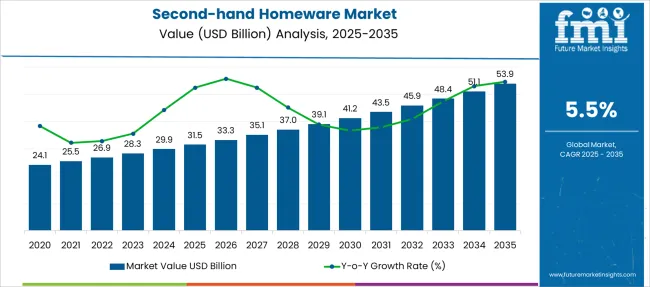

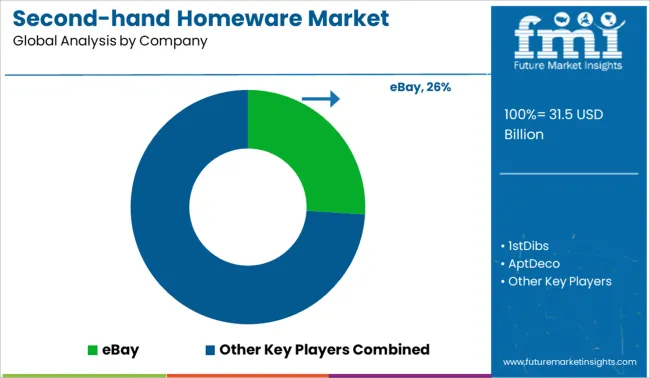

The Second-hand Homeware Market is estimated to be valued at USD 31.5 billion in 2025 and is projected to reach USD 53.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| Second-hand Homeware Market Estimated Value in (2025E) | USD 31.5 billion |

| Second-hand Homeware Market Forecast Value in (2035F) | USD 53.9 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The second-hand homeware market is witnessing a significant rise in adoption as sustainability consciousness, affordability, and circular economy practices gain momentum among consumers and businesses alike. Growing preference for reusing and upcycling homeware items has been observed, driven by rising costs of new products and greater environmental awareness.

The market is being shaped by organized retail platforms and peer-to-peer marketplaces, which have improved accessibility, transparency, and quality assurance for pre-owned homeware. Enhanced consumer acceptance and willingness to buy used items, especially in urban areas, are reinforcing the growth trajectory.

Future opportunities are expected to arise from the digitalization of resale channels, increased standardization of quality grading, and wider participation by mainstream retailers. Evolving lifestyle trends and regulatory support for reuse initiatives are paving the way for sustained expansion of the market across diverse demographic groups.

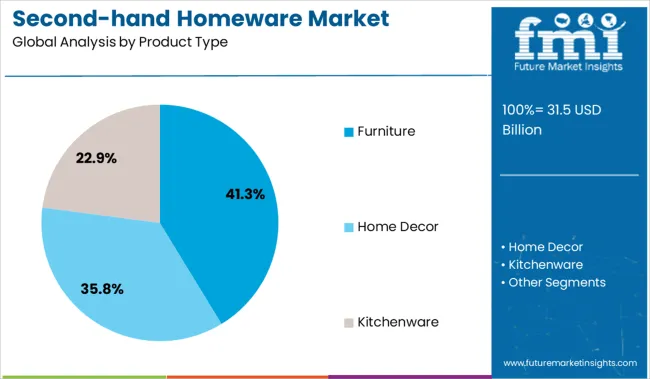

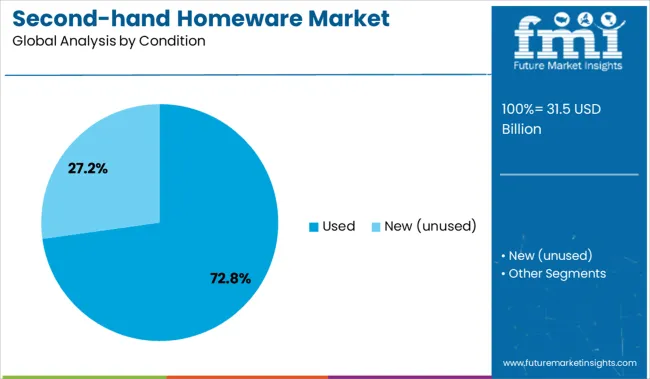

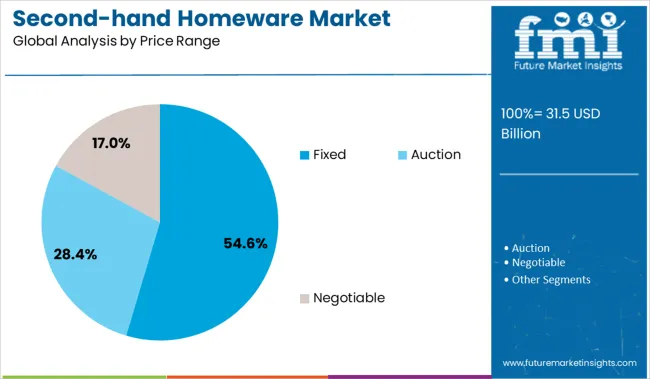

The second-hand homeware market is segmented by product type, condition, price range, and distribution channel and geographic regions. By product type of the second-hand homeware market is divided into Furniture, Home Decor, Kitchenware, Tableware, Textiles, and Others. In terms of condition of the second-hand homeware market is classified into Used and New (unused). Based on price range of the second-hand homeware market is segmented into Fixed, Auction, and Negotiable. By distribution channel of the second-hand homeware market is segmented into Online and Offline. Regionally, the second-hand homeware industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by product type, furniture is projected to hold 41.3% of the total market revenue in 2025, emerging as the leading product category. This dominance has been driven by strong demand for durable, high-value items that retain usability and appeal even after prolonged use.

Furniture has been favored due to its longer lifecycle, higher resale value, and strong demand among cost-conscious as well as sustainability-oriented buyers. The availability of well-maintained, branded, and vintage pieces has further strengthened consumer trust in second-hand furniture purchases.

Additionally, logistical improvements and refurbishment services have made it easier to acquire and resell furniture, improving turnover and margins within this segment. The enduring consumer preference for affordable and character-rich furnishings in residential and commercial spaces reinforces its continued leadership.

Segmented by condition, used products are expected to account for 72.8% of the second-hand homeware market revenue in 2025, maintaining a commanding share. This leadership has been attributed to widespread consumer acceptance of gently used items at attractive price points compared to refurbished or remanufactured alternatives.

Buyers have been increasingly comfortable with minor imperfections as long as functionality and aesthetic appeal remain intact. The abundance of supply from household decluttering trends, estate sales, and rental turnover has ensured a steady stream of quality used items.

Sellers and platforms have also prioritized transparency in grading and showcasing authentic product images, which has bolstered buyer confidence. The lower price threshold and immediacy of availability of used goods continue to make this segment the most accessible and attractive for the majority of second-hand homeware consumers.

When segmented by price range, fixed pricing is forecast to capture 54.6% of the market revenue in 2025, positioning itself as the preferred pricing strategy. This prominence has been supported by consumer preference for clear, upfront pricing that simplifies decision-making and reduces negotiation friction.

Platforms and retailers have increasingly standardized pricing models to improve customer experience and streamline transactions. Fixed pricing has also been associated with greater trust and perceived fairness in the resale market, especially when backed by quality assurance and transparent condition grading.

Sellers have benefited from faster turnover and reduced operational complexity by adopting fixed price points. This strategy has aligned well with the expectations of both online and offline buyers, ensuring consistency and predictability, which have contributed to its leading share in the market.

Consumer interest in affordability, sustainability-lite choices, and unique decor breadth is boosting demand. Opportunities lie in online resale platforms, curated vintage collections, and partnerships with local refurbishers and design influencers.

Rising cost sensitivity among households is driving growth in the second-hand homeware market. Buyers seek quality items—furniture, décor, kitchenware—at significantly lower prices than new retail. Vintage and distinctive pieces offer décor flexibility across aesthetic styles, promoting resale as a preferred route for personalization without heavy spending. Platforms specializing in curated listings with condition grading, shipping logistics, and returns assurance reduce buyer friction. Pop-up thrift markets and resale consignment stores provide tangible browsing experiences. As more consumers shift toward cautious spending and experiment with eclectic design, resale channels for pre-owned homeware are gaining traction as trusted and cost-effective alternatives to mass-market purchases.

Growth opportunities include launching digital platforms that offer curated vintage homeware selections with style themes, expert authentication, and restoration services. Collaborating with local refurbishing artisans provides refreshed pieces with premium appeal, extending lifecycle and value. Partnerships with interior designers and influencers can showcase upcycled sets for rental or display, raising resale profile. Subscription-based access or staging services for second-hand homewares, targeting short-term renters or Airbnb hosts- present a new usage model. Expanding through regional sourcing hubs enables faster turnover and lower shipping costs. Integrating digital storytelling around provenance, craftsmanship, and reuse helps engage value-conscious and eco-aware customers while unlocking sustainable revenue growth in resale home goods.

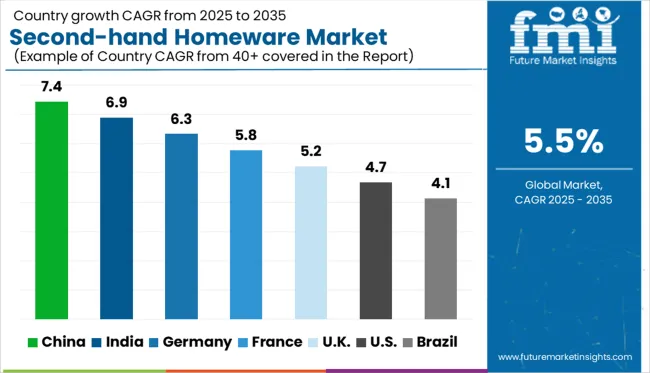

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

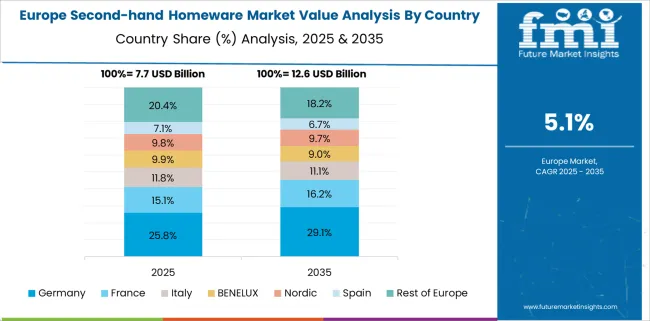

The global second-hand homeware market is projected to expand at a CAGR of 5.5% from 2025 to 2035, driven by growing environmental consciousness, circular economy adoption, and digital resale platforms. BRICS countries are showing higher-than-average momentum, with China leading at 7.4% CAGR due to rapid urbanization, tech-enabled resale ecosystems, and shifting consumer values around reuse. India follows at 6.9%, propelled by cost-sensitive middle-class households and the expansion of organized thrift channels. Germany, representing the OECD, is growing at 6.3%, driven by sustainability-oriented consumers and government support for reuse markets. In contrast, the United Kingdom (5.2%) and the United States (4.7%) show slightly below-average growth, influenced by market maturity and slower transition from traditional to digital resale behaviors. This report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

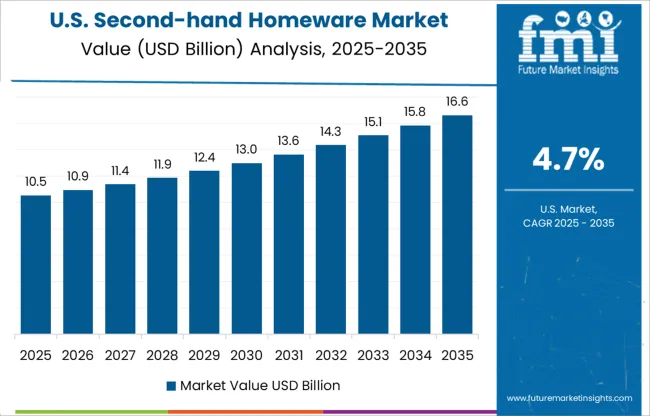

The United States resale sector is expected to grow at 4.7% CAGR, lagging behind the high growth markets of China and India. While resale apps like Kaiyo, OfferUp, and AptDeco add trust and delivery support, adoption remains behind digitally mature Asian markets. In contrast, China’s resale platforms generate user confidence through factory refurbishment standards, whereas US resale relies on peer trust and item authenticity checks. US urban renters are increasingly choosing compact, multifunctional second hand furniture, but penetration remains shallow in suburban and rural areas.

The UK resale market is forecast to grow at 5.2% CAGR, slower than China, India, and Germany, reflecting more modest demand for pre owned homeware despite strong circular fashion trends. Platforms like Vinted and Facebook Marketplace facilitate access, but UK resale culture still relies on charity fairs and vintage events, unlike digital resale ecosystems in China. Whereas German reuse emphasizes quality and certification, UK resale emphasizes aesthetic variety and affordability. Shelter and lifestyle budgets are driving urban consumers toward resale, even as inflation safe investment in new furniture remains preferred in resilience focused households.

Germany can expect 6.3% CAGR, slightly ahead of the UK but lower than China and India, reflecting strong circular economy values but slower digital adoption. Unlike mobile first resale in Asia, Germany’s resale is anchored in neighborhood markets, vintage fairs, and certified pre owned stores. Cultural emphasis on material durability shapes purchasing habits, while UK reuse trends lean more toward novelty and décor. Germany contrasts with India’s affordability centric resale initiatives, instead favoring formal authentication and repair certification. Sellers in Germany also emphasize sustainability and product longevity over instant fashion resale.

India is projected to grow at 6.9% CAGR, with resale expanding faster than in the UK and the US, where reuse remains more niche. While Germany emphasizes quality and certified vintage pieces, India’s second hand scene blends affordability with rotation of used goods, especially in tier 2 metros. Platforms like OLX, Quikr, and social commerce stores enable low income families to access furniture options. In contrast to China’s live streamed resale trend, Indian resale commerce is peer driven and informal. However budding platform startups are introducing refurbishment standards and payment plans, which brings it closer to formal resale ecosystems seen elsewhere.

China stands to outpace many Western markets with a 7.4% CAGR, growing faster than the UK and US resale sectors combined. Digital commerce giants like Xianyu and JD’s second hand channels are fueling urban acceptance, while platforms in Germany and India remain more fragmented. Young consumers view refurbished design as both sustainable and aspirational, while in Germany reuse emphasizes thrift, not trend. Live auction streams and branded refurbishment labs in China are normalizing resale habits. Branded trust and e-commerce convenience contrast sharply with the slower, offline thrift culture seen in parts of Europe and North America.

The second-hand homeware market is highly fragmented, with eBay leading at a significant share due to its vast global user base, diverse listings, and strong logistics integration. Niche platforms like Chairish, AptDeco, and 1stDibs focus on curated, high-end or vintage furniture and décor, targeting design-savvy consumers. Companies like Kaiyo, Trove, and Vinterior specialize in local logistics and sustainability-driven resale, while Letgo, OfferUp, and Mercari attract budget-conscious buyers via mobile-first experiences. Retailers like IKEA and Wayfair are entering the resale space through take-back and refurbishment programs. Growing consumer interest in circular economy models, sustainability, and cost-efficiency is fueling rapid expansion and competition across digital and physical resale channels.

On January 28, 2025, IKEA expanded its IKEA Pre-owned marketplace across Spain and Norway, supporting peer-to-peer resale of furniture and homeware. This initiative aligns with its circular goals, following pilots in Madrid and Oslo.

| Item | Value |

|---|---|

| Quantitative Units | USD 31.5 Billion |

| Product Type | Furniture, Home Decor, Kitchenware, Tableware, Textiles, and Others |

| Condition | Used and New (unused) |

| Price Range | Fixed, Auction, and Negotiable |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | eBay, 1stDibs, AptDeco, Chairish, Goodwill industries international, IKEA Retail, Kaiyo, Letgo, Mercari, OfferUp, Rejuvenation, The RealReal, Trove marketplace, Vinterior group, and Wayfair |

| Additional Attributes | Dollar sales by product category, resale channel, and consumer segment; regional demand driven by sustainability awareness, housing affordability, and urban lifestyle trends; innovation in online resale platforms, item authentication, and circular economy logistics; cost dynamics influenced by product condition, brand, and shipping models; environmental impact from waste reduction and reuse; and emerging use cases in home staging, rental furnishing, and eco-conscious interior design. |

The global second-hand homeware market is estimated to be valued at USD 31.5 billion in 2025.

The market size for the second-hand homeware market is projected to reach USD 53.9 billion by 2035.

The second-hand homeware market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in second-hand homeware market are furniture, _sofa, _chairs, _tables, _beds, _dressers, _others, home decor, _wall art, _mirror, _carpet & rugs, _others, kitchenware, _cookware, _bakeware, _dinnerware, _others, tableware, textiles and others.

In terms of condition, used segment to command 72.8% share in the second-hand homeware market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Secondhand Apparel Market Analysis - Size, Share, and Forecast 2025 to 2035

Secondhand Goods Industry Analysis in Europe - Size, Share, and Forecast Outlook 2025 to 2035

Asia Pacific Secondhand Goods Market Growth, Trends and Forecast from 2025 to 2035

USA & Canada Secondhand Apparel Market Growth, Trends and Forecast from 2025 to 2035

GCC Secondhand Apparel Market Growth, Trends and Forecast from 2025 to 2035

Competitive Overview of Secondhand Apparel Market Share

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA