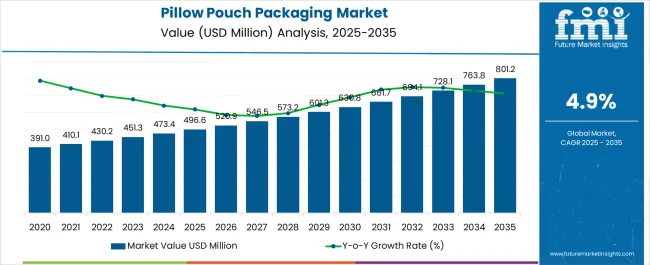

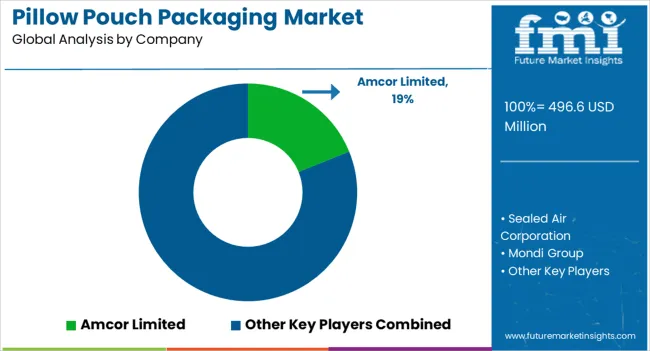

The Pillow Pouch Packaging Market is estimated to be valued at USD 496.6 million in 2025 and is projected to reach USD 801.2 million by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

| Metric | Value |

|---|---|

| Pillow Pouch Packaging Market Estimated Value in (2025 E) | USD 496.6 million |

| Pillow Pouch Packaging Market Forecast Value in (2035 F) | USD 801.2 million |

| Forecast CAGR (2025 to 2035) | 4.9% |

The pillow pouch packaging market is expanding steadily due to rising demand from the food and beverage sector, cost-effectiveness, and high adaptability of the format across diverse product categories. Current growth dynamics are influenced by the increasing need for lightweight, flexible, and durable packaging solutions that reduce logistics costs and improve shelf appeal.

Manufacturers are investing in advanced printing, barrier films, and sealing technologies to enhance performance and brand differentiation. Regulatory emphasis on sustainable materials and recyclability is pushing innovation in eco-friendly plastic alternatives while maintaining the efficiency of existing production lines.

The market outlook is supported by rising consumption of packaged foods, the rapid expansion of retail chains, and the growing role of e-commerce in distributing consumer goods. Growth rationale is founded on the balance of affordability, convenience, and protection offered by pillow pouches, along with scalable production capabilities that ensure widespread adoption across emerging and developed regions.

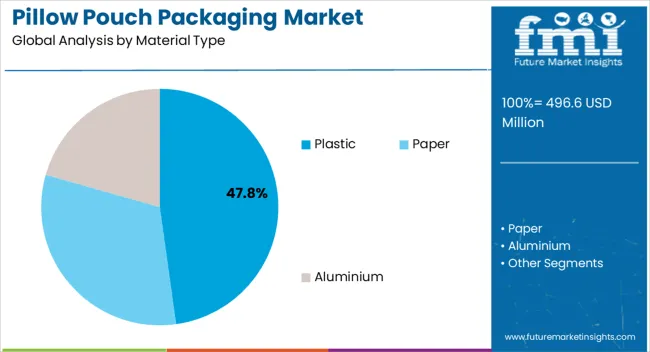

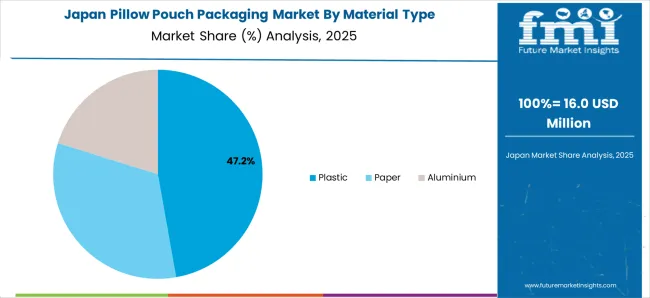

The plastic segment, holding 47.8% of the material type category, dominates due to its durability, flexibility, and cost efficiency in high-volume packaging. Plastic films provide strong barrier properties that extend product shelf life while maintaining freshness and safety.

Lightweight characteristics reduce transportation costs and improve logistics efficiency, making plastic the most preferred option for large-scale food manufacturers. Technological advancements in recyclable and bio-based plastics are further strengthening the segment’s position as sustainability demands rise.

The ability to support high-quality printing and branding adds commercial value, ensuring continued reliance on plastic in pillow pouch packaging applications. Market leadership is expected to persist as producers optimize plastic formulations to balance environmental compliance with performance requirements.

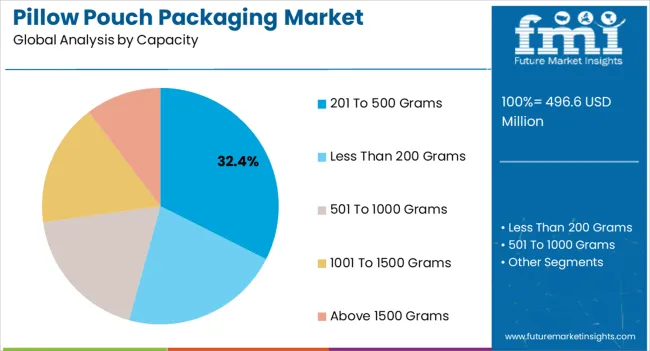

The 201 to 500 grams capacity segment, accounting for 32.4% of the category, has gained prominence due to its suitability for medium-sized product packaging commonly demanded in retail and household consumption. This capacity range provides convenience in portioning, affordability in pricing, and efficiency in storage and handling.

It is widely used in food and snack products where balanced pack sizes meet consumer expectations for both value and convenience. Growth is supported by expanding supermarket penetration and rising disposable incomes in developing economies, which are fueling higher demand for ready-to-eat and on-the-go packaged items.

Manufacturers are standardizing this capacity segment for mass-market production, which ensures economies of scale and sustains its leading position within the market.

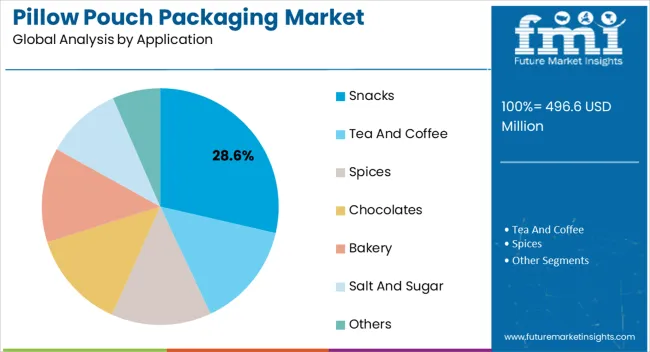

The snacks application segment, representing 28.6% of the category, leads due to the growing popularity of packaged snack foods and their reliance on convenient and attractive packaging formats. Pillow pouches are favored in this application because of their ability to preserve freshness, provide portion control, and offer strong visual branding opportunities.

Increasing snacking culture across urban populations and the global shift toward ready-to-consume food products are reinforcing demand. The segment is further supported by product innovation in healthy and functional snacks, which require reliable packaging to maintain quality.

Expanding retail and e-commerce channels are amplifying the reach of packaged snacks, ensuring steady growth for pillow pouch packaging in this segment. Over the forecast horizon, the application’s leadership is expected to strengthen as snack manufacturers adopt advanced packaging films and printing technologies for greater market appeal.

| CAGR from 2020 to 2025 | 4.0% |

|---|---|

| CAGR from 2025 to 2035 | 4.9% |

This section discusses the CAGR for the pillow pouch packaging market over two distinct periods. From 2020 to 2025, the CAGR is 4.0%, indicating a steady but moderate growth trend during this initial timeframe. Moving forward, the CAGR from 2025 to 2035 is projected to increase to 4.9%, signaling an acceleration in the market's growth rate over the long term.

Short-term Analysis of the Pillow Pouch Packaging Market from 2020 to 2025

| 2020 | USD 391 million |

|---|---|

| 2025 | USD 496.6 million |

Witnessing a swift rise, the pillow pouch packaging industry surged from USD 391 million in 2020 to USD 496.6 million in 2025. The sales growth was primarily due:

Mid-term Analysis of Pillow Pouch Packaging Market from 2025 to 2035

| 2025 | USD 496.6 million |

|---|---|

| 2035 | USD 801.2 million |

Maintaining sustained growth, the market value is expected to climb from USD 496.6 million in 2025 to USD 801.2 million in 2035. The demand is likely to rise due to:

Long-term Analysis of the Pillow Pouch Packaging Market from 2035 to 2035

| 2035 | USD 801.2 million |

|---|---|

| 2035 | USD 801.2 million |

The market is anticipated to reach USD 801.2 million in 2035 from USD 801.2 million in 2035. The adoption of pillow packaging is anticipated to rise due to:

The market is witnessing a significant shift toward sustainable packaging solutions, driven by consumer demand for eco-friendly options. Manufacturers increasingly incorporate recyclable and biodegradable materials, aligning with global environmental consciousness.

The industry is integrating smart packaging features into pillow pouch packaging designs. This includes interactive labels, QR codes, and other innovations to enhance user engagement, traceability, and product information accessibility.

Brands are leveraging pillow pouch packaging as a canvas for creative and customized packaging designs. This trend caters to the growing importance of brand identity, with companies using unique shapes, colors, and graphics to distinguish their products and enhance consumer recognition.

With the rise of online shopping, pillow pouch packaging is adapting to the specific requirements of eCommerce packaging. This includes features like tamper-evident seals and durable materials to ensure product integrity during shipping, reflecting the nature of modern retail.

Pillow pouches are increasingly chosen for packaging health and wellness products. The pouch design allows convenient and precise portioning, appealing to consumers seeking on-the-go, portion-controlled, and health-conscious packaging solutions.

Globalization is influencing pillow pouch packaging designs and material choices. Manufacturers are considering regional preferences, cultural aesthetics, and regulatory standards, leading to various pillow pouch packaging options tailored to specific market demands.

The section discusses various pillow pouch packaging market segments, offering industry players valuable details to inform strategic decisions. By breaking down the key categories, the section sheds light on the dominance of plastic, which holds a commanding market share of 55.80% in 2025.

This insight is crucial for manufacturers and suppliers to align their production with prevailing market preferences. Additionally, the focus on the top application reveals that snacks occupy a significant space in the market, capturing a substantial share of 48.90% in 2025.

| Attributes | Details |

|---|---|

| By Material Type | Plastic |

| Market Share in 2025 | 55.80% |

Plastic emerges as the go-to material for pillow pouch packaging, resonating with market preferences:

| Attributes | Details |

|---|---|

| Top Application | Snacks |

| Market Share in 2025 | 48.90% |

The impressive 48.90% market share mirrors the booming trend of increased consumer snacking, promoting pillow pouch packaging for snacks as a go-to choice for manufacturers.

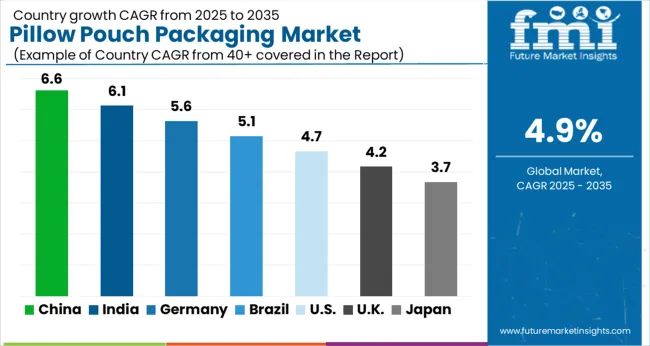

This section analyzes the pillow pouch packaging industry by countries, including the United States, Germany, Japan, Australia, China, India, and the United Kingdom. The table presents the CAGR for each country, indicating the expected growth of the pillow pouch packaging industry in that country through 2035.

The pillow pouch packaging industry in the United States is expected to rise at a steady CAGR of 4.40% through 2035.

Germany's pillow pouch packaging industry is expected to grow sluggishly by 3.10% through 2035. However, by observing the shifting demand patterns in Germany, there are chances of growth.

The pillow pouch packaging industry in Japan is expected to witness a moderate CAGR of 2.50% through 2035. The forecast predicts that sales are likely to witness a spike as:

The pillow pouch packaging industry in Australia is expected to witness a steady CAGR of 3.90% through 2035.

China's pillow pouch packaging industry is expected to grow by 6.50% through 2035.

The demand for pillow pouch packaging in India is anticipated to rise at a CAGR of 7.40% through 2035.

The pillow pouch packaging industry in the United Kingdom is expected to witness a CAGR of 2.70% through 2035. The growth rate may be moderate, but things could get interesting for manufacturers as:

Pillow pouch manufacturers are doubling down on their leadership by employing a range of strategic initiatives. To address the diverse packaging needs of various industries and consumer preferences, they are expanding their product portfolios to include a wider variety of pouch sizes, materials, and features.

For instance, they introduce pillow pouch packaging made from recyclable materials, offer convenient pillow-style bags for easy storage, and incorporate eye-catching designs to enhance product appeal.

Moreover, these manufacturers are investing heavily in research and development to create innovative pillow pouch packaging solutions that are more sustainable, efficient, and appealing to consumers. For example, they are developing pouches with improved barrier properties to extend product shelf life, exploring sustainable alternatives to traditional plastic films, and incorporating smart packaging technologies to track product freshness and provide consumer information.

To reach a broader customer base, pillow pouch packaging manufacturers are strengthening their distribution channels domestically and internationally.

They are forging partnerships with eCommerce platforms to expand their online presence, collaborating with retail chains to ensure their products are readily available at brick-and-mortar stores, and partnering with food service providers to cater to the growing demand for convenient and sustainable packaging solutions in the food service industry.

Recent Developments in the Pillow Pouch Packaging Industry:

The global pillow pouch packaging market is estimated to be valued at USD 496.6 million in 2025.

The market size for the pillow pouch packaging market is projected to reach USD 801.2 million by 2035.

The pillow pouch packaging market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in pillow pouch packaging market are plastic, pe, pp, pvc, evoh, pet, bopp, paper, kraft paper, recycled paper and aluminium.

In terms of capacity, 201 to 500 grams segment to command 32.4% share in the pillow pouch packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Insights of Leading Pillow Pouch Packaging Providers

Pillow Holder for Tablets Market Size and Share Forecast Outlook 2025 to 2035

Pillow Cases Market Analysis - Growth & Demand Forecast 2025 to 2035

Pillow Market

Examining Market Share Trends in Pillow Pack Packaging

Pillow Pack Packaging Market

Neck Pillows Market Analysis - Trends, Growth & Forecast 2025 to 2035

Market Share Breakdown of Beauty Pillowcase Manufacturers

US Bed Pillow Market Growth - Size, Trends & Forecast 2024 to 2034

Beauty Pillowcase Market Report - Growth & Industry Outlook 2024-2034

Cervical Pillow Market Forecast and Outlook 2025 to 2035

Void Fill Pillows Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in the Void Fill Pillows Industry

Hospital Bedsheet & Pillow Cover Market Analysis - Size, Trends & Forecast 2024 to 2034

Pouch Tapes Market Size and Share Forecast Outlook 2025 to 2035

Pouch Filler Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Pouch Film Market Trends & Industry Growth Forecast 2024-2034

Pouch Market Insights – Growth & Trends 2024-2034

Pouch Sealing Machine Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA