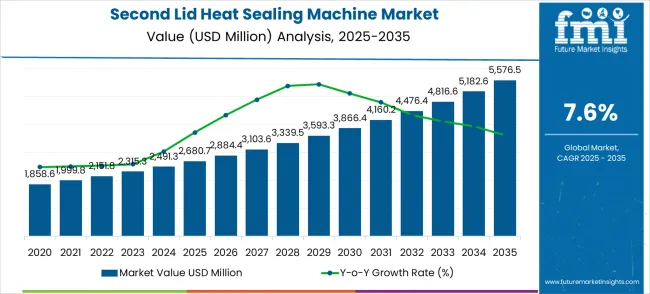

The second lid heat sealing machine market is poised for significant growth, projected to expand from USD 2,680.7 million in 2025 to USD 5,576.5 million by 2035, reflecting a compound annual growth rate (CAGR) of 7.6%. This upward trend is indicative of a growing demand for reliable and efficient sealing solutions across a range of industries. The market’s expansion is largely driven by the increasing emphasis on packaging integrity and product safety, particularly in the food and beverage, pharmaceuticals, and consumer goods industries. With growing consumer demand for high-quality, well-sealed packaging, manufacturers are investing in heat sealing machines that ensure optimal protection against leakage, contamination, and spoilage. Over the next decade, the market will continue to experience a gradual but steady increase in demand, as companies look to streamline their operations and meet regulatory standards for packaging.

In addition to improving product protection, the rise in demand for second lid heat sealing machines is also attributed to the growing focus on operational efficiency. These machines are integral in providing faster and more accurate sealing, reducing waste, and enhancing overall production efficiency. With heightened focus on safety, regulations around packaging standards are expected to become more stringent, particularly in sectors where hygiene and contamination are critical, such as pharmaceuticals and food. The second lid heat sealing machine market is thus forecast to experience a steady increase in adoption, driven by the need for advanced machinery that can meet the rigorous demands of modern manufacturing processes. The demand for such machinery is anticipated to grow, supported by an expanding global market for packaged goods.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 2,680.7 million |

| Forecast Value in (2035F) | USD 5,576.5 million |

| Forecast CAGR (2025 to 2035) | 7.6% |

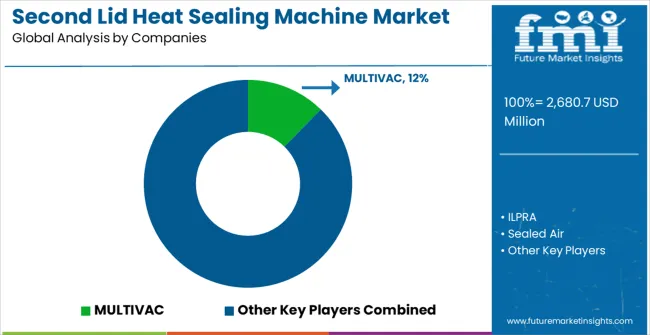

The second lid heat sealing machine market holds a notable share in the packaging machinery sector, contributing around 12% of the overall market. Within the food packaging market, the share is approximately 8%, as these machines are essential for sealing packaged food products. The pharmaceutical packaging market benefits from a 5% share due to its critical role in the integrity of pharmaceutical product seals. In the consumer goods packaging market, the second lid heat sealing machine market occupies around 7%, owing to its use in sealing non-food items. Finally, in the industrial sealing equipment market, the share is estimated to be 10%, where these machines are used for both product safety and production efficiency. The varied applications across these parent markets highlight the machine's importance in several industries.

The second lid heat sealing machine market is poised for substantial growth, projected to expand from USD 2.68 billion in 2025 to USD 5.58 billion by 2035 at a CAGR of 7.6%, driven by rising automation demand, packaging efficiency, and sector-specific regulatory requirements. By 2035, these pathways collectively represent USD 3.0–4.2 billion in incremental revenue opportunities.

Pathway A – Food & Beverage Automation. Manual and semi-automatic machines are widely adopted in food and beverage packaging lines for enhanced sealing efficiency and contamination prevention, unlocking USD 0.8–1.2 billion in near-term revenue.

Pathway B – Pharmaceutical Compliance & Safety. Semi-automatic and fully automatic sealers support stringent regulatory standards in pharmaceutical packaging, ensuring product integrity and reducing errors, representing a potential USD 0.7–1.0 billion opportunity.

Pathway C – Cosmetics & Personal Care. Fully automatic machines enable high-speed packaging of creams, lotions, and gels while maintaining product aesthetics and quality, creating an incremental revenue pool of USD 0.5–0.8 billion.

Pathway D – Emerging Market Adoption. Growing packaged goods demand in Asia, Latin America, and Africa drives the need for cost-effective and reliable sealing solutions, accounting for USD 0.4–0.7 billion.

Pathway E – High-Speed Automation & Line Integration. Large-scale production facilities are increasingly deploying fully automatic sealers integrated with conveyor systems and IoT-enabled monitoring, offering USD 0.3–0.5 billion in revenue potential.

Pathway F – OEM & Turnkey Solutions. Customized sealing systems for food, pharma, and cosmetics manufacturers seeking turnkey or line-specific solutions are projected to contribute USD 0.2–0.4 billion.

Pathway G – Technology Upgrades. Smart sensors, predictive maintenance, and automation software integration enhance efficiency and reduce downtime, creating USD 0.1–0.3 billion in additional revenue.

Pathway H – Sustainability & Energy Efficiency. Energy-efficient and low-emission sealing machines, aligned with sustainability goals, represent a smaller but emerging pool of USD 0.1–0.2 billion.

Market expansion is being supported by the rapid increase in packaged food and pharmaceutical products worldwide and the corresponding need for specialized sealing machines that ensure tamper-proof packaging. Modern manufacturing facilities rely on precise heat sealing and temperature control to ensure proper functioning of packaging systems including automatic lidding, container sealing, and tamper-evident closure applications. Even minor adjustments or equipment upgrades can require comprehensive recalibration to maintain optimal system performance and packaging integrity.

The growing complexity of packaging technologies and increasing liability concerns are driving demand for professional sealing machines from certified manufacturers with appropriate certifications and expertise. Regulatory agencies are increasingly requiring proper sealing documentation following production runs to maintain compliance and ensure product safety standards. Manufacturing specifications and quality control requirements are establishing standardized sealing procedures that require specialized tools and trained operators.

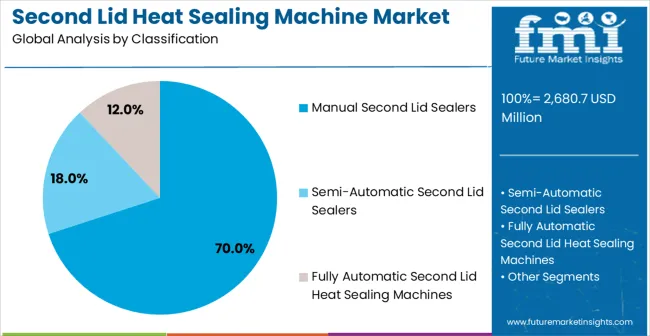

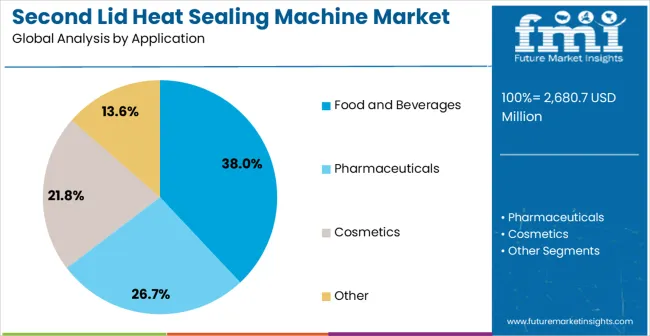

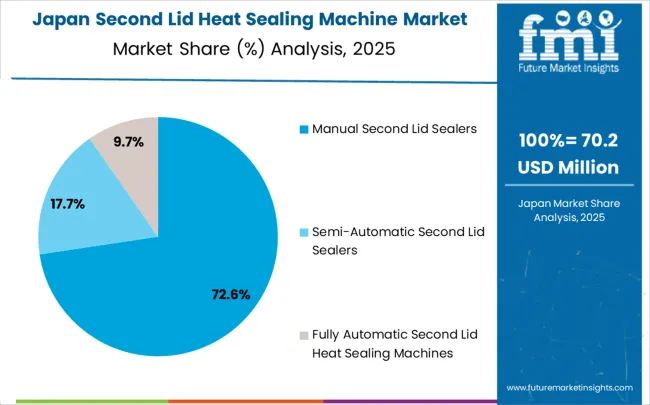

The market is segmented by machine type, end-use, and region. Manual second lid sealers are expected to hold 70% of the market in 2025, driven by their cost-effectiveness and flexibility for small to medium-scale packaging operations. The food and beverages segment is projected to capture 38% market share, fueled by growing demand for efficient sealing solutions that ensure product freshness and safety. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Manual second lid sealers are expected to account for 70% of the second lid heat sealing machine market in 2025, primarily driven by their widespread adoption in small to medium-scale packaging operations. These systems offer cost-effective, operator-controlled processes and flexible production environments, making them the preferred choice for custom packaging and specialty products. Manual sealers are particularly favored by small-scale food processors, pharmaceutical compounding facilities, and specialty cosmetics manufacturers due to their ability to adjust sealing parameters like temperature, pressure, and dwell time. This flexibility allows for precise control over sealing, ideal for batch production and product testing. The segment benefits from established manufacturing procedures and extensive equipment availability from multiple suppliers, making manual systems an optimal solution for cost-conscious environments requiring precise control and adaptability.

The food and beverages segment is projected to account for 38% of the second lid heat sealing machine market in 2025, securing its position as the leading application. This significant market share is driven by the increasing demand for efficient and reliable sealing technologies in the food packaging industry. Heat sealing machines play a crucial role in ensuring product freshness, safety, and extended shelf life, especially in the food and beverage sector where packaging integrity is essential. The segment’s dominance is supported by the ongoing growth of the packaged food industry and the continuous innovation in packaging solutions to meet evolving consumer demands. As food safety regulations become stricter and demand for sealed packaging increases, the food and beverages segment is expected to maintain its leadership in the market.

The second lid heat sealing machine market is witnessing steady growth, driven by increasing demand for reliable, efficient sealing solutions in the packaging industry. These machines are critical in ensuring airtight seals for products in food, pharmaceuticals, and cosmetics. Opportunities are emerging due to rising consumer expectations for packaging quality and growing industrial automation. However, challenges like high machinery costs, integration complexities, and maintenance issues may limit their adoption, particularly in cost-sensitive regions and small businesses.

A key trend in the second lid heat sealing machine market is the growing demand for customizable and high-performance machines. In opinion, manufacturers are increasingly focused on offering sealing machines with customizable settings to meet specific packaging requirements, such as varying product sizes or types of packaging material. Additionally, machines with enhanced capabilities like adjustable temperature controls and faster sealing speeds are becoming more popular. These trends reflect the industry's need for versatile solutions that can adapt to different packaging needs while ensuring quality, consistency, and efficiency in high-volume environments.

The second lid heat sealing machine market faces challenges primarily related to high initial costs and maintenance complexities. In opinion, the advanced technology required for high-quality heat sealing machines often results in significant upfront costs, making them less accessible to small or cost-conscious businesses. Furthermore, the machines require regular maintenance and skilled operators to ensure their optimal performance, which can increase operational costs. Manufacturers need to focus on developing cost-effective, easy-to-maintain solutions without compromising on the quality and performance required by industries relying on these machines for their critical packaging needs.

| Country | CAGR (2025-2035) |

|---|---|

| China | 10.3% |

| India | 9.5% |

| Germany | 8.7% |

| Brazil | 8.0% |

| United States | 7.2% |

| United Kingdom | 6.5% |

| Japan | 5.7% |

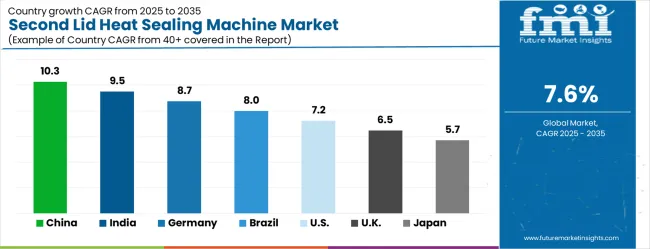

The second lid heat sealing machine market is growing rapidly, with China leading at a 10.3% CAGR through 2035, driven by strong manufacturing expansion, automation adoption, and expanding packaging networks. India follows at 9.5%, supported by rising industrial automation in manufacturing and food processing sectors and increasing certified equipment availability. Germany grows steadily at 8.7%, emphasizing precision engineering, quality standards, and advanced manufacturing expertise. Brazil records 8.0%, integrating sealing technology into its established manufacturing industry. The United States shows growth at 7.2%, focusing on technology advancement, standardization, and regulatory compliance. The United Kingdom demonstrates consistent growth at 6.5%, supported by pharmaceutical and food packaging modernization. Japan maintains steady expansion at 5.7%, driven by precision manufacturing and quality control requirements. Overall, China and India emerge as the leading drivers of global Second Lid Heat Sealing Machine market expansion.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

The second lid heat sealing machine market in China is growing at a CAGR of 10.3%, supported by the country's rapidly expanding packaging industry. As China continues to be a manufacturing hub, the demand for high-efficiency sealing machines is increasing, especially in food, pharmaceutical, and consumer goods packaging. China's focus on enhancing product quality, meeting international packaging standards, and improving production efficiency boosts market expansion. The country’s government policies encouraging industrial automation and advanced manufacturing technologies also contribute to the market’s growth.

The second lid heat sealing machine market in India is projected to grow at a CAGR of 9.5%, driven by the country’s booming packaging industry. India’s food and beverage sector, along with pharmaceuticals and consumer goods, is experiencing rapid growth, leading to an increasing demand for efficient heat sealing technologies. The market is further fueled by rising automation in the manufacturing sector and investments in improving packaging standards to ensure better product protection and consumer safety.

The second lid heat sealing machine market in Germany is expected to grow at a CAGR of 8.7%, supported by the country’s advanced manufacturing sector and high-quality packaging requirements. Germany’s strong industrial base, particularly in automotive, food, and pharmaceuticals, is a key driver of demand for heat sealing machines. With increasing emphasis on product integrity and efficiency in packaging, German manufacturers are increasingly investing in automation and advanced sealing technologies to meet regulatory standards.

The second lid heat sealing machine market in Brazil is projected to grow at a CAGR of 8.0%, fueled by the growing demand for packaging solutions in the food and beverage, pharmaceutical, and consumer goods sectors. Brazil’s expanding manufacturing industry and increasing investments in modern packaging technologies are propelling the market forward. The rise in domestic consumption, along with increasing exports, drives the demand for advanced heat sealing machinery to ensure product integrity and compliance with international standards.

The second lid heat sealing machine market in the United States is growing at a CAGR of 7.2%, driven by the rising demand for packaging solutions across various industries, including food, pharmaceuticals, and healthcare. USA manufacturers are increasingly adopting heat sealing technologies to improve packaging efficiency and ensure product integrity. Regulatory compliance and the growing focus on sustainable packaging solutions further support market growth, as industries seek to reduce costs and enhance product quality.

The second lid heat sealing machine market in the United Kingdom is projected to grow at a CAGR of 6.5%, supported by the country's growing demand for packaging solutions in food, beverage, and pharmaceutical industries. As the UK embraces automation and advanced packaging technologies, the adoption of heat sealing machines increases. The market benefits from government regulations aimed at improving product quality and packaging standards, along with the rising need for packaging machinery that ensures precise sealing and product protection.

The second lid heat sealing machine market in Japan is expected to grow at a CAGR of 5.7%, driven by the country’s focus on technological advancements in manufacturing and packaging. Japan’s high demand for precision packaging solutions, especially in food, pharmaceuticals, and electronics, continues to fuel market growth. The adoption of heat sealing machines is further accelerated by Japan's emphasis on automation, quality control, and meeting international packaging standards.

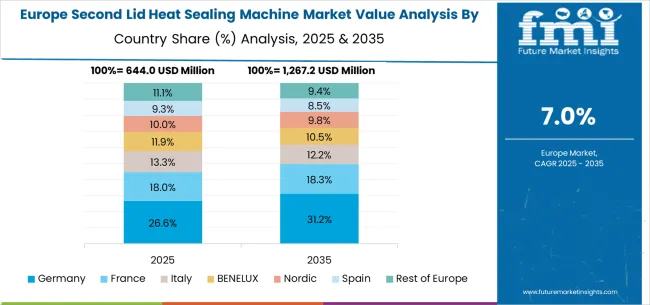

The second lid heat sealing machine market in Europe is projected to grow from USD 644.0 million in 2025 to USD 1,267.2 million by 2035, at a CAGR of 7.0%. Germany will lead with 26.6% in 2025, rising to 31.2% by 2035, supported by its expansive packaging machinery ecosystem and advanced sealing technology infrastructure. The United Kingdom will remain strong at 19.4% in 2025, slightly easing to 17.2% by 2035, reflecting steady growth in pharmaceutical and food packaging applications. France will contribute 9.3% in 2025, stabilizing at 8.8% by 2035, while Italy increases from 10.0% to 10.5%, reflecting resilient adoption in industrial packaging.

Spain grows from 11.9% in 2025 to 12.6% in 2035, supported by regional automation adoption, while Nordic countries improve from 11.8% to 12.5%, reflecting advanced packaging and quality-control adoption. BENELUX stabilizes around 10.0% to 9.8%, while the Rest of Europe declines from 11.1% in 2025 to 9.4% in 2035, reflecting slower adoption compared to Western Europe.

The second lid heat sealing machine market is defined by competition among specialized equipment manufacturers, packaging technology companies, and industrial automation providers. Companies are investing in advanced sealing technologies, automated system capabilities, standardized procedures, and operator training to deliver precise, reliable, and cost-effective sealing solutions. Strategic partnerships, technological innovation, and geographic expansion are central to strengthening equipment portfolios and market presence.

MULTIVAC, Germany-based, offers comprehensive heat sealing solutions with a focus on precision, automation, and technical expertise. ILPRA, operating globally, provides specialized sealing equipment integrated with packaging system technologies. Sealed Air, United States, delivers technologically advanced sealing solutions with standardized procedures and system integration. Ishida, Japan, emphasizes precision engineering and quality control for packaging applications.

G Mondini, Italy, offers sealing solutions integrated into comprehensive packaging operations. PACK LINE Ltd., provides automated sealing systems with technical support. IMA Group delivers sealing equipment alongside pharmaceutical packaging solutions. Ulma Packaging, ReePack, and Proseal (JBT Corporation) offer specialized sealing expertise, standardized procedures, and equipment reliability across global and regional networks.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 2,680.7 million |

| Machine Type | Manual Second Lid Sealers, Semi-Automatic Second Lid Sealers, Fully Automatic Second Lid Heat Sealing Machines, and Others |

| End-use Industry | Food and Beverages, Pharmaceuticals, Cosmetics, and Other Applications |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | MULTIVAC, ILPRA, Ishida, G Mondini, PACK LINE Ltd., IMA Group, Ulma Packaging, ReePack, Proseal (JBT Corporation), Syntegon, Nantong Tongji Co., Ltd., Hualian Machinery Group, Nantong Wintech Packaging Machinery |

| Additional Attributes | Dollar sales by machine type, end-use industry, and automation level, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established manufacturers and emerging technology providers, buyer preferences for automated versus manual systems, integration with digital manufacturing platforms |

The global second lid heat sealing machine market is estimated to be valued at USD 2,680.7 million in 2025.

The market size for the second lid heat sealing machine market is projected to reach USD 5,576.5 million by 2035.

The second lid heat sealing machine market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in second lid heat sealing machine market are manual second lid sealers, semi-automatic second lid sealers and fully automatic second lid heat sealing machines.

In terms of application, food and beverages segment to command 38.0% share in the second lid heat sealing machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Second-Life Battery Storage Systems Market Size and Share Forecast Outlook 2025 to 2035

Second-hand Apparel Market in Europe Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Secondary Alkane Sulfonate Market Size and Share Forecast Outlook 2025 to 2035

Secondary Smelting and Alloying of Aluminium Market Size and Share Forecast Outlook 2025 to 2035

Secondary Myelofibrosis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Second-Hand Fashion Market Size and Share Forecast Outlook 2025 to 2035

Secondhand Apparel Market Analysis - Size, Share, and Forecast 2025 to 2035

Second-hand Homeware Market Size and Share Forecast Outlook 2025 to 2035

Secondary Containment Trays Market Size and Share Forecast Outlook 2025 to 2035

Secondhand Goods Industry Analysis in Europe - Size, Share, and Forecast Outlook 2025 to 2035

Second-Hand Bag Market Trends – Growth & Forecast 2025 to 2035

Second Hand Designer Shoes Market Trends – Growth & Forecast to 2035

Competitive Overview of Secondhand Apparel Market Share

Second Lid Air Leakage Test Machine Market Size and Share Forecast Outlook 2025 to 2035

GCC Secondhand Apparel Market Growth, Trends and Forecast from 2025 to 2035

Femtosecond Optical Parametric Oscillator Market Forecast and Outlook 2025 to 2035

Agricultural Secondary Nutrients Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Secondhand Goods Market Growth, Trends and Forecast from 2025 to 2035

USA & Canada Secondhand Apparel Market Growth, Trends and Forecast from 2025 to 2035

Pharmaceutical Secondary Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA