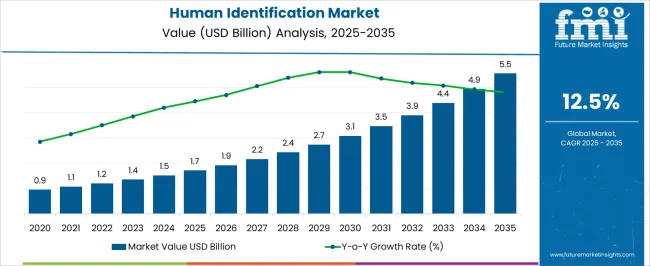

The Human Identification Market is estimated to be valued at USD 1.7 billion in 2025 and is projected to reach USD 5.5 billion by 2035, registering a compound annual growth rate (CAGR) of 12.5% over the forecast period.

| Metric | Value |

|---|---|

| Human Identification Market Estimated Value in (2025 E) | USD 1.7 billion |

| Human Identification Market Forecast Value in (2035 F) | USD 5.5 billion |

| Forecast CAGR (2025 to 2035) | 12.5% |

The human identification market is experiencing consistent growth owing to the rising demand for advanced forensic tools, expanding applications in law enforcement, and the growing importance of genetic databases. The increasing incidence of criminal investigations, missing person identification, and disaster victim recognition has driven the adoption of advanced molecular diagnostic solutions.

Technological innovation in polymerase chain reaction systems, next generation sequencing, and rapid DNA analysis is strengthening efficiency, accuracy, and processing speed. Government funding and institutional collaborations have further supported the integration of these technologies across forensic laboratories and research institutions.

The outlook remains favorable as demand rises for precision in forensic analysis, expansion of genetic profiling initiatives, and cross border cooperation in criminal investigation and identity verification.

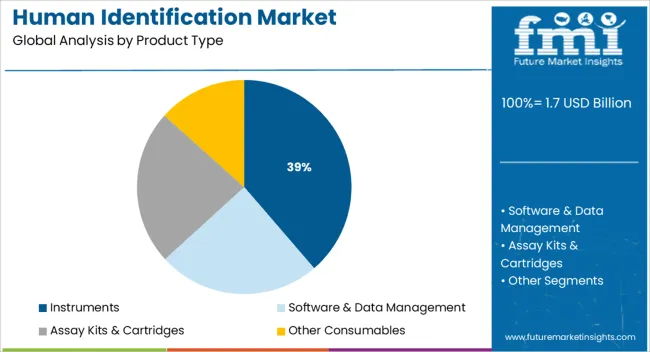

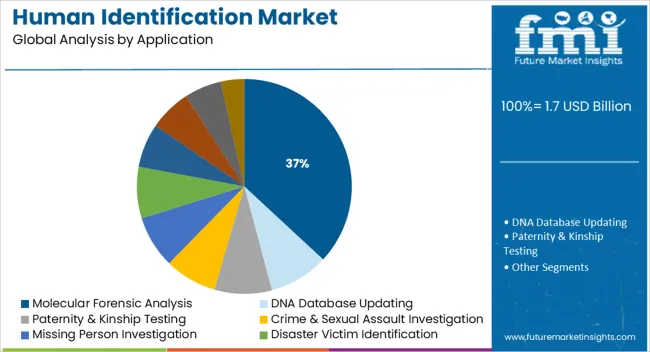

The market is segmented by Product Type, Technology, Application, and End User and region. By Product Type, the market is divided into Instruments, Software & Data Management, Assay Kits & Cartridges, and Other Consumables. In terms of Technology, the market is classified into Polymerase Chain Reaction (PCR), Short Tandem Repeats (STR), Microarray Technology, Capillary Electrophoresis, Next Generation Sequencing (NGS), Nucleic Acid Extraction & Purification, and Rapid DNA Analysis. Based on Application, the market is segmented into Molecular Forensic Analysis, DNA Database Updating, Paternity & Kinship Testing, Crime & Sexual Assault Investigation, Missing Person Investigation, Disaster Victim Identification, Anthropology Studies, Cell Line Identification, Population-based Studies, and Genetic-based Studies. By End User, the market is divided into Forensic Laboratories, Law Enforcement Agencies, Academic & Research Labs, Pharmaceutical & Biotech Companies, Contract Research Organizations, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The instruments product type segment is projected to represent 38.70% of the market revenue by 2025, making it the dominant category. This growth is driven by the reliance on highly accurate and efficient platforms for DNA extraction, amplification, and analysis.

Instruments offer consistent performance, scalability, and reliability that are essential for forensic laboratories handling large volumes of samples. Investment in automation and high throughput systems has further enhanced productivity and minimized human error.

The integration of instruments into national and regional forensic laboratories has reinforced their importance, solidifying their position as the leading product type segment.

The molecular forensic analysis application segment is projected to hold 36.90% of market revenue by 2025, positioning it as the leading application. This dominance is driven by the increasing use of molecular methods to analyze trace evidence, biological samples, and degraded DNA.

Molecular forensic analysis provides greater accuracy in human identification, enabling the resolution of complex cases that traditional methods cannot address. Its role has been reinforced by the integration of advanced molecular tools into criminal investigations, disaster response, and paternity testing.

The growing demand for reliable, court admissible evidence has accelerated adoption, ensuring that molecular forensic analysis remains the leading application segment within the human identification market.

According to a Future Market Insights study, the global forum of human identification has shown exceptional growth in recent years. The market's significant players are working together to address the growing demand for human identification. The CAGR was 12.5% from 2020 to 2025, and it is expected to climb to 9.6% over the projected period.

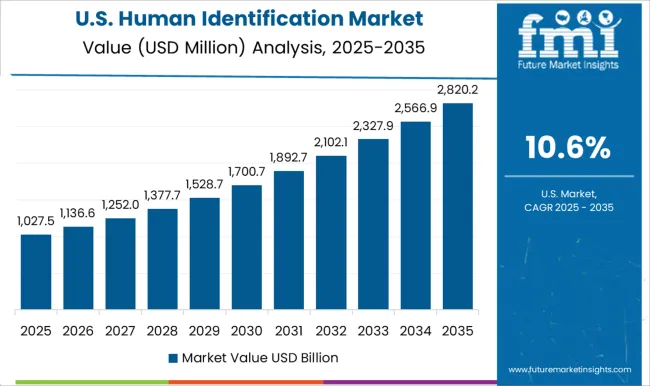

| Country | United States of America |

|---|---|

| CAGR (2025 to 2035) | 9.4% |

| HCAGR (2020 to 2025) | 12.1% |

| Country | United Kingdom |

|---|---|

| CAGR (2025 to 2035) | 8.7% |

| HCAGR (2020 to 2025) | 11.1% |

| Country | China |

|---|---|

| CAGR (2025 to 2035) | 9% |

| HCAGR (2020 to 2025) | 11.7% |

| Country | Japan |

|---|---|

| CAGR (2025 to 2035) | 8.1% |

| HCAGR (2020 to 2025) | 10.6% |

| Country | South Korea |

|---|---|

| CAGR (2025 to 2035) | 7.3% |

| HCAGR (2020 to 2025) | 9.2% |

| Attributes | Details |

|---|---|

| United States Market Size (2035) | USD 1.1 billion |

| United States Market Absolute Dollar Growth (USD million/billion) | USD 629.3 million |

North America currently holds the largest share of the human identification market, particularly in the USA, which holds a revenue share of 9.4%. The value of the human identification market in the USA is estimated to reach a high of USD 1.1 billion. This is attributed to the financial backing by the government for forensic research. The USA is the most important market for human identification, and the country's expanding DNA database is another element driving market expansion.

Community members, law enforcement agencies, and workers receive hands-on training from key providers, which includes public lectures, demonstrations of field recovery procedures, and workshops. Their staff includes qualified teachers for California's Peace Officer Standards and Training (POST) Homicide Courses. Moreover, it includes a range of stand-alone training in excavation procedures, human remains recovery, search and rescue, and bone identification.

Key players supply fraud prevention solutions by safeguarding the systems of end users. This enables client ID verification through the use of an AI-powered biometric recognition service. With the assistance of their staff, consumers may secure high-quality identity verification. Key players are capable of adhering to rules and directives that impact the end user's company. Furthermore, the criteria for Know Your Customer (KYC) and Anti-Money Laundering (AML) are satisfied. These useful features are expected to drive market growth.

Few biometric technologies arouse as much interest as face recognition. Forensic anthropological services are provided by key players to state and federal law enforcement, medical examiners, and attorneys. They help the court system handle criminal and missing person situations, giving families closure. The findings of sponsored testing at the Maryland Test Facility were disclosed by the US Homeland Security Science and Technology Directorate at the end of May 2020. (MdTF). These real-world experiments assessed the performance of 12 facial recognition systems in a 2 m by 2.5 m hallway.

| Attributes | Details |

|---|---|

| UK Market Size (2035) | USD 126.3 million |

| UK Market Absolute Dollar Growth (USD million/billion) | USD 71.2 million |

With a high-paced revenue growth rate of 8.7% and a projected value of USD 126.3 million over the projection period, the United Kingdom offers enormous market potential. To maintain current market rivalry, enterprises run by market goliaths routinely update their product catalogs with new and application-specific items. Moreover, experts in the country specialize in the identification and interpretation of charred and extremely fragmented remains, as well as disaster victim identification (DVI).

Capillary electrophoresis (CE) and massively parallel sequencing (MPS) are two typical procedures used for human identification in forensic and paternity testing facilities in the United Kingdom. DNA is collected from a range of materials in both methods, and certain portions of the DNA are evaluated to create a unique genetic fingerprint for each person. Key providers supply reagents, instruments, services, and support for capillary electrophoresis and massively parallel sequencing techniques for DNA extraction, quantification, STR amplification, and analysis.

Human identification products are offered by key providers through specialized teams of former forensic DNA practitioners. They provide laboratories with application training, validation of DNA analysis methodologies, and setup and maintenance of workflow automation equipment. On a local and global scale, forensic archaeologists and anthropologists aid both civilian and military police officers with the finding, retrieval, and identification of human remains from crime scenes, conflict zones, and mass mortality situations.

| Attributes | Details |

|---|---|

| South Korea Market Size (2035) | USD 103.5 million |

| South Korea Market Absolute Dollar Growth (USD million/billion) | USD 52.4 million |

Asia Pacific has a substantial human identification market, particularly in Japan and South Korea. This is owing to the increasing knowledge of forensic technology in this region. Many economies are investing heavily in the human identification sector. Furthermore, the surge in criminal activity in nations like China, Japan, and South Korea has prompted governments to take steps to enhance their technology, which is contributing to market growth.

South Korea accounts for 7.3% of the overall demand in the human identification market. South Korea's human identification industry is predicted to reach a peak of USD 103.5 million. The government has a human identification research facility in place to collect human identification technologies that can differentiate between the identities of live and deceased corpses, as well as the data of Korean characters required for it.

These centers also exist to build a bank of human identity data based on quality control and standardization of these data and technologies, as well as to contribute to the resolution of local or global societal concerns involving human identification. The government has announced the design and execution of a new array, the Korea Biobank Array (also known as KoreanChip). With such initiatives, the market is expected to surge in the region.

KoreanChip has been customized for the Korean population and is likely to display findings from GWAS of blood biochemical characteristics. KoreanChip had over 833,000 markers, including over 247,000 rare-frequency or functional variations estimated from over 2,500 Korean sequencing data sets.

| Attributes | Details |

|---|---|

| Japan Market Size (2035) | USD 176 million |

| Japan Market Absolute Dollar Growth (USD million/billion) | USD 95.1 million |

Japan is a very profitable human identification market, with a revenue growth rate of 8.1% and a projected value of USD 176 million throughout the forecast period. The Publication of Human Genetics is the official journal of the Japan Society of Human Genetics, publishing high-quality original research papers, brief communications, reviews, correspondences, and editorials on all aspects of human genetics and genomics. It is the main genetics journal in the Asia-Pacific market.

Japanese key players have a global research team that includes social, political, cognitive, personality, and cross-cultural psychologists. They are focusing on issues of identification with all humanity, as well as its psychological roots and societal ramifications. Their objectives include implementing research findings to improve international collaboration in tackling global challenges, peacebuilding, and human rights oriented.

Start-up companies are contributing to the global human identification market growth, with the help of advanced technologies such as AI:

Human - It offers emotional intelligence technology powered by AI. Its engine analyzes human facial expressions and movements in order to gain a deeper understanding of sentiments, emotions, attributes, and personalities. Based on its analysis, it assigns ratings to characteristics of behavior such as honesty, confidence, interest, passion, anxiousness, and so on. It may be used in recruiting, employee retention, financial fraud detection, customer experience analysis, security, sales forecasting, law enforcement, and other areas.

Digital Identity - The company delivers blockchain-enabled digital identification solutions for a variety of industries. It includes EidOo, a blockchain-to-human interface that allows the blockchain and its users to communicate and interact. It offers TwinWallet, an open-source and app-based Bitcoin wallet program, for user identification. The app is accessible for both iOS and Android smartphones.

FHID - It is a forensic human identification service provider. The company offers a technique called paragon snapshot DNA phenotyping, which assists in the identification of human remains at crime scenes. They examine the retrieved case-relevant genotypic data.

Skeleton - It provides law enforcement with an AI-based forensic person identification program. AM/PM databases, virtual labs, statistics, reports, case files, access management tools, and skull-face overlay tools are among the services it provides. It also provides editing software, visualization software, 3D models, and scanners. It serves the law enforcement, government, and police sectors.

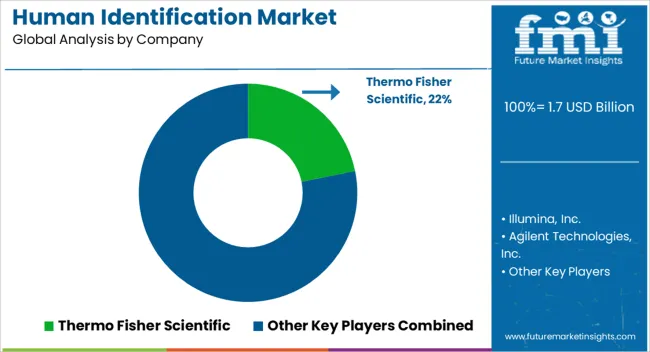

Owing to the presence of multiple established competitors, the human identification market share is very competitive. To capitalize on market growth prospects, these firms are concentrating on strengthening their footprint through acquisitions, expansions, product approvals, and launches.

Latest Developments:

In January 2025, a research team led by Stanford University set the first Guinness World Record for the quickest DNA sequencing technology, which was utilized to sequence the human genome in 5 hours and 2 minutes.

In June 2024, Precision ID GlobalFiler NGS STR Panel v2 for forensic DNA analysis has been released by Thermo Fisher Scientific. The capability of the Applied Biosystems Precision ID GlobalFiler NGS STR Panel v2 is combined with that of the Converge Software 2.0 solution in this next-generation sequencing STR panel.

In 2024, QIAGEN introduced the EZ2 Connect Instrument Line, which may accelerate the advancement of biological research, forensics, and clinical diagnostics.

The global human identification market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the human identification market is projected to reach USD 5.5 billion by 2035.

The human identification market is expected to grow at a 12.5% CAGR between 2025 and 2035.

The key product types in human identification market are instruments, software & data management, assay kits & cartridges and other consumables.

In terms of technology, polymerase chain reaction (pcr) segment to command 42.6% share in the human identification market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Human Transferrin Detection Kit Market Size and Share Forecast Outlook 2025 to 2035

Human Papilloma Virus Testing Market Size and Share Forecast Outlook 2025 to 2035

Human-Centric Lighting Market Size and Share Forecast Outlook 2025 to 2035

Human Immunodeficiency Virus Type 1 (HIV 1) Market Size and Share Forecast Outlook 2025 to 2035

Humanoid Robot Market Size and Share Forecast Outlook 2025 to 2035

Humanized Mouse Model Market Size and Share Forecast Outlook 2025 to 2035

Human Milk Oligosaccharides Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Human Combinatorial Antibody Libraries (HuCAL) Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Human Growth Hormone (HGH) Treatment and Drugs Market Trends - Growth & Forecast 2025 to 2035

Human Augmentation Technology Market Growth - Trends & Forecast 2025 to 2035

Key Companies & Market Share in the Human Milk Oligosaccharides Sector

Human RSV Treatment Market Insights - Innovations & Forecast 2025 to 2035

Human Osteoblasts Market – Growth & Forecast 2024-2034

Human Capital Management Market

Human Anatomical Models Market

Human Machine Interface Market

UK Human Milk Oligosaccharides Market Trends – Size, Demand & Forecast 2025-2035

USA Human Milk Oligosaccharides Market Insights – Growth & Demand 2025-2035

ASEAN Human Milk Oligosaccharides Market Report – Size, Demand & Growth 2025–2035

Europe Human Milk Oligosaccharides Market Growth – Trends, Demand & Innovations 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA