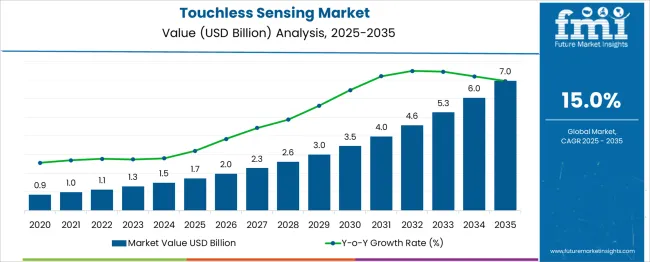

The Touchless Sensing Market is estimated to be valued at USD 1.7 billion in 2025 and is projected to reach USD 7.0 billion by 2035, registering a compound annual growth rate (CAGR) of 15.0% over the forecast period. Analysis of the Growth Rate Volatility Index shows high acceleration in the early adoption phase, followed by steady compounding growth as the technology matures. Between 2025 and 2030, the market grows from USD 1.7 billion to USD 3.5 billion, adding USD 1.8 billion and contributing nearly 34% of total growth, driven by rising demand for gesture-based interfaces, hygiene-sensitive automation in healthcare, and integration of touchless solutions in consumer electronics and automotive systems.

This period reflects a high volatility index as penetration in emerging applications such as public infrastructure and industrial automation intensifies. From 2030 to 2035, growth stabilizes with a rolling CAGR near 14%, adding USD 3.5 billion, as touchless sensing becomes a standard feature across smart devices, retail environments, and connected vehicles. Volatility moderates during this phase as market expansion shifts from innovation-driven to volume-driven adoption. Companies investing in AI-enhanced gesture recognition, multimodal sensor fusion, and low-power designs will maintain a competitive edge in a market where early volatility evolves into predictable, high-scale demand patterns.

| Metric | Value |

|---|---|

| Touchless Sensing Market Estimated Value in (2025 E) | USD 1.7 billion |

| Touchless Sensing Market Forecast Value in (2035 F) | USD 7.0 billion |

| Forecast CAGR (2025 to 2035) | 15.0% |

The touchless sensing market is positioned as a high-growth segment across multiple technology ecosystems. In the consumer electronics and smart devices market, it accounts for 25-30%, driven by integration into smartphones, smart TVs, and wearables to enhance user convenience through gesture and proximity-based interactions. Within the automotive HMI and infotainment systems sector, touchless technology contributes 15-18%, supported by demand for gesture-based controls, driver fatigue detection, and seamless in-cabin experiences. In healthcare and sanitary technologies, its share stands at 10–12%, where hospitals and hygiene-sensitive environments adopt touch-free faucets and operating panels for safety and infection control.

Across the retail and smart infrastructure market, touchless interfaces and payment systems hold 12–14%, aligning with the shift toward contact-free customer engagement. In security and access control systems, its contribution is 20–22%, reflecting increased use of facial recognition and iris-based solutions for airports, workplaces, and residential buildings. Growth is propelled by trends emphasizing convenience, hygiene, and safety. Innovations in AI-based gesture recognition, 3D imaging, and infrared sensors are enhancing reliability and accuracy. With rising adoption across consumer and enterprise applications, touchless sensing is emerging as a core enabler for smart environments, frictionless interactions, and enhanced security solutions worldwide.

Growing concerns over infection control, particularly in healthcare and public facilities, have accelerated the adoption of sensor-based systems that eliminate the need for physical touch. Governments and corporations are investing in smart environments, where user interaction with systems is increasingly being managed through gesture recognition, motion detection, and other non-contact modalities. Technological advancements in sensor miniaturization, integration with AI, and compatibility with IoT platforms are further enabling flexible and scalable deployments.

Consumer awareness regarding hygiene and operational safety has increased, contributing to market growth across multiple end-use industries. The long-term outlook remains favorable as touchless systems continue to enhance user experience, reduce contamination risks, and deliver operational efficiency, thereby cementing their place in healthcare, retail, automotive, and public infrastructure ecosystems..

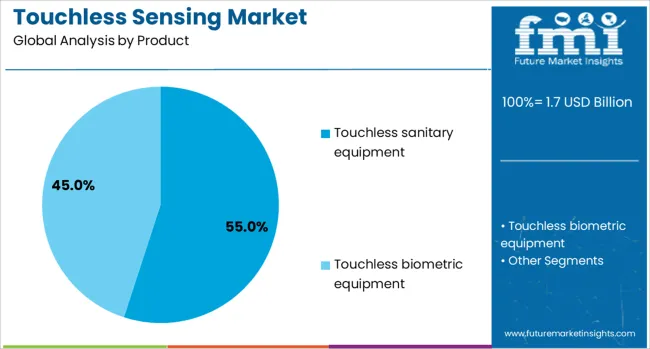

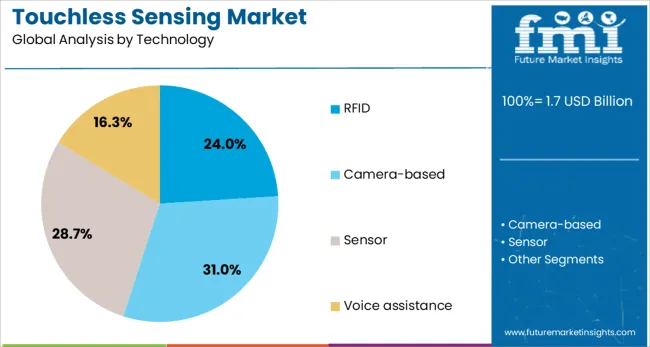

The touchless sensing market is segmented by product, technology, end-use industry, and geographic regions. The touchless sensing market is divided into Touchless sanitary equipment and Touchless biometric equipment. The touchless sensing market is classified into RFID, Camera-based, Sensor, and Voice assistance. The touchless sensing market is segmented by end-use industry into Healthcare, Automotive, Consumer electronics, BFSI, Aerospace & defense, and Others. Regionally, the touchless sensing industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The touchless sanitary equipment segment is projected to account for 55% of the Touchless Sensing market revenue share in 2025, making it the leading product category. The segment’s dominance has been supported by rising awareness of hygiene and safety protocols, particularly in washroom automation and shared facilities across public and commercial spaces. A notable increase in installations of touch-free faucets, soap dispensers, flush valves, and hand dryers has been observed, driven by the need to minimize surface contact and transmission of infectious agents.

The adoption of these systems has also been encouraged by updated regulatory guidelines in the healthcare and hospitality sectors. Touchless sanitary equipment is often integrated with infrared and proximity sensors, providing reliable performance and reducing water and energy consumption.

Their maintenance-friendly design, combined with the increasing focus on sustainable building solutions, has further strengthened their presence across global markets. As businesses and institutions continue to prioritize contactless technologies in facility management, this segment is expected to maintain its leading position..

The RFID segment is estimated to hold a significant position within the technology segmentation of the Touchless Sensing market in 2025. This growth has been driven by the technology’s ability to enable seamless object and individual identification without requiring physical contact or line-of-sight access. RFID-based sensing solutions have been adopted across various sectors due to their scalability, reliability, and integration with cloud-based tracking systems.

The technology enables automated access control, inventory management, and smart facility operations, which have become increasingly essential in modern infrastructure planning. Advancements in passive and active RFID systems have enhanced read ranges and data transfer efficiency, enabling their use in high-traffic environments such as hospitals, manufacturing units, and corporate facilities.

The ability to deliver real-time tracking, coupled with reduced manual intervention, has positioned RFID as a critical component in next-generation touchless ecosystems. Its compatibility with existing enterprise systems and its role in enhancing operational transparency are expected to support ongoing adoption..

The healthcare segment is projected to contribute 29% of the Touchless Sensing market revenue share in 2025, positioning it as the leading end-use industry. This growth has been attributed to the critical need for infection prevention, operational efficiency, and patient safety across hospitals, clinics, and diagnostic centers. Healthcare facilities have increasingly implemented touchless systems to automate door access, hand hygiene monitoring, and equipment interaction to reduce the risk of cross-contamination.

The integration of contactless technologies with electronic health record systems and medical equipment has further elevated their strategic value. Motion detection, RFID, and proximity sensing have become essential in high-sensitivity areas such as operating rooms and isolation wards.

Additionally, government mandates and healthcare accreditation requirements have prompted widespread investments in smart hospital infrastructure. As demand continues to rise for safe, automated, and digitally connected healthcare environments, the segment is expected to maintain its leadership in driving innovation and adoption within the Touchless Sensing market..

Touchless sensing refers to technologies such as capacitive proximity detectors, infrared sensors, radar-based switches, and gesture control interfaces that enable contact-free interaction. These systems are adopted across healthcare, retail, intelligent buildings, and industrial safety environments. Growth has been supported by demand for hygienic user interaction, automation, and hands-free control during operations. Providers offering sensors with fast responsiveness, easy integration, and robust detection accuracy have been preferred. Solutions featuring low power consumption, compact design, and adaptive sensitivity continue to guide procurement decisions in environments with high user throughput or strict hygiene considerations.

The need for hands-free control in public and hygiene-sensitive settings has driven the adoption of touchless sensing technology. Applications in restrooms, elevators, retail checkout, and industrial control panels have prioritized contact-free interfaces to reduce touchpoints. Automation of door access, lighting, or dispenser systems has improved operational efficiency and reduced manual interaction. Health-conscious facility operators have favored sensors that support minimal contact, quick response, and consistent operation. Integration with building management systems for lighting or access control has further reinforced adoption. Rising priorities for cleanliness, convenience, and automated response in high-traffic and healthcare environments have supported overall demand.

Adoption has been restricted by compatibility challenges when integrating sensor modules with existing control systems or automation platforms. Calibration of sensitivity to avoid false triggers or missed events requires technical expertise and can vary by environment. Durability of sensor housings and resistance to dust, moisture, and vandalism can be insufficient in some industrial or outdoor contexts. Variable performance under changing lighting conditions or electromagnetic interference has impacted reliability in certain deployments. The high initial cost of advanced radar or gesture systems has deterred adoption in low-margin applications. Maintenance and troubleshooting may require specialized knowledge, further complicating expansion in less technology-savvy sectors.

Opportunities are being created by the growth of smart building installations, retail automation, and self-service kiosks incorporating touchless interaction. Partnerships with architects and system integrators for hands-free facility design projects are driving specification. Expansion into healthcare and laboratory settings has accelerated adoption for automatic faucets, dispensers, and contactless door activation. Gesture-based control interfaces are gaining traction in interactive retail displays and infotainment units. Customized sensor modules for high-security or clean-room environments offer additional value. Development of plug-and-play sensor kits for prototyping or retrofitting traditional control panels supports flexible use cases and recurring deployment across contexts.

Emerging trends include the integration of touchless sensors with IoT platforms for real-time device analytics, usage tracking, and fault detection. Machine learning–based algorithms are being used to adjust sensitivity or adapt to user patterns in specific zones. Multi-modal interfaces combining gesture, proximity, and voice control are being developed for a seamless user experience. Energy harvesting or ultra-low-power sensor designs are being introduced to support battery-free actuator locations. Use of edge processing enables rapid response without heavy data transmission. Standardization of communication protocols such as MQTT or BACnet enhances interoperability across smart infrastructure systems. Growing focus on modular sensor architecture allows for easy OEM integration and scalable deployments.

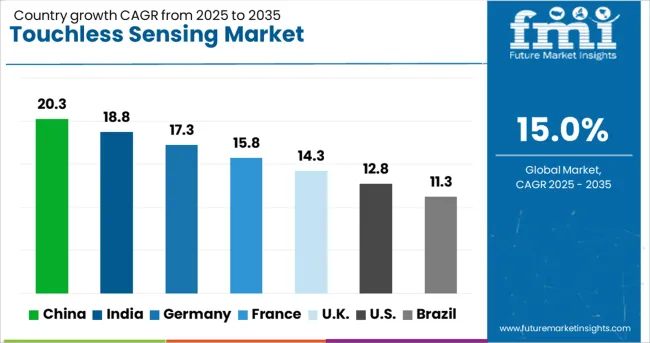

| Country | CAGR |

|---|---|

| China | 20.3% |

| India | 18.8% |

| Germany | 17.3% |

| France | 15.8% |

| UK | 14.3% |

| USA | 12.8% |

| Brazil | 11.3% |

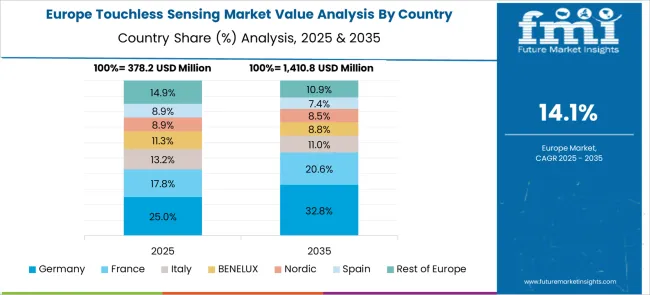

The touchless sensing market is projected to grow at a CAGR of 15% from 2025 to 2035, fueled by the adoption of gesture recognition systems, biometric authentication, and contactless interfaces across consumer electronics, healthcare, and automotive sectors. China, a leading BRICS economy, dominates with 20.3%, supported by large-scale smart device deployment and automotive technology integration. India, also within BRICS, follows at 18.8%, driven by digital transformation initiatives and demand for hygiene-focused solutions. Among OECD markets, Germany posts 17.3%, emphasizing industrial automation and secure access systems. The United Kingdom records 14.3%, while the United States grows at 12.8%, reflecting heavy investment in biometric security and interactive touchless technologies. The analysis includes over 40 countries, with the top five detailed below.

China is projected to achieve a CAGR of 20.3% through 2035, driven by widespread deployment of gesture-based controls and biometric authentication solutions in consumer electronics and automotive applications. Growing investment in smart infrastructure and IoT-enabled devices supports adoption in retail and public service sectors. Manufacturers are introducing AI-powered touchless sensors for interactive displays, payment systems, and smart appliances. Domestic tech companies lead innovation in gesture recognition algorithms, while international brands collaborate with local firms to strengthen market presence. Demand is further fueled by hygiene-focused applications across healthcare and hospitality segments, reinforcing China’s dominance in global touchless sensing adoption.

India is forecasted to post a CAGR of 18.8% through 2035, supported by the rapid adoption of touchless access systems, voice-enabled devices, and biometric authentication platforms across enterprises and residential spaces. Demand is strong in healthcare facilities, transportation hubs, and banking environments, where hygiene and security remain priorities. Domestic manufacturers focus on cost-effective sensor solutions for mid-range consumer electronics, while global firms introduce premium gesture-based control technologies. Government-led initiatives in digitalization and smart city programs drive large-scale adoption of touchless technologies. Increased penetration of e-commerce accelerates demand for contact-free payment authentication and secure identity verification systems.

Germany is projected to grow at a CAGR of 17.3% through 2035, supported by strong investments in industrial automation, automotive innovation, and advanced healthcare solutions. Manufacturers are integrating infrared sensors, ultrasonic technologies, and 3D gesture control systems to enhance productivity and safety in manufacturing environments. Touchless sensing plays a critical role in autonomous vehicle development, particularly in gesture-controlled infotainment systems. Healthcare applications include contactless monitoring systems for patient care, reflecting growing demand for precision and hygiene in clinical settings. Strategic partnerships between German firms and global technology companies accelerate R&D for AI-enabled sensing platforms.

The United Kingdom is forecasted to achieve a CAGR of 14.3% through 2035, driven by the deployment of touchless security systems and voice-command solutions in public transport, retail, and office spaces. Demand is increasing for gesture-based controls in home automation systems, reflecting consumer preference for convenience and hygiene. Manufacturers are focusing on AI-enhanced facial recognition and multi-sensor platforms for smart building applications. Growth in the hospitality sector accelerates the adoption of touchless kiosks and interactive displays for customer engagement. Partnerships between UK-based firms and global sensor technology providers enhance the availability of scalable, advanced solutions in both residential and commercial markets.

The United States is expected to record a CAGR of 12.8% through 2035, supported by strong uptake of biometric security solutions, gesture-based consumer electronics, and voice-controlled smart home devices. Touchless sensing technologies are gaining prominence in automotive applications, including gesture-controlled infotainment and driver assistance systems. Healthcare facilities are integrating contact-free monitoring and patient management systems, reinforcing demand for hygienic interfaces. Major tech companies are investing in AI-driven sensor technologies for immersive AR/VR platforms and advanced digital ecosystems. The rise of e-commerce and digital banking further fuels the adoption of touchless payment authentication solutions in the US market.

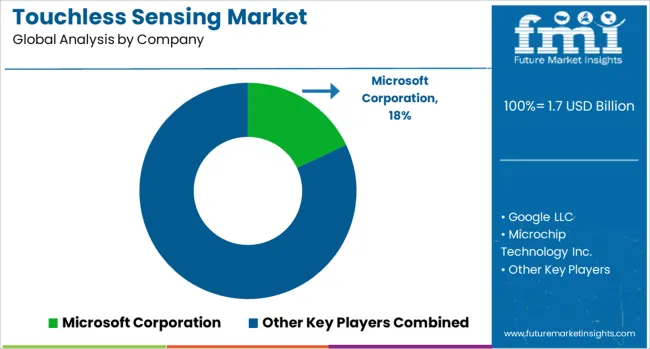

The touchless sensing market is defined by strong participation from global technology leaders such as Microsoft Corporation, Google LLC, Microchip Technology Inc., Synaptics Incorporated, and Cognitec Systems GmbH. Microsoft has developed advanced gesture control systems integrated into gaming consoles and enterprise platforms, leveraging AI and depth-sensing cameras for high-precision detection. Google focuses on embedding touchless features within its Android ecosystem and IoT frameworks, combining AI-driven voice and gesture technologies for consumer devices.

Microchip Technology Inc. offers proximity and motion sensing components tailored for automotive safety, industrial automation, and healthcare environments, prioritizing energy efficiency and accuracy. Synaptics specializes in biometric and gesture-based interfaces, delivering sensor solutions for laptops, smart displays, and wearable electronics. Cognitec Systems GmbH remains a key player in facial recognition systems for security and authentication applications, catering to public infrastructure and enterprise sectors requiring advanced identity verification.

Competitive differentiation centers on sensor responsiveness, accuracy in varied environmental conditions, and ease of integration into OEM designs. Companies are focusing on multimodal sensing technologies, combining gesture, voice, and facial recognition to improve user experience and device functionality. Entry barriers include the need for advanced algorithm development, adherence to privacy regulations, and strong IP portfolios for AI and biometric technologies. Strategic initiatives include acquisitions to strengthen sensor portfolios, investment in AI-enabled platforms, and collaboration with consumer electronics and automotive OEMs for embedded applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.7 Billion |

| Product | Touchless sanitary equipment and Touchless biometric equipment |

| Technology | RFID, Camera-based, Sensor, and Voice assistance |

| End-Use Industry | Healthcare, Automotive, Consumer electronics, BFSI, Aerospace & defense, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Microsoft Corporation, Google LLC, Microchip Technology Inc., Synaptics Incorporated, and Cognitec Systems GmbH |

| Additional Attributes | Dollar sales by technology type (gesture recognition, facial recognition, voice-based sensing, proximity detection) and application (consumer electronics, automotive, industrial, healthcare, security), with growth supported by integration into IoT devices and smart infrastructure projects. Regional dynamics highlight strong adoption in North America and Europe due to advanced device ecosystems, while Asia-Pacific demonstrates rapid expansion through rising smartphone penetration and smart home adoption. Innovation trends focus on AI-based image processing, ultra-low power sensors for portable devices, and secure biometric systems integrated with cloud and edge computing platforms. |

The global touchless sensing market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the touchless sensing market is projected to reach USD 7.0 billion by 2035.

The touchless sensing market is expected to grow at a 15.0% CAGR between 2025 and 2035.

The key product types in touchless sensing market are touchless sanitary equipment and touchless biometric equipment.

In terms of technology, rfid segment to command 0.0% share in the touchless sensing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Touchless Tubes Market

Sensing Cable Market

Self Sensing Nanocomposites Market Size and Share Forecast Outlook 2025 to 2035

Depth Sensing Market Trends - Growth & Forecast 2025 to 2035

Remote Sensing Services Market Trends - Growth & Forecast 2025 to 2035

Inertial Sensing Products Market Size and Share Forecast Outlook 2025 to 2035

Multi Touch Sensing Market Size and Share Forecast Outlook 2025 to 2035

Temperature Sensing Foley Catheter Market

Bioacoustics Sensing Market Size and Share Forecast Outlook 2025 to 2035

Distributed Temperature Sensing Systems Market Size and Share Forecast Outlook 2025 to 2035

Non-Dispersive Infrared Sensing Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA