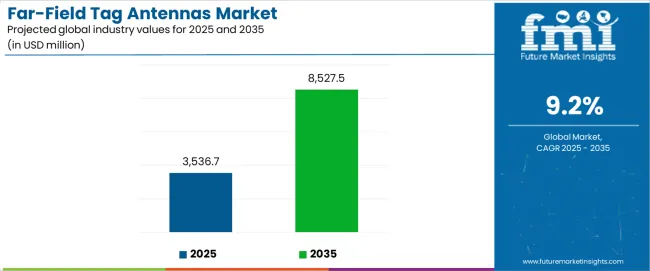

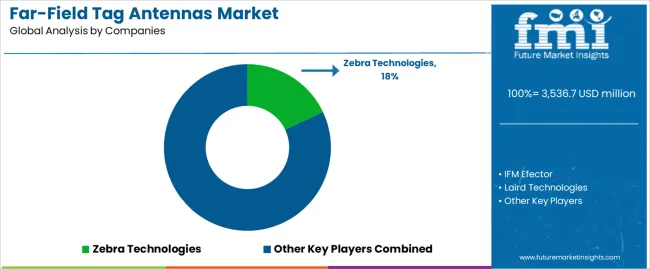

The global far-field tag antennas market is projected to increase from USD 3,536.7 million in 2025 to USD 8,527.5 million by 2035, adding USD 4,990.8 million in value and recording a CAGR of 9.2%. The overall size will grow by about 2.4X, driven by RFID adoption, IoT integration, and advanced automation in logistics, retail, and industry. A year-over-year analysis highlights both steady expansion and certain periods of accelerated demand shaped by technology adoption, regulatory mandates, and regional infrastructure rollouts.

Between 2025 and 2026, the far-field tag antennas market is expected to witness a sharp uptick as governments and enterprises increase RFID implementation for supply chain visibility. This early surge reflects rapid demand growth in retail and warehouse management, where far-field tag antennas improve inventory accuracy and reduce shrinkage. From 2026 to 2027, expansion may stabilize, but growth remains strong as deployments expand into transportation hubs and cross-border logistics facilities. By 2028, incremental value accelerates again, driven by large-scale retail adoption in North America and Europe.

From 2029 to 2030, growth may face temporary moderation due to cost pressures in antenna deployment and integration challenges with legacy IT systems. Despite this, global demand remains positive as IoT-enabled logistics platforms standardize RFID-based tracking. Year-over-year analysis shows that even during periods of moderation, the compound effect of adoption across retail, healthcare, and industrial applications maintains upward momentum. By 2030, the far-field tag antennas market will have already captured close to 50% of forecast gains.

Between 2031 and 2033, expansion intensifies once more as Asia Pacific accelerates adoption, fueled by rapid e-commerce penetration and government-backed initiatives to modernize logistics networks. Growth in these years outpaces earlier forecasts, reflecting regional imbalances where emerging economies are catching up with mature markets. By 2034 and 2035, the year-over-year growth curve begins to stabilize, reflecting maturity in early adopting regions such as North America and Europe, while Asia Pacific and Latin America continue to contribute to incremental expansion. The year-over-year growth trend for the far-field tag antennas market demonstrates alternating phases of rapid adoption and relative stabilization. Peaks coincide with large-scale rollouts in logistics and retail, while troughs reflect temporary adoption slowdowns caused by infrastructure or budgetary constraints. Across the decade, the far-field tag antennas market delivers consistent long-term growth, underpinned by recurring demand for RFID solutions, IoT integration in supply chains, and enterprise focus on efficiency, visibility, and automation.

| Item | Value / Description |

|---|---|

| Market Value (2025) | USD 3,536.7 million |

| Forecast Value (2035) | USD 8,527.5 million |

| Forecast CAGR (2025–2035) | 9.2% |

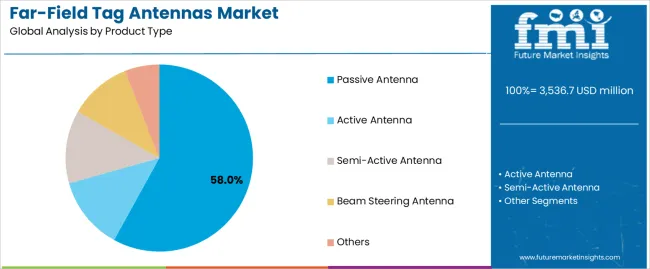

| Leading Product Type (2025) | Active Antenna (58% share) |

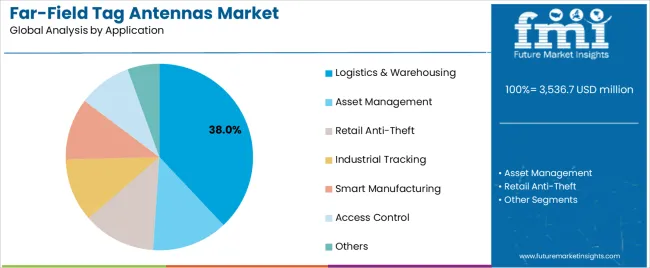

| Leading Application (2025) | Logistics & Warehousing (38% share) |

| Leading Distribution Channel (2025) | Direct Sales (65% share) |

| Key Growth Regions | Asia Pacific; North America; Europe |

| Top Companies by Market Share | Zebra Technologies; IFM Efector; Laird Technologies |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 3,536.7 million |

| Market Forecast Value (2035) | USD 8,527.5 million |

| Forecast CAGR (2025–2035) | 9.2% |

| IoT & AUTOMATION TRENDS | SUPPLY CHaiN REQUIREMENTS | TECHNOLOGY & PErfORMANCE STANDARDS |

|---|---|---|

| IoT Integration Movement --- Continuous expansion of Internet of Things applications across industrial and retail sectors driving demand for advanced rfID antenna solutions. | Supply Chain Visibility --- Modern logistics systems require precision antennas delivering accurate tracking and enhanced inventory management. | Read Range Standards --- Industry requirements establishing performance benchmarks favoring high-gain antenna components. |

| Industrial Automation Growth --- Growing emphasis on automated tracking and real-time inventory monitoring creating demand for reliable far-field antennas. | Warehouse Optimization Demands --- Distribution centers investing in advanced antennas offering precise read capabilities and superior range while maintaining system reliability. | signal Processing Optimization --- Quality standards requiring optimal signal strength distribution and minimal interference in complex environments. |

| Smart Manufacturing Performance --- Superior read range and tracking capabilities making far-field antennas essential for Industry 4.0 applications. | Asset Management Requirements --- Certified antennas with proven specifications required for enterprise asset tracking applications. | Frequency Band Technology Requirements --- Advanced UHF and microwave frequency specifications driving need for precision manufacturing capabilities. |

Category Segments Covered

| Category | Segments / Values |

|---|---|

| By Product Type | Passive Antenna; Active Antenna; Semi-Active Antenna; Beam Steering Antenna; Others |

| By Application | Logistics & Warehousing; Asset Management; Retail Anti-Theft; Industrial Tracking; Smart Manufacturing; Access Control; Others |

| By Frequency Band | UHF (860-960 MHz); Microwave (2.45 GHz); Sub-GHz (433 MHz); Multi-Band; Others |

| By Distribution Channel | Direct Sales; System Integrators; Technology Partners; Online Distributors; Regional Dealers |

| By Region | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Segment | 2025–2035 Outlook |

|---|---|

| Active Antenna | Leader in 2025 with 58% market share; likely to maintain strong position through 2035. Superior performance with integrated amplification, extended read range, and enhanced signal processing. Momentum: strong growth driven by industrial automation. Watchouts: higher power consumption and cost considerations. |

| Passive Antenna | Cost-effective segment with 35.2% share, benefiting from widespread rfID adoption and budget-conscious implementations requiring reliable basic functionality. Momentum: steady growth in price-sensitive markets. Watchouts: limited range compared to active solutions. |

| Semi-Active Antenna | Emerging segment offering balanced performance between passive and active solutions, particularly in asset tracking applications. Momentum: moderate growth in specialized applications requiring extended battery life. |

| Beam Steering Antenna | Advanced technology offering directional control and enhanced precision for specialized industrial applications. Momentum: high growth potential in smart manufacturing and automated systems. |

| Others (MIMO, Phased Array, etc.) | Includes multiple-input multiple-output and phased array antennas for specialized professional applications. High performance specifications, premium market. Momentum: selective growth in advanced industrial and research segments. |

| Segment | 2025–2035 Outlook |

|---|---|

| Logistics & Warehousing | Largest application segment in 2025 at 38% share, supported by e-commerce growth and automated distribution centers. Driven by supply chain optimization and real-time inventory management requirements. Momentum: strong growth from logistics automation and warehouse modernization investments. Watchouts: integration complexity with existing systems. |

| Asset Management | Key segment for enterprise asset tracking and industrial equipment monitoring. Requires high-precision antennas for accurate location identification and status monitoring. Momentum: steady growth through digital transformation initiatives. Watchouts: competition from alternative tracking technologies. |

| Retail Anti-Theft | Traditional retail security applications requiring reliable detection and inventory protection systems. Momentum: moderate growth in omnichannel retail implementations. Watchouts: shift toward integrated retail management systems. |

| Industrial Tracking | Manufacturing and production environments demanding robust antennas for work-in-progress tracking and quality control applications. Momentum: strong growth from Industry 4.0 adoption. Watchouts: harsh environment requirements and interference challenges. |

| Smart Manufacturing | Advanced manufacturing systems integrating rfID antennas for automated production monitoring, quality assurance, and process optimization. Momentum: high growth potential in automated factories. Watchouts: technology integration complexity and standardization requirements. |

| Distribution Channel | Status & Outlook (2025–2035) |

|---|---|

| Direct Sales | Dominant channel in 2025 with 65% share for enterprise and industrial applications. Offers technical consultation, custom configuration, and comprehensive support services. Momentum: steady growth driven by complex system requirements and professional installations. Watchouts: resource-intensive sales process and margin pressure. |

| System Integrators | Rapidly growing channel serving complex installations requiring specialized expertise and multi-vendor solutions. Provides value through complete system design and implementation. Momentum: strong growth as enterprises seek turnkey solutions; digital transformation accelerating adoption. |

| Technology Partners | Strategic channel for OEM integrations and technology partnerships in specialized applications. Momentum: rising as antenna manufacturers collaborate with system vendors. Focus on co-development and technology licensing. |

| Online Distributors | Expanding channel for standard products and smaller volume requirements. Includes specialized rfID component distributors and general electronics suppliers. Momentum: moderate growth in commodity antenna segments with enhanced logistics and technical support. |

| Regional Dealers | Local channel serving regional markets and smaller enterprises requiring local support and service. Expert knowledge of regional requirements and regulatory compliance. Momentum: selective growth in emerging markets and specialized regional applications. |

| DRIVERS | RESTRaiNTS | KEY TRENDS |

|---|---|---|

| Rapid IoT adoption across industrial and retail sectors is driving demand for advanced rfID antenna solutions enabling comprehensive tracking capabilities. | High implementation costs and complex system integration requirements limit adoption among smaller enterprises and cost-sensitive applications. | Development of beamforming technology, advanced signal processing, and multi-band capabilities are enabling superior performance and coverage. |

| Supply Chain Digitization --- Increasing demand for real-time visibility and automated inventory management is creating demand for precision antenna components. | Technical Complexity --- Setup requirements and integration challenges affect deployment speed and maintenance capabilities across diverse environments. | Miniaturization Innovation --- Enhanced antenna designs, improved gain characteristics, and optimized form factors are advancing application possibilities. |

| Industrial Automation Growth --- Rising demand for automated tracking in manufacturing and warehouse applications fuels steady antenna adoption across enterprise segments. | Interference Challenges --- RF interference and environmental factors impact system performance and reliability in complex industrial environments. | Specialized Application Development --- Emerging demand for antennas tailored to healthcare, automotive, and smart city applications requiring specific performance characteristics. |

| Regulatory Compliance Requirements --- Industry standards and traceability mandates drive adoption of reliable tracking solutions across various sectors. | Technology Obsolescence --- Rapid advancement in competing technologies and evolving standards create uncertainty in long-term investment decisions. | Ongoing R&D Focus --- Continuous improvement in antenna gain, frequency optimization, and environmental durability to meet evolving industrial and commercial standards. |

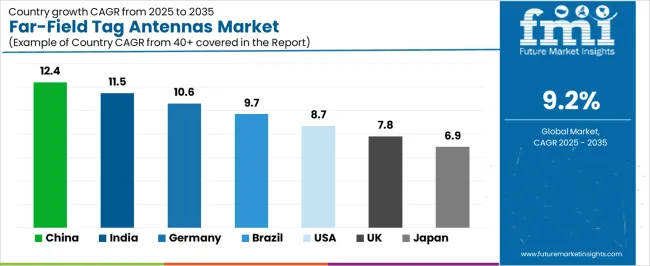

| Country | CAGR (2025–2035) |

|---|---|

| China | 12.4% |

| India | 11.5% |

| Germany | 10.6% |

| Brazil | 9.7% |

| United States | 8.7% |

| United Kingdom | 7.8% |

| Japan | 6.9% |

Revenue from Far-Field Tag Antennas in China is projected to exhibit strong growth with a market value of USD 1,892.3 million by 2035, driven by expanding IoT infrastructure development and comprehensive smart manufacturing initiatives creating substantial opportunities for antenna suppliers across logistics operations, industrial automation sectors, and enterprise tracking applications. The country's established electronics manufacturing tradition and expanding rfID capabilities are creating significant demand for both passive and active antenna systems. Major technology companies and manufacturing enterprises including Alibaba, Tencent, and BYD are establishing comprehensive local antenna production facilities to support large-scale automation operations and meet growing demand for efficient tracking solutions.

Revenue from Far-Field Tag Antennas in India is expanding to reach USD 1,456.7 million by 2035, supported by extensive digital transformation initiatives and comprehensive IoT adoption programs creating demand for reliable antenna solutions across diverse industrial automation categories and enterprise tracking segments. The country's growing technology sector and expanding manufacturing capabilities are driving demand for antenna solutions that provide consistent tracking performance while supporting cost-effective system requirements. Technology integrators and industrial automation providers are investing in local market development to support growing enterprise operations and manufacturing automation demand.

Demand for Far-Field Tag Antennas in Germany is projected to reach USD 1,267.8 million by 2035, supported by the country's leadership in Industry 4.0 implementation and advanced automation technologies requiring sophisticated rfID systems for manufacturing and logistics applications. German industrial companies are implementing high-precision tracking systems that support advanced read range capabilities, operational reliability, and comprehensive quality protocols. The far-field tag antennas market is characterized by focus on engineering excellence, system integration, and compliance with stringent industrial automation and performance standards.

Revenue from Far-Field Tag Antennas in Brazil is growing to reach USD 1,089.4 million by 2035, driven by industrial modernization programs and increasing automation adoption creating opportunities for antenna suppliers serving both manufacturing operations and logistics contractors. The country's expanding industrial sector and growing technology awareness are creating demand for antenna components that support diverse industrial requirements while maintaining performance standards. System integrators and automation equipment service providers are developing distribution strategies to support operational efficiency and customer satisfaction.

Demand for Far-Field Tag Antennas in United States is projected to reach USD 967.2 million by 2035, expanding at a CAGR of 8.7%, driven by advanced automation technologies and specialized industrial capabilities supporting comprehensive supply chain development and high-performance tracking applications. The country's established manufacturing automation tradition and mature enterprise technology markets are creating demand for high-quality antenna components that support operational performance and tracking standards. Antenna manufacturers and system integration suppliers are maintaining comprehensive development capabilities to support diverse industrial requirements.

Revenue from Far-Field Tag Antennas in United Kingdom is growing to reach USD 823.7 million by 2035, supported by supply chain innovation initiatives and established logistics automation communities driving demand for advanced antenna solutions across traditional distribution systems and modern e-commerce applications. The country's strong logistics heritage and established technology integration capabilities create demand for antenna components that support both legacy system upgrades and modern automated applications.

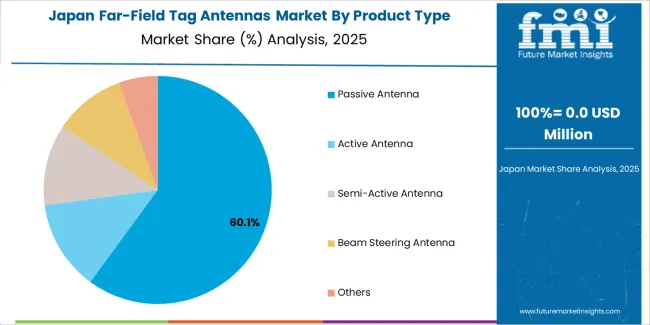

Demand for Far-Field Tag Antennas in Japan is projected to reach USD 756.8 million by 2035, driven by precision manufacturing tradition and established antenna technology leadership supporting both domestic industrial automation markets and export-oriented component production. Japanese companies maintain sophisticated antenna development capabilities, with established manufacturers continuing to lead in high-frequency technology and precision manufacturing standards.

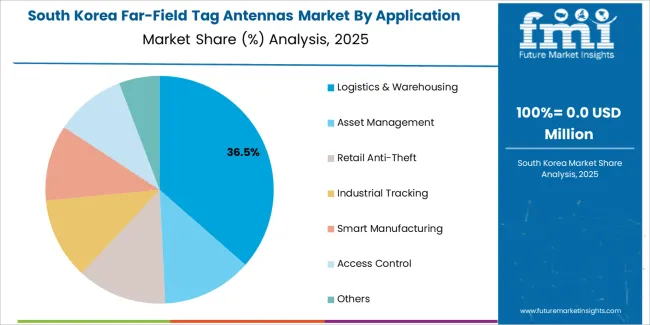

South Korean Far-Field Tag Antenna operations reflect the country's advanced electronics manufacturing sector and export-oriented business model. Major conglomerates including Samsung and LG drive component procurement strategies for their industrial automation divisions, establishing direct relationships with specialized antenna suppliers to secure consistent quality and pricing for their IoT and rfID system operations targeting both domestic and international markets.

The Korean market demonstrates particular strength in integrating antenna technologies into consumer electronics and industrial automation formats, with companies developing products that bridge traditional rfID applications and modern smart manufacturing systems. This integration approach creates demand for specific performance specifications that differ from traditional applications, requiring suppliers to adapt frequency characteristics and signal processing capabilities.

Regulatory frameworks emphasize electronics safety and electromagnetic compatibility, with Korean Communications Commission standards often exceeding international requirements. This creates barriers for smaller component suppliers but benefits established manufacturers who can demonstrate compliance capabilities. The regulatory environment particularly favors suppliers with KCC certification and comprehensive documentation systems.

Supply chain efficiency remains critical given Korea's technological advancement focus and competitive market dynamics. Companies increasingly pursue development contracts with suppliers in Japan, Germany, and specialized manufacturers to ensure access to advanced antenna technologies while managing technological risks. Investment in research and development supports quality advancement during extended product development cycles.

European Far-Field Tag Antenna operations are increasingly concentrated between German industrial automation leadership and broader EU manufacturing modernization initiatives. German facilities dominate high-performance antenna production for industrial and enterprise applications, leveraging advanced signal processing technologies and strict quality protocols that command price premiums in global markets. Nordic manufacturers maintain leadership in specialized antenna designs and harsh environment applications, with companies like Nokia and Ericsson driving technical specifications that smaller suppliers must meet to access industrial automation contracts.

Eastern European operations in Czech Republic, Poland, and Hungary are capturing volume-oriented production contracts through skilled labor advantages and EU regulatory compliance, particularly in passive antennas for logistics and warehouse applications. These facilities increasingly serve as manufacturing capacity for Western European brands while developing their own engineering expertise.

The regulatory environment presents both opportunities and constraints. CE marking requirements create quality standards that favor established European manufacturers over imports while ensuring consistent performance specifications. GDPR compliance has created additional complexity for tracking applications, driving opportunities for privacy-compliant antenna solutions and secure data handling capabilities.

Supply chain consolidation accelerates as manufacturers seek economies of scale to absorb rising material costs and precision manufacturing expenses. Vertical integration increases, with major automation system manufacturers acquiring antenna production facilities to secure component supplies and quality control. Smaller manufacturers face pressure to specialize in niche applications or risk displacement by larger, more efficient operations serving mainstream industrial automation requirements.

Profit pools are consolidating upstream in advanced signal processing and RF circuit manufacturing and downstream in application-specific antenna designs for industrial automation, logistics, and enterprise tracking markets where certification, read range performance, and consistent tracking reliability command premiums. Value is migrating from basic passive antenna production to specification-driven, application-ready components where engineering expertise, frequency optimization, and reliable signal processing create competitive advantages.

Several archetypes define market leadership: established technology companies defending share through system integration expertise and comprehensive product portfolios; specialized RF component manufacturers leveraging antenna design intellectual property and industrial relationships; enterprise solution providers with automation system connections and professional service capabilities; and emerging manufacturers pursuing cost-competitive production while developing technical capabilities. Switching costs - system compatibility, professional certification, enterprise integration - provide stability for established suppliers, while technological advancement and performance requirements create opportunities for innovative manufacturers.

Consolidation continues as companies seek manufacturing scale and technology breadth; direct enterprise sales grow for complex systems while traditional distribution remains relationship-driven. Focus areas: secure industrial automation and enterprise market positions with application-specific performance specifications and technical support; develop RF technology and precision manufacturing capabilities; explore specialized applications including smart manufacturing, healthcare tracking, and smart city implementations.

| Stakeholder Type | Primary Advantage | Repeatable Plays |

|---|---|---|

| Technology Integration Leaders | System integration expertise; comprehensive product portfolios; established enterprise relationships | Complete solution development; cross-platform compatibility; enterprise service delivery |

| rf Specialist Manufacturers | Advanced antenna design; frequency optimization expertise; superior signal processing capabilities | Precision manufacturing; adherence to RF specifications; custom antenna development |

| Enterprise Solution Providers | Application expertise; technical support; trusted by industrial and logistics customers | Enterprise relationships; professional-grade specifications; service-based support |

| Emerging Cost-Competitive Producers | Manufacturing efficiency; cost-effective production; competitive market pricing | Production scaling; technology development; market entry strategies |

| System Integrators | Technical integration networks; installation and configuration support | Technical expertise; system design services; customer training and support |

| Item | Value |

|---|---|

| Quantitative Units | USD 3,536.7 million |

| Product Types | Passive Antenna; Active Antenna; Semi-Active Antenna; Beam Steering Antenna; Others |

| Applications | Logistics & Warehousing; Asset Management; Retail Anti-Theft; Industrial Tracking; Smart Manufacturing; Access Control |

| Frequency Band | UHF (860-960 MHz), Microwave (2.45 GHz), Sub-GHz (433 MHz), Multi-Band, Others |

| Distribution Channels | Direct Sales; System Integrators; Technology Partners; Online Distributors; Regional Dealers |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East & Africa |

| Key Countries | China; India; Germany; Brazil; United States; United Kingdom; Japan (+35 additional countries) |

| Key Companies Profiled | Zebra Technologies; IFM Efector; Laird Technologies; Harting; Molex; Abracon; Kathrein Solutions; Honeywell International; rfRain; PREMO USA; Tec-Tus; Impinj; Invengo rfID; Myers Engineering International; Murata Electronics; Alien Technology; TagItron GmbH |

| Additional Attributes | Dollar sales by product and distribution channel; Regional demand trends (NA, EU, APAC); Competitive landscape; Direct vs. channel adoption patterns; Manufacturing and system integration; RF engineering innovations driving tracking enhancement, performance reliability, and technical excellence |

The global far-field tag antennas market is estimated to be valued at USD 3,536.7 million in 2025.

The market size for the far-field tag antennas market is projected to reach USD 8,527.5 million by 2035.

The far-field tag antennas market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types in far-field tag antennas market are passive antenna, active antenna, semi-active antenna, beam steering antenna and others.

In terms of application, logistics & warehousing segment to command 38.0% share in the far-field tag antennas market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tags Market Insights - Growth & Demand 2025 to 2035

Tagatose Market Analysis by Application, Sweetness Profile, Industry Demand, and Regional Forecast from 2025 to 2035

Metagenomics Market Trends - Industry Analysis & Forecast 2025 to 2035

Outage Management System Market Insights – Forecast 2025-2035

Voltage Tester Market Size and Share Forecast Outlook 2025 to 2035

Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Voltage Regulator For Advanced Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

Voltage Detector Market Size and Share Forecast Outlook 2025 to 2035

Voltage Transducer Market Size and Share Forecast Outlook 2025 to 2035

Voltage Controlled Oscillators Market Size and Share Forecast Outlook 2025 to 2035

Postage Stamp Paper Market Size, Share & Forecast 2025 to 2035

Global Vintage Packaging Market Growth – Trends & Forecast 2024-2034

Market Share Breakdown of Heritage Tourism Service Providers

Global Heritage Tourism Market Analysis by Experience Type, by End User, and by Region - Forecast for 2025 to 2035

NFC Tag ICs Market Analysis by Memory, Connection, Application, Industry and Region Through 2025 to 2035

Heritage Railway Train Market Analysis – Trends & Forecast 2024-2034

Hang Tag Applicators Market Size and Share Forecast Outlook 2025 to 2035

Hang Tags Market Insights – Growth & Trends Forecast 2025 to 2035

Multistage Ring Section Pumps Market Size and Share Forecast Outlook 2025 to 2035

Multistage Electric Submersible Pump Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA