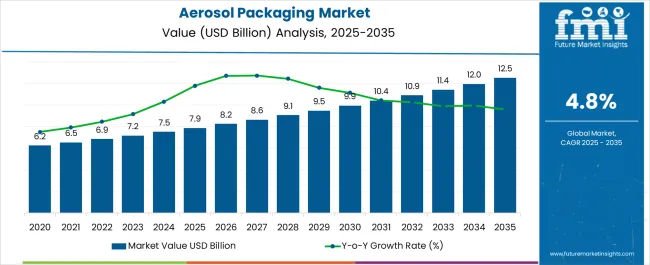

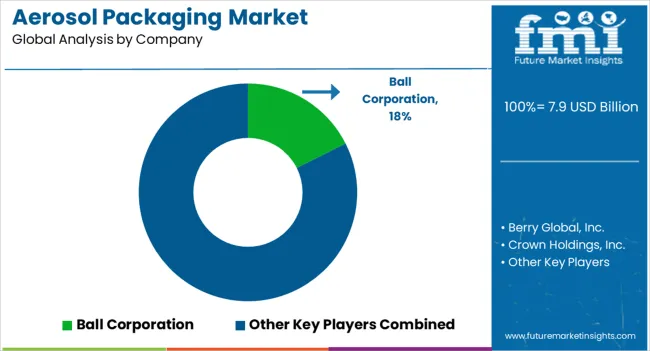

The Aerosol Packaging Market is estimated to be valued at USD 7.9 billion in 2025 and is projected to reach USD 12.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

| Metric | Value |

|---|---|

| Aerosol Packaging Market Estimated Value in (2025 E) | USD 7.9 billion |

| Aerosol Packaging Market Forecast Value in (2035 F) | USD 12.6 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The aerosol packaging market is witnessing robust growth. Increasing demand from personal care, household, and industrial applications is driving market expansion. Current market dynamics are shaped by consumer preference for convenient and ready-to-use products, innovations in packaging design, and regulatory emphasis on safety and sustainability.

Manufacturers are adopting advanced materials and production techniques to enhance product durability, reduce environmental impact, and comply with global standards. The future outlook is driven by rising urbanization, growing e-commerce distribution, and expansion in emerging markets, which are expected to increase product accessibility and adoption.

Growth rationale is supported by technological advancements in aerosol dispensing mechanisms, increasing awareness regarding packaging hygiene and preservation, and the ability of manufacturers to innovate across materials and product types Strategic investments in supply chain optimization and distribution networks further underpin sustained market growth, ensuring that manufacturers can meet evolving consumer and industrial requirements efficiently while maintaining cost-effectiveness and product reliability.

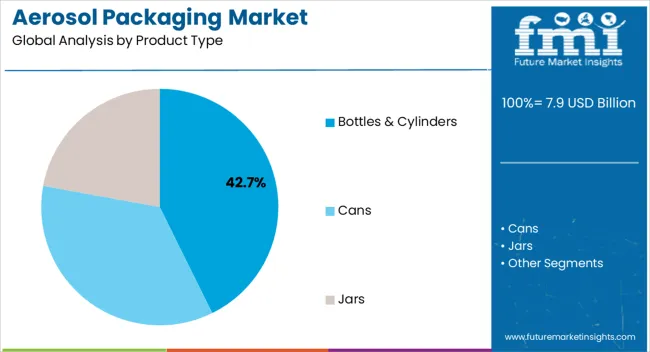

The bottles and cylinders segment, holding 42.70% of the product type category, has maintained market leadership due to its versatility and widespread use across personal care, household, and industrial products. Adoption has been reinforced by durability, lightweight design, and compatibility with multiple filling processes.

Manufacturing innovations have enhanced resistance to pressure and environmental stress, ensuring product safety and longevity. Demand has been stabilized by broad end-user applications and consistent industrial adoption.

Supply chain integration and compliance with safety standards have supported reliability and market confidence Continuous development in design aesthetics and functional features, such as refillable and collapsible formats, is expected to sustain market share and drive incremental growth within the aerosol packaging landscape.

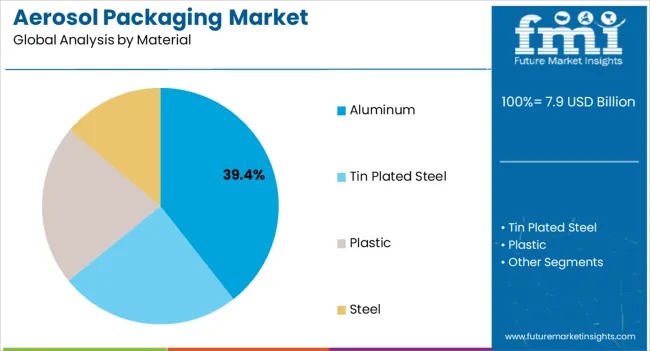

The aluminum segment, representing 39.40% of the material category, has led the market owing to its lightweight, corrosion-resistant, and recyclable properties. Adoption has been facilitated by compliance with environmental regulations and growing consumer preference for sustainable packaging solutions.

Aluminum’s high barrier performance and durability have enhanced product protection and shelf life. Manufacturing efficiencies and global availability have ensured consistent supply for large-scale industrial and consumer applications.

Innovations in coating and finishing processes have improved product safety and aesthetics Continued focus on sustainability initiatives and cost optimization is expected to support aluminum’s dominance and reinforce its contribution to the overall market growth.

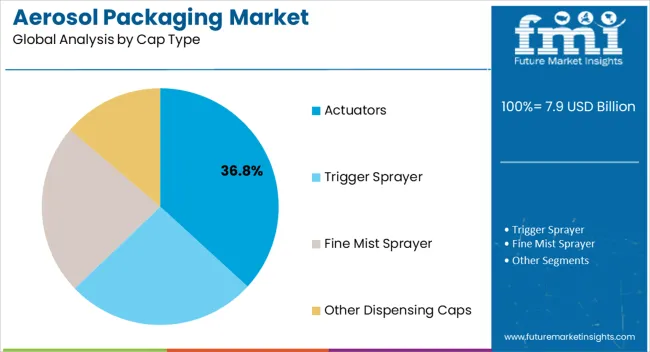

The actuators segment, holding 36.80% of the cap type category, has emerged as the leading component due to its critical role in controlling product dispensation and enhancing user convenience. Adoption has been driven by compatibility with a wide range of aerosol formulations, durability, and ergonomic design.

Manufacturing advancements have improved precision, reliability, and consistency in spray performance. Demand stability has been supported by the growing popularity of personal care and household aerosol products.

Continuous innovation in actuator design, including metered and multifunctional options, is expected to sustain segment market share and support broader adoption across diverse aerosol packaging applications globally.

The aerosol packaging market heavily relies on consumer demand for goods across different industries. Trends in various industries, such as food and beverage, pharmaceuticals, personal care, e-commerce, etc., also influence the global market. Economic factors, like GDP growth, inflation rates, and unemployment, also play a crucial role in the overall growth of the aerosol packaging market, as these conditions decide the fate of manufacturing industries across the world.

In the last few years, the market for aerosol packaging has seen a series of ups and downs. During the pandemic, as the world faced shutdowns, the manufacturing units worldwide had to cease their operations. This had a negative impact on the aerosol packaging market. However, the incorporation of aerosol containers in the packaging of disinfectants, sanitizers, nasal sprays, etc., rapidly lifted the growth rate.

Post-pandemic, as the world got accustomed to the new normal, the e-commerce sector gained substantial traction in developing and underdeveloped nations. The heightened focus on hygiene and safety during the pandemic also increased the demand for packaging in the healthcare sector. All these factors have collectively led to a stable growth rate in recent years. With technological innovations in this field, the market will have a promising future in the coming years.

| Attributes | Key Statistics |

|---|---|

| Market Size (2020) | USD 6.7 billion |

| Market Value (2025) | USD 7.2 billion |

| CAGR (2020 to 2025) | 7.46% |

| Attributes | Details |

|---|---|

| Product Type | Bottles |

| Market share | 45.30% |

Aerosol products generally consist of liquids, and there is no alternative to bottles that effectively store and dispense the content in the container. The increasing demand for bottles in the aerosol products industry is attributed to their flexibility, catering to diverse applications, spanning from personal care items such as hairsprays and deodorants to household products like air fresheners and cleaning sprays.

On the basis of product type, bottles dominate the global aerosol packaging market with a remarkable share of 45.30%. Bottles are also demanded substantially in the international marketplace because of their capability to offer a high degree of customization and branding opportunities. The labeling and printing options available on bottles facilitate effective branding strategies, enabling companies to create visually appealing and recognizable packaging for their aerosol products.

| Attributes | Details |

|---|---|

| End User | Personal Care and Cosmetics |

| Market share | 40.40% |

Post-pandemic, the personal care and cosmetics industry has been growing at an exponential rate. Aerosol packaging solutions have firmly established their place in the personal care and cosmetics industry due to their convenience, efficiency, and innovative applications. The surging significance of aerosol packaging solutions in the manufacturing of personal care products, such as deodorants, hairsprays, and cosmetic sprays, has contributed considerably to global market revenue.

Based on end users, the personal care and cosmetics industry dominates the aerosol packaging market with a whopping share of 40.4%. The demand for aerosol packaging solutions in these industries is also because certain products, like hair sprays, utilize aerosol packaging for its ability to deliver fine and even mists, ensuring uniform application and optimal styling results.

The section provides an analysis of the aerosol packaging market by countries, including China, India, the United Kingdom, Thailand, and South Korea. The table presents the CAGR for each country, indicating the expected market growth in that country through 2035.

| Countries | CAGR |

|---|---|

| India | 7.70% |

| China | 6.80% |

| Thailand | 6.60% |

| South Korea | 5.90% |

| The United Kingdom | 4.50% |

The India aerosol packaging market is anticipated to retain its dominance by progressing at an annual growth rate of 7.70% till 2035.

The booming e-commerce industry in India has significantly contributed to the growth of the aerosol packaging market. The need for secure and efficient packaging for the safety of products, ranging from beauty and personal care items to household goods, during transit has fuelled the market growth for aerosol packaging solutions. Besides this, the rising disposable income of the Indian middle class has increased consumer spending on a variety of products with sophisticated packaging, such as aerosols.

China is another Asian country that is leading this market. Over the next ten years, the demand for aerosol packaging solutions in China is projected to rise at a 6.80% CAGR.

Growing environmental awareness in China has resulted in a shift towards sustainable packaging solutions. To respond to this demand of eco-conscious consumers, manufacturing units are developing eco-friendly alternatives for packaging, such as recyclable materials and propellant innovations. China’s rapid urbanization and evolving lifestyle have also led to the demand for convenient and on-the-go cosmetics, which are packaged using this methodology.

In the ASEAN region, Thailand leads the market for aerosol packaging solutions. The market in Thailand is poised to showcase a 6.60% advancement per year from 2025 to 2035.

Thailand is renowned for its robust tourism and hospitality sector in the entire world. Millions of tourists from all over the world flock to the country annually. These tourists often require travel-sized personal care products, such as perfumes, hair sprays, sanitizers, etc. Aerosol-packed containers are the perfect choice for these products, fuelling the overall market.

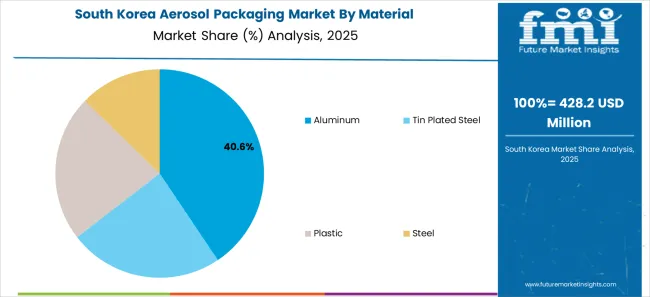

The South Korean aerosol packaging market is anticipated to register a CAGR of 5.90% through 2035.

South Korea is a global hub for beauty and skincare innovations. The aerosol packaging market has significantly benefited from the popularity of K-beauty trends. The aerosol packaging methodology is commonly used in the packaging of innovative skincare and cosmetic products, contributing to its growth in the country.

In Europe, the United Kingdom aerosol packaging market is anticipated to register a CAGR of 4.50% through 2035.

The United Kingdom is home to the well-to-do population in the world. There is a great demand for premium cosmetics and luxury goods in the domestic market. Aerosol packaging is gaining a lot of impetus in the United Kingdom, as it allows brands to create visually appealing and unique products, enhancing their market presence in a competitive landscape.

The market for aerosol packaging is filled with numerous players, such as Berry Global Inc., Crown Holdings Inc., Ball Corporation, etc. These companies dominate the majority share of the global market valuation. The said players have a strong foothold and have gained a loyal consumer base. The market is already saturated in terms of innovations. Small brands, though, find it very challenging to sustain in this cut-throat competition due to lower profit margins, limited financial resources, and restricted market expertise.

Recent Developments

The global aerosol packaging market is estimated to be valued at USD 7.9 billion in 2025.

The market size for the aerosol packaging market is projected to reach USD 12.6 billion by 2035.

The aerosol packaging market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in aerosol packaging market are bottles & cylinders, cans and jars.

In terms of material, aluminum segment to command 39.4% share in the aerosol packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Leaders & Share in the Aerosol Packaging Industry

Metal Aerosol Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plastic Aerosol Packaging Market

Aerosol Cap Market Size and Share Forecast Outlook 2025 to 2035

Aerosol Printing And Graphics Market Size and Share Forecast Outlook 2025 to 2035

Aerosol Market Size and Share Forecast Outlook 2025 to 2035

Aerosol Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Aerosol Propellants Market Size and Share Forecast Outlook 2025 to 2035

Analyzing Aerosol Cap Market Share & Industry Leaders

Market Share Breakdown of Aerosol Valves Industry

Market Share Breakdown of Aerosol Printing and Graphics

Market Share Insights of Aerosol Actuators Product Providers

Aerosol Valves Market Growth and Trends 2025 to 2035

Aerosol Sprayers Market

Aerosol Dispensing Systems Market

Non-Aerosol Overcaps Market Size and Share Forecast Outlook 2025 to 2035

VCI Aerosol Market

Metal Aerosol Can Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Aerosol Cans Market Size and Share Forecast Outlook 2025 to 2035

Monobloc Aerosol Cans Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA