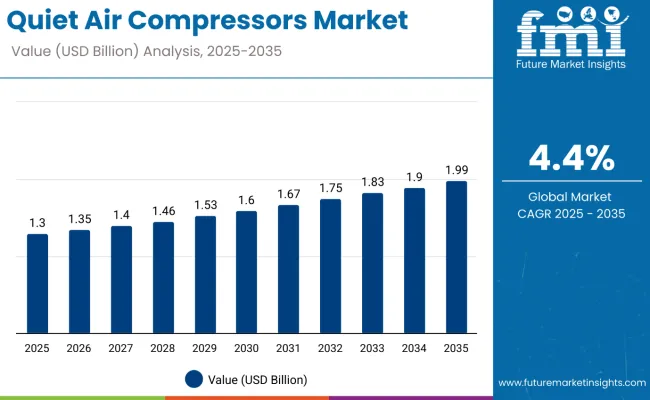

The global quiet air compressors market is projected to grow from USD 1.30 billion in 2025 to USD 1.99 billion by 2035, registering a CAGR of 4.4% during the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.3 billion |

| Industry Value (2035F) | USD 1.99 billion |

| CAGR (2025 to 2035) | 4.4% |

This reflects an absolute increase of USD 690 million and a value expansion of nearly 1.53X over the decade. The market has gained prominence due to the rising need for low-noise compressed air systems in residential, healthcare, and light industrial environments where operational silence and compliance with occupational safety norms are critical.

Between 2025 and 2030, the market is expected to increase from USD 1.30 billion to USD 1.60 billion, driven by higher adoption of oil-free and scroll-type compressors in indoor workspaces, laboratories, and dental clinics. Demand is also rising in multi-family housing and home workshops where space optimization and noise control remain essential criteria. Integration of inverter-driven motors and vibration-reduction enclosures is also contributing to the shift toward premium, quiet models.

From 2030 to 2035, the market is anticipated to grow from USD 1.60 billion to USD 1.99 billion. This phase will likely benefit from widespread deployment in urban retrofit projects, smart buildings, and hybrid work environments that prioritize air quality, minimal acoustic interference, and efficient HVAC operations. Global regulations around permissible decibel levels in workplace environments are expected to further stimulate adoption across commercial sectors.

From 2020 to 2024, the quiet air compressors market expanded steadily, driven by increasing demand in medical facilities, electronics manufacturing plants, and food processing industries, where noise reduction is crucial for worker comfort and compliance.

During this period, the market value increased from nearly USD 1 billion in 2020 to USD 1.2 billion in 2024, reflecting consistent adoption across both developed and emerging economies. Growth was further supported by health and safety regulations in Europe and East Asia, as well as by the adoption of oil-free, low-maintenance units in the healthcare and dental sectors.

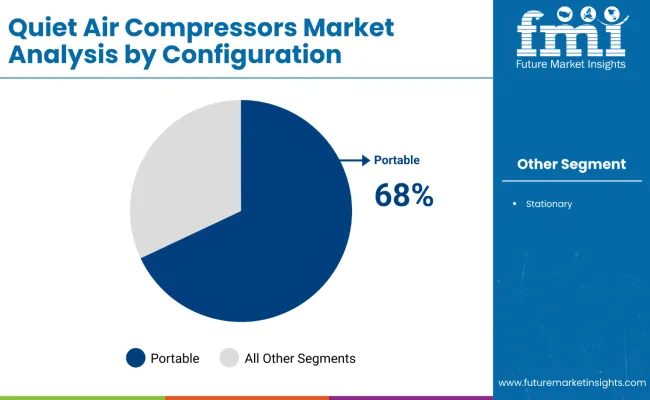

The industry landscape during this time was dominated by portable configurations, which accounted for 68% of sales in 2024, supported by strong uptake in small workshops, mobile service vans, and home-based maintenance operations. These models gained favor due to their lightweight build, mobility, and ease of storage, enabling a wider penetration in the DIY and SME segments. Market participation was led by established industrial equipment manufacturers leveraging authorized distributor networks, after-sales service packages, and region-specific product certifications to gain trust in highly regulated industries.

By 2025, the market is estimated to reach a valuation of USD 1.3 billion. This transition is being influenced by the rising preference for 1.1 to 5 HP capacity models in industrialized countries, improvements in energy efficiency ratings, and the integration of vibration-dampening technology to comply with occupational health standards.

As industries continue to prioritize quiet, efficient, and mobile compressed air systems, demand is gradually shifting toward units that combine low-noise operation, ergonomic handling, and low maintenance cycles. The 2025 baseline is set to serve as a springboard for more rapid growth, particularly as the sector aligns with urban noise ordinances and green building codes in major markets across Europe and Asia-Pacific.

The growth of the quiet air compressors market is being driven by multiple converging factors, including tightening workplace noise regulations, expansion of noise-sensitive industrial applications, and technological advances in oil-free and energy-efficient compressor designs. Manufacturers have introduced low-decibel rotary screw models, vibration-reduction frameworks, and automated pressure control systems that extend product life, enhance operator comfort, and reduce maintenance downtime, thus improving cost efficiency for industrial users in regions with high labor costs.

The surge in urban redevelopment projects and precision manufacturing facilities has reinforced the need for noise-compliant compressed air solutions. Quiet air compressors are increasingly integrated into dental surgeries, electronics assembly plants, and automotive service centers where excessive noise can disrupt operations or breach legal limits. Product demand is also being influenced by the shift toward multi-purpose, modular air systems that can be adapted for both industrial-scale operations and mobile service applications.

Consumer-driven segments such as home renovation, craftsmanship studios, and DIY mechanical work are contributing to the expansion of compact, lightweight quiet compressor units. Growth in e-commerce distribution channels and targeted digital marketing campaigns is enhancing product visibility among non-professional users, particularly in North America and Western Europe.

Compliance with OSHA, EU occupational safety directives, and Asia-Pacific urban noise control policies is encouraging the adoption of compressors with integrated acoustic enclosures and oil-free operation. Combined with improved motor efficiency and portable designs, these advancements are positioning quiet air compressors as the preferred option across sectors ranging from automotive refinishing in South Korea to electronics manufacturing in Japan.

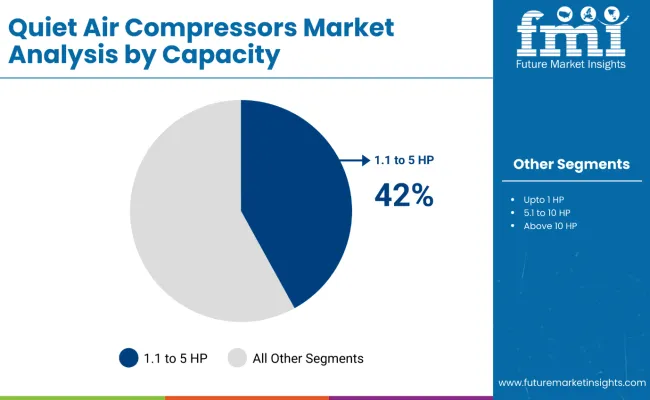

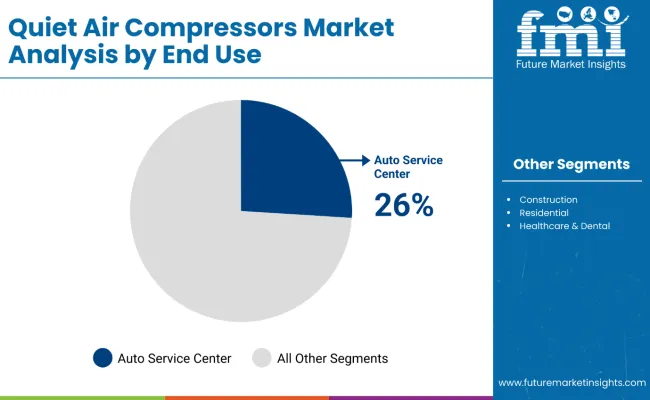

The market is segmented by capacity into units ranging from up to 1 HP, 1.1 to 5 HP, 5.1 to 10 HP, and above 10 HP, reflecting differing usage intensities across industries. End-use industries include auto service centers, residential, construction, healthcare, woodworking, manufacturing, and others, covering both commercial and home applications. Configuration-wise, the market comprises portable and stationary compressors, addressing mobility needs and fixed installations respectively. This segmentation enables targeted product development and demand analysis across industrial, residential, and service-based use cases.

Compressors with 1.1 to 5 HP capacity are estimated to contribute 42% of global market revenue in 2025 and are projected to grow at a CAGR of 4.6% through 2035. These systems offer a balance between power and noise suppression, making them suitable for small-to-medium workshops, commercial garages, and light industrial tasks. Their quieter operation is achieved through low RPM motors, advanced enclosure design, and vibration dampening technologies. The segment is witnessing higher adoption across sectors like automotive repair, light-duty manufacturing, and residential garages where noise regulations or indoor usage are key considerations.

Auto service centers are projected to account for 26% of market value in 2025 and are likely to grow at a CAGR of 4.3% through 2035. Quiet compressors are increasingly preferred for tasks like tire inflation, spray painting, pneumatic tool operation, and lift systems in enclosed garages. With rising vehicle maintenance volumes and stricter workplace noise norms, garages and workshops are upgrading to low-noise systems to improve technician comfort and customer experience. Integration of oil-free compressors and soundproof housing in automotive service environments further reinforces demand for this end-use segment.

Portable compressors are expected to capture 68% of total market share in 2025 and grow at a CAGR of 4.7% through 2035. Their lightweight construction, compact form factor, and wheel-mounted designs support usage across varied work environments such as homes, construction sites, and mobile repair services. Technological advances have enabled quieter operation even in portable variants by using insulated motor housings and dual-piston configurations. These compressors are increasingly used by professionals requiring mobility without compromising on low decibel performance.

Demand for angle sanders is being supported by rising demand from noise-sensitive applications, shift toward oil-free and smart-enabled models, and emphasis on regulatory compliance and urban noise reduction.

Rising Demand from Noise-Sensitive Applications

The quiet air compressors market is being propelled by its expanding role in medical, electronics, and precision manufacturing sectors. Hospitals, dental clinics, and laboratory environments require low-decibel, vibration-free air supply to maintain sterile and comfortable conditions. In Germany, these units are increasingly adopted in medical technology production and pharmaceutical packaging facilities, where noise pollution can disrupt sensitive processes.

Shift Toward Oil-Free and Smart-Enabled Models

Oil-free compressor adoption is accelerating due to strict environmental regulations and the need to avoid contamination in industries such as food & beverage and pharmaceuticals. Japan’s electronics industry is a prime example, integrating oil-free rotary screw units with real-time pressure monitoring sensors for energy optimization and process reliability.

Emphasis on Regulatory Compliance and Urban Noise Reduction

Regulations in Europe (e.g., Directive 2003/10/EC) and local Asian ordinances are setting stricter noise limits, pushing end users to upgrade equipment. In China, urban redevelopment projects often mandate low-noise construction equipment, creating demand for quiet compressors in both construction support and building maintenance services.

| Countries | Share (2025) |

|---|---|

| Germany | 26% |

| Italy | 14% |

| France | 16% |

| UK | 12% |

| Spain | 8% |

| BENELUX | 3% |

| Russia | 9% |

| Rest of Europe | 12% |

| Countries | Share (2035) |

|---|---|

| Germany | 25% |

| Italy | 12% |

| France | 15% |

| UK | 14% |

| Spain | 9% |

| BENELUX | 3% |

| Russia | 11% |

| Rest of Europe | 11% |

Europe’s quiet air compressors market is set to grow steadily, reaching USD 634.9 million by 2035, up from USD 386.1 million in 2025. This growth is attributed to rising environmental compliance across industrial hubs, especially in noise-sensitive zones such as healthcare, research labs, and precision manufacturing facilities. Germany continues to lead the regional market, supported by strong engineering exports and automation adoption in automotive and electronics sectors.

The UK is projected to witness share gain by 2035, aided by increased adoption in commercial renovation and energy-efficient HVAC systems. Russia is expected to gain share due to infrastructure modernization and localized production initiatives. In contrast, Italy is projected to see a slight decline in share owing to capacity rationalization in legacy industries.

Europe’s demand for quiet air compressors is anchored in compliance-driven replacements, energy-efficiency retrofits, and noise-sensitive operations across healthcare, food & beverage, and precision engineering. While Western Europe shows mature, replacement-led demand, Southern and parts of Eastern Europe are gaining share as manufacturing footprints expand and public procurement programs fund equipment upgrades. Oil-free rotary screw platforms and portable, acoustically enclosed units remain the winning configurations due to their hygiene, reliability, and low dB(A) profiles in mixed-use urban settings.

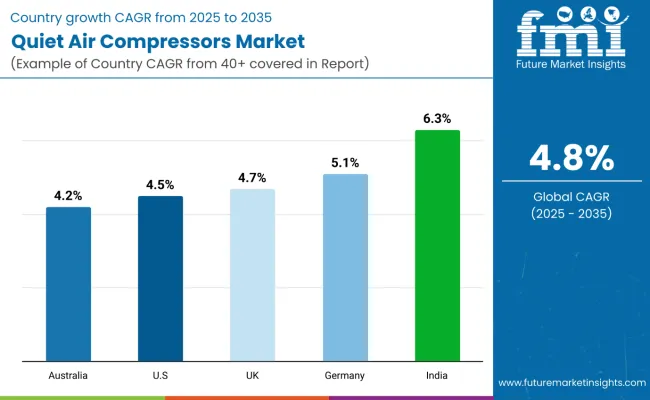

India leads the market with a projected CAGR of 6.3% from 2025 to 2035. The growth is driven by infrastructure upgrades, electronics manufacturing, and the government’s ‘Make in India’ push. Urban construction norms around noise reduction are also supporting demand.

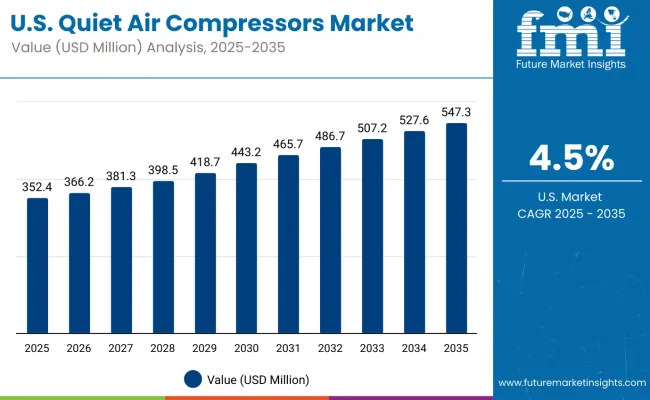

The USA quiet air compressors market is projected to grow at a CAGR of 4.5% from 2025 to 2035, driven by strong demand from auto service centers, industrial maintenance teams, and construction service providers. OSHA’s stringent noise exposure limits are accelerating the shift from traditional compressors to low-decibel, oil-free portable models in both large repair chains and municipal maintenance operations.

The automotive aftermarket remains a core demand driver, especially with the growth of electric vehicle (EV) service facilities requiring air systems for tire inflation, brake system servicing, and precision pneumatic tools in quieter service bays. Aerospace and defense manufacturing hubs in states such as Texas and Washington are also adopting 1.1 to 5 HP oil-free rotary screw models to ensure compliance with workplace safety rules while maintaining high air delivery rates.

In the residential and DIY segment, portable units with vibration reduction and compact storage designs are increasingly popular through big-box retailers like Home Depot and Lowe’s, as well as via e-commerce platforms serving rural mechanics and small workshops.

Japan’s quiet air compressors market is forecast to grow at a CAGR of 4.1% from 2025 to 2035, shaped by high-density urban manufacturing and service environments. The country’s preference for compact, low-vibration compressors is influenced by workshop space constraints and strict local noise ordinances.

The 1.1 to 5 HP capacity range dominates, holding up to 45% market share in 2025, balancing portability with sufficient air delivery for automotive repair, dental clinics, and electronics assembly lines. In precision manufacturing sectors such as robotics and semiconductors, oil-free rotary screw compressors are integrated into production lines to maintain cleanroom standards while keeping noise below industrial thresholds.

Shipbuilding yards in Nagasaki and Yokohama are replacing older models with quiet, portable units to reduce noise exposure during enclosed dock maintenance. Healthcare facilities increasingly opt for oil-free piston compressors for patient comfort, particularly in pediatric care.

The UK quiet air compressors market is projected to grow at a CAGR of 4.7% from 2025 to 2035, supported by infrastructure renewal programs, a thriving home improvement sector, and increasing compliance with workplace noise limits.

Projects such as railway modernization and energy facility retrofits create demand for portable units capable of operating in noise-sensitive zones. The UK’s active DIY culture boosts sales of compact portable compressors through hardware retailers and online platforms. Tradespeople in urban areas are choosing oil-free units for indoor work, reducing sound disturbance in occupied buildings.

Short-term leasing of portable compressors is also rising, especially in metropolitan regions where small contractors prefer flexible, cost-effective access to professional-grade equipment.

Germany’s quiet air compressors market is expected to grow at a CAGR of 5.1% through 2035, led by precision engineering, automotive component manufacturing, and medical equipment production. The adoption of oil-free rotary screw models is accelerating due to strict DIN-compliant noise control requirements and an emphasis on workplace ergonomics.

Automotive OEMs and Tier-1 suppliers in Stuttgart and Wolfsburg are replacing older models with low-vibration, energy-efficient units to enhance worker comfort and reduce noise emissions. Precision machining facilities in Bavaria and Baden-Württemberg are also integrating quiet compressors to reduce acoustic interference across production cells.

The medical technology sector favors oil-free piston compressors for sterile and quiet operation, with government-backed industrial retrofit subsidies encouraging wider SME adoption.

Australia’s quiet air compressors market is projected to grow at a CAGR of 4.2% from 2025 to 2035, supported by large-scale infrastructure upgrades, the expansion of mining and energy projects, and increasing adoption in the automotive service sector. Ongoing urban development in Sydney, Melbourne, and Brisbane is driving demand for portable, low-noise compressors that can operate in compliance with strict municipal noise ordinances, particularly near residential zones.

In the mining-heavy regions of Western Australia and Queensland, quiet compressors are being deployed in on-site maintenance workshops to reduce operator fatigue and meet occupational health requirements in enclosed workspaces. The automotive repair market is another growth driver, with service chains and independent garages investing in oil-free rotary screw models to handle pneumatic tools while keeping noise levels low for both staff and customers.

Australia’s strong DIY and home improvement culture also sustains demand for compact portable units, with sales channels dominated by national hardware retailers such as Bunnings Warehouse and Mitre 10. Additionally, renewable energy facilities, particularly wind and solar farms are increasingly using quiet compressors for maintenance operations in remote areas, where equipment reliability and low-noise operation are critical.

The quiet air compressors market in Japan is projected to demonstrate stable growth through 2035, with demand largely concentrated in 1.1 to 5 HP capacities, which account for 45% of the total market share in 2025. Japan’s end-use mix reflects dense urban footprints, precision manufacturing, and patient-facing environments.

Workshops must fit compressors into small footprints and keep dB(A) low to respect neighborhood ordinances. The 1.1-5 HP capacity band leads due to the balance of airflow, portability, and energy draw, aligning with bay-by-bay deployment in auto repair and light industrial cells.

The South Korean angle sander market is driven by auto service centers and residential end use, which together represent 54% of the total end use share in 2025. Mobile and bay-based jobs favor compact, portable compressors with fast start/stop, low vibration, and sub-60-65 dB(A) operation to keep multi-bay workflows productive without hearing fatigue.

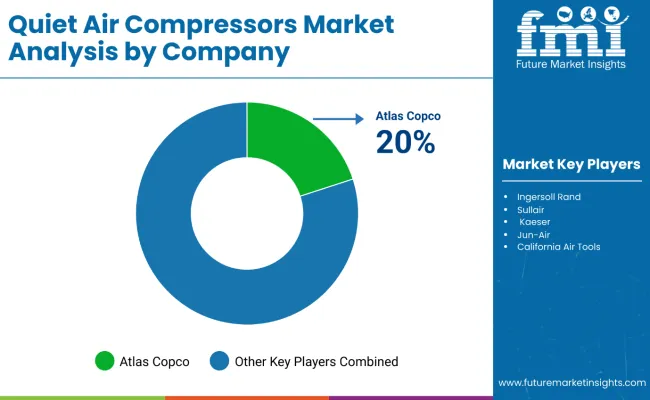

The quiet air compressors market is increasingly competitive, with global and regional manufacturers expanding their oil-free, portable, and energy-efficient product portfolios to capture rising demand from noise-sensitive applications. Leading companies are focusing on innovation in motor efficiency, acoustic dampening, and IoT integration to differentiate their offerings in both professional and consumer segments.

Atlas Copco and KaeserKompressoren dominate in high-performance industrial applications, leveraging strong dealer networks and after-sales service programs. Ingersoll Rand and Hitachi Industrial Equipment maintain strong positions in both the automotive service and manufacturing sectors, emphasizing oil-free rotary screw models for clean air delivery.

Smaller players, such as Senco and regional brands in Asia-Pacific, are gaining traction in portable compressor sales by offering competitively priced units through online and retail channels. Domestic brands in China are aggressively expanding into mid-tier industrial markets, while Australian and European distributors are promoting noise-compliant models to meet local regulations.

Strategic collaborations with tool manufacturers, bundling compressors with pneumatic tools, and offering financing or leasing options are becoming common competitive tactics. Additionally, compliance with ISO 8573-1 air quality standards and alignment with regional noise legislation are central to winning contracts in sectors such as healthcare, food processing, and precision engineering.

| Item | Value |

|---|---|

| Quantitative Units | USD 463.6 Million (2025) |

| Capacity | Upto 1 HP, 1.1 TO 5 hp, 5.1 to 10 HP, Above 10 HP |

| End Use | Auto Service Centers, Construction, Residential, Healthcare & Dental, Woodworking, Manufacturing, Others |

| Configuration | Portable, Stationary |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, United Kingdom, Japan, China, France, Italy, South Korea, Spain, BENELUX |

| Key Companies Profiled | Atlas Copco, Ingersoll Rand, Sullair, Kaeser, Jun-Air, California Air Tools, Emax Compressor, Werther Int. |

The global quiet air compressors market is estimated to be valued at USD 1.3 billion in 2025, supported by sustained demand from automotive service centers, healthcare facilities, and precision manufacturing sectors.

The market is projected to reach approximately USD 2 billion by 2035, reflecting the growing preference for portable, oil-free, and noise-compliant compressors across industrial and residential applications.

The market is forecast to expand at a CAGR of 4.4% during this period, with growth driven by urban infrastructure projects, stricter noise regulations, and the expansion of healthcare and electronics manufacturing.

The 1.1 to 5 HP capacity range is expected to maintain the largest share in 2025, offering the best balance of power output, portability, and energy efficiency, with particularly high adoption in Japan and South Korea.

Auto service centers are projected to be the leading end-use segment in 2025, accounting for the largest share due to their reliance on quiet, reliable compressed air systems for multi-shift operations in urban environments.

Key companies include Atlas Copco, Ingersoll Rand, Kaeser Kompressoren, Hitachi Industrial Equipment, Senco, California Air Tools, Emax Compressor, and Werther International.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Refrigeration and Air Conditioning Compressors Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in Refrigeration and Air Conditioning Compressors

Air Fryer Paper Liners Market Size and Share Forecast Outlook 2025 to 2035

Air Struts Market Size and Share Forecast Outlook 2025 to 2035

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Air Separation Plant Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Turbo Generators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Air Conditioning Compressor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA