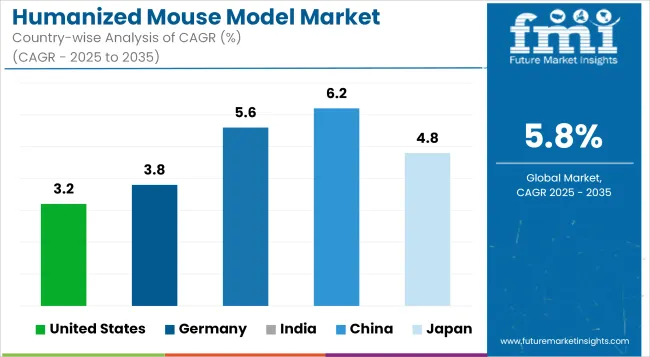

The Humanized Mouse Model Market is anticipated to be valued at USD 113.6 million in 2025 and is expected to reach USD 119.6 million by 2035, registering a CAGR of 5.8%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 113.6 Million |

| Industry Value (2035F) | USD 119.6 million |

| CAGR (2025 to 2035) | 5.8% |

The Humanized Mouse Model Market is experiencing significant growth, driven by the increasing demand for preclinical drug development and research in oncology, immunology, and infectious diseases. These models offer a more accurate representation of human physiology and disease compared to traditional animal models, leading to improved efficacy and safety assessments of new therapeutics. Technological advancements, such as CRISPR and other gene-editing tools, have enhanced the development of sophisticated humanized mouse models, further boosting market expansion.

The rising prevalence of chronic diseases and the growing emphasis on personalized medicine are also contributing to the market's growth. Pharmaceutical and biotechnology companies are investing heavily in these models to accelerate drug discovery processes and reduce the failure rates of clinical trials. The market is poised for continued expansion as the need for reliable and translational preclinical models becomes increasingly critical in the development of innovative therapies.

Prominent players in the Humanized Mouse Model Market include The Jackson Laboratory, Charles River Laboratories, Inotiv Inc., and genOway. These companies are at the forefront of developing advanced humanized mouse models that cater to the evolving needs of biomedical research. In July 2024, Scientists at The University of Texas Health Science Center at San Antonio announced the creation of world’s first mouse model equipped with a fully functional human immune system.

Named TruHuX (for truly human, or THX), these humanized mice represent a significant advancement in immunological and microbiological research. Paolo Casali, MD, the University of Texas Ashbel Smith Professor and Distinguished Research Professor, explained that “THX mice utilize estrogen activity to bolster human stem cell and immune cell development, enhancing antibody responses.”

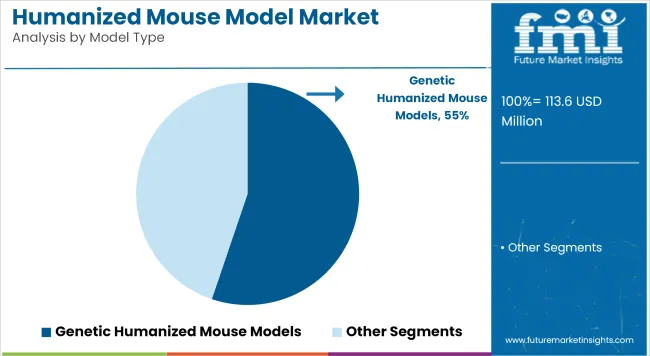

The dominance of genetic humanized mouse models, accounting for 55.20% of the market in 2025, can be attributed to their engineered ability to replicate human gene functions and immunological pathways. Their utilization has been prioritized in studies requiring accurate in vivo models for human immune responses, particularly in oncology and autoimmune disease research.

These models are often developed using CRISPR and other gene-editing technologies, allowing for precise human gene knock-in, which improves translational outcomes in preclinical trials. Their growth has been further supported by increased industry and academic focus on gene-based therapies and personalized medicine. Additionally, regulatory bodies have increasingly recognized the value of such models in replacing or supplementing traditional animal testing, thus strengthening their adoption.

Collaborative initiatives between CROs, biopharma companies, and academic centers have also accelerated model development and availability. As a result, genetic models have been positioned as a cornerstone in preclinical research for next-generation biologics and immunotherapies.

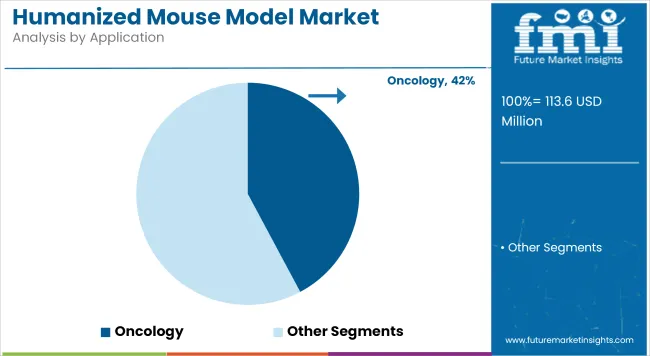

With a 42.2% market share in 2025, oncology remains the dominant application segment within the Humanized Mouse Model Market. This leadership has been driven by the urgent need for predictive and reproducible preclinical models capable of mimicking human tumor microenvironments.

Humanized mouse models have been widely employed in immuno-oncology, especially in assessing checkpoint inhibitors, CAR-T therapies, and bispecific antibodies. A substantial shift toward personalized cancer treatment has created demand for highly human-relevant models.

Furthermore, pharmaceutical companies have increasingly relied on these models to evaluate tumor-immune interactions and drug toxicity profiles with greater translational accuracy. The ongoing rise in cancer prevalence worldwide, coupled with a robust pipeline of targeted therapies in development, has necessitated advanced testing platforms thereby accelerating adoption. As these models continue to validate their clinical predictability, their utility in oncology research is expected to further expand, supporting regulatory approval and commercial success of novel therapies.

The pharmaceutical and biotechnology companies segment, holding a 60.21% market share in 2025, has been propelled by the increasing requirement for reliable in vivo validation platforms. Humanized mouse models have been integrated into drug discovery pipelines to support the development of monoclonal antibodies, gene therapies, and immunotherapies.

Their application has enabled better assessment of pharmacokinetics, safety, and efficacy prior to human trials. This growth has been reinforced by companies prioritizing pipeline acceleration, risk reduction, and personalized therapy development. Significant R&D investment, paired with strategic alliances with CROs and academic institutions, has expanded access to sophisticated model libraries.

Moreover, with biologics becoming a dominant therapeutic class, especially in oncology and autoimmune disorders, demand for human-relevant preclinical models has surged. Regulatory pressure to adopt more predictive and ethical testing models has also influenced industry adoption positively. Consequently, pharmaceutical and biotech firms have emerged as the primary users of humanized models to de-risk innovation and improve clinical translation.

High Cost and Technical Complexity Hinders the Adoption of Humanized Mouse Model

The primary disadvantage in terms of adoption of humanized mouse models remains their extremely costly and technically demanding status. Their generation-and maintenance-require specialized knowledge, state-of-the-art genetic engineering techniques, and immunological alterations to an extent that they are far more expensive than their classical counterparts.

Moreover, extended gestation periods coupled with poor breeding efficiencies only make matters worse in terms of cost and render such models low on scalability.Furthermore, variability with engraftment success and variation in immune response will add to the experimental unpredictability of these models, therefore demanding an extra level of procedure validation.

Rising Demand for Infectious Disease Researchposes significant opportunity for humanized mouse model

Humanized mice are critical for modeling human-specific pathogens such as HIV, SARS-CoV-2, Zika, and the hepatitis viruses that otherwise do not infect conventional mouse models. Following continuous advances in antiviral drug discovery and vaccine development, humanized mice are presently employed by the pharmaceutical and biotechnology industry for testing novel therapies in settings of human immune systems helmeting physiologically relevant counterparts.

Furthermore, global pandemics preparedness programs and an increase in concerns regarding antimicrobial resistance (AMR) are creating a necessity for advanced preclinical models that may closely mimic human responses. Increased government and research institutional investment in infectious disease modeling is accelerating humanized mouse market development.

Expanding Role in Immuno-Oncology Research Surges the Growth of the Market

Humanized mouse models occupy center stage in immuno-oncology drug discovery, where human immune cells can be studied for interaction with cancer. The pharmaceutical industry, in turn, is finding increasing applicability of these models in the screening of immune checkpoint inhibitors, CAR-T therapies, and monoclonal antibodies. Compared with more isolated conventional models, humanized mice are highlighting safety and efficacy methods for rapid clinical translation in immunotherapy.

Towards developing cancer immunotherapies, leading biotech and pharmaceutical companies have invested substantially in improving engraftment methodologies and in the development of customized humanized models to specifically interrogate certain cancers, thus driving demand on the part of such preclinical reagents.

Rising Adoption in Infectious Disease Research Anticipates the Growth of the Market

The need for more efficacious models in infectious diseases prompted the increasing usage of humanized mouse models, especially in research relating to viral infections such as HIV, hepatitis, and tuberculosis.Research organizations and pharmaceutical companies utilize these models extensively to design new therapeutic avenues against novel and re-emerging infectious diseases.

Further, public health agencies and regulatory bodies would also support funding programs for the application of humanized mice to dissecting the pathogenesis of the disease and drug responses, thus paving the way for industry development.

Expansion of Hematopoietic Stem Cell (HSC)-Humanized Models

Amongst the emerging trends in humanized mouse research is the generation of advanced HSC-humanized models that support long-term engraftments for functional human immune cells. These models offer a more relevant platform for studying autoimmune diseases, chronic inflammation, and hematological tumors.

The HSC-humanized mouse model is now gaining increasing acceptance by pharmaceutical companies to assess next-generation immunotherapies targeted at bispecific antibodies and cytokine-based therapies. In the same vein, there is increased emphasis on streamlining engraftment and immune cell differentiation for a more reproducible and consistent model of drug development and disease modelling.

Increasing Use in Transplantation and Graft-Versus-Host Disease (GVHD) Research

With rising cases of organ transplantation worldwide, organ transplant scientists are working on these models to study compatibility of immune responses and tolerance-creating approaches to organ transplant patients. The pharmaceutical industry is using humanized models for the screening of new immuno-suppressants toward decreasing rejection rates in transplants.

The increasing rates of bone marrow and stem cell transplantation, together with the rising technology in human immune system reconstruction are creating further demand for these models in transplantation studies.

Between 2020 and 2024, market growth was stimulated by rising demand for preclinical drug testing; increased funding for infectious diseases and oncology research; and improvements to the methodology for the reconstruction of immune systems. The COVID-19 pandemic also sped up the use of the model in the development of antivirals, drugs, and vaccines.

For the period 2025 to 2035, growth would be further stimulated by advances in stem cell engraftment, research on transplantation, and hematopoietic models. The demand further fueled by increasing applications in autoimmune disease, regenerative medicine, and transplantation studies. Increased funding and regulatory support in conjunction with pharma collaborations will drive continuous innovations and wider acceptance across various research domains.

Market Outlook

The greatest market of humanized mouse models is by far the USA because much spending on research and development is directed to cancer immunotherapy, infectious disease, and autoimmune disease. There are other reasons why the market has high growth, such as the presence of leading pharma companies and strong academic research supported by NIH funding. Adoption is further driven due to increasing FDA approvals of humanized models for preclinical drug testing.

Market Growth Factors

Market Outlook

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.2% |

Market Outlook

This country is very strong on biomedical research and has a very stringent regulatory environment which really advances the use of humanized mouse models. Further spurred on by the nation's advances in oncology and immunotherapy research and the increasing number of pharmaceutical partnerships within Germany, the market grows. Increasing amounts of government funding made available for translational medicine and studies on drug effectiveness accelerates demand further into the nation.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.8% |

Market Outlook

Emergence of biotechnology industries and increasing number of contract research organizations (CROs), in addition to focus on vaccine and drug development, thus many factors propelling growth. Through funding programs and the relaxation of clinical trial regulations, there are also incentives from the government that enhance adoption.

People are becoming increasingly aware of the requirement for research on humanized mouse models, and so in above factors, there are increasing global partnerships that further strengthen demand.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.6% |

Market Outlook

The market for humanized mouse models in China is growing at an extremely rapid pace due to the investment in translational research and precision medicine in China. Activities funded by the government for the improvement of drug discovery, expanding biotech firms, and enhanced requirement for immuno-oncology research boost the market growth. Another area of growth for local CROs that further endorses adoption in pharma R&D.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.2% |

Market Outlook

Japan has advanced research capabilities and puts much weight on regenerative medicine and stem cell research. All these act towards propelling the market for humanized mouse models. The aging of the population in Japan thus adds to a higher demand for preclinical research towards age-related disorders. Infrastructures and government policies further improve the academia-pharma collaboration towards the increased use of these models.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

Intense competition is present in the humanized mouse model market due to the emergence of technical advancement in genetic engineering people on the side of the regulatory authorities and huge demand for preclinical models that will map onto clinical outcome accurately. Authorities such as the FDA and EMA focusing on ethical issues and replicability during drug testing will further determine market trends.

Market leaders secure their share through alliances with pharma companies, biotech industries, and academia to develop disease-specific humanized models. On these premises, regional players throw challenges to global leaders with inexpensive alternatives, specialized localized settings, and scalable research services. On the balance of the emerging market for lucrative opportunities, competition is thrown by innovative pricing mechanisms, enhanced CRO collaborations, and making of tailored models.

The market is segmented into Genetic and Cell-Based (CD34, PBMC, and BLT).

The market is segmented into Oncology, Immunology and Infectious Diseases, Neuroscience, Toxicology, Hematopoiesis, and Other Applications.

The market is segmented into Pharmaceutical & Biotechnology Companies, Contract Research Organizations, and Academic & Research Institutions.

The Humanized Mouse Model Market is analyzed across North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and the Middle East & Africa.

The overall market size for humanized mouse model market was USD 113.6 Million in 2025.

The humanized mouse model market is expected to reach USD 119.6 million in 2035.

Expanding Cancer Research and Immunotherapy Development anticipates the growth of the humanized mouse model market.

The top key players that drives the development of humanized mouse model market are Ingenious Targeting Laboratory, Axenis S.A.S, Trans Genic Inc., Horizon Discovery Group PLC and Champions Oncology Inc.

Genetic segment by product is expected to dominate the market during the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mouse RNase Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Mouse Elevated Cross Maze Market Size and Share Forecast Outlook 2025 to 2035

Rat and Mouse Forced Swimming Test System Market Size and Share Forecast Outlook 2025 to 2035

Wireless Mouse Market

Model Based Testing Tools Market Size and Share Forecast Outlook 2025 to 2035

Model-Based Manufacturing Technologies Market Analysis by Solution, Deployment, Enterprise Size, Industry, and Region Through 2035

Animal Model Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Remodeling Market Size and Share Forecast Outlook 2025 to 2035

AI-Driven Agent-Based Modeling – Predictive Insights & Analysis

Data Center Modeling and Simulation Tools Market

3D Mapping and Modeling Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Brain Model Market Analysis – Trends & Forecast 2024-2034

Human Anatomical Models Market

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Surgical Models Market Analysis - Size, Share, and Forecast 2025 to 2035

Building Information Modeling Market Size and Share Forecast Outlook 2025 to 2035

Tourism Independent Contractor Model Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA