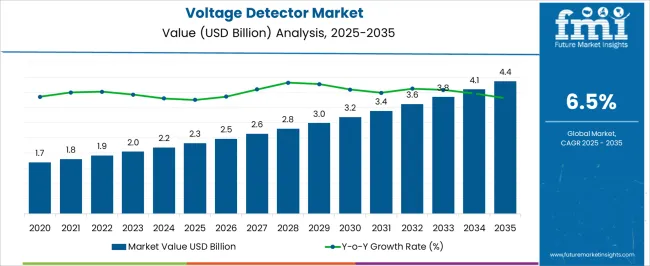

The voltage detector market is estimated to be valued at USD 2.3 billion in 2025 and is projected to reach USD 4.4 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period. The Asia-Pacific region is positioned as the largest contributor to market growth, reflecting strong demand from emerging economies where rapid electrification, industrialization, and smart grid initiatives drive increased adoption of voltage detection technologies. Between 2025 and 2035, the Asia-Pacific region is expected to consistently outpace other regions, leveraging high-volume deployment in construction, energy distribution, and manufacturing sectors, which together sustain the region’s dominant market share.

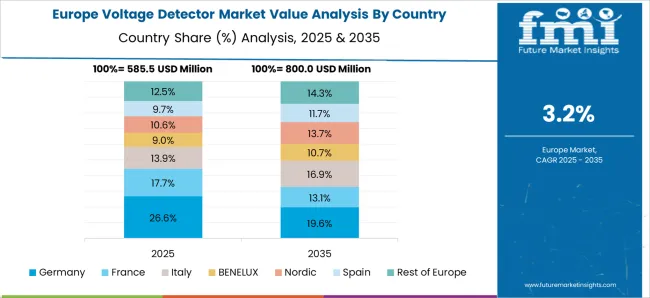

Europe demonstrates steady, moderate growth due to mature electrical infrastructure and stringent safety regulations. The European market benefits from a regulatory environment that emphasizes compliance and operational safety, ensuring sustained demand for advanced voltage detection solutions. However, overall expansion remains slower compared to the Asia-Pacific region due to a saturated installation base. North America shows incremental growth, supported by technological adoption in industrial automation and utility management, but the pace is constrained by established infrastructure and slower expansion relative to Asia-Pacific.

By 2035, the market is projected at USD 4.4 billion, with Asia-Pacific capturing the largest share, Europe maintaining moderate contribution, and North America providing stable yet comparatively limited growth. The regional imbalance underscores the correlation between infrastructure investment, regulatory enforcement, and technology adoption in driving voltage detector market expansion across geographies.

Production environments experience operational complexity when integrating voltage detectors into existing electrical safety procedures. Plant electricians coordinate with equipment operators to establish lockout-tagout protocols that incorporate voltage verification steps without disrupting production flow. This creates training requirements spanning multiple departments as operators, maintenance technicians, and safety personnel must understand both detection equipment capabilities and procedural modifications required for different voltage ranges and equipment configurations.

Utility infrastructure teams face installation challenges as voltage detectors require integration with existing switchgear and distribution equipment that may have varying voltage ratings and connection configurations. Field crews coordinate with engineering departments to evaluate compatibility between detection devices and legacy electrical systems, particularly when retrofitting older substations where space constraints and existing cable routing limit detector placement options.

Cross-functional coordination between safety departments and operations management creates ongoing tension around voltage detection protocols. Safety teams prioritize comprehensive verification procedures while production managers focus on minimizing downtime duration. This dynamic influences equipment selection as facilities evaluate detector response times, accuracy specifications, and reset procedures against operational efficiency requirements across different voltage ranges and system configurations.

| Metric | Value |

|---|---|

| Voltage Detector Market Estimated Value in (2025 E) | USD 2.3 billion |

| Voltage Detector Market Forecast Value in (2035 F) | USD 4.4 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The voltage detector market is experiencing notable expansion as industries, utilities, and residential sectors prioritize electrical safety, energy efficiency, and smart monitoring. Driven by advancements in semiconductor integration, digital sensing, and real-time monitoring technologies, voltage detectors have evolved into essential tools across both maintenance and operational domains. The growing demand for contactless inspection methods, predictive maintenance, and faster fault detection in live circuits is encouraging widespread adoption of portable and panel-integrated voltage detectors.

Technological improvements in sensitivity, multi-voltage compatibility, and real-time data feedback are enhancing user safety and diagnostic accuracy. Regulatory pressure around occupational safety and stricter electrical compliance standards have further accelerated the adoption of voltage detection tools across industrial, construction, and energy segments.

As infrastructure modernization gains momentum globally and grid networks incorporate more renewable sources, the need for accurate voltage monitoring is becoming critical The future outlook remains positive, supported by the integration of IoT-enabled diagnostics and digital displays in next-generation devices.

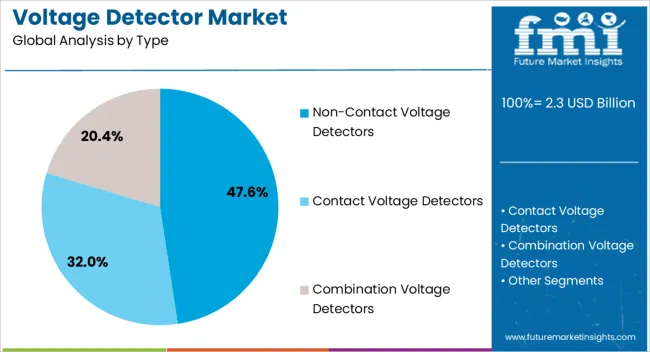

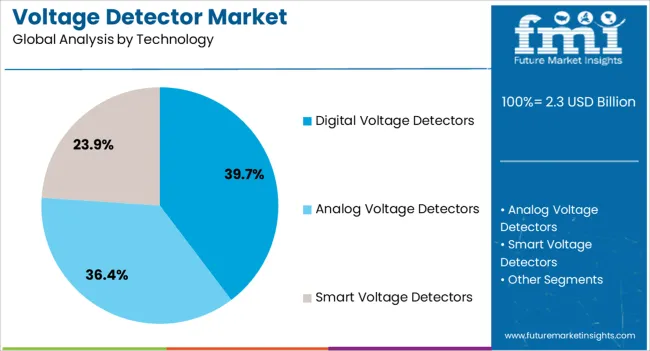

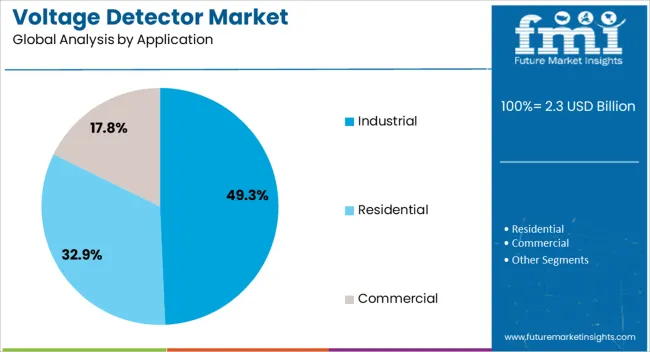

The voltage detector market is segmented by type, technology, application, end use, and geographic regions. By type, the voltage detector market is divided into Non-Contact Voltage Detectors, Contact Voltage Detectors, and Combination Voltage Detectors. In terms of technology, the voltage detector market is classified into Digital Voltage Detectors, Analog Voltage Detectors, and Smart Voltage Detectors. Based on the application, the voltage detector market is segmented into Industrial, Residential, and Commercial. By end use, the voltage detector market is segmented into Electrical Testing, Maintenance, and Construction. Regionally, the voltage detector industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The non contact voltage detectors segment is expected to account for 47.6% of the total revenue share in the voltage detector market in 2025, making it the leading product type. Growth of this segment is being driven by its ability to detect voltage presence without requiring direct contact with conductors, which significantly enhances user safety during electrical inspections. These detectors are being increasingly preferred in residential, commercial, and industrial applications due to their compact design, affordability, and ease of operation.

Improvements in capacitive sensing technology and automatic range detection have allowed more accurate voltage identification even in low-voltage scenarios. The ability to provide visual and audio alerts, combined with insulation-safe design, has reduced accident risks in live circuit environments.

Additionally, non contact devices have been favored for their maintenance-free operation and suitability for confined or complex wiring systems Their rapid adoption is being supported by stringent safety regulations and a growing emphasis on efficient fault detection methods across energy infrastructure and utility sectors.

The digital voltage detectors segment is projected to represent 39.7% of the overall revenue share in the voltage detector market in 2025. The dominance of this segment is being attributed to its precision-based measurement capabilities and integration with microcontroller-based systems. These detectors have gained traction in industrial and electrical utility environments where real-time accuracy and intelligent feedback are critical for operational continuity.

Advancements in display interfaces, signal processing algorithms, and microchip integration have significantly improved functionality, enabling users to view exact voltage values, frequency, and signal strength. Unlike analog counterparts, digital detectors offer high reliability, enhanced calibration features, and longer operational life.

Software-based customization and digital fault logging capabilities have contributed to wider adoption in power distribution, machinery maintenance, and renewable energy systems Moreover, compliance with international safety and performance standards has positioned digital voltage detectors as a future-ready solution for precision-focused electrical diagnostics across dynamic power environments.

The industrial application segment is forecast to hold 49.3% of the total revenue share in the voltage detector market by 2025, highlighting its dominant position. Growth in this segment is being supported by the widespread deployment of voltage detectors across manufacturing plants, substations, process industries, and heavy electrical infrastructure. Increased automation and the integration of high-voltage machinery have made regular voltage monitoring essential for safety and operational efficiency.

Industrial operators are favoring detectors that provide rapid, accurate readings to support predictive maintenance and avoid equipment damage. Digital interfaces, programmable alarms, and extended detection ranges are enabling real-time fault identification across motor control panels, switchgears, and transformers.

The need to meet workplace safety standards and minimize downtime in mission-critical environments has led to consistent investment in advanced detection technologies As industries transition toward Industry 4.0 frameworks, voltage detectors with smart diagnostic capabilities are expected to play a pivotal role in supporting automated inspection and compliance-driven electrical monitoring systems.

The market has been expanding due to increasing demand for electrical safety, maintenance, and monitoring solutions across industrial, commercial, and residential sectors. Voltage detectors have been valued for their ability to identify live wires, prevent electrical hazards, and ensure compliance with safety regulations. Market growth has been reinforced by technological advancements in non-contact detection, LED indicators, and multifunctional designs. Rising adoption in power utilities, construction, and manufacturing operations has further strengthened demand, positioning voltage detectors as critical devices for electrical safety, operational efficiency, and hazard prevention worldwide.

The market has been significantly driven by adoption in industrial and construction applications, where electrical safety and reliable voltage monitoring are critical. Detectors have been employed to check live wires, verify circuits, and prevent short circuits, shocks, and accidental contact with energized equipment. Industrial plants, construction sites, and commercial facilities have relied on handheld, portable, and non-contact voltage detectors for maintenance and troubleshooting. Rising installation of complex electrical systems, including high-voltage networks and automation equipment, has increased the need for reliable detection solutions. Safety compliance standards and regulatory frameworks have further reinforced demand, requiring accurate voltage testing and monitoring. Manufacturers have introduced ergonomic, durable, and multifunctional designs with audible, visual, and digital indicators. The combination of safety, operational efficiency, and reliability has established voltage detectors as indispensable tools across industrial and construction sectors worldwide.

Technological advancements have strengthened the market by improving accuracy, user convenience, and safety features. Non-contact voltage detection, integrated LED indicators, digital displays, and audible alarms have enhanced usability while reducing risk of accidental contact. Multi-function devices combining voltage detection with continuity, current, and resistance measurement have enabled comprehensive electrical diagnostics. Portable, battery-operated designs with ergonomic grips have facilitated safe operation in confined and high-risk environments. Integration with IoT-enabled platforms and data logging systems has allowed remote monitoring, automated alerts, and predictive maintenance for industrial and commercial operations. These innovations have reinforced the effectiveness of voltage detectors in maintaining workplace safety, improving electrical troubleshooting, and ensuring compliance with electrical standards, making them essential for modern electrical maintenance and operational management globally.

The market has been reinforced by adoption in power utilities, energy generation, and distribution networks. Detectors have been employed for routine inspection, maintenance, and fault identification in transmission lines, substations, and renewable energy installations. Non-contact and digital voltage detectors have improved operational efficiency while reducing downtime and minimizing risks for technicians working with high-voltage equipment. Integration with smart grid infrastructure and automated maintenance protocols has allowed accurate monitoring of electrical networks, facilitating early fault detection and preventive measures. Rising investments in grid modernization, renewable energy deployment, and energy storage systems have further strengthened demand. Voltage detectors have become crucial for ensuring worker safety, operational reliability, and regulatory compliance across the energy and utilities sector worldwide.

Despite growth, the market has faced challenges associated with device cost, durability, and environmental sensitivity. High-precision digital and multifunction detectors have required advanced circuitry, sensors, and safety features, increasing production and retail prices. Environmental factors, including extreme temperatures, humidity, dust, and electromagnetic interference, have influenced performance and reliability. Maintenance, battery replacement, and calibration have posed operational considerations, particularly for industrial and utility applications. Manufacturers have responded with ruggedized designs, automated self-testing functions, and energy-efficient components to enhance durability and reliability. Continuous improvements in detection sensitivity, operational safety, and device robustness have been critical for sustaining adoption across industrial, commercial, and energy sectors globally.

| Countries | CAGR |

|---|---|

| China | 8.8% |

| India | 8.2% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

The market is projected to grow at a CAGR of 6.5% between 2025 and 2035, driven by increasing electrical safety regulations, industrial electrification, and rising adoption in commercial and residential sectors. China leads with an 8.8% CAGR, producing detectors at scale for industrial and utility applications. India follows at 8.2%, expanding through rising infrastructure projects and electrical safety initiatives. Germany, at 7.5%, benefits from advanced manufacturing capabilities and stringent safety standards. The UK, growing at 6.2%, innovates through integration in smart electrical systems, while the USA, at 5.5%, witnesses’ steady adoption in utilities and industrial sectors. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to grow at a country-specific CAGR of 8.8%, driven by increasing industrial automation, electrical infrastructure upgrades, and adoption of smart grid technologies. Demand is rising for reliable, high-accuracy voltage detection devices to ensure operational safety and efficiency across residential, commercial, and industrial applications. Manufacturers are innovating portable and digital voltage detection solutions with advanced sensing capabilities, durability, and real-time monitoring features. Government initiatives to modernize power distribution networks and enhance electrical safety further stimulate market expansion. Strategic collaborations with global technology providers accelerate innovation, while rising awareness among electricians and industrial users reinforces adoption.

India’s market is expected to expand at a CAGR of 8.2%, supported by rapid industrialization, power sector modernization, and increasing emphasis on electrical safety. Rising adoption of advanced voltage detection solutions in manufacturing, construction, and infrastructure projects is creating growth opportunities. Manufacturers are focusing on compact, easy-to-use, and precise detectors with digital interfaces for real-time monitoring. Government programs promoting safe electrical installations and modern power grids enhance market potential. Strategic partnerships with local and international technology firms accelerate product innovation. Increasing demand from the automotive and renewable energy sectors also contributes to market expansion.

Germany is anticipated to grow at a CAGR of 7.5%, fueled by stringent safety regulations, industrial automation, and modernization of electrical networks. High-accuracy and durable detection solutions are preferred in manufacturing plants, power distribution, and automotive sectors. Local manufacturers emphasize developing sensors capable of real-time voltage monitoring, predictive fault detection, and integration with industrial IoT systems. The government’s focus on energy efficiency, safety compliance, and smart grid initiatives further strengthens market prospects. Collaborations between technology providers and industrial solution integrators accelerate the development of innovative detection products.

The United Kingdom’s market is projected to expand at a CAGR of 6.2%, with growth driven by industrial safety compliance, smart building projects, and automation of power systems. Manufacturers focus on high-precision, portable voltage detectors with advanced sensing and alerting features suitable for commercial and industrial applications. Increasing installation of renewable energy systems and expansion of power networks heighten demand for advanced voltage monitoring tools. Collaborations between local distributors and technology providers enable efficient distribution and adoption of new solutions. The market is further supported by government regulations enforcing safety and efficiency in electrical installations.

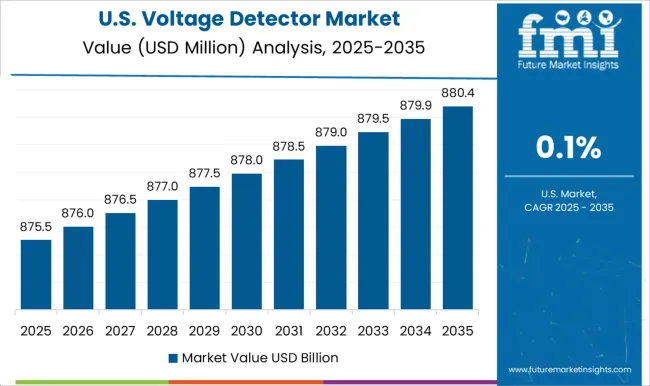

The United States market is expected to grow at a CAGR of 5.5%, driven by adoption in industrial, commercial, and residential power systems. Increasing emphasis on electrical safety, predictive maintenance, and smart grid integration supports growth. Manufacturers are introducing compact, digital, and wireless voltage detectors capable of real-time monitoring and fault detection. Strategic collaborations between domestic and international firms enhance product innovation and compliance with regulatory standards. Rising demand from construction, manufacturing, and utility sectors strengthens market expansion. Awareness campaigns promoting safe electrical practices further increase adoption among end users.

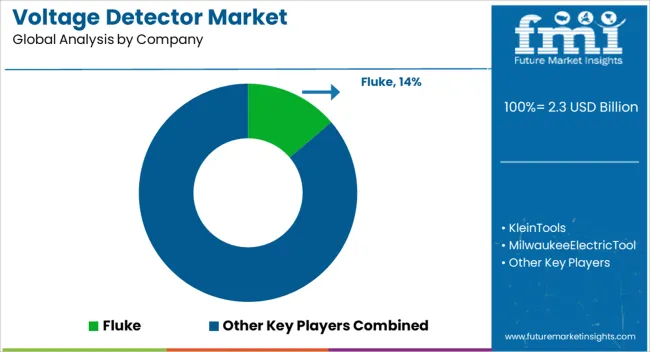

The market is witnessing significant growth driven by the increasing need for electrical safety, precise voltage monitoring, and efficient maintenance across residential, commercial, and industrial sectors. Fluke Corporation, Klein Tools, Inc., and Milwaukee Electric Tool Corporation are recognized as key players, offering highly reliable and durable voltage detection solutions. Their products are widely used by electricians, engineers, and maintenance professionals to ensure accurate live voltage identification, reduce the risk of electrical hazards, and enhance workplace safety. IDEAL Industries, Inc., Megger Group Limited, and Stanley Black & Decker, Inc. contribute to the market by providing a broad range of handheld and compact voltage detectors designed for rapid testing, high sensitivity, and user-friendly operation.

AEMC Instruments (Chauvin Arnoux Group), Southwire Company, LLC, and Kyoritsu Electrical Instruments Works, Ltd. offer specialized solutions for industrial applications with extended detection ranges and advanced signal indicators, improving efficiency in complex electrical systems. Sonel S.A., Test Products International (TPI Corporation), PCE Instruments (PCE Holding GmbH), Tester France SAS, and Amprobe Instruments (Fluke Corporation) expand the market with cost-effective and portable devices suitable for routine inspections, field measurements, and preventive maintenance. Collectively, these leading voltage detector providers drive innovation through the integration of advanced sensing technologies, ergonomic designs, and multifunctional features. Their combined efforts ensure high-accuracy performance, safety compliance, and reliability, addressing the growing demand for efficient electrical testing and monitoring across diverse industries.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.3 Billion |

| Type | Non-Contact Voltage Detectors, Contact Voltage Detectors, and Combination Voltage Detectors |

| Technology | Digital Voltage Detectors, Analog Voltage Detectors, and Smart Voltage Detectors |

| Application | Industrial, Residential, and Commercial |

| End Use | Electrical Testing, Maintenance, and Construction |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Fluke Corporation; Klein Tools, Inc.; Milwaukee Electric Tool Corporation; Extech Instruments (Teledyne FLIR LLC); IDEAL Industries, Inc.; Megger Group Limited; Stanley Black & Decker, Inc.; AEMC Instruments (Chauvin Arnoux Group); Southwire Company, LLC; Kyoritsu Electrical Instruments Works, Ltd.; Sonel S.A.; Test Products International (TPI Corporation); PCE Instruments (PCE Holding GmbH); Tester France SAS; Amprobe Instruments (Fluke Corporation). |

| Additional Attributes | Dollar sales by detector type and application, demand dynamics across residential, commercial, and industrial sectors, regional trends in electrical safety adoption, innovation in accuracy, portability, and connectivity, environmental impact of manufacturing and disposal, and emerging use cases in smart grid maintenance and automated safety systems. |

The global voltage detector market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the voltage detector market is projected to reach USD 4.4 billion by 2035.

The voltage detector market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in voltage detector market are non-contact voltage detectors, contact voltage detectors and combination voltage detectors.

In terms of technology, digital voltage detectors segment to command 39.7% share in the voltage detector market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Voltage Monitoring Integrated Circuit Market Size and Share Forecast Outlook 2025 to 2035

Voltage Tester Market Size and Share Forecast Outlook 2025 to 2035

Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Voltage Regulator For Advanced Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

Voltage Transducer Market Size and Share Forecast Outlook 2025 to 2035

Voltage Controlled Oscillators Market Size and Share Forecast Outlook 2025 to 2035

AC Voltage Transducer Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Components Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Substation Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Disconnect Switch Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Commercial Electric Boiler Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Composite Insulators Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Drives Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Electric Boiler Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA