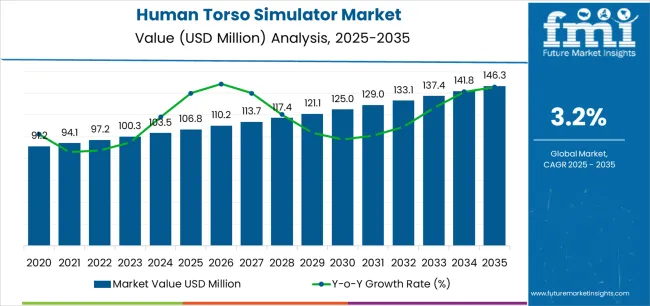

The global human torso simulator market is valued at USD 106.8 million in 2025 and is projected to reach USD 146.3 million by 2035, advancing at a compound annual growth rate of 3.2%. Growth in this sector is influenced by increasing demand for anatomically accurate training models in medical education, surgical planning, and device testing. Institutions seek cost-effective and reusable alternatives to cadaver-based instruction, which continues to expand adoption across universities, research centers, and clinical training programs.

Product development focuses on improving material realism and sensor integration, allowing simulators to replicate physiological responses such as respiration and organ motion. These innovations support advanced training in minimally invasive procedures and trauma management. Manufacturers are also incorporating digital feedback systems that enable quantitative assessment of trainee performance, aligning with competency-based medical curricula.

Demand from the defense and emergency response sectors remains stable, driven by simulation-based preparedness programs emphasizing human-factor accuracy in critical care scenarios. North America retains a strong market position due to established simulation centers and continuous academic funding. Asia Pacific demonstrates rising participation as medical institutions expand digital learning infrastructure and local manufacturing capabilities. Supply chain stability and component standardization remain practical considerations influencing cost and production timelines through the forecast period.

Between 2025 and 2030, the Human Torso Simulator Market is projected to increase from USD 106.8 million to USD 121.1 million, representing a growth of USD 14.3 million, which accounts for 47.7% of the decade’s overall expansion. This phase of growth will be influenced by the increasing demand for realistic anatomical simulation in medical training, expanding use in trauma response programs, and advancements in material realism and sensor integration. Manufacturers are focusing on enhancing biomechanical accuracy, durability, and feedback systems, while academic institutions and healthcare providers invest in simulation-based learning to improve practitioner performance and procedural precision.

From 2030 to 2035, the market is expected to expand further from USD 121.1 million to USD 146.3 million, contributing an additional USD 25.2 million, or 52.3% of the ten-year growth. This period will be characterized by widespread adoption of high-fidelity simulation systems, integration of AI-driven analytics, and cross-sector collaboration between medical device developers and research institutions. Increasing emphasis on remote medical education and defense medical training will also fuel market growth. Enhanced design modularity, digital interactivity, and performance data capture capabilities will redefine standards in human torso simulation across medical, academic, and industrial applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 106.8 million |

| Market Forecast Value (2035) | USD 146.3 million |

| Forecast CAGR (2025 to 2035) | 3.2% |

The human torso simulator market is expanding due to the increasing demand for high-fidelity anatomical models in medical training, surgical planning, and device testing. Healthcare institutions and research organizations use these simulators to improve procedural accuracy and enhance practitioner competence without relying on live subjects or cadaveric material. Manufacturers focus on producing anatomically precise, sensor-integrated models that replicate human tissue responses, enabling more consistent and measurable training outcomes. Medical schools and professional training centers adopt torso simulators to meet accreditation standards that emphasize practical proficiency and procedural safety.

Growth is further supported by advancements in materials science and simulation technologies that allow for realistic feedback, multi-layer tissue structures, and compatibility with imaging systems. The expanding use of torso simulators in robotic surgery training and minimally invasive technique development broadens their application scope beyond traditional education environments. Regulatory bodies encouraging simulation-based assessment in clinical certification programs also contribute to demand. However, high manufacturing costs, maintenance requirements, and limited access to advanced simulation infrastructure in lower-income regions constrain broader adoption. Despite these factors, consistent investments in healthcare education technology and rising emphasis on patient safety sustain market development across academic, clinical, and research settings.

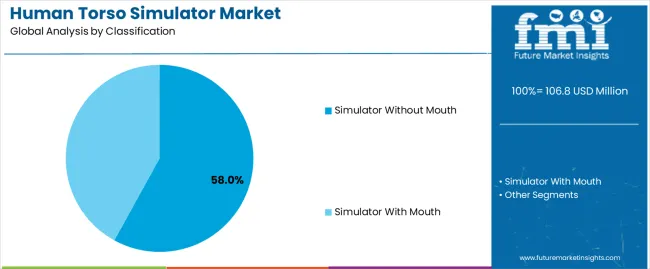

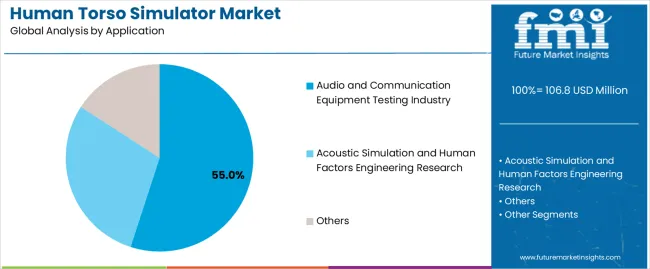

The human torso simulator market is segmented by classification and application. By classification, the market is divided into simulator without mouth and simulator with mouth. Based on application, the market is categorized into audio and communication equipment testing, acoustic simulation and human factors engineering research, and others. These segments collectively define the demand landscape for torso simulators used in research, testing, and acoustic measurement environments.

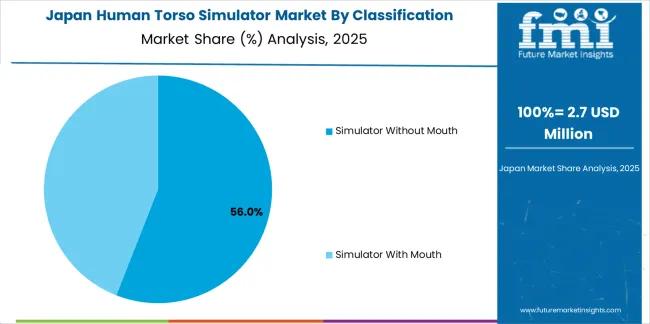

The simulator without mouth segment accounts for approximately 58.0% of the global human torso simulator market in 2025, making it the leading classification segment. This dominance reflects its broad use in standardized acoustic testing, particularly in evaluating loudspeakers, microphones, and other sound-related devices. The simulator without mouth configuration is preferred in controlled acoustic environments where speech simulation is not required, providing consistent and repeatable data for frequency response and sound pressure level measurements.

The segment’s leading position is supported by demand from audio testing laboratories, telecommunications firms, and equipment certification agencies prioritizing accuracy and reproducibility. Its simplified design reduces calibration complexity and system variability, contributing to widespread industrial adoption. Manufacturers focus on producing compact and cost-effective units that meet international acoustic testing standards such as ITU-T P.58. The continued need for reliable acoustic performance verification across audio equipment production and research maintains this segment’s prominence, especially in high-precision testing environments requiring uniform acoustic transfer characteristics.

The audio and communication equipment testing segment represents around 55.0% of the total market demand for human torso simulators in 2025, establishing it as the largest application category. This segment’s growth is tied to the increasing complexity of communication systems, where precise evaluation of microphones, headsets, and mobile devices is essential. Testing laboratories and device manufacturers employ torso simulators to replicate human acoustic characteristics, ensuring realistic voice transmission and reception analysis.

The segment benefits from sustained innovation in telecommunication and audio product development, as manufacturers require standardized testing conditions for product certification and performance optimization. The use of human torso simulators allows consistent evaluation of sound pressure distribution and frequency response under real-world acoustic scenarios. Industry compliance with ISO and ITU standards continues to drive investment in this equipment. Additionally, the transition toward voice-enabled consumer electronics reinforces demand for accurate simulation of human acoustic responses. The audio and communication testing segment will remain the central application area due to its critical role in maintaining quality assurance and design validation processes across the global acoustic testing industry.

The human torso simulator market is expanding due to the growing adoption of simulation-based medical training. Educational institutions and healthcare providers are increasingly using realistic anatomical models to improve procedural learning and reduce reliance on cadavers. Technological advancements such as 3D printing, augmented reality, and virtual reality integration enhance simulator realism and usability. However, high product costs, infrastructure limitations, and competition from digital-only simulation tools restrain wider adoption. Key trends include modular and customisable product designs, hybrid digital-physical training systems, and strong growth in emerging regions investing in healthcare education and advanced medical training technologies.

Growth is driven by rising demand for simulation-based learning in healthcare education. Medical schools and hospitals seek alternatives to cadaver-based instruction to enhance procedural training and standardise outcomes. Technological advances have produced more realistic, functional torso models, improving user engagement and accuracy. The global expansion of medical education, combined with emphasis on patient safety and minimally invasive procedures, reinforces simulator adoption. Institutional investment in simulation centres and government support for healthcare training continue to strengthen the market’s foundation.

High product costs and maintenance requirements limit widespread adoption, especially in smaller institutions and developing economies. Advanced simulators with integrated electronics or digital features demand significant capital investment and ongoing servicing. Additionally, infrastructure gaps such as limited simulation lab availability and insufficient instructor training reduce utilisation efficiency. Competition from lower-cost virtual or software-based alternatives also restricts demand for physical models. These economic and operational challenges collectively slow the rate of adoption and create barriers for new entrants seeking to scale production.

Manufacturers are focusing on modular, customisable, and digitally enhanced torso simulators to meet evolving training needs. Integration of sensors, augmented reality overlays, and performance-tracking software allows more comprehensive skill assessment. Hybrid physical-digital platforms are gaining preference as institutions adopt blended learning models. Regional growth is shifting toward Asia-Pacific and Latin America, supported by rising investment in medical education infrastructure. As simulation becomes central to competency-based training, innovation in realism, interactivity, and accessibility is defining the next phase of market evolution.

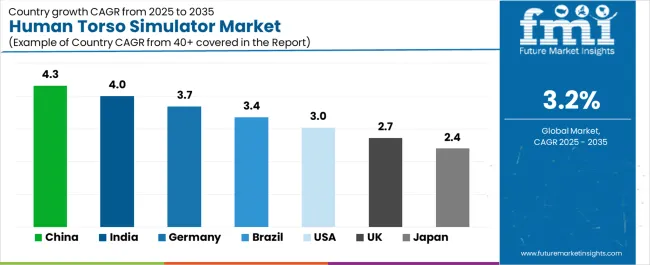

| Country | CAGR (%) |

|---|---|

| China | 4.3 |

| India | 4.0 |

| Germany | 3.7 |

| Brazil | 3.4 |

| USA | 3.0 |

| UK | 2.7 |

| Japan | 2.4 |

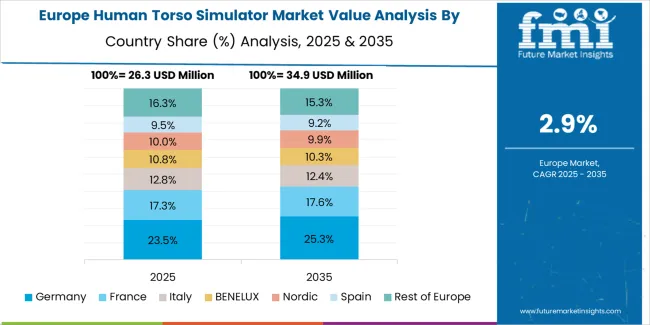

The human torso simulator market shows steady international growth, led by China at a 4.3% CAGR, supported by rapid medical training expansion, R&D investments, and simulation-based education programs. India follows with 4.0%, driven by government healthcare initiatives, medical infrastructure improvements, and rising demand for advanced clinical training systems. Germany grows at 3.7%, leveraging precision engineering and integration in medical device manufacturing. Brazil records 3.4%, benefitting from growing healthcare education and simulation adoption. The USA maintains 3.0%, reflecting a mature market with continuous innovation in surgical simulation. The UK expands at 2.7%, emphasizing healthcare digitalization and medical academia, while Japan’s 2.4% growth reflects its focus on quality assurance, manufacturing excellence, and technical simulation precision.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

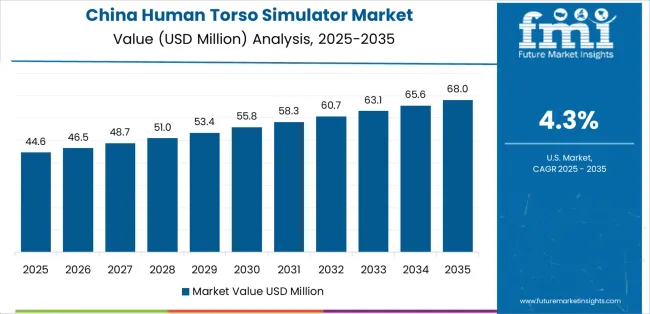

Revenue from human torso simulators in China is projected to grow at a CAGR of 4.3% through 2035, supported by the country’s expanding medical education infrastructure and government-backed healthcare modernization programs. Growth in simulation-based training for surgery, diagnostics, and emergency response is creating demand for anatomically accurate torso simulators. Investments in medical universities and clinical training centers are increasing adoption across academic and research institutions. Domestic manufacturers are improving production capabilities to meet regional demand and international quality standards.

Revenue from human torso simulators in India is expanding at a CAGR of 4.0%, driven by rising emphasis on clinical skill training and medical education reform. The establishment of new medical colleges and skill laboratories under national healthcare programs is stimulating product demand. Investments in simulation centers for surgical and paramedical training are improving practical learning standards. Manufacturers and distributors are expanding domestic supply networks to address growing institutional requirements.

Revenue from human torso simulators in Germany is increasing at a CAGR of 3.7%, supported by strong engineering standards in medical device manufacturing and established healthcare training frameworks. The country’s emphasis on precision design and realistic simulation in clinical education is promoting adoption. Hospitals and training institutes are integrating advanced simulators for surgical procedure rehearsal and anatomy instruction. German firms are developing high-accuracy systems aligned with European quality certifications.

Revenue from human torso simulators in Brazil is projected to rise at a CAGR of 3.4%, supported by government initiatives to expand medical training and improve healthcare service quality. Investments in teaching hospitals and simulation centers are enhancing training standards for physicians and nurses. The focus on realistic anatomy models for emergency medicine and surgical instruction is promoting simulator adoption. Local distributors are partnering with international suppliers to improve access and training support.

Revenue from human torso simulators in the United States is growing at a CAGR of 3.0%, supported by advanced medical education programs and widespread integration of simulation technology in clinical training. Research institutions and healthcare providers are investing in high-fidelity simulators for procedural accuracy and safety improvement. Continuous development in materials and sensor technology enhances the realism and feedback of torso models used in surgical and diagnostic practice.

Revenue from human torso simulators in the United Kingdom is advancing at a CAGR of 2.7%, supported by integration of simulation systems in medical training and continuing professional development programs. Academic institutions and healthcare providers are prioritizing realistic practice environments to enhance procedural competence. Ongoing research in simulation methodologies and materials is improving model accuracy and durability. Procurement is concentrated in universities, teaching hospitals, and national training centers.

Revenue from human torso simulators in Japan is increasing at a CAGR of 2.4%, supported by the country’s established precision manufacturing base and emphasis on high-quality medical education. Universities and hospitals employ torso simulators for detailed anatomical study and minimally invasive procedure training. Domestic manufacturers prioritize realistic model development aligned with advanced sensor and material technologies. Market growth reflects stable demand across academic and clinical sectors.

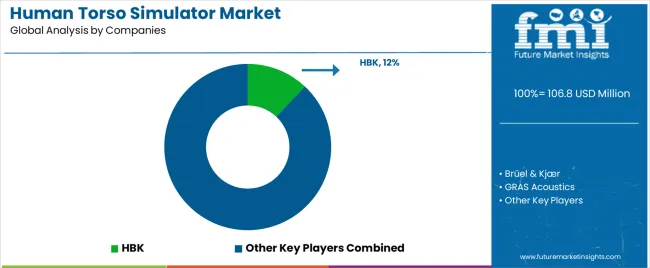

The global human torso simulator market presents a moderate to high level of competition, shaped by established acoustic measurement specialists and niche simulator developers. HBK leads the market with an estimated 12% share, supported by its integration of Brüel & Kjær and GRAS Acoustics under a unified portfolio. The company’s focus on precision acoustic simulation, standardized measurement systems, and compatibility with advanced testing environments sustains its dominant position. Brüel & Kjær and GRAS Acoustics contribute significant technical depth through microphone calibration and human acoustic interface systems used in product validation across consumer electronics and automotive applications. ACO Co., Ltd. maintains a strong regional presence in Asia, emphasizing compact simulator designs and cost-effective production.

Humanetics competes through its experience in anthropomorphic test systems and safety instrumentation, expanding applications into acoustic and vibration testing. HEAD acoustics GmbH specializes in binaural measurement and psychoacoustic evaluation systems, targeting research laboratories and audio device manufacturers. Listen, Inc. focuses on integrated software-driven acoustic testing platforms combining data analysis and hardware control. Fujikon operates within the OEM segment, developing simulation solutions aligned with headset and earphone manufacturing. TME Systems Pte Ltd supports distribution and system integration in the Asia-Pacific region, linking simulator technologies with broader acoustic testing frameworks. Competition in this market is driven by advancements in sensor fidelity, digital calibration, and human–device interaction modeling, while strategic differentiation depends on measurement accuracy, modular design, and integration with multi-channel testing architectures.

| HBK |

|---|

| Brüel & Kjær |

| GRAS Acoustics |

| ACO Co., Ltd. |

| Humanetics |

| HEAD acoustics GmbH |

| Listen, Inc. |

| Fujikon |

| TME Systems Pte Ltd |

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type (Classification) | Simulator Without Mouth, Simulator With Mouth |

| Application | Audio and Communication Equipment Testing, Acoustic Simulation and Human Factors Engineering Research, Others |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, USA, Germany, Japan, UK, Brazil, South Korea, Italy, and 40+ countries |

| Key Companies Profiled | HBK, Brüel & Kjær, GRAS Acoustics, ACO Co. Ltd., Humanetics, HEAD acoustics GmbH, Listen Inc., Fujikon, TME Systems Pte Ltd |

| Additional Attributes | Dollar sales by classification and application categories; regional growth and adoption trends across East Asia, Europe, and North America; competitive landscape covering simulator manufacturers and acoustic testing firms; product development driven by precision measurement and digital integration; analysis of regulatory and institutional drivers for simulation-based training and testing adoption. |

The global human torso simulator market is estimated to be valued at USD 106.8 million in 2025.

The market size for the human torso simulator market is projected to reach USD 146.3 million by 2035.

The human torso simulator market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in human torso simulator market are simulator without mouth and simulator with mouth.

In terms of application, audio and communication equipment testing industry segment to command 55.0% share in the human torso simulator market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Human Transferrin Detection Kit Market Size and Share Forecast Outlook 2025 to 2035

Human Papilloma Virus Testing Market Size and Share Forecast Outlook 2025 to 2035

Human-Centric Lighting Market Size and Share Forecast Outlook 2025 to 2035

Human Identification Market Size and Share Forecast Outlook 2025 to 2035

Human Immunodeficiency Virus Type 1 (HIV 1) Market Size and Share Forecast Outlook 2025 to 2035

Humanoid Robot Market Size and Share Forecast Outlook 2025 to 2035

Humanized Mouse Model Market Size and Share Forecast Outlook 2025 to 2035

Human Milk Oligosaccharides Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Human Combinatorial Antibody Libraries (HuCAL) Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Human Growth Hormone (HGH) Treatment and Drugs Market Trends - Growth & Forecast 2025 to 2035

Human Augmentation Technology Market Growth - Trends & Forecast 2025 to 2035

Key Companies & Market Share in the Human Milk Oligosaccharides Sector

Human RSV Treatment Market Insights - Innovations & Forecast 2025 to 2035

Human Osteoblasts Market – Growth & Forecast 2024-2034

Human Capital Management Market

Human Anatomical Models Market

Human Machine Interface Market

UK Human Milk Oligosaccharides Market Trends – Size, Demand & Forecast 2025-2035

USA Human Milk Oligosaccharides Market Insights – Growth & Demand 2025-2035

ASEAN Human Milk Oligosaccharides Market Report – Size, Demand & Growth 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA