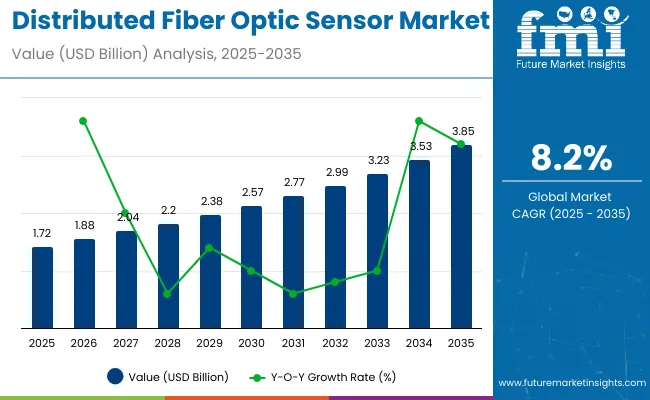

The global distributed fiber optic sensor market is projected to grow significantly over the next decade, expanding from USD 1.72 billion in 2025 to approximately USD 3.85 billion by 2035, reflecting a CAGR of 8.2%. This steady rise in market valuation is primarily attributed to the expanding need for reliable, long-distance sensing technologies in industrial safety, energy efficiency, and infrastructure resilience.

Distributed fiber optic sensing solutions offer a high-resolution, real-time approach to monitoring environmental and mechanical conditions across critical assets, positioning them as essential tools for predictive diagnostics, automation, and operational continuity.

As industries increasingly transition toward smart infrastructure and Industry 4.0 paradigms, demand is accelerating for solutions that can deliver real-time monitoring of parameters like temperature, pressure, strain, and acoustic signatures. These sensors offer continuous feedback over extended distances, enabling businesses to detect potential failures before they escalate.

Technologies such as Distributed Temperature Sensing (DTS) and Distributed Acoustic Sensing (DAS) are leading this transformation by enhancing safety protocols in sectors such as oil & gas, civil infrastructure, transportation, and defense. Their ability to function in harsh or remote environments while remaining immune to electromagnetic interference is contributing to their growing adoption.

The rise of AI-enabled analytics platforms is further amplifying the value of distributed fiber optic sensors. Modern systems can not only detect anomalies but also analyze contextual data to provide actionable insights for maintenance teams, security operators, and utility providers. With governments focusing on border surveillance, pipeline safety, and rail infrastructure optimization, fiber optic sensors are now becoming embedded in next-generation asset protection systems.

In a Wired article, Jessica Kahanek, spokesperson for the Association of American Railroads (AAR) stated “Distributed acoustic sensing is one area that suppliers and carriers are exploring to see if it can meaningfully advance safety goals.”

Key players in the market, including Schlumberger, Silixa, AP Sensing, and OptaSense, are investing in integrated platforms that combine hardware reliability with software intelligence. As environmental regulations tighten and the need for digital infrastructure accelerates, distributed fiber optic sensors are emerging as a core enabler of industrial transformation and sustainable monitoring strategies.

Leading companies in distributed fiber optic sensors are integrating technologies such as distributed acoustic sensing, distributed temperature sensing, strain monitoring, AI analytics, and cloud-edge computing to enable real-time monitoring across sectors like energy, infrastructure, and security.

Schlumberger (Optiq Systems):

Schlumberger offers the Optiq fiber-optic sensing platform which combines distributed acoustic sensing, distributed temperature sensing, and strain monitoring. Their solutions provide real-time insights for subsurface operations and seismic monitoring primarily in the oil and gas sector.

Halliburton (Odassea DAS):

Halliburton provides the Odassea distributed acoustic sensing system designed for subsea well monitoring and wellbore diagnostics. This system delivers high-frequency acoustic data with real-time analytics for reservoir characterization and seismic imaging.

Yokogawa Electric Corporation:

Yokogawa offers distributed fiber optic sensor solutions integrated with industrial automation systems. Their products are used widely in utilities and energy sectors for monitoring power lines, pipelines, and critical infrastructure.

Luna Innovations (ODiSI and OptaSense):

Luna Innovations develops the ODiSI distributed fiber optic sensing system and has expanded its portfolio through the acquisition of OptaSense. Their solutions are focused on structural health monitoring and infrastructure protection.

AP Sensing:

AP Sensing specializes in distributed temperature and acoustic sensing technologies for asset monitoring such as pipelines, cables, and tunnels. Their systems are applied in energy, transport, and safety monitoring.

Distributed fiber optic sensors (DFOS) are increasingly used for real-time monitoring in critical infrastructure, energy, telecommunications, and security sectors. As their deployment grows, governments have established regulations to ensure safety, data security, environmental compliance, and operational reliability. Regulatory frameworks focus on standards for equipment certification, data privacy, electromagnetic compatibility, and adherence to national security requirements, especially for applications in critical infrastructure and defense.

Equipment Safety and Certification Requirements:

Regulatory agencies mandate that DFOS hardware comply with safety standards such as IEC (International Electrotechnical Commission) and ISO certifications. These standards ensure electrical safety, electromagnetic compatibility, and reliability under various environmental conditions to prevent operational hazards and interference with other systems.

Data Security and Privacy Regulations:

Given that DFOS often transmit sensitive monitoring data, compliance with data protection laws such as the General Data Protection Regulation (GDPR) in the EU and similar national frameworks is required. These regulations govern secure data transmission, storage, and access control to protect against unauthorized data breaches.

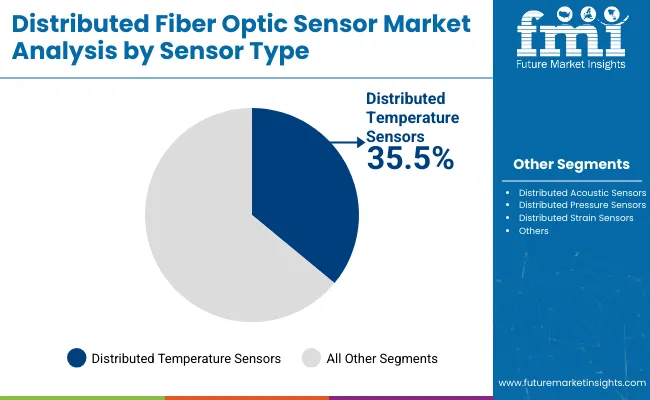

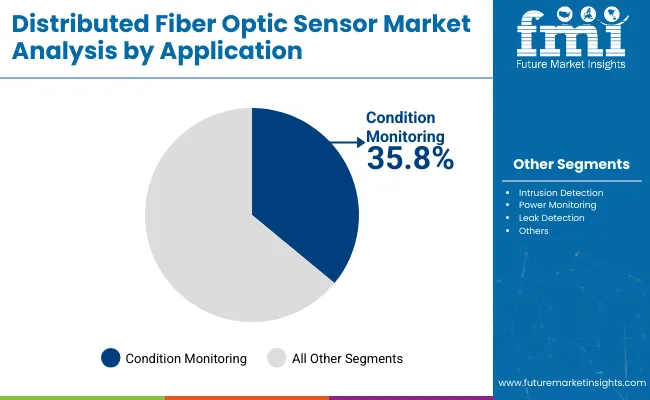

The market’s most lucrative segments are distributed temperature sensors (DTS) and condition monitoring applications. DTS leads sensor technology due to its thermal monitoring capabilities in energy and infrastructure. Condition Monitoring dominates end-use due to its vital role in predictive maintenance and operational efficiency across oil & gas, power, and transportation.

Distributed temperature sensors (DTS) are expected to lead the sensor type segment, accounting for an estimated 35.5% share of the global market in 2025. Their ability to provide continuous thermal monitoring over long distances makes them particularly valuable in high-risk environments such as oil wells, power transmission lines, and industrial pipelines.

DTS systems are widely used in the oil & gas industry for wellbore integrity monitoring, leak detection, and temperature profiling. They are also being increasingly deployed in smart grid applications for real-time cable temperature analysis and fire detection systems across tunnels and data centers.

The sensors’ passive nature, immunity to electromagnetic interference, and high spatial resolution make them ideal for both harsh and regulated environments. Companies such as AP Sensing, Schlumberger, and Halliburton are leading DTS innovation by offering systems enhanced with AI analytics for automated alerts and maintenance scheduling.

The growing emphasis on safety compliance and cost efficiency in energy infrastructure is boosting DTS installations. Their ability to reduce operational risk while increasing asset longevity places DTS at the forefront of smart industrial monitoring.

Condition monitoring is projected to hold a dominant 35.8% share of the global distributed fiber optic sensor market in 2025, driven by its broad utility across multiple industries. This application enables real-time tracking of critical infrastructure components-such as pipelines, railway tracks, and electrical cables-ensuring early fault detection and helping prevent catastrophic failures.

By measuring strain, vibration, temperature shifts, and pressure anomalies along extensive distances, these sensors support predictive maintenance and operational continuity. The technology is particularly crucial in the energy, civil, and transportation sectors, where asset failure can lead to high costs and safety hazards.

Companies including Silixa, Luna Innovations, and Schlumberger are enhancing condition monitoring systems with cloud integration and AI-powered diagnostics. These platforms allow users to visualize real-time health indices, schedule interventions proactively, and reduce unplanned downtimes.

As governments and private enterprises aim to optimize asset performance and comply with regulatory frameworks, condition monitoring through distributed fiber optic sensors is gaining widespread adoption. The combination of scalability, precision, and automation makes it a cornerstone in next-generation industrial monitoring frameworks.

Growth is driven by demand for real-time infrastructure intelligence, sustainability compliance, and technological advancements in fiber optics. However, the market faces challenges such as high initial costs and system integration complexities. Expanding applications in security, power, and civil infrastructure offer compelling opportunities, while technical standardization remains an industry-wide concern.

AI-Driven Infrastructure Monitoring Accelerates Market Adoption

The integration of artificial intelligence (AI) into distributed fiber optic sensor platforms is revolutionizing how industries monitor infrastructure. AI-enabled DAS and DTS systems can not only detect but also classify events such as leaks, intrusions, or structural anomalies in real-time. This intelligence layer helps operators make faster, more accurate decisions, improving asset reliability and lowering response times. For instance, AI models can distinguish between seismic activity and man-made vibration, allowing for precise situational alerts.

As industries strive to automate asset maintenance and ensure continuous operation, AI analytics becomes essential. Leading companies such as Silixa, AP Sensing, and OptaSense are incorporating machine learning into their systems to improve data interpretation and prediction capabilities. These innovations enhance threat detection, safety compliance, and long-term planning. With smart cities and digital twins expanding globally, the convergence of AI and fiber optic sensing is positioning the market for strong, technology-led growth over the next decade.

High Initial Costs and Integration Complexity Slow Widespread Adoption

While the benefits of distributed fiber optic sensors are well established, widespread adoption is constrained by high upfront investment costs and deployment complexity. Installing these systems often involves specialized labor, integration with SCADA or enterprise software, and adjustments to legacy infrastructure.

This is especially challenging in older facilities or low-margin industries where budget constraints limit digital transformation initiatives. Fiber optic systems require calibration, custom cabling, and environmental conditioning, which increase project costs and implementation timelines.

Moreover, stakeholders without prior experience in optical systems may be hesitant to adopt a new monitoring paradigm. The absence of plug-and-play standards across vendors further complicates installation and long-term support. These hurdles are most prominent among small and mid-sized enterprises lacking technical expertise.

Companies are addressing this by offering modular, preconfigured systems and managed service models. Even so, the market's full potential can only be realized through continued efforts to simplify deployment and lower adoption barriers.

Perimeter Security and Border Surveillance Offer High-growth Opportunities

Distributed Acoustic Sensors (DAS) are gaining traction as reliable tools for perimeter security and border surveillance applications. These sensors detect unauthorized intrusions, foot traffic, or vehicle movements over extensive perimeters such as national borders, power plants, data centers, and military bases.

DAS systems can monitor vibrations, acoustic signatures, and disturbances in real-time, alerting operators to potential threats without relying on cameras or motion detectors. Governments and defense agencies are adopting these systems to secure critical infrastructure while reducing manpower and increasing automation.

For example, fiber-optic perimeter surveillance was deployed along energy installations and military outposts in the Middle East and Europe. Vendors such as OptaSense, Fotech Solutions, and QinetiQ Group are developing AI-enhanced DAS platforms capable of distinguishing between environmental noise and genuine threats. This growing need for intelligent, 24/7 monitoring-especially in high-risk or remote areas-positions perimeter and border surveillance as a high-opportunity segment within the distributed fiber optic sensor market.

Lack of Product Standardization Hampers Interoperability and Scale

A critical barrier to distributed fiber optic sensor market expansion is the lack of standardized product formats and communication protocols. Each manufacturer often uses proprietary software, calibration methods, and signal interpretation techniques, making it difficult to integrate multi-vendor systems or switch suppliers.

This fragmentation leads to interoperability issues, particularly in large infrastructure projects that span multiple jurisdictions or contractors. As a result, organizations may become locked into single-vendor ecosystems that limit flexibility and drive up long-term costs.

The absence of universally accepted standards also affects product testing, certification, and regulatory approvals, slowing down procurement cycles. This challenge is especially problematic in international collaborations involving energy pipelines, rail networks, or fiber-optic communications. Industry associations and government bodies are beginning to push for harmonized frameworks, but progress remains slow. Until interoperability improves through open standards and plug-and-play integration, product differentiation and scaling will remain difficult for vendors and infrastructure managers alike.

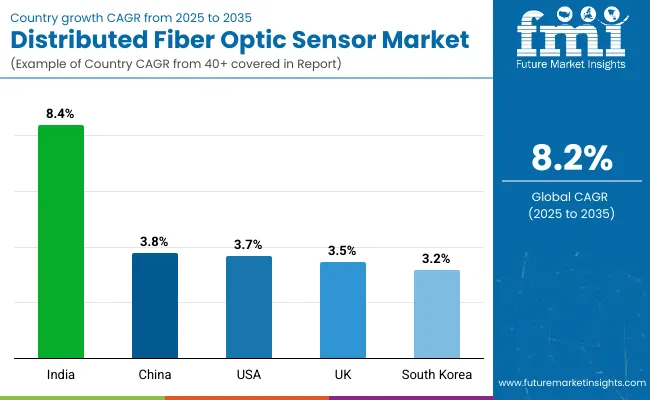

The United States dominates the global market by value, driven by mature oil & gas and security infrastructure. India, with rapid infrastructure growth and digitization, exhibits the highest CAGR of 8.4%. China, South Korea, and the UK contribute steadily, supported by manufacturing advancements and smart monitoring initiatives.

The United States distributed fiber optic sensor market is projected to expand at a CAGR of 3.7% between 2025 and 2035. This growth is fueled by ongoing investments in pipeline integrity, power grid modernization, and national security infrastructure. Distributed Acoustic Sensors (DAS) are extensively used in perimeter protection, especially in defense bases, data centers, and cross-border zones.

Distributed Temperature Sensors (DTS) are gaining traction for thermal monitoring in high-voltage cables and substations. Companies such as Luna Innovations, Schlumberger, and VIAVI offer integrated platforms that include fiber sensing hardware, SCADA compatibility, and AI-driven diagnostics.

Federal agencies and utility firms are actively integrating fiber-based systems for early fault detection and predictive maintenance, improving both safety and operational continuity. As more regions invest in smart infrastructure, fiber optic sensors are expected to play a central role in digital asset monitoring across urban and industrial environments. The USA remains a technology leader with high-value projects shaping demand.

The United Kingdom distributed fiber optic sensor market is projected to grow at a CAGR of 3.5% from 2025 to 2035. Growth is supported by infrastructure modernization, expansion of offshore wind farms, and smart transportation initiatives. Fiber optic sensors are widely deployed in subsea cables, metro tunnels, and coastal energy projects. DAS technology is used for perimeter security in airports, data centers, and defense zones, while DTS is applied for temperature control in energy transmission systems.

Companies like OptaSense (QinetiQ) and Bandweaver are leading local innovation, offering AI-powered acoustic sensing solutions customized for both public and private sectors. Government efforts to enhance energy efficiency and reduce carbon emissions are further supporting deployments in power grids and rail networks. As the UK reinforces its commitment to sustainable infrastructure, demand for continuous asset monitoring using fiber sensors is expected to rise steadily, especially in the context of smart cities and cyber-physical infrastructure protection.

China’s distributed fiber optic sensor market is forecast to grow at a CAGR of 3.8% from 2025 to 2035, driven by its expansive infrastructure development and focus on industrial safety. The government’s commitment to smart city implementation and national energy corridors has accelerated the adoption of both DTS and DAS technologies. Distributed sensors are widely integrated across high-speed rail lines, coal-fired power stations, urban tunnels, and oil pipelines.

Domestic manufacturers are delivering scalable, cost-efficient solutions suited to China’s rapid deployment environment. In particular, fiber sensors are being used to monitor temperature variations, strain, and acoustic disturbances across critical infrastructure.

Smart factories and logistics hubs are also leveraging these systems to improve operational efficiency and reduce downtime. China’s policy push around intelligent monitoring, environmental compliance, and infrastructure digitization will continue to support long-term demand. As a global manufacturing powerhouse, the country remains essential to the future scalability and affordability of fiber optic sensing technologies.

South Korea’s distributed fiber optic sensor market is expected to expand at a 3.2% CAGR from 2025 to 2035, supported by its strategic investments in border security, urban safety, and smart infrastructure. Fiber sensors are increasingly deployed in subway systems, bridges, and energy installations to provide real-time diagnostics and enhance asset longevity. The defense sector uses DAS technology for perimeter monitoring across sensitive areas, including military zones, airports, and research facilities.

Local firms, in collaboration with the government, are advancing ruggedized sensor solutions that integrate with AI-based surveillance and predictive maintenance platforms. DTS systems are applied in data centers, metro lines, and smart buildings for fire detection and thermal regulation.

The country’s dense urban environments demand compact, high-precision sensors capable of seamless integration into existing IT networks. With strong government support and a highly digitized infrastructure ecosystem, South Korea is expected to maintain consistent demand across both civil and defense applications.

India is the fastest-growing market, projected to expand at a CAGR of 8.4% from 2025 to 2035, driven by rapid infrastructure buildout, industrial automation, and nationwide digitalization initiatives. Distributed fiber optic sensors are being deployed across oil pipelines, power grids, freight corridors, and metro networks for real-time condition and security monitoring. Government programs such as Digital India, Smart Cities Mission, and Make in India are actively promoting the integration of advanced sensor systems in both public and private infrastructures.

Companies including AP Sensing, Halliburton, and emerging local providers offer cost-effective, rugged solutions tailored for India’s diverse terrain. Increasing investments in solar parks, data centers, and transportation corridors further support adoption. DTS is being applied for temperature profiling and fire detection, while DAS enhances perimeter and rail security. As automation and digital asset tracking become critical to India’s growth narrative, fiber optic sensing is emerging as a cornerstone of future-ready infrastructure strategies.

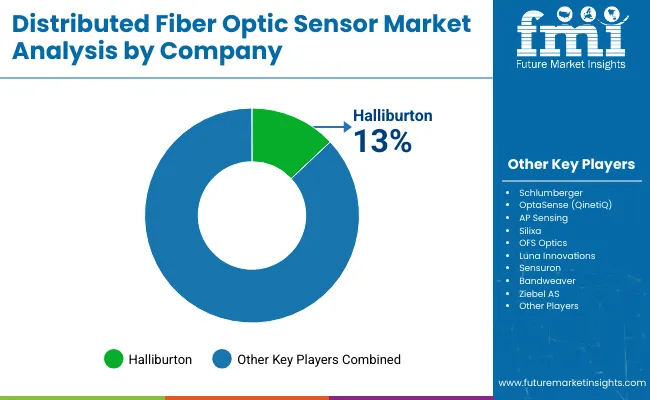

The distributed fiber optic sensor market is moderately consolidated, with clear differentiation between Tier 1, Tier 2, and niche technology players. Tier 1 firms such as Schlumberger, Halliburton, and OptaSense (QinetiQ company) dominate global deployments, particularly in the oil & gas and national security sectors.

These players offer end-to-end platforms that integrate hardware, software, and analytics-backed by strong service infrastructure and global partnerships. AP Sensing and Silixa Ltd. are gaining traction for their innovations in distributed temperature and acoustic sensing with enhanced AI analytics.

Tier 2 and emerging companies, such as Luna Innovations, Sensuron, and Bandweaver, focus on high-precision, customizable solutions for specific applications in civil infrastructure, smart grids, and transportation. These vendors often lead in innovation and agility, offering machine learning-enhanced diagnostics and modular deployments tailored to customer needs.

Entry into this market remains challenging due to the capital-intensive nature of R&D, stringent environmental and defense compliance, and complexity of sensor calibration and deployment. Suppliers are increasingly focused on offering plug-and-play systems, interoperable software, and scalable cloud integrations to differentiate their offerings in a competitive yet expanding landscape.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.72 billion |

| Projected Market Size (2035) | USD 3.85 billion |

| CAGR (2025 to 2035) | 8.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for market value and million units for volume |

| Sensor Types Analyzed | Distributed Temperature Sensors (DTS), Distributed Acoustic Sensors (DAS), Distributed Pressure Sensors, Distributed Strain Sensors, Others |

| Applications Covered | Condition Monitoring, Intrusion Detection, Power Monitoring, Leak Detection, Others |

| Industries Covered | Oil & Gas, Civil Infrastructure, Industrial, Power & Utilities, Military & Border Security, Transportation, Others |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Highlighted | United States, United Kingdom, China, South Korea, India |

| Key Companies Profiled | Schlumberger, Halliburton, OptaSense (QinetiQ), AP Sensing, Silixa , OFS Optics, Luna Innovations, Sensuron , Bandweaver , Ziebel AS |

| Additional Attributes | AI-powered analytics, multi-parameter sensing, smart city integration, perimeter surveillance use, plug-and-play modular systems, compliance with defense and utility regulations |

By sensor type, the segmentation is into distributed temperature sensors, distributed acoustic sensors, distributed pressure sensors, distributed strain sensors, and other sensor technologies.

By application, the segmentation is into condition monitoring, intrusion detection, power monitoring, leak detection, and other critical monitoring functions.

By industry, the segmentation includes oil & gas, civil infrastructures, industrial sectors, power & utilities, military & border security, transportation, and other specialized fields.

The report covers regions including North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa (MEA).

The industry is estimated at USD 1.72 billion in 2025.

The market is expected to grow to USD 3.85 billion by 2035 at a CAGR of 8.2%.

Top firms include Schlumberger, OptaSense, Silixa, Halliburton, and AP Sensing.

Distributed Temperature Sensors (DTS) dominate with a 35.5% share.

India leads with a CAGR of 8.4% due to infrastructure and digital expansion.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Sensor Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Sensor Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Sensor Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Sensor Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Sensor Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Sensor Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Sensor Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Sensor Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Sensor Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Sensor Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Sensor Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Sensor Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Sensor Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Sensor Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Sensor Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Sensor Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Industry, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Sensor Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Industry, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Sensor Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Sensor Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Sensor Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Sensor Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 21: Global Market Attractiveness by Sensor Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by Industry, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Sensor Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Industry, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Sensor Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Sensor Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Sensor Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Sensor Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 45: North America Market Attractiveness by Sensor Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by Industry, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Sensor Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Industry, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Sensor Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Sensor Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Sensor Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Sensor Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Sensor Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Industry, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Sensor Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Industry, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Sensor Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Sensor Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Sensor Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Sensor Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Sensor Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Industry, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Sensor Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Industry, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Sensor Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Sensor Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Sensor Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Sensor Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Sensor Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Industry, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Sensor Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Industry, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Sensor Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Sensor Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sensor Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sensor Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Sensor Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Industry, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Sensor Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Industry, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Sensor Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Sensor Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Sensor Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Sensor Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Sensor Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Industry, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Sensor Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Industry, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Sensor Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Sensor Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Sensor Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sensor Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Sensor Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Industry, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Distributed Temperature Sensing Systems Market Size and Share Forecast Outlook 2025 to 2035

Distributed Antenna Systems (DAS) Market Insights - Demand, Trends & Outlook 2025 to 2035

Understanding Market Share Trends in Distributed Antenna Systems (DAS)

Distributed Cloud Market

United States Distributed Antenna System (DAS) Market Growth – Trends & Forecast 2024-2034

Distributed Control System Market

Fiber Lid Market Forecast and Outlook 2025 to 2035

Fiberglass Tanks Market Size and Share Forecast Outlook 2025 to 2035

Fiber Sorter Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer Panel and Sheet Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Market Size and Share Forecast Outlook 2025 to 2035

Fiber Spinning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Plastic (FRP) Panels & Sheets Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Fabric Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Duct Wrap Insulation Market Size and Share Forecast Outlook 2025 to 2035

Fiber-Based Blister Pack Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Coding System Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer (FRP) Rebars Market Size and Share Forecast Outlook 2025 to 2035

Fiber Supplements Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA