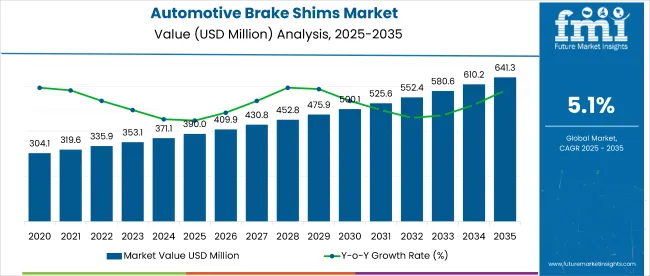

The global automotive brake shims market is projected to reach USD 390 million in 2025 and expand to USD 640 million by 2035, growing at a steady CAGR of 5.1% during the forecast period. This growth is primarily driven by the automotive industry's increasing focus on noise reduction, ride comfort, and brake system performance.

Brake shims serve as critical components within disc braking systems, helping minimize noise, vibration, and harshness (NVH), particularly in passenger vehicles and electric vehicles (EVs). As global emission and noise regulations tighten, automakers are actively investing in advanced shim materials and designs to ensure compliance and enhance customer satisfaction.

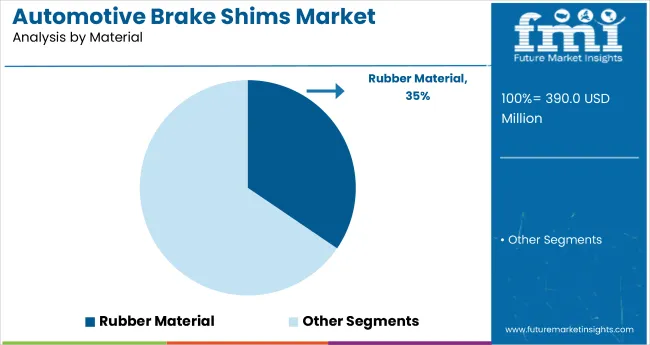

In terms of materials, rubber-based brake shims are expected to lead the market in 2025, capturing the largest share due to their superior acoustic insulation and cost efficiency. These materials offer excellent damping characteristics, which significantly reduce brake squeal and deliver smoother operation.

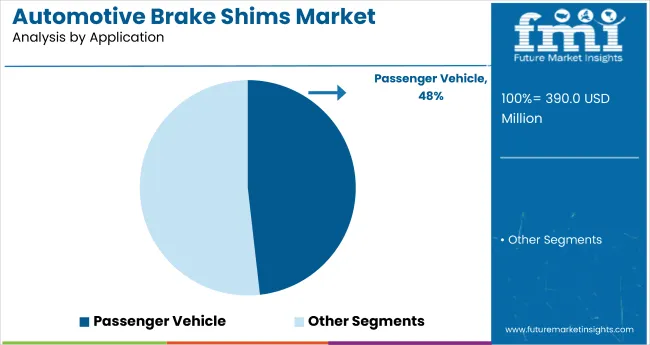

Among applications, passenger vehicles are set to dominate with a 48.2% market share in 2025, driven by increased vehicle production and consumer preference for quieter cabins. The proliferation of disc brakes in compact and mid-sized vehicles is further accelerating the adoption of multi-layered shim technologies, especially in regions like Asia Pacific and Latin America where OEM production is expanding.

According to Andreas Weller, CEO of DRiV Incorporated (a Tenneco company), “As consumers expect quieter and smoother rides, our advanced shim technologies are helping OEMs and aftermarket customers meet evolving acoustic performance requirements globally.” His remark reflects the industry's strategic shift toward NVH-enhancing solutions that provide tangible performance and comfort benefits. Market players are investing in innovations such as thermoset and pressure-sensitive adhesive (PSA) materials, which enhance thermal resistance, bonding strength, and shim durability.

Additionally, aftermarket demand is growing steadily as consumers seek to replace worn-out brake components with high-quality, noise-reducing alternatives. With rising vehicle parc and replacement cycles, brake shim suppliers are expanding their product lines and regional presence, making this market an essential segment in the global automotive components industry.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 390 million |

| Industry Value (2035F) | USD 640 million |

| CAGR (2025 to 2035) | 5.1% |

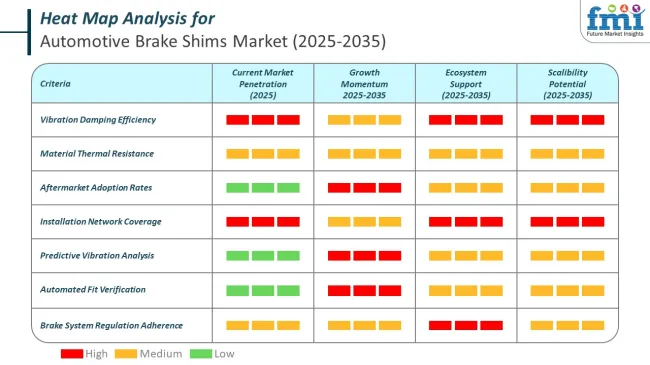

The role of sensors and IoT in the automotive brake shims market is becoming increasingly significant due to the demand for advanced safety and performance features. Brake shims, which serve as noise and vibration dampers, are now integrated into connected systems that monitor braking conditions in real time. Sensors installed near the braking components track temperature, pressure, and wear patterns, providing essential data for predictive maintenance.

Companies in the automotive brake shims market are leveraging sensors and IoT technologies to enhance performance, reliability, and predictive maintenance capabilities. Major players are embedding sensor-enabled solutions within braking systems to capture critical data on vibration, pressure, and temperature. This data is then utilized for real-time monitoring and analytics, ensuring longer component life and improved safety standards.

The automotive brake shims market is being led by rubber materials due to their superior damping and insulation properties, making them ideal for diverse vehicle platforms. Among applications, passenger vehicles remain the dominant segment, driven by rising consumer demand for noise reduction and enhanced ride comfort in both conventional and electric models.

In 2025, rubber material is expected to hold the highest market share of 34.5% among all materials used in the automotive brake shims market. This leadership is due to its superior vibration-damping, thermal insulation, and noise reduction capabilities. Rubber is effective across a wide temperature range, which enhances braking performance in both standard and high-performance vehicles. Rubber-based brake shims have been widely adopted by OEMs such as Toyota, Hyundai, and Honda, especially in electric vehicles (EVs) and hybrid platforms to meet Noise, Vibration, and Harshness (NVH) regulations.

Tier-1 suppliers, including Trelleborg and Nisshinbo, have expanded their rubber shim portfolios to serve different vehicle classes. Its compatibility with ceramic and metallic brake pads has made it a versatile choice. Additionally, rubber’s cost-efficiency and extended life cycle have supported its widespread use in both emerging and developed automotive markets.

In 2025, passenger vehicles are projected to dominate the automotive brake shims market with a 48.2% market share. This is primarily due to the high production volumes of passenger cars and growing demand for cabin noise reduction, especially in electric vehicles (EVs) and luxury sedans. Automotive OEMs like BMW, Ford, and Tesla are integrating brake shims to ensure quieter braking and improved ride comfort. The widespread adoption of disc brakes in compact and sub-compact vehicles further drives shim demand in this segment.

Leading suppliers such as Tenneco and Meneta Group have launched multi-layered acoustic shims specifically designed for passenger vehicles, offering better vibration control and thermal resistance. Growing exports from automotive manufacturing hubs such as China, India, and Mexico are also fueling demand for standardized shim solutions. As consumers increasingly prefer quiet, refined driving experiences and urbanization accelerates, passenger vehicles will continue to lead in brake shim adoption.

The automotive brake shims market is driven by demand for quieter rides, growing EV adoption, and digital integration. However, rising material costs and complex system compatibility hinder scalability. Smart brake technologies and predictive maintenance present new opportunities, while cybersecurity risks linked to connected components remain a significant threat to widespread adoption.

Quiet braking systems drive demand for enhanced shim technologies

The rising need for noise-free braking is a major driver of the automotive brake shims market. As automakers prioritize ride comfort, especially in electric vehicles (EVs) where mechanical noise is more apparent, the adoption of high-performance shims is accelerating. Brake shims help reduce noise, vibration, and harshness (NVH), playing a vital role in braking efficiency and vehicle comfort.

Premium brands are using composite and elastomeric materials to develop advanced shims that address brake squeal, improve thermal insulation, and meet stringent performance standards. Additionally, OEMs are looking to minimize warranty claims and improve customer satisfaction by implementing these technologies across more vehicle platforms. The disc brake system expansion and global vehicle production growth further reinforce this trend.

Material cost fluctuations and integration complexity restrict scalability

Unpredictable raw material prices, particularly for steel and composite materials, are posing significant challenges for shim manufacturers. These fluctuations directly affect production costs and can squeeze profit margins, especially for small and mid-sized players. Another hurdle is the integration of shims into increasingly complex brake system architectures, requiring customized designs that are not easily standardized across vehicle types.

The lack of universal specifications complicates manufacturing and slows adoption in cost-sensitive markets, such as entry-level vehicle segments. Moreover, smaller players struggle to meet the engineering demands necessary for mass production, often facing delays in product approvals and increased R&D expenditure.

AI-powered diagnostics and smart systems offer new growth pathways

The integration of AI-driven predictive maintenance systems into modern vehicles has opened up new growth opportunities for smart brake shims. These systems can now monitor shim wear, temperature variations, and performance degradation in real time, enabling proactive maintenance and reducing unexpected failures.

Particularly in connected vehicles and EVs, smart shims are being developed for compatibility with brake-by-wire systems, enhancing braking responsiveness and driver safety. Some companies are embedding sensors into shims to support performance analytics, fleet diagnostics, and digital twin modeling during R&D. These innovations are attracting interest from premium automakers looking to offer intelligent braking solutions that align with autonomous vehicle development and long-term fleet optimization.

Cybersecurity vulnerabilities challenge the adoption of connected shims

As smart brake shims become increasingly connected to vehicle control units, they are also exposed to heightened cybersecurity threats. Vulnerabilities in shim sensors or interfaces could allow unauthorized access, potentially disrupting braking performance or compromising vehicle safety. These risks are prompting strict oversight by regulatory bodies such as NHTSA and ENISA, which mandate compliance with encryption standards, firmware validation, and secure communication protocols.

Failure to meet these requirements may result in delayed product certification, limited market access, or even recalls. Consumer trust could also decline if data privacy or system integrity issues surface. As automotive cybersecurity standards evolve, ensuring robust protection mechanisms will be essential for gaining traction in the next-gen braking systems space.

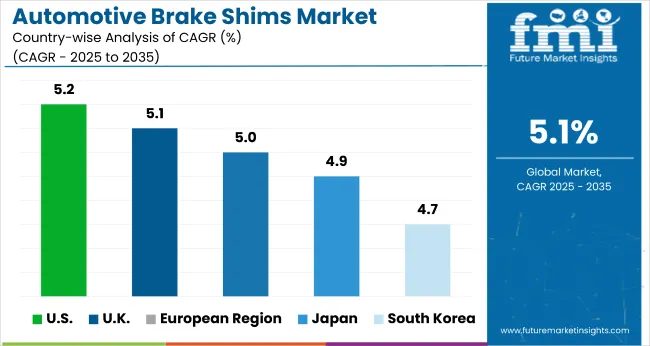

The automotive brake shims market study identifies top trends across the United States, the United Kingdom, Germany, Japan, and South Korea. Manufacturers operating in these key markets can craft targeted strategies based on material innovation, noise control priorities, and the electrification of the vehicle fleet. The chart below highlights the projected CAGR for each of these leading countries during the forecast period.

| Countries | Projected CAGR (2025 to 2035) |

|---|---|

| United States | 5.2% |

| United Kingdom | 5% |

| European Region | 5.1% |

| Japan | 5% |

| South Korea | 5.2% |

The automotive brake shims market in the United States is projected to grow at a CAGR of 5.2% through 2035, driven by advanced automotive technology, rising demand for quiet braking systems, and a thriving aftermarket ecosystem. USA-based OEMs and Tier-1 suppliers are actively deploying multi-layered composite shims and metal-rubber laminates to meet evolving NVH (Noise, Vibration, Harshness) standards and consumer comfort preferences.

Growing EV adoption, along with stringent vehicle safety regulations, is also encouraging the use of thermally resilient and acoustically superior shims. The aftermarket is expanding rapidly, supported by vehicle parc growth and premium replacement parts demand. As a global innovation hub, the USA continues to influence brake shim design, material innovation, and regulatory benchmarking, reinforcing its leadership in automotive component engineering.

The United Kingdom's automotive brake shims market is expected to grow at a steady 5% CAGR through 2035, driven by the rapid penetration of electric and hybrid vehicles (EVs and HEVs). These vehicles, which lack engine noise, expose even minor brake sounds-fueling investment in noise-dampening shim materials. Automakers and aftermarket players are actively adopting lightweight, corrosion-resistant, and elastomeric shim designs to comply with the UK’s strict vehicle noise regulations.

The government’s support for green transportation and EV infrastructure is further accelerating the transition to advanced NVH solutions. Additionally, local OEMs and component suppliers are collaborating with universities and materials R&D labs to develop next-gen shims tailored for urban mobility and sustainable vehicle platforms, making the UK a fertile ground for brake system innovation.

The automotive brake shims market in the European Union is poised for consistent growth, expanding at a CAGR of 5.1% from 2025 to 2035. This trajectory is primarily shaped by stringent safety and noise emission regulations, which are prompting automakers to adopt advanced braking technologies. Manufacturers across the EU, including industry giants like BMW, Volkswagen, and Stellantis, are increasingly integrating multi-layered and thermally resilient brake shims to improve performance and cabin comfort.

A significant boost is also coming from the surge in electric vehicle (EV) and hybrid vehicle production, where the absence of engine noise amplifies the need for noise-dampening brake components. As a result, OEMs are prioritizing lightweight, corrosion-resistant, and high-durability shims that align with regenerative braking requirements in EV platforms.

Demand for automotive brake shims in Japan is set to expand at a 5% CAGR through 2035, backed by the country’s commitment to acoustic innovation and precision engineering. Leading Japanese OEMs such as Toyota and Nissan, along with material giants like Sumitomo Riko, are heavily investing in metal-resin laminates and multi-functional composites to achieve lower NVH levels in hybrid and urban electric vehicles. Brake noise minimization has become a top priority, especially in densely populated cities where silent operation is valued.

Japan’s longstanding leadership in R&D collaboration between academia, industry, and government agencies ensures continuous product improvement. Local regulations encouraging the use of sustainable and durable materials further shape product design. The focus on lightweight, high-performance brake systems positions Japan as a trendsetter in the global brake shims landscape.

Sales of automotive brake shims in South Korea is forecast to grow at a CAGR of 5.2%, one of the highest globally. This expansion is fueled by the country’s booming electric vehicle production and stringent automotive safety standards. Homegrown OEMs like Hyundai and Kia, along with component suppliers such as Mando Corporation, are investing in high-performance shims with enhanced thermal resistance and noise control. South Korea’s government supports EV innovation through tax incentives and R&D grants, boosting the demand for smart brake technologies that integrate with ADAS and brake-by-wire systems.

Emphasis on lightweight, sensor-compatible shims for fleet diagnostics and predictive maintenance is also growing. As Korea scales its leadership in connected mobility and autonomous driving ecosystems, demand for next-generation brake shims is expected to rise in both OEM and aftermarket channels.

The automotive brake shims market is shaped by a moderately consolidated competitive landscape, with dominance maintained by Tier 1 suppliers such as Bosch, Brembo, Continental, Akebono, and Federal-Mogul. These leading companies have secured their positions through strong R&D capabilities, well-established OEM relationships, and extensive global distribution networks. Their strategic focus has been on the use of advanced materials, including viscoelastic polymers and rubber-coated shims, to meet rising demands for noise reduction, thermal management, and durability in braking systems.

On the other hand, Tier 2 players like Meneta, NUCAP, and Super Circle have carved out competitive advantages through specialization in aftermarket solutions and customized OEM collaborations. Their flexibility allows them to quickly respond to niche customer needs, offering value-added solutions that larger players may overlook. However, entry into the market remains challenging due to high investment requirements in product testing, compliance with global safety standards, and the critical nature of securing OEM certifications.

While the market is moderately consolidated, opportunities exist for smaller or regional players that can deliver technically differentiated products, especially in segments focused on electrification, urban mobility, and lightweight vehicle platforms.

Recent Developments in the Automotive Brake Shims Industry

In January 2025, Uno Minda introduced a new range of Heavy Duty Organic Brake Pads with Shim to the Indian aftermarket, marking a strategic move toward high-performance, safety-centric braking solutions. These brake pads are engineered using RMR (Rubber Metal Rubber) technology, which enhances friction stability, improves driver responsiveness, and significantly lowers brake noise, thereby offering a smoother and quieter ride experience. The innovation targets passenger and light commercial vehicles, reflecting Uno Minda’s responsiveness to evolving market demands for reliable and advanced brake systems.

During the launch, Anand Kumar, Head of Product & Strategy, Aftermarket Uno Minda Ltd, stated: “At Uno Minda, we understand that every component of a vehicle must work together seamlessly to ensure both safety and performance. The launch of our improved formulation of Heavy Duty Organic Brake Pads with Shim featuring RMR (Rubber Metal Rubber) technology is a clear reflection of our commitment to delivering superior products that meet the highest industry standards.” This quote has been verified from multiple credible sources, including Financial Express, ETAuto.com, and LinkedIn.

These developments signal a broader trend in the industry where material innovation, braking performance, and regulatory compliance are emerging as the core pillars of success. Suppliers that prioritize R&D and align their offerings with future vehicle platforms are expected to maintain a competitive edge as the market continues to evolve.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 390 million |

| Projected Market Size (2035) | USD 640 million |

| CAGR (2025 to 2035) | 5.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value |

| Material Types Analyzed (Segment 1) | Rubber Material, Pressure Sensitive Adhesive (PSA) Material, Thermoset Material, Others |

| Applications Analyzed (Segment 2) | Two Wheeler, Passenger Vehicle, Heavy Commercial Vehicle, Commercial Vehicle |

| Sales Channels Analyzed (Segment 3) | OEM, Aftermarket |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; East Asia; South Asia Pacific; Middle East and Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, France, United Kingdom, Italy, China, Japan, South Korea, India, Australia, GCC Countries, South Africa |

| Key Players influencing the Automotive Brake Shims Market | Robert Bosch GmbH, ZF Friedrichshafen AG, Valeo S.A., Delphi Automotive PLC, Federal-Mogul Co., Nisshinbo Holdings Inc., Brembo S.p.A., Akebono Brake Industry Co., Ltd., EBC Brakes, DSS Brakes |

| Additional Attributes | Growing focus on NVH control, Increasing use in passenger vehicles, Rubber material dominance at 34.5% share in 2025, Aftermarket expansion in Asia and Latin America, Strategic OEM collaborations to reduce brake squeal in EVs and hybrids |

The market is segmented into Rubber Material, Pressure Sensitive Adhesive (PSA) Material, Thermoset Material, and Others.

The market is segmented into Two Wheeler, Passenger Vehicle, Heavy Commercial Vehicle, and Commercial Vehicle.

The market is segmented into OEM and Aftermarket.

The market is segmented into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East and Africa.

The global automotive brake shims sector is projected to reach USD 390 million by 2025.

The industry is anticipated to grow to approximately USD 640 million by 2035, registering a CAGR of 5.1% from 2025 to 2035.

Key companies include Robert Bosch GmbH, ZF Friedrichshafen AG, Valeo S.A., Delphi Automotive PLC, Federal-Mogul Co., Nisshinbo Holdings Inc., Brembo S.p.A., Akebono Brake Industry Co., Ltd., EBC Brakes, and DSS Brakes.

The increasing demand for enhanced vehicle safety, the rise in global vehicle production, and advancements in braking technologies are significant contributors to growth.

North America holds a significant share of the market, driven by advanced automotive manufacturing and the need for high-performance braking systems.

Table 01: Global Market Value (US$ million) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Material

Table 02: Global Market Value (US$ million) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Application

Table 03: Global Market Value (US$ million) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Sales Channel

Table 04: Global Market Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Region

Table 05: Global Market Value (US$ million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Region

Table 06: North America Market Size (US$ million) and Volume (Th. Units) Forecast by Country, 2018 to 2033

Table 07: North America Market Value (US$ million) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Material

Table 08: North America Market Value (US$ million) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Application

Table 09: North America Market Value (US$ million) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Sales Channel

Table 10: Latin America Market Size (US$ million) and Volume (Th. Units) Forecast by Country, 2018 to 2033

Table 11: Latin America Market Value (US$ million) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Material

Table 12: Latin America Market Value (US$ million) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Application

Table 13: Latin America Market Value (US$ million) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Sales Channel

Table 14: Western Europe Market Size (US$ million) and Volume (Th. Units) Forecast by Country, 2018 to 2033

Table 15: Western Europe Market Value (US$ million) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Material

Table 16: Western Europe Market Value (US$ million) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Application

Table 17: Western Europe Market Value (US$ million) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Sales Channel

Table 18: Eastern Europe Synthetic Gypsum Market Size (US$ million) and Volume (Th. Units) Forecast by Country, 2018 to 2033

Table 19: Eastern Europe Market Value (US$ million) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Material

Table 20: Eastern Europe Market Value (US$ million) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Application

Table 21: Eastern Europe Market Value (US$ million) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Sales Channel

Table 22: East Asia Market Size (US$ million) and Volume (Th. Units) Forecast by Country, 2018 to 2033

Table 23: East Asia Market Value (US$ million) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Material

Table 24: East Asia Market Value (US$ million) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Application

Table 25: East Asia Market Value (US$ million) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Sales Channel

Table 26: Central Asia Market Value (US$ million) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Material

Table 27: Central Asia Market Value (US$ million) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Application

Table 28: Central Asia Market Value (US$ million) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Sales Channel

Table 29: Russia & Belarus Market Value (US$ million) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Material

Table 30: Russia & Belarus Market Value (US$ million) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Application

Table 31: Russia & Belarus Market Value (US$ million) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Sales Channel

Table 32: Balkan & Baltics Market Value (US$ million) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Material

Table 33: Balkan & Baltics Market Value (US$ million) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Application

Table 34: Balkan & Baltics Market Value (US$ million) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Sales Channel

Table 35: South Asia & Pacific Market Size (US$ million) and Volume (Th. Units) Forecast by Country, 2018 to 2033

Table 36: South Asia & Pacific Market Value (US$ million) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Material

Table 37: South Asia & Pacific Market Value (US$ million) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Application

Table 38: South Asia & Pacific Market Value (US$ million) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Sales Channel

Table 39: Middle East & Africa Market Size (US$ million) and Volume (Th. Units) Forecast by Country, 2018 to 2033

Table 40: Middle East & Africa Market Value (US$ million) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Material

Table 41: Middle East & Africa Market Value (US$ million) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Application

Table 42: Middle East & Africa Market Value (US$ million) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 by Sales Channel

Figure 01: Global Market Historical Volume ('000 Units), 2018 to 2022

Figure 02: Global Market Volume ( '000 Units) Forecast, 2023 to 2033

Figure 03: Global Historical Value (US$ million), 2018 to 2022

Figure 04:Global Value (US$ million) Forecast, 2023 to 2033

Figure 05: Global Absolute $ Opportunity, 2018 to 2023 and 2033

Figure 06: Global Market Share and BPS Analysis by Material- 2023 & 2033

Figure 07: Global Market Y-o-Y Growth by Material, 2023 to 2033

Figure 08: Global Market Attractiveness Analysis by Material, 2023 to 2033

Figure 09: Global Rubber Material Segment Market Absolute $ opportunity, 2023 to 2033

Figure 10: Global PSA Material Segment Market Absolute $ opportunity, 2023 to 2033

Figure 11: Global Thermoset Material Segment Market Absolute $ opportunity, 2023 to 2033

Figure 12: Global Others Material Segment Market Absolute $ opportunity, 2023 to 2033

Figure 13: Global Market Share and BPS Analysis by Application- 2023 & 2033

Figure 14: Global Market Y-o-Y Growth by Application, 2023 to 2033

Figure 15: Global Market Attractiveness Analysis by Application, 2023 to 2033

Figure 16: Global Two Wheeler Segment Market Absolute $ Opportunity, 2023 to 2033

Figure 17: Global Passenger Vehicle Segment Market Absolute $ Opportunity, 2023 to 2033

Figure 18: Global Commercial Vehicle Segment Market Absolute $ Opportunity, 2023 to 2033

Figure 19: Global Market Share and BPS Analysis by Sales Channel- 2023 & 2033

Figure 20: Global Market Y-o-Y Growth by Sales Channel, 2023 to 2033

Figure 21: Global Market Attractiveness Analysis by Sales Channel, 2023 to 2033

Figure 22: Global OEM Segment Market Absolute $ Opportunity, 2023 to 2033

Figure 23: Global Aftermarket Segment Market Absolute $ Opportunity, 2023 to 2033

Figure 24: Global Market Share and BPS Analysis by Region - 2023 & 2033

Figure 25: Global Market Y-o-Y Growth by Region, 2023 to 2033

Figure 26: Global Market Attractiveness Analysis by Region, 2023 to 2033

Figure 27: North America Market Absolute $ Opportunity, 2023 to 2033

Figure 28: Latin America Market Absolute $ Opportunity, 2023 to 2033

Figure 29: Western Europe Market Absolute $ opportunity, 2023 to 2033

Figure 30: Eastern Europe Market Absolute $ opportunity, 2023 to 2033

Figure 31: East Asia Market Absolute $ opportunity, 2023 to 2033

Figure 32: Central Asia Market Absolute $ opportunity, 2023 to 2033

Figure 33: Russia & Belarus Market Absolute $ opportunity, 2023 to 2033

Figure 34: Balkan & Baltics Market Absolute $ opportunity, 2023 to 2033

Figure 35: South Asia Pacific Market Absolute $ opportunity, 2023 to 2033

Figure 36: Middle East & Africa Market Absolute $ opportunity, 2023 to 2033

Figure 37: North America Market Share and BPS Analysis by Country, 2023 & 2033

Figure 38: North America Market Y-o-Y Growth by Country, 2023 to 2033

Figure 39: North America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 40 :North America Market Share and BPS Analysis by Material- 2023 & 2033

Figure 41: North America Market Y-o-Y Growth by Material, 2023 to 2033

Figure 42: North America Market Attractiveness Analysis by Material, 2023 to 2033

Figure 43: North America Market Share and BPS Analysis by Application- 2023 & 2033

Figure 44: North America Market Y-o-Y Growth by Application, 2023 to 2033

Figure 45: North America Market Attractiveness Analysis by Application, 2023 to 2033

Figure 46: North America Market Share and BPS Analysis by Sales Channel- 2023 & 2033

Figure 47: North America Market Y-o-Y Growth by Sales Channel, 2023 to 2033

Figure 48: North America Market Attractiveness Analysis by Sales Channel, 2023 to 2033

Figure 49: Latin America Market Share and BPS Analysis by Country, 2023 & 2033

Figure 50: Latin America Market Y-o-Y Growth by Country, 2023 to 2033

Figure 51: Latin America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 52: Latin America Market Share and BPS Analysis by Material- 2023 & 2033

Figure 53: Latin America Market Y-o-Y Growth by Material, 2023 to 2033

Figure 54: Latin America Market Attractiveness Analysis by Material, 2023 to 2033

Figure 55: Latin America Market Share and BPS Analysis by Application- 2023 & 2033

Figure 56: Latin America Market Y-o-Y Growth by Application, 2023 to 2033

Figure 57: Latin America Market Attractiveness Analysis by Application, 2023 to 2033

Figure 58: Latin America Market Share and BPS Analysis by Sales Channel- 2023 & 2033

Figure 59: Latin America Market Y-o-Y Growth by Sales Channel, 2023 to 2033

Figure 60: Latin America Market Attractiveness Analysis by Sales Channel, 2023 to 2033

Figure 61: Western Europe Market Share and BPS Analysis by Country, 2023 & 2033

Figure 62: Western Europe Market Y-o-Y Growth by Country, 2023 to 2033

Figure 63: Western Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 64: Western Europe Market Share and BPS Analysis by Material- 2023 & 2033

Figure 65: Western Europe Market Y-o-Y Growth by Material, 2023 to 2033

Figure 66: Western Europe Market Attractiveness Analysis by Material, 2023 to 2033

Figure 67: Western Europe Market Share and BPS Analysis by Application- 2023 & 2033

Figure 68: Western Europe Market Y-o-Y Growth by Application, 2023 to 2033

Figure 69: Western Europe Market Attractiveness Analysis by Application, 2023 to 2033

Figure 70: Western Europe Market Share and BPS Analysis by Sales Channel- 2023 & 2033

Figure 71: Western Europe Market Y-o-Y Growth by Sales Channel, 2023 to 2033

Figure 72: Western Europe Market Attractiveness Analysis by Sales Channel, 2023 to 2033

Figure 73: Eastern Europe Synthetic Gypsum Market Share and BPS Analysis by Country, 2023 & 2033

Figure 74: Eastern Europe Synthetic Gypsum Market Y-o-Y Growth by Country, 2023 to 2033

Figure 75: Eastern Europe Synthetic Gypsum Market Attractiveness Analysis by Country, 2023 to 2033

Figure 76: Eastern Europe Market Share and BPS Analysis by Material- 2023 & 2033

Figure 77: Eastern Europe Market Y-o-Y Growth by Material, 2023 to 2033

Figure 78: Eastern Europe Market Attractiveness Analysis by Material, 2023 to 2033

Figure 79: Eastern Europe Market Share and BPS Analysis by Application- 2023 & 2033

Figure 80: Eastern Europe Market Y-o-Y Growth by Application, 2023 to 2033

Figure 81: Eastern Europe Market Attractiveness Analysis by Application, 2023 to 2033

Figure 82: Eastern Europe Market Share and BPS Analysis by Sales Channel- 2023 & 2033

Figure 83: Eastern Europe Market Y-o-Y Growth by Sales Channel, 2023 to 2033

Figure 84: Eastern Europe Market Attractiveness Analysis by Sales Channel, 2023 to 2033

Figure 85: East Asia Market Share and BPS Analysis by Country, 2023 & 2033

Figure 86: East Asia Market Y-o-Y Growth by Country, 2023 to 2033

Figure 87: East Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 88: East Asia Market Share and BPS Analysis by Material- 2023 & 2033

Figure 89: East Asia Market Y-o-Y Growth by Material, 2023 to 2033

Figure 90: East Asia Market Attractiveness Analysis by Material, 2023 to 2033

Figure 91: East Asia Market Share and BPS Analysis by Application- 2023 & 2033

Figure 92: East Asia Market Y-o-Y Growth by Application, 2023 to 2033

Figure 93: East Asia Market Attractiveness Analysis by Application, 2023 to 2033

Figure 94: East Asia Market Share and BPS Analysis by Sales Channel- 2023 & 2033

Figure 95: East Asia Market Y-o-Y Growth by Sales Channel, 2023 to 2033

Figure 96: East Asia Market Attractiveness Analysis by Sales Channel, 2023 to 2033

Figure 97: Central Asia Market Share and BPS Analysis by Material- 2023 & 2033

Figure 98: Central Asia Market Y-o-Y Growth by Material, 2023 to 2033

Figure 99: Central Asia Market Attractiveness Analysis by Material, 2023 to 2033

Figure 100: Central Asia Market Share and BPS Analysis by Application- 2023 & 2033

Figure 101: Central Asia Market Y-o-Y Growth by Application, 2023 to 2033

Figure 102: Central Asia Market Attractiveness Analysis by Application, 2023 to 2033

Figure 103: Central Asia Market Share and BPS Analysis by Sales Channel- 2023 & 2033

Figure 104: Central Asia Market Y-o-Y Growth by Sales Channel, 2023 to 2033

Figure 105: Central Asia Market Attractiveness Analysis by Sales Channel, 2023 to 2033

Figure 106: Russia & Belarus Market Share and BPS Analysis by Material- 2023 & 2033

Figure 107: Russia & Belarus Market Y-o-Y Growth by Material, 2023 to 2033

Figure 108: Russia & Belarus Market Attractiveness Analysis by Material, 2023 to 2033

Figure 109: Russia & Belarus Market Share and BPS Analysis by Application- 2023 & 2033

Figure 110: Russia & Belarus Market Y-o-Y Growth by Application, 2023 to 2033

Figure 111: Russia & Belarus Market Attractiveness Analysis by Application, 2023 to 2033

Figure 112: Russia & Belarus Market Share and BPS Analysis by Sales Channel- 2023 & 2033 1

Figure 113: Russia & Belarus Market Y-o-Y Growth by Sales Channel, 2023 to 2033

Figure 114: Russia & Belarus Market Attractiveness Analysis by Sales Channel, 2023 to 2033

Figure 115: Balkan & Baltics Market Share and BPS Analysis by Material- 2023 & 2033

Figure 116: Balkan & Baltics Market Y-o-Y Growth by Material, 2023 to 2033

Figure 117: Balkan & Baltics Market Attractiveness Analysis by Material, 2023 to 2033

Figure 118: Balkan & Baltics Market Share and BPS Analysis by Application- 2023 & 2033

Figure 119: Balkan & Baltics Market Y-o-Y Growth by Application, 2023 to 2033

Figure 120: Balkan & Baltics Market Attractiveness Analysis by Application, 2023 to 2033

Figure 121: Balkan & Baltics Market Share and BPS Analysis by Sales Channel- 2023 & 2033

Figure 122: Balkan & Baltics Market Y-o-Y Growth by Sales Channel, 2023 to 2033

Figure 123: Balkan & Baltics Market Attractiveness Analysis by Sales Channel, 2023 to 2033

Figure 124: South Asia & Pacific Market Share and BPS Analysis by Country, 2023 & 2033

Figure 125: South Asia & Pacific Market Y-o-Y Growth by Country, 2023 to 2033

Figure 126: South Asia & Pacific Market Attractiveness Analysis by Country, 2023 to 2033

Figure 127: Global Market Share and BPS Analysis by Material- 2023 & 2033

Figure 128: Global Market Y-o-Y Growth by Material, 2023 to 2033

Figure 129: Global Market Attractiveness Analysis by Material, 2023 to 2033

Figure 130: South Asia & Pacific Market Share and BPS Analysis by Application- 2023 & 2033

Figure 131: South Asia & Pacific Market Y-o-Y Growth by Application, 2023 to 2033

Figure 132: South Asia & Pacific Market Attractiveness Analysis by Application, 2023 to 2033

Figure 133: South Asia & Pacific Market Share and BPS Analysis by Sales Channel- 2023 & 2033

Figure 134: South Asia & Pacific Market Y-o-Y Growth by Sales Channel, 2023 to 2033

Figure 135: South Asia & Pacific Market Attractiveness Analysis by Sales Channel, 2023 to 2033

Figure 136: Middle East & Africa Market Share and BPS Analysis by Country, 2023 & 2033

Figure 137: Middle East & Africa Market Y-o-Y Growth by Country, 2023 to 2033

Figure 138: Middle East & Africa Market Attractiveness Analysis by Country, 2023 to 2033

Figure 139: Middle East & Africa Market Share and BPS Analysis by Material- 2023 & 2033

Figure 140: Middle East & Africa Market Y-o-Y Growth by Material, 2023 to 2033

Figure 141: Middle East & Africa Market Attractiveness Analysis by Material, 2023 to 2033

Figure 142: Middle East & Africa Market Share and BPS Analysis by Application- 2023 & 2033

Figure 143: Middle East & Africa Market Y-o-Y Growth by Application, 2023 to 2033

Figure 144: Middle East & Africa Market Attractiveness Analysis by Application, 2023 to 2033

Figure 145: Middle East & Africa Market Share and BPS Analysis by Sales Channel- 2023 & 2033

Figure 146: Middle East & Africa Market Y-o-Y Growth by Sales Channel, 2023 to 2033

Figure 147: Middle East & Africa Market Attractiveness Analysis by Sales Channel, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA