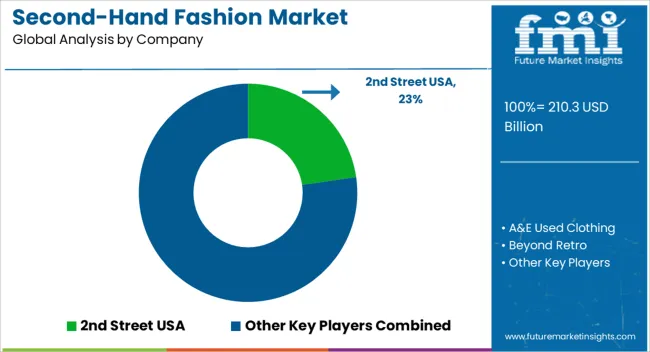

The Second-Hand Fashion Market is estimated to be valued at USD 210.3 billion in 2025 and is projected to reach USD 581.3 billion by 2035, registering a compound annual growth rate (CAGR) of 10.7% over the forecast period. Asia Pacific is emerging as a high-growth region due to rising digital adoption, expanding e-commerce platforms, and increasing consumer receptivity toward resale and sustainable fashion.

The market trajectory in the Asia-Pacific region is likely to outpace that of other regions, driven by younger, tech-savvy demographics and the increasing penetration of mobile marketplaces facilitating second-hand apparel transactions.

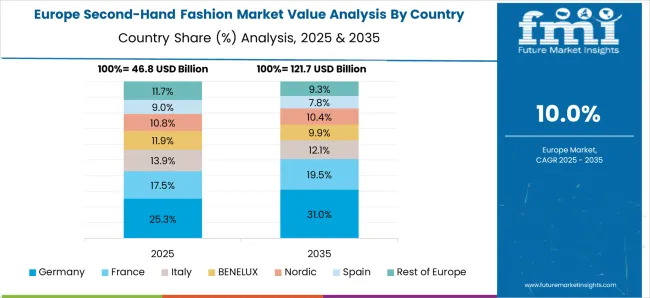

Europe, historically a mature market, continues to demonstrate steady growth with a strong culture of sustainable consumption and well-established resale infrastructure. Regulatory frameworks promoting circular fashion and incentivizing second-hand retail further reinforce market penetration, although overall growth rates are comparatively moderate due to market saturation in key Western European countries.

North America, while witnessing significant adoption of resale fashion, exhibits a balanced but slower growth trend compared to the Asia-Pacific region, reflecting mature retail structures and competitive dynamics that moderate rapid expansion. This regional imbalance indicates that strategic investments in digital platforms, localized supply chains, and consumer engagement in Asia-Pacific will be critical for capturing market share.

The Europe and North America are expected to prioritize operational efficiency, regulatory compliance, and brand differentiation. The market’s uneven regional development underscores the necessity for tailored strategies to exploit growth opportunities while navigating maturity-related constraints across continents.

| Metric | Value |

|---|---|

| Second-Hand Fashion Market Estimated Value in (2025 E) | USD 210.3 billion |

| Second-Hand Fashion Market Forecast Value in (2035 F) | USD 581.3 billion |

| Forecast CAGR (2025 to 2035) | 10.7% |

The second hand fashion market is experiencing rapid expansion fueled by increased environmental awareness, changing consumer attitudes toward sustainable consumption, and the rise of digital resale platforms. Consumers are increasingly valuing circular fashion models that reduce textile waste and offer affordability without compromising on style.

The shift is further supported by fashion retailers integrating resale initiatives into their business models to align with sustainability goals and attract environmentally conscious shoppers. Technological advancements in authentication, logistics, and platform user experience have made second hand shopping more accessible and trustworthy.

Social media influence and evolving fashion trends are also contributing to the normalization of second hand apparel across various consumer demographics. The market outlook remains strong as more consumers prioritize value, individuality, and environmental impact in their fashion choices.

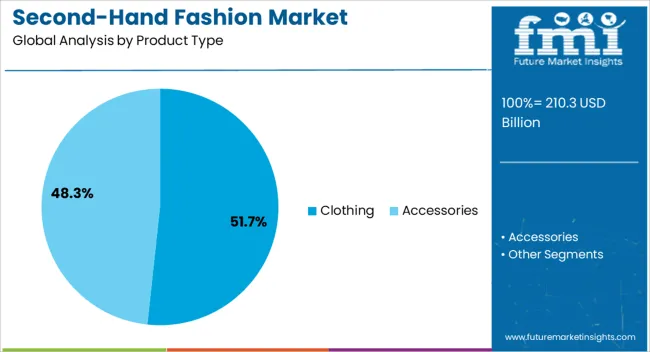

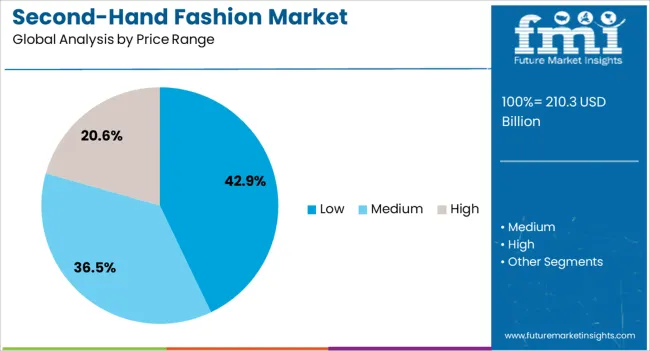

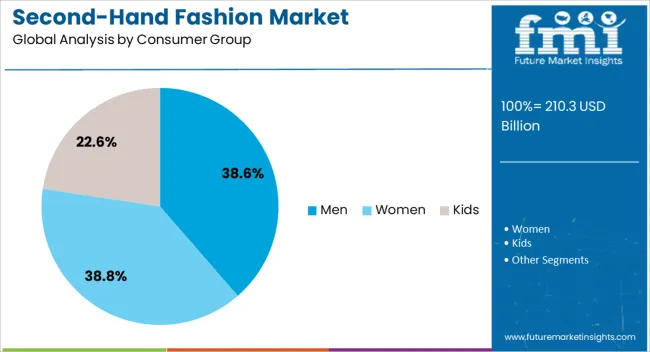

The second-hand fashion market is segmented by product type, price range, consumer group, distribution channel, and geographic regions. By product type, the second-hand fashion market is divided into Clothing and Accessories. In terms of price range, the second-hand fashion market is classified into Low, Medium, and High. Based on consumer group, the second-hand fashion market is segmented into Men, Women, and Kids.

By distribution channel, the second-hand fashion market is segmented into Online and Offline. Regionally, the second-hand fashion industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The clothing segment is expected to contribute 51.70% of total market revenue by 2025 within the product type category, making it the leading segment. This dominance is driven by the vast volume of apparel available in the second-hand ecosystem and the rapid turnover of clothing trends among fashion consumers.

The low entry cost, combined with high demand for branded and vintage apparel, has reinforced clothing as the primary driver of resale growth. Clothing also offers high repeat purchase potential and is easily listed, shipped, and authenticated on online resale platforms.

With fashion influencers promoting thrifted outfits and conscious fashion gaining popularity, the clothing segment continues to lead within the second hand fashion market.

The low price range segment is projected to hold 42.90% of the overall market revenue by 2025, highlighting strong consumer interest in affordability and accessible fashion. This segment appeals to cost-sensitive buyers looking for value-driven alternatives to fast fashion without compromising on quality or style.

Increased economic pressures and inflationary trends have also pushed consumers to seek budget-friendly fashion choices. Additionally, resale platforms often use competitive pricing strategies in this segment to drive volume and customer acquisition.

As more consumers embrace financially sustainable purchasing habits, the low price range is expected to remain the most active tier in the second-hand fashion landscape.

The men consumer group segment is forecasted to represent 38.60% of total revenue by 2025, reflecting rising participation of male shoppers in the resale fashion economy. Historically underrepresented in fashion resale, male consumers are now engaging more due to improved curation, targeted marketing, and availability of premium and streetwear brands on second hand platforms.

The rise of minimalist and utility-focused fashion trends has also influenced male consumer interest in buying versatile and durable pre-owned clothing.

As resale platforms continue to diversify their offerings and user experience to cater to male audiences, this consumer group is gaining prominence and contributing significantly to market growth.

The market has been expanding due to increasing consumer interest in affordable, sustainable, and unique apparel options. The growth of online resale platforms, thrift stores, and peer-to-peer marketplaces has influenced demand. Market expansion has been reinforced by trends in circular fashion, the digitalization of resale channels, and a growing awareness of the environmental impact caused by fast fashion. Pre-owned clothing, accessories, and footwear have been valued for cost-effectiveness, quality, and exclusivity. Technological innovations in authentication, logistics, and online payment systems have further bolstered global market growth.

The second-hand fashion market has been primarily driven by the proliferation of online resale platforms, mobile applications, and e-commerce marketplaces. Pre-owned apparel and accessories have been sold through specialized platforms, social media channels, and peer-to-peer networks, allowing consumers to access a wider range of brands and styles. Convenience, affordability, and the ability to sell unused items have enhanced consumer engagement. Platforms have incorporated authentication services, quality grading, and secure payment systems to build trust and increase transaction volume. Additionally, marketing campaigns emphasizing sustainable fashion and circular consumption have encouraged consumers to participate in resale activities. This digital shift has expanded the reach of second-hand fashion, attracting urban and tech-savvy buyers worldwide.

Environmental concerns have significantly influenced the second-hand fashion market, positioning it as a key component of circular economy initiatives. Pre-owned clothing has been recognized for reducing textile waste, minimizing carbon footprint, and extending the life cycle of garments. Consumers and brands have increasingly adopted sustainable practices by buying and selling second-hand items, recycling materials, and promoting ethical production. Corporations have launched resale programs and collaborations to enhance sustainability credentials. Government and non-government campaigns promoting eco-friendly fashion consumption have helped drive market adoption. These factors have contributed to growing awareness of environmental responsibility, encouraging consumers to choose pre-owned fashion alternatives while reducing reliance on resource-intensive new clothing production.

Technological innovations have strengthened the second-hand fashion market by enhancing product verification, inventory management, and logistics efficiency. Artificial intelligence, image recognition, and blockchain solutions have been applied to authenticate brand products, prevent counterfeiting, and improve consumer confidence. Mobile applications and integrated platforms have streamlined inventory listing, order processing, and shipping, enabling faster and more reliable transactions. Advanced packaging and reverse logistics solutions have ensured safe transportation and easy returns for pre-owned items. Data analytics has been leveraged to understand consumer preferences, optimize pricing, and forecast demand. These technological improvements have enhanced the overall buying and selling experience, increased market transparency, and facilitated global expansion of second-hand fashion platforms.

Despite growth, the second-hand fashion market has faced challenges related to quality assurance, consumer perception, and pricing volatility. Concerns regarding hygiene, wear-and-tear, and authenticity have influenced purchase decisions, particularly for high-end brands. Fragmented resale channels and inconsistent grading standards have occasionally reduced consumer confidence. Price fluctuations for limited-edition or premium items have complicated valuation and transaction processes. The logistics and return management costs have affected platform profitability. Market participants have responded by implementing strict quality checks, standardized grading systems, and insurance or certification programs to enhance trust. Continuous consumer education and technology-driven verification processes have been employed to overcome perception barriers and ensure sustainable market growth.

| Countries | CAGR |

|---|---|

| China | 14.4% |

| India | 13.4% |

| Germany | 12.3% |

| France | 11.2% |

| UK | 10.2% |

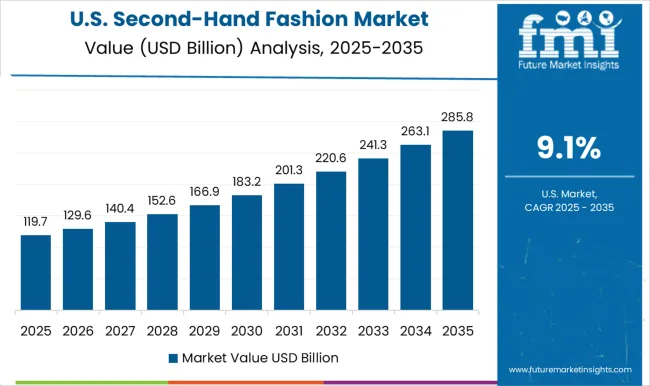

| USA | 9.1% |

| Brazil | 8.0% |

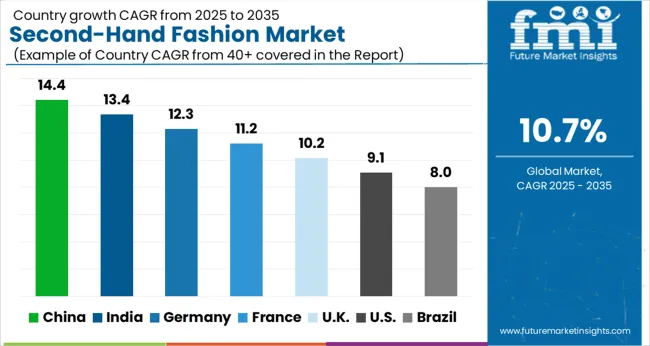

The market is expected to grow at a CAGR of 10.7% from 2025 to 2035, driven by increasing consumer awareness of sustainable fashion, digital resale platforms, and growing demand for affordable apparel. China leads with a 14.4% CAGR, fueled by e-commerce platforms and rising interest in sustainable clothing. India follows at 13.4%, supported by expanding online marketplaces and changing consumer preferences. Germany, at 12.3%, benefits from established thrift culture and circular economy initiatives. The UK, growing at 10.2%, focuses on online resale and vintage fashion adoption, while the USA, at 9.1%, sees steady growth from second-hand retail chains and sustainable fashion trends. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 14.4%, driven by rising consumer interest in affordable and sustainable fashion alternatives. Online resale platforms and social commerce are expanding rapidly, enhancing market penetration. Adoption is also fueled by younger demographics seeking trendy, eco-conscious clothing options. Retailers are investing in authentication technologies and digital marketplaces to improve consumer trust and shopping convenience. Influencer marketing and partnerships with logistics providers are further supporting growth, while second-hand fashion events and pop-up stores increase visibility.

India is expected to expand at a CAGR of 13.4%, supported by increasing awareness of circular fashion and affordability concerns. E-commerce platforms specializing in pre-owned clothing are witnessing accelerated adoption. Local thrift stores and curated online marketplaces are enhancing accessibility, while collaborations with social media influencers promote trend-driven purchases. Rising interest in vintage and branded apparel contributes to market expansion. Logistics and payment innovations are also facilitating smoother transactions, further driving market growth.

Germany is forecasted to grow at a CAGR of 12.3%, supported by eco-conscious consumer behavior and established second-hand networks. Online marketplaces, thrift shops, and swap initiatives are expanding penetration. Demand is driven by sustainable fashion awareness and government-backed initiatives promoting circular economy practices. Market players are introducing quality verification services and resale loyalty programs to increase trust and repeat purchases. Retailers and fashion brands are exploring resale integration to enhance brand value and reach younger audiences.

The United Kingdom is projected to grow at a CAGR of 10.2%, influenced by strong demand for sustainable fashion and cost-effective alternatives. E-commerce resale platforms and consignment stores are leading market adoption. Trend-driven purchases are supported by social media campaigns and digital fashion communities. Retailers are focusing on authentication, quality control, and premium resale offerings to enhance consumer confidence. Collaborations with influencers and charitable organizations further improve market visibility and penetration.

The United States is forecasted to grow at a CAGR of 9.1%, driven by increasing consumer interest in circular fashion and cost-saving trends. Online resale marketplaces and peer-to-peer apps are accelerating adoption. Vintage and branded clothing are in high demand among millennials and Gen Z consumers. Retailers are investing in authentication technologies, logistics solutions, and marketing campaigns to boost trust and sales. Market growth is further enhanced by collaborations with fashion events, pop-up stores, and influencer campaigns.

The market has witnessed significant growth as consumer preferences shift toward sustainable and affordable apparel. Major players such as ThredUp, Poshmark, and The RealReal have established strong online platforms, enabling users to buy and sell pre-owned clothing with ease. These companies leverage technology to provide seamless transaction experiences, authentication of branded products, and curated collections to meet diverse consumer tastes. eBay, StockX, and Vinted offer extensive marketplaces that connect buyers and sellers globally, catering to both luxury and everyday fashion segments.

Companies like Beyond Retro, Buffalo Exchange, and 2nd Street USA focus on brick-and-mortar retail experiences while integrating digital channels to expand reach. Goodfair and GoodwillFinds emphasize social impact, combining fashion resale with charitable initiatives. Grailed and Vestiaire specialize in high-end streetwear and luxury apparel, providing authentication and quality assurance to enhance consumer trust.

The market growth is driven by increasing awareness of environmental sustainability, economic considerations, and the rising popularity of unique and vintage fashion. Innovation in mobile apps, AI-powered recommendations, and logistics solutions allows these providers to improve accessibility, convenience, and user engagement. Collectively, these leading companies are shaping the second-hand fashion market, offering diverse choices, enhanced trust, and a sustainable alternative to traditional retail.

| Item | Value |

|---|---|

| Quantitative Units | USD 210.3 Billion |

| Product Type | Clothing and Accessories |

| Price Range | Low, Medium, and High |

| Consumer Group | Men, Women, and Kids |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 2nd Street USA, A&E Used Clothing, Beyond Retro, Buffalo Exchange, Chikatex, eBay, GoodwillFinds eCommerce, Goodfair, Grailed, Poshmark, StockX, ThredUp, The RealReal, Vestiaire, and Vinted |

| Additional Attributes | Dollar sales by product type and consumer segment, demand dynamics across online and offline resale channels, regional trends in sustainable fashion adoption, innovation in authentication and resale platforms, environmental impact of textile waste reduction, and emerging use cases in circular fashion and luxury pre-owned markets. |

The global second-hand fashion market is estimated to be valued at USD 210.3 billion in 2025.

The market size for the second-hand fashion market is projected to reach USD 581.3 billion by 2035.

The second-hand fashion market is expected to grow at a 10.7% CAGR between 2025 and 2035.

The key product types in second-hand fashion market are clothing, _top wear, _bottom wear, accessories, _bags and purses, _shoes, _jewelry and _other accessories.

In terms of price range, low segment to command 42.9% share in the second-hand fashion market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fashion Accessories Packaging Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Fashion Accessories Packaging Companies

Global Fashion Bag Market Analysis – Growth & Forecast 2024-2034

Secondhand Apparel Market Analysis - Size, Share, and Forecast 2025 to 2035

Secondhand Goods Industry Analysis in Europe - Size, Share, and Forecast Outlook 2025 to 2035

Asia Pacific Secondhand Goods Market Growth, Trends and Forecast from 2025 to 2035

USA & Canada Secondhand Apparel Market Growth, Trends and Forecast from 2025 to 2035

GCC Secondhand Apparel Market Growth, Trends and Forecast from 2025 to 2035

Competitive Overview of Secondhand Apparel Market Share

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA