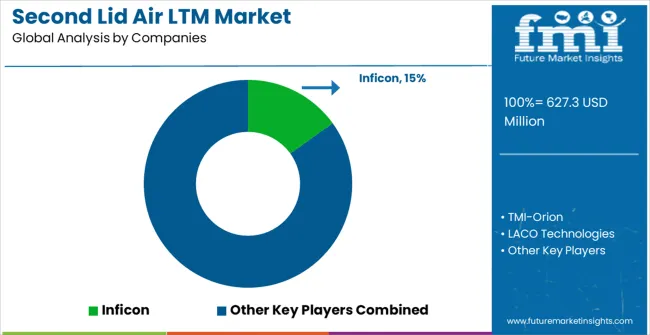

The second lid air leakage test machine market is projected to expand from USD 627.3 million in 2025 to USD 1,177.5 million by 2035, reflecting a compound annual growth rate (CAGR) of 6.5%. Over the next decade, this market is expected to see consistent growth, with gradual annual increases observed. For example, the market will grow by 6.5% from 2025 to 2026, followed by a steady 6.4% growth rate in the following years. These projections indicate a solid demand for air leakage test machines, primarily driven by their growing importance in packaging industries, automotive testing, and product manufacturing processes. As manufacturing standards continue to evolve, particularly in regulated sectors like food and beverage, pharmaceuticals, and consumer goods, the need for precise testing equipment will increase, resulting in steady market expansion. The adoption of these machines is largely attributed to the increasing emphasis on quality control and packaging integrity.

As the second lid air leakage test machine market grows, key industries such as food and beverage, pharmaceuticals, and consumer electronics are driving demand. The rapid growth rate from 2025 to 2035 reflects not only an increase in manufacturing standards but also a shift toward more rigorous safety and quality compliance requirements. This growth trajectory also highlights the growing reliance on automated testing systems in production lines. Manufacturers are investing more in accurate and reliable testing solutions, which can significantly reduce operational risks and costs in the long term. The market's continued growth is anticipated to be supported by the broader push for greater product safety and compliance, positioning air leakage test machines as indispensable tools across multiple sectors. Consequently, the market is set for a decade of consistent expansion, driven by both heightened industry standards and the increased focus on operational efficiency.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 627.3 million |

| Forecast Value in (2035F) | USD 1,177.5 million |

| Forecast CAGR (2025 to 2035) | 6.5% |

The second lid air leakage test machine market is a subset of the leak testing equipment market, where it accounts for approximately 3.5% of the total share. Within the packaging machinery market, this segment contributes about 2.2%, driven by its use in testing airtight seals for packaging applications. In the broader industrial testing equipment market, the share is around 1.9%, due to the growing need for accurate and reliable testing in manufacturing processes. Within the automation testing equipment market, second lid air leakage test machines capture around 2.5% of the market share, reflecting their growing adoption in automated systems for high-efficiency manufacturing. Finally, in the manufacturing equipment market, the segment accounts for about 2.8%, as more manufacturers seek precision in quality control, ensuring product integrity and compliance with standards. These trends are indicative of a rising focus on improving testing accuracy and reliability across various industries.

Market expansion is being supported by the rapid increase in packaged goods consumption worldwide and the corresponding need for specialized leak testing equipment that ensures package integrity and prevents product contamination. Modern packaging operations rely on precise leak detection and seal verification technologies to ensure proper container sealing performance including hermetic seals, vacuum packaging, and modified atmosphere packaging systems. Even minor seal defects can cause significant product quality issues and require comprehensive testing validation to maintain optimal package performance and consumer safety.

The growing complexity of packaging materials and increasing regulatory requirements are driving demand for professional leak testing equipment from established manufacturers with appropriate certifications and measurement accuracy capabilities. Food and pharmaceutical manufacturers are increasingly requiring comprehensive seal integrity documentation following packaging operations to maintain regulatory compliance and quality assurance standards. Industry regulations and safety standards are establishing mandatory testing procedures that require specialized equipment and trained quality control personnel.

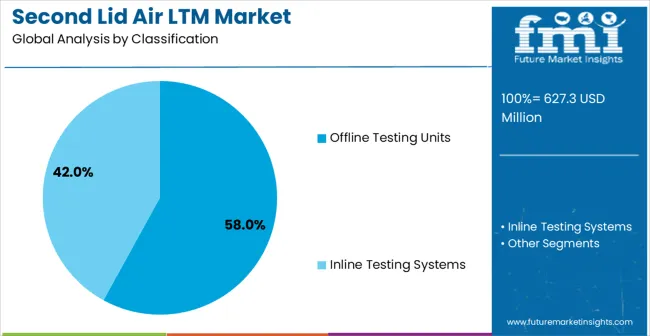

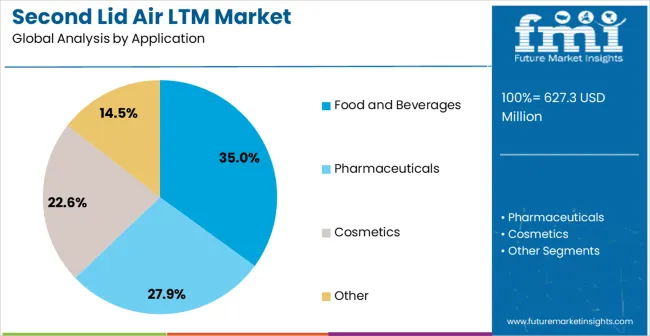

The market is segmented by machine type, end-use applications, and region. Offline testing units are projected to hold 58% of the second lid air leakage test machine market by 2025, driven by their accuracy and comprehensive validation for packaging integrity. The food and beverages segment is expected to capture 35% market share, fueled by the need for enhanced packaging quality control to ensure product freshness and safety. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Offline testing units are projected to account for 58% of the second lid air leakage test machine market in 2025, driven by their widespread use in quality control for packaging validation. These systems offer comprehensive testing with dedicated stations and controlled environments, making them ideal for facilities that need thorough seal integrity checks and detailed quality documentation. Offline testing excels in testing accuracy and validation, offering precise leak detection, statistical analysis of seal performance, and supporting regulatory compliance. Their flexibility in handling various package formats and testing requirements makes them particularly valuable in multi-product packaging operations. This dominance is further supported by established methodologies and broad equipment availability from specialized manufacturers.

The food and beverages segment is projected to account for 35% of the second lid air leakage test machine market in 2025, maintaining its leading position. This significant market share is driven by the growing need for quality control and packaging integrity in the food and beverage industry. As packaging safety and product shelf life become increasingly critical, food and beverage manufacturers are adopting advanced testing technologies, including air leakage testing, to ensure product freshness and prevent contamination. The high demand for sealed packaging to protect products during distribution and storage supports the continued dominance of this segment. The food and beverages segment is expected to continue to drive market growth, particularly as packaging regulations tighten across regions.

The second lid air leakage test machine market is growing as industries increasingly prioritize product quality and packaging integrity in sectors such as pharmaceuticals, food, and automotive. These machines are essential for ensuring airtight seals, preventing contamination, and improving the safety and performance of products. Opportunities are rising due to stringent packaging regulations and the expansion of global manufacturing. However, challenges such as high costs, technological complexities, and the need for skilled operators may hinder widespread adoption.

The second lid air leakage test machine market is witnessing rising demand due to increasing requirements for airtight packaging across industries. In opinion, sectors such as pharmaceuticals, food, and automotive are seeking advanced solutions to ensure the integrity of their sealed packages. These machines help manufacturers detect even the smallest air leaks, which is critical for maintaining product safety, preventing contamination, and improving shelf life. As regulatory requirements for packaging and product safety become more stringent, the demand for air leakage test machines is set to rise further, especially in high-stakes industries.

Opportunities in the second lid air leakage test machine market are expanding with the rise in packaging regulations and the growth of global manufacturing. In opinion, as packaging standards become more stringent, particularly in the pharmaceutical and food sectors, companies are investing in more reliable testing methods to comply with these regulations. Furthermore, the expansion of manufacturing facilities in emerging markets presents significant growth opportunities. These regions, where packaging practices are evolving rapidly, are likely to drive the demand for advanced testing machines, creating opportunities for manufacturers of air leakage test machines.

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| Brazil | 6.8% |

| United States | 6.2% |

| United Kingdom | 5.5% |

| Japan | 4.9% |

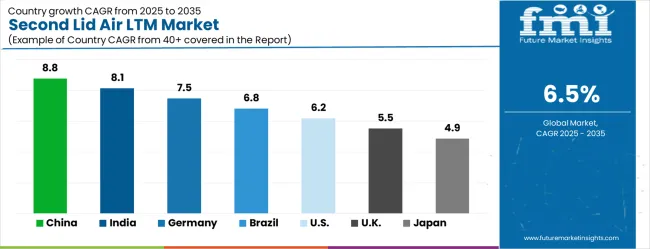

The second lid air leakage test machine market is growing robustly, with China leading at an 8.8% CAGR through 2035, driven by massive packaging industry expansion, food safety regulation enforcement, and increasing quality control automation. India follows at 8.1%, supported by growing packaged food consumption and expanding pharmaceutical manufacturing capabilities. Germany grows steadily at 7.5%, emphasizing precision engineering, quality excellence, and advanced packaging technology expertise. Brazil records 6.8%, integrating leak testing technology into its expanding food processing and packaging sectors. The United States shows growth at 6.2%, focusing on food safety compliance and packaging innovation leadership. The United Kingdom demonstrates growth at 5.5%, supported by pharmaceutical packaging and food safety requirements. Japan maintains expansion at 4.9%, driven by precision manufacturing standards and quality control excellence. Overall, China and India emerge as the leading drivers of global Second Lid Air Leakage Test Machine market expansion.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

The second lid air leakage test machine market in China is expanding at a CAGR of 8.8%, driven by the country’s booming manufacturing sector and increasing demand for stringent quality control in packaging processes. China’s rapid industrialization and growing focus on improving product quality in industries such as food packaging, automotive, and pharmaceuticals are major factors contributing to the adoption of air leakage test machines. Government policies supporting manufacturing excellence and technological advancements further propel market growth.

The second lid air leakage test machine market in India is projected to grow at a CAGR of 8.1%, fueled by the country’s expanding manufacturing and packaging industries. With rising demand for packaging integrity and the focus on enhancing product quality, Indian manufacturers are increasingly adopting air leakage test machines. The market is also supported by government initiatives to improve the quality of industrial products and the rising trend of automation in production lines.

The second lid air leakage test machine market in Germany is expected to grow at a CAGR of 7.5%, supported by the country’s strong industrial base and focus on manufacturing excellence. Germany is known for its high-quality standards in manufacturing, especially in automotive, pharmaceutical, and food packaging industries. With rising demand for efficient testing solutions and the need for precision in packaging, the market for air leakage test machines is expanding steadily.

The second lid air leakage test machine market in Brazil is projected to grow at a CAGR of 6.8%, driven by the growing demand for packaging solutions in the food and beverage industries. As Brazil’s manufacturing sector continues to develop, the need for reliable quality control and testing equipment increases. The market is further supported by rising awareness of product integrity and the growing emphasis on regulatory compliance in packaging.

The second lid air leakage test machine market in the United States is growing at a CAGR of 6.2%, supported by the country’s advanced manufacturing and packaging industries. With increasing demand for automation and precision testing solutions, the USA market is embracing air leakage test machines for better quality control. The growing focus on food safety, pharmaceuticals, and consumer goods packaging further accelerates the adoption of these testing machines.

The second lid air leakage test machine market in the United Kingdom is projected to grow at a CAGR of 5.5%, as demand for efficient and precise testing solutions increases in the packaging industry. The UK has a well-established manufacturing sector, with a growing emphasis on automation and quality control. The market is driven by the increasing need for packaging integrity in food, beverage, and pharmaceutical industries, as well as government regulations on product safety.

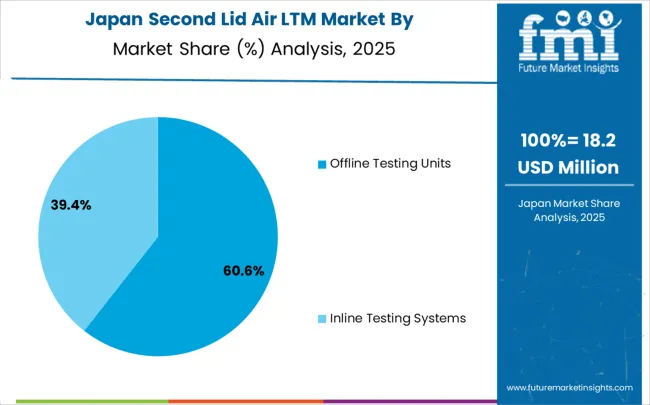

The second lid air leakage test machine market in Japan is expected to grow at a CAGR of 4.9%, driven by the country’s advanced manufacturing processes and focus on high-quality standards. Japan’s strong emphasis on automation and robotics in production lines, combined with the need for precise quality control in packaging, contributes to the growth of air leakage test machines. The automotive, electronics, and food packaging sectors are key drivers of the market.

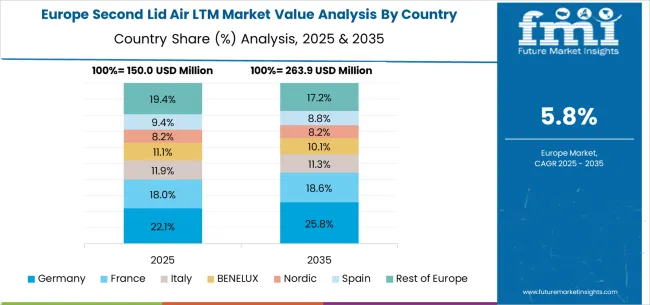

The second lid air leakage test machine market in Europe is projected to grow from USD 150.0 million in 2025 to USD 263.9 million by 2035, registering a CAGR of 5.8%. Germany will remain the largest market, increasing from 22.1% in 2025 to 25.8% in 2035, supported by its packaging machinery industry, precision automation, and food processing sector. The United Kingdom will follow with 19.4% in 2025, declining to 17.2% by 2035, though still benefiting from strong performance in pharmaceutical packaging and food safety applications. France will contribute 9.4% in 2025, easing slightly to 8.8% in 2035, while Italy holds steady at 8.2% to 10.1%, reflecting resilience in its advanced packaging technologies sector.

Spain is forecasted at 11.9% in 2025, rising to 11.6% by 2035, while the Nordic region grows from 10.3% in 2025 to 11.0% in 2035, reflecting strong adoption in automation and quality-focused packaging applications. The BENELUX countries remain stable at 8.2% in 2025 and 8.3% in 2035, while the Rest of Europe will decrease from 19.4% in 2025 to 17.2% in 2035, reflecting slower uptake in smaller Eastern European markets.

The second lid air leakage test machine market is defined by competition among specialized testing equipment manufacturers, packaging machinery providers, and quality control technology companies. Companies are investing in advanced sensor technologies, automated testing capabilities, comprehensive software platforms, and global technical support services to deliver accurate, reliable, and user-friendly leak testing solutions. Strategic partnerships, technological innovation, and regional market expansion are central to strengthening product portfolios and market presence.

Inficon offers comprehensive leak testing solutions with focus on high-precision measurement, advanced sensor technologies, and technical expertise for diverse packaging applications. TMI-Orion provides specialized testing equipment with emphasis on package integrity validation and quality control for pharmaceutical and food packaging sectors. LACO Technologies delivers established testing platforms with proven reliability and extensive industry experience across packaging quality control applications.

WITT-Gasetechnik focuses on gas analysis and leak testing technologies with comprehensive technical support for food packaging and modified atmosphere applications. ZED Industries Inc. provides innovative testing solutions with emphasis on automation and data integration capabilities. Bonfiglioli Engineering, Ateq Leak Testing, PBI-Dansensor (AMETEK MOCON), Oxipack, Steinfurth GmbH, TQC Sheen, Loma Systems, Pamasol Willi Mäder AG, DigiVac, and Baker Perkins offer diverse testing solutions, specialized applications, and technical expertise across global and regional packaging markets.

Second lid air leakage test machines represent critical quality assurance equipment ensuring package integrity and product safety across food and beverage, pharmaceutical, and cosmetic industries, with the global market valued at $627.3 million in 2023 and projected to reach $1,177.5 million by 2030, growing at a 6.5% CAGR. These specialized testing systems, available in offline testing units and inline testing configurations, detect microscopic seal failures and container defects that could compromise product sterility, shelf-life, and consumer safety. Market growth is driven by stringent packaging regulations, increasing consumer safety expectations, expanding ready-to-eat food markets, and advancing pharmaceutical packaging requirements. However, scaling requires coordinated efforts across sensor technology advancement, automation integration, regulatory compliance, and specialized workforce development.

Regulatory Framework Enhancement: Establish mandatory package integrity testing requirements for pharmaceuticals, infant foods, and medical devices while providing technical guidance on appropriate testing methodologies and acceptance criteria. Create fast-track approval pathways for innovative leak detection technologies meeting enhanced safety standards.

Manufacturing Excellence Centers: Develop specialized testing and calibration facilities for package integrity equipment, providing traceable measurement standards and validation services. Offer subsidized access to advanced leak testing equipment for small and medium food processors and pharmaceutical manufacturers.

Research and Development Investment: Fund national research programs focusing on next-generation leak detection technologies including non-destructive testing methods, artificial intelligence integration, and real-time monitoring systems. Support university partnerships developing breakthrough sensor technologies and data analytics platforms.

Industry Standards Development: Collaborate with international standards organizations to harmonize package integrity testing protocols across different product categories and regulatory jurisdictions. Develop standardized training curricula for leak testing technicians and quality assurance professionals.

Food Safety and Pharmaceutical Security: Integrate package integrity requirements into national food safety and pharmaceutical regulatory frameworks, emphasizing the critical role of leak testing in preventing contamination and ensuring product efficacy throughout distribution chains.

Testing Protocol Standardization: Develop comprehensive testing standards for different package types including rigid containers, flexible pouches, and blister packaging across various product applications. Establish standardized leak rate specifications and test methodologies ensuring consistent quality across manufacturers.

Validation and Qualification Guidelines: Create detailed protocols for leak testing equipment validation, including installation qualification (IQ), operational qualification (OQ), and performance qualification (PQ) procedures. Develop guidelines for routine calibration, maintenance schedules, and performance verification programs.

Technology Assessment and Benchmarking: Establish independent testing programs evaluating different leak detection technologies including pressure decay, vacuum decay, tracer gas, and optical methods. Provide comparative performance data helping manufacturers select appropriate testing solutions for specific applications.

Training and Certification Programs: Develop comprehensive certification programs for leak testing operators, maintenance technicians, and quality assurance managers. Create continuing education frameworks keeping professionals current with evolving technologies and regulatory requirements.

Best Practices Documentation: Publish industry guides covering optimal testing parameters, environmental considerations, sample handling procedures, and data interpretation methodologies. Maintain databases of common failure modes and troubleshooting solutions.

Advanced Sensor Technologies: Develop ultra-sensitive leak detection systems capable of detecting microscopic defects at production speeds. Invest in MEMS-based pressure sensors, laser interferometry systems, and advanced tracer gas detection technologies improving sensitivity and reducing false rejection rates.

Automation and Integration Systems: Create fully automated inline testing systems integrating with high-speed production lines and packaging equipment. Develop machine learning algorithms for adaptive testing parameters and predictive maintenance capabilities reducing downtime and optimizing performance.

Multi-Technology Platforms: Design hybrid testing systems combining multiple detection methods including pressure decay, helium leak testing, and optical inspection for comprehensive package integrity assessment. Develop modular platforms enabling customization for specific package formats and testing requirements.

Data Analytics and Connectivity: Implement Industry 4.0 technologies including IoT connectivity, cloud-based data analytics, and real-time monitoring dashboards. Develop statistical process control systems enabling continuous improvement and predictive quality management.

Specialized Application Solutions: Create dedicated testing solutions for emerging package formats including pouches with reclosable features, child-resistant containers, and sustainable packaging materials. Develop testing systems for specialized applications including sterile pharmaceutical packaging and modified atmosphere food packages.

Quality System Integration: Implement leak testing as integral components of comprehensive quality management systems including HACCP, ISO 22000, and pharmaceutical GMPs. Develop risk-based testing protocols prioritizing critical packaging applications and high-risk products.

Statistical Process Control: Establish robust data collection and analysis systems tracking leak testing results, identifying trends, and enabling continuous improvement initiatives. Implement control charts and capability studies optimizing testing parameters and acceptance criteria.

Operator Training and Competency: Develop comprehensive training programs for production operators, quality technicians, and maintenance personnel covering equipment operation, calibration procedures, and troubleshooting techniques. Create competency assessment programs ensuring consistent testing practices.

Preventive Maintenance Programs: Establish systematic maintenance schedules for leak testing equipment including calibration verification, sensor cleaning, and system performance checks. Develop spare parts inventory management and emergency response procedures minimizing production disruptions.

Supplier Qualification and Auditing: Implement rigorous qualification programs for packaging suppliers including leak testing capability assessments and ongoing performance monitoring. Develop supplier scorecards tracking package integrity performance and continuous improvement initiatives.

Technology Innovation Investment: Finance research and development programs advancing leak detection sensitivity, automation capabilities, and integration with smart manufacturing systems. Back startups developing breakthrough technologies including artificial intelligence applications and novel sensor systems.

Manufacturing Capacity Expansion: Provide capital for leak testing equipment manufacturers expanding production capabilities and establishing regional service networks. Structure investments supporting both established companies and emerging technology providers with innovative solutions.

Market Penetration Financing: Fund expansion into emerging markets where food safety regulations and pharmaceutical manufacturing are rapidly developing. Support establishment of regional service centers providing technical support, training, and maintenance services.

Digital Transformation Investment: Back companies developing comprehensive quality management platforms integrating leak testing with other quality assurance processes and manufacturing execution systems. Support development of cloud-based analytics and predictive maintenance solutions.

Acquisition and Consolidation: Finance strategic acquisitions enabling leak testing equipment manufacturers to expand technology portfolios, geographic reach, and customer service capabilities. Support vertical integration initiatives connecting equipment manufacturers with sensor technology companies and software developers.

| Items | Values |

|---|---|

| Quantitative Units | USD 1,177.5 million |

| Machine Type | Offline Testing Units and Inline Testing Systems |

| End-Use Applications | Food and Beverages, Pharmaceuticals, Cosmetics and Personal Care, and Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | INFICON, TMI-Orion, LACO Technologies, WITT-Gasetechnik GmbH, ZED Industries Inc., Bonfiglioli Engineering, ATEQ Leak Testing, PBI-Dansensor (AMETEK MOCON), Oxipack, Steinfurth GmbH, TQC Sheen, Loma Systems, Pamasol Willi Mäder AG, DigiVac, Baker Perkins |

| Additional Attributes | Dollar sales by machine type, end-use application, and testing technology, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established equipment manufacturers and emerging technology providers, buyer preferences for offline versus inline testing approaches, integration with packaging line automation and quality management systems, innovations in sensor technologies and data analytics for enhanced detection capabilities |

The global second lid air leakage test machine market is estimated to be valued at USD 627.3 million in 2025.

The market size for the second lid air leakage test machine market is projected to reach USD 1,177.5 million by 2035.

The second lid air leakage test machine market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in second lid air leakage test machine market are offline testing units and inline testing systems.

In terms of application, food and beverages segment to command 35.0% share in the second lid air leakage test machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Second-Life Battery Storage Systems Market Size and Share Forecast Outlook 2025 to 2035

Second-hand Apparel Market in Europe Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Secondary Alkane Sulfonate Market Size and Share Forecast Outlook 2025 to 2035

Secondary Smelting and Alloying of Aluminium Market Size and Share Forecast Outlook 2025 to 2035

Secondary Myelofibrosis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Second-Hand Fashion Market Size and Share Forecast Outlook 2025 to 2035

Secondhand Apparel Market Analysis - Size, Share, and Forecast 2025 to 2035

Second-hand Homeware Market Size and Share Forecast Outlook 2025 to 2035

Secondary Containment Trays Market Size and Share Forecast Outlook 2025 to 2035

Secondhand Goods Industry Analysis in Europe - Size, Share, and Forecast Outlook 2025 to 2035

Second-Hand Bag Market Trends – Growth & Forecast 2025 to 2035

Second Hand Designer Shoes Market Trends – Growth & Forecast to 2035

Competitive Overview of Secondhand Apparel Market Share

Second Lid Heat Sealing Machine Market Size and Share Forecast Outlook 2025 to 2035

GCC Secondhand Apparel Market Growth, Trends and Forecast from 2025 to 2035

Femtosecond Optical Parametric Oscillator Market Forecast and Outlook 2025 to 2035

Agricultural Secondary Nutrients Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Secondhand Goods Market Growth, Trends and Forecast from 2025 to 2035

USA & Canada Secondhand Apparel Market Growth, Trends and Forecast from 2025 to 2035

Pharmaceutical Secondary Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA