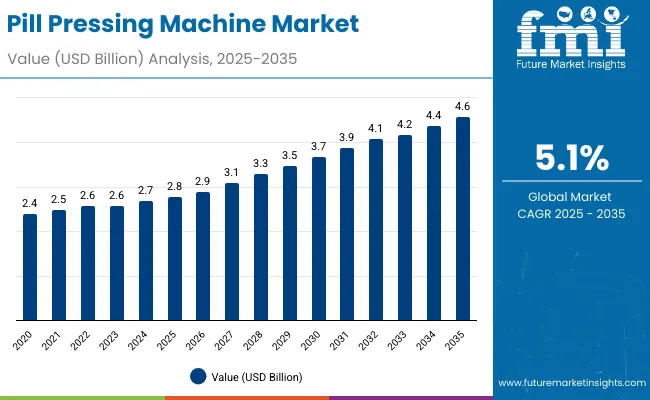

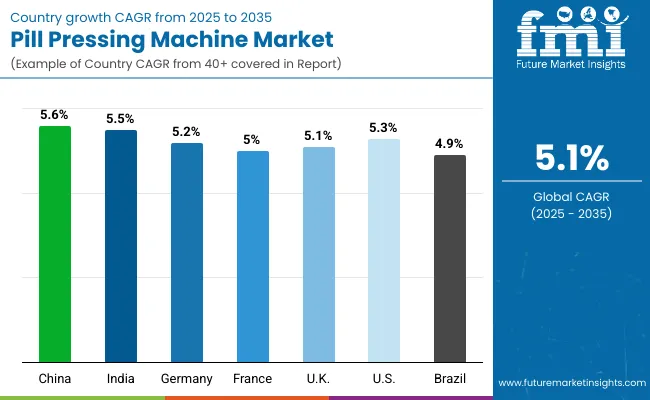

The pill pressing machine market is expected to grow from USD 2.8 billion in 2025 to USD 4.6 billion by 2035, resulting in a total increase of USD 1.8 billion over the forecast decade. This represents a 64.3% total expansion, with the market advancing at a compound annual growth rate (CAGR) of 5.1%. Over ten years, the market grows by a 1.6 multiple.

| Metric | Value |

|---|---|

| Pill Pressing Machine Market Estimated Value in (2025 E) | USD 2.8 billion |

| Pill Pressing Machine Market Forecast Value in (2035 F) | USD 4.6 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

In the first five years (2025-2030), the market progresses from USD 2.8 billion to USD 3.6 billion, contributing USD 0.8 billion, or 44.4% of total decade growth. This phase is shaped by rising pharmaceutical output, particularly in generics, nutraceuticals, and dietary supplements. Demand for high-speed, GMP-compliant equipment drives early adoption across Asia-Pacific and North America.

In the second half (2030-2035), the market grows from USD 3.6 billion to USD 4.6 billion, adding USD 1.0 billion, or 55.6% of the total growth. This acceleration is supported by smart automation, IoT-enabled monitoring, and flexible tooling for diverse pill formats. Increasing investments in precision medicine and global health infrastructure solidify pill pressing machines as a core component of pharmaceutical manufacturing capacity.

From 2020 to 2024, the pill pressing machine market grew from USD 2.2 billion to USD 2.6 billion, fueled by pharmaceutical and nutraceutical expansion where precision, speed, and regulatory compliance were critical. Nearly 70% of revenue was dominated by OEMs offering rotary and high-speed tablet presses. Leaders such as Fette Compacting, KORSCH AG, and Romaco emphasized automation, multi-layer tablet production, and GMP-certified hygienic designs.

Differentiation focused on compression force control, output efficiency, and digital monitoring, while AI-enabled predictive analytics remained secondary. Service-driven offerings such as machine validation and operator training contributed less than 18% of revenue, with capital-focused purchases leading investments.

By 2035, the pill pressing machine market will reach USD 4.6 billion, growing at a CAGR of 5.10%, with smart-enabled and software-driven presses representing more than 40% of market value. Competition will intensify as solution providers introduce AI-powered defect detection, real-time quality control, and IoT-enabled maintenance. Established players are pivoting toward hybrid models that pair physical machines with SaaS-based optimization platforms. Emerging entrants such as Cadmach Machinery, Syntegon Technology, and IMA Group are expanding share by offering energy-efficient presses, modular tooling systems, and flexible designs tailored for growing demand in pharmaceuticals, nutraceuticals, and personalized medicine.

The growing pharmaceutical and nutraceutical production worldwide is driving growth in the pill pressing machine market. These machines ensure high precision, consistency, and scalability in tablet manufacturing, meeting the rising demand for medicines and dietary supplements. Stricter regulatory standards and expanding healthcare access further support adoption across global markets.

Advanced pill pressing machines featuring high-speed automation, multi-layer compression, and real-time monitoring are gaining popularity for their ability to enhance productivity and reduce errors. Their adaptability to varied formulations, including controlled release tablets, expands their use in complex drug development. Energy-efficient designs and compliance with GMP standards reinforce their importance in modern pharmaceutical manufacturing.

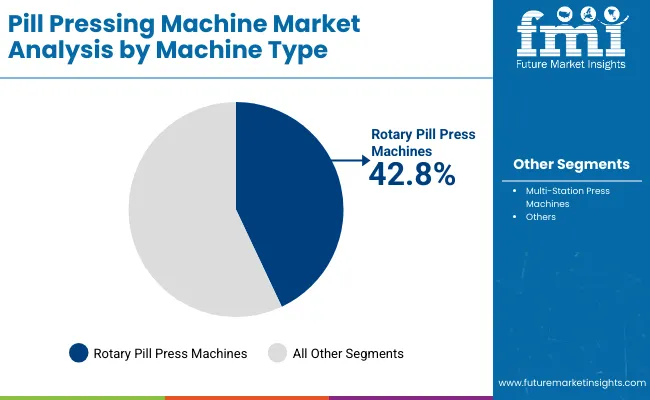

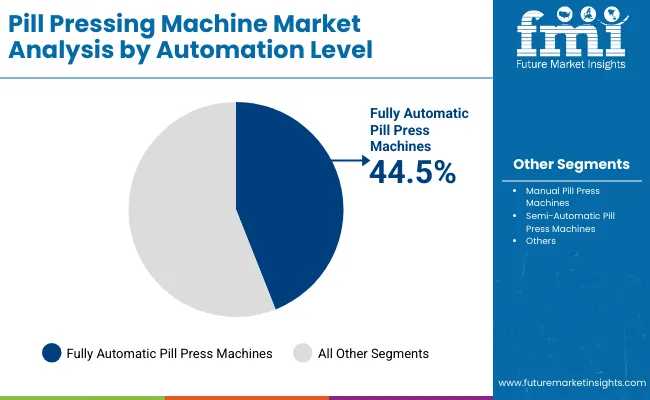

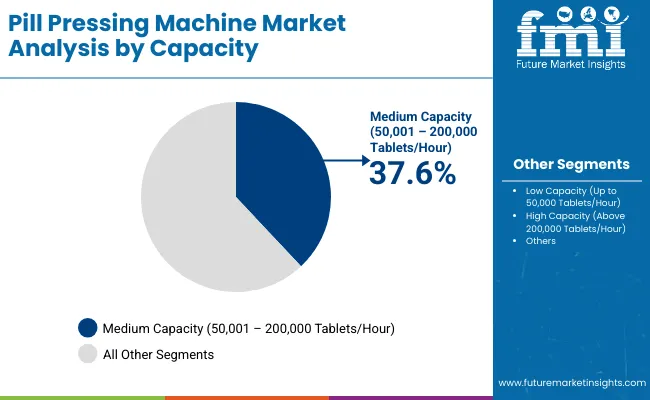

The market is segmented by machine type, automation level, capacity, application, end-use industry, and region. Machine type segmentation includes rotary pill press machines and multi-station press machines, delivering efficiency and consistency in tablet manufacturing. Automation level covers manual, semi-automatic, and fully automatic pill press machines, offering flexibility for varying production requirements. Capacity segmentation includes low capacity (up to 50,000 tablets/hour), medium capacity (50,001-200,000 tablets/hour), and high capacity (above 200,000 tablets/hour), supporting scalability.

Applications span pharmaceutical tablet production, nutraceuticals and dietary supplements, veterinary medicine tablets, and industrial and specialty chemicals, meeting broad sector needs. End-use industries include pharmaceutical manufacturers, nutraceutical companies, research and development laboratories, veterinary healthcare producers, and contract manufacturing organizations (CMOs). Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Rotary pill press machines are forecast to account for 42.8% of the market in 2025, owing to their ability to produce tablets at high speeds with consistent quality. They support multi-layered and shaped tablets, making them suitable for complex pharmaceutical and nutraceutical formulations. Their durability and scalability make them standard in large-scale production facilities.

Adoption is supported by rising global drug demand and continuous innovation in tablet formulations. Rotary presses provide flexibility for small to mass production, reducing changeover time and enhancing operational efficiency. Their precision ensures compliance with strict pharmaceutical standards, reinforcing their market leadership.

Fully automatic pill press machines are projected to hold 44.5% of the market in 2025, reflecting demand for high-throughput, continuous production. These machines integrate advanced controls, touch-screen interfaces, and automated monitoring systems to minimize human intervention. Their real-time data collection enhances quality assurance and process optimization.

Manufacturers prefer fully automated systems for their consistency, scalability, and ability to reduce operating costs. Integration with Industry 4.0 technologies, such as predictive maintenance and IoT connectivity, further supports adoption. As compliance and efficiency remain priorities, automation leads as the standard in modern pill pressing operations.

Medium capacity machines, producing 50,001-200,000 tablets per hour, are forecast to account for 37.6% of the market in 2025. These machines balance throughput with flexibility, serving both mid-sized pharmaceutical companies and large-scale nutraceutical producers. Their adaptability across multiple formulations supports varied production needs.

Adoption is growing in facilities requiring frequent product changeovers or seasonal production spikes. Medium capacity machines provide cost efficiency while maintaining compliance with regulatory requirements. Their scalability makes them an attractive option for expanding manufacturers in emerging markets.

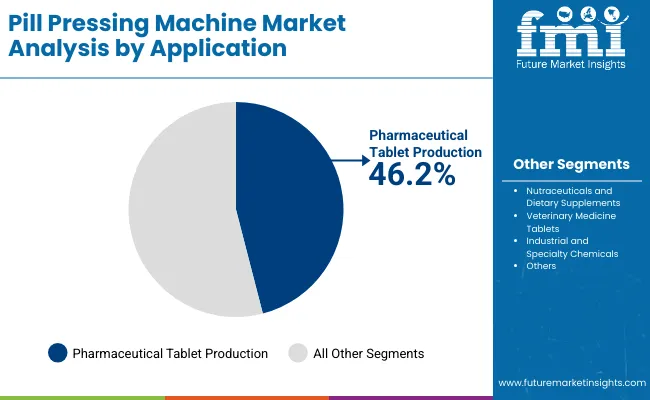

Pharmaceutical tablet production is expected to represent 46.2% of the market in 2025, as rising chronic disease prevalence and global healthcare demand drive large-scale tablet manufacturing. Pill pressing machines ensure consistent dosage, hardness, and disintegration profiles critical for patient safety.

Adoption is reinforced by increasing investments in generics and specialty drugs. Manufacturers rely on these machines for flexibility in producing coated, uncoated, and multi-layered tablets. As regulatory scrutiny intensifies, precision and validation features of pill pressing equipment remain essential.

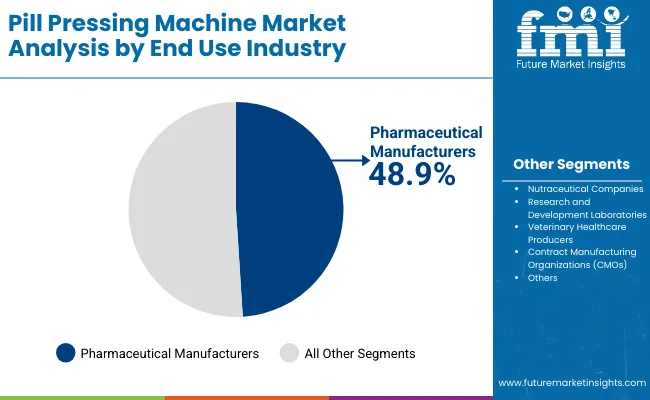

Pharmaceutical manufacturers are projected to account for 48.9% of the market in 2025, reflecting their central role in global medicine production. These firms require machines capable of meeting stringent quality, safety, and output standards. High demand for generics and patented drugs sustains adoption at scale.

Automation and digital integration further enhance efficiency, ensuring compliance with Good Manufacturing Practices (GMP). Partnerships with equipment providers enable customized solutions for complex formulations. As healthcare spending and drug consumption rise worldwide, pharmaceutical manufacturers remain the core end-users of pill pressing machines.

The pill pressing machine market is expanding as demand rises in pharmaceuticals, nutraceuticals, and dietary supplements for efficient, high-capacity tablet production. Growth is supported by rising chronic disease prevalence, increased generic drug manufacturing, and consumer health trends. However, high capital costs and stringent regulatory compliance limit adoption. Advances in automation, multi-layer pressing, and continuous manufacturing are shaping the market’s future direction.

High-volume Production, Precision, and Pharmaceutical Demand Driving Adoption

Pill pressing machines are essential for producing uniform, high-quality tablets at scale. Pharmaceutical companies rely on them to meet strict dosage accuracy and product consistency requirements. Nutraceutical and supplement manufacturers also benefit from their ability to process varied formulations, including herbal and vitamin-based tablets. Features such as multi-station rotary presses, real-time monitoring, and automated feeding systems improve productivity and reduce human error. These advantages position pill pressing machines as indispensable tools in the global healthcare and wellness sectors.

High Equipment Costs, Compliance Burdens, and Maintenance Needs Restraining Growth

Despite strong demand, adoption is limited by significant capital investment and maintenance costs, especially for advanced high-speed machines. Strict regulatory standards for pharmaceutical equipment validation add complexity, requiring rigorous documentation and frequent inspections. Smaller manufacturers face financial and technical barriers in meeting Good Manufacturing Practice (GMP) requirements. Mechanical wear from continuous operation also necessitates regular calibration and skilled technicians for upkeep. These factors create hurdles for smaller firms and emerging market players.

Automation, Continuous Manufacturing, and Multi-layer Tablet Technology Trends Emerging

Key trends include integration of automation and robotics to reduce manual intervention, enhance speed, and improve precision in tablet pressing. Continuous manufacturing systems are gaining traction, offering improved efficiency and reduced batch variability. Multi-layer tablet technology is enabling the production of combination drugs, expanding therapeutic applications. Manufacturers are also developing compact, modular presses suitable for small-batch and personalized medicine production. These innovations are redefining pill pressing machines as high-tech solutions aligned with pharmaceutical innovation, efficiency, and regulatory compliance.

The global pill pressing machine market is growing steadily, supported by rising pharmaceutical demand, nutraceutical expansion, and increasing automation in drug manufacturing. Asia-Pacific is emerging as a high-growth region, with China and India driving adoption due to expanding generics production and contract manufacturing services. Developed economies such as the USA, Germany, and Japan are advancing precision-engineered, high-speed tablet press machines that comply with GMP standards, integrating automation and data monitoring to improve quality, safety, and efficiency.

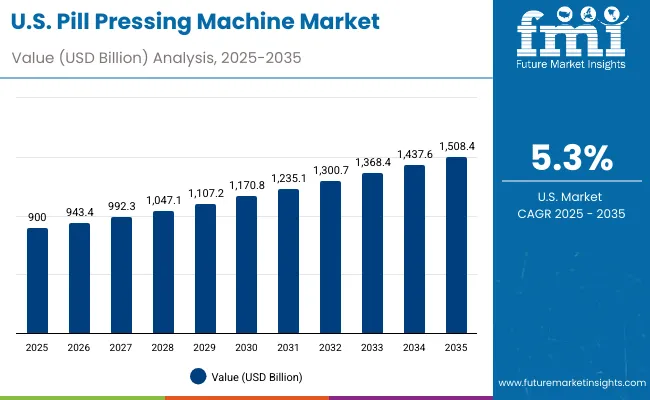

The USA market is projected to grow at a CAGR of 5.3% from 2025 to 2035, driven by demand in pharmaceuticals, nutraceuticals, and OTC drug production. Manufacturers are adopting advanced rotary tablet presses with higher output, precision dosing, and compliance with FDA regulations. Automation and real-time monitoring systems are increasingly being integrated into pill pressing machines to reduce downtime, improve efficiency, and maintain consistent quality across high-volume production lines.

Germany’s market is expected to grow at a CAGR of 5.2%, supported by its strong pharmaceutical manufacturing ecosystem and stringent EU compliance standards. Demand is rising for modular, high-precision tablet presses with rapid changeover capabilities to handle multi-product lines. Innovation focuses on automation, energy efficiency, and real-time defect detection. German OEMs are developing GMP-compliant equipment designed for both large-scale pharmaceutical firms and SMEs producing specialty drugs and nutraceutical products.

The UK market is forecast to grow at a CAGR of 5.1%, driven by pharmaceutical research, clinical trials, and growing nutraceutical consumption. Small and medium manufacturers are investing in cost-efficient pill pressing machines for contract production. Demand is also rising for equipment with serialization and traceability features to meet MHRA standards. OEMs are providing compact, automated presses suitable for both pilot-scale production and large-scale commercial manufacturing of tablets and capsules.

China’s market is projected to grow at a CAGR of 5.6%, fueled by rapid expansion of pharmaceutical manufacturing, generics production, and healthcare modernization. Domestic firms are adopting advanced rotary tablet presses to increase efficiency and meet GMP standards. Government initiatives to strengthen drug safety and quality assurance are boosting demand for automated systems. Local OEMs are scaling production of affordable, high-capacity pill pressing machines for both domestic use and exports to developing markets.

India is forecast to grow at a CAGR of 5.5%, supported by its role as a global hub for generics and contract manufacturing. Pharma exporters are increasingly investing in high-speed, automated pill presses to meet international compliance standards. Nutraceutical startups are adopting compact, flexible machines for small-batch runs. With government initiatives promoting “Pharma Vision 2020” and global exports, demand for cost-efficient, GMP-certified pill pressing equipment is rising significantly in the Indian market.

Japan’s market is projected to grow at a CAGR of 5.0%, anchored by strong demand for precision in pharmaceuticals, healthcare, and supplements. Pill pressing machines with compact design, high reliability, and advanced safety systems are in demand. Local manufacturers emphasize precision engineering and compliance with strict quality norms. The trend is toward integrating automation and real-time inspection in presses to ensure accuracy and minimize risks in high-value tablet and capsule production.

South Korea’s market is expected to grow at a CAGR of 5.1%, driven by pharmaceuticals, nutraceuticals, and biotechnology. Companies are adopting pill pressing machines with automation-ready features to improve scalability and compliance. Demand for compact systems among SMEs and advanced rotary presses among large firms is rising. The emphasis on exports of K-pharma and dietary supplements is boosting adoption of machines designed for compliance with global standards and consistent production.

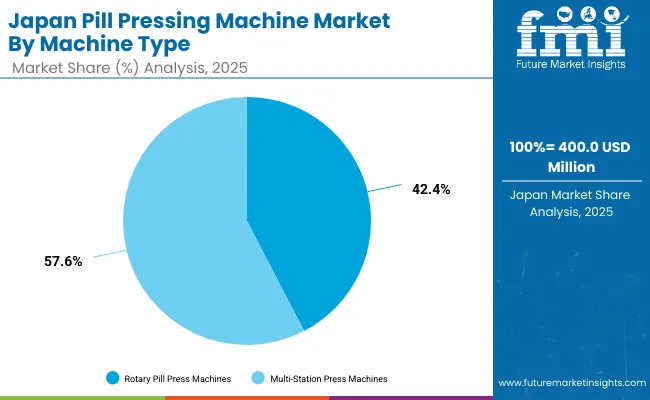

Japan’s pill pressing machine market in 2025, valued at USD 400 million, is dominated by multi-station press machines, holding 57.5% share due to their high capacity and efficiency in large-scale pharmaceutical production. Rotary pill press machines account for 42.5%, supporting mid-range production with reliability and flexibility. The preference for multi-station machines reflects Japan’s advanced pharmaceutical manufacturing sector, emphasizing mass production, precision, and consistent quality. Rotary machines continue to find relevance in smaller-scale and diversified applications. This balance indicates Japan’s dual focus on maximizing production efficiency while maintaining operational versatility to meet diverse pharmaceutical and nutraceutical industry requirements.

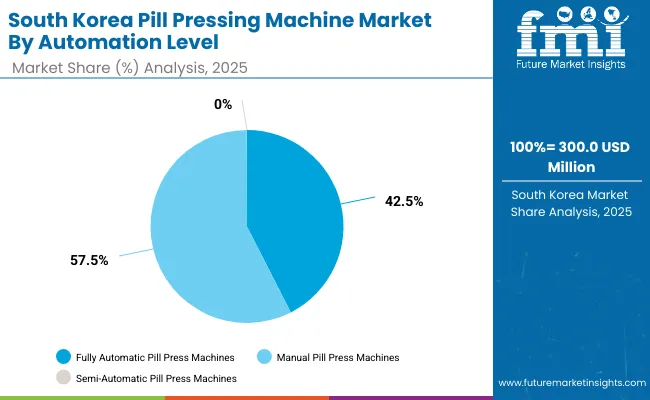

South Korea’s pill pressing machine market, worth USD 300 million in 2025, is led by manual machines with 56.1% share, reflecting their affordability and widespread use among smaller manufacturers. Fully automatic machines follow at 43.9%, driven by rising adoption in large-scale pharmaceutical facilities for speed and precision. Semi-automatic machines currently hold negligible share. The dominance of manual presses underscores South Korea’s significant presence of small and medium enterprises, where cost-effectiveness drives equipment choice. However, the growing transition toward automation reflects industry modernization, regulatory compliance, and the pursuit of efficiency. This dynamic highlights South Korea’s evolving pharmaceutical manufacturing landscape.

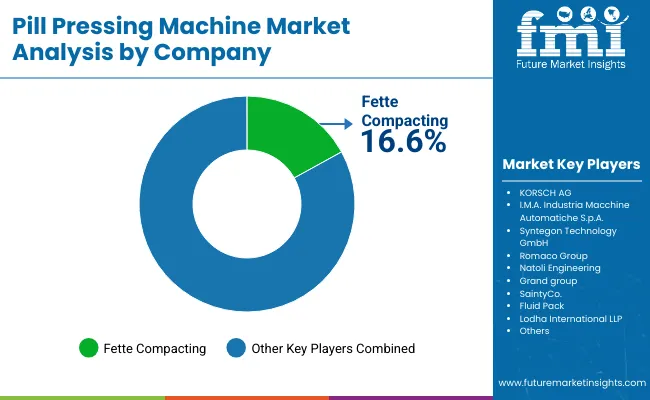

The pill pressing machine market is moderately fragmented, with pharmaceutical machinery leaders, process automation specialists, and regional equipment manufacturers competing across generics, nutraceuticals, and large-scale pharma production. Global leaders such as Fette Compacting, KORSCH AG, and I.M.A. Industria Macchine Automatiche S.p.A. hold notable market share, driven by high-speed rotary presses, precision dosing, and compliance with cGMP and FDA standards. Their strategies increasingly emphasize digital monitoring, quick tooling changeovers, and continuous manufacturing integration.

Established mid-sized players including Syntegon Technology GmbH, Romaco Group, and Natoli Engineering are supporting adoption of advanced pill pressing systems featuring servo-driven controls, automated weight adjustment, and multi-layer tablet capabilities. These companies are especially active in oral solid dosage forms, offering flexibility for complex formulations, real-time data acquisition, and robust quality assurance through integrated inspection systems.

Specialized regional providers such as Grand Group, SaintyCo, Fluid Pack, and Lodha International LLP focus on cost-efficient solutions for emerging pharma markets and contract manufacturers. Their strengths lie in modular press designs, scalability for small-to-large batch production, and simplified maintenance, while also investing in smart automation features to improve productivity and ensure global regulatory compliance.

Key Development

| Item | Value |

|---|---|

| Quantitative Units | USD 2.8 Billion |

| By Machine Type | Rotary Pill Press Machines, Multi-Station Press Machines |

| By Automation Level | Manual Pill Press Machines, Semi-Automatic Pill Press Machines, Fully Automatic Pill Press Machines |

| By Capacity | Low Capacity (Up to 50,000 Tablets/Hour), Medium Capacity (50,001 - 200,000 Tablets/Hour), High Capacity (Above 200,000 Tablets/Hour) |

| By Application | Pharmaceutical Tablet Production, Nutraceuticals and Dietary Supplements, Veterinary Medicine Tablets, Industrial and Specialty Chemicals |

| By End-Use Industry | Pharmaceutical Manufacturers, Nutraceutical Companies, Research and Development Laboratories, Veterinary Healthcare Producers, Contract Manufacturing Organizations (CMOs) |

| Key Companies Profiled | Fette Compacting, KORSCH AG, I.M.A. Industria Macchine Automatiche S.p.A., Syntegon Technology GmbH, Romaco Group, Natoli Engineering, Grand Group, SaintyCo, Fluid Pack, Lodha International LLP |

| Additional Attributes | Strong demand for high-capacity rotary press machines in large-scale pharmaceutical production, rising adoption of fully automatic systems to improve precision and output, nutraceutical and dietary supplement expansion driving medium-capacity machine use, growing role of CMOs in cost-efficient manufacturing, and increased adoption in veterinary and specialty chemicals requiring uniform dosage and compliance with global GMP standards. |

The global pill pressing machine market is estimated to be valued at USD 2.8 billion in 2025.

The market size for the pill pressing machine market is projected to reach USD 4.6 billion by 2035.

The pill pressing machine market is expected to grow at a CAGR of 5.1% between 2025 and 2035.

The key automation levels in the pill pressing machine market include manual, semi-automatic, and fully automatic pill press machines.

The fully automatic pill press machines segment is projected to account for the highest share of 44.5% in the pill pressing machine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pillow Pouch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pillow Holder for Tablets Market Size and Share Forecast Outlook 2025 to 2035

Pillow Cases Market Analysis - Growth & Demand Forecast 2025 to 2035

Market Share Insights of Leading Pillow Pouch Packaging Providers

Examining Market Share Trends in Pillow Pack Packaging

Pillow Market

Pillow Pack Packaging Market

Pills Counting & Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Papillary Thyroid Cancer Market Size and Share Forecast Outlook 2025 to 2035

Pupillometer Market Size and Share Forecast Outlook 2025 to 2035

Capillary Electrophoresis Market Size, Growth, and Forecast 2025 to 2035

Capillary Underfill Material Market

Neck Pillows Market Analysis - Trends, Growth & Forecast 2025 to 2035

Smart Pill Box Market Size and Share Forecast Outlook 2025 to 2035

Smart Pill Technologies Market Analysis - Growth & Forecast 2025 to 2035

Smart Pill Boxes & Bottles Market Size, Growth, and Forecast for 2025 to 2035

Market Share Breakdown of Beauty Pillowcase Manufacturers

US Bed Pillow Market Growth - Size, Trends & Forecast 2024 to 2034

Beauty Pillowcase Market Report - Growth & Industry Outlook 2024-2034

Human Papilloma Virus Testing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA