal care and household applications as major drivers of aerosol adoption across both developed and emerging markets.

Technological improvements in aerosol propellants and packaging systems have supported market growth by enhancing efficiency and safety. Low global warming potential (GWP) and hydrofluoroolefin (HFO)-based propellants have been developed to replace traditional hydrofluorocarbons, reducing environmental impact. Advances in valve and actuator designs have improved product delivery consistency, minimized wastage, and ensured precise dosage. Packaging innovations such as recyclable cans, lightweight metals, and safety caps have enhanced convenience and regulatory compliance. These technological advancements have enabled manufacturers to meet evolving consumer expectations for eco-friendly and efficient aerosol products, expanding adoption in both personal care and industrial segments. Continuous investment in R&D has further facilitated the introduction of specialty formulations, strengthening the market’s competitive positioning.

The market has been shaped by environmental regulations and sustainability initiatives globally. Stringent standards related to volatile organic compounds (VOCs), flammability, and propellant safety have required manufacturers to adopt compliant formulations and production practices. Policies promoting low-GWP propellants and recyclable packaging have encouraged innovation in sustainable aerosol solutions. Consumer awareness regarding environmental impact has reinforced demand for eco-friendly products, including refillable and recyclable cans. Companies have collaborated with environmental agencies and industry associations to implement best practices in product design, labeling, and disposal. Regulatory compliance, coupled with sustainability trends, has driven investment in green technologies, influencing both formulation strategies and market growth trajectories.

Industrial applications, including lubricants, paints, coatings, and disinfectants, have contributed significantly to aerosol market expansion. Aerosols have been utilized for precise delivery, uniform coverage, and contamination-free application in manufacturing, automotive, and maintenance sectors. Despite strong industrial demand, challenges such as high raw material costs, flammability hazards, and stringent transportation regulations have constrained growth. Market volatility in propellant and aluminum prices has influenced production economics, particularly for small- and medium-scale manufacturers. The competition from alternative delivery methods such as pump sprays and non-aerosol formats has impacted adoption. Manufacturers have responded by enhancing product safety, introducing low-emission formulations, and optimizing supply chains to maintain market competitiveness while addressing regulatory and operational challenges.

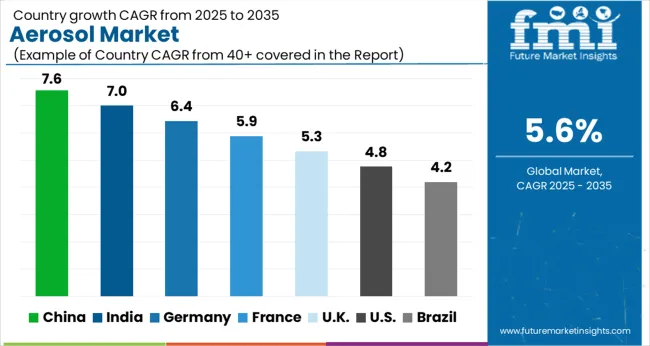

| Countries | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

The market is expected to grow at a CAGR of 5.6% between 2025 and 2035, driven by increasing demand in personal care, household, and industrial applications. China leads with a 7.6% CAGR, supported by large-scale manufacturing and growing consumer adoption of aerosol products. India follows at 7.0%, fueled by rising urban consumption and expansion of domestic production facilities. Germany, at 6.4%, benefits from established industrial production and innovation in specialty aerosols. The UK, growing at 5.3%, focuses on premium product segments, while the USA, at 4.8%, experiences steady demand from personal care and household sectors. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 7.6% over the forecast period, driven by increasing consumption in personal care, household, and industrial products. Rising urban population density and growing awareness of convenient spray-based solutions are supporting market adoption. Manufacturers are focusing on innovative formulations, sustainable propellants, and product differentiation to expand their footprint. Strategic alliances with global brands and increased e-commerce penetration are further boosting market presence. The market benefits from well-established distribution networks and strong chemical manufacturing capabilities.

India is forecasted to expand at a CAGR of 7.0%, supported by growing use in cosmetics, household cleaners, and automotive maintenance products. Increasing consumer preference for convenient, ready-to-use sprays is driving sales. Companies are launching eco-friendly propellant solutions and diversified product portfolios. Strategic partnerships with local distributors and online retail expansion are improving market reach. Regulatory emphasis on reducing VOC emissions is encouraging adoption of environmentally safer formulations, fostering market growth.

Germany is expected to grow at a CAGR of 6.4%, driven by demand in industrial, cosmetic, and personal care segments. Regulatory focus on environmental safety and sustainable propellants influences product innovation. Manufacturers are investing in high-performance spray technologies and lightweight packaging. Increasing collaborations between chemical producers and downstream users are enhancing market penetration. Strong consumer awareness and industrial application adoption support consistent demand, while government regulations ensure adherence to safety and emission standards.

The United Kingdom is forecasted to expand at a CAGR of 5.3%, influenced by rising household and personal care aerosol consumption. Companies are focusing on high-quality formulations, eco-friendly propellants, and product diversification. Retail expansion, online sales channels, and promotional campaigns enhance accessibility. Market growth is supported by consumer awareness regarding convenience, safety, and environmental impact. Investments in research and development for advanced spray technologies further drive adoption across multiple applications.

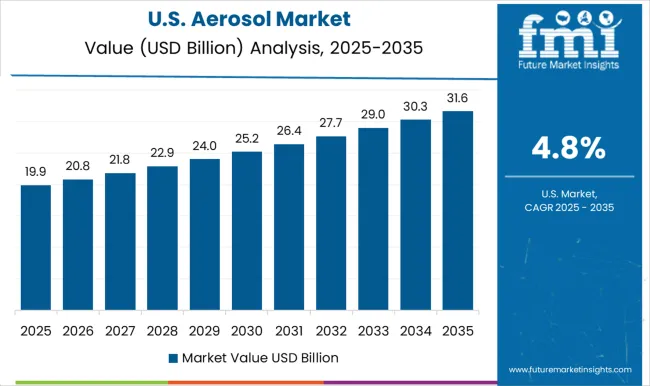

The United States is projected to grow at a CAGR of 4.8%, driven by demand in personal care, household, and industrial segments. Adoption of aerosol products in cosmetic and cleaning applications is increasing due to convenience and efficiency. Manufacturers are focusing on propellant alternatives, innovative spray mechanisms, and sustainable packaging solutions. Regulatory frameworks emphasizing VOC reduction and environmental safety influence product development strategies. Strategic partnerships with retailers and online distribution channels enhance market accessibility and expansion.

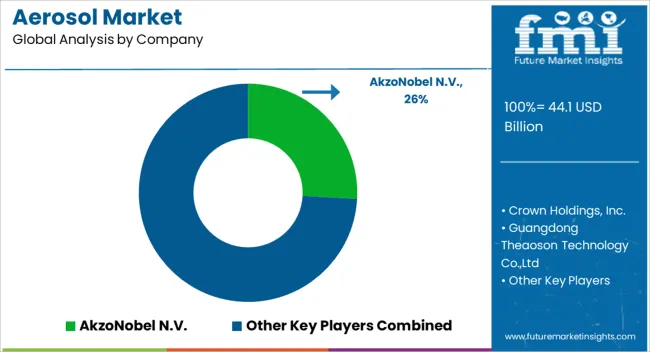

The global market is witnessing steady growth driven by increasing demand across personal care, household, and industrial sectors. Key players such as AkzoNobel N.V. and Henkel AG & Co. KGaA have strengthened their positions by offering innovative aerosol formulations and high-quality packaging solutions. Their focus on product performance, sustainability, and regulatory compliance allows them to meet evolving consumer preferences while expanding their global footprint. Crown Holdings, Inc. and Toyo Seikan Group Holdings, Ltd. provide advanced aerosol can manufacturing technologies, ensuring durability, safety, and compatibility with diverse formulations.

Companies like Honeywell International Inc. and S.C. Johnson & Son Inc. are contributing through specialized propellant technologies and eco-friendly solutions, emphasizing low environmental impact and energy-efficient production. Regional players, such as Guangdong Theaoson Technology Co., Ltd., Vaspal Packaging LLP, and Vanesa Cosmetics Pvt. Ltd., are expanding their market reach by catering to local consumer needs with customizable aerosol designs and innovative packaging solutions. HCP Wellness is focusing on wellness and health-oriented aerosol products, aligning with the rising global trend for functional and safe personal care solutions.

The collaborative efforts of these providers in research, sustainable production, and product diversification are driving market competitiveness. With increasing consumer awareness, regulatory support for environmentally friendly aerosols, and continuous technological advancements, these companies are shaping the future trajectory of the aerosol industry. Strategic investments and partnerships are expected to strengthen their positions further, enabling growth in emerging and established markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 44.1 Billion |

| Propellant Type | Compressed Gas Propellants, Liquefied Gas Propellants, and Miscellaneous Propellants |

| Can Type | Aluminum, Steel, Plastic, and Others |

| Application | Personal Care, Household, Paints & Coating, Food Products, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AkzoNobel N.V., Crown Holdings, Inc., Guangdong Theaoson Technology Co.,Ltd, HCP Wellness, Henkel AG & Co. KGaA, Honeywell International Inc., S.C. Johnson & Son Inc., Toyo Seikan Group Holdings, Ltd., Vanesa Cosmetics Pvt. Ltd, and Vaspal Packaging LLP |

| Additional Attributes | Dollar sales by product type and end-use segment, demand dynamics across personal care, household, and industrial sectors, regional trends in aerosol adoption, innovation in propellant technology and formulation safety, environmental impact of emissions and packaging waste, and emerging use cases in sustainable and refillable aerosol solutions. |

The global aerosol market is estimated to be valued at USD 44.1 billion in 2025.

The market size for the aerosol market is projected to reach USD 76.1 billion by 2035.

The aerosol market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in aerosol market are compressed gas propellants, liquefied gas propellants and miscellaneous propellants.

In terms of can type, aluminum segment to command 54.2% share in the aerosol market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aerosol Cap Market Size and Share Forecast Outlook 2025 to 2035

Aerosol Packaging Market Size and Share Forecast Outlook 2025 to 2035

Aerosol Printing And Graphics Market Size and Share Forecast Outlook 2025 to 2035

Aerosol Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Aerosol Propellants Market Size and Share Forecast Outlook 2025 to 2035

Market Leaders & Share in the Aerosol Packaging Industry

Analyzing Aerosol Cap Market Share & Industry Leaders

Market Share Breakdown of Aerosol Valves Industry

Market Share Breakdown of Aerosol Printing and Graphics

Market Share Insights of Aerosol Actuators Product Providers

Aerosol Valves Market Growth and Trends 2025 to 2035

Aerosol Sprayers Market

Aerosol Dispensing Systems Market

Non-Aerosol Overcaps Market Size and Share Forecast Outlook 2025 to 2035

VCI Aerosol Market

Metal Aerosol Can Market Size and Share Forecast Outlook 2025 to 2035

Metal Aerosol Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plastic Aerosol Packaging Market

Aluminum Aerosol Cans Market Size and Share Forecast Outlook 2025 to 2035

Monobloc Aerosol Cans Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA