The thriving worldwide currency counting machines marketplace is predicted to witness vital growth between 2025 and 2035, pushed through emerging calls for automated hard cash coping answers in banks, retail, and business enterprises.

As companies take care of bigger volumes of hard cash, the will for right, environment-friendly, and fraud-resistant currency counting machines has become an important part of daily operations. The construction of state-of-the-art skills, similar to counterfeit detection, multi-currency processing, and connectivity with digital financial platforms, propels marketplace growth.

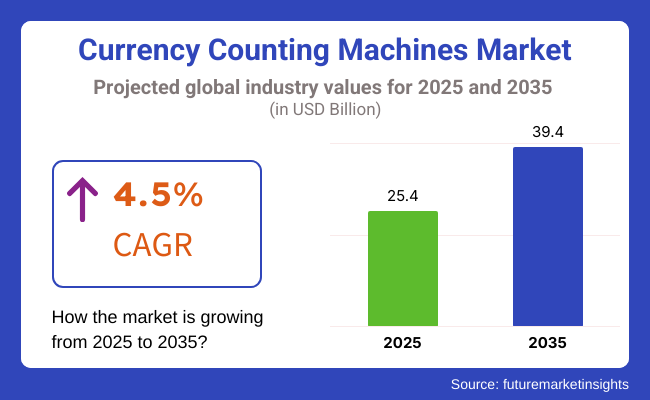

In 2025, the currency counting machines industry was once valued at roughly USD 25.4 Billion, and it's expected to achieve USD 39.4 Billion by 2035. This represents a compound annual increase price (CAGR) of 4.5% over the forecast length.

Developments in digitization multiplied ATM usage, and the growth of retail chains throughout rising economies are key elements contributing to this growth. Monetary institutions and cash-intensive industries increasingly adopt these machines to streamline hard cash processing and enhance accuracy, lowering operational prices and manual errors.

Moreover, growing awareness of hard cash fraud and the necessity for environment-friendly hard cash management have driven developments in currency counting device know-how.

Integrating device getting-to-know and AI-enabled options ensures dependable counterfeit detection, real-time reporting, and enhanced security, making those machines indispensable in each massive-scale monetary institution and small-scale retail operation.

The generation of innovative features, alongside automatic document printing, batch recounting for verification functions, and cellular connectivity for far-off tracking, increase the versatility of those machines.

Due to its mature banking and financial frameworks, North America dominates the currency counting machines industry. The United States and Canada boast considerable implementation of cutting-edge cash handling systems due to prioritizing functional proficiency and protection.

Stores, gaming facilities, and sizable commercial ventures in the area rely enormously on currency-counting machines to systematize everyday dealings, administer monetary flows, and identify fake bills. Regular investments in revolutionary cash-handling innovations are anticipated to preserve the market’s rising pattern over the long term.

Furthermore, the diversity in sentence structures between paragraphs showcases the complex nature of financial enterprises in the region seeking both efficiency and security through technologically advanced solutions.

Europe continues to be a powerful market for currency-counting machines, supported by robust banking infrastructure and stringent regulatory frameworks surrounding cash management. Countries such as Germany, France, and the United Kingdom are pioneering adopters, with financial institutions emphasizing high-accuracy and counterfeit detection capacities above all else.

Retail and hospitality industries also propel the need for compact, user-friendly machines capable of handling multiple currencies. The European Union's efforts to strengthen fiscal transparency and anti-money laundering actions moreover increase the necessity for cutting-edge currency counting technologies.

Asia Pacific is expected to see the fastest progress in the currency counting machines market, powered by the speedy development of retail chains, more ATM setups, and flourishing commercial actions in emerging economies. Countries such as China, India, and Southeast Asia are observing more cash dealings, necessitating the utilization of capable cash-counting remedies.

Increasing knowledge regarding fake currency, combined with authorities' work to improve fiscal safety, is spurring demand for progressive currency counting machines. Nearby makers also present reasonably priced versions to address the region’s varied requirements, further backing market extension.

Challenge

Maintenance costs are too high, and system integration tends to be complex.

Furthermore, the maintenance of these machines is expensive, hindering the market's growth. These machines are an integral part of banking, retail, e-commerce, and financial sectors; however, they need to be calibrated, the sensors replaced, and software updated regularly to ensure precise detection and avoid any failures in counterfeit currency detection.

Moreover, whether integrated with currency counting systems or modern point-of-sale (POS) and banking software, operational complications require businesses to purchase compatible technology.

To address these challenges, manufacturers must create low-cost, low-maintenance machines with sophisticated counterfeit detection and real-time connectivity that allow them to plug into financial networks easily. Integration of self-cleaning sensors and AI-based mistake identification can further reduce operational interruptions and lengthen machine life.

Opportunity

Automated Cash Handling & Security-Based Currency Processing

Currency counting machines market: drivers and restraints. The rising demand for automated cash handling solutions and fraud prevention services offers considerable opportunities for the Currency Counting Machines Market.

Increased adoption of advanced cash management service systems by businesses and financial institutions also helps reduce human error, improve operational efficiency, and enhance security. This evolution is spearheaded by deploying AI-fuelled counterfeiting detection, multi-currency recognition, and automated sorting apparatus.

Moreover, the growth of upcoming economies where cash-based dealings remain the prominent, driven needs for rapid counting and precise counting machines. This will create a competitive advantage for companies specializing in biometric security upgrades, cloud-based transaction analytics, and environmentally-friendly innovations in currency handling equipment.

The (Currency Counting Machines Market) grew steadily from 2020 to 2024 as the demand for fraud detection, efficient cash handling, and automation in banking and retail sectors increased. Modern counting machines with ultraviolet (UV) and magnetic (MG) counterfeit detection technologies improved financial security.

Nevertheless, trends such as the increasing demand for digital payments, cashless programs, and disruptions to the supply chain impacted on the market growth. In response, companies improved the accuracy of banknote recognition, integrated touchless operating features, and updated their machines to read high-security polymer banknotes efficiently, meeting global currency designs as they evolved.

Future Trends (2025 to 2035) gaining traction are AI-enabled verification, real-time remote monitoring, and smart cash provisioning for a more streamlined process. Cloud-based cash management solutions will help businesses to monitor and study cash flow trends efficiently. Moreover, the increasing focus on sustainability will evolve energy-efficient currency counting machines with recyclable materials to minimize environmental impact.

In the coming years, however, we are more likely to see system compatibility for modern users, such as blockchain-based cash verification systems and biometric access controls, and other tried and true systems necessary for continuing market breadth, health, and integrity. The next decade of currency-counting market innovation will be led by companies focusing more on automation, fraud prevention, and digital connectivity.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with financial security regulations for cash handling |

| Technological Advancements | Growth in UV and MG counterfeit detection technologies |

| Industry Adoption | Increased use in banks, retail, and casinos |

| Supply Chain and Sourcing | Dependence on hardware-based cash-counting technologies |

| Market Competition | Presence of established cash-handling equipment manufacturers |

| Market Growth Drivers | Rising demand for counterfeit detection and accuracy in cash transactions |

| Sustainability and Energy Efficiency | Initial implementation of low-energy counting mechanisms |

| Integration of Smart Monitoring | Limited real-time tracking in currency counting devices |

| Advancements in Currency Recognition | Traditional detection of paper currency and counterfeit markers |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of AI-driven compliance monitoring and block chain-based cash verification. |

| Technological Advancements | Adoption of AI-powered recognition, biometric authentication, and smart cash tracking. |

| Industry Adoption | Expansion into automated cash dispensers, logistics, and contactless financial transactions. |

| Supply Chain and Sourcing | Shift towards software-integrated, cloud-based cash management solutions. |

| Market Competition | Growth of start-ups offering digital cash verification and fraud prevention systems. |

| Market Growth Drivers | Increased adoption of automation, real-time transaction monitoring, and eco-friendly cash processing. |

| Sustainability and Energy Efficiency | Full-scale transition to energy-efficient, recyclable, and AI-optimized counting machines. |

| Integration of Smart Monitoring | AI-powered fraud detection, predictive maintenance, and cloud-based financial analytics. |

| Advancements in Currency Recognition | Enhanced AI-based recognition of polymer banknotes, micro printing, and next-gen security features. |

The United States currency counting machines industry has steadily expanded due to high cash flows within retail, banking, and hospitality which have amplified concerns regarding counterfeited money and increased adoption of sophisticated currency authentication solutions. The Federal Reserve's strict policies regarding counterfeit detection motivate enterprises to invest in highly precise currency counters with ultraviolet and infrared scanning capabilities.

The casino and gaming sector, where enormous amounts of physical currency change hands daily, is a major client of rapid and multi-currency counting appliances. At the same time, banks and financial institutions are integrating AI-powered cash automation systems to boost efficiency and decrease human mistakes.

With continuous technological innovation and a strong need for protected cash handling systems, the USA currency counting machines market is expected to grow steadily. While counterfeiting issues persist, automated currency verification aids many industries in securing sizable transactions and upholding the integrity of the tender. The continuous evolution of accounting technology and demand across various domains suggest the ongoing expansion of this industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.8% |

While physical monies stay an important aspect of commerce in certain sections of the United Kingdom, digital payments are progressively becoming the norm. Specifically, wee shops, roadside vendors, and hospitality locations rely substantially on hard cash. Consequently, the persisting utilization of money in these fields and developing worries about counterfeit banknotes have led the national marketplace for banknote counters to expand.

British banking and cash transportation corporations are also incorporating more computerized options for dealing with banknotes. This permits them to streamline the methods included in transporting, sorting, and analyzing notes.

A key motivator for technology adoption amongst financial organizations is the Bank of England's debut of cutting-edge security qualities in polymer banknotes. These next-gen expenses inspire associations to obtain currency counters with sophisticated forgery discovery abilities.

Given the carrying-on usage of cash combined with increasing protection issues and assimilation of hybrid technologies, experts foresee a continuing need strengthening within the United Kingdom's banknote counting machines sector. The ongoing execution of mechanized cash handling answers promises steady market development in the coming years.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.3% |

The diverse economies across Europe have fostered a lasting demand for currency authentication solutions. Nations sustaining robust cash usage still rely on reliable validation machines, compelling suppliers to innovate protection against forgery. Furthermore, the European Central Bank aggressively campaigns for counterfeit deterrence. Their pressures push organizations to adopt more exacting bill inspection systems.

At the same time, intelligent ATMs and self-service deposit kiosks incorporating monetary denomination recognition are proliferating in financial halls and stores. As technologies merge to streamline cash processes, various institutions automate currency handling.

With the region's unyielding prioritization of fiscal safety and a rising need for solutions verifying valid tender in various settings, the market for European currency enumeration machines is anticipated to develop steadily. Strict policies and persistent preferences for physical money guarantee the continuation of this pattern.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.6% |

Cash remains integral to the Japanese economy, necessitating reliable banknote processing systems. Various industries rely on efficient currency handling, spurring interest in technologically sophisticated counting machines. Precise equipment reduces errors and fraud while streamlining operations vital to transport and retail.

While digital alternatives emerge, paper currency sustains significant commercial sectors. Those handling immense cash volumes require advanced solutions. Similarly, shops utilize compact counters incorporating artificial intelligence to automate transactions.

With progressive authentication innovations and certain activities depending on notes and coins, forecasters predict steady expansion for Japan's currency counting machinery industry. Though technologies change how consumers pay, cash continues underpinning key enterprises, ensuring the need for counting technology stays consistent.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.4% |

The South Korean currency counting machines industry has witnessed steady growth, fueled by the continued prevalence of cash usage in retail, gaming, and small business settings, alongside enhancements in AI-propelled cash enumeration technologies. While South Korea transitions towards a cashless society, numerous enterprises, particularly in hospitality, transportation, and monetary services, still necessitate protected and effective banknote dealing with solutions.

The policies of the Bank of Korea aimed at hindering counterfeiting have motivated companies to embrace high-speed counters furnished with deception discovery along with varied lengths and structures of sentences. In addition, the developing e-commerce and logistics sectors are incorporating computerized cash management systems into their procedures.

With ongoing innovations in digital cash administration and increasing issues concerning security, experts anticipate that the South Korean currency counting machines market will continue growing gradually but steadily, driven by complexity and variation.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.5% |

Currency counting machines are mainly segmented based on their type, such as loose note and bundle note segments, which are fitted with the high-speed and accurate cash counting devices used inside the financial institutions, retail businesses, and commercial sectors, which is anticipated to register a significant share in the currency counting machines market from 2018 to 2023.

These high-performance currency counters are vital for streamlining cash-handling operations, speeding up the transaction process, and enhancing security, making them an essential solution across banks, retail stores, casinos, government offices, and large-scale commercial enterprises.

Loose note currency counter machines were among the first widely adopted cash-handling solutions with high-speed counting, batching, and counterfeit detection capabilities. Loose note machines accurately and quickly count single notes, eliminating operational errors and accommodating cash-intensive environments compared to traditional manual counting methods.

Growing demand for loose note-counting machines for cash handling in the retail and banking sectors to ensure fast and error-free processes has further propelled the adoption of advanced type currency counters in the market. Loose note currency counting machines increase the efficiency of counting by more than 80%, according to Studies, and provide the best possible accuracy with much less work for the cashier.

Another factor driving the market growth of loose note counters in casinos and entertainment venues with integrated counterfeit detection and denomination sorting, which have expanded the market for loose note counters, is fostering demand for loose note counters through wider adoption in cash-intensive environments.

AI-powered currency recognition technology with note authentication of real-time and batch counting optimization has also contributed to adoption by providing better fraud detection and cash reconciliation accuracy.

This has resulted in the market growth of lightweight and portable loose note currency counter machines with lightweight designs for mobile cash management solutions.

Market expansion has been bolstered by adopting the multi-currency counting capabilities of automatic currency identification, upholding the ability to better adapt to cash movements across global cash processing, international business transactions and foreign exchange services.

However, they have drawbacks, including sensitivity to worn or damaged notes, the occasional miscount caused by a bill being out of alignment, and increased dependence on regular maintenance, despite being faster, more efficient, and capable of detecting more counterfeits than their loose note counterparts.

Nonetheless, advancements in AI-based note verification, self-calibrating counting systems, and new-age sensor-based currency detection systems are driving accuracy, reliability, and cost-effectiveness, allowing loose note currency counting machines to remain a steady-growing market.

The market for bundle note currency counting machines has found significant market penetration in several key segments, including banking, corporate cash vaults, and government financial institutions, as businesses and organizations continue to invest in high-volume cash processing solutions to improve productivity and streamline bulk cash handling operations.

However, unlike loose note counters, bundle note machines keep entire stacks of currency at once, which makes them capable of achieving peak counting speeds, allowing for greater efficiency in areas with lots of cash.

As banks and government treasuries place greater importance on operational efficiency and security, the growing need for bundle note counters in financial institutions for high-speed batch processing of large cash deposits is expected to translate into demand for advanced bulk currency counters. According to research, bundle note currency counting machines save more than 70% bulk cash processing time and ensure enhanced transaction speed and accuracy.

This trend translates into increased adoption of bundle note-counting machines in armored cash logistics services, with secure, tamper-proof cash handling mechanisms driving market demand, particularly for cash-in-transit operations and corporate cash management.

Advancing automation, such as high-speed bundle counting technology with automated stacking, banding, and counterfeit detection, has also achieved higher adoption, ensuring greater efficiency for bulk cash verification and processing.

These heavy-duty bundle note counters are highly durable. They are designed for long operation life, making them ideal for cash processing in high frequency, which propels the growth of the market by providing financial institutions with high durability and cost-effective solutions.

The utilization of AI-enabled bundle note verification, with live error identification and automatic denomination separation, has further bolstered market growth, offering improved suitability in high-security cash vaults and commercial banking processes.

Although these machines offer benefits like faster cash processing, better security, and efficiency in bulk processing, they also come with challenges like high initial investment cost pressures, significant space requirements, and the need for periodic maintenance of moving parts.

However, innovations in compact bundle counting designs, artificial intelligence-powered error correction strategies, and self-cleansing note feeding mechanisms are driving efficiency, adaptability, and long-term operational cost-effectiveness, propelling the increased penetration of bundle note currency counting machines over the forthcoming years.

Basic note counters and intelligent counting cum counterfeit detection machines are two of the major segments driving the market as enterprises increasingly adopt smart and high-speed cash-handling solutions to cut fraud and errors while optimizing cash management workflows.

Basic note counters are one of the most common cash-handling solutions, providing simple yet functional and effective counting devices for retail, hospitality, and small business. Basic note counters lack advanced security features but allow for fast and accurate counting without the need for expensive counterfeit detection machines, making them ideal for businesses not prone to fraud.

Entry-level currency counting machines are gaining traction in small and medium-sized businesses, with basic note counters used to count single denominations for daily cash reconciliation, fuelling adoption rate in local retail stores amid rising demand for automation in these local stores for both efficiency and affordability.

Research shows that the basic note counters increase cash counting speed by more than 60%, thus facilitating good operational efficiency in small-scale cash-based business transactions.

The growing availability of basic note counters in supermarkets and grocery chains, with batch counting functions to balance cash registers, has catalyzed market demand and increased use cases in fast-paced retail environments.

Portable battery-operated basic note counters with wireless and lightweight designs for cash handling have further increased adoption with improved flexibility within outdoor and field-based retail operations.

Mini and easy apparatus note counters are designed with touch screens for easy functions, which maximize market growth and ensure higher usability in small and medium enterprises.

Although they have certain benefits like low price, high speed, and convenient operation, the basic note counters fail to provide features like counterfeit detection and mixed-denomination sorting and are less durable for frequent cash handling. But recent advancements in AI-based note-counting algorithms, rugged light materials, and improved stacking mechanisms are increasing efficiency, durability, and cost-effectiveness in the basic note-counting machine market, securing its future.

Banks, large retail chains, and other high-security financial institutions are adopting intelligent counting cum counterfeit detection machines at a very high rate as businesses are increasingly investing in fraud detection and high-speed cash verification solutions. In contrast to simple note counters, intelligent machines rely on UV (ultraviolet), magnetic ink, and infrared, as well as AI-powered pattern recognition, to detect counterfeit and soiled notes, providing better cash handling security.

However, the growing requirement for counterfeit detection in corporate cash vaults (real-time fraud detection, multi-currency processing) in the financial sector has compelled the adoption of high-security Note Counters because financial institutions have always prioritized fraud prevention.

The growing number of intelligent note counters deployed in casinos and gaming centres, along with advanced features, such as high-speed multi-denomination sorting and serial number tracking, have been boosting market demand, accelerating adoption across cash-intensive environments.

AI-powered counterfeit detection with real-time pattern recognition and biometric verification, as its combined use has also been a driver for increased adoption, as fraud prevention and high-volume transaction accuracy cannot be compromised.

Despite their benefits in terms of fraud detection, accuracy, and the ability to process large volumes of cash, intelligent counting machines must overcome challenges- including high initial costs, greater complexity of software integration, and sensitivity to variations in note quality, among others.

Nevertheless, the advent of advanced solutions, including blockchain-supported cash tracking, AI-based error rectification, and smart connectivity features, are addressing the concerns for security, usability, and operational cost-effectiveness, ensuring prolonged growth of intelligent counting cum counterfeit detection machines.

The growth of the currency counting machines market is attributed to rising demand for automatic cash handling solutions, counterfeit detection, and high-speed currency processing in banks, retail businesses, casinos, and government institutions.

Organizations prioritize AI-integrated fraud detection, multi-currency compatibility, and high-precision counting technology powered by intelligent software to improve operational efficiency, security, and accuracy.

Comprising global financial equipment manufacturers and specialized currency-counting solution providers, the market also benefits from technological advancements in note sorting, counterfeit detection, and high-speed counting machines.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Glory Ltd. | 15-20% |

| Cummins Allison (A Crane Co. Company) | 12-16% |

| Giesecke+Devrient GmbH | 10-14% |

| Hitachi-Omron Terminal Solutions, Corp. | 8-12% |

| De La Rue plc | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Glory Ltd. | Develops AI-powered cash recycling and high-speed currency counting solutions with counterfeit detection technology. |

| Cummins Allison (A Crane Co. Company) | Specializes in multi-currency note counters, sorters, and counterfeit detection systems. |

| Giesecke+Devrient GmbH | Manufactures high-precision banknote processing systems with advanced authentication features. |

| Hitachi-Omron Terminal Solutions, Corp. | Provides cash sorting and validation systems, integrating AI-based fraud detection. |

| De La Rue plc | Offers intelligent banknote counters and security-feature-enhanced currency sorting solutions. |

Key Company Insights

Glory Ltd. (15-20%)

The global leader in currency counting machines, Glory's focus on smart cash handling, intelligent tools to count denominations, and processing and sequenced sorting of currency has placed it at the forefront of AI-powered authentication and sorting technology.

Cummins Allison (A Crane Co. Company) (12-16%)

Cummins Allison designs powerful, high-speed currency processing equipment for multi-currency and counterfeit detection.

Giesecke and Devrient GmbH (10-14%)

Giesecke and Devrient develop intelligent note-processing systems for efficient cash management in both the banking and the retail world.

Hitachi-Omron Terminal Solutions, Corp. (8-12%)

Hitachi-Omron manufactures XD and H-F series automated checking systems for rapid currency authentication.

De La Rue plc (5-9%)

De La Rue makes currency counting and sorting machines outfitted with AI-powered counterfeit detection and authentication.

Other Key Players (40-50% Combined)

These innovations include currency counting machines of the next generation, AI-based fraud detection, and automated cash processing solutions from various financial technology and security solution providers. These include:

The overall market size for Currency Counting Machines Market was USD 25.4 Billion in 2025.

The Currency Counting Machines Market expected to reach USD 39.4 Billion in 2035.

The demand for currency counting machines will be driven by factors such as the increasing need for accuracy and efficiency in cash handling, growing banking and retail sectors, and advancements in counterfeit detection technology. Additionally, the rise in cash transactions and the focus on operational cost reduction will further boost market growth.

The top 5 countries which drives the development of Currency Counting Machines Market are USA, UK, Europe Union, Japan and South Korea.

Loose Note and Bundle Note Machines Drive Market Growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Range, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Range, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Range, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Range, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Range, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Range, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Range, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Range, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Range, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Range, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Range, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Range, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Range, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Range, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Range, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Range, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Range, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Range, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Range, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Range, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Range, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 21: Global Market Attractiveness by Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Range, 2023 to 2033

Figure 23: Global Market Attractiveness by Application, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Range, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Range, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Range, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Range, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Range, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 45: North America Market Attractiveness by Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Range, 2023 to 2033

Figure 47: North America Market Attractiveness by Application, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Range, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Range, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Range, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Range, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Range, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Range, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Range, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Range, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Range, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Range, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Range, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Range, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Range, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Range, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Range, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Range, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Range, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Range, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Range, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Range, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Range, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Range, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Range, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Range, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Range, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Range, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Range, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Range, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Range, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Range, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Range, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Range, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Range, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Range, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Range, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Range, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Currency Exchange Bureau Software Market – FinTech Evolution

Accounting Software Market Size and Share Forecast Outlook 2025 to 2035

Pills Counting & Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Cryptocurrency Market Size and Share Forecast Outlook 2025 to 2035

Lathe Machines Market

Sorter Machines Market Size and Share Forecast Outlook 2025 to 2035

Tablet Counting Machine Market Trends & Forecast 2024-2034

Virtual Machines Market by Type, by Enterprise Size, by Industry & Region Forecast till 2035

Bandsaw Machines Market Growth - Trends & Forecast 2025 to 2035

Wrapping Machines for Handkerchiefs Market Size and Share Forecast Outlook 2025 to 2035

Sleeving Machines Market Size and Share Forecast Outlook 2025 to 2035

Drilling Machines Market Size and Share Forecast Outlook 2025 to 2035

Spinning Machines Market Size and Share Forecast Outlook 2025 to 2035

Knitting Machines Market Size and Share Forecast Outlook 2025 to 2035

Stamping Machines Market Growth and Outlook 2025 to 2035

Twist Tie Machines Market Size and Share Forecast Outlook 2025 to 2035

Cartoning Machines Market from 2025 to 2035

Flow Wrap Machines Market by Horizontal & Vertical Systems Through 2025 to 2035

Flake Ice Machines Market - Industry Growth & Market Demand 2025 to 2035

Flow Wrap Machines Market Analysis – Size, Share & Industry Trends 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA