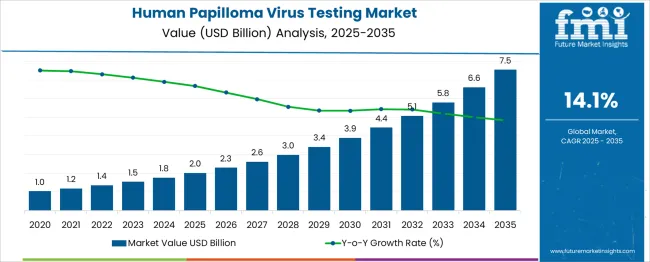

The global human papilloma virus testing market is projected to grow from USD 2 billion in 2025 to approximately USD 7.5 billion by 2035, recording an absolute increase of USD 5.5 billion over the forecast period. This translates into a total growth of 275.8%, with the market forecast to expand at a compound annual growth rate (CAGR) of 14.1% between 2025 and 2035. The market size is expected to grow by nearly 3.8X during the same period, supported by increasing awareness about cervical cancer prevention, rising adoption of molecular diagnostic technologies, and growing government initiatives for women's health screening programs.

Between 2025 and 2030, the human papilloma virus testing market is projected to expand from USD 2 billion to USD 3.9 billion, resulting in a value increase of USD 1.9 billion, which represents 34.5% of the total forecast growth for the decade.

This phase of growth will be shaped by rising awareness about HPV-related cancers, increasing adoption of preventive healthcare measures, and growing penetration of advanced molecular diagnostic technologies in emerging markets. Healthcare providers and diagnostic companies are expanding their HPV testing portfolios to address the growing demand for comprehensive women's health screening solutions.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 2 billion |

| Forecast Value in (2035F) | USD 7.5 billion |

| Forecast CAGR (2025 to 2035) | 14.1% |

From 2030 to 2035, the market is forecast to grow from USD 3.9 billion to USD 7.5 billion, adding another USD 3.6 billion, which constitutes 65.5% of the ten-year expansion. This period is expected to be characterized by expansion of point-of-care testing solutions, integration of artificial intelligence in diagnostic workflows, and development of personalized screening protocols. The growing adoption of self-collection methods and home-based testing solutions will drive demand for innovative HPV testing technologies with enhanced accuracy and patient convenience.

Between 2020 and 2025, the human papilloma virus testing market experienced robust expansion, driven by increasing awareness about cervical cancer prevention and growing adoption of molecular diagnostic techniques. The market developed as healthcare systems recognized the importance of early detection and prevention of HPV-related cancers. Government initiatives promoting women's health screening programs and healthcare provider recommendations began emphasizing the critical role of regular HPV testing in comprehensive preventive healthcare strategies.

Market expansion is being supported by the increasing global burden of cervical cancer and the corresponding demand for effective screening and early detection solutions. Modern healthcare systems are increasingly focused on preventive care measures that can identify high-risk HPV infections before they progress to cervical cancer or other HPV-related malignancies. HPV testing's proven efficacy in detecting oncogenic HPV strains and its role in cervical cancer screening programs make it an essential component of women's healthcare protocols worldwide.

The growing focus on molecular diagnostics and precision medicine is driving demand for advanced HPV testing technologies that can provide genotype-specific information and risk stratification. Healthcare providers' preference for comprehensive testing solutions that combine HPV detection with cytology screening is creating opportunities for innovative diagnostic platforms. The rising influence of healthcare digitization and telemedicine is also contributing to increased adoption of HPV testing solutions that can integrate with electronic health records and support remote patient monitoring.

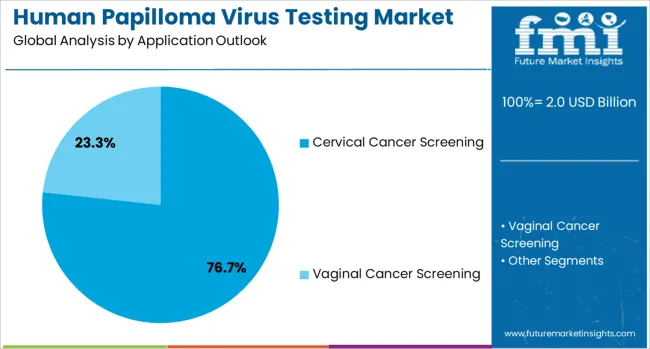

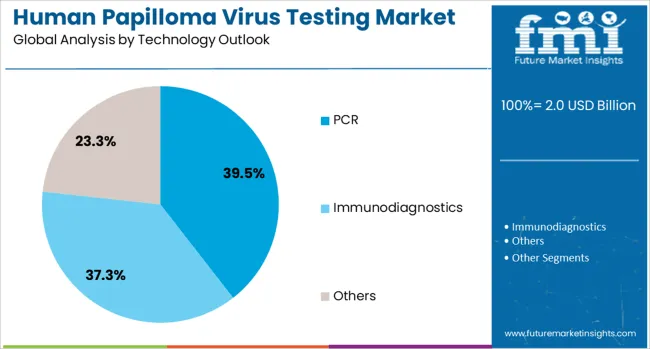

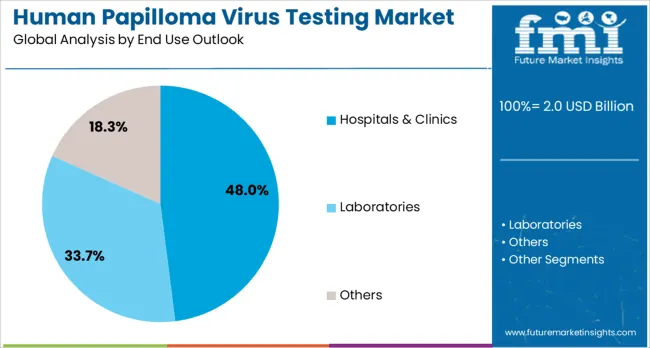

The market is segmented by application, product, technology, end use, and region. By application, the market is divided into cervical cancer screening and vaginal cancer screening. Based on product, the market is categorized into consumables, instruments, and services. In terms of technology, the market is segmented into PCR, immunodiagnostics, and others. By end use, the market is classified into hospitals & clinics, laboratories, and others. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The cervical cancer screening application is projected to account for 76.7% of the human papilloma virus testing market in 2025, reaffirming its position as the category's primary driver. Healthcare systems worldwide increasingly recognize the critical importance of regular cervical cancer screening in preventing HPV-related malignancies and reducing mortality rates. HPV testing's superior sensitivity compared to traditional cytology methods makes it the preferred choice for primary cervical cancer screening programs.

This application forms the foundation of most national screening guidelines, as it represents the most evidence-based and clinically validated use of HPV testing technology. Medical societies and public health organizations continue to strengthen recommendations for HPV-based screening protocols. With increasing awareness about cervical cancer prevention and growing access to healthcare services globally, cervical cancer screening applications align with both population health goals and individual patient care objectives. Its widespread adoption across diverse healthcare settings ensures dominance, making it the central growth driver of HPV testing market demand.

Consumables are projected to represent 65.3% of human papilloma virus testing demand in 2025, underscoring their role as the essential components for routine HPV screening operations. Healthcare facilities rely on consumables, including sample collection kits, reagents, and testing cartridges for daily HPV testing workflows. The recurring nature of consumables purchases creates revenue streams for manufacturers while ensuring continuous availability of testing capabilities.

The segment is supported by the increasing volume of HPV tests performed globally and the need for standardized, high-quality testing materials. Technological advances in consumables design are improving sample collection efficiency, test accuracy, and user experience. As healthcare systems expand HPV screening programs and adopt higher-throughput testing protocols, consumables will continue to dominate market demand, reinforcing their essential position within the HPV testing ecosystem.

The PCR (Polymerase Chain Reaction) technology is forecasted to contribute 39.5% of the human papilloma virus testing market in 2025, reflecting its established role as the gold standard for HPV DNA detection and genotyping. PCR-based HPV tests offer superior analytical sensitivity and specificity compared to other detection methods, enabling reliable identification of high-risk HPV strains associated with cervical cancer development.

This technology provides the molecular precision required for accurate risk stratification and clinical decision-making in HPV screening programs. PCR platforms also enable multiplex detection of multiple HPV genotypes in single assays, improving testing efficiency and clinical utility. The segment benefits from continuous technological improvements in PCR instrumentation, assay design, and automation capabilities. With healthcare providers increasingly adopting evidence-based screening protocols that require high analytical performance, PCR technology serves as the foundation for comprehensive HPV testing solutions.

The hospitals & clinics end-use segment is projected to account for 48% of the human papilloma virus testing market in 2025, representing the primary point of care for women's health services and cervical cancer screening. These healthcare facilities serve as the main interface between patients and HPV testing services, providing both routine screening and follow-up diagnostic testing for women across all age groups.

This segment encompasses a diverse range of healthcare settings including general hospitals, women's health clinics, gynecology practices, and community health centers. The integration of HPV testing into routine gynecological care and the expansion of women's health services globally support demand growth. Healthcare facilities are increasingly adopting comprehensive HPV testing protocols that combine screening, genotyping, and patient counseling services to deliver optimal patient care outcomes.

The human papilloma virus testing market is advancing rapidly due to increasing awareness about cervical cancer prevention and growing adoption of molecular diagnostic technologies. The market faces challenges including healthcare infrastructure limitations in developing regions, cost constraints in public health programs, and competition from alternative screening methods. Innovation in point-of-care testing technologies and integration of artificial intelligence continue to influence product development and market expansion patterns.

The growing implementation of national cervical cancer screening programs is enabling widespread access to HPV testing services and driving systematic adoption of preventive healthcare measures. Government health initiatives provide funding for population-based screening, creating demand for HPV testing solutions. Public health campaigns and healthcare provider education programs are increasing awareness about the importance of regular HPV screening in cervical cancer prevention.

Modern HPV testing manufacturers are developing point-of-care diagnostic solutions and self-collection systems that enable testing in diverse healthcare settings and improve patient accessibility. These technologies reduce barriers to screening participation while maintaining high analytical performance standards. Advanced diagnostic platforms also enable rapid result delivery and immediate clinical decision-making, enhancing patient care efficiency and screening program effectiveness.

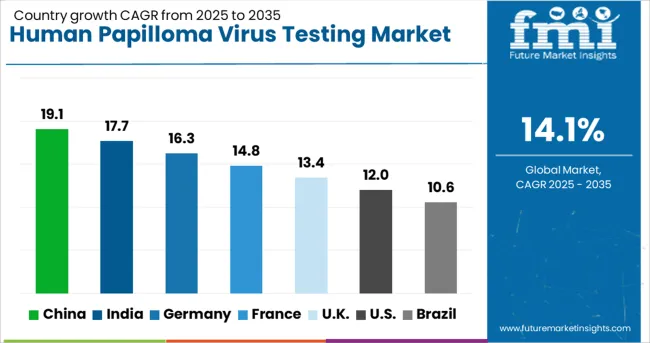

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 19.1% |

| India | 17.7% |

| Germany | 16.3% |

| France | 14.8% |

| UK | 13.4% |

| USA | 12% |

| Brazil | 10.6% |

The human papilloma virus testing market is experiencing robust growth globally, with China leading at a 19.1% CAGR through 2035, driven by massive healthcare infrastructure investment, expanding women's health programs, and growing awareness about cervical cancer prevention. India follows closely at 17.7%, supported by government health initiatives, increasing healthcare access, and rising disposable income. Germany shows strong growth at 16.3%, emphasizing advanced diagnostic technologies and comprehensive screening programs. France records 14.8%, focusing on innovative testing solutions and public health initiatives. The UK demonstrates 13.4% growth, prioritizing evidence-based screening protocols and healthcare system efficiency.

Revenue from human papilloma virus testing in China is projected to exhibit exceptional growth with a CAGR of 19.1% through 2035, driven by massive government investment in healthcare infrastructure and expanding women's health services. The country's growing focus on preventive healthcare and cervical cancer screening is creating unprecedented demand for advanced HPV testing solutions across urban and rural healthcare facilities.

Revenue from human papilloma virus testing in India is expanding at a CAGR of 17.7%, supported by government health initiatives, increasing healthcare awareness, and growing investment in women's health services. The country's large population base and expanding middle class create substantial opportunities for comprehensive cervical cancer screening programs and advanced diagnostic services.

Revenue from human papilloma virus testing in Germany is projected to grow at a CAGR of 16.3% through 2035, driven by the country's strong focus on healthcare quality, advanced diagnostic technologies, and comprehensive screening programs. German healthcare systems consistently demand high-quality, clinically validated HPV testing solutions that deliver superior analytical performance.

Revenue from human papilloma virus testing in France is projected to grow at a CAGR of 14.8% through 2035, supported by the country's comprehensive public health system and strong commitment to women's healthcare services. French healthcare authorities consistently implement evidence-based screening guidelines that prioritize HPV testing for effective cervical cancer prevention programs.

Demand for human papilloma virus testing in the UK is projected to grow at a CAGR of 13.4%, supported by the NHS's systematic approach to cervical cancer screening and strong focus on clinical evidence validation. British healthcare systems prioritize cost-effective, high-quality diagnostic solutions that deliver optimal patient outcomes and population health benefits.

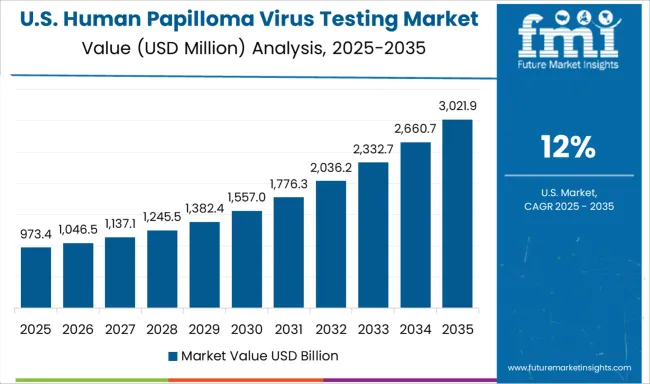

Demand for human papilloma virus testing in the USA is projected to grow at a CAGR of 12%, supported by advanced healthcare infrastructure, comprehensive insurance coverage, and strong focus on preventive care. American healthcare providers increasingly adopt evidence-based screening guidelines that prioritize HPV testing for cervical cancer prevention and early detection.

Revenue from human papilloma virus testing in Brazil is projected to grow at a CAGR of 10.6% through 2035, driven by expanding healthcare access, increasing government investment in women's health programs, and growing awareness about cervical cancer prevention. The country's large population base and developing healthcare infrastructure create significant opportunities for HPV testing market expansion.

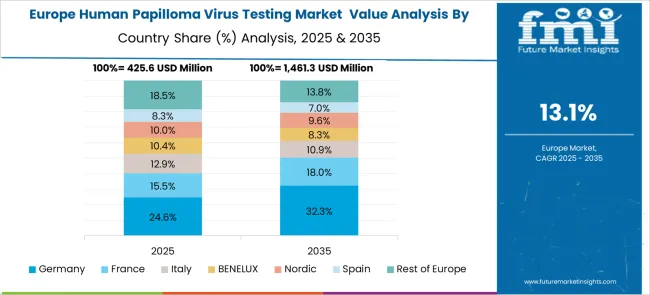

The European Human Papilloma Virus testing market demonstrates sophisticated development across major economies with Germany leading through its precision diagnostic excellence and advanced healthcare technology capabilities, supported by companies like F. Hoffmann-La Roche and Siemens Healthineers pioneering comprehensive HPV testing solutions with a focus on molecular diagnostics, cervical cancer screening, and women's health applications, while emphasizing clinical accuracy and regulatory compliance. The UK shows strength in evidence-based screening protocols and healthcare system efficiency, with companies specializing in systematic HPV testing programs that meet strict clinical standards and provide consistent diagnostic outcomes.

France contributes through companies delivering integrated HPV testing solutions and public health excellence for comprehensive women's healthcare applications. Italy and Spain demonstrate growth in specialized diagnostic formulations for cancer screening programs. The market benefits from stringent EU healthcare regulations, established diagnostic infrastructure, and growing focus on preventive healthcare methods positioning Europe as a key center for advanced HPV testing technologies.

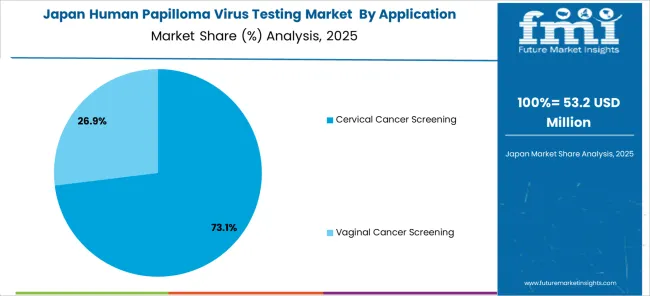

The Japanese Human Papilloma Virus testing market demonstrates steady growth driven by precision healthcare focus, advanced diagnostic technologies, and healthcare system preference for high-quality molecular testing systems ensuring superior clinical accuracy and safety compliance throughout women's health operations. International companies establish presence through cutting-edge HPV testing technologies aligning with Japan's sophisticated healthcare industry and stringent quality standards while incorporating AI integration and automated diagnostic capabilities.

The market emphasizes automated laboratory systems, precision molecular diagnostics excellence, and advanced screening innovations reflecting Japanese healthcare precision and attention to detail in diagnostic processes. Growing investment in healthcare digitization supports intelligent testing systems with real-time monitoring, predictive analytics, and optimized diagnostic performance. Japanese healthcare providers prioritize test reliability, consistent clinical outcomes, and regulatory compliance, creating opportunities for premium HPV testing solutions delivering exceptional performance across hospitals, clinics, and laboratory applications requiring highest quality standards.

The South Korean Human Papilloma Virus testing market shows exceptional growth potential driven by expanding healthcare infrastructure, increasing adoption of advanced diagnostic technologies, and growing awareness about women's health requiring efficient and comprehensive HPV screening solutions. The market benefits from South Korea's technological advancement capabilities and increasing focus on healthcare competitiveness driving investment in modern molecular diagnostics meeting international clinical standards and regulatory requirements.

Korean healthcare facilities increasingly adopt automated diagnostic systems, advanced molecular testing equipment, and integrated screening technologies improving diagnostic accuracy and patient care while ensuring clinical compliance. Growing influence of Korean healthcare innovations in global markets supports demand for sophisticated HPV testing solutions ensuring clinical excellence while maintaining cost-effectiveness. Integration of digital health principles and smart diagnostic technologies creates opportunities for intelligent testing systems with connectivity features, predictive capabilities, and real-time clinical optimization across diverse women's healthcare applications.

The human papilloma virus testing market is characterized by competition among established diagnostic companies, biotechnology firms, and emerging molecular diagnostic specialists. Companies are investing in advanced testing technologies, point-of-care solutions, artificial intelligence integration, and global market expansion to deliver comprehensive, accessible, and innovative HPV testing solutions. Product portfolio diversification, regulatory compliance, and healthcare partnership development are central to strengthening market presence and competitive positioning.

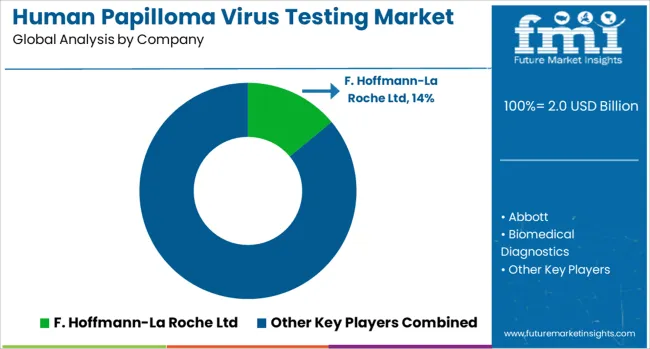

F. Hoffmann-La Roche Ltd leads the market with significant global presence, offering comprehensive HPV testing solutions with a focus on molecular diagnostics and automated testing platforms. Abbott provides innovative diagnostic technologies with an focus on point-of-care testing and healthcare accessibility. Biomedical Diagnostics delivers specialized HPV testing solutions with a focus on clinical accuracy and laboratory efficiency. bioMerieux offers advanced molecular diagnostic platforms with integrated laboratory automation.

Bio-Rad Laboratories Inc. focuses on high-quality reagents and testing systems for laboratory applications. Fujirebio provides specialized cancer diagnostic solutions with focus on biomarker detection. Oncolab delivers comprehensive oncology diagnostic services including HPV testing. Hologic Inc. offers integrated women's health solutions combining HPV testing with cytology screening. Qiagen provides molecular diagnostic technologies and sample preparation solutions. Siemens Healthineers AG delivers comprehensive laboratory automation and diagnostic testing systems.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 2 billion |

| Application | Cervical cancer screening, Vaginal cancer screening |

| Product | Consumables, Instruments, Services |

| Technology | PCR, Immunodiagnostics, Others |

| End Use | Hospitals & clinics, Laboratories, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia, and 40+ countries |

| Key Companies Profiled | F. Hoffmann-La Roche Ltd, Abbott, Biomedical Diagnostics, bioMerieux, Bio-Rad Laboratories Inc., Fujirebio, Oncolab, Hologic Inc., Qiagen, and Siemens Healthineers AG |

| Additional Attributes | Revenue analysis by HPV genotype and risk stratification, regional screening program trends, competitive landscape analysis, healthcare provider preferences for testing platforms, integration with cytology and molecular diagnostics, innovations in point-of-care testing, artificial intelligence applications, and self-collection technologies |

The global human papilloma virus testing market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the human papilloma virus testing market is projected to reach USD 7.5 billion by 2035.

The human papilloma virus testing market is expected to grow at a 14.1% CAGR between 2025 and 2035.

The key product types in human papilloma virus testing market are cervical cancer screening and vaginal cancer screening.

In terms of product outlook , consumables segment to command 65.3% share in the human papilloma virus testing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Human Torso Simulator Market Size and Share Forecast Outlook 2025 to 2035

Human Transferrin Detection Kit Market Size and Share Forecast Outlook 2025 to 2035

Human-Centric Lighting Market Size and Share Forecast Outlook 2025 to 2035

Human Identification Market Size and Share Forecast Outlook 2025 to 2035

Humanoid Robot Market Size and Share Forecast Outlook 2025 to 2035

Humanized Mouse Model Market Size and Share Forecast Outlook 2025 to 2035

Human Milk Oligosaccharides Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Human Combinatorial Antibody Libraries (HuCAL) Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Human Growth Hormone (HGH) Treatment and Drugs Market Trends - Growth & Forecast 2025 to 2035

Human Augmentation Technology Market Growth - Trends & Forecast 2025 to 2035

Key Companies & Market Share in the Human Milk Oligosaccharides Sector

Human Osteoblasts Market – Growth & Forecast 2024-2034

Human Capital Management Market

Human Anatomical Models Market

Human Machine Interface Market

Human Immunodeficiency Virus Type 1 (HIV 1) Market Size and Share Forecast Outlook 2025 to 2035

Human RSV Treatment Market Insights - Innovations & Forecast 2025 to 2035

UK Human Milk Oligosaccharides Market Trends – Size, Demand & Forecast 2025-2035

USA Human Milk Oligosaccharides Market Insights – Growth & Demand 2025-2035

ASEAN Human Milk Oligosaccharides Market Report – Size, Demand & Growth 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA