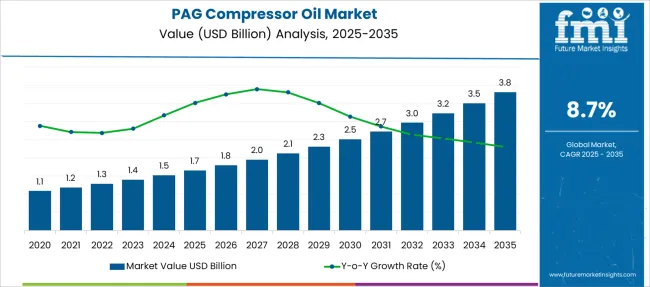

The PAG Compressor Oil Market is estimated to be valued at USD 1.7 billion in 2025 and is projected to reach USD 3.8 billion by 2035, registering a compound annual growth rate (CAGR) of 8.7% over the forecast period.

| Metric | Value |

|---|---|

| PAG Compressor Oil Market Estimated Value in (2025 E) | USD 1.7 billion |

| PAG Compressor Oil Market Forecast Value in (2035 F) | USD 3.8 billion |

| Forecast CAGR (2025 to 2035) | 8.7% |

The PAG compressor oil market is expanding steadily due to the rising demand for efficient lubrication solutions in automotive air conditioning and industrial applications. Polyalkylene glycol based oils offer superior thermal stability, low volatility, and high solubility with refrigerants such as R134a and R1234yf, making them a preferred choice in next generation compressors.

Increasing automotive production, particularly in electric and hybrid vehicles, is boosting the consumption of PAG compressor oils which are compatible with modern refrigerant systems. Additionally, the growing focus on energy efficiency and system longevity in industrial environments is encouraging the shift toward synthetic lubricant alternatives.

With evolving regulatory standards for emissions and energy consumption, the adoption of PAG compressor oils is expected to increase across both OEM and aftermarket segments, reinforcing long term growth prospects for the market.

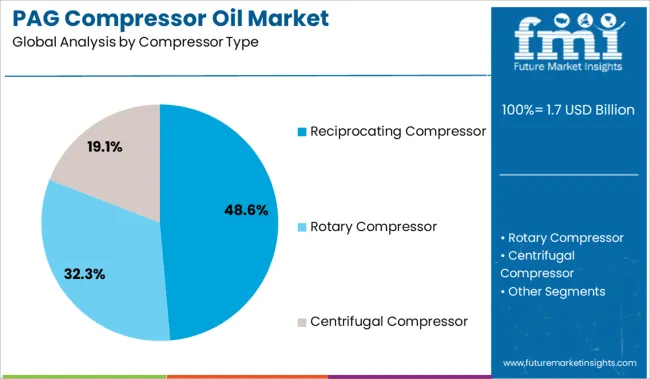

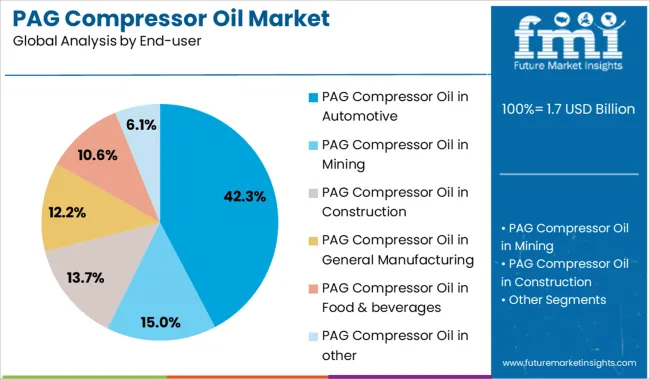

The market is segmented by Compressor Type and End-user and region. By Compressor Type, the market is divided into Reciprocating Compressor, Rotary Compressor, and Centrifugal Compressor. In terms of End-user, the market is classified into PAG Compressor Oil in Automotive, PAG Compressor Oil in Mining, PAG Compressor Oil in Construction, PAG Compressor Oil in General Manufacturing, PAG Compressor Oil in Food & beverages, and PAG Compressor Oil in other. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The reciprocating compressor segment is projected to account for 48.60% of total market revenue by 2025 under the compressor type category, emerging as the leading segment. This dominance is driven by the widespread use of reciprocating compressors in automotive air conditioning systems and small scale refrigeration units.

These compressors benefit from PAG oils due to their high load carrying capacity and excellent lubricity under extreme pressure and temperature conditions. The ease of maintenance, relatively lower cost, and strong performance across intermittent operations have further reinforced the segment’s market position.

Moreover, the compatibility of reciprocating compressors with a wide range of refrigerants and oils enhances their operational versatility, supporting their continued leadership in the compressor type category.

The automotive end user segment is anticipated to hold 42.30% of the total market share by 2025, making it the most prominent within the end user category. This is primarily due to the growing demand for vehicle air conditioning systems, both in passenger and commercial vehicles, across global markets.

PAG oils are particularly effective in automotive AC systems due to their non corrosive properties, superior lubricity, and strong compatibility with environmentally friendly refrigerants. As automakers shift toward electric and hybrid vehicles that require efficient thermal management, PAG compressor oils are being increasingly adopted to support system efficiency and reliability.

Additionally, aftermarket servicing and regular maintenance cycles have contributed to sustained demand in the automotive segment, solidifying its lead in the PAG compressor oil market.

The PAG Compressor oil market is witnessing significant growth, especially in East Asia and South Asia Pacific. Strong industrial infrastructure spending in regions such as Europe and North America has resulted in significant growth in the market. The demand is expected to rise consistently in industries such as generation, automotive, chemical industry, pharmaceuticals, food and beverages, and others.

According to FMI’s analysis, the PAG compressor oil market has been estimated to witness a CAGR of % CAGR between 2025 and 2035. Growth is expected to be contributed by the utilization of various compressors such as reciprocating compressors, rotary compressors, centrifugal compressors, screw compressors, and other types in various industries. The rising investment in Research and Development is also contributing to the growth.

PAG Compressor oil demand witnessed a marginal decline during the COVID-19 outbreak. The market for PAG Compressor oil recorded a CAGR (2020 to 2025) between % during the same period. The suspension of transportation operations and the closure of industrial plants both had an impact on the demand for lubricants as well as the PAG compressor oil market.

The growing automotive industry provides an opportunity for the market growth

The rise in population and urbanization are key factors that are expected to boost vehicle production volumes across the globe. This, in turn, is expected to increase the demand for PAG compressor oil during the forecast period.

Increasing demand from the automotive industry for high-performance lubricants that can withstand high temperatures and extreme pressure is expected to drive the growth of the PAG compressor oil market.

Asia Pacific has become the hub of the automotive industry in the last few years. The surge in demand for automobiles in expanding economies, such as China and India, is driving the global automobile industry, which in turn is boosting the need for the PAG compressor oil market.

The rise in the number of investments in the automotive sector, typically in the Middle East & Africa, is expected to be a key factor that propels the PAG compressor oil market in the region.

Increasing Application in End-Use Industry to Drive the Market Growth

Increasing demand in mining, automotive, and other industries has resulted due to a number of factors such as increasing consumer power, focus on sustainability, urbanization, consolidation, and a growing middle-class population. These changes are propelling the demand for investments and economies of scale, which is creating significant opportunities for PAG compressor oil.

Rising awareness about the benefits offered by polyalkene glycol PAG-based lubricants among consumers is also expected to boost the PAG compressor oil market sales over the next few years.

Compressor oils ensure smoother operation and help in reducing the downtime and repair of the machine. Moreover, heat generated by compressors during operations results in more power consumption and wear & tear on the machine Thus, the sales of compressor oil are anticipated to rise significantly in the near future which will boost the demand for PAG compressor oil. Hence, the rising demand for consumer appliances and increasing industrial infrastructure across the globe are creating significant opportunities for PAG compressor oil manufacturers.

Fluctuating Prices May Impede the Market Growth

Although multiple application of PAG compressor oil is driving market demand there exist market restraining factors as well. Increasing fluctuations in raw material prices would impede industry growth. The constant changes in crude oil, additives, and base oils prices make it difficult for product manufacturers to maintain cost-effectiveness in production cycles while adding to higher costs and reduced profit margins.

Rapid Industrialization in North America to Boost the Market Growth

North America dominates the market with a CAGR of 8.6% in 2025. Changes in regulatory norms regarding the control of harmful gas emissions are expected to drive the market in the region during the forecast period. Nearly 80% of harmful emissions come from manufacturing units, mines, and thermal power plants.

An increase in pressure by the government to maintain air quality and equipment is boosting the demand for PAG compressor oil in the industrial sector in North America. Latin America and the Middle East & Africa are relatively less attractive regions of the global PAG compressor oil market.

Demand in North America is also largely driven by rapid industrialization in Mexico, which has emerged as a major automobile manufacturing hub over the past decade. Low tariffs and production costs on account of the country’s extensive free trade agreements are strengthening the potential for Mexico to become a prime global export base.

The regional market presents numerous opportunities for innovators to introduce new products with advantageous product characteristics to tap into niche applications.

Well-Established Industrial Sector in The Region to Drive The PAG Compressor Oil Market

The Europe PAG compressor oil market is expected to rise at a CAGR of 8.5 % from 2025 to 2035. Europe is the second-largest shareholder in the market, mainly due to the growing end-use industries in the region. Europe PAG compressor oil market size is anticipated to be valued at more than USD million by 2035.

This is attributed to the expanding presence of various end-user industries including chemical, manufacturing, mining, food and beverage, and automotive in the European continent. As these verticals are expanding at a stellar pace, the demand for PAG compressor oils with improved operation cycles and the ability to reduce maintenance time would gain massive traction in the ensuing year

Rising industrial activities and the modernization of industrial machinery are likely to drive growth in the European market. The presence of countries such as Germany France, and Spain with their established industrial sector is expected to drive the market growth.

The Growing Automotive Industry in Asia Pacific Propels the Market Growth

Asia Pacific PAG compressor oil market held a CAGR of 8.5% in 2025. The growth of the market in Asia Pacific is attributed to the high growth rate of major end-use industries such as metalworking, food processing, chemicals, and textiles, coupled with rapid urbanization and industrialization.

Asia Pacific is the largest PAG compressor oil market dusting the forecast period owing to the high growth of the construction and mining industries in emerging countries such as China, India, and South Korea.

Domestic and foreign investment in the construction industry has been consistently growing over the past decade in this region. Moreover, rising investment in infrastructure development in developing countries of Asia Pacific is fueling the demand for the PAG compressor oil market.

| United Kingdom | 8.5 % |

|---|---|

| India | 8.4 % |

| South Korea | 8.3% |

| China | 8.5% |

| USA | 8.6% |

Centrifugal Compressor Segment Remains Dominant Among Other

The centrifugal compressors segment is projected to surge beyond the CAGR of 8.3% by 2035. In centrifugal compressors, PAG oil is utilized to lubricate radial and thrust rolling elements bearing and radial and thrust journal bearings across different industries.

In addition, the mounting product demand from natural gas processing facilities, thermal power plants, chemical plants, and oil refineries would complement the centrifugal compressors segment growth

General Manufacturing Segment Generates High Revenue in PAG Compressor Oil Market

The general manufacturing segment is projected to account for more than 8.1% CAGR during the forecast period.

The general manufacturing sector is the largest user of compressors, and therefore, PAG compressor oils are likely to witness the highest demand from this sector. The growth of the sector can be attributed to rising maintenance activities and lubrication applications.

Rapid industrialization in the Asia Pacific along with the booming automotive industry is poised to boost the sales of compressors, thereby augmenting the demand for compressor oil over the forecast period.

On the other hand, the demand for PAG compressor oil in the oil & gas industry is likely to increase on account of growing compressor installations. Burgeoning consumption of natural gas is one of the key factors contributing to the growth of the segment.

Infrastructure development in this industry is capital-intensive owing to which it is necessary to improve the efficiency of equipment to avoid cutting down profits. Rising planned shutdowns for maintenance are expected to drive product demand in the oil & gas industry over the forecast period.

How do New Entrants Contribute to the PAG Compressor Oil Market?

With technological innovations happening at a rapid pace, and companies looking for ways to increase customer engagement, start-ups are taking all possible steps to establish a name for themselves in the PAG compressor oil market.

Value Lubricants Pvt Ltd - is engaged in offering a quality-proven range of PAG Lubricant Oil. The offered oil is processed from superior-grade chemical compounds and contemporary techniques in sync with the set industry standards. Find their widespread usage in the automobile industry.

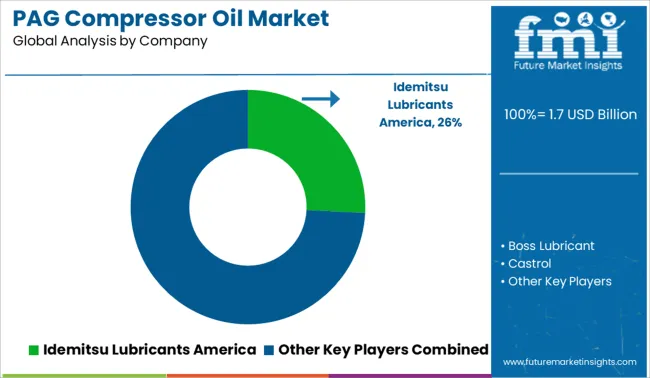

Idemitsu Lubricants America, Boss Lubricant, Castrol, Phillip 66 Lubricant, Total Lubricant USA Inc., Mannol, AMSOIL, Exxon Mobil Corporation, Technical Lubricants International B.V., Shandong Shing Chemical Co., Ltd. are some of the key players in the PAG Compressor Oil industry.

The manufacturers are involved in the production of PAG Compressor Oil in a larger capacity. The global PAG Compressor Oil Market is consolidated with the presence of major international players. However, the presence of small- and medium-sized domestic players makes the market highly competitive.

| Report Attribute | Details |

|---|---|

| Growth Rate | 8.7% CAGR from 2025 to 2035 |

| Expected Market Value (2025) | USD 1.7 billion |

| ProjectedForecast Value (2035) | USD 3.8 billion |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million & CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive L&scape, Growth Factors, Trends & Pricing Analysis |

| Segments Covered | Compressor Oil, End-User, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East and Africa(MEA) |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, Malaysia, Thail&, India, Singapore, GCC Countries, South Africa, Israel |

| Key Companies Profiled | Idemitsu Lubricants America; Boss Lubricant; Castrol; Phillip 66 Lubricant; Total Lubricant USA Inc.; Mannol; AMSOIL; Exxon Mobil Corporation; Technical Lubricants International B.V.; Shandong Shing Chemical Co., Ltd. |

| Customization | Available Upon Request |

The global pag compressor oil market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the pag compressor oil market is projected to reach USD 3.8 billion by 2035.

The pag compressor oil market is expected to grow at a 8.7% CAGR between 2025 and 2035.

The key product types in pag compressor oil market are reciprocating compressor, rotary compressor and centrifugal compressor.

In terms of end-user, pag compressor oil in automotive segment to command 42.3% share in the pag compressor oil market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

PAG Base Stock Market Size and Share Forecast Outlook 2025 to 2035

Champagne Market Analysis by Price Range, Sales Channel, and Region Through 2035

Landing Page Builders Market Analysis - Size, Share, and Forecast 2025 to 2035

Wireless Paging Systems Market Size and Share Forecast Outlook 2025 to 2035

USA Landing Page Builders Market Analysis – Size, Trends & Forecast 2025-2035

India Landing Page Builders Market Trends – Growth, Demand & Forecast 2025-2035

Thumb Hole Book Page Holder Market Size and Share Forecast Outlook 2025 to 2035

Germany Landing Page Builders Market Trends – Growth, Demand & Forecast 2025-2035

Compressor Rental Market Size, Share, and Forecast 2025 to 2035

Compressors and Vacuum Pumps Market Growth - Trends & Forecast 2025 to 2035

Compressor Control System Market

Compressor Oil Market Size and Share Forecast Outlook 2025 to 2035

Air Compressor Filters and Compressed Air Dryers Market Growth - Trends & Forecast 2025 to 2035

Screw Compressor Market Size and Share Forecast Outlook 2025 to 2035

Chest Compressors Market

Thermocompressors Market

Dental Compressors Market Analysis - Size, Share & Forecast 2025 to 2035

Gas Jet Compressor Market Size and Share Forecast Outlook 2025 to 2035

Booster Compressor Market Size and Share Forecast Outlook 2025 to 2035

Chlorine Compressors Market Analysis – Share, Size, and Forecast 2025 to 2035.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA