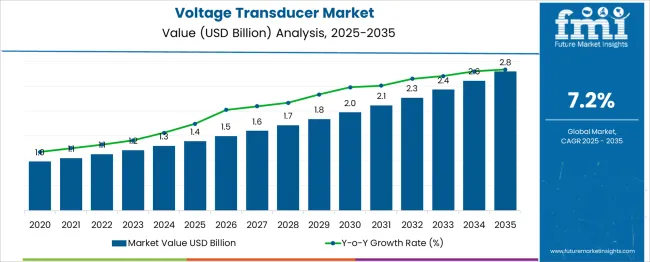

The Voltage Transducer Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 2.8 billion by 2035, registering a compound annual growth rate (CAGR) of 7.2% over the forecast period.

| Metric | Value |

|---|---|

| Voltage Transducer Market Estimated Value in (2025 E) | USD 1.4 billion |

| Voltage Transducer Market Forecast Value in (2035 F) | USD 2.8 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

The voltage transducer market is progressing steadily as global industries prioritize electrical monitoring, safety, and efficiency across various high-voltage environments. The increasing integration of smart grid infrastructure, renewable energy systems, and advanced automation in industrial operations has driven widespread adoption of voltage transducers for real-time measurement and control.

Demand is further supported by the growing emphasis on system reliability and predictive maintenance in energy-intensive sectors. Ongoing innovations in compact design, signal accuracy, and digital interface compatibility are enhancing product performance and market attractiveness.

With regulatory bodies enforcing stricter power quality and safety standards, voltage transducers are becoming indispensable in modern electrical networks. The future outlook is promising, particularly with the rise in electrification initiatives and infrastructure upgrades across both developed and emerging markets.

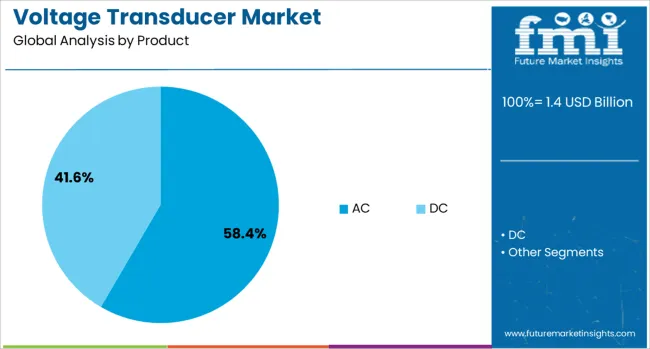

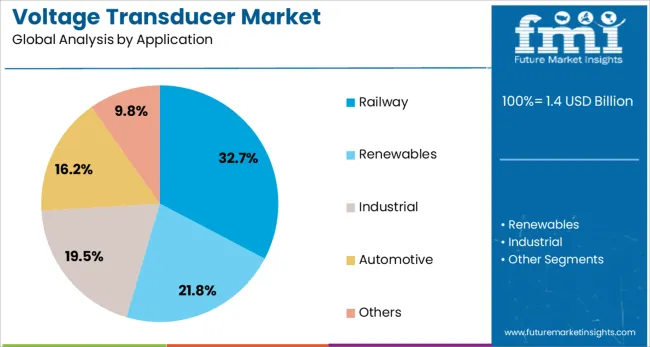

The voltage transducer market is segmented by product and application and geographic regions. By product of the voltage transducer market is divided into AC and DC. In terms of application of the voltage transducer market is classified into Railway, Renewables, Industrial, Automotive, and Others. Regionally, the voltage transducer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The AC segment dominates the voltage transducer market with a commanding 58.40% share, reflecting its critical role in industrial and power distribution applications. AC voltage transducers are widely deployed for monitoring alternating current parameters in environments such as manufacturing facilities, substations, and energy distribution grids.

Their ability to offer accurate, isolated signal conversion for AC voltages ensures operational safety and control system efficiency. The segment benefits from the widespread use of AC power systems in global infrastructure, along with a strong replacement demand for legacy analog transducers with digital-ready variants.

Enhanced designs offering compact form factors, low power consumption, and integration with IoT platforms are further supporting adoption. As industries transition toward smarter, automated networks, the need for precise AC voltage monitoring is expected to maintain the segment’s leadership.

The railway segment accounts for 32.70% of the application share in the voltage transducer market, driven by the critical requirement for electrical monitoring in traction systems, onboard power management, and signaling infrastructure. Voltage transducers are essential in rail environments to ensure the reliable and safe conversion of high-voltage signals for monitoring control systems, protecting sensitive components from voltage surges, and enabling energy-efficient train operations.

The electrification of railway networks across Asia, Europe, and parts of North America has significantly contributed to increased adoption. Additionally, the shift toward high-speed rail and the integration of renewable power sources in rail systems are further driving demand for advanced transducer solutions.

As global transportation policies focus on sustainable and low-emission mobility, the railway segment is expected to remain a vital application area within the voltage transducer market.

Voltage transducers are being integrated into power distribution systems, industrial automation and renewable energy installations to enable accurate voltage measurement, monitoring and signal conversion. Industries such as utility networks, switchgear assembly, and solar farms have implemented transducers for grid stability, predictive maintenance and process control. Demand has been supported by requirements for safety compliance, real-time diagnostics and digital control system integration within SCADA and PLC platforms.

Voltage transducers have been selected to ensure accurate voltage sensing across medium and high voltage networks where precise measurement is critical. Devices with transformer isolation and compact footprint enabled safe installation within panel boards and switchgear cubicles. Real-time voltage data allowed operational systems to detect anomalies, maintain power quality and support fault diagnostics. Compliance with IEC and ANSI measurement standards encouraged adoption among utilities and industrial operators. Data outputs in 4‑20 mA, voltage analog, and Modbus formats were integrated into SCADA networks for remote monitoring. As voltage instability and harmonics challenges increased in distributed energy systems, transducer deployment was increased to maintain system integrity and support predictive maintenance workflows.

Voltage transducer deployment has been limited by challenges in managing electromagnetic interference and maintaining signal accuracy in noisy electrical environments. Calibration requirements for high-voltage sensors have imposed maintenance intervals and certified validation procedures. Variations in output range, burden resistance and response speed across device models have complicated integration into existing control systems. Transducers requiring external power supplies or auxiliary modules increased installation complexity and panel footprint. Small utilities and industrial users have faced budget constraints due to high-spec transducer pricing and setup costs. As remote sites and microgrid projects expanded, difficulties in sourcing compatible transducer variants and managing field calibration logistics have restricted faster adoption.

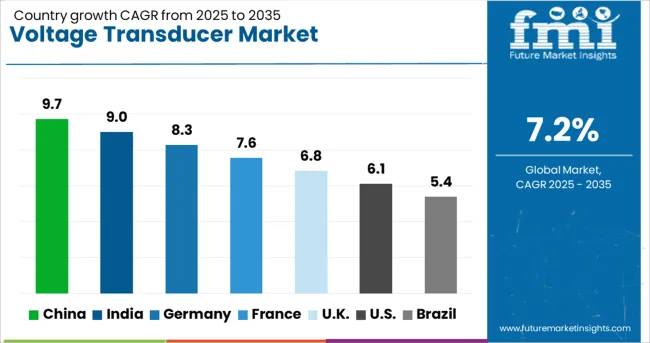

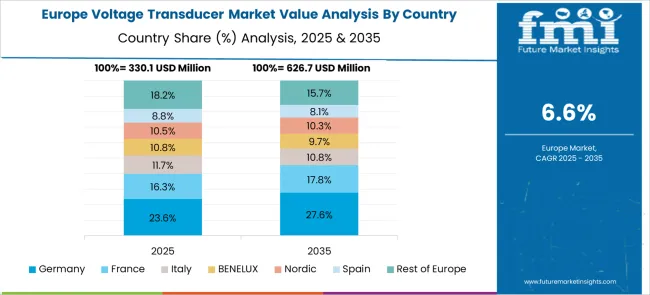

| Country | CAGR |

|---|---|

| China | 9.7% |

| India | 9.0% |

| Germany | 8.3% |

| France | 7.6% |

| UK | 6.8% |

| USA | 6.1% |

| Brazil | 5.4% |

The global voltage transducer market is projected to grow at a CAGR of 7.2% from 2025 to 2035. China leads with 9.7%, followed by India at 9% and Germany at 8.3%. France records 7.6%, while the United Kingdom posts 6.8%. Growth is driven by rising demand for grid monitoring, renewable energy integration, and industrial automation.

China and India dominate due to grid modernization and EV infrastructure projects, while Germany emphasizes high-precision transducers for smart grid and renewable systems. France and the UK prioritize advanced transducer designs for industrial and energy applications under decarbonization strategies.

China is forecast to grow at 9.7%, driven by massive power grid expansion and renewable energy deployment. Local manufacturers are investing in digital and high-accuracy transducers for smart substations. Widespread EV adoption boosts demand for transducers in fast-charging networks. Integration of IoT-enabled monitoring systems enhances reliability and predictive maintenance in power infrastructure.

India is projected to grow at 9%, supported by strong investments in renewable energy projects and transmission infrastructure upgrades. Industrial automation and increased demand for power quality monitoring enhance transducer adoption in manufacturing hubs. Government-driven initiatives for 24/7 power supply and microgrid development create opportunities for high-performance voltage sensing solutions.

Germany is forecast to grow at 8.3%, supported by its leadership in renewable integration and smart energy systems. Voltage transducers are increasingly used for dynamic load management in distributed energy resources. German OEMs emphasize R&D for transducers compatible with high-frequency switching applications in EV chargers and solar inverters. Compliance with strict EU energy efficiency norms drives innovation in ultra-low power designs.

France is projected to grow at 7.6%, driven by electrification of transportation and modernization of power infrastructure. Manufacturers focus on compact, modular transducers for space-constrained industrial panels. Growing deployment of offshore wind energy systems further boosts demand for high-performance monitoring solutions. Integration with SCADA systems improves remote control and fault detection capabilities.

The UK is expected to grow at 6.8%, driven by grid reinforcement projects and accelerated renewable energy penetration. Manufacturers prioritize intelligent transducers with real-time data analytics for grid performance optimization. Demand for high-isolation devices increases in EV charging and rail electrification projects. Digital platforms supporting remote calibration and monitoring enhance operational efficiency.

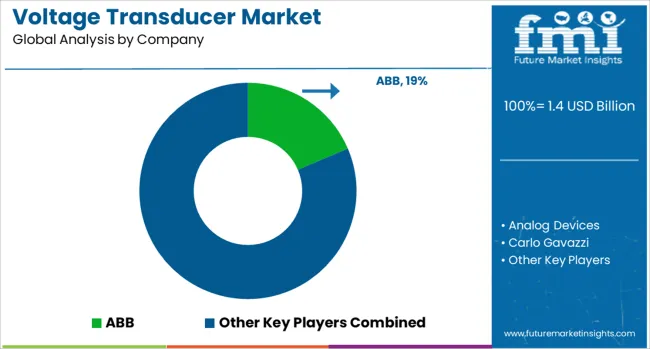

The voltage transducer market is moderately consolidated, led by ABB with an 18.6% market share. The company holds a dominant position through its advanced sensor technologies, broad product portfolio, and strong presence in global power monitoring and automation applications. Dominant player status is held exclusively by ABB. Key players include Analog Devices, Carlo Gavazzi, CR Magnetics, LEM International, NK Technologies, Phoenix Contact, Schneider Electric, Siemens, and Socomec, each offering voltage transducers designed for accurate measurement, energy monitoring, and integration into industrial and utility systems. Emerging players remain limited in this segment due to high technical standards, compliance requirements, and the strong market position of established electrical equipment manufacturers. Market demand is driven by the expansion of smart grid infrastructure, increasing focus on energy efficiency, and rising adoption of advanced monitoring solutions in industrial automation and renewable energy projects.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion |

| Product | AC and DC |

| Application | Railway, Renewables, Industrial, Automotive, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Analog Devices, Carlo Gavazzi, CR Magnetics, LEM International, NK Technologies, Phoenix Contact, Schneider Electric, Siemens, and Socomec |

| Additional Attributes | Dollar sales by transducer type (isolated, non-isolated, fiber-optic), regional demand trends, competitive landscape, buyer preferences for high accuracy, safety, and fast response, integration with smart grids and power quality monitoring systems, innovations in wireless communication, digital-output formats, miniaturization, and wide-bandwidth transducers for renewable and industrial automation applications. |

The global voltage transducer market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the voltage transducer market is projected to reach USD 2.8 billion by 2035.

The voltage transducer market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in voltage transducer market are ac and dc.

In terms of application, railway segment to command 32.7% share in the voltage transducer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

AC Voltage Transducer Market Size and Share Forecast Outlook 2025 to 2035

Voltage Tester Market Size and Share Forecast Outlook 2025 to 2035

Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Voltage Regulator For Advanced Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

Voltage Detector Market Size and Share Forecast Outlook 2025 to 2035

Voltage Controlled Oscillators Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Components Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Substation Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Disconnect Switch Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Commercial Electric Boiler Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Composite Insulators Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Drives Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Electric Boiler Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA