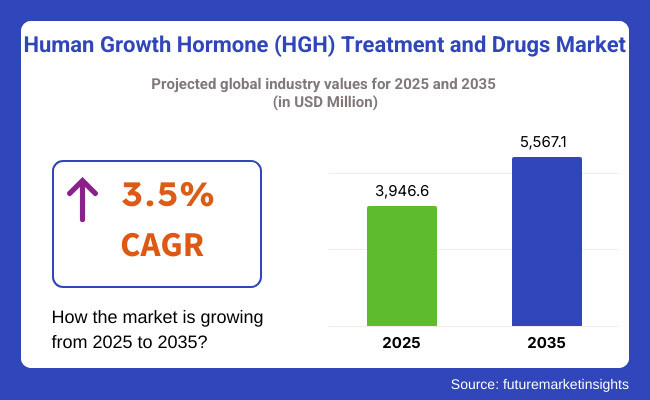

The excel in human growth hormone (HGH) treatment and drugs market is expected between 2025 and 2035, owing to the prevalence of growth disorders, increasing use of recombinant DNA technology for mass production, and increasing applications of HGH in the anti-aging and sports medicine segments. The market is expected to be valued at USD 3,946.6 million in 2025 and will be nearing USD 5,567.1 million by 2035, exhibiting a CAGR of 3.5% over the forecast period.

Growth hormone therapies are widely used for the management of paediatric growth hormone deficiency (GHD), Turner syndrome, Prader-Willi syndrome and adult hormone deficiencies. Development of ubiquitous HGH formulations, availability of long-acting growth hormones and a growing awareness regarding early diagnosis of hormone-related conditions are fuelling demand for HGH therapy in the market. However, challenges to market expansion include high treatment costs, stringent regulatory approvals, and potential misuse in sports and bodybuilding.

Innovations in needle-free delivery systems, long-acting formulations of HGH, and intelligent drug monitoring applications are enhancing patient compliance and treatment outcomes. New gene-based and regenerative medicine technologies are also providing new opportunities for HGH-based therapies.

North America stands as the principal world's producer and is likely to dominate the HGH treatment market, owing to the healthcare expenditure levels of the USA in the region, as well as approval of new HGH treatments from the region's FDA, and rising requirement for anti-ageing medicine across the nation.

Because of this, recombinant HGH products, biosimilar HGH medicines and growth hormone replacement therapies are witnessing healthy adoption in the USA and Canada. Ample amounts of secretion of HGH also in turn provides posterior the regulation and the systems of frequency in documentation of the prescription.

HGH Adoption in Europe is on the rise with the help of expanding clinical trials, advancements in pediatric endocrinology, and rising awareness on growth disorders. Top producers of recombinant HGH and biosimilar products include Germany, UK, France, and Italy. The EMA emphasizes the availability of cheaper and safer HGH alternatives to facilitate access to growth hormone therapies.

The Asia-Pacific region is expected to register the fastest growth, owing to the growing investment in healthcare, increasing number of pediatric patients with growth hormone deficiency, and the rising demand for biosimilar HGH therapies in countries such as China, India, Japan and South Korea.

At the same time, China is booming in recombinant HGH production, and Japan and South Korea are working on gene-editing routes to hormone replacement. India: a leading force behind affordable HGH biosimilar and generics, helping to bring HGH treatment to developing markets.

Challenges: High Treatment Costs and Misuse Concerns

Though HGH therapy is paramount in the management of growth disorders, significant hurdles like the high cost of recombinant HGH, restricted insurance coverage options, and rigorous regulatory approval processes remain operational hurdles. Moreover, misuse of HGH in performance-enhancement and anti-aging therapies is raising awareness towards regulatory obstacles for prescribing and substance monitoring products.

Opportunities: Long-acting HGH and AI-driven Treatment Optimization

Market growth opportunities are being created with the rise in adoption of long-acting HGH formulations, wearable HGH monitoring systems, and AI-assisted treatment recommendations. Gene therapy, for example, has become the biotechnology of the future, enabling scientists to combat genetic diseases, and CRISPR-based growth hormone treatments are emerging as a cornerstone for 21st-century precision medicine in endocrinology. Furthermore, the emergence of telemedicine platforms and digital prescription services is enhancing patient access to HGH therapies at a global degree.

Between 2020 and 2024, the HGH Treatment and Drugs Market witnessed moderate growth on account of increasing prevalence of growth hormone deficiencies (GHD), growing adoption of recombinant DNA technology and steady innovations in injectable HGH formulations. There was increasing movement toward biosynthetic HGH and long-acting growth hormone formulations, with reports of success in AI and personalized dosing, especially focused on areas like pediatric endocrinology, adult hormone replacement therapy, and performance-enhancement treatment.

New devices for needle-free delivery of HGH, the discovery of more stable forms of recombinant HGH, and artificial intelligence means of monitoring patients gave a great boost to the efficacy of treatment. Despite this, high treatment costs, regulatory scrutiny and the risk of HGH misuse for non-medical applications have limited widespread adoption.

In the coming years: 2025 to 2035, the market will continue to thrive and even see a shift towards AI-driven precision dosing, bioengineered HGH alternatives, and gene therapy for hormone regulation. Oral and nasal HGH delivery systems, prescription authentication thru blockchain technology and AI driven predictive therapy response modelling can make it all halves.

Continued innovations in lab-grown HGH-producing cells, self-regulating smart hormone patches, and personalized genetic-based HGH therapy will facilitate market evolution. The reports of fully synthetic HGH with no excitatory side effects, AI endocrinology, and sustainability-driven biopharmaceutical manufacturers completely redefine market fit and provide guarantees regarding more precise, accessible and ethical treatment.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA, EMA, and WHO regulations on HGH use and distribution. |

| Technological Innovation | Use of recombinant DNA-derived HGH, standard injectable formulations, and growth monitoring tools. |

| Industry Adoption | Growth in pediatric GHD treatment, adult hormone deficiency therapy, and HGH supplementation in age-related conditions. |

| Smart & AI-Enabled Solutions | Early adoption of AI-driven dosage calculation, smart injection pens, and cloud-based treatment adherence tracking. |

| Market Competition | Dominated by biopharmaceutical firms, endocrinology treatment providers, and specialty HGH drug manufacturers. |

| Market Growth Drivers | Demand fuelled by rising GHD cases, increasing acceptance of HGH therapy, and advancements in biologic drug formulations. |

| Sustainability and Environmental Impact | Early adoption of sustainable biopharma production, AI-assisted resource efficiency, and improved drug stability for reduced waste. |

| Integration of AI & Digitalization | Limited AI use in treatment monitoring, patient adherence tracking, and therapy optimization. |

| Advancements in Manufacturing | Use of traditional recombinant DNA production, single-dose HGH injections, and manual dose adjustments. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter AI-driven prescription tracking, blockchain-backed anti-doping compliance, and bioethical governance of gene-based HGH therapies. |

| Technological Innovation | Adoption of gene-editing solutions for HGH synthesis, AI-powered real-time growth hormone monitoring, and bioengineered smart HGH patches. |

| Industry Adoption | Expansion into AI-assisted personalized endocrinology, regenerative medicine-driven hormone balancing, and precision Nano-drug HGH delivery systems. |

| Smart & AI-Enabled Solutions | Large-scale deployment of self-learning HGH therapy models, predictive hormone imbalance AI diagnostics, and real-time patient monitoring via wearable biosensors. |

| Market Competition | Increased competition from AI-integrated biotech firms, regenerative medicine startups, and gene therapy-driven hormone regulation companies. |

| Market Growth Drivers | Growth driven by AI-powered precision dosing, zero-risk synthetic HGH alternatives, and fully automated smart hormone regulation systems. |

| Sustainability and Environmental Impact | Large-scale transition to zero-waste bioengineered HGH production, AI-driven eco-friendly drug formulation, and carbon-neutral biopharmaceutical manufacturing. |

| Integration of AI & Digitalization | AI-powered real-time hormone fluctuation detection, blockchain-backed medical data security, and predictive hormone imbalance modelling. |

| Advancements in Manufacturing | Evolution of lab-grown HGH-producing cells, AI-assisted adaptive HGH delivery systems, and Nano-technology-driven bioavailability enhancement. |

Increasing prevalence of growth hormone deficiency (GHD), adoption of recombinant HGH therapies and increases in endocrinology research investments have made the USA a big market for human growth hormone (HGH) treatment and drugs.

Market growth is driven by the expanding number of pediatric and adult GHD treatment programs and increasing availability of biosimilar HGH products. Novel drug delivery innovations like needle-free injectors and long-acting HGH formulations are further enhancing treatment adherence and patient outcomes. The rising use of telemedicine for hormone therapy treatment is also evolving the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.7% |

Growing demand for personalized medicine and increasing research into endocrinology disorders is also aiding growth in the UK human growth hormone (HGH) treatment and drugs market, which is supported by increasing government initiatives to expand access to hormone therapies. Market adoption is driven by the expansion of pediatric endocrinology clinics and availability of biosimilar HGH drugs.

Moreover, models that use artificial intelligence for diagnostics are playing an increasingly important role in the early diagnosis of growth pathologies, which is further shaping the current treatment standards. Market developments are also being shaped by the industry trend toward patient-centric care models and self-administration therapy options.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.3% |

Germany, France, and Italy are the top three countries in the European Union growth of the HGH treatment and drugs market, owing to robust healthcare infrastructure, investments in recombinant DNA technology, as well as increased awareness of hormone replacement therapies. Focusing on regulation-based approval of biosimilar and long duration HGH forms is expected to boost market growth in the EU.

Moreover, genetic screening advancements for the early diagnosis of growth hormone deficiency (GHD) and Turner syndrome to drive growth hormone therapy market growth. Remote patient monitoring for chronic conditions is becoming increasingly wide-spread due to the emergence of digital health solutions, which are making patient treatment easier than ever.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.4% |

Japan's human growth hormone (HGH) treatment and drugs market is expected to grow owing to rising adoption of novel drug formulations, strong government initiatives for treatment of rare diseases, and growing accessibility of biosimilar HGH products.

The country’s leading position in biotechnology and gene therapy research is pushing innovations in hormone therapies. Moreover, AI and machine learning had also been used for the management of various endocrine disorders with an impact on clinical practice. The growing use of automated drug delivery systems and enhanced treatment adherence strategies also play a role in market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.2% |

South Korea has become a prominent market for human growth hormone treatment and human growth hormone drugs due to increasing investments in pharmaceutical biotechnology, growing government initiatives to improve pediatric care, and high demand for effective hormone replacement therapy in the country.

This has made the market more competitive, as the country is very passionate about developing cost-effective biosimilar HGH formulations. To improve patient adherence, the design of smart drug delivery systems well help. Increasing uptake of telemedicine platforms for management of endocrine disorders is also aiding the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.6% |

Subcutaneous Administration Leads Market Adoption as It Enhances Patient Compliance

The Subcutaneous segment has grown to become the most common route of administration for human growth hormone therapies, owing to its low invasiveness, self-administration ease, and prolonged drug release benefits. In contrast to other delivery methods, subcutaneous injections stabilize hormone levels with fewer fluctuations, which is the preferred administration method for long-term therapy.

Revolutionary needle-free subcutaneous injection devices, including auto-injectors, pen-based HGH delivery systems, & microneedle patches, that are more patient-compliant have been developed, further enhancing the market penetration. The introduction of long-acting growth hormone formulations, including once a week injections, sustained-release microsphere and recombinant DNA derived HGH analogy, have also enabled the market demand, leading to providing better compliance and less dosing frequency.

This is a market encompassing refined formulations of HGH for subcutaneous routes of administration, including low-pain formulation types and temperature-stable alternative drug delivery, along with biocompatible excipients, enabling optimal growth of the market by providing improved patient comfort and therapeutic success.

It includes the entrance of biologics, which is a distinctive class of drugs that were delivered on the market to treat chronic conditions, though the Subcutaneous segment may have benefits of being patient-friendly when they administered, steady drug absorption, and even self-injectable licensing convenience.

Else, new developments in nanoparticle-based subcutaneous delivery, AI-mediated dose optimization, and biologically-derived HGH stabilizers are increasing efficacy, comfort and their patient adherence, testing the global expansion of subcutaneous growth hormone therapies.

Intravenous Administration Gains Popularity in Acute Growth Hormone Deficiency Cases

Intravenous segment shows robust market growth as physicians search for fast-acting growth hormone medications for seriously patients and acute hormone insufficiency symptoms. IV administration avoids metabolic degradation enabling immediate therapeutic effects, unlike subcutaneous injections which in contrast requires a time dosage.

The rising use of intravenous HGH infusions with precision-controlled infusion pumps, included AI-assisted dose titration and integration of continuous glucose monitors for the use of post-surgical recovery, pediatric endocrinology, and emergency hormone differentiation, with developed markets expansion have driven growth of the market.

The market demand to provide healthcare services such as hospital-based infrastructure with IV growth hormone program hospital facilities with more specialized endocrine clinics, hormone therapy infusion centers, and multi-disciplinary patient care models have further enhanced the market demand for the growth hormone based treatment to progress easier to treatment, with expert supervision to ensure assured therapy outcomes.

The availability of higher purity IV rHGH solutions, on the basis of phosphate-buffered formulations, non-immunogenic excipients, as well as improved solubility characterization profiles has significantly aided market growth due to improved compatibility with intravenous infusion protocols.

The Intravenous segment, while offering advantages like rapid hormone replenishment, controlled dosing precision, and emergency-use effectiveness, also faces challenges, including higher administration costs, hospital dependency, and risks of infusion-related reactions.

Yet, advances in Nano liposomal IV hormone carriers and AI-based infusion regulation and remote-monitored (endocrine) therapeutic units are improving treatment precision, cost-effectiveness and patient safety, paving the way for steady growth of intravenous HGH therapies across the global markets.

The Growth Hormone Deficiency (GHD) and Turner Syndrome segments hold a significant share in the Human Growth Hormone Treatment and Drugs Market, as pediatric and adult patients increasingly rely on HGH therapies to correct hormonal imbalances, improve height velocity, and enhance metabolic health.

Growth Hormone Deficiency Leads Market Demand as HGH Therapy Becomes Standard Treatment

The Growth Hormone Deficiency (GHD) application segment has emerged as the largest application area for HGH treatments, owing to increases in cases of pediatric growth disorders (PGD), adult-onset GHD, and hormone deficiencies associated with endocrine dysfunction.

Market demand has been further augmented by the rising prevalence of congenital and acquired GHD cases treated with human growth hormone (HGH) therapy which includes aspects like custom dosing in infants, AI-assisted tracking of hormone responses, and genetic screening-guided therapy selection.

The emergence of personalized growth hormone replacement therapies, comprised of age-appropriate dosing approaches, profile matching for treatment based on genetic markers, and AI-enhanced growth tracking, has provided stimulus to the market as these strategies deliver precision-oriented patient outcomes.

Adoption has also been propelled by the integration of cloud-based endocrine disorder management platforms comprising telemedicine-enabled hormone therapy consultations, remote injectable compliance tracking, and AI-driven endocrinology diagnostics, ensuring wider availability for growth disorder patients.

The GHD segment, while beneficial for addressing height deficiencies, improving metabolic function, and restoring hormonal balance, also experiences challenges such as treatment costs, poor insurance coverage, and low patient compliance.

Nevertheless, innovative advancements involving artificial intelligence-powered growth monitoring, wearable hormone sensors, and genetic biomarker-driven therapy matching are enhancing cost-effectiveness, treatment precision, and adherence solutions that notch continue to drive growth of GHD-targeted HGH therapies globally.

Turner Syndrome Treatment Expands as HGH Therapy Improves Growth Outcomes

The Turner Syndrome & growth hormone segment continues to see strong market growth as pediatric endocrinologists are more frequently prescribing the HGH therapy for adults in particular to increase height growth, delay early onset of puberty, and maximize cardiovascular health in affected individuals.

The market growth is driven by the accelerating adoption of HGH therapy in managing Turner Syndrome, which includes long-term endocrine follow-ups, AI-aided height prediction models, and customized adjunctive oestrogen therapy. Long-term HGH therapy is used in more than 50% of children suffering from Turner Syndrome according to previous studies, which leads to the assurance of early intervention and the opportunity for maximum growth potential.

Conversely, growing protocols for combination hormone therapy owing to HGH-oestrogen co-administration, puberty onset prediction aided by AIs, and integrated tracking of metabolic health have bolstered market demand, facilitating Turner syndrome care holistically.

The Turner Syndrome segment, though with its benefits such as long-term effect on height, cardiovascular functions, and delaying premature ovarian failure, still suffers from drawbacks like the need for long-term treatment, expensive medication, and heterogeneous responses to the treatment.

Conversely, newly developed HGH biosimilar, artificial intelligence (AI)-guided endocrine therapy optimization, and hormone monitoring smart wearables are enhancing treatment accessibility and affordability as well as long-lasting patient supervision, therefore, reassured enhancing market growth for Turner Syndrome-oriented HGH therapies globally.

Some of the factors that are driving the growth of human growth hormone (HGH) treatment and drugs market includes increasing incidence of growth hormone deficiency, technological advancement in recombinant DNA processes, and increasing demand for anti-aging and performance-enhancing treatments. The market is already seeing steady growth, with applications extending to paediatrics, adult hormone deficiency, and sports medicine. Significant trends affecting the industry comprise long-acting HGH formulations, biosimilar, and needle-free delivery systems.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Novo Nordisk A/S | 12-16% |

| Pfizer Inc. | 10-14% |

| Eli Lilly and Company | 8-12% |

| Merck KGaA | 6-10% |

| Ferring Pharmaceuticals | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Novo Nordisk A/S | Develops long-acting HGH formulations with improved efficacy and patient adherence. |

| Pfizer Inc. | Specializes in recombinant human growth hormone therapies for pediatric and adult deficiencies. |

| Eli Lilly and Company | Offers advanced HGH treatments with targeted delivery systems for enhanced absorption. |

| Merck KGaA | Focuses on biosimilar HGH solutions to improve affordability and accessibility. |

| Ferring Pharmaceuticals | Provides innovative HGH formulations with enhanced bioavailability and delivery options. |

Key Company Insights

Novo Nordisk A/S (12-16%) Novo Nordisk leads in long-acting HGH therapies, integrating patient-friendly administration methods to improve adherence.

Pfizer Inc. (10-14%) Pfizer specializes in recombinant HGH treatments, catering to both pediatric and adult growth hormone deficiencies.

Eli Lilly and Company (8-12%) Eli Lilly focuses on targeted delivery systems for HGH, ensuring improved bioavailability and therapeutic outcomes.

Merck KGaA (6-10%) Merck pioneers in biosimilar HGH solutions, making treatment more affordable and accessible worldwide.

Ferring Pharmaceuticals (4-8%) Ferring develops innovative formulations with advanced delivery mechanisms for better treatment compliance.

Other Key Players (45-55% Combined) Several pharmaceutical and biotechnology companies contribute to the expanding HGH Treatment and Drugs Market. These include:

The overall market size for the human growth hormone treatment and drugs market was USD 3,946.6 million in 2025.

The human growth hormone treatment and drugs market is expected to reach USD 5,567.1 million in 2035.

The demand for human growth hormone (HGH) treatment and drugs will be driven by increasing prevalence of growth hormone deficiencies, rising adoption of recombinant HGH therapies, growing demand for anti-aging treatments, and advancements in drug delivery technologies such as long-acting formulations and needle-free administration.

The top 5 countries driving the development of the human growth hormone treatment and drugs market are the USA, China, Germany, Japan, and France.

The Recombinant Human Growth Hormone (rHGH) segment is expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033 by Route of Administration

Table 2: Global Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033 by Application

Table 3: Global Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033 by Distribution Channel

Table 4: Global Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by Region

Table 5: North America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033 by Country

Table 6: North America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033 by Route of Administration

Table 7: North America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033 by Application

Table 8: North America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033 by Distribution Channel

Table 9: Latin America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033 by Country

Table 10: Latin America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033 by Route of Administration

Table 11: Latin America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033 by Application

Table 12: Latin America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033 by Distribution Channel

Table 13: Europe Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033 by Country

Table 14: Europe Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033 by Route of Administration

Table 15: Europe Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033 by Application

Table 16: Europe Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033 by Distribution Channel

Table 17: East Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033 by Country

Table 18: East Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033 by Route of Administration

Table 19: East Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033 by Application

Table 20: East Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033 by Distribution Channel

Table 21: South Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033 by Country

Table 22: South Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033 by Route of Administration

Table 23: South Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033 by Application

Table 24: South Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033 by Distribution Channel

Table 25: Oceania Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033 by Country

Table 26: Oceania Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033 by Route of Administration

Table 27: Oceania Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033 by Application

Table 28: Oceania Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033 by Distribution Channel

Table 29: Middle East and Africa Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033 by Country

Table 30: Middle East and Africa Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033 by Route of Administration

Table 31: Middle East and Africa Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033 by Application

Table 32: Middle East and Africa Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033 by Distribution Channel

Figure 01: Global Market Value (US$ Million) Analysis, 2017 to 2022

Figure 02: Global Market Forecast and Y-o-Y Growth, 2023 to 2033

Figure 03: Global Market Absolute $ Opportunity (US$ Million) Analysis, 2022 to 2033

Figure 04: Global Market Value Share (%) Analysis 2023 and 2033, by Route of Administration

Figure 05: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Route of Administration

Figure 06: Global Market Attractiveness Analysis 2023 to 2033, by Route of Administration

Figure 07: Global Market Value Share (%) Analysis 2023 and 2033, by Application

Figure 08: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Application

Figure 09: Global Market Attractiveness Analysis 2023 to 2033, by Application

Figure 10: Global Market Value Share (%) Analysis 2023 and 2033, by Distribution Channel

Figure 11: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Distribution Channel

Figure 12: Global Market Attractiveness Analysis 2023 to 2033, by Distribution Channel

Figure 13: Global Market Value Share (%) Analysis 2023 and 2033, by Region

Figure 14: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Region

Figure 15: Global Market Attractiveness Analysis 2023 to 2033, by Region

Figure 16: North America Market Value (US$ Million) Analysis, 2017 to 2022

Figure 17: North America Market Value (US$ Million) Forecast, 2023 to 2033

Figure 18: North America Market Value Share, by Route of Administration (2023 E)

Figure 19: North America Market Value Share, by Application (2023 E)

Figure 20: North America Market Value Share, by Distribution Channel (2023 E)

Figure 21: North America Market Value Share, by Country (2023 E)

Figure 22: North America Market Attractiveness Analysis by Route of Administration, 2023 to 2033

Figure 23: North America Market Attractiveness Analysis by Application, 2023 to 2033

Figure 24: North America Market Attractiveness Analysis by Distribution Channel, 2023 to 2033

Figure 25: North America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 26: USA Market Value Proportion Analysis, 2022

Figure 27: Global Vs. USA Growth Comparison

Figure 28: USA Market Share Analysis (%) by Route of Administration, 2022 and 2033

Figure 29: USA Market Share Analysis (%) by Application, 2022 and 2033

Figure 30: USA Market Share Analysis (%) by Distribution Channel, 2022 and 2033

Figure 31: Canada Market Value Proportion Analysis, 2022

Figure 32: Global Vs. Canada. Growth Comparison

Figure 33: Canada Market Share Analysis (%) by Route of Administration, 2022 and 2033

Figure 34: Canada Market Share Analysis (%) by Application, 2022 and 2033

Figure 35: Canada Market Share Analysis (%) by Distribution Channel, 2022 and 2033

Figure 36: Latin America Market Value (US$ Million) Analysis, 2017 to 2022

Figure 37: Latin America Market Value (US$ Million) Forecast, 2023 to 2033

Figure 38: Latin America Market Value Share, by Route of Administration (2023 E)

Figure 39: Latin America Market Value Share, by Application (2023 E)

Figure 40: Latin America Market Value Share, by Distribution Channel (2023 E)

Figure 41: Latin America Market Value Share, by Country (2023 E)

Figure 42: Latin America Market Attractiveness Analysis by Route of Administration, 2023 to 2033

Figure 43: Latin America Market Attractiveness Analysis by Application, 2023 to 2033

Figure 44: Latin America Market Attractiveness Analysis by Distribution Channel, 2023 to 2033

Figure 45: Latin America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 46: Mexico Market Value Proportion Analysis, 2022

Figure 47: Global Vs Mexico Growth Comparison

Figure 48: Mexico Market Share Analysis (%) by Route of Administration, 2022 and 2033

Figure 49: Mexico Market Share Analysis (%) by Application, 2022 and 2033

Figure 50: Mexico Market Share Analysis (%) by Distribution Channel, 2022 and 2033

Figure 51: Brazil Market Value Proportion Analysis, 2022

Figure 52: Global Vs. Brazil. Growth Comparison

Figure 53: Brazil Market Share Analysis (%) by Route of Administration, 2022 and 2033

Figure 54: Brazil Market Share Analysis (%) by Application, 2022 and 2033

Figure 55: Brazil Market Share Analysis (%) by Distribution Channel, 2022 and 2033

Figure 56: Argentina Market Value Proportion Analysis, 2022

Figure 57: Global Vs Argentina Growth Comparison

Figure 58: Argentina Market Share Analysis (%) by Route of Administration, 2022 and 2033

Figure 59: Argentina Market Share Analysis (%) by Application, 2022 and 2033

Figure 60: Argentina Market Share Analysis (%) by Distribution Channel, 2022 and 2033

Figure 61: Europe Market Value (US$ Million) Analysis, 2017 to 2022

Figure 62: Europe Market Value (US$ Million) Forecast, 2023 to 2033

Figure 63: Europe Market Value Share, by Route of Administration (2023 E)

Figure 64: Europe Market Value Share, by Application (2023 E)

Figure 65: Europe Market Value Share, by Distribution Channel (2023 E)

Figure 66: Europe Market Value Share, by Country (2023 E)

Figure 67: Europe Market Attractiveness Analysis by Route of Administration, 2023 to 2033

Figure 68: Europe Market Attractiveness Analysis by Application, 2023 to 2033

Figure 69: Europe Market Attractiveness Analysis by Distribution Channel, 2023 to 2033

Figure 70: Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 71: United Kingdom Market Value Proportion Analysis, 2022

Figure 72: Global Vs. United Kingdom Growth Comparison

Figure 73: United Kingdom Market Share Analysis (%) by Route of Administration, 2022 and 2033

Figure 74: United Kingdom Market Share Analysis (%) by Application, 2022 and 2033

Figure 75: United Kingdom Market Share Analysis (%) by Distribution Channel, 2022 and 2033

Figure 76: Germany Market Value Proportion Analysis, 2022

Figure 77: Global Vs. Germany Growth Comparison

Figure 78: Germany Market Share Analysis (%) by Route of Administration, 2022 and 2033

Figure 79: Germany Market Share Analysis (%) by Application, 2022 and 2033

Figure 80: Germany Market Share Analysis (%) by Distribution Channel, 2022 and 2033

Figure 81: Italy Market Value Proportion Analysis, 2022

Figure 82: Global Vs. Italy Growth Comparison

Figure 83: Italy Market Share Analysis (%) by Route of Administration, 2022 and 2033

Figure 84: Italy Market Share Analysis (%) by Application, 2022 and 2033

Figure 85: Italy Market Share Analysis (%) by Distribution Channel, 2022 and 2033

Figure 86: France Market Value Proportion Analysis, 2022

Figure 87: Global Vs France Growth Comparison

Figure 88: France Market Share Analysis (%) by Route of Administration, 2022 and 2033

Figure 89: France Market Share Analysis (%) by Application, 2022 and 2033

Figure 90: France Market Share Analysis (%) by Distribution Channel, 2022 and 2033

Figure 91: Spain Market Value Proportion Analysis, 2022

Figure 92: Global Vs Spain Growth Comparison

Figure 93: Spain Market Share Analysis (%) by Route of Administration, 2022 and 2033

Figure 94: Spain Market Share Analysis (%) by Application, 2022 and 2033

Figure 95: Spain Market Share Analysis (%) by Distribution Channel, 2022 and 2033

Figure 96: Russia Market Value Proportion Analysis, 2022

Figure 97: Global Vs Russia Growth Comparison

Figure 98: Russia Market Share Analysis (%) by Route of Administration, 2022 and 2033

Figure 99: Russia Market Share Analysis (%) by Application, 2022 and 2033

Figure 100: Russia Market Share Analysis (%) by Distribution Channel, 2022 and 2033

Figure 101: BENELUX Market Value Proportion Analysis, 2022

Figure 102: Global Vs BENELUX Growth Comparison

Figure 103: BENELUX Market Share Analysis (%) by Route of Administration, 2022 and 2033

Figure 104: BENELUX Market Share Analysis (%) by Application, 2022 and 2033

Figure 105: BENELUX Market Share Analysis (%) by Distribution Channel, 2022 and 2033

Figure 106: East Asia Market Value (US$ Million) Analysis, 2017 to 2022

Figure 107: East Asia Market Value (US$ Million) Forecast, 2023 to 2033

Figure 108: East Asia Market Value Share, by Route of Administration (2023 E)

Figure 109: East Asia Market Value Share, by Application (2023 E)

Figure 110: East Asia Market Value Share, by Distribution Channel (2023 E)

Figure 111: East Asia Market Value Share, by Country (2023 E)

Figure 112: East Asia Market Attractiveness Analysis by Route of Administration, 2023 to 2033

Figure 113: East Asia Market Attractiveness Analysis by Application, 2023 to 2033

Figure 114: East Asia Market Attractiveness Analysis by Distribution Channel, 2023 to 2033

Figure 115: East Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 116: China Market Value Proportion Analysis, 2022

Figure 117: Global Vs. China Growth Comparison

Figure 118: China Market Share Analysis (%) by Route of Administration, 2022 and 2033

Figure 119: China Market Share Analysis (%) by Application, 2022 and 2033

Figure 120: China Market Share Analysis (%) by Distribution Channel, 2022 and 2033

Figure 121: Japan Market Value Proportion Analysis, 2022

Figure 122: Global Vs. Japan Growth Comparison

Figure 123: Japan Market Share Analysis (%) by Route of Administration, 2022 and 2033

Figure 124: Japan Market Share Analysis (%) by Application, 2022 and 2033

Figure 125: Japan Market Share Analysis (%) by Distribution Channel, 2022 and 2033

Figure 126: South Korea Market Value Proportion Analysis, 2022

Figure 127: Global Vs South Korea Growth Comparison

Figure 128: South Korea Market Share Analysis (%) by Route of Administration, 2022 and 2033

Figure 129: South Korea Market Share Analysis (%) by Application, 2022 and 2033

Figure 130: South Korea Market Share Analysis (%) by Distribution Channel, 2022 and 2033

Figure 131: South Asia Market Value (US$ Million) Analysis, 2017 to 2022

Figure 132: South Asia Market Value (US$ Million) Forecast, 2023 to 2033

Figure 133: South Asia Market Value Share, by Route of Administration (2023 E)

Figure 134: South Asia Market Value Share, by Application (2023 E)

Figure 135: South Asia Market Value Share, by Distribution Channel (2023 E)

Figure 136: South Asia Market Value Share, by Country (2023 E)

Figure 137: South Asia Market Attractiveness Analysis by Route of Administration, 2023 to 2033

Figure 138: South Asia Market Attractiveness Analysis by Application, 2023 to 2033

Figure 139: South Asia Market Attractiveness Analysis by Distribution Channel, 2023 to 2033

Figure 140: South Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 141: India Market Value Proportion Analysis, 2022

Figure 142: Global Vs. India Growth Comparison

Figure 143: India Market Share Analysis (%) by Route of Administration, 2022 and 2033

Figure 144: India Market Share Analysis (%) by Application, 2022 and 2033

Figure 145: India Market Share Analysis (%) by Distribution Channel, 2022 and 2033

Figure 146: Indonesia Market Value Proportion Analysis, 2022

Figure 147: Global Vs. Indonesia Growth Comparison

Figure 148: Indonesia Market Share Analysis (%) by Route of Administration, 2022 and 2033

Figure 149: Indonesia Market Share Analysis (%) by Application, 2022 and 2033

Figure 150: Indonesia Market Share Analysis (%) by Distribution Channel, 2022 and 2033

Figure 151: Malaysia Market Value Proportion Analysis, 2022

Figure 152: Global Vs. Malaysia Growth Comparison

Figure 153: Malaysia Market Share Analysis (%) by Route of Administration, 2022 and 2033

Figure 154: Malaysia Market Share Analysis (%) by Application, 2022 and 2033

Figure 155: Malaysia Market Share Analysis (%) by Distribution Channel, 2022 and 2033

Figure 156: Thailand Market Value Proportion Analysis, 2022

Figure 157: Global Vs. Thailand Growth Comparison

Figure 158: Thailand Market Share Analysis (%) by Route of Administration, 2022 and 2033

Figure 159: Thailand Market Share Analysis (%) by Application, 2022 and 2033

Figure 160: Thailand Market Share Analysis (%) by Distribution Channel, 2022 and 2033

Figure 161: Oceania Market Value (US$ Million) Analysis, 2017 to 2022

Figure 162: Oceania Market Value (US$ Million) Forecast, 2023 to 2033

Figure 163: Oceania Market Value Share, by Route of Administration (2023 E)

Figure 164: Oceania Market Value Share, by Application (2023 E)

Figure 165: Oceania Market Value Share, by Distribution Channel (2023 E)

Figure 166: Oceania Market Value Share, by Country (2023 E)

Figure 167: Oceania Market Attractiveness Analysis by Route of Administration, 2023 to 2033

Figure 168: Oceania Market Attractiveness Analysis by Application, 2023 to 2033

Figure 169: Oceania Market Attractiveness Analysis by Distribution Channel, 2023 to 2033

Figure 170: Oceania Market Attractiveness Analysis by Country, 2023 to 2033

Figure 171: Australia Market Value Proportion Analysis, 2022

Figure 172: Global Vs. Australia Growth Comparison

Figure 173: Australia Market Share Analysis (%) by Route of Administration, 2022 and 2033

Figure 174: Australia Market Share Analysis (%) by Application, 2022 and 2033

Figure 175: Australia Market Share Analysis (%) by Distribution Channel, 2022 and 2033

Figure 176: New Zealand Market Value Proportion Analysis, 2022

Figure 177: Global Vs New Zealand Growth Comparison

Figure 178: New Zealand Market Share Analysis (%) by Route of Administration, 2022 and 2033

Figure 179: New Zealand Market Share Analysis (%) by Application, 2022 and 2033

Figure 180: New Zealand Market Share Analysis (%) by Distribution Channel, 2022 and 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis, 2017 to 2022

Figure 182: Middle East and Africa Market Value (US$ Million) Forecast, 2023 to 2033

Figure 183: Middle East and Africa Market Value Share, by Route of Administration (2023 E)

Figure 184: Middle East and Africa Market Value Share, by Application (2023 E)

Figure 185: Middle East and Africa Market Value Share, by Distribution Channel (2023 E)

Figure 186: Middle East and Africa Market Value Share, by Country (2023 E)

Figure 187: Middle East and Africa Market Attractiveness Analysis by Route of Administration, 2023 to 2033

Figure 188: Middle East and Africa Market Attractiveness Analysis by Application 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness Analysis by Distribution Channel 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness Analysis by Country, 2023 to 2033

Figure 191: GCC Countries Market Value Proportion Analysis, 2022

Figure 192: Global Vs GCC Countries Growth Comparison

Figure 193: GCC Countries Market Share Analysis (%) by Route of Administration, 2022 and 2033

Figure 194: GCC Countries Market Share Analysis (%) by Application, 2022 and 2033

Figure 195: GCC Countries Market Share Analysis (%) by Distribution Channel, 2022 and 2033

Figure 196: Türkiye Market Value Proportion Analysis, 2022

Figure 197: Global Vs. Türkiye Growth Comparison

Figure 198: Türkiye Market Share Analysis (%) by Route of Administration, 2022 and 2033

Figure 199: Türkiye Market Share Analysis (%) by Application, 2022 and 2033

Figure 200: Türkiye Market Share Analysis (%) by Distribution Channel, 2022 and 2033

Figure 201: South Africa Market Value Proportion Analysis, 2022

Figure 202: Global Vs. South Africa Growth Comparison

Figure 203: South Africa Market Share Analysis (%) by Route of Administration, 2022 and 2033

Figure 204: South Africa Market Share Analysis (%) by Application, 2022 and 2033

Figure 205: South Africa Market Share Analysis (%) by Distribution Channel, 2022 and 2033

Figure 206: North Africa Market Value Proportion Analysis, 2022

Figure 207: Global Vs North Africa Growth Comparison

Figure 208: North Africa Market Share Analysis (%) by Route of Administration, 2022 and 2033

Figure 209: North Africa Market Share Analysis (%) by Application, 2022 and 2033

Figure 210: North Africa Market Share Analysis (%) by Distribution Channel, 2022 and 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Human Transferrin Detection Kit Market Size and Share Forecast Outlook 2025 to 2035

Human Papilloma Virus Testing Market Size and Share Forecast Outlook 2025 to 2035

Human-Centric Lighting Market Size and Share Forecast Outlook 2025 to 2035

Human Identification Market Size and Share Forecast Outlook 2025 to 2035

Human Immunodeficiency Virus Type 1 (HIV 1) Market Size and Share Forecast Outlook 2025 to 2035

Humanoid Robot Market Size and Share Forecast Outlook 2025 to 2035

Humanized Mouse Model Market Size and Share Forecast Outlook 2025 to 2035

Human Milk Oligosaccharides Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Human Combinatorial Antibody Libraries (HuCAL) Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Human Augmentation Technology Market Growth - Trends & Forecast 2025 to 2035

Key Companies & Market Share in the Human Milk Oligosaccharides Sector

Human Osteoblasts Market – Growth & Forecast 2024-2034

Human Capital Management Market

Human Anatomical Models Market

Human Machine Interface Market

Human RSV Treatment Market Insights - Innovations & Forecast 2025 to 2035

UK Human Milk Oligosaccharides Market Trends – Size, Demand & Forecast 2025-2035

USA Human Milk Oligosaccharides Market Insights – Growth & Demand 2025-2035

ASEAN Human Milk Oligosaccharides Market Report – Size, Demand & Growth 2025–2035

Europe Human Milk Oligosaccharides Market Growth – Trends, Demand & Innovations 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA