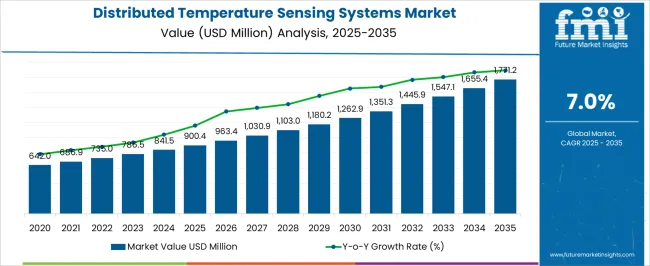

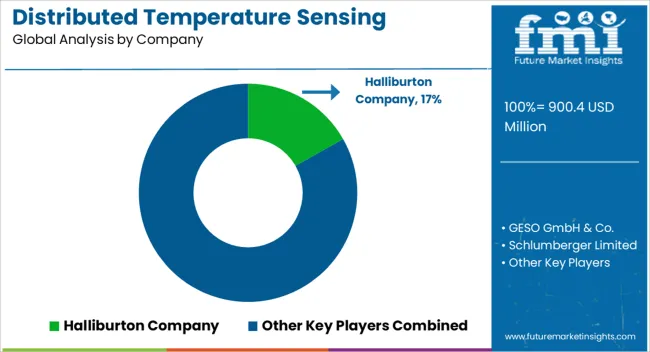

The Distributed Temperature Sensing Systems Market is estimated to be valued at USD 900.4 million in 2025 and is projected to reach USD 1771.2 million by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

| Metric | Value |

|---|---|

| Distributed Temperature Sensing Systems Market Estimated Value in (2025 E) | USD 900.4 million |

| Distributed Temperature Sensing Systems Market Forecast Value in (2035 F) | USD 1771.2 million |

| Forecast CAGR (2025 to 2035) | 7.0% |

The distributed temperature sensing systems market is experiencing significant growth, driven by the increasing demand for real-time monitoring and predictive maintenance across critical infrastructure sectors. Adoption is being supported by the ability of these systems to provide continuous temperature measurement over long distances, enhancing operational safety and reducing maintenance costs. Industries such as oil and gas, power generation, and industrial manufacturing are increasingly integrating these solutions to detect hotspots, prevent equipment failures, and improve process efficiency.

Technological advancements in optical fibers, sensor accuracy, and data analytics platforms are enhancing system reliability and enabling broader deployment. The growing need for condition monitoring in remote and high-risk environments, combined with regulatory standards that prioritize safety and energy efficiency, is further encouraging adoption.

As organizations aim to optimize operations and minimize downtime, the distributed temperature sensing systems market is positioned for sustained expansion Investments in smart infrastructure and industrial digitization are expected to open additional growth avenues while fostering the development of next-generation sensing technologies capable of providing high-resolution temperature mapping.

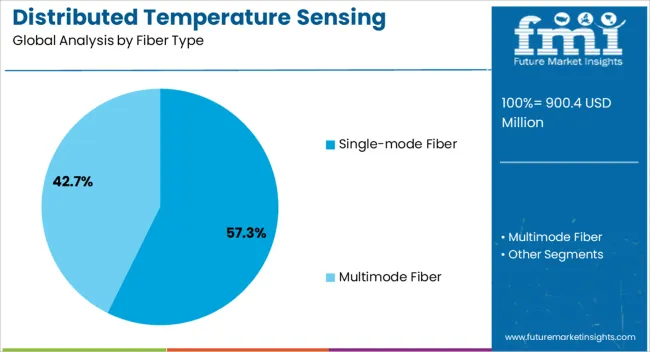

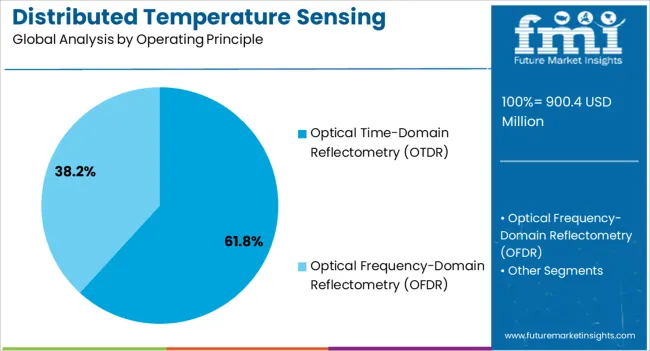

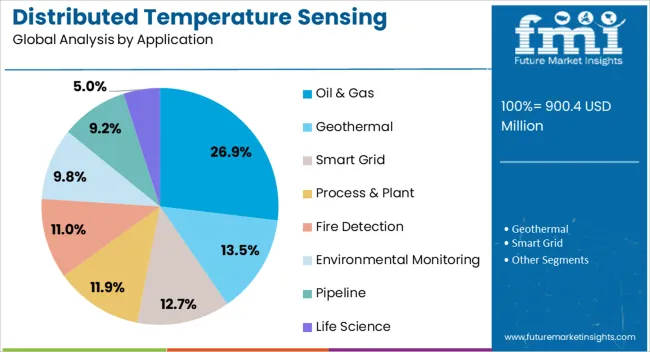

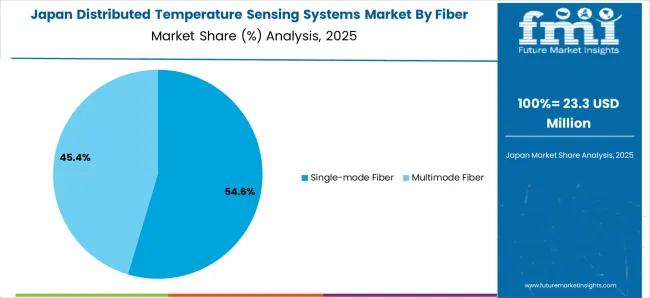

The distributed temperature sensing systems market is segmented by fiber type, operating principle, application, and geographic regions. By fiber type, distributed temperature sensing systems market is divided into Single-mode Fiber and Multimode Fiber. In terms of operating principle, distributed temperature sensing systems market is classified into Optical Time-Domain Reflectometry (OTDR) and Optical Frequency-Domain Reflectometry (OFDR). Based on application, distributed temperature sensing systems market is segmented into Oil & Gas, Geothermal, Smart Grid, Process & Plant, Fire Detection, Environmental Monitoring, Pipeline, and Life Science. Regionally, the distributed temperature sensing systems industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The single-mode fiber segment is projected to hold 57.3% of the distributed temperature sensing systems market revenue share in 2025, making it the leading fiber type. Its dominance is being driven by superior signal transmission capabilities over long distances, minimal signal attenuation, and high sensitivity, which are essential for accurate temperature measurements in industrial and infrastructure applications.

Single-mode fibers are preferred for applications requiring high precision and reliability, including long pipelines, power lines, and critical process monitoring. The segment is also benefiting from advances in optical fiber manufacturing and coating technologies that enhance durability under harsh environmental conditions.

Its compatibility with advanced interrogation techniques and optical sensing platforms ensures efficient data collection and integration into centralized monitoring systems As demand for real-time, continuous temperature monitoring grows across industries, single-mode fiber is expected to maintain leadership due to its ability to provide high-resolution measurements with consistent performance, reducing operational risks and supporting predictive maintenance strategies.

The optical time-domain reflectometry segment is anticipated to account for 61.8% of the distributed temperature sensing systems market revenue share in 2025, positioning it as the dominant operating principle. Its adoption is being supported by the capability to provide precise location-specific temperature measurements along the entire length of the optical fiber. OTDR-based systems are preferred for their ability to detect anomalies, identify hotspots, and monitor infrastructure integrity in real time.

Industries with long linear assets, such as pipelines and power transmission networks, are increasingly deploying OTDR solutions to minimize downtime, improve safety, and optimize operational efficiency. Continuous advancements in OTDR resolution, data processing algorithms, and integration with monitoring software are enhancing measurement accuracy and system scalability.

The growing emphasis on predictive maintenance and operational safety is further driving the adoption of OTDR systems As infrastructure networks expand and monitoring requirements become more complex, OTDR is expected to remain the preferred operating principle in distributed temperature sensing systems.

The oil and gas application segment is expected to hold 26.9% of the distributed temperature sensing systems market revenue share in 2025, making it the leading application. Its prominence is being driven by the critical need for continuous monitoring of pipelines, wells, and storage facilities to detect leaks, prevent failures, and enhance operational safety. Distributed temperature sensing systems enable real-time detection of temperature fluctuations, which helps in early identification of equipment malfunctions and abnormal flow conditions.

The segment is also benefiting from stringent regulatory requirements for environmental safety, operational reliability, and process optimization in the oil and gas sector. Integration with centralized monitoring platforms allows operators to make informed decisions and implement predictive maintenance strategies, reducing downtime and operational costs.

Continuous advancements in fiber optic sensing technologies, coupled with the increasing deployment of long-distance pipelines and offshore facilities, are reinforcing the segment’s leadership As demand for safer and more efficient energy infrastructure grows globally, the oil and gas sector is expected to remain a key driver of distributed temperature sensing system adoption.

Distributed temperature sensing systems are finding a wide range of applications across the power generation, transmission, and distribution sectors, on the back of their advantages such as resistance to ionizing radiation and compact size immunity to electromagnetic interference.

In hydrologic processes, these systems are extensively being used across applications such as in monitoring temperature patterns in the stream bed, characterizing the interaction of a stream, and determining transmissive fractures in bedrock boreholes. Distributed temperature sensing systems also assist in monitoring the downhole temperature in order to study hydrogeological processes at high frequency and spatial resolution.

With deployment of these systems in passive mode for in-site investigation of groundwater flow, in-well flow, and for anticipation of subsurface thermal property on the rise, the sales of distributed temperature sensing systems are projected to exhibit robust growth in the market.

In addition, rising safety concerns regarding workplace safety, growing adoption of data-based analytics, and increasing supportive government policies pertaining to leakage detectio are factors further facilitating the growth in the distributed temperature sensing system market.

As the trend of miniaturization continues to create deeper inroads, manufacturers are increasingly integrating innovative technologies to shrink the size of distributed temperature sensing systems without compromising the performance, thereby, making the manufacturing processes expensive.

In addition to this, lack of technical awareness, complexity of identifying thermal events in detection systems, need for basic training before the adoption, and extravagant cost of distributed temperature sensing systems are factors hindering the sales in the market.

Future Market Insights reveals that North America is anticipated to emerge as the most remunerative market for distributed temperature sensing systems between 2025 and 2035.

Rapid industrialization and rising sales of automotive vehicles have resulted in increasing the demand for fossil fuel products such as diesel, natural gas, gasoline, and others across North America. Hence, governments in countries across the region are increasingly focusing on increasing the production of oil &gas.

For instance, according to a report by the Energy Information Administration (EIA), the production of crude oil and natural gas increased 12.7% and 9.8% respectively in the year 2025 in comparison to 2025. As distributed temperature sensing systems in used for continuous and real-time monitoring of downhole to optimize the economic and operational performance of oil & gas assets, such initiatives are estimated to augment the sales in the North America market.

As per FMI, Asia Pacific excluding Japan is estimated to project robust growth in the global distributed temperature sensing system market over the forecast period 2025-2035.

With rising trend of automation and electrification across the industrial sector, a significant surge in demand for electricity and efficient power distribution is being witnessed across Asia Pacific. Hence, governments in several countries are aiming at developing smart grids and replacing old power infrastructure to decrease electricity loss.

For instance, according to the India Smart Grid Forum (ISGF), the Indian Government announced allocating US$ 129.9 Mn under the National Smart Grid Mission (NSGM) for transforming the country's power infrastructure and developing smart grids infrastructure across smart cities in India.

Distributed temperature sensing system is increasingly used for monitoring the temperature of high-voltage cables across power transmission and distribution. Hence, increasing number of such smart grid development missions in countries such as China, Australia, South Korea, and others are expected to propel the demand for distributed temperature sensing systems in the market.

Some of the leading players in the distributed temperature sensing system market are Halliburton Company, GESO GmbH & Co., Schlumberger Limited, OFS Fitel, Yokogawa Electric Corporation, Weatherford International PLC, Sumitomo Electric Industries, AP Sensing GmbH, NKT Photonics, Bandweaver Technologies.

The market for IGBT is highly competitive, due to large number of participants and increasing adoption product launch and capacity expansion strategies by leading players.

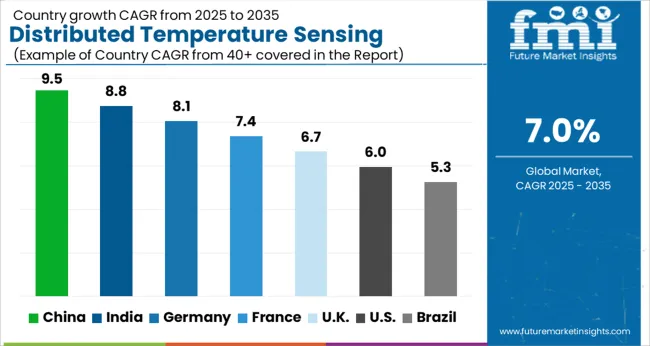

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

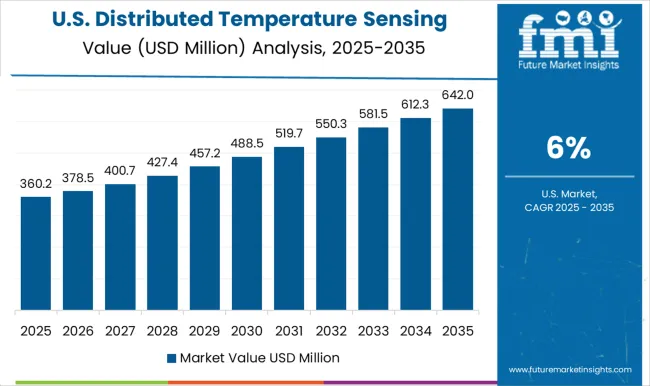

The Distributed Temperature Sensing Systems Market is expected to register a CAGR of 7.0% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 9.5%, followed by India at 8.8%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 5.3%, yet still underscores a broadly positive trajectory for the global Distributed Temperature Sensing Systems Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 8.1%. The USA Distributed Temperature Sensing Systems Market is estimated to be valued at USD 309.6 million in 2025 and is anticipated to reach a valuation of USD 551.8 million by 2035. Sales are projected to rise at a CAGR of 6.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 42.9 million and USD 30.0 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 900.4 Million |

| Fiber Type | Single-mode Fiber and Multimode Fiber |

| Operating Principle | Optical Time-Domain Reflectometry (OTDR) and Optical Frequency-Domain Reflectometry (OFDR) |

| Application | Oil & Gas, Geothermal, Smart Grid, Process & Plant, Fire Detection, Environmental Monitoring, Pipeline, and Life Science |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Halliburton Company, GESO GmbH & Co., Schlumberger Limited, OFS Fitel, Yokogawa Electric Corporation, Weatherford International PLC, Sumitomo Electric Industries, AP Sensing GmbH, NKT Photonics, and Bandweaver Technologies |

The global distributed temperature sensing systems market is estimated to be valued at USD 900.4 million in 2025.

The market size for the distributed temperature sensing systems market is projected to reach USD 1,771.2 million by 2035.

The distributed temperature sensing systems market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in distributed temperature sensing systems market are single-mode fiber and multimode fiber.

In terms of operating principle, optical time-domain reflectometry (otdr) segment to command 61.8% share in the distributed temperature sensing systems market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Temperature Sensing Foley Catheter Market

Distributed Antenna Systems (DAS) Market Insights - Demand, Trends & Outlook 2025 to 2035

Understanding Market Share Trends in Distributed Antenna Systems (DAS)

Temperature Controlled Pharmaceutical Packaging Solutions Market Forecast and Outlook 2025 to 2035

Temperature Monitoring Device Market Size and Share Forecast Outlook 2025 to 2035

Temperature Controlled Vaccine Packaging Market Size and Share Forecast Outlook 2025 to 2035

Temperature and Freshness Sensors Market Size and Share Forecast Outlook 2025 to 2035

Distributed Fiber Optic Sensor Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Temperature Detection Screen Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Temperature Loggers Market Size, Share & Forecast 2025 to 2035

Temperature Controlled Pharma Packaging Market Size, Share & Forecast 2025 to 2035

Temperature Controlled Packaging Solution Market - Size, Share, and Forecast Outlook 2025 to 2035

Temperature Transmitter Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Temperature Controlled Packaging Solutions

Temperature Sensors Market Growth - Trends & Forecast 2025 to 2035

Distributed Cloud Market

Temperature Controlled Pharmaceutical Container Market Analysis, Size, Share & Forecast 2024 to 2034

United States Distributed Antenna System (DAS) Market Growth – Trends & Forecast 2024-2034

Temperature Controlled Packaging Boxes Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA