The Distributed Antenna Systems market is growing rapidly as better wireless connectivity increases demand within both indoor and outdoor areas. Businesses, industries, and public venues look to implement DAS solutions to improve network coverage and capacity within commercial buildings, industrial facilities, public spaces, and residential complexes.

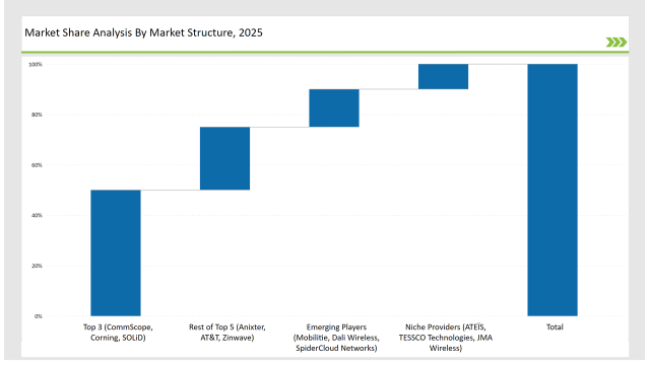

Leading vendors are enriching their portfolios with active, passive, and hybrid DAS solutions, utilizing advanced technologies like 5G, IoT, and Wi-Fi to cater to changing connectivity needs. By 2025, top players such as CommScope, Corning, and SOLiD will lead the market, collectively holding a 50% share. These companies deliver advanced DAS solutions that provide strong coverage, greater capacity, and effortless integration with other communication systems.

Other major vendors, including Anixter, AT&T, and Zinwave, will capture an additional 25%, focusing on large commercial buildings and public venues. Emerging players like Mobilitie, Dali Wireless, and SpiderCloud Networks will account for 15% of the market, specializing in small to mid-scale DAS deployments. Their focus on cost-effective solutions and tailored services makes them attractive to regional players.

Meanwhile, niche providers such as ATEÏS, TESSCO Technologies, and JMA Wireless will secure the remaining 10%, catering to specialized needs like rural coverage, regulatory compliance, and smaller-scale deployments. With connectivity demands rising, the DAS market is becoming more competitive, pushing vendors to innovate and refine their offerings to stay ahead.

| Category | Industry Share (%) |

|---|---|

| Top 3 (CommScope, Corning, SOLiD) | 50% |

| Rest of Top 5 (Anixter, AT&T, Zinwave) | 25% |

| Emerging Players (Mobilitie, Dali Wireless, SpiderCloud Networks) | 15% |

| Niche Providers (ATEÏS, TESSCO Technologies, JMA Wireless) | 10% |

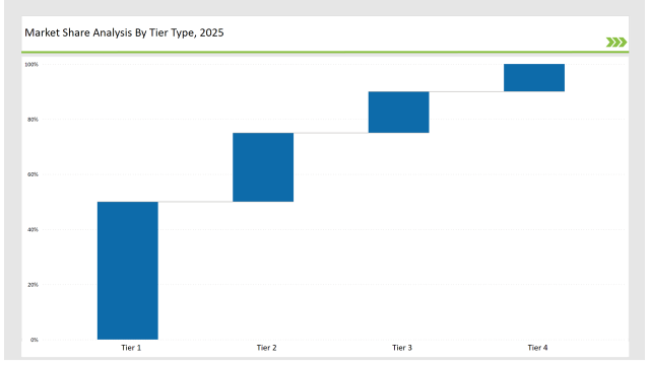

The DAS market is moderately consolidated with the top vendors controlling close to 50-60% of the market. While the large players like CommScope, Corning, and SOLiD control the big chunk at the high end and large-scale DAS, the mid-sized vendors are continuously pushing the boundaries into the cost-effective, modular, and scalable DAS solutions. The mid-size vendors are particularly poised to service the small to medium-sized enterprises, as well as rural areas and emerging markets.

In terms of the DAS type, there are three major categories: Active Distributed Antenna Systems (DAS), Passive Distributed Antenna Systems (DAS), and Hybrid Distributed Antenna Systems (DAS). These types deploy differently and vary based on any additional scalability or cost structure required for network deployment.

DAS solutions are applied in both indoor and outdoor coverage scenarios, with each application addressing different types of network challenges.

| Tier | Tier 1 |

|---|---|

| Vendors | CommScope, Corning, SOLiD |

| Consolidated Market Share (%) | 50% |

| Tier | Tier 2 |

|---|---|

| Vendors | Anixter, AT&T, Zinwave |

| Consolidated Market Share (%) | 25% |

| Tier | Tier 3 |

|---|---|

| Vendors | Mobilitie, Dali Wireless, SpiderCloud Networks |

| Consolidated Market Share (%) | 15% |

| Tier | Tier 4 |

|---|---|

| Vendors | ATEÏS, TESSCO Technologies, JMA Wireless |

| Consolidated Market Share (%) | 10% |

Vendors are expected to continue refining their DAS offerings with a focus on 5G, edge computing, and IoT. Integration with smart city infrastructures, automation of network management, and AI-driven performance optimization will be key areas for growth. The expansion into emerging markets will be crucial for long-term success, with regional-specific adaptations needed to cater to local coverage and regulatory requirements.

| Vendor | Key Focus |

|---|---|

| CommScope | Next-gen Active DAS solutions, 5G deployment |

| Corning | Hybrid DAS solutions for large venues |

| SOLiD | Passive DAS solutions for rural and suburban areas |

| Mobilitie | Cost-effective DAS solutions for public venues |

| Zinwave | Industrial DAS solutions for complex environments |

| Anixter | DAS product distribution and integration for enterprises |

CommScope, Corning, and SOLiD lead the market, holding about 50% of the share.

The market will be moderately consolidated with the top vendors controlling 50-60% of the market.

Active DAS is preferred for large-scale, high-capacity networks due to superior signal strength and coverage.

5G is driving growth in the DAS market by increasing demand for high-speed, low-latency coverage in urban areas and public venues.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Distributed Fiber Optic Sensor Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Distributed Cloud Market

Distributed Control System Market

Distributed Temperature Sensing Systems Market Size and Share Forecast Outlook 2025 to 2035

United States Distributed Antenna System (DAS) Market Growth – Trends & Forecast 2024-2034

Distributed Antenna Systems (DAS) Market Insights - Demand, Trends & Outlook 2025 to 2035

Antenna Switch Module Market Size and Share Forecast Outlook 2025 to 2035

Antenna, Transducer, and Radome (ATR) Market Size and Share Forecast Outlook 2025 to 2035

Chip Antenna Market

RFID Antenna Market

Printed Antenna Market Size and Share Forecast Outlook 2025 to 2035

Wireless Antenna Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Antenna Market

Satellite Antenna Market

Microwave Antenna Market

Automotive Antenna Module Market Size and Share Forecast Outlook 2025 to 2035

Flat Panel Antenna Market Size and Share Forecast Outlook 2025 to 2035

Commercial Antennas Market

Base Station Antenna Market Insights - Size, Share & Growth Forecast 2025 to 2035

Far-field Tag Antennas Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA