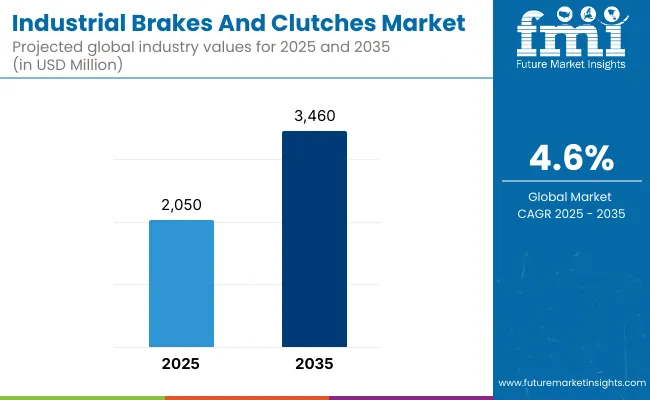

The industrial brakes and clutches marketis projected to grow steadily between 2025 and 2035, driven by increasing demand for automation in industrial processes, enhanced safety systems, and precision machinery.

The market is expected to rise from USD 2,050 million in 2025 to USD 3,460 million by 2035, reflecting a compound annual growth rate (CAGR) of 4.6% during the forecast period.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 2,050 million |

| Market Value (2035F) | USD 3,460 million |

| CAGR (2025 to 2035) | 4.6% |

The increasing demand for effective motion control in heavy-duty equipment, mining, construction, and manufacturing industries is further driving the market. These have been popular in high-torque applications that also need fast engagement and low maintenance such as electromagnetic clutches and brakes, along with pneumatic/ hydraulic systems.

Rising industrial automation trends and the increase use of smart sensors and monitoring technologies are also boosting the demand for advanced braking and clutch solutions.

Europe and North America continue to be key markets on account of their robust industrial base and regulatory focus on workplace safety. On the other hand, the Asia-Pacific is growing as a profitable region due to increasing Industrial activity, infrastructure developments as well as investment in robotics and automated systems.

The industrial brakes and clutches market is expected to celebrate consistent growth across developed and developing economies, as focus on operational efficiency, downtime reduction, and next-generation drive system continues to gain momentum.

With a relatively solid manufacturing industry, and an increase in automations in Industrial machineries and a great adaptation for technologically advanced motion control systems, the North America region holds a notable portion of the Industrial brakes and clutches market.

The United States, in this regard, is leading with well-established industries such as mining, metal processing and marine applications, which rely heavily on impeccably functioning braking and clutch systems for safe and accurate operation. Strengthened key segment in the region stems from factors such as incorporation of smart braking systems and need for fail-safe components in high-load applications leading to ongoing developments.

There is also market growth from investments in renewable energy via use of wind turbines,which need specific braking systems for control of operation. Workplace safety and equipment efficiency regulatory mandates that require industries to replace legacy systems with modern clutches and brakes only heighten that drive. Nonetheless, supply chain challenges and the variability in raw material costs continue to worry OEMs and system integrators.

Demand for industrial automation and advanced manufacturing landscapes led by the likes of Germany,France, Italy, and the UK puts Europe second in line. A strong emphasis on engineering excellence and sustainability in this region leads to widespread adoption of energy-efficient braking and clutch systems in several sectors such as robotics, railways, construction machinery, and automotive manufacturing.

Due to the increasing focus on reducing carbon footprint and enhancing productivity of the machines, integration of regenerative braking and electromechanical clutch is being encouraged.

This has led to increased adoption of reliable, maintenance-free solutions due to the EU regulations concerning machinery safety standards and performance efficiency. In addition, the evolution of Industry 4.0 and smart factory projects have generated demand for accurate process control systems, which is also boosting the market. Indeed, while regulatory environments are often stricter and production costs relatively high, Europe continues to be a centre of technological innovation for industrial components.

Asia-Pacific is going to have the fastest-growing regional market because of rapid industrialization, increasing manufacturing bases, and rising automation in developing economies. Among the key countries these include Japan, India,China and South Korean activities, heavy machinery and construction investments, and resources investments in mining, oil and gas and energy.

High performance, low maintenance industrial braking and clutch systems that provide smooth operation to keep up with wind energy generation and urban infrastructure projects are in great demand in the industry.

The competitive manufacturing cost structure of the region, coupled with the growing demand for domestically manufactured machinery, is driving regional players to concentrate on product differentiation and reliability. While Japan and South Korea focus on high-end innovations in mechatronic brake and clutch technologies, in volume sales, China is king.

The major growth restraints in the market are related to the manufacturing and distribution industries across the world that lacks basic quality certifications and low levels of development in rural areas, however increasing focus on automation and employee safety are gradually breaking through these barriers.

Challenges - High Cost of Advanced Systems and Downtime Risks

The factors that are expected to restrain growth of the industrial brakes and clutches market include high cost of advanced braking systems and downtime during repair or replacement. High capital expenditure associated with modern electromechanical and automated brake systems can also act as a hindrance for small and medium-scale industries from adoption. Moreover, the breakdown of the brake and clutch of heavy equipment makes the downtime and productivity loss, critical especially in industries such as mining,marine, and manufacturing, where continuous operation is necessary.

Opportunities - Adoption of Smart Braking Systems and Predictive Maintenance

Emerging opportunities are seen in the adoption of smart braking and clutch systems that incorporate sensors and IoT-enabled monitoring solutions. These systems allow for real-time diagnostics, predictive maintenance, and automated response mechanisms leading to safer operations and reduced unplanned outages. With the rapid adoption of Industry 4.0, the need for intelligent braking solutions that improve operational efficiency and extend machine life is on the rise in automotive, wind energy and material handling industries.

From 2020 to 2024, advanced automation in the industrial sector, growing use of material handling equipment, and rising demand for safety and efficiency drove steady growth of the industrial brakes and clutches market. Global supply chain issues, especially for raw materials and electronics parts, however, created temporary headwinds. And although there was a move towards electromechanical alternatives, mechanical systems remained more affordable and dominant.

The market is set to pivot toward smart and sustainable braking solutions in 2025 to 2035. Electromagnetic and hydraulic systems with sophisticated monitoring features will become more widespread, especially in robotics, wind turbines and construction-related machines. Moreover, higher thermal resistance and recyclability of the new friction material development will also meet the sustainability challenges and the regulatory assurance.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Basic safety compliance for industrial machinery |

| Technological Advancements | Increased use of pneumatic and hydraulic braking systems |

| Industry Adoption | Heavy machinery, automotive, and manufacturing sectors |

| Supply Chain and Sourcing | Dependence on traditional materials like asbestos substitutes |

| Market Competition | Dominance of established mechanical brake manufacturers |

| Market Growth Drivers | Demand for operational safety and automation |

| Sustainability and Energy Efficiency | Low focus on recyclability |

| Consumer Preferences | Preference for reliable, cost-effective solutions |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter safety mandates and environmental standards for friction materials |

| Technological Advancements | Growth in smart, sensor-based, and electromechanical systems |

| Industry Adoption | Expansion into renewable energy, robotics, and autonomous systems |

| Supply Chain and Sourcing | Transition to sustainable, high-performance, and recyclable materials |

| Market Competition | Entry of IoT -integrated brake system providers and tech-driven firms |

| Market Growth Drivers | Industry 4.0 adoption and predictive maintenance technologies |

| Sustainability and Energy Efficiency | High focus on eco-friendly, low-emission, and energy-efficient components |

| Consumer Preferences | Shift toward smart, low-maintenance, and safety-enhanced systems |

The industrial brakes and clutches market in the United States holds considerable share owing to the presence of heavy machinery, mining, manufacturing,and construction sectors in the country. The demand summons primarily from the growing need for reliable and high-performance motion control components used in critical applications including oil & gas, wind energy, material handling, and robotics.

Growing investments toward industrial automation & smart manufacturing continue to drive impetus for advanced braking systems adopting precision torque control & fail-safe capabilities. Key players in the region are also emphasising on improving durability, decreasing maintenance, and incorporating IoT-enabled diagnostics to boost system uptime.

| Country | CAGR (2025 to 2035) |

|---|---|

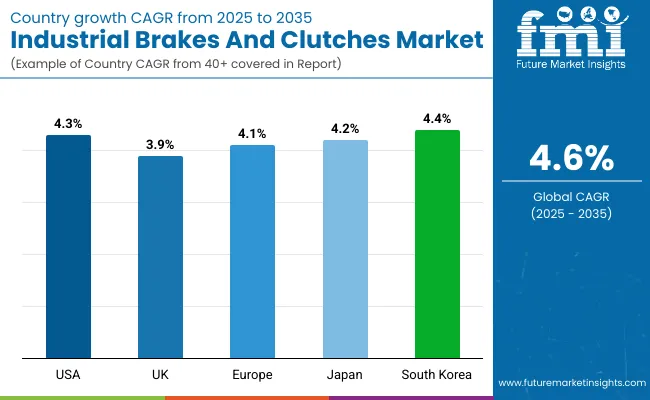

| United States | 4.3% |

Growing adoption of industrial brakes and clutches in marine, defence and renewable energy sectors has been leading the market for UK industrial brakes and clutches market toward constant growth. Tight, energy efficient brake and clutch technologies are particularly being taken up in wind turbine maintenance and shipbuilding applications.

The market is gaining traction as a result of the availability of advanced engineering firms and regulations for the safety and sustainability of equipment that encourage the adoption of automation-ready components. It also has a positive outlook on the return of domestic production and demand growth, through Brexit, coupled with some initiatives aimed at boosting the domestic manufacturing sector.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.9% |

The industrial brakes and clutches market in the European Union is a well-developed, widely adopted, and technologically adept region. Germany, France and Italy are all at the forefront of the emerging high-performance brake systems market across machine tools, conveyors, elevators and power generation industries.

This push toward industry 4.0, with its increased automation and predictive maintenance needs, is driving innovation in safety brakes, electromagnetic clutches, and hydraulic systems. In addition, adhering to stringent EU standards regarding equipment safety, efficiency, and practices for reducing emissions drives the regular upgrading of equipment, as well as retrofitting older machines.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.1% |

Japan has a strong position in robotics, precision manufacturing, and automotive that creates industry demand, boosting the country's market for industrial brakes and clutches. Japanese conveyers and industrial systems have a high requirement for operational efficiency and safety, and as such they depend on reliable braking and clutch systems that result in minimal downtime.

The country’s dedication to next-gen automation and smart factory deployment ensures continued demand for motion control technologies. Moreover, R&D activities in developed small size, high-torque devices having heat resistance build-in domestic innovation and likely increase exports.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.2% |

Restructuring of industrial sectors including manufacturing,logistics, steel and heavy industries provides opportunity for industrial brakes and clutches market in South Korea. The government’s focus on increasing renewable energy capacity has been driving demand for turbine brakes and couplings, particularly in wind farms.

In addition, the advancing automation and robotics in the country are paving the way towards compact and programmable clutch systems that are used across multiple production lines. Incorporating smart diagnostics and lightweight materials in the product offerings are also boosting global competitiveness for local manufacturers.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.4% |

With growing demands in sectors like manufacturing, energy, construction, marine, and material handling, the industrial brakes and clutches market is thriving.

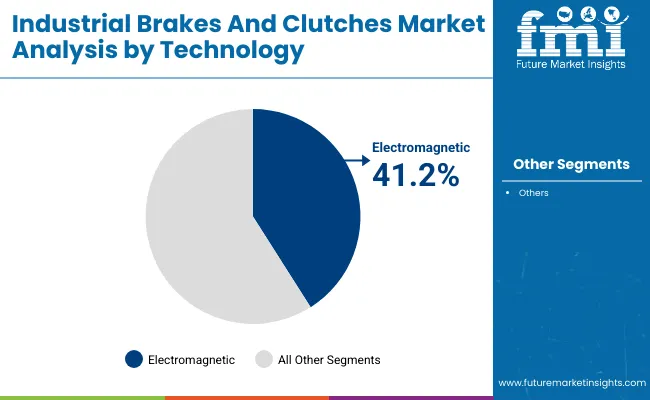

With the transition of industries towards O.E.M's automated, high-torque, and precision-based equipment, the selection of brake and clutch technology is a critical decision that will affect operational control and equipment lifespan. Electromagnetic, oil-immersed, and other components hold a significant market presence due to their reliability in heavy-duty applications as well as the ability to resist environmental wear once installed.

Electromagnetic Technology Commands Highest Market Share Due to Superior Responsiveness and Integration with Automation

| Technology | Market Share (2025) |

|---|---|

| Electromagnetic | 41.2% |

Driven by quick response time, wear-free operation, and the ability of the system to adapt to automated machinery conditions, electromagnetic brakes and clutches are expected to hold 41.2% of the market share in 2025. These mechanisms are commonly found in CNC machinery, robotics, and packaging machines where accurate engagement and disengagement is critical. They maximize performance and minimize mechanical downtime through compatibility with modern programmable control systems.

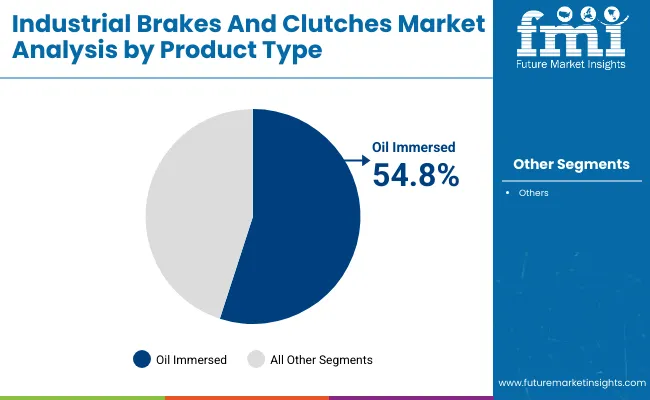

Oil-Immersed Brakes and Clutches Lead Product Adoption Due to Heat Dissipation and Extended Service Life

| Product Type | Market Share (2025) |

|---|---|

| Oil Immersed | 54.8% |

The oil-immersed types are expected to occupy a 54.8% segment in 2025, especially for heavy-load and high-cycle situations. These components are made for constant lubrication which helps in substantially reducing friction, dissipating heat, and prolonging the longevity of units. In their extreme industrial conditions, a tolerable extreme within the performance of the performance is essential for mining, material handling,wind energy, etc.

They may also be used as interchangeable parts between two or more related products with other variations of material and construction. The demand for reliable torque transmission, safety, and motion control solutions has never been more vital than now, with industries leaning towards automation and heavy-duty solutions.

The propulsion of electrification in industrial machinery together with automation of industrial processes may lead to advanced robotic solutions in industrial settings that will make manufacturers to provide accurate, energy-efficient and durable braking and clutch technologies.

Market Share Analysis by Key Players & Manufacturers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Altra Industrial Motion Corp. | 13-18% |

| Eaton Corporation | 10-14% |

| Siemens AG | 9-13% |

| Warner Electric (Regal Rexnord) | 7-11% |

| Other Companies (Combined) | 40-50% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Altra Industrial Motion Corp. | Launched high-torque electromagnetic brakes and clutches for automation systems in 2024. |

| Eaton Corporation | Released durable hydraulic clutches for off-highway and heavy-duty industrial equipment in 2024. |

| Siemens AG | Introduced modular braking systems with remote diagnostics for industrial drives in 2025. |

| Warner Electric (Regal Rexnord) | Delivered low-maintenance clutch/brake packages for packaging and conveyor machinery in 2025. |

Key Market Insights

Altra Industrial Motion Corp. (13-18%)

Altra leads the industrial brakes and clutches space with a comprehensive range of electromagnetic and mechanical braking systems, known for precision control and overload protection in critical applications.

Eaton Corporation (10-14%)

Eaton focuses on powerful, fluid-based clutch technologies designed for construction, agriculture, and mining sectors, ensuring consistent performance under harsh environments.

Siemens AG (9-13%)

Siemens offers integrated motion control systems that combine automation platforms with advanced braking technology, enabling real-time monitoring and smart diagnostics.

Warner Electric (Regal Rexnord) (7-11%)

Warner Electric specializes in compact and modular brakes and clutches, catering to material handling, packaging, and OEM machinery, with an emphasis on quick installation and energy efficiency.

Other Key Players (40-50% Combined)

Notable contributors in the market include:

The overall market size was USD 2,050 million in 2025.

The market is expected to reach USD 3,460 million in 2035.

Growth is driven by increasing demand for automation in industrial processes, rising emphasis on safety systems, and the need for precision control in heavy machinery and equipment.

The top 5 countries driving the development of the market are the USA, Germany, China, Japan, and South Korea.

Electromagnetic braking systems and oil-immersed clutches are expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Energy Management System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Insulation Market Size and Share Forecast Outlook 2025 to 2035

Industrial Safety Gloves Market Size and Share Forecast Outlook 2025 to 2035

Industrial Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Pepper Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

Industrial Absorbent Market Forecast and Outlook 2025 to 2035

Industrial Furnace Industry Analysis in Europe Forecast and Outlook 2025 to 2035

Industrial Denox System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronic Pressure Switch Market Size and Share Forecast Outlook 2025 to 2035

Industrial WiFi Module Market Size and Share Forecast Outlook 2025 to 2035

Industrial Security System Market Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA