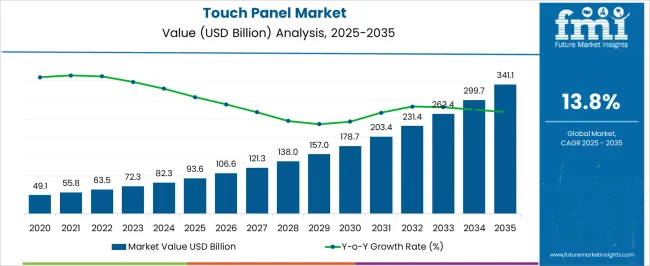

The Touch Panel Market is estimated to be valued at USD 93.6 billion in 2025 and is projected to reach USD 341.1 billion by 2035, registering a compound annual growth rate (CAGR) of 13.8% over the forecast period. Between 2025 and 2030, the market is expected to rise from USD 93.6 billion to USD 178.7 billion, driven by increasing demand for touch-enabled devices across smartphones, tablets, automotive, and industrial applications. Year-on-year analysis shows robust growth, with values reaching USD 106.6 billion in 2026 and USD 121.3 billion in 2027, supported by advancements in touch technologies like in-cell and on-cell displays, as well as growing adoption in consumer electronics.

By 2028, the market is forecasted to hit USD 138.0 billion, advancing to USD 157.0 billion in 2029 and USD 178.7 billion by 2030. Growth is expected to be further reinforced by the rising trend of interactive displays in retail, education, and healthcare sectors, as well as innovations in flexible and transparent touch panels. These dynamics position the touch panel market as a key segment within the consumer electronics and smart device industries, with significant opportunities for product development and market expansion in the coming decade.

| Metric | Value |

|---|---|

| Touch Panel Market Estimated Value in (2025 E) | USD 93.6 billion |

| Touch Panel Market Forecast Value in (2035 F) | USD 341.1 billion |

| Forecast CAGR (2025 to 2035) | 13.8% |

The touch panel market is advancing steadily, driven by increasing demand for interactive displays in consumer electronics, industrial controls, automotive infotainment, and healthcare devices. Continuous innovations in multi-touch functionality, haptic feedback, and display durability are expanding application scope, especially in environments requiring precision and responsiveness.

Manufacturers are responding to demand for thinner, lightweight, and high-resolution panels by investing in advanced sensor technologies and streamlined integration techniques. Supply chain improvements and scaling of fabrication facilities have enhanced availability and cost competitiveness, particularly in mid-range device segments.

The market is further bolstered by increased deployment of smart devices and the rise in human-machine interface technologies across public and private sectors. Regulatory trends emphasizing touchless controls and surface sanitization in public environments have also contributed to the shift toward durable and high-performance panel materials.

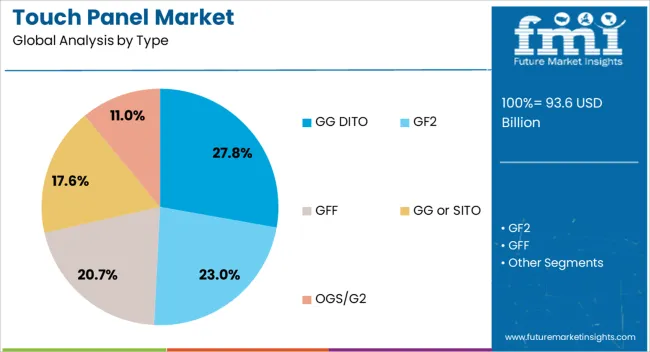

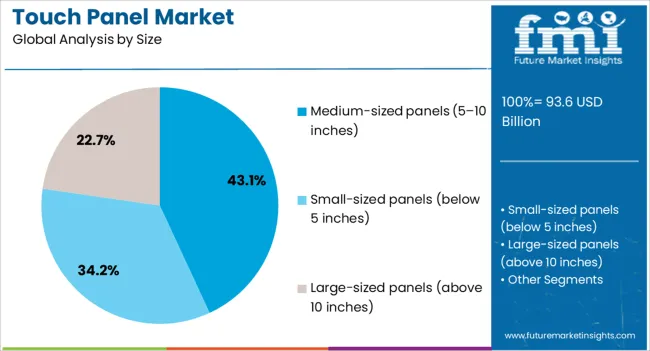

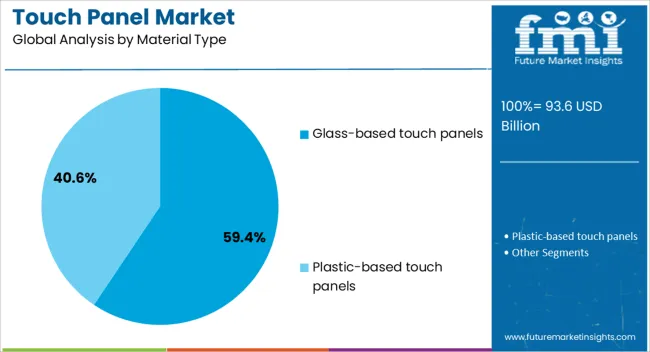

The touch panel market is segmented by type, size, material type, application, end-use industry, and geographic regions. By type, the touch panel market is divided into GG DITO, GF2, GFF, GG or SITO, and OGS/G2. The touch panel market is classified into Medium-sized panels (5–10 inches), Small-sized panels (below 5 inches), and Large-sized panels (above 10 inches). Based on the material type, the touch panel market is segmented into Glass-based touch panels and Plastic-based touch panels. By application, the touch panel market is segmented into mobile phones, Laptops, iPads, touchscreen devices, and Other Devices.

The touch panel market is segmented by end-use industry into Consumer electronics, Automotive, Industrial automation, Healthcare, Retail and hospitality, and Others. Regionally, the touch panel industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The GG DITO (Double-sided Indium Tin Oxide) segment is expected to account for 27.8% of total revenue in the touch panel market by 2025, establishing it as the leading panel type. Its rise is being driven by the increasing demand for durability, optical clarity, and responsiveness in portable electronics and embedded display systems.

The glass-on-glass configuration enhances structural rigidity and offers superior conductivity, allowing for faster and more accurate multi-touch sensing. GG DITO panels are particularly suited for mid to high-end devices where longevity and optical performance are critical.

Moreover, their strong resistance to flexing and warping under high-temperature or high-usage environments has led to broader adoption in commercial tablets and professional touchscreen monitors.

Medium-sized touch panels ranging between 5 and 10 inches are projected to hold 43.1% of the market share in 2025, making them the leading size category. This segment’s growth is linked to the widespread use of mid-size screens in smartphones, tablets, automotive dashboards, and industrial equipment.

The balance between portability and screen real estate has made this size segment attractive across a broad spectrum of use cases, especially in consumer electronics and infotainment systems. With increased demand for enhanced visual clarity and responsive touch controls in portable formats, manufacturers have optimized sensor accuracy and reduced bezel dimensions to meet both aesthetic and functional expectations.

Rapid turnover cycles in mid-sized devices have further sustained volume growth, ensuring continued investment in this segment.

Glass-based touch panels are anticipated to dominate the material type category with a 59.4% market share in 2025. This leadership stems from the material’s exceptional durability, scratch resistance, and superior optical transmission.

Glass substrates support higher precision and transparency, making them ideal for devices requiring consistent touch sensitivity and premium visual output. Additionally, glass-based panels enable integration of advanced coatings for anti-glare, anti-fingerprint, and antimicrobial properties features increasingly valued in both consumer and commercial applications.

Their compatibility with high-temperature processing and thin-film deposition also facilitates the inclusion of capacitive sensors and multi-layer functionality. As user expectations rise for clarity and responsiveness, glass remains the preferred material for mid-to-high-end touch interfaces across verticals.

The touch panel market is driven by rising demand in consumer electronics, automotive, and industrial applications. In 2024 and 2025, the major growth drivers include increasing consumer preference for interactive displays and touch-based interfaces. Opportunities are emerging in the automotive sector, where touch panels are used in infotainment systems.

Trends include the integration of touch technology in more compact devices, and the shift toward flexible displays. However, high manufacturing costs and competition from alternative display technologies are restraining market growth.

A significant growth driver for the touch panel market is the increasing demand for interactive displays in consumer electronics. In 2024, the growing popularity of smartphones, tablets, and smart home devices contributed to a surge in touch panel adoption. These devices rely heavily on user-friendly touch interfaces to enhance customer experiences. As more consumer electronics incorporate touch functionality, the touch panel market continues to expand, driven by the need for efficient, intuitive, and versatile display solutions.

Opportunities in the touch panel market are expanding in the automotive sector, particularly in infotainment systems. In 2025, automakers adopted touch-based interfaces for more interactive and user-friendly in-car experiences. The growing trend of connected vehicles and advanced driver-assistance systems (ADAS) fueled the demand for high-quality touch panels in automotive displays. As the automotive industry focuses on enhancing user experience with smart displays, the touch panel market has significant opportunities for growth within this sector.

Emerging trends in the touch panel market include the rise of flexible displays and miniaturization. In 2024, consumer electronics manufacturers began developing thinner, more flexible touch panels to create sleeker, portable devices. Flexible touch panels allow for curved, foldable, and rollable displays, enabling the creation of new device form factors. As the demand for compact and adaptable touch screens grows, these innovative display solutions are expected to drive the market forward, particularly in smartphones, wearables, and next-gen electronics.

The major market restraint is the high manufacturing cost associated with producing advanced touch panels. In 2024 and 2025, the cost of materials and the complexity of producing high-performance touch panels for devices such as smartphones, tablets, and automotive displays remained significant. Additionally, competition from alternative technologies, such as voice recognition and gesture control, could limit the market’s growth. Overcoming these challenges will require cost-reduction strategies and innovative solutions to remain competitive in an evolving market.

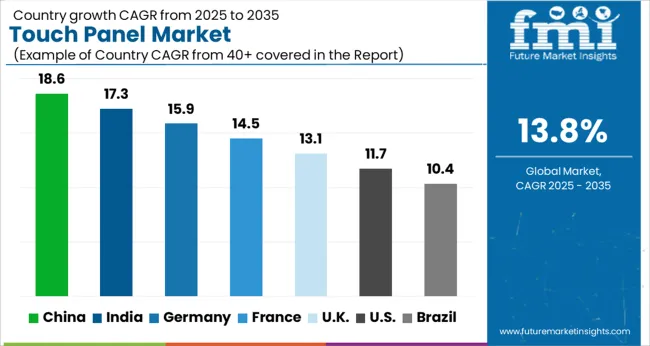

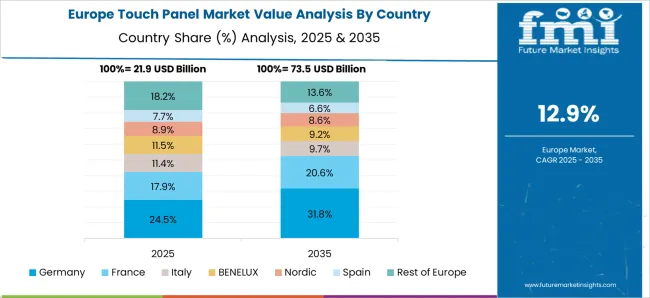

The global touch panel market is projected to grow at 13.8% CAGR from 2025 to 2035. China leads with 18.6% CAGR, driven by rapid advancements in consumer electronics, automotive applications, and industrial automation. India follows at 17.3%, fueled by the growing demand for touch panels in smartphones, tablets, and emerging sectors like automotive and healthcare. Germany records 15.9% CAGR, supported by the increasing adoption of touch panel technology in automotive, industrial, and consumer electronics applications. The United Kingdom grows at 13.1%, while the United States posts 11.7%, reflecting steady demand in mature markets, with a growing focus on innovative touchscreen technology in smart devices, automotive, and retail applications. Asia-Pacific leads the market growth, while Europe and North America emphasize technological innovation and high-performance solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

The touch panel market in China is forecasted to grow at 18.6% CAGR, driven by the country’s dominance in electronics manufacturing, particularly smartphones, tablets, and smart devices. China’s growing focus on industrial automation and advancements in automotive touch panel technology further accelerates market growth. Government investments in smart manufacturing technologies and the expansion of consumer electronics contribute to the rising demand for touch panels across various industries.

The touch panel market in India is projected to grow at 17.3% CAGR, driven by the increasing demand for touch panels in consumer electronics, smartphones, and tablets. India’s expanding IT sector, along with rising disposable incomes and demand for smart devices, fuels the market for touch panels. Additionally, emerging applications in automotive, healthcare, and industrial automation further contribute to the adoption of touch panel technology across the country.

The touch panel market in Germany is expected to grow at 15.9% CAGR, driven by the demand for touch panel technology in automotive, industrial automation, and consumer electronics. Germany’s strong automotive industry, coupled with increasing adoption of touchscreens in smart devices and industrial applications, strengthens the market for touch panels. The country’s focus on innovation and high-performance solutions further accelerates the integration of touch panel technologies across various sectors.

The touch panel market in the United Kingdom is projected to grow at 13.1% CAGR, supported by the rising demand for touch panels in consumer electronics, automotive, and retail applications. The UK’s focus on smart devices, IoT integration, and advanced automotive systems contributes to the increasing adoption of touch panel technology. Additionally, the growth of retail and interactive kiosk systems further boosts the market for touch panels.

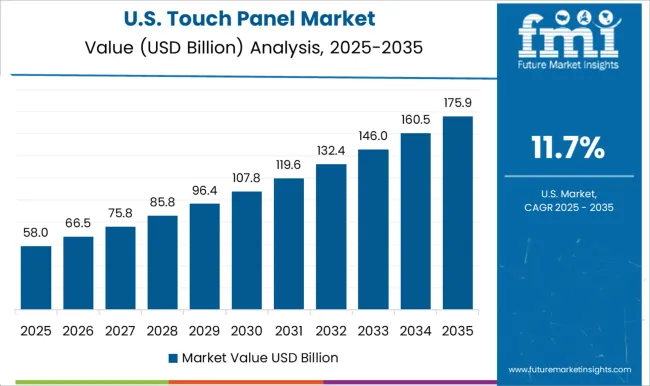

The touch panel market in the United States is projected to grow at 11.7% CAGR, reflecting steady demand driven by the rising adoption of touchscreen technology in smartphones, tablets, automotive, and retail systems. As the USA continues to lead in technological innovation, there is a growing focus on integrating touch panel solutions into smart devices, automotive infotainment systems, and interactive kiosks. Additionally, the growing trend of automation in industries and retail further strengthens market growth.

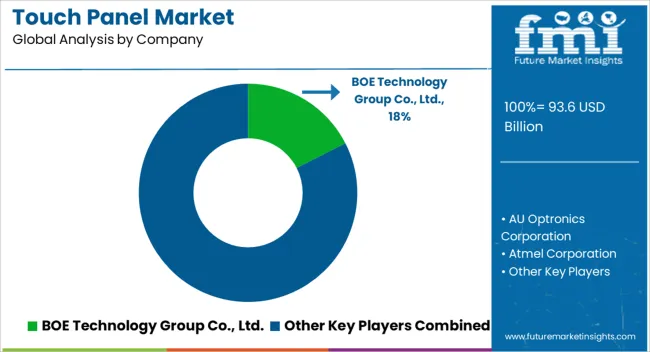

The touch panel market is dominated by BOE Technology Group Co., Ltd., which leads with its extensive portfolio of high-performance touch panel solutions used in smartphones, tablets, automotive displays, and interactive kiosks. BOE’s dominance is supported by its advanced manufacturing capabilities, innovative touchscreen technologies, and strong relationships with leading consumer electronics companies.

Key players such as AU Optronics Corporation, Corning Incorporated, Cypress Semiconductor, and LG Display Co., Ltd. maintain significant market shares by offering cutting-edge capacitive, resistive, and optical touch technologies. These companies focus on providing high-resolution, responsive, and durable touch panels tailored for a wide range of applications, driving market growth in consumer electronics, automotive, and industrial sectors. Emerging players like Atmel Corporation, DISplax Interactive Systems, Elo Touch Solutions, Fujitsu Limited, General Interface Solution Ltd. (GIS), and Innolux Corporation are expanding their presence by delivering cost-effective touch panel solutions with specialized features such as multi-touch capabilities, curved glass panels, and enhanced durability for commercial and industrial uses.

Their strategies include targeting emerging markets, increasing production efficiency, and improving touch sensitivity in various environments. Market growth is driven by the increasing adoption of touch interfaces in smartphones, tablets, and consumer electronics, as well as the growing demand for interactive and intuitive display technologies in education, retail, and automotive sectors. Continuous innovation in touch technology, such as flexible displays and advanced haptic feedback, is expected to shape competitive dynamics in the global touch panel market.

Manufacturers are focusing on creating customized touch panels that cater to specific industries or applications. For example, touch panels for medical devices and industrial applications need to meet stringent durability and reliability standards. Rugged touch panels, designed to withstand harsh environments, are in demand in industries such as aerospace, military, manufacturing, and automotive.

| Item | Value |

|---|---|

| Quantitative Units | USD 93.6 Billion |

| Type | GG DITO, GF2, GFF, GG or SITO, and OGS/G2 |

| Size | Medium-sized panels (5–10 inches), Small-sized panels (below 5 inches), and Large-sized panels (above 10 inches) |

| Material Type | Glass-based touch panels and Plastic-based touch panels |

| Application | Mobile phone, Laptop, iPad, Touch screen device, and Other |

| End-Use Industry | Consumer electronics, Automotive, Industrial automation, Healthcare, Retail and hospitality, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BOE Technology Group Co., Ltd., AU Optronics Corporation, Atmel Corporation, Corning Incorporated, Cypress Semiconductor, DISplax Interactive Systems, Elo Touch Solutions, Fujitsu Limited, General Interface Solution Ltd. (GIS), Innolux Corporation, and LG Display Co., Ltd. |

| Additional Attributes | Dollar sales by panel type and application, demand dynamics across consumer electronics, automotive, and industrial sectors, regional trends in touch panel adoption, innovation in multi-touch and flexible panel technologies, impact of regulatory standards on safety and performance, and emerging use cases in smart appliances and healthcare devices. |

The global touch panel market is estimated to be valued at USD 93.6 billion in 2025.

The market size for the touch panel market is projected to reach USD 341.1 billion by 2035.

The touch panel market is expected to grow at a 13.8% CAGR between 2025 and 2035.

The key product types in touch panel market are gg dito, gf2, gff, gg or sito and ogs/g2.

In terms of size, medium-sized panels (5–10 inches) segment to command 43.1% share in the touch panel market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA