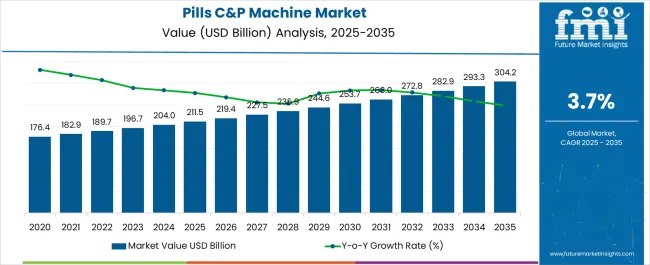

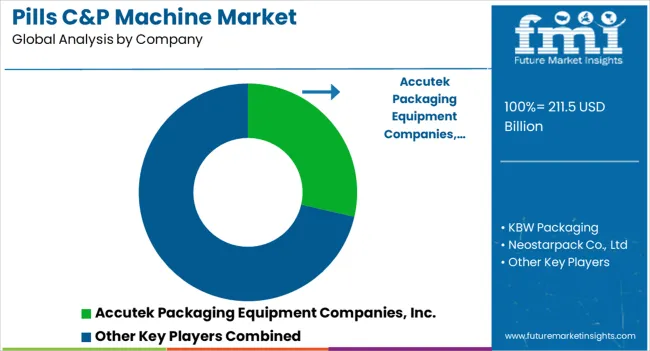

The Pills Counting & Packaging Machine Market is estimated to be valued at USD 211.5 billion in 2025 and is projected to reach USD 304.2 billion by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period.

| Metric | Value |

|---|---|

| Pills Counting & Packaging Machine Market Estimated Value in (2025 E) | USD 211.5 billion |

| Pills Counting & Packaging Machine Market Forecast Value in (2035 F) | USD 304.2 billion |

| Forecast CAGR (2025 to 2035) | 3.7% |

The pills counting and packaging machine market is experiencing robust growth fueled by rising demand for automation in pharmaceutical manufacturing and increasing focus on efficiency, accuracy, and regulatory compliance. Growing production volumes of prescription and over the counter medicines are driving the adoption of advanced packaging systems that ensure speed and precision.

Stringent guidelines from health authorities regarding labeling and packaging integrity are further influencing investment in modern counting and packaging solutions. The integration of technologies such as vision inspection, track and trace, and data connectivity has enhanced the reliability and compliance of these machines.

Additionally, the need to reduce operational errors and labor dependency is supporting the shift toward automated solutions. The market outlook remains promising as pharmaceutical companies and healthcare providers increasingly prioritize patient safety, operational efficiency, and cost effective production methods.

The automatic segment is expected to represent 54.70% of total market revenue by 2025 within the automation category, establishing itself as the leading segment. Growth in this segment is supported by the ability of automatic machines to deliver high throughput, consistent accuracy, and reduced dependency on manual intervention.

Their role in minimizing human error and maintaining regulatory compliance has made them indispensable for large scale pharmaceutical production. Furthermore, the integration of smart sensors and real time monitoring capabilities has reinforced their value in ensuring product integrity and traceability.

The shift toward efficiency driven manufacturing processes has positioned automatic machines as the preferred choice across global pharmaceutical operations.

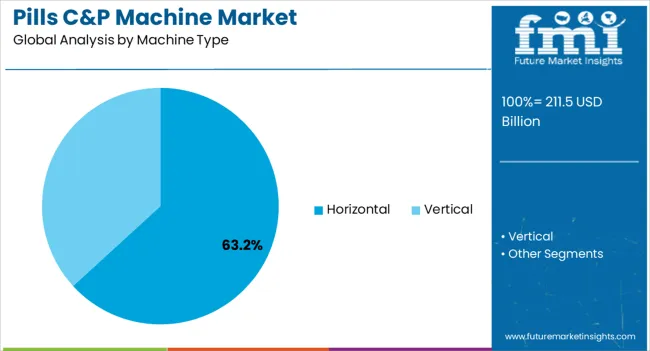

The horizontal machine type segment is projected to account for 63.20% of total revenue by 2025 within the machine type category, making it the dominant configuration. This dominance is attributed to its suitability for high volume packaging, streamlined workflow integration, and ability to handle diverse pill shapes and sizes.

Horizontal machines offer operational stability and facilitate efficient line automation, supporting faster turnaround times in pharmaceutical production. Their adaptability to advanced packaging technologies, including blister and bottle packaging, has further increased their adoption.

By delivering scalability and consistent output, horizontal machines have emerged as the preferred type for large scale operations..

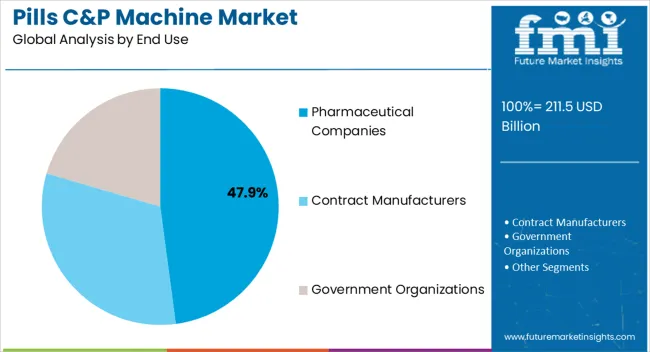

The pharmaceutical companies segment is projected to contribute 47.90% of total market revenue by 2025 under the end use category, positioning it as the leading segment. This leadership is driven by the rising global consumption of medicines, strict compliance mandates, and continuous investments in automated production facilities.

Pharmaceutical companies have prioritized advanced packaging systems to enhance safety, minimize contamination risk, and support serialization requirements. Increased demand for high speed and accurate packaging of a wide range of formulations has further strengthened adoption in this segment.

As the pharmaceutical industry continues to expand with growing therapeutic needs and global distribution requirements, this end use remains the cornerstone of market demand for pills counting and packaging machines.

From 2020 to 2025, the global pills counting & packaging machine market experienced a CAGR of 3.2%, reaching a market size of USD 211.5 million in 2025.

Over the years, the historic worldwide pills counting and packaging machine market has seen substantial growth and transformation. Various distinct elements that have created the market landscape have fueled demand for these equipment.

The rising complexity of drug regimens and the rise in chronic diseases globally have driven market demand. With an ageing population and an increase in the prevalence of chronic diseases, there is a greater demand for precise pill counting and efficient packaging solutions to ensure appropriate dosing and medication adherence.

Pill counting and packaging machines have evolved as critical instruments in the pharmaceutical sector, allowing producers to expedite production operations and deliver pharmaceuticals to patients in a safe and correct manner.

The historic global pills counting and packing machine market has grown dramatically due to factors such as prescription regimen complexity, demanding regulatory compliance, technology improvements, and the shift towards personalised medicine.

The global pills counting and packing machine market's future market forecast is positive, with various unique aspects driving its growth and influencing the industry landscape. To improve operational efficiency and productivity, the sector is progressively embracing automation, connectivity, and data-driven operations.

By incorporating new technology, pill counting and packing machines are expected to play a critical part in this shift. The global pills counting and packing machine market's future market prognosis appears hopeful, driven by factors such as customization requests , digital transformation, sustainability initiatives, track-and-trace requirements, and the entry of new market competitors.

Manufacturers who adapt to these changes, invest in technological integration, and align their offers with shifting industry needs will be well positioned to capitalise on the growth potential in this dynamic market.

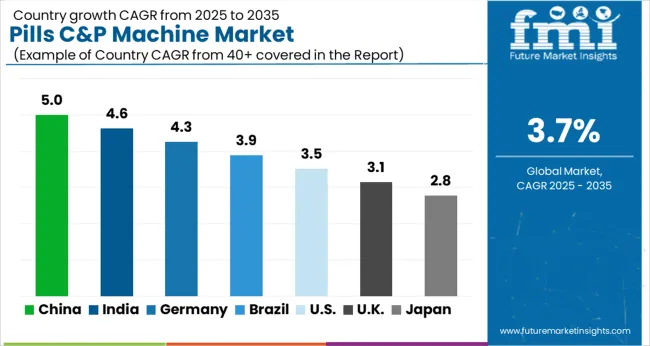

| Country | China |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 38.6 million |

| CAGR % 2025 to End of Forecast (2035) | 5.4% |

China has a significant market share in the global pills counting and packing machine market, firmly establishing itself as the industry leader. China's large pharmaceutical production sector is essential. The country's pharmaceutical industry is massive, serving both domestic and international markets.

There is a significant demand for pharmaceuticals due to a large population and rising healthcare costs. China's strategic export efforts have boosted its market share in the pill counting and packaging machine market.

Chinese manufacturers have been proactively exporting their machines to a range of countries, capitalizing on the country's favorable trade policies, competitive pricing, and consistent product quality. China's global expansion has solidified its position as a major market player and increased its market share.

| Country | India |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 17.6 million |

| CAGR % 2025 to End of Forecast (2035) | 5.9% |

India has emerged as a prominent market base for the pills counting and packing machine market, displaying enormous potential and helping to the expansion of the industry. The country is well-known for its robust generic medicine manufacturing business, and it has grown into a global pharmaceutical manufacturing powerhouse.

The growing demand for pharmaceutical products, both domestically and internationally, has increased the need for precise pill counting and packing systems. India's growing population and increasing healthcare facilities are driving demand for pharmaceutical items, thus fuelling the market for pill counting and packing equipment.

Rising healthcare spending in the country, expanded access to healthcare services, and a growing middle class with better healthcare expectations all contribute to an increased demand for dependable pharmaceutical packaging solutions.

The rise of the pharmaceutical industry, manufacturing capabilities, government efforts, emphasis on quality and compliance, and the development of healthcare infrastructure all contribute to India's strong market position in the pills counting and packaging machine market.

| Country | UK |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 14.7 million |

| CAGR % 2025 to End of Forecast (2035) | 3.9% |

The United Kingdom has great growth potential in the pills counting and packaging machine market, owing to factors such as a strong regulatory compliance, pharmaceutical sector requirements, the adoption of novel technologies, and a focus on sustainability.

The United Kingdom's commitment to innovation, quality standards, and environmental responsibility makes it an appealing target for pill counting and packing machine manufacturers looking to extend their footprint and suit the region's expanding pharmaceutical industry needs.

The automatic segment controls a substantial market share in the pills counting and packing machine market due to its multiple advantages and distinguishing features that satisfy the pharmaceutical industry's expanding needs.

The high efficiency and productivity of an automatic pill counting and packaging machine is one of its key advantages. By automating counting, sorting, and packaging tasks, these robots are intended to eliminate manual labour and human error. Automatic machines can handle massive amounts of pills with accuracy and speed, resulting in increased production throughput and overall operational efficiency.

Furthermore, the automatic segment of pill counting and packaging devices is in line with the industry's increasing emphasis on regulatory compliance and serialisation.

Regulatory agencies around the world require pharmaceutical producers to implement traceability systems to ensure the authenticity and integrity of medications along the supply chain.

Thus, the automatic sector accounts for a substantial market share in the pills counting and packing machine market due to its high efficiency, integration of new technologies, adaptability in handling various medications and package designs, and compliance with regulatory standards.

Because of its distinctive features and advantages that respond to the increasing needs of the pharmaceutical sector, horizontal pill counting and packaging machines are playing an important role in driving market expansion.

These machines are designed to count and package pills in a horizontal orientation, making it possible to handle a variety of dosage forms such as tablets, capsules, and soft gels efficiently. Horizontal machines can accommodate a variety of pill sizes, shapes, and materials, allowing for greater packaging flexibility.

Furthermore, horizontal machines frequently include innovative technology such as machine vision systems and sensors. Machine vision systems detect and count pills using cameras and image processing algorithms, assuring perfect dosage packaging. Sensors detect any irregularities or faults during the counting or packaging processes, reducing the possibility of product problems.

Horizontal pill counting and packaging machines are propelling market growth by providing versatility in handling a wide range of pharmaceuticals and packaging formats, high-speed operation, compact and space-saving designs, integration of sophisticated technology, and support for sustainable practices.

As the primary end-users and consumers of these machines, pharmaceutical corporations and contract manufacturers dominate the pills counting and packing machine market. Pharmaceutical firms are at the cutting edge of medicine manufacturing and packaging.

Pill counting and packing devices are used to assure precise dosage packaging, product quality, and compliance with regulatory standards.

Contract manufacturers are also important players in the pills counting and packing machine market. These companies specialise in offering contract manufacturing and packaging services to pharmaceutical companies.

They serve both large pharmaceutical corporations and small to medium-sized businesses that outsource their production and packaging operations. To suit the different needs of their clients, contract manufacturers require pill counting and packing equipment that are flexible, versatile, and fast.

The expanding trend of contract manufacturing of pharmaceutical production and packaging operations has raised demand for pill counting and packaging devices.

Market players in the global pills counting and packaging machine market remain competitive by implementing various strategies and initiatives that allow them to differentiate themselves and satisfy changing client needs.

Market players in the global pills counting and packaging machine market remain competitive by focusing on technological innovation, customisation, complete after-sales services, cooperation and partnerships, and quality and regulatory compliance.

These strategies enable them to differentiate themselves, efficiently address client needs, and maintain a strong market position. Market companies can prosper in a competitive market environment by constantly evolving and adapting to the changing demands of the pharmaceutical sector.

Key strategies in Pills Counting & Packaging Machine market:

Product Innovation:

Advanced machine vision systems, robotics and automation, connection and smart features, small and modular designs, and sustainability drive product innovation in the pills counting and packaging machine market. These breakthroughs address the industry's requirement for precision, efficiency, adaptability, and environmental sustainability.

Customization:

The pills counting and packaging machine market's customization enables pharmaceutical industry and contract manufacturers with personalised solutions that address their individual drug types, package styles, production quantities, and operational preferences.

Sustainability:

The pills counting and packaging machine market achieves sustainability through a variety of activities centred on energy efficiency, waste reduction, water conservation, and environmentally responsible industrial practises. Energy-saving innovations, optimised packaging material consumption, and water-efficient systems are being implemented in industry.

Strategic Expansion:

Strategic expansion, strategic collaborations, mergers and acquisitions, and R&D investments are included in strategic expansion in the pills counting and packaging machine market. Market players can use these expansion tactics to capitalise on growth possibilities, broaden their client base, and increase their competitive position.

The global pills counting & packaging machine market is estimated to be valued at USD 211.5 billion in 2025.

The market size for the pills counting & packaging machine market is projected to reach USD 304.2 billion by 2035.

The pills counting & packaging machine market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in pills counting & packaging machine market are automatic, semi-automatic and manual.

In terms of machine type, horizontal segment to command 63.2% share in the pills counting & packaging machine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Accounting Software Market Size and Share Forecast Outlook 2025 to 2035

Tablet Counting Machine Market Trends & Forecast 2024-2034

Currency Counting Machines Market Growth - Trends & Forecast 2025 to 2035

Hydrocarbon Accounting Solution Market by Service Type, by End User & Region Forecast till 2035

Analyzing Hydrocarbon Accounting Solution Market Share & Industry Leaders

Construction Accounting Software Market Size and Share Forecast Outlook 2025 to 2035

Europe Hydrocarbons Accounting Solution Market Insights – Demand & Growth 2025 to 2035

Construction Anchor Industry Analysis in United Kingdom Size and Share Forecast Outlook 2025 to 2035

India Decorative Veneer Industry Size and Share Forecast Outlook 2025 to 2035

Thermal Interface Material Market Size and Share Forecast Outlook 2025 to 2035

United States Hand Holes Market Size and Share Forecast Outlook 2025 to 2035

Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

Signage Market Size and Share Forecast Outlook 2025 to 2035

Retail Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Sublimation Paper Market Size and Share Forecast Outlook 2025 to 2035

Unidirectional Tape (UD) Market Size and Share Forecast Outlook 2025 to 2035

Tableware Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Label Market Size and Share Forecast Outlook 2025 to 2035

Intermediate Bulk Container (IBC) Market Size and Share Forecast Outlook 2025 to 2035

Growlers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA